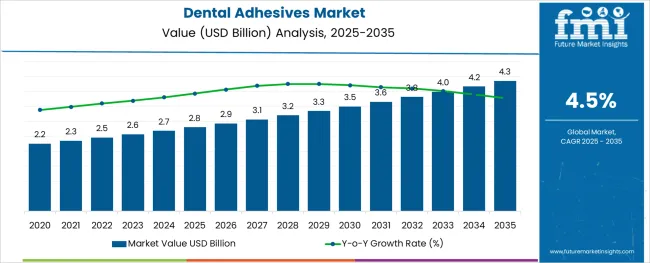

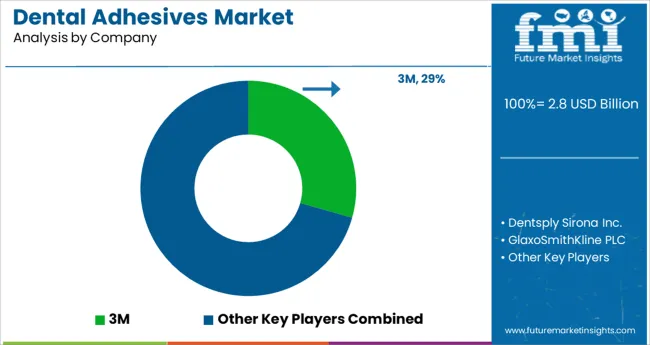

The Dental Adhesives Market is estimated to be valued at USD 2.8 billion in 2025 and is projected to reach USD 4.3 billion by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period.

The dental adhesives market is experiencing consistent growth due to an aging population, increased prevalence of dental disorders, and rising awareness around oral care solutions. As edentulism and periodontal diseases become more common among elderly individuals, the demand for secure and comfortable denture fixation has intensified.

Advances in biocompatible ingredients, formulation stability, and long-lasting adhesive performance are further supporting product innovation in the market. The rise in cosmetic dentistry and emphasis on patient comfort have also enhanced consumer adoption of advanced adhesive solutions.

Dental professionals and consumers alike are seeking reliable, easy to apply products that improve denture retention and overall oral hygiene. The outlook remains positive as manufacturers focus on product convenience, enhanced shelf life, and formulation transparency to meet evolving regulatory and consumer expectations across global oral care markets.

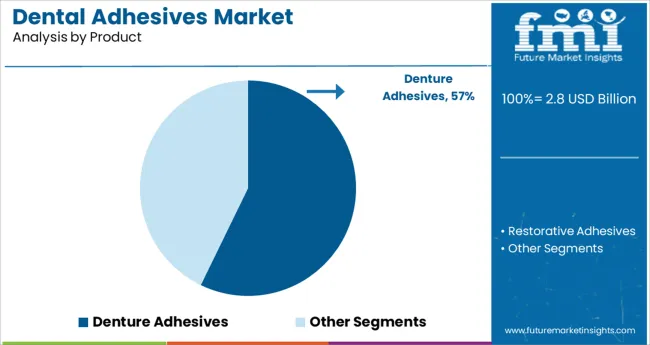

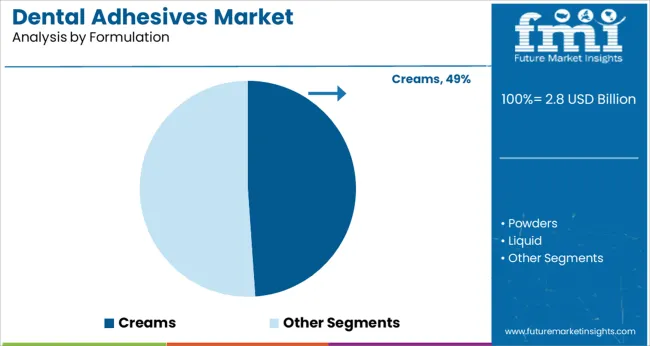

The market is segmented by Product, Formulation, and Distribution Channel and region. By Product, the market is divided into Denture Adhesives and Restorative Adhesives. In terms of Formulation, the market is classified into Creams, Powders, Liquid, and Others. Based on Distribution Channel, the market is segmented into Dental Clinics, Hospitals, Dental Academic and Research Institutes, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The denture adhesives segment is projected to account for 57.20% of total market revenue by 2025 under the product category, making it the leading segment. This is primarily driven by the rising number of individuals using full or partial dentures, particularly among the elderly.

Denture adhesives offer improved grip, comfort, and confidence by minimizing slippage during eating and speaking. The demand has been further fueled by over the counter availability and increasing consumer inclination toward enhanced oral comfort and hygiene.

Manufacturers have focused on developing zinc free and flavor neutral formulations to address safety and user experience. The reliability and ease of application provided by denture adhesives have made them the preferred product choice in the dental adhesives space.

Within the formulation category, the creams segment is expected to hold 48.90% of total market revenue by 2025, establishing it as the dominant formulation type. This is due to its ease of application, even distribution, and strong adhesion properties that provide long lasting hold.

Creams are widely favored by consumers for their cushioning effect and ability to form a secure seal that prevents food particles from entering under the denture. The formulation is also easy to clean and provides consistent results across different oral environments.

As manufacturers continue to enhance cream formulations for improved taste, hypoallergenic performance, and moisture resistance, the segment has maintained strong user preference. Its comfort and effectiveness have positioned it as the formulation of choice in the dental adhesives market.

The market value for dental adhesives was approximately 28.8% of the overall ~USD 2.7 billion global dental materials market in 2024.

The global dental adhesives market showed growth at a historic CAGR of 3.9% from 2012 to 21.

According to the Article Published by Bunker Hill Dentistry, the most common aesthetic dentistry procedure is still dental bonding. In 2020, it made up 43% of all cosmetic treatments. These stats also determine the need for use of these adhesive etching materials for restorative procedures.

Moreover, for dental prosthetics, the two key elements for a successful total denture therapy are technical excellence during prosthesis production and efficient patient management. The patient's requirements regarding stability and retention of the denture might be challenging for even the most skilled practitioners to meet, hence it is frequently thought reasonable to recommend a denture adhesive for these individuals.

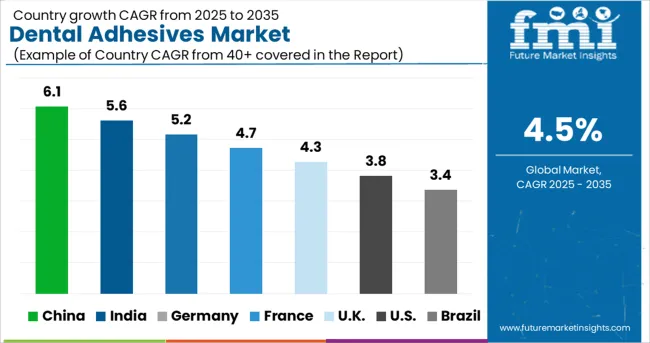

Thus, high patient satisfaction and increasing demand for cosmetic procedures will boost demand for the global dental adhesives market to grow at a CAGR of 4.5% during the forecast period from 2025 to 2035.

Because of their superior mechanical and aesthetically pleasing qualities, resin-based dental materials are frequently used in restorative procedures, particularly direct adhesive restoration. Direct composite resin adhesive repair has replaced amalgam fillings as the primary method of treating dental flaws in the development of minimally invasive dental procedures.

In order to preserve the living pulp, conservation remineralization has been recommended for dentin that is caries-affected near to the pulp. These advances are set to provide traction to the overall market during the forecasted years.

According to the Orthodontics statistics by Johnson Elite Ortho, in December 2024, The American Dental Association reported that 70% of orthodontic brackets placed are on females, and they are largely for aesthetic purposes. The majority of patients in them are between 12-15 years of age.

For treatment with fixed appliances to be effective and efficient, orthodontic brackets must be bonded to teeth. And this can be eventually achieved with a good quality adhesive that also does not cause any adverse reaction to the patients.

Additionally, Xerostomia caused due to smoking and other medical problems reduces the salivary flow in the oral cavity, and hence promotes the use of denture adhesives, especially in the geriatric group of patients.

Therefore, over the projection period from 2025 to 2035, the market for dental adhesives will reach new heights thanks to cutting-edge, innovative products like 6th and 7th-generation bonding agents for restorative adhesives offered by top manufacturers like 3M and Vista Apex, and the expanding adoption of the market in both developed and emerging nations.

The rising expense of dental care procedures is one factor limiting the demand for dental adhesives.

The most crucial feature of every dental material is biocompatibility, yet not all dental materials are 100 percent safe to use. The usage of these adhesives has also been associated with several negative effects.

The FDA has listed the case reports in the medical literature connecting adverse effects, like nerve injury, numbness, or tingling sensations, to prolonged misuse of denture adhesives containing zinc.

Apart from these, there are stringent government regulations in every country, for the use of dental materials, which can restrict the market growth in the future expansion of dental adhesive materials.

With a market share of roughly 82.0% in 2024, the USA. will continue to dominate the North American region. This large market share is predicted to continue throughout the forecast period.

The demand for dental adhesives is increasing in the United States, owing to rising dental awareness and the rising number of cosmetic procedures. Patients' preferences, which have evolved from simple hygiene to more appearance consciousness, are responsible for the industry's evolving dynamics.

This will result in the propulsion of demand for dental adhesives in the country during the forecast period of 2025 to 2035.

The United Kingdom dominates the European region with a total market share of about 26.1% in 2024 and is expected to continue to experience the same growth throughout the forecast period.

According to a survey conducted in the United Kingdom, most people who have dentures lose confidence because they do not feel comfortable with ill-fitting dentures in their mouths. As a result, they might avoid social situations.

Due to the high prevalence of dental and oral conditions like tooth decay, edentulousness, and demand for dentures, cosmetic requirements, and conditions like xerostomia, the market for dental adhesives is expected to experience profitable growth over the course of the forecast period as a result of rising adoption of various new and advanced adhesive products.

Japan has a market share of 33.9% in the East Asia dental adhesives market in 2024 and is expected to show promising growth in the future also.

In Japan, despite advancements in dentistry, tooth loss associated with aging is still a possibility. In almost 58% of adult populations around the world, total edentulism is anticipated. There is likely to be a higher need for complete or partial dentures as the number of older individuals who are edentulous rises. Wearers of complete dentures frequently experience issues with retention, stability, and function.

This increases the growth of dental adhesives and their usage in the forecast years in Japan.

India has a market share of 28.6% in the South Asia market in 2024 and a market value of USD 2.7 million in 2024.

India is one of the dental markets with the greatest growth rates in the world and is likely to become a significant player soon. Significant technological advancements have been made in the dental sector in India. As more people are willing to invest in their appearance and personality, cosmetic dentistry is growing in popularity.

Restorative adhesives are expected to present high growth at a CAGR of 4.6% throughout the forecast period, with a market share of about 64.9% in the global market in 2024.

The demand for this product is high because these adhesives have been used since traditional times in dentistry. These restorative adhesives are commonly used for all kinds of minor to major restoration of tooth with same coloured material. In addition, because of advancement in the material science, the new generation of adhesives that have been used in the dental practice.

This development raises its requirement as more biocompatible and aesthetically pleasing material for bonding and etching. Hence, its market is expected to surge in the coming years.

Liquid formulations have a market share of 30.0% in the dental adhesives market globally in 2024.

Liquids are easy to use and they can be mixed in the required consistency and amount for restoration of the teeth and bonding of orthodontic brackets. They also are an excellent formulation as material for maxillary dentures stability in ill-fitting dentures, because of its property of creating a required surface tension and negative pressure between the denture and oral mucosa.

Hence, they are used more commonly and expected to grow in the forecast years with a CAGR of about 6.4%.

Dental clinics hold the highest market share value of 40.3% during the year 2024. The increased use of these adhesives in dental clinics is attributed to the rise in dental health awareness and restorative as well as prosthetic dental procedures among private dental practitioners.

Also, orthodontic brackets and their placements are done primarily in dental clinics, which require the use of adhesives and etchants.

Thus, dental clinics help in driving the demand for dental adhesives during the forecast period from 2025 to 2035.

The market of dental adhesives is fragmented. Manufacturers and suppliers are collaborating, launching new products as well as expanding the sales of these dental materials in the industry.

Instances of key developmental strategies by the industry players in the dental adhesives market are given below:

Similarly, recent developments related to companies manufacturing dental adhesives, have been tracked by the team at Future Market Insights, which are available in the full report.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2012 to 2024 |

| Market Analysis | million for Value and Units for Volume |

| Key Regions Covered | North America, Latin America, Europe, South Asia, East Asia, Oceania, and Middle East & Africa |

| Key Countries Covered | The USA, Canada, Brazil, Mexico, Argentina, The United Kingdom, Germany, Italy, Russia, Spain, France, BENELUX, India, Thailand, Indonesia, Malaysia, Japan, China, South Korea, Australia, New Zealand, Turkey, GCC, North Africa, South Africa |

| Key Market Segments Covered | Product, Formulation, Distribution Channel, and Region |

| Key Companies Profiled | 3M; Dentsply Sirona Inc.; GlaxoSmithKline PLC; Procter & Gamble Co.; Ultradent Products, Inc.; Henkel AG & Co. KGaA; Johnson & Johnson Services Inc.; Mitsui Chemicals Inc.; Colgate-Palmolive Company; Ivoclar Vivadent AG; Tokuyama Dental Corporation Inc.; Den-Mat Holdings LLC.; Prime Dental Manufacturing; New World Imports. |

| Pricing | Available upon Request |

The global dental adhesives market is estimated to be valued at USD 2.8 billion in 2025.

It is projected to reach USD 4.3 billion by 2035.

The market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types are denture adhesives and restorative adhesives.

creams segment is expected to dominate with a 48.9% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dental Implant and Prosthetic Market Size and Share Forecast Outlook 2025 to 2035

Dental Imaging Equipment Market Forecast and Outlook 2025 to 2035

Dental Wounds Treatment Market Size and Share Forecast Outlook 2025 to 2035

Dental Radiometer Market Size and Share Forecast Outlook 2025 to 2035

Dental Anaesthetic Market Size and Share Forecast Outlook 2025 to 2035

Dental Diamond Bur Market Size and Share Forecast Outlook 2025 to 2035

Dental Laboratory Market Size and Share Forecast Outlook 2025 to 2035

Dental Matrix Systems Market Size and Share Forecast Outlook 2025 to 2035

Dental Permanent Cements Market Size and Share Forecast Outlook 2025 to 2035

Dental Bleaching Agent Market Size and Share Forecast Outlook 2025 to 2035

Dental Care Products Market Size and Share Forecast Outlook 2025 to 2035

Dental Etching Liquid Market Size and Share Forecast Outlook 2025 to 2035

Dental Sutures Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dental Hygiene Devices Market Size and Share Forecast Outlook 2025 to 2035

Dental Implantology Software Market Analysis - Size, Growth, & Forecast Outlook 2025 to 2035

Dental Veneers Market Size and Share Forecast Outlook 2025 to 2035

Dental X-Ray Systems Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dental Suction Systems Market Size and Share Forecast Outlook 2025 to 2035

Dental Articulators Market Size and Share Forecast Outlook 2025 to 2035

Dental Fluoride Varnish Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA