The marketplace for dental orthotic devices is continuously growing, owing to the escalated awareness towards treating orofacial pain, a growing incidence of TMDs (temporomandibular joint disorders), and also an increase in appreciation of non-invasive modes.

Recently, dental orthotic devices like mandibular advancement splints, bite guards, and stabilization appliances have been gaining significant prominence in the hands of dentists and orthodontists for treating neuromuscular dental conditions and airway-related sleep disorders. Lastly, it is knocking the door and focusing on the customized 3D-printed orthotic devices meant that probably more comfort for the patients, and, consequently, would have more compliance in the treatment.

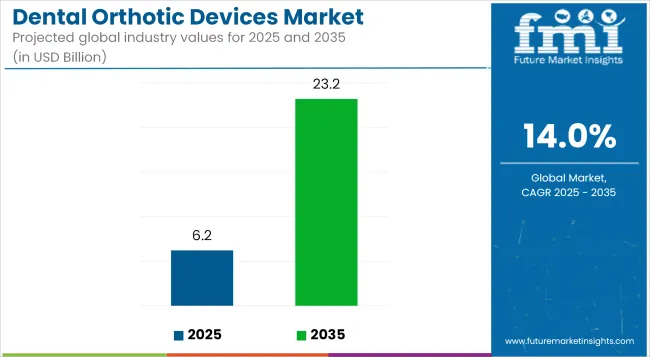

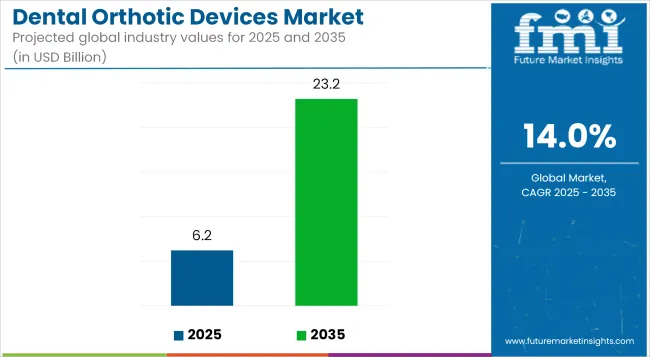

The market is predicted to rise-up from USD 6.2 Billion in 2025 to well up to USD 23.2 Billion by the year 2035, with a CAGR of 14.0% during the study period.

The technological advancements being made in imaging and digital impressions for the dentistry field are further considered the catalysts enhancing the global acceptance of orthotic devices with improved collaboration between dentistry and sleep medicine. Besides, an ever-increasing elderly population usually affected badly by TMDs and sleep disorders- stands readily to greatly boost future demand growth prospects.

Market Metrics

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 6.2 Billion |

| Market Value (2035F) | USD 23.2 Billion |

| CAGR (2025 to 2035) | 14.0% |

North America is the greatest region for the dental orthotic devices market, and the most significant part of this is the USA. The factors further boosting the growth of the region include the highest prevalence of bruxism and sleep apnea, good insurance coverage, availability of high-end dental clinics and laboratories, and maximum incorporation of digital dentistry with more patient awareness of oral health.

The European continent has balanced growth because of its national oral health programs, increased elderly populations, and increasing numbers for non-surgical TMD modalities; thereby, unlike many other continents. Belgium, Germany, France, the UK, are among those countries that devote their spending on promising modern dental solutions and assure services from hospitals to dental specialists.

Growth is anticipated to be fastest in the Asia Pacific region over the coming forecast period, with some growth from dental tourism and the burgeoning middle-class population in the regions, while the other side sees an increasing incidence of untreated sleep apnea. Countries such as China, India, and South Korea are in a furious drive to provide dental care infrastructure and digital health adoption, creating significant demand for dental orthotic devices.

Limited Awareness and Access in Emerging Markets

One of the major challenges facing the world of dental orthotic devices is low awareness of orofacial conditions like TMD and bruxism in developing areas. In rural and underserved regions, access to certified dental professionals and modern diagnostic facilities is still limited, thus delaying the early diagnosis and timely initiation of orthotic treatment solutions.

Growth of Custom-Fit and 3D Printed Orthotics

Availability of 3D scan and digital fabrication technologies into more cents for the market. These will fully provide products that are very much personalized dental orthotic devices whose better fit, durability, and compliance by the patients can be guaranteed.

Along with getting highly cost-effective turnaround times, reduced costs, and expanded options of customized therapeutic solutions for TMD and sleep apnea, dental offices these days are increasingly adopting in-house CAD/CAM techniques.

During the years 2020 to 2024, growing clinical recognition of bruxism and sleep-related breathing disorders contributed to the acceptance of basic bite guards and prefabricated mandibular devices. Traditional impressions and off-the-shelf alternatives dominated dental clinics due to limited access to digital workflows. Rising public awareness of temporomandibular joint dysfunction also contributed to early growth in the market.

From 2025 to 2035, the market is expected to energize toward some advanced, digitally designed orthotic devices with improved biomechanical performance. AI will grant the opportunity to redefine the customization of orthoses through occlusion analysis, intraoral scanners going mainstream, as well as cloud-based treatment-planning platforms.

An increasing number of partnerships among dentists, ENT specialists, and sleep-oriented physicians will advocate for a multidisciplinary approach to therapy. The market, too, stands to benefit from remote patient monitoring features that will keep the patients accountable to their therapy and also allow for real-time modifications.

Market Shifts: 2020 to 2024 vs. 2025 to 2035

| Key Dimensions | 2020 to 2024 |

|---|---|

| Device Format | Prefabricated and basic bite guards |

| Diagnostic Approach | Manual assessments and physical impressions |

| Use Cases | Bruxism and TMJ stabilization |

| Manufacturing Model | Centralized labs with slow turnaround |

| Regional Penetration | Limited to developed urban regions |

| Specialist Collaboration | Isolated dental practice |

| Data Integration | Standalone devices with no data feedback |

| Key Dimensions | 2025 to 2035 |

|---|---|

| Device Format | Fully customized, 3D-printed and digitally designed orthotics |

| Diagnostic Approach | Digital scans and AI-assisted occlusion mapping |

| Use Cases | Sleep apnea , facial pain, neuromuscular rehabilitation |

| Manufacturing Model | In-house CAD/CAM production and rapid prototyping |

| Regional Penetration | Expansion to tier-2 cities and remote locations via tele-dentistry |

| Specialist Collaboration | Multidisciplinary approach including sleep and ENT specialists |

| Data Integration | Cloud-connected devices with real-time monitoring |

Leading the dental orthotic devices market is the United States because it has the most developed dental healthcare system and the vastest awareness of temporomandibular joint disorder and bruxism treatment non-invasive alternatives. Patient demand for custom-fit dental appliances such as occlusal splints and mandibular advancement devices has substantially grown and continues to increase.

The quality of available orthodontists and prosthodontists per capita, improved insurance coverage, good patient willingness to spend further in this area keep up the growth in the market. In addition, integration of digital impressions and 3D technologies in fabricating these devices facilitates spinning the process for the patient in both turnaround time and outcome.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 14.5% |

Rising demand for dental orthotics is sharply witnessed in the schedules of the United Kingdom in the treatment of sleep apnea and TMJ dysfunctions . Adoption is driven by increased consumer focus on oral health and increased appeal in aesthetic and functional solutions.

Public and private dental practices are now adopting modes of the digital workflow faster, thereby effecting a much quicker diagnostic process and precise customization of the devices. Along with these, awareness programs and training related to the field of dental sleep medicine are likely to increase usage of devices across age groups.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 14.2% |

Across the European Union, the dental orthotic device market is growing consistently, driven by aging populations, increasing cases of malocclusion and jaw alignment disorders, and the demand for non-invasive alternatives to surgery. Countries like Germany, France, and Italy are investing in 3D-printed oral appliances and digital workflow integration for better patient outcomes in dental clinics and orthodontic practices.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 14.1% |

The Japan dentistry orthotic devices market is moving toward slow progress with the increasing old population going for non-invasive treatment of jaw joint disorders or bruxism and sleep apnea. Based on the strong government support to oral health and a culturally entrenched emphasis on dental hygiene, regular check-ups and early interventions have become quite essential.

More areas of Japan's dental clinics have started to adopt advanced intraoral scanning and CAD/CAM solutions for obtaining highly accurate orthotic appliances. Some of the reasons for high-end consumer compliance are high standards set by local manufacturers on quality, biocompatibility, and comfort.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 14.3% |

The South Korean market for dental orthopedic devices is growing due to awareness campaigns for dental health among consumers, techies, or the growing incidence of bruxism among urban dwellers. These developments suggest that dentistry in South Korea is going digital, thus allowing the production of bespoke or pretty orthotics by the practitioner.

TMJ correction devices are popular due to the vast fame of cosmetic dentistry clinics and the cultural push toward aesthetics, especially related to the face. With innovations in materials and aligner technologies propelling the strong market growth through urban centers, these trends are set to continue.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 14.4% |

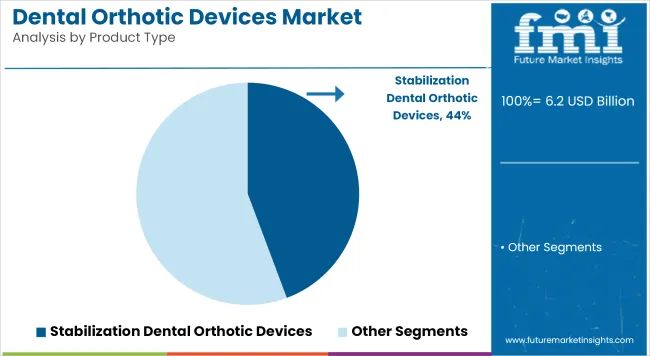

Stabilization Dental Orthotic Devices to Hold Leading Market Position by 2025

| Product Type | Market Share |

|---|---|

| Stabilization Dental Orthotic Devices | 44.3% |

It is forecasted that the stabilization segment will dominate in the dental orthotic device market with a remarkable share of 44.3% in 2025. These therapeutic apparatuses are frequently offered for the treatment of TMD and bruxism by stabilizing the jaw and reducing muscle activity during sleep or awake hours. Their efficacy extends even to relieving symptoms like jaw pain, headaches, and wear of teeth thus making them more popular with dental practitioners.

With the ever-increasing prevalence of TMD and sleep-related issues, the recent spike in awareness about oral health has greatly increased the demand for stabilization devices. Advances in technology have seen the introduction of custom-fit devices that are more patient-friendly in terms of compliance which would eventually yield better treatment outcomes. Again, the increasing dental expenses and the increase in the percentage of the older population suffering from musculoskeletal problems have contributed to the phenomenal growth being experienced by this segment.

On several levels of design regimes offered to satisfy the needs of different patients and with scalping areas of possible alternatives offered to invasiveness with options of a surgical route, stabilization dental orthotic devices have rightfully become a non-invasive solution for selection in clinical practice throughout the world.

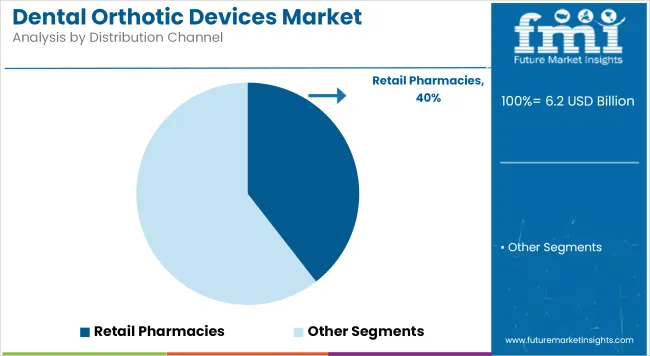

Retail Pharmacies to Dominate Distribution Channels with Expanding Accessibility

| Distribution Channel | Market Share |

|---|---|

| Retail Pharmacies | 39.5% |

Although most experts agree that retail pharmacies will emerge in the leading-distribution-channel segment in 2025 with a contribution of about 39.5%, it is available to the mass public, and in most cases, this is the first place where they would go for dental orthotics, particularly stabilization and bite plane products. Generally beyond the counter, available and capable open target retail pharmacies constitute the first point of contact for consumers seeking dental orthotics.

Consumers find retail pharmacies very convenient because of the distribution and extension of operational hours where they can buy goods. It will also trigger self-medication whereby patients will be conscious about oral health issues and purchase medicines directly from these retail outlets.

Some of those retail pharmacies established their good relationships with dental product manufacturers and suppliers to increase their product portfolio. Furthermore, the increased development of pharmacies from an increasing number of retail pharmacy chains in developed and developing economies will continue to strengthen this sector.

Aside from these benefits, retail pharmacies also offer value-added services such as consultation and product demonstrations to customers, thus enhancing their confidence and providing them with more opportunities to try adoption of dental orthotic devices.

Aggregate overall growth experiences in the dental orthotics market phenomenal growth between the years 2025 and 2035 because of the rise in awareness regarding oral health among the population and increasing incidence of temporomandibular joint disorders (TMD), bruxism, and obstructive sleep apnea. Advancement in digital dentistry such as 3D printing, CAD/CAM, etc., increases the customizability and comfortability of orthotic devices promising better patient acceptance of treatment.

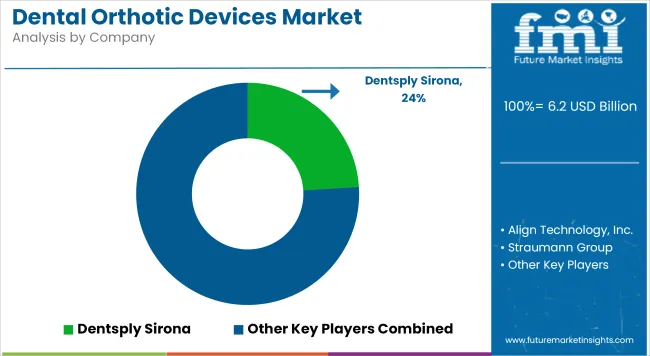

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Dentsply Sirona | 20-24% |

| Align Technology, Inc. | 17-21% |

| Straumann Group | 15-18% |

| Danaher Corporation | 10-13% |

| Other Companies (combined) | 30-35% |

| Company Name | Key Offerings/Activities |

|---|---|

| Dentsply Sirona | In 2024, Dentsply Sirona launched advanced digital orthotic devices with improved fit using 3D scanning and printing. In 2025, it plans to enhance software integration for customized treatment planning. |

| Align Technology, Inc. | Align introduced new clear dental orthotics in 2024 featuring better durability and patient comfort. In 2025, the company will expand AI-based monitoring tools for treatment progress. |

| Straumann Group | Straumann developed innovative splints with bio-compatible materials in 2024 and aims to integrate tele-dentistry features by 2025. |

| Danaher Corporation | Danaher enhanced its dental orthotic device portfolio in 2024 with modular designs for ease of adjustment. In 2025, it will focus on automation in manufacturing to reduce costs. |

Key Company Insights

Dentsply Sirona (20-24%)

Dentsply Sirona leads in digital dental orthotic devices, leveraging 3D printing and scanning to deliver highly customized solutions with improved patient comfort.

Align Technology, Inc. (17-21%)

Align focuses on clear dental orthotics and AI-powered monitoring tools, driving innovations that enhance treatment adherence and effectiveness.

Straumann Group (15-18%)

Straumann emphasizes bio-compatible materials and tele-dentistry integration to provide advanced patient-centric orthotic solutions.

Danaher Corporation (10-13%)

)Danaher offers modular, easy-to-adjust devices with a focus on manufacturing automation to increase efficiency and reduce production costs.

Other Key Players (30-35% Combined)

The overall market size for the dental orthotic devices market was USD 6.2 billion in 2025.

The market is expected to reach USD 23.2 billion in 2035.

Demand will be driven by increasing prevalence of temporomandibular joint disorders, rising dental awareness, advancements in orthotic device technology, and growing geriatric population.

The top 5 contributing countries are USA, UK, Europe, Japan, and South Korea.

The stabilization dental orthotic devices segment is expected to lead the market due to its effectiveness in treating sleep apnea and related disorders.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dental Implant and Prosthetic Market Size and Share Forecast Outlook 2025 to 2035

Dental Imaging Equipment Market Forecast and Outlook 2025 to 2035

Dental Wounds Treatment Market Size and Share Forecast Outlook 2025 to 2035

Dental Radiometer Market Size and Share Forecast Outlook 2025 to 2035

Dental Anaesthetic Market Size and Share Forecast Outlook 2025 to 2035

Dental Diamond Bur Market Size and Share Forecast Outlook 2025 to 2035

Dental Laboratory Market Size and Share Forecast Outlook 2025 to 2035

Dental Matrix Systems Market Size and Share Forecast Outlook 2025 to 2035

Dental Permanent Cements Market Size and Share Forecast Outlook 2025 to 2035

Dental Bleaching Agent Market Size and Share Forecast Outlook 2025 to 2035

Dental Care Products Market Size and Share Forecast Outlook 2025 to 2035

Dental Etching Liquid Market Size and Share Forecast Outlook 2025 to 2035

Dental Sutures Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dental Implantology Software Market Analysis - Size, Growth, & Forecast Outlook 2025 to 2035

Dental Veneers Market Size and Share Forecast Outlook 2025 to 2035

Dental X-Ray Systems Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dental Suction Systems Market Size and Share Forecast Outlook 2025 to 2035

Dental Articulators Market Size and Share Forecast Outlook 2025 to 2035

Dental Fluoride Varnish Market Size and Share Forecast Outlook 2025 to 2035

Dental Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA