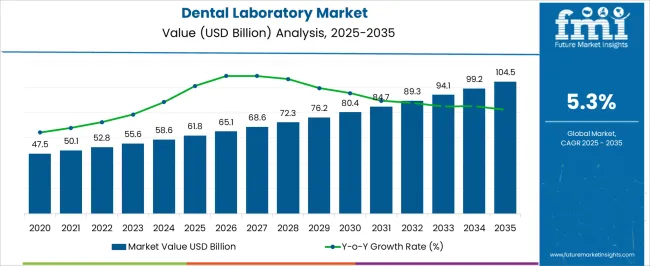

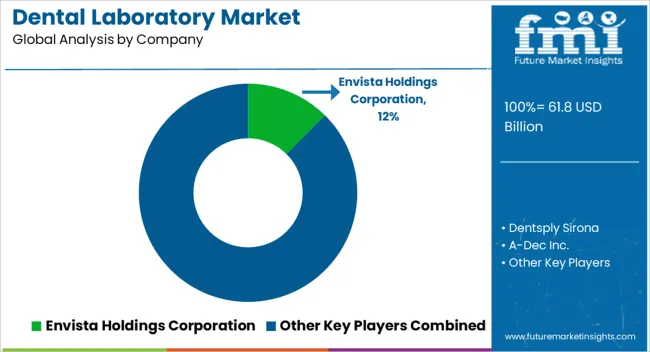

The Dental Laboratory Market is estimated to be valued at USD 61.8 billion in 2025 and is projected to reach USD 104.5 billion by 2035, registering a compound annual growth rate (CAGR) of 5.3% over the forecast period.

| Metric | Value |

|---|---|

| Dental Laboratory Market Estimated Value in (2025 E) | USD 61.8 billion |

| Dental Laboratory Market Forecast Value in (2035 F) | USD 104.5 billion |

| Forecast CAGR (2025 to 2035) | 5.3% |

The dental laboratory market is progressing steadily, shaped by rising demand for restorative and cosmetic dental procedures and technological advancements in digital dentistry. Industry updates and dental association reports have highlighted the increasing integration of CAD/CAM systems, 3D printing, and advanced milling machines, which have transformed laboratory workflows by improving precision and efficiency.

Growing awareness about oral health, coupled with the expanding elderly population requiring dental prosthetics, has further accelerated demand. Press releases from dental manufacturers have noted significant investments in systems that support same-day restorations and customized implants, enabling laboratories to meet evolving patient expectations.

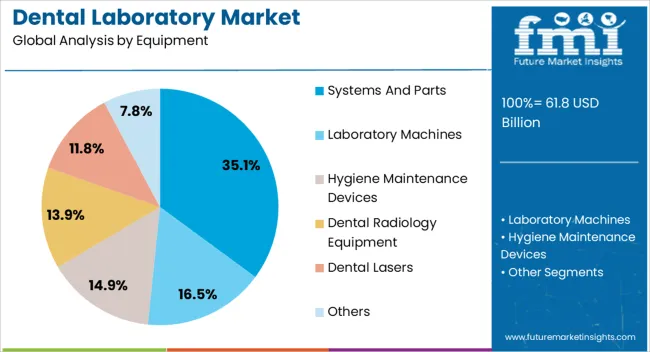

Additionally, global trends toward aesthetic dentistry have stimulated growth in specialized dental products and prosthetic solutions. Looking ahead, the market is expected to expand as laboratories increasingly adopt digital workflows, leverage advanced materials, and align with dental clinics for rapid turnaround times. Key segmental growth is projected in systems and parts within equipment and implants within product categories, reflecting both clinical necessity and patient preference.

The Systems and Parts segment is projected to account for 35.1% of the dental laboratory market revenue in 2025, sustaining its role as the leading equipment category. This dominance has been driven by the widespread adoption of digital systems that enhance workflow integration and output quality. Dental laboratories have increasingly relied on CAD/CAM units, scanners, and milling systems to deliver precision-fitted crowns, bridges, and prosthetics.

The continuous replacement and upgrading of system components, combined with demand for compatible parts, have reinforced the segment’s revenue base. Press announcements from manufacturers have emphasized investments in modular systems and user-friendly parts designed to improve accuracy, speed, and cost-efficiency.

As the complexity of dental restorations rises and laboratories adapt to higher patient volumes, the reliance on advanced systems and replacement parts is expected to remain central to their operations, sustaining the segment’s market leadership.

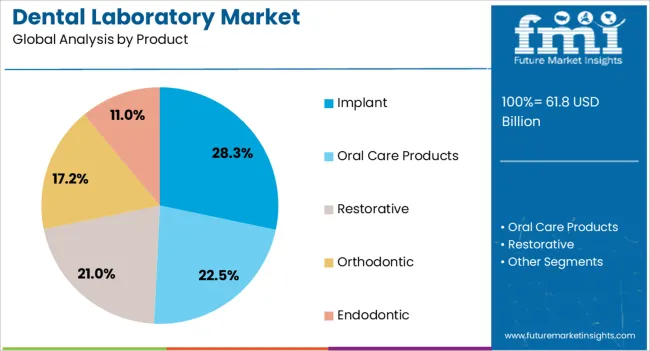

The Implant segment is projected to contribute 28.3% of the dental laboratory market revenue in 2025, making it the leading product category. Growth of this segment has been supported by the increasing prevalence of tooth loss due to aging populations, trauma, and periodontal diseases. Dental journals have documented a growing preference for implants over traditional bridges and dentures, driven by superior durability, functionality, and aesthetic outcomes.

Laboratories have expanded their capabilities to design and produce custom implants that integrate seamlessly with digital imaging and surgical planning tools, ensuring improved patient outcomes. Moreover, the rising adoption of implant-supported prosthetics has increased laboratory workloads, boosting the demand for precision-milled components and biocompatible materials.

With patients increasingly seeking long-term restorative solutions and clinicians promoting implants as the standard of care, the Implant segment is expected to maintain steady growth and continue leading the product category within the dental laboratory market.

The industry is predicted to expand significantly in the upcoming years due to the surge in the geriatric population globally. Also, rising popularity of cosmetic dentistry procedures is creating a demand for dental laboratory services.

Robust advancement in technologies in the dental laboratory sector has resulted in reduced chair time, faster recovery, and less pain treatment, making them a popular option. On top of that, customizing dental applications has recently seized consumer interest in the industry. This is impacting the expansion of aesthetics and appeal in the field of dentistry within the industry.

High cost associated with dental equipment and other materials is expected to impede growth. Moreover, survival of new entrants and small players is anticipated to be difficult in the industry, posing a challenge.

Advancements in 3D printing technologies have revolutionized the industry by offering high accuracy in dental applications. On the other hand, growing implementation of CAD/CAM technology in dental laboratories is fueling growth by magnifying precision and reducing human error. Also, rapid adoption of tele-dentistry and virtual consultations has impacted the industry with the potential for digital impressions and tele-denture design to become more prevalent.

Systems & parts are expected to account for 35.1% of the industry share by form in 2025. Growing demand for cosmetic dentistry and dental implants is increasing awareness about aesthetics and the availability of advanced procedures. This is leading to an increasing demand for dental lab equipment, especially systems and parts, impacting the number of laboratories.

Advancements in technologies utilized in dental laboratories are surging toward more accurate and efficient dental lab equipment. This is resulting in a rapid deployment of systems and parts across the industry.

| Attributes | Details |

|---|---|

| By Equipment | Systems & Parts |

| Industry Share (2025) | 35.1% |

Implants, the top product type, are expected to account for 35.1% of the industry share by form in 2025. The increasing prevalence of dental disorders and rising demand for dental implants have contributed to the adoption of implant product types in the industry.

Implant-support dentures and bridges are gaining traction due to their durability, aesthetic appeal, and comfort, driving the demand for implants. Hence, implants are estimated to maintain their dominant position in the industry through dental restorative procedures and the adoption of digital dentistry.

| Attributes | Details |

|---|---|

| By Product Type | Implant |

| Industry Share (2025) | 28.3% |

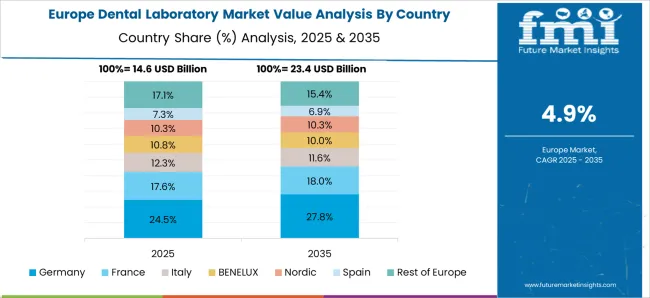

Industries in key countries can be observed in the subsequent tables. The government is helping automation in laboratories, and people are trying harder to take care of oral health. This is going to make the industry grow in North America. In Europe, many dentists and dental professionals are there. This helps the dental industry in Europe proliferate. Many people in Asia Pacific have oral diseases as a lot of people consume tobacco products. This is going to push the industry in Asia Pacific forward.

| Countries | CAGR (2025 to 2035) |

|---|---|

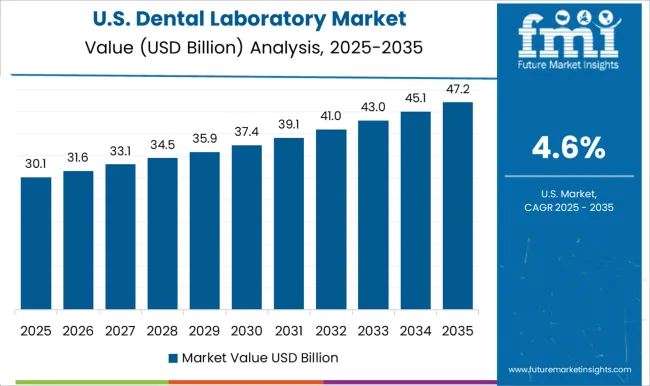

| United States | 5.6% |

| Germany | 5.9% |

| United Kingdom | 5.4% |

| China | 6.6% |

| India | 6.3% |

The dental laboratory market in the United States is expected to record a moderate CAGR of 5.6% through 2035. Advancements in technology in the United States are supporting the growth. Top technologies utilized in the United States industry are digital impression systems and 3D printing.

The higher demand for dental prosthetics and restorative treatment in the aging population drives the growth. The population retains their natural teeth longer, increasing the need for dental implants.

Demand for dental laboratories in China is projected to witness a CAGR of 6.6% through 2035. Growing middle class in China has increased disposable income, allowing people to afford dental treatment beyond basic oral care. This is leading to a surge in demand for dental prosthetics.

The government is investing in the healthcare sector, including dental care, to improve public health. These policies endorsing oral health education and access to dental services are contributing to the growth.

Adoption of dental laboratories in India is anticipated to record a CAGR of 6.3% through 2035. With the growing population of youths, India presents continuous opportunities for dental laboratories. The increase in urbanization has contributed to the higher demand for dental services. The rising awareness of oral hygiene and aesthetics among the population has also led to a large demand for dental treatment.

The dental laboratory market in Germany is anticipated to rise at a CAGR of 5.9% through 2035. Germany is famous for its high standards in healthcare, including the dental care sector. The country is a leader in dental technology and innovation. Multiple research institutions and dental product manufacturers contribute to the development of cutting-edge dental products.

Health insurance coverage in Germany includes dental care for most citizens. This ensures that a specific portion of the population has access to dental treatment, boosting the demand for dental laboratory services.

The dental laboratory market in the United Kingdom is likely to upsurge at a CAGR of 5.4% through 2035. Low insolvency risk for dental practices is expected due to withdrawn government support. This is creating opportunities for large consolidators to make economical acquisitions.

Dental laboratories are attractive acquisition targets for companies expanding their dental services presence in the country. Successful acquisitions require careful financial performance analysis and company identification.

Advancements in technology continue to impact dental laboratories. The adoption of automation and data interchange plays a vital role in the rising demand for dental services. Working on the digital platform and implementing new techniques has revolutionized the traditional dental workflow. This is leading to an upward trend in the industry's value. The utilization of automated equipment and processes is raising the efficiency of dental laboratories, ensuring timely service delivery to patients.

Numerous players operate in the market, each with their own strategies. Industry players expand by opening chains and new laboratories, thereby increasing the industry's share value. Regulatory innovative products keep the industry competitive by offering better and more efficient solutions. Collaboration with other key players can share resources and knowledge, improving services to increase their share of the industry.

GC Corp. has acquired BioCentriq, a United States-based contract development and manufacturing organization, enhancing its capabilities in the growing cell and gene therapy CDMO industry. The acquisition aims to accelerate GC's growth and provide diverse healthcare solutions.

Mitsui Chemicals has started implementing digital traceability in office supply recycling. It has been included in the Dow Jones Sustainability Indices Asia Pacific for five years and is preparing for Japan's first biomass-derived plastic production.

Recent Developments in the Dental Laboratory Market

The market is categorized into dental radiology equipment, dental lasers, systems and parts, laboratory machines, hygiene maintenance devices, and others

Dental laboratories include restorative, orthodontic, endodontic, implant, and oral care products.

Industry analysis has been carried out in key countries of North America, Latin America, Europe, South Asia, East Asia, Oceania, as well as the Middle East and Africa (MEA)

The global dental laboratory market is estimated to be valued at USD 61.8 billion in 2025.

The market size for the dental laboratory market is projected to reach USD 104.5 billion by 2035.

The dental laboratory market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in dental laboratory market are systems and parts, laboratory machines, hygiene maintenance devices, dental radiology equipment, dental lasers and others.

In terms of product, implant segment to command 28.3% share in the dental laboratory market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dental Repair Membranes for Implant Procedures Market Size and Share Forecast Outlook 2025 to 2035

Dental Cavity Filling Materials Market Size and Share Forecast Outlook 2025 to 2035

Laboratory Precision Oven Market Size and Share Forecast Outlook 2025 to 2035

Dental Implant and Prosthetic Market Size and Share Forecast Outlook 2025 to 2035

Laboratory Information System Market Forecast and Outlook 2025 to 2035

Dental Imaging Equipment Market Forecast and Outlook 2025 to 2035

Dental Wounds Treatment Market Size and Share Forecast Outlook 2025 to 2035

Dental Radiometer Market Size and Share Forecast Outlook 2025 to 2035

Dental Anaesthetic Market Size and Share Forecast Outlook 2025 to 2035

Dental Diamond Bur Market Size and Share Forecast Outlook 2025 to 2035

Laboratory Centrifuge & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Laboratory Shakers Market Size and Share Forecast Outlook 2025 to 2035

Laboratory Washers Market Size and Share Forecast Outlook 2025 to 2035

Laboratory Rockers and Shakers Market Size and Share Forecast Outlook 2025 to 2035

Laboratory Filtration Devices Market Size and Share Forecast Outlook 2025 to 2035

Dental Matrix Systems Market Size and Share Forecast Outlook 2025 to 2035

Dental Permanent Cements Market Size and Share Forecast Outlook 2025 to 2035

Dental Bleaching Agent Market Size and Share Forecast Outlook 2025 to 2035

Laboratory and Medical Scale Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Dental Care Products Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA