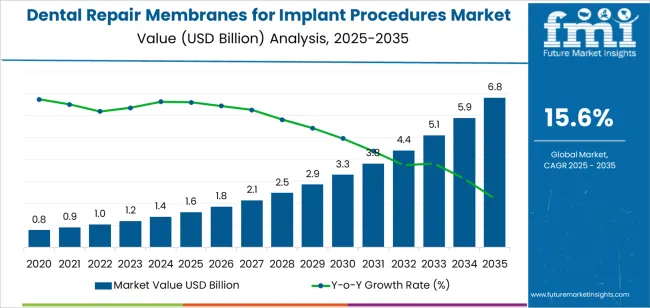

The dental repair membranes for implant procedures market is valued at USD 1.6 billion in 2025 and is projected to reach USD 6.8 billion by 2035, registering a CAGR of 15.6%. Market growth is driven by the rising prevalence of dental implant surgeries, increasing demand for guided bone regeneration (GBR) and guided tissue regeneration (GTR) materials, and the growing adoption of biomaterial-based membranes that enhance post-surgical healing outcomes. Advancements in regenerative dentistry, coupled with higher patient awareness of oral health restoration, continue to influence market expansion.

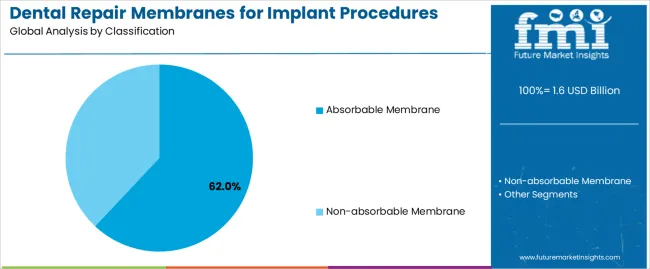

Absorbable membranes represent the leading product type, favored for their biodegradability, ease of application, and elimination of secondary surgery for removal. These membranes, typically composed of collagen or synthetic polymers such as polylactic acid (PLA), promote predictable tissue integration and controlled resorption during the healing process. Non-absorbable membranes remain relevant for complex implant procedures requiring long-term structural stability and barrier protection.

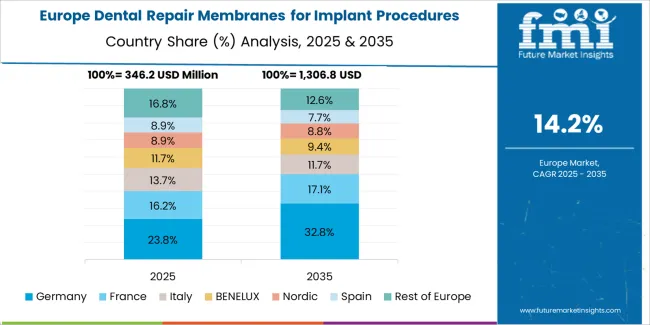

Asia Pacific leads global growth, supported by the rapid expansion of dental care infrastructure and the increased adoption of advanced implant techniques in China, India, and South Korea. Europe and North America maintain demand through established dental implant markets and continuous innovation in regenerative materials. Key companies include Geistlich, Cook Medical, Genoss, Zimmer Biomet, and Zhenghai Bio-Tech, focusing on biomaterial development, clinical efficacy, and regulatory compliance.

The early growth curve, covering 2025 to 2029, will exhibit rapid acceleration driven by increasing dental implant procedures and broader adoption of guided bone regeneration techniques. During this phase, demand will be influenced by the growing use of resorbable collagen membranes and improvements in implant success rates supported by biomaterial innovations. Rising patient preference for restorative and aesthetic dentistry will also contribute to early-stage expansion.

The late growth curve, extending from 2030 to 2035, will maintain positive momentum but at a slightly moderated pace as leading markets approach maturity. Growth will shift toward emerging economies where dental infrastructure is expanding and awareness of regenerative dental treatments is increasing. Continued development of bioactive and composite membranes will sustain product relevance and competitive differentiation. The comparison between early and late growth curves reflects a market evolving from innovation-driven acceleration to maturity marked by technological refinement, broader clinical acceptance, and global standardization in dental regenerative procedures.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1.6 billion |

| Market Forecast Value (2035) | USD 6.8 billion |

| Forecast CAGR (2025-2035) | 15.6% |

The dental repair membranes for implant procedures market is growing as the number of dental implant surgeries and bone regeneration treatments continues to rise. Repair membranes are used to guide tissue and bone regeneration, improving implant stability and long-term success rates. The increasing prevalence of periodontal disease, tooth loss, and age-related dental conditions has expanded the patient pool requiring regenerative dental treatments. Advances in biomaterials and membrane technology, including collagen-based and synthetic polymer products, have improved biocompatibility, durability, and resorption control, making these membranes more efficient in clinical use.

The rise of dental tourism, improved healthcare infrastructure, and wider adoption of implant dentistry in developing regions further support market growth. Manufacturers are investing in research to produce membranes that promote faster healing and better integration with bone and soft tissue. The market faces constraints from varying reimbursement structures, high treatment costs, and differences in regulatory approval processes that limit uniform adoption across regions.

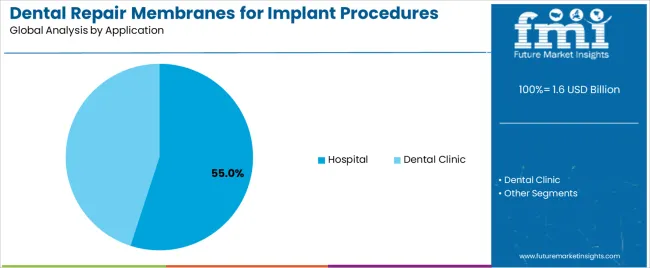

The dental repair membranes for implant procedures market is segmented by classification and application. By classification, the market is divided into absorbable membranes and non-absorbable membranes. Based on application, it is categorized into hospitals and dental clinics. Regionally, the market is divided into Asia Pacific, Europe, North America, and other key regions.

The absorbable membrane segment holds the leading position in the dental repair membranes for implant procedures market, representing approximately 62.0% of total market share in 2025. Absorbable membranes, typically made from collagen or synthetic polymers such as polylactic acid (PLA) and polyglycolic acid (PGA), are designed to degrade naturally within the body after serving their purpose in guided bone regeneration (GBR) and guided tissue regeneration (GTR). Their dominance is attributed to superior biocompatibility, reduced need for secondary surgical removal, and ease of integration with surrounding tissues.

These membranes are widely used in implant dentistry to stabilize bone grafts, prevent soft tissue ingrowth, and support alveolar bone regeneration. The growing preference for bioresorbable materials aligns with advancements in regenerative dental techniques and patient demand for minimally invasive treatment solutions. The non-absorbable membrane segment, comprising materials such as expanded polytetrafluoroethylene (ePTFE), remains in use for complex cases requiring long-term structural stability but accounts for a smaller market share due to additional removal procedures.

Key factors supporting the absorbable membrane segment include:

The hospital segment accounts for approximately 55.0% of the dental repair membranes for implant procedures market in 2025. Hospitals lead this market due to their capacity to handle complex implant surgeries, bone grafting, and regenerative dental procedures requiring multidisciplinary expertise and advanced surgical infrastructure. Institutional procurement frameworks and higher case volumes in hospital-based dental departments contribute significantly to the demand for high-quality regenerative membranes.

The dental clinic segment follows, supported by the growing availability of specialized implantology services in private practices and the rising number of trained implant dentists. Clinics increasingly utilize absorbable membranes for single-tooth and small-area regenerative procedures, though hospital-based care continues to dominate in large or multi-implant cases.

Primary dynamics driving demand from the hospital segment include:

Rising dental implant adoption, increasing demand for bone and tissue regeneration, and advancements in biomaterial technology are driving market growth.

The dental repair membranes for implant procedures market is expanding due to the global increase in dental implant procedures and the corresponding need for guided bone and tissue regeneration. Dental membranes are essential in implantology for separating soft and hard tissues to facilitate bone growth and implant stabilization. The growing prevalence of periodontal diseases, coupled with an aging population seeking restorative treatments, has boosted demand. Technological innovations in resorbable collagen, synthetic polymer, and reinforced composite membranes are improving biocompatibility, healing time, and ease of handling. These advancements are promoting adoption among dental professionals and expanding clinical applications.

High product costs, complex regulatory processes, and limited reimbursement coverage are restraining market adoption.

Dental repair membranes are relatively expensive compared to conventional dental supplies, restricting their accessibility in low- and middle-income regions. The complex manufacturing and regulatory approval processes for medical-grade biomaterials add to overall production costs. Limited insurance coverage for implant-related regenerative procedures further discourages patient uptake. The need for skilled practitioners to ensure precise membrane placement increases procedural complexity and affects clinical outcomes, posing another barrier to widespread use across general dental practices.

Shift toward resorbable membranes, integration of digital workflows, and expansion in emerging markets define the market outlook.

The industry trend is moving toward resorbable and hybrid membranes that eliminate the need for secondary surgeries and improve patient recovery times. Digital imaging and 3D-guided surgical systems are enhancing procedural precision and customization. Growth in emerging regions such as Asia-Pacific and Latin America is supported by improving dental infrastructure, growing disposable income, and rising demand for aesthetic and restorative dental care. Manufacturers are focusing on developing cost-effective, biocompatible solutions to address evolving clinical needs and expand their global presence.

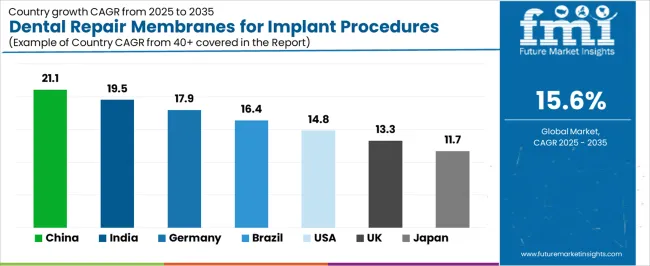

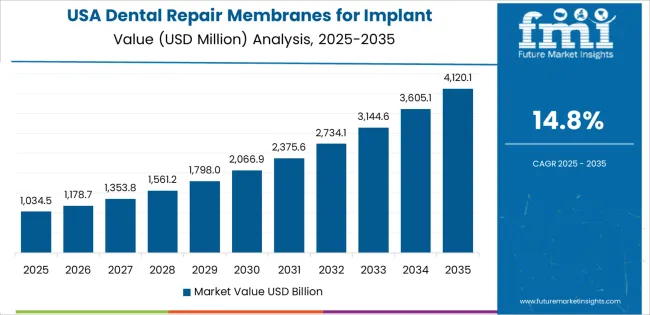

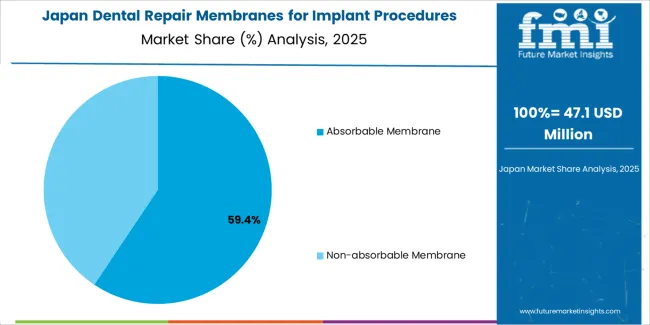

The global dental repair membranes for implant procedures market is expanding rapidly through 2035, supported by advancements in regenerative dentistry, increased implant adoption, and biocompatible material innovation. China leads with a 21.1% CAGR, followed by India at 19.5%, driven by rapid growth in oral healthcare infrastructure and dental implant accessibility. Germany grows at 17.9%, reflecting its leadership in biomaterial research and digital dentistry. Brazil records 16.4%, supported by expanding private clinics and medical tourism. The United States posts 14.8%, benefiting from innovation in collagen and synthetic barrier membranes. The United Kingdom (13.3%) and Japan (11.7%) maintain steady progress through advanced clinical integration and R&D investment in regenerative materials.

| Country | CAGR (%) |

|---|---|

| China | 21.1 |

| India | 19.5 |

| Germany | 17.9 |

| Brazil | 16.4 |

| USA | 14.8 |

| UK | 13.3 |

| Japan | 11.7 |

China’s market grows at 21.1% CAGR, supported by strong demand for implant dentistry, advanced material development, and government-backed healthcare reforms. Domestic dental manufacturers are scaling production of resorbable collagen and synthetic polylactic acid (PLA) membranes used in guided bone regeneration (GBR) and guided tissue regeneration (GTR). Universities and biotechnology firms are collaborating on nanocomposite membranes with improved bioactivity and mechanical strength. Expansion of private dental chains and increased affordability of implant procedures are accelerating adoption. The country’s Healthy China 2030 policy supports local innovation and imports of high-performance dental biomaterials.

Key Market Factors:

India’s market grows at 19.5% CAGR, driven by expanding dental implant adoption, material localization, and cost-effective regenerative dentistry solutions. Domestic dental biomaterial firms are producing resorbable and non-resorbable membranes suitable for GBR procedures. Increased patient awareness and growth in oral rehabilitation procedures contribute to steady demand. Government healthcare initiatives and medical tourism strengthen infrastructure for implantology. Collaboration with international dental suppliers enhances product accessibility and clinical training. The country’s focus on affordable regenerative materials supports growth in both metropolitan and regional dental markets.

Market Development Factors:

Germany’s market grows at 17.9% CAGR, supported by its advanced dental manufacturing ecosystem, regulatory precision, and research excellence in biomaterials. The country leads in the development of xenogeneic and alloplastic membranes with controlled degradation profiles. Integration of digital implant planning with regenerative materials supports precision surgical procedures. German dental companies collaborate with universities to improve collagen membrane porosity and mechanical stability. The market benefits from a strong patient base seeking aesthetic implant restoration. Compliance with EU Medical Device Regulation (MDR) ensures quality assurance and traceability across all regenerative dental products.

Key Market Characteristics:

Brazil’s market grows at 16.4% CAGR, supported by the expansion of private dental clinics, dental tourism, and the introduction of advanced regenerative materials. Domestic suppliers and distributors are importing and producing collagen-based membranes for implant procedures. Universities and dental research centers are conducting clinical trials on resorbable materials suited to local biological conditions. Public health initiatives promoting dental restoration accessibility contribute to long-term growth. The country’s strong presence in cosmetic and restorative dentistry supports continuous demand for guided bone regeneration products.

Market Development Factors:

The United States grows at 14.8% CAGR, supported by advancements in regenerative biomaterials, digital dentistry integration, and clinical adoption of evidence-based implant techniques. Manufacturers are developing next-generation collagen, synthetic polymer, and composite membranes with enhanced resorption control. The market benefits from widespread insurance coverage for dental implants and growing patient demand for minimally invasive bone regeneration. FDA-approved innovations in crosslinked collagen and nanofiber scaffolds are improving osteoconductive performance. Academic and corporate collaborations continue to refine the biological compatibility and structural properties of dental membranes.

Key Market Factors:

The United Kingdom’s market grows at 13.3% CAGR, driven by rising dental implant procedures, clinical training expansion, and bioengineering innovation. National dental networks are adopting biodegradable membranes for predictable implant outcomes. Innovate UK-funded projects support R&D in advanced biopolymers and tissue-compatible scaffolds. Collaboration between academic institutions and dental device companies promotes the commercialization of resorbable and hybrid membrane technologies. Growth is sustained by increased patient preference for long-term, aesthetic implant restorations. The country’s alignment with EU regulatory standards ensures consistent product performance and clinical safety.

Market Development Factors:

Japan’s market grows at 11.7% CAGR, supported by advanced material science research, dental implant adoption, and precision manufacturing. Domestic firms specialize in collagen and synthetic polymer membranes designed for controlled degradation and biocompatibility. The Green Innovation Fund supports R&D in bioresorbable materials for medical and dental applications. Collaborations between universities and dental product manufacturers drive high-performance regenerative product development. The market benefits from rising demand for minimally invasive and aesthetically restorative procedures, supported by Japan’s aging population and high healthcare quality standards.

Key Market Characteristics:

The dental repair membranes for implant procedures market is moderately concentrated, with nearly fifteen global and regional manufacturers specializing in regenerative biomaterials for oral surgery. Geistlich leads the market with an estimated 21.0% global share, supported by its long-established expertise in collagen-based and resorbable membrane technologies. Its leadership is reinforced by strong clinical validation, wide product adoption among implantologists, and partnerships with dental research institutions across Europe, North America, and Asia.

Cook Medical, Zimmer Biomet, and Dentsply Sirona follow as leading competitors, leveraging broad dental implant portfolios and integrated regenerative solutions. Their competitive strengths include biocompatible materials, structural integrity under surgical conditions, and global regulatory compliance. Botiss Biomaterials, Genoss, and ACE Surgical operate as mid-tier players emphasizing innovation in synthetic and xenogenic membranes that offer predictable tissue regeneration and ease of handling.

Asian manufacturers such as Zhenghai Bio-Tech, Beijing Datsing Bio-Tech, and RESHINE-BIO contribute to regional growth through cost-effective membrane production and expanded clinical education initiatives. Bioteck, Dentegris, and Keystone Dental maintain steady positions through reliable supply chains and consistent product performance across multiple implant systems.

Competition in this market centers on biocompatibility, resorption rate, and membrane handling properties rather than pricing alone. Demand is increasing for next-generation collagen and synthetic barrier membranes that enhance guided bone regeneration (GBR) outcomes, reflecting a broader shift toward biologically integrated, minimally invasive implant procedures.

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| Classification | Absorbable Membrane, Non-absorbable Membrane |

| Application | Hospital, Dental Clinic |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Countries Covered | India, China, USA, Germany, South Korea, Japan, Italy, and 40+ countries |

| Key Companies Profiled | Geistlich, Cook Medical, Genoss, Zimmer Biomet, Zhenghai Bio-Tech, Botiss Biomaterials, Dentsply Sirona, ACE Surgical, OraPharma, Neoss Limited, Keystone Dental, Bioteck, Dentegris, ALLGENS MEDICAL, Pashionbio, RESHINE-BIO, Beijing Datsing Bio-Tech |

| Additional Attributes | Dollar sales by classification and application categories; regional adoption trends across Asia Pacific, Europe, and North America; competitive landscape of dental biomaterial and regenerative product manufacturers; advancements in absorbable and non-absorbable barrier membranes; integration with guided bone regeneration and dental implant procedures. |

The global dental repair membranes for implant procedures market is estimated to be valued at USD 1.6 billion in 2025.

The market size for the dental repair membranes for implant procedures market is projected to reach USD 6.8 billion by 2035.

The dental repair membranes for implant procedures market is expected to grow at a 15.6% CAGR between 2025 and 2035.

The key product types in dental repair membranes for implant procedures market are absorbable membrane and non-absorbable membrane.

In terms of application, hospital segment to command 55.0% share in the dental repair membranes for implant procedures market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dental Cavity Filling Materials Market Size and Share Forecast Outlook 2025 to 2035

Dental Imaging Equipment Market Forecast and Outlook 2025 to 2035

Dental Wounds Treatment Market Size and Share Forecast Outlook 2025 to 2035

Dental Radiometer Market Size and Share Forecast Outlook 2025 to 2035

Dental Anaesthetic Market Size and Share Forecast Outlook 2025 to 2035

Dental Diamond Bur Market Size and Share Forecast Outlook 2025 to 2035

Dental Laboratory Market Size and Share Forecast Outlook 2025 to 2035

Dental Matrix Systems Market Size and Share Forecast Outlook 2025 to 2035

Dental Permanent Cements Market Size and Share Forecast Outlook 2025 to 2035

Dental Bleaching Agent Market Size and Share Forecast Outlook 2025 to 2035

Dental Care Products Market Size and Share Forecast Outlook 2025 to 2035

Dental Etching Liquid Market Size and Share Forecast Outlook 2025 to 2035

Dental Sutures Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dental Hygiene Devices Market Size and Share Forecast Outlook 2025 to 2035

Dental Veneers Market Size and Share Forecast Outlook 2025 to 2035

Dental X-Ray Systems Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dental Suction Systems Market Size and Share Forecast Outlook 2025 to 2035

Dental Articulators Market Size and Share Forecast Outlook 2025 to 2035

Dental Fluoride Varnish Market Size and Share Forecast Outlook 2025 to 2035

Dental Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA