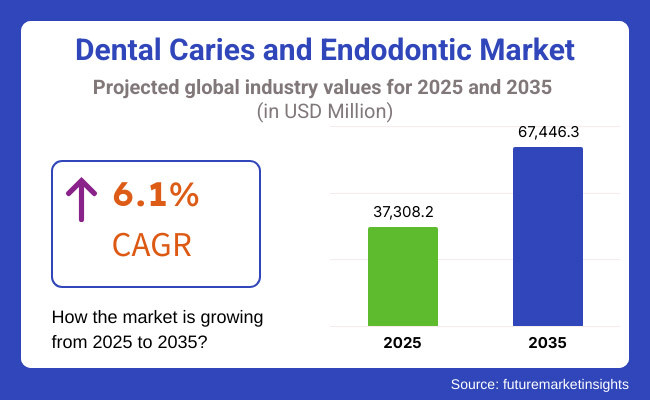

The dental caries and endodontic market is expected to reach USD 37,308.2 million by 2025 and is expected to steadily grow at a CAGR of 6.1% to reach USD 67,446.3 million by 2035. In 2024, dental caries and endodontic market have generated roughly USD 35,163.2 million in revenues.

Dental caries are tooth decay caused due to the action of bacteria, and the demineralization of the tooth structure. Endodontics is a specialty that deals with treating the soft pulp of the teeth, mostly for infection or injury, by methods from root canal treatments.

The higher intake of sugary foods and beverages among general population has increased the incidence of caries. Aging populations in developed countries have dental issues which demands for preventive and therapeutic curb. Greater awareness regarding oral health and availability of state-of-the-art dental technology few of the factors that attribute to the growing adoption of these treatments. Furthermore, increased dental insurance coverage has also motivated patients to opt for early detection and interventions of the disease, which further propels the market growth.

In the years between 2020 and 2024, there were some unprecedented events that contributed to the reasons for employing dental caries and endodontics. The very first effect of the COVID-19 pandemic was the complete disruption of dental care facilities, resulting in an increase in untreated dental conditions like caries and pulp infection. After such an extended duration, when dental clinics started functioning again, another flow of patients moved in to seek preventive and curative care for their postponed treatments. Besides, there was increased concern for general health, as well as for mouth health during the pandemic, which put dental checkups in the front of many people's minds.

Particularly in developed economies, increased coverage under dental insurance in various markets has led to significant growth in adoption of dental care treatments. Moreover, heavy consumption of fast food and sugary snacks among younger population leads to a rise in dental caries, which further propels the increase in demand for restorative and endodontics therapy during the forecast period i.e., 2025 to 2035

New indications show that consumption of candies, soda, and packaged junk foods leads to increase in cases of dental cavities. With a newly spun aging population around the region, most of the restorative-care treatments like root canals would have to be carried out for these patients. More and more patients have greater access to preventive and therapeutic care from better dental insurance coverage, especially in Canada and the USA which further surges its market growth. Moreover, increase in introduction of new technologies such as laser therapy approaches, rotary endodontics, and digital imaging, has caused higher accuracy of procedures which contribute to increase in adoption of these treatment options.

Dental caries and endodontic processes are rapidly increasing in the European region owing to the rising number of people suffering from dental caries. The nature of dental complications in the elderly population of Europe makes them further candidates for endodontic procedures such as root canals. Strong healthcare systems and a majority of countries with a sufficient umbrella of dental coverage contribute to increase in number of dental care to be more accessible. Further technological innovations such as rotary endodontics, digital imaging, and laser-assisted treatment increase the precision, efficiency, and comfort with which such procedures can be undertaken. An increase in oral health awareness among the public, growing awareness for early treatment and diagnosis, leads to further growth of endodontic and dental caries care.

The accelerated process of industrialization and the various changes in diet- which include increased amounts of sugars that are being consumed-tend to be among most common causes of the apparently high prevalence of dental caries. New educational campaigns and government policies have raised awareness levels on oral health, promoting more visits to the dentist's clinic. Furthermore, increasing focus of people towards maintaining their dental aesthetics further anticipate the growth of the market in countries such as India, Thailand, and Malaysia. Furthermore, growing innovation in dental equipment and materials, along with increase in number of private dental clinics further anticipate the growth of the market in the region.

Challenges

Uneven Accessibility to Dental Care Across Regions Hinder its Adoption in the Market

Treatment of dental caries or endodontic therapy is challenged most by the inequalities of dental care delivery between geographical locations, particularly in developing countries and rural communities. Most parts of the Asia-Pacific and Africa and to some extent Latin America suffer from a lack of dental infrastructure, public unawareness about preventive oral care, and high out-of-pocket cost preventive access to early diagnosis and treatment of dental caries. These constraints lead to late treatment, which then in most cases requires more complex and expensive endodontic procedures instead of early treatment. The scenario is further complicated by cultural beliefs, fears of dental treatment, and the low grade that is assigned to dental health vis-à-vis overall health, rendering it impossible to ensure universal acceptance and accessibility of advanced endodontic treatment globally.

Opportunities

Technological Advancements that Enhance Treatment Efficiency and Patient Comfort Poses new Opportunities in the Market

At the moment, technology offers the greatest opportunity in dentistry for dental caries and endodontics. Advances in technology have greatly improved treatment efficacy and comfortability. Apart from that, awareness campaigns are being established to build a connection between general and oral health issues in diseases such as diabetes and cardiovascular disease, leading to more regular visits to the dentist. This, combined with the explosion in dental tourism in developing nations where patients travel across borders to obtain better-quality treatment at lower costs, provides yet another source of growth. Joint efforts of governments, dental associations, and private companies are encouraged to set up preventative oral care programs which in turn will increase market growth by spreading both restorative and preventive care throughout all segments of the population.

Increasing Integration of Digital Dentistry Is Transforming the Dental Caries and Endodontic Market

The growing adoption of digital dentistry is revolutionizing the field of caries/imaging and endodontia by improving diagnosis, treatment planning, and procedural accuracy. The use of imaging modalities such as cone-beam computer tomography (CBCT) and intraoral scanners provides exact visualization of the tooth structures and root canals, improving the precision of treatment. This paradigm shift of technology indicates that dental caries can be diagnosed much earlier, thereby limiting the progression of much more-demanding endodontic treatment.

Rise in Dental Insurance Coverage across Major Markets Anticipates the Growth of the Market

Access to increased dental insurance coverage in some key markets particularly Germany, Switzerland, Nordic Nominations, and other Northern, Central, and West European markets have picked up dental caries treatments and endodontic outlets and escaped these avenues. Dental insurance, covering therapeutic and preventive care, has been included in most developed markets as a main feature. These clients do not face any financial hardship when they attend for check-up, prescribed medications, diagnostic tests including radiographic exposure, sealing of deep grooves, and restorations.

The Growing Emphasis on Minimally Invasive Dentistry is Shaping the Future of Dental Caries and Endodontic Treatments

Dentistry is infusing into the ideas of a new set of ways and strategies towards the treatment for dental caries and endodontic care. More and more dentists are encouraged to opt for the placement of preventive, restorative, conservative biomimetic dentistry using bio-friendly materials that confer the design of disability-free dentistry. In caries and endodontics, minimally invasive technologies such as air abrasion and direct online enamel caries ablation laser could use a minimally invasive laser; handpieces could be engineered to assist less aggressively, contributing toward successful patient acceptance suring market growth.

Rising Demand for Biocompatible and Sustainable Materials is Emerging as a Key Trend in Dental Caries And Endodontic Treatments

A shift to use biocompatible and environmentally friendly materials is growing in importance in the market condition of dental caries and endodontic therapy. Patients and dental professionals are stressing heavily on tooth-colored restorations that are mercury-free, comprising bio ceramics, composites, or glass ionomer technology that are highly aesthetic, biocompatible, and very durable. Endodontics lay claim of bioactive materials like calcosilicate sealers and regenerative treatments for regenerating tissues to enhance healing-associated mechanisms to the healthy dentition and contribute to the growth of the market.

In the face of an uptrend in dental disease prevalence, sugary food intake, and growing oral hygiene awareness, the market for dental caries and endodontics witness steady growth during the years 2020 to 2024. Conversely, the incorporation of technology improvements in diagnostics (AI, CBCT) and treatment methodologies (laser therapy, rotary endodontics) facilitated adoption through those very five years. Between 2025 and 2035, advances on the basis of the ageing population supporting more dental coverage plans and increasing interest in preventive oral health care will further assist the growth of this market. Regenerative endodontics, biocompatible materials, and more minimally invasive techniques for treatment will change the way we treat, while digital dentistry and teledentistry will enable access to treatment, especially in developing countries, further enhancing the market growth.

| Category | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | To emphasize the efficacy, safety, and biocompatibility of dental materials like restorative materials, sealants, or root canal treatment materials, and particularly for the stringent quality control of endodontic instruments and dental adhesives. |

| Technological Advancements | The movement farther away from invasive carious treatment methods focused on enhanced dental imaging capabilities (CBCT) and advanced rotary endodontic instruments. Antibacterial materials such as silver nanoparticles and bioactive glasses gained popularity |

| Consumer Demand | The increased awareness about oral health, the rising significance of cosmetic restorations, and growing demand for pain-free and quick treatment techniques all helped create a demand for high-tech caries treatment and endodontics |

| Market Growth Drivers | Increasing dental consultations due to increased awareness, higher dental insurance coverage, and government programs for preventive dental care have been the drivers for market growth |

| Sustainability | Reducing disposable plastic in dental products, turning packaging of dental products in an environmentally friendly way, and making dental materials more durable to reduce replacements. |

| Category | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Expectedly, approval procedures by 2035 for bioactive materials, regenerative endodontic treatments, and AI-supported diagnostic equipment will accelerate. Smooth product release around the globe might be assured through global harmonization of dental care standards |

| Technological Advancements | Stem cell regenerative dentistry, endodontics with AI, and bespoke 3D-printed dental restorations would all have reached mainstream adoption by 2035, alongside the real-time detection of caries with intelligent sensors |

| Consumer Demand | By 2035, growth will hinge on an aging population in need of sophisticated restorative care, rising forces for preventive and cosmetic dentistry, and the growing propensity for personalized treatment plans based on genetic and lifestyle information. |

| Market Growth Drivers | The market will further expand due to a wider access to advanced technologies in places with emerging economies, greater acceptance of regenerative dental therapies, and a rapid growth in dental tourism for high-quality and cost-effective treatment. |

| Sustainability | Sustainability will imply biodegradable materials for fillings, energy-efficient devices for dental treatments, and circular economies by 2035, where materials from extracted teeth will be reused for research and educational purposes. |

Growing awareness about oral health, increasing trends in cosmetic dentistry, and increasing dental insurances are the upsurge factors at present in the market involving caries and endodontics within the country. Investments continue into regenerative endodontics, intelligent diagnostic equipment, and patient-friendly minimally invasive treatment to drive innovation and robust consumer demand in a technologically advanced dental market.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.2% |

Market Outlook

The endodontic and dental caries markets in Germany are driven by sophisticated dental infrastructure, large insurance coverage, and emphasis on preventive dentistry. Increased usage of digital dentistry like AI-based diagnostics and minimally invasive endodontics, along with an increasing demand for bioactive materials, boosts market prospects; hence, Germany is the leader in dental innovations. Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 4.4% |

Market Outlook

The Indian dental caries and endodontics market is driven primarily by the growth of dental tourism and rising disposable incomes together with improving awareness of oral health. Increasing dental outreach programs and requirements for painless but affordable procedures drive market growth while governments' spending more on inexpensive bioactive materials widen access in rural as well as urban populations.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 4.2% |

China's endodontic and dental care markets greatly benefit from rapid urbanization, increased spending on oral healthcare, and campaigns for government promotion of oral health. Exogenous huge demands for advanced rotary endodontic instruments, novel material domestic production, and AI-assisted diagnostics expansion will make China a technology-driven rapidly growing dental market.

Market Growth Drivers

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 5.1% |

This segment of market is mostly driven by the elderly population of Japan. Their demand for advanced restorations and root canal treatments is fueling the demand for endodontic and dental caries services. Parallel imaging high advance technology, keenly interested patients in minimally invasive procedures, and a strong emphasis on retention of the natural teeth by using bioactive and regenerative materials are the trends that usher this highly developed and prevention-driven market economy.

Market Growth Drivers

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.8% |

Dental Restoration segment dominates the Dental Caries and Endodontic market due to the high global prevalence

The Dental Restoration segment is the most lucrative segment in the Dental Caries and Endodontics market due to the high worldwide prevalence of dental caries, which require filling, crowning and inlaying restore treatments as well as aesthetics-oriented tooth-colored restorations. Development of therapy and biocatalyst-containing materials, such as bioactive fillings that release fluoride and provide strength augmentation with therapeutic properties, has pushed this market into leadership position. Moreover, with the growing awareness and availability of dental services widespread, especially in developed countries, the demand for restoration treatments is likely to increase further and hence strengthen the hold of the industry, as treatment for both function-oriented and aesthetic restoration is sought by patients for dental caries and loss of tooth structure.

Endodontic segment holds a significant share owing to its, necessitating root canal treatment

The increasing recognition of the significance of retaining natural teeth has paved the way for greater acceptance for endodontic treatment than extraction. Using advanced technology such as rotary endodontic instruments, CBCT-assisted procedures, and bioceramic sealers has absolutely sophisticated treatment outcome and accuracy, thus, contributing more to the attractiveness of these processes. Another instance is the urgent need for endodontic treatments in the elderly due to increased cases of dental trauma. Furthermore, another noticeable advancement regarding awareness about preventive dentistry is actually encouraging the rising trend toward endodontic treatments, mainly through earlier diagnosis. Hence, today's dental healthcare makes the endodontic segment quite a considerable part of the market.

Specialized Dental Hospitals dominate the Dental Caries and Endodontic market due to their comprehensive infrastructure

Advanced or specialized Dental Hospitals have access to high-tech diagnostic devices, such as cone-beam computed tomography (CBCT) and intraoral scanners that they can use because they are situated within a multidisciplinary premise. The advanced services these specialized hospitals offer include complex root canal treatment and total oral rehabilitation; patients who pay for such very expensive treatments are considered high-end treatment seekers. These hospitals also happen to have very good insurance partner associations with them to enable the patients to afford such expensive treatments easily. With high patient capacity, provision applicable specialized treatment for complicated or recurrent caries cases, and improved infection control, these hospitals have consolidated their hold in the worldwide market for dental treatment.

Independent Dental Clinics are growing rapidly in the Dental Caries and Endodontic market due to their widespread presence

Independent Dental Clinics offer services that are becoming increasingly attractive to a new generation embracing new advancements in technology, such as digital imaging, rotary endodontics, and AI-based diagnostics, for improved treatment accuracy. As more patients desire easy access to community-level health services, there will be increased visits to independent clinics, especially for preventive and restorative dental care. Additionally, independent clinics benefit from increased awareness regarding early caries detection encouraging frequent checkups.

The Dental Caries & Endodontic market remains highly competitive with dental diseases being the main driver, newer technologies bettering the mood of patients wanting aesthetic durable restorations. Among competing offers, the more bioactive and less invasive materials for restoration and endodontics, and AI-based diagnostics would hold sway over others. Competing companies are busy developing faster and cheaper solutions in root canal treatment and durable restorative solutions. Strategic alliances with dental chain groups, research institutions, and technology companies lend product validation support and carry professional education into the bargain. Insurance support, compliance with, digital workflows, and differentiation with innovative biomaterials are the key forces that drive market leadership and competitive positioning.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Dentsply Sirona Inc. | 32.6% - 36.5% |

| 3M Company | 20.4% - 22.6% |

| Coltene Group | 15.1% - 17.2% |

| SHOFU Inc. | 4.6% - 6.8% |

| Other Companies (combined) | 12.1% - 15.4% |

Key Company Developments and Activities

| Company Name | Key Offerings/Activities |

|---|---|

| Dentsply Sirona Inc. | Dentsply Sirona has innovative products like bioactive restorative materials, rotary systems for endodontics, and digital imaging for early detection of caries. It also devotes a large part of its resources to the training and education program of dental professionals |

| 3M Company | 3M sponsors joint research with universities in creating technologies for caries prevention such as fluoride-releasing materials and intelligent diagnostics. |

| Coltene Group | Coltene is an eminent key-player in the endodontic segment and provides full-fledged solutions such as obturation materials, endodontic files, and sealing products |

| SHOFU Inc. | SHOFU Inc. is involved in the design and manufacture of restorative and preventive dental materials, focusing on aesthetic treatment of caries. |

The overall market size for dental caries and endodontic market was USD 37,308.2 million in 2025.

The dental caries and endodontic market is expected to reach USD 67,446.3 million in 2035.

Increase in number of population suffering from dental caries anticipates the growth of the medical bionic implant and artificial organs market.

The top key players that drives the development of dental caries and endodontic market are Dentsply Sirona Inc., 3M Company, Coltene Group, SHOFU Inc. and Essential Dental Systems Inc.

Dental Restoration segment by product is expected to dominate the market during the forecast period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 4: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 7: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 10: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 11: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 12: Western Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 13: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 15: Eastern Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 16: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 18: South Asia and Pacific Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 19: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 21: East Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 22: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 23: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 24: Middle East and Africa Market Value (US$ Million) Forecast by End User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 13: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 14: Global Market Attractiveness by End User, 2023 to 2033

Figure 15: Global Market Attractiveness by Region, 2023 to 2033

Figure 16: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 17: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 18: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 19: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 20: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 21: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 23: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 24: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 28: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 29: North America Market Attractiveness by End User, 2023 to 2033

Figure 30: North America Market Attractiveness by Country, 2023 to 2033

Figure 31: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 32: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 33: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 34: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 35: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 36: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 38: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 39: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 41: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 42: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 43: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 44: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 45: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 46: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 47: Western Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 48: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 49: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 50: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 51: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 52: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 53: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 54: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 56: Western Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 57: Western Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 58: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 59: Western Europe Market Attractiveness by End User, 2023 to 2033

Figure 60: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 61: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 62: Eastern Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 63: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 64: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 65: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 66: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 67: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 68: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 69: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 70: Eastern Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 71: Eastern Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 72: Eastern Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 73: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 74: Eastern Europe Market Attractiveness by End User, 2023 to 2033

Figure 75: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 76: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 77: South Asia and Pacific Market Value (US$ Million) by End User, 2023 to 2033

Figure 78: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 81: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 82: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 83: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 84: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 85: South Asia and Pacific Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 86: South Asia and Pacific Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 87: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 88: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 89: South Asia and Pacific Market Attractiveness by End User, 2023 to 2033

Figure 90: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 91: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: East Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 93: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 96: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 97: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 98: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 99: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 100: East Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 101: East Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 102: East Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 103: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 104: East Asia Market Attractiveness by End User, 2023 to 2033

Figure 105: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 106: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 107: Middle East and Africa Market Value (US$ Million) by End User, 2023 to 2033

Figure 108: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 109: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 110: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 111: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 112: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 113: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 114: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 115: Middle East and Africa Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 116: Middle East and Africa Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 117: Middle East and Africa Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 118: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 119: Middle East and Africa Market Attractiveness by End User, 2023 to 2033

Figure 120: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dental Repair Membranes for Implant Procedures Market Size and Share Forecast Outlook 2025 to 2035

Dental Cavity Filling Materials Market Size and Share Forecast Outlook 2025 to 2035

Dental Implant and Prosthetic Market Size and Share Forecast Outlook 2025 to 2035

Dental Imaging Equipment Market Forecast and Outlook 2025 to 2035

Dental Wounds Treatment Market Size and Share Forecast Outlook 2025 to 2035

Dental Radiometer Market Size and Share Forecast Outlook 2025 to 2035

Dental Anaesthetic Market Size and Share Forecast Outlook 2025 to 2035

Dental Diamond Bur Market Size and Share Forecast Outlook 2025 to 2035

Dental Laboratory Market Size and Share Forecast Outlook 2025 to 2035

Dental Matrix Systems Market Size and Share Forecast Outlook 2025 to 2035

Dental Permanent Cements Market Size and Share Forecast Outlook 2025 to 2035

Dental Bleaching Agent Market Size and Share Forecast Outlook 2025 to 2035

Dental Care Products Market Size and Share Forecast Outlook 2025 to 2035

Dental Etching Liquid Market Size and Share Forecast Outlook 2025 to 2035

Dental Sutures Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dental Hygiene Devices Market Size and Share Forecast Outlook 2025 to 2035

Dental Implantology Software Market Analysis - Size, Growth, & Forecast Outlook 2025 to 2035

Dental Veneers Market Size and Share Forecast Outlook 2025 to 2035

Dental X-Ray Systems Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dental Suction Systems Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA