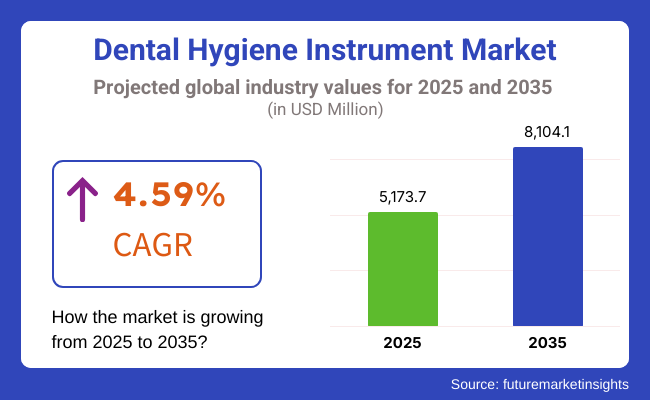

The growth potential of the dental hygiene instrument market will be immense from 2025 to 2035 due to increasing oral health awareness and advances in dental technology, not to mention the elderly requiring dental care. The market is expected to account for a valuation of USD 5173 million in 2025 and then expand to approximately USD 8104 million by 2035, with a CAGR of 4.59% during this period.

Some growth drivers include increasing dental disorders' prevalence, such as periodontitis and cavities; increased investments in dental infrastructure; and the uptake of new dental hygiene equipment like ultrasonic scaler machines and smart toothbrushes. Some of these new emerging opportunities for market players will include eco-friendly and biodegradable dental instruments and increased adoption of home-based oral hygiene solutions.

High costs associated with advanced dental instruments, regulatory complexities in medical device approvals, and lack of access to modern dental care in certain regions. Stringent regulatory requirements for new dental technologies add to the cost and time required for product approvals, slowing down innovation and entry.

Technological advancements in dental instruments, increased adoption of AI and automation in dental procedures, and rising consumer demand for eco-friendly and sustainable dental hygiene solutions. Emerging markets, especially in Asia and Latin America, present a lucrative growth opportunity with a growing investment in dental care infrastructure and consumer education.

According to the World Health Organization, oral diseases are among the most prevalent diseases globally, affecting nearly half the world's population. Furthermore, the rise of digital dentistry such as teledentistry and remote dental consultations is providing new channels for growth as they provide more accessible access to professional dental care for underserved populations.

This includes designing ultrasonic scalers that increase efficacy and minimize patient discomfort in the dental office. Embracing innovation, new-gen ultrasonic devices have become advanced with precision, design, low noise, and patient comfort. AI powered toothbrush manufacturers and real-time oral health tracking devices are transforming oral health at home. Smart toothbrush is an example which has sensors that can predict and access the provided oral care, it even helps to improve oral health care.

Governments regulate dental instruments through regulatory agencies and other health regulator arms to ensure compliance with health regulations. The increasing usage of sterilization and infection control guidelines are anticipated to register the highest CAGR growth for the current forecast period.

The period spanning 2020 to 2024 saw steady growth in the dental hygiene instrument market, driven by the increasing awareness of oral health, rising incidences of periodontal diseases, and the greater adoption of professional dental cleaning tools. The demand for ultrasonic scalers, hand instruments, and electric toothbrushes rose with changing trends toward improved dental care practices and preventive dentistry.

Innovations such as AI-integrated smart toothbrushes and antimicrobial-coated instruments improved efficiency and patient outcome. However, hindrances to the industry included the high cost of the advanced instruments, regulatory compliance on infection control, as well as supply chain disruptions hindering the availability of dental equipment.

In 2025 to 2035, AI-enabled dental hygiene tools, smart self-cleaning instruments, and sustainable materials for dental care products will drive the landscape. The regulatory authorities shall enforce stricter hygiene as well as sterilization regulations on reusable instruments for patient safety. The second aspect of sustainability would promote the use of biodegradable and recyclable dental instruments, while increased automation will improve efficiency in professional cleanings.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| FDA and CE approvals focused on infection control and sterilization of reusable instruments. Increased regulations on antimicrobial coatings. | Stricter global regulations on reusable instrument sterilization. AI-integrated hygiene tools require compliance with digital health standards. |

| Growth in ultrasonic scalers, ergonomic hand instruments, and antimicrobial coatings. Introduction of AI-powered smart toothbrushes. | AI-driven dental hygiene automation enhances cleaning precision. Development of self-sterilizing dental instruments and bioactive materials for plaque prevention. |

| High demand for electric toothbrushes, professional scalers, and flossing devices. Increasing preference for home-use dental hygiene innovations. | Increased adoption of AI-powered toothbrushes with personalized feedback. Expansion of minimally invasive dental hygiene tools for at-home and clinical use. |

| Rising awareness of oral health, increasing prevalence of periodontal diseases, and expansion of professional dental care services. | Growth in smart dental care, integration of nanotechnology in hygiene tools, and AI-powered diagnostics for oral disease prevention. |

| Some manufacturers introduced biodegradable toothbrushes and recyclable floss picks. Efforts to reduce plastic waste in dental care products. | Widespread adoption of biodegradable dental instruments. AI-optimized production reduces material waste and improves supply chain sustainability. |

| Dependence on dental instrument manufacturers in North America, Europe, and Asia. Supply chain disruptions impacted product availability. | Growth in localized production to reduce environmental impact. AI-driven supply chain automation enhances inventory management. |

Role of Ergonomic Instrument Designs and Antimicrobial Coatings in Purchasing Decisions

Lightweight and balanced handles with wider grips and textured surfaces have enabled the use of silicone or resin-coated readymade handles, which provides more comfort and better control, and leads to more frequent use. More than 60% of dental professionals suffer from hand strain, making it important to consider ergonomics when choosing instruments.

Silver-ion and copper-based treatments, for example, are types of antimicrobial coatings that reduce bacterial adhesion and cross-contamination. These coatings, which are made using expensive raw materials with rigorous sterilization procedures, will find increasing usage as infection control measures, especially in high dental volume practices and teaching institutions, driving demand for instruments with ergonomic and microorganism-resistant properties.

Purchasing Decisions based on Reusable vs Disposable Dental Hygiene Tools

Reusable stainless steel instruments are still the gold standard for durability and cost-effectiveness but must be regularly sterilized and maintained. Disposable instruments, commonly used in infection-prone environments such as mobile medical units or nursing homes, entirely remove any risk of cross-contamination but are more expensive in the long term.

Tightened post-COVID infection control regulations have also raised demand for single-use hygiene kits and plastic-free disposables. One of the most dominant trends in modern dental practices is a hybrid approach that uses a combination of reusable (rotary) and disposable tools that match the requirements of a procedure.

| Key Factors | Details |

|---|---|

| Key Buyers | General dentists, dental hygienists, periodontists, orthodontists, endodontists, dental schools, hospitals, mobile dental clinics, government healthcare programs, and dental supply distributors. |

| Top Features End Users Look At | Scalpel-sharp cutting edges for scalers and curettes, ergonomic lightweight handles to reduce hand strain, corrosion-resistant stainless steel or titanium coating for longevity, easy sterilization compatibility (autoclave safe), antimicrobial coatings for infection control, and color-coded instruments for procedure differentiation. |

| Top Concerns of End Users | Manual instruments need sharpened often, due to wear after re-sterilization instruments can break or get worn down, manual instruments must comply with regulatory standards in infection control, there is a shortage of ecologically friendly disposable options, and the application of ultrasonic scalers to existing dental units is challenging. |

| Pricing Influence among End Users | Cost vs. longevity - dentists know it well, and see it every day in their chairs, with premium brands filling their high-end clinics. Individual practitioners seek cost-effective yet durable instruments, while group dental practices and hospitals prefer bulk buying. Buying decisions are affected by the warranty, sharpening services, and trade-in programs. |

| Preferred Distribution Channels | Dentists primarily obtain instruments from authorized dental distributors, directly from manufacturers, online marketplaces and dental trade shows. Big clinics and hospitals negotiate bulk contracts, while independent practitioners favor flexible ordering options and discounts. |

| Countries | CAGR (2024 to 2034) |

|---|---|

| United States | 3.7% |

| Germany | 4.5% |

| India | 9.4% |

The growth in the USA is attributed to growing awareness of oral health and preventive care in keeping teeth healthy. Understanding the causes of dental disease, progress in the use of more sophisticated dental instruments, and the growth of an aging population all help with this increase. The other factors include advancing technology in digital advancements such as intraoral scanners and systems for computer-aided design and computer-aided manufacturing (CAD/CAM), which improve diagnostic accuracy and treatment outcomes, helping to drive growth.

Growth Factors in the USA

| Key Factor | Details |

|---|---|

| Rising Prevalence of Dental Diseases | Rising prevalence of dental caries and periodontal diseases propels the need for advanced tools. |

| Technological Advancements | Technological advances like 3D printing and digital imaging all improve treatment accuracy and patient outcomes. |

| Aging Population | An expanding geriatric population will require frequent dental care, which will drive demand for hygiene instruments. |

| Preventive Care Focus | A movement towards preventative dentistry will encourage more regular check-ups and cleanings, increasing instrument consumption. |

| Professional Dental Services Demand | Rising demand for professional dental cleaning and maintenance services supports market growth. |

The market is well positioned to expand regarding dental hygiene instruments. This is compounded by the excellent health infrastructure in place to back high-quality dental care. The reasons behind the optimistic outlook for this market are the increasing incidences of dental diseases among the people, the increasing number of the aging population, and the emergence of technological innovations in dental instruments.

Furthermore, top dental instrument manufacturers in the country combined with a strong interest in research and development toward dental technologies play paramount roles in pushing the growth of this market.

Growth Factors in Germany

| Key Factor | Details |

|---|---|

| Advanced Healthcare System | Germany has a well-established healthcare infrastructure, which ensures that patients have a rapid access to high quality dental care, thus driving demand of hygiene instruments. |

| High Dental Disease Prevalence | Craniofacial diseases are among most prevalent diseases in the world, and the demand for hygiene instruments is expected to increase significantly. |

| Technological Innovation | Innovations in dental technology keep improving the efficiency and efficacy of hygiene tools. |

| Aging Demographic | Increasing geriatric population base leads to a surge in demand for specific dental hygiene instruments as they need certain types of dental care. |

| Strong Manufacturing Base | Germany hosts major dental instrument manufacturers, ensuring market availability and fostering innovation. |

The robustness of the Indian dental hygiene instrument market is on account of the intensifying awareness around oral health, growing disposable income, and better access to dental health services. Such factors include a big base population, higher incidence rates of dental diseases, and government initiatives regarding the promotion of oral health among the public. In addition, upsurge in dental tourism coupled with setting up of state-of-the-art dental clinics laced with modern instruments are promising ventures for the future of this market.

Growth Factors in India

| Key Factor | Details |

|---|---|

| Large Population Base | A large population means an expansive potential customer base for dental hygiene products and services |

| Rising Oral Health Awareness | Increased demand for instruments is attributed to public awareness programs educating patients about proper dental hygiene. |

| Economic Growth | Increased disposable income allows consumers to spend more on dental care and hygiene product. |

| Government Initiatives | The market growth is supported by national oral health programs and subsidies administered to better access dental care. |

| Dental Tourism | Increasing demand for good quality dental hygiene instruments owing to India having a recognized status as dental tourism, is also projected to drive the market over the forecast period. |

Japan's dental hygiene instrument market is expanding, influenced by an aging population, high standards of oral healthcare, and technological advancements. The market is projected to grow at a CAGR of 4.5% from 2024 to 2034.

The country's focus on preventive dental care and the integration of advanced technologies, such as laser dentistry and digital imaging, are key drivers. Moreover, government healthcare policies supporting dental health and the presence of skilled dental professionals further enhance market growth.

Growth Factors in Japan

| Key Factor | Details |

|---|---|

| Aging Population | The rise in the ageing population intensifies the need for dental care and hygiene instruments. |

| Preventive Care Emphasis | There is a strong cultural emphasis on preventive dentistry that leads to frequent dental visits and more frequent instrument use. |

| Technological Adoption | The integration of advanced dental technologies enhances treatment precision and efficiency. |

| Government Support | The market size is driven by favorable policies and oral health initiative. |

| Skilled Workforce | A skilled dental workforce is essential in making quality care and professional hygiene instruments increasingly adopted in children's clinics. |

The dental hygiene instrument market in Brazil is experiencing growth due to increasing awareness of oral health, a rise in disposable incomes, and government efforts to improve access to dental care. The Brazilian population has a high prevalence of dental caries and periodontal diseases, driving demand for both preventive and curative dental instruments.

The expansion of private dental clinics, along with government-backed initiatives such as the "Brasil Sorridente" program, has improved access to professional dental care. Moreover, the rise of cosmetic dentistry and a strong cultural emphasis on aesthetic appearance further propel the demand for advanced hygiene instruments.

Growth Factors in Brazil

| Key Factor | Details |

|---|---|

| High Prevalence of Dental Diseases | Oral health problems are prevalent, leading to a higher need for hygiene instruments. |

| Government Oral Health Initiatives | Initiatives such as Brasil Sorridente increase access to dental care, spurring the demand for instruments from professionals. |

| Growth of Private Dental Clinics | The growth of private dental practices increases access to and adoption of high-quality dental tools. |

| Increasing Disposable Income | Higher income levels lead to increased spending for preventive and professional dental care. |

| Cosmetic Dentistry Trend | The increasing demand for aesthetic and teeth whitening procedures is further expected to accelerate the industry for specialized dental hygiene instruments. |

Dental scaler instruments are among the most popular applications for hygiene instruments that are essential in plaque, tartar, and calculus buildup arrests on tooth surfaces and below the gumline. North America and Europe still dominate due to the high public awareness of oral health, regular visits to the dentist, and a good adoption of advanced scaling technologies.

However, demand is rising within Asia-Pacific owing to growing preventive focus in dental care and more expansion of dental clinics. Future trends include AI-integrated scalers for precision cleaning, ergonomic scaler designs for enhanced comfort, and antimicrobial coatings for cross-contamination prevention.

From cavity preparation and scaling to polishing, an array of dental procedures is performed using dental handpieces, which makes them another lucrative segment to invest in. The increasing demand for electric and air-driven handpieces is attributable to the high accuracy and efficiency that these handpieces afford in carrying out procedures, as well as added comfort for patients. Other handpieces equipped with the latest fiber optics and LED systems improve visibility and accuracy during procedures, thus decreasing treatment time.

In North America and Europe, the adoption of advanced dental equipment and strict infection control protocols justify their dominance in this segment, whereas the Asia-Pacific region is expected to experience high growth owing to increasing disposable incomes, growth in dental tourism, as well as high investments in dental clinics. Future innovation pathways include smart handpieces with real-time diagnostics, cordless handpieces using wireless power transfer capabilities, and AI-driven automation to increase precision of treatment in dental procedures.

Periodontitis is becoming more widespread, general awareness of oral hygiene is on the rise, and preventive dentistry is gaining ground, fuelling demand for scaling and cleaning instruments. The developed regions North America and Europe lead the segment because of regular professional visits for dental care and strong insurance cover for preventive care as opposed to flourishing growth in Asia-Pacific arising out of rising oral health awareness and increased access to professional dental care.

Trends of the future may bring along AI-powered ultrasonic scalers, laser-assisted cleaning systems, and smart oral-hygiene instruments for personalized dental-care recommendations.

Growing incidence of periodontal diseases, an increasing geriatric population, and rising consumer demand for nonsurgical periodontal treatment are some of the factors contributing to the market's growth. Periodontal care adoption is high in North America and Europe due to their awareness and accessibility of specialized periodontists, while the developing Asia-Pacific region is rapidly progressing because of governmental oral health initiatives coupled with growing investments in dental infrastructure. Future innovations would include laser-assisted periodontal therapy, smart probes with real-time bacterial detection, and biodegradable antimicrobial periodontal treatments.

The dental hygiene instrument industry is highly competitive, with key global players and emerging brands driving innovation and growth. Increasing awareness of oral health, technological advancements in dental tools, and growing demand for professional and at-home dental care solutions have fueled significant expansion.

Companies are investing in ultrasonic scalers, smart toothbrushes, and ergonomic dental hand instruments to maintain a competitive edge. The landscape is shaped by well-established dental equipment manufacturers and oral care brands, each contributing to the evolving landscape of dental hygiene solutions.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Dentsply Sirona | 22-26% |

| Hu-Friedy (Cantel Medical) | 18-22% |

| Colgate-Palmolive | 10-14% |

| Procter & Gamble (Oral-B) | 8-12% |

| Young Innovations, Inc. | 5-9% |

| Other Companies (combined) | 25-35% |

| Company Name | Key Offerings/Activities |

|---|---|

| Dentsply Sirona | Provides a wide range of dental hygiene instruments, including ultrasonic scalers, hand instruments, and air polishing devices, focusing on professional dental care. |

| Hu-Friedy (Cantel Medical) | Offers high-quality dental hand instruments, hygiene scalers, and periodontal tools, emphasizing durability and ergonomic designs. |

| Colgate-Palmolive | Develops consumer oral care products, including electric toothbrushes, flossing tools, and professional dental hygiene solutions. |

| Procter & Gamble (Oral-B) | Specializes in smart toothbrushes and advanced oral hygiene solutions, integrating AI technology for personalized dental care. |

| Young Innovations, Inc. | Manufactures preventive dental care products, including prophy angles, handpieces, and fluoride varnishes for dental professionals. |

Key Company Insights

Other Key Players (25-35% Combined)

The landscape is segmented based on product type into Periodontal Probes, Dental Hand Instruments, Dental Handpieces, Tongue Deplaquing Tools, Air Polishing Systems, Prophy Angles, Dental Scalers, Mouth Mirrors, and Accessories & Consumables.

The application segmentation includes Oral Examination, Periodontal Care, Restorative Care, Scaling and Cleaning, Orthodontic Care, and Fluoride & Sealant Application.

The lanscape is divided into Disposable and Reusable dental hygiene instruments.

The end user includes Hospitals, Dental Clinics, Group Dental Practices, Ambulatory Centers, and Academic & Research Institutions.

Geographically, the market is segmented into North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, and the Middle East & Africa.

The market is expected to reach USD 5,173.7 million in 2025.

The dental hygiene instrument market is expected to garner a revenue of USD 8,104.1 million in 2035.

Rising awareness about oral health, increasing dental disorders, advancements in dental technology, and growing demand for preventive dental care will propel the market.

The leading companies in the dental hygiene instrument market include Dentsply Sirona, Hu-Friedy (Cantel Medical), Colgate-Palmolive, Procter & Gamble (Oral-B), and Young Innovations, Inc.

Scaling instruments and ultrasonic scalers are expected to command a significant share over the assessment period.

Table 01: Global Market Value (US$ Million) Analysis and Forecast 2018 to 2034, by Product

Table 02: Global Market Volume (Units) Analysis and Forecast 2018 to 2034, by Product

Table 03: Global Market Value (US$ Million) Analysis and Forecast 2018 to 2034, by Application

Table 04: Global Market Value (US$ Million) Analysis and Forecast 2018 to 2034, by Usage

Table 05: Global Market Value (US$ Million) Analysis and Forecast 2018 to 2034, by End User

Table 06: North America Market Value (US$ Million) Analysis 2017-2021 and Forecast 2024 to 2034, by Country

Table 07: North America Market Value (US$ Million) Analysis and Forecast 2018 to 2034, by Product

Table 08: North America Market Volume (Units) Analysis and Forecast 2018 to 2034, by Product

Table 09: North America Market Value (US$ Million) Analysis and Forecast 2018 to 2034, by Application

Table 10: North America Market Value (US$ Million) Analysis and Forecast 2018 to 2034, by Usage

Table 11: North America Market Value (US$ Million) Analysis and Forecast 2018 to 2034, by End User

Table 12: Latin America Market Value (US$ Million) Analysis 2017-2021 and Forecast 2024 to 2034, by Country

Table 13: Latin America Market Value (US$ Million) Analysis and Forecast 2018 to 2034, by Product

Table 14: Latin America Market Volume (Units) Analysis and Forecast 2018 to 2034, by Product

Table 15: Latin America Market Value (US$ Million) Analysis and Forecast 2018 to 2034, by Application

Table 16: Latin America Market Value (US$ Million) Analysis and Forecast 2018 to 2034, by Usage

Table 17: Latin America Market Value (US$ Million) Analysis and Forecast 2018 to 2034, by End User

Table 18: East Asia Market Value (US$ Million) Analysis 2017-2021 and Forecast 2024 to 2034, by Country

Table 19: East Asia Market Value (US$ Million) Analysis and Forecast 2018 to 2034, by Product

Table 20: East Asia Market Volume (Units) Analysis and Forecast 2018 to 2034, by Product

Table 21: East Asia Market Value (US$ Million) Analysis and Forecast 2018 to 2034, by Application

Table 22: East Asia Market Value (US$ Million) Analysis and Forecast 2018 to 2034, by Usage

Table 23: East Asia Market Value (US$ Million) Analysis and Forecast 2018 to 2034, by End User

Table 24: South Asia & Pacific Market Value (US$ Million) Analysis 2017-2021 and Forecast 2024 to 2034, by Country

Table 25: South Asia & Pacific Market Value (US$ Million) Analysis and Forecast 2018 to 2034, by Product

Table 26: South Asia & Pacific Market Volume (Units) Analysis and Forecast 2018 to 2034, by Product

Table 27: South Asia & Pacific Market Value (US$ Million) Analysis and Forecast 2018 to 2034, by Application

Table 28: South Asia & Pacific Market Value (US$ Million) Analysis and Forecast 2018 to 2034, by Usage

Table 29: South Asia & Pacific Market Value (US$ Million) Analysis and Forecast 2018 to 2034, by End User

Table 30: Western Europe Market Value (US$ Million) Analysis 2017-2021 and Forecast 2024 to 2034, by Country

Table 31: Western Europe Market Value (US$ Million) Analysis and Forecast 2018 to 2034, by Product

Table 32: Western Europe Market Volume (Units) Analysis and Forecast 2018 to 2034, by Product

Table 33: Western Europe Market Value (US$ Million) Analysis and Forecast 2018 to 2034, by Application

Table 34: Western Europe Market Value (US$ Million) Analysis and Forecast 2018 to 2034, by Usage

Table 35: Western Europe Market Value (US$ Million) Analysis and Forecast 2018 to 2034, by End User

Table 36: Eastern Europe Market Value (US$ Million) Analysis 2017-2021 and Forecast 2024 to 2034, by Country

Table 37: Eastern Europe Market Value (US$ Million) Analysis and Forecast 2018 to 2034, by Product

Table 38: Eastern Europe Market Volume (Units) Analysis and Forecast 2018 to 2034, by Product

Table 39: Eastern Europe Market Value (US$ Million) Analysis and Forecast 2018 to 2034, by Application

Table 40: Eastern Europe Market Value (US$ Million) Analysis and Forecast 2018 to 2034, by Usage

Table 41: Eastern Europe Market Value (US$ Million) Analysis and Forecast 2018 to 2034, by End User

Table 42: Middle East & Africa Market Value (US$ Million) Analysis 2017-2021 and Forecast 2024 to 2034, by Country

Table 43: Middle East & Africa Market Value (US$ Million) Analysis and Forecast 2018 to 2034, by Product

Table 44: Middle East & Africa Market Volume (Units) Analysis and Forecast 2018 to 2034, by Product

Table 45: Middle East & Africa Market Value (US$ Million) Analysis and Forecast 2018 to 2034, by Application

Table 46: Middle East & Africa Market Value (US$ Million) Analysis and Forecast 2018 to 2034, by Usage

Table 47: Middle East & Africa Market Value (US$ Million) Analysis and Forecast 2018 to 2034, by End User

Figure 1: Global Market Volume (Units), 2018 to 2023

Figure 2: Global Market Volume (Units) & Y-o-Y Growth (%) Analysis,

Figure 3: Market , Pricing Analysis per unit (US$), in 2022

Figure 4: Market , Pricing Forecast per unit (US$), in 2034

Figure 5: Global Market Value (US$ Million) Analysis, 2018 to 2023

Figure 6: Global Market Forecast & Y-o-Y Growth, 2024 to 2034

Figure 7: Global Market Absolute $ Opportunity (US$ Million) Analysis, 2023 to 2034

Figure 8: Global Market Value Share (%) Analysis 2023 to 2034, by Product

Figure 9: Global Market Y-o-Y Growth (%) Analysis 2023 to 2034, by Product

Figure 10: Global Market Attractiveness Analysis 2024 to 2034, by Product

Figure 11: Global Market Value Share (%) Analysis 2023 to 2034, by Application

Figure 12: Global Market Y-o-Y Growth (%) Analysis 2023 to 2034, by Application

Figure 13: Global Market Attractiveness Analysis 2024 to 2034, by Application

Figure 14: Global Market Value Share (%) Analysis 2023 to 2034, by Usage

Figure 15: Global Market Y-o-Y Growth (%) Analysis 2023 to 2034, by Usage

Figure 16: Global Market Attractiveness Analysis 2024 to 2034, by Usage

Figure 17: Global Market Value Share (%) Analysis 2023 to 2034, by End User

Figure 18: Global Market Y-o-Y Growth (%) Analysis 2023 to 2034, by End User

Figure 19: Global Market Attractiveness Analysis 2024 to 2034, by End User

Figure 20: Global Market Value Share (%) Analysis 2023 to 2034, by Region

Figure 21: Global Market Y-o-Y Growth (%) Analysis 2023 to 2034, by Region

Figure 22: Global Market Attractiveness Analysis 2024 to 2034, by Region

Figure 23: North America Market Value (US$ Million) Analysis, 2018 to 2023

Figure 24: North America Market Value (US$ Million) Forecast, 2023 to 2034

Figure 25: North America Market Value Share, by Product (2024 E)

Figure 26: North America Market Value Share, by Application (2024 E)

Figure 27: North America Market Value Share, by Usage (2024 E)

Figure 28: North America Market Value Share, by End User (2024 E)

Figure 29: North America Market Value Share, by Country (2024 E)

Figure 30: North America Market Attractiveness Analysis by Product, 2024 to 2034

Figure 31: North America Market Attractiveness Analysis by Application, 2024 to 2034

Figure 32: North America Market Attractiveness Analysis by Usage, 2024 to 2034

Figure 33: North America Market Attractiveness Analysis by End User, 2024 to 2034

Figure 34: North America Market Attractiveness Analysis by Country, 2024 to 2034

Figure 35: USA Market Value Proportion Analysis, 2023

Figure 36: Global Vs. USA Growth Comparison, 2023 to 2034

Figure 37: USA Market Share Analysis (%) by Product, 2023 to 2034

Figure 38: USA Market Share Analysis (%) by Application, 2023 to 2034

Figure 39: USA Market Share Analysis (%) by Usage, 2023 to 2034

Figure 40: USA Market Share Analysis (%) by End User, 2023 to 2034

Figure 41: Canada Market Value Proportion Analysis, 2023

Figure 42: Global Vs. Canada. Growth Comparison, 2023 to 2034

Figure 43: Canada Market Share Analysis (%) by Product, 2023 to 2034

Figure 44: Canada Market Share Analysis (%) by Application, 2023 to 2034

Figure 45: Canada Market Share Analysis (%) by Usage, 2023 to 2034

Figure 46: Canada Market Share Analysis (%) by End User, 2023 to 2034

Figure 47: Mexico Market Value Proportion Analysis, 2023

Figure 48: Global Vs. Mexico Growth Comparison, 2023 to 2034

Figure 49: Mexico Market Share Analysis (%) by Product, 2023 to 2034

Figure 50: Mexico Market Share Analysis (%) by Application, 2023 to 2034

Figure 51: Mexico Market Share Analysis (%) by Usage, 2023 to 2034

Figure 52: Mexico Market Share Analysis (%) by End User, 2023 to 2034

Figure 53: Latin America Market Value (US$ Million) Analysis, 2018 to 2023

Figure 54: Latin America Market Value (US$ Million) Forecast, 2023 to 2034

Figure 55: Latin America Market Value Share, by Product (2024 E)

Figure 56: Latin America Market Value Share, by Application (2024 E)

Figure 57: Latin America Market Value Share, by Usage (2024 E)

Figure 58: Latin America Market Value Share, by End User (2024 E)

Figure 59: Latin America Market Value Share, by Country (2024 E)

Figure 60: Latin America Market Attractiveness Analysis by Product, 2024 to 2034

Figure 61: Latin America Market Attractiveness Analysis by Application, 2024 to 2034

Figure 62: Latin America Market Attractiveness Analysis by Usage, 2024 to 2034

Figure 63: Latin America Market Attractiveness Analysis by End User, 2024 to 2034

Figure 64: Latin America Market Attractiveness Analysis by Country, 2024 to 2034

Figure 65: Brazil Market Value Proportion Analysis, 2023

Figure 66: Global Vs. Brazil. Growth Comparison, 2023 to 2034

Figure 67: Brazil Market Share Analysis (%) by Product, 2023 to 2034

Figure 68: Brazil Market Share Analysis (%) by Application, 2023 to 2034

Figure 69: Brazil Market Share Analysis (%) by Usage, 2023 to 2034

Figure 70: Brazil Market Share Analysis (%) by End User, 2023 to 2034

Figure 71: Chile Market Value Proportion Analysis, 2023

Figure 72: Global Vs. Chile Growth Comparison, 2023 to 2034

Figure 73: Chile Market Share Analysis (%) by Product, 2023 to 2034

Figure 74: Chile Market Share Analysis (%) by Application, 2023 to 2034

Figure 75: Chile Market Share Analysis (%) by Usage, 2023 to 2034

Figure 76: Chile Market Share Analysis (%) by End User, 2023 to 2034

Figure 77: East Asia Market Value (US$ Million) Analysis, 2018 to 2023

Figure 78: East Asia Market Value (US$ Million) Forecast, 2023 to 2034

Figure 79: East Asia Market Value Share, by Product (2024 E)

Figure 80: East Asia Market Value Share, by Application (2024 E)

Figure 81: East Asia Market Value Share, by Usage (2024 E)

Figure 82: East Asia Market Value Share, by End User (2024 E)

Figure 83: East Asia Market Value Share, by Country (2024 E)

Figure 84: East Asia Market Attractiveness Analysis by Product, 2024 to 2034

Figure 85: East Asia Market Attractiveness Analysis by Application, 2024 to 2034

Figure 86: East Asia Market Attractiveness Analysis by Usage, 2024 to 2034

Figure 87: East Asia Market Attractiveness Analysis by End User, 2024 to 2034

Figure 88: East Asia Market Attractiveness Analysis by Country, 2024 to 2034

Figure 89: China Market Value Proportion Analysis, 2023

Figure 90: Global Vs. China Growth Comparison, 2023 to 2034

Figure 91: China Market Share Analysis (%) by Product, 2023 to 2034

Figure 92: China Market Share Analysis (%) by Application, 2023 to 2034

Figure 93: China Market Share Analysis (%) by Usage, 2023 to 2034

Figure 94: China Market Share Analysis (%) by End User, 2023 to 2034

Figure 95: Japan Market Value Proportion Analysis, 2023

Figure 96: Global Vs. Japan Growth Comparison, 2023 to 2034

Figure 97: Japan Market Share Analysis (%) by Product, 2023 to 2034

Figure 98: Japan Market Share Analysis (%) by Application, 2023 to 2034

Figure 99: Japan Market Share Analysis (%) by Usage, 2023 to 2034

Figure 100: Japan Market Share Analysis (%) by End User, 2023 to 2034

Figure 101: South Korea Market Value Proportion Analysis, 2023

Figure 102: Global Vs South Korea Growth Comparison, 2023 to 2034

Figure 103: South Korea Market Share Analysis (%) by Product, 2023 to 2034

Figure 104: South Korea Market Share Analysis (%) by Application, 2023 to 2034

Figure 105: South Korea Market Share Analysis (%) by Usage, 2023 to 2034

Figure 106: South Korea Market Share Analysis (%) by End User, 2023 to 2034

Figure 107: South Asia & Pacific Market Value (US$ Million) Analysis, 2018 to 2023

Figure 108: South Asia & Pacific Market Value (US$ Million) Forecast, 2023 to 2034

Figure 109: South Asia & Pacific Market Value Share, by Product (2024 E)

Figure 110: South Asia & Pacific Market Value Share, by Application (2024 E)

Figure 111: South Asia & Pacific Market Value Share, by Usage (2024 E)

Figure 112: South Asia & Pacific Market Value Share, by End User (2024 E)

Figure 113: South Asia & Pacific Market Value Share, by Country (2024 E)

Figure 114: South Asia & Pacific Market Attractiveness Analysis by Product, 2024 to 2034

Figure 115: South Asia & Pacific Market Attractiveness Analysis by Application, 2024 to 2034

Figure 116: South Asia & Pacific Market Attractiveness Analysis by Usage, 2024 to 2034

Figure 117: South Asia & Pacific Market Attractiveness Analysis by End User, 2024 to 2034

Figure 118: South Asia & Pacific Market Attractiveness Analysis by Country, 2024 to 2034

Figure 119: India Market Value Proportion Analysis, 2023

Figure 120: Global Vs. India Growth Comparison, 2023 to 2034

Figure 121: India Market Share Analysis (%) by Product, 2023 to 2034

Figure 122: India Market Share Analysis (%) by Application, 2023 to 2034

Figure 123: India Market Share Analysis (%) by Usage, 2023 to 2034

Figure 124: India Market Share Analysis (%) by End User, 2023 to 2034

Figure 125: ASEAN Countries Market Value Proportion Analysis, 2023

Figure 126: Global Vs. ASEAN Countries Growth Comparison, 2023 to 2034

Figure 127: ASEAN Countries Market Share Analysis (%) by Product, 2023 to 2034

Figure 128: ASEAN Countries Market Share Analysis (%) by Application, 2023 to 2034

Figure 129: ASEAN Countries Market Share Analysis (%) by Usage, 2023 to 2034

Figure 130: ASEAN Countries Market Share Analysis (%) by End User, 2023 to 2034

Figure 131: Australia & New Zealand Market Value Proportion Analysis, 2023

Figure 132: Global Vs. Australia & New Zealand Growth Comparison, 2023 to 2034

Figure 133: Australia & New Zealand Market Share Analysis (%) by Product, 2023 to 2034

Figure 134: Australia & New Zealand Market Share Analysis (%) by Application, 2023 to 2034

Figure 135: Australia & New Zealand Market Share Analysis (%) by Usage, 2023 to 2034

Figure 136: Australia & New Zealand Market Share Analysis (%) by End User, 2023 to 2034

Figure 137: Western Europe Market Value (US$ Million) Analysis, 2018 to 2023

Figure 138: Western Europe Market Value (US$ Million) Forecast, 2023 to 2034

Figure 139: Western Europe Market Value Share, by Product (2024 E)

Figure 140: Western Europe Market Value Share, by Application (2024 E)

Figure 141: Western Europe Market Value Share, by Usage (2024 E)

Figure 142: Western Europe Market Value Share, by End User (2024 E)

Figure 143: Western Europe Market Value Share, by Country (2024 E)

Figure 144: Western Europe Market Attractiveness Analysis by Product, 2024 to 2034

Figure 145: Western Europe Market Attractiveness Analysis by Application, 2024 to 2034

Figure 146: Western Europe Market Attractiveness Analysis by Usage, 2024 to 2034

Figure 147: Western Europe Market Attractiveness Analysis by End User, 2024 to 2034

Figure 148: Western Europe Market Attractiveness Analysis by Country, 2024 to 2034

Figure 149: UK Market Value Proportion Analysis, 2023

Figure 150: Global Vs. UK Growth Comparison, 2023 to 2034

Figure 151: UK Market Share Analysis (%) by Product, 2023 to 2034

Figure 152: UK Market Share Analysis (%) by Application, 2023 to 2034

Figure 153: UK Market Share Analysis (%) by Usage, 2023 to 2034

Figure 154: UK Market Share Analysis (%) by End User, 2023 to 2034

Figure 155: Germany Market Value Proportion Analysis, 2023

Figure 156: Global Vs. Germany Growth Comparison, 2023 to 2034

Figure 157: Germany Market Share Analysis (%) by Product, 2023 to 2034

Figure 158: Germany Market Share Analysis (%) by Application, 2023 to 2034

Figure 159: Germany Market Share Analysis (%) by Usage, 2023 to 2034

Figure 160: Germany Market Share Analysis (%) by End User, 2023 to 2034

Figure 161: Italy Market Value Proportion Analysis, 2023

Figure 162: Global Vs. Italy Growth Comparison, 2023 to 2034

Figure 163: Italy Market Share Analysis (%) by Product, 2023 to 2034

Figure 164: Italy Market Share Analysis (%) by Application, 2023 to 2034

Figure 165: Italy Market Share Analysis (%) by Usage, 2023 to 2034

Figure 166: Italy Market Share Analysis (%) by End User, 2023 to 2034

Figure 167: France Market Value Proportion Analysis, 2023

Figure 168: Global Vs France Growth Comparison, 2023 to 2034

Figure 169: France Market Share Analysis (%) by Product, 2023 to 2034

Figure 170: France Market Share Analysis (%) by Application, 2023 to 2034

Figure 171: France Market Share Analysis (%) by Usage, 2023 to 2034

Figure 172: France Market Share Analysis (%) by End User, 2023 to 2034

Figure 173: Spain Market Value Proportion Analysis, 2023

Figure 174: Global Vs Spain Growth Comparison, 2023 to 2034

Figure 175: Spain Market Share Analysis (%) by Product, 2023 to 2034

Figure 176: Spain Market Share Analysis (%) by Application, 2023 to 2034

Figure 177: Spain Market Share Analysis (%) by Usage, 2023 to 2034

Figure 178: Spain Market Share Analysis (%) by End User, 2023 to 2034

Figure 179: Nordic Countries Market Value Proportion Analysis, 2023

Figure 180: Global Vs Nordic Countries Growth Comparison, 2023 to 2034

Figure 181: Nordic Countries Market Share Analysis (%) by Product, 2023 to 2034

Figure 182: Nordic Countries Market Share Analysis (%) by Application, 2023 to 2034

Figure 183: Nordic Countries Market Share Analysis (%) by Usage, 2023 to 2034

Figure 184: Nordic Countries Market Share Analysis (%) by End User, 2023 to 2034

Figure 185: BENELUX Market Value Proportion Analysis, 2023

Figure 186: Global Vs BENELUX Growth Comparison, 2023 to 2034

Figure 187: BENELUX Market Share Analysis (%) by Product, 2023 to 2034

Figure 188: BENELUX Market Share Analysis (%) by Application, 2023 to 2034

Figure 189: BENELUX Market Share Analysis (%) by Usage, 2023 to 2034

Figure 190: BENELUX Market Share Analysis (%) by End User, 2023 to 2034

Figure 191: Eastern Europe Market Value (US$ Million) Analysis, 2018 to 2023

Figure 192: Eastern Europe Market Value (US$ Million) Forecast, 2023 to 2034

Figure 193: Eastern Europe Market Value Share, by Product (2024 E)

Figure 194: Eastern Europe Market Value Share, by Application (2024 E)

Figure 195: Eastern Europe Market Value Share, by Usage (2024 E)

Figure 196: Eastern Europe Market Value Share, by End User (2024 E)

Figure 197: Eastern Europe Market Value Share, by Country (2024 E)

Figure 198: Eastern Europe Market Attractiveness Analysis by Product, 2024 to 2034

Figure 199: Eastern Europe Market Attractiveness Analysis by Application, 2024 to 2034

Figure 200: Eastern Europe Market Attractiveness Analysis by Usage, 2024 to 2034

Figure 201: Eastern Europe Market Attractiveness Analysis by End User, 2024 to 2034

Figure 202: Eastern Europe Market Attractiveness Analysis by Country, 2024 to 2034

Figure 203: Russia Market Value Proportion Analysis, 2023

Figure 204: Global Vs. Russia Growth Comparison, 2023 to 2034

Figure 205: Russia Market Share Analysis (%) by Product, 2023 to 2034

Figure 206: Russia Market Share Analysis (%) by Application, 2023 to 2034

Figure 207: Russia Market Share Analysis (%) by Usage, 2023 to 2034

Figure 208: Russia Market Share Analysis (%) by End User, 2023 to 2034

Figure 209: Hungary Market Value Proportion Analysis, 2023

Figure 210: Global Vs Hungary Growth Comparison, 2023 to 2034

Figure 211: Hungary Market Share Analysis (%) by Product, 2023 to 2034

Figure 212: Hungary Market Share Analysis (%) by Application, 2023 to 2034

Figure 213: Hungary Market Share Analysis (%) by Usage, 2023 to 2034

Figure 214: Hungary Market Share Analysis (%) by End User, 2023 to 2034

Figure 215: Poland Market Value Proportion Analysis, 2023

Figure 216: Global Vs Poland Growth Comparison, 2023 to 2034

Figure 217: Poland Market Share Analysis (%) by Product, 2023 to 2034

Figure 218: Poland Market Share Analysis (%) by Application, 2023 to 2034

Figure 219: Poland Market Share Analysis (%) by Usage, 2023 to 2034

Figure 220: Poland Market Share Analysis (%) by End User, 2023 to 2034

Figure 221: Middle East & Africa Market Value (US$ Million) Analysis, 2018 to 2023

Figure 222: Middle East & Africa Market Value (US$ Million) Forecast, 2023 to 2034

Figure 223: Middle East & Africa Market Value Share, by Product (2024 E)

Figure 224: Middle East & Africa Market Value Share, by Application (2024 E)

Figure 225: Middle East & Africa Market Value Share, by Usage (2024 E)

Figure 226: Middle East & Africa Market Value Share, by End User (2024 E)

Figure 227: Middle East & Africa Market Value Share, by Country (2024 E)

Figure 228: Middle East & Africa Market Attractiveness Analysis by Product, 2024 to 2034

Figure 229: Middle East & Africa Market Attractiveness Analysis by Application, 2024 to 2034

Figure 230: Middle East & Africa Market Attractiveness Analysis by Usage, 2024 to 2034

Figure 231: Middle East & Africa Market Attractiveness Analysis by End User, 2024 to 2034

Figure 232: Middle East & Africa Market Attractiveness Analysis by Country, 2024 to 2034

Figure 233: Saudi Arabia Market Value Proportion Analysis, 2023

Figure 234: Global Vs Saudi Arabia Growth Comparison, 2023 to 2034

Figure 235: Saudi Arabia Market Share Analysis (%) by Product, 2023 to 2034

Figure 236: Saudi Arabia Market Share Analysis (%) by Application, 2023 to 2034

Figure 237: Saudi Arabia Market Share Analysis (%) by Usage, 2023 to 2034

Figure 238: Saudi Arabia Market Share Analysis (%) by End User, 2023 to 2034

Figure 239: Türkiye Market Value Proportion Analysis, 2023

Figure 240: Global Vs. Türkiye Growth Comparison, 2023 to 2034

Figure 241: Türkiye Market Share Analysis (%) by Product, 2023 to 2034

Figure 242: Türkiye Market Share Analysis (%) by Application, 2023 to 2034

Figure 243: Türkiye Market Share Analysis (%) by Usage, 2023 to 2034

Figure 244: Türkiye Market Share Analysis (%) by End User, 2023 to 2034

Figure 245: South Africa Market Value Proportion Analysis, 2023

Figure 246: Global Vs. South Africa Growth Comparison, 2023 to 2034

Figure 247: South Africa Market Share Analysis (%) by Product, 2023 to 2034

Figure 248: South Africa Market Share Analysis (%) by Application, 2023 to 2034

Figure 249: South Africa Market Share Analysis (%) by Usage, 2023 to 2034

Figure 250: South Africa Market Share Analysis (%) by End User, 2023 to 2034

Figure 251: Other African Union Market Value Proportion Analysis, 2023

Figure 252: Global Vs Other African Union Growth Comparison, 2023 to 2034

Figure 253: Other African Union Market Share Analysis (%) by Product, 2023 to 2034

Figure 254: Other African Union Market Share Analysis (%) by Application, 2023 to 2034

Figure 255: Other African Union Market Share Analysis (%) by Usage, 2023 to 2034

Figure 256: Other African Union Market Share Analysis (%) by End User, 2023 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dental Imaging Equipment Market Forecast and Outlook 2025 to 2035

Dental Wounds Treatment Market Size and Share Forecast Outlook 2025 to 2035

Dental Radiometer Market Size and Share Forecast Outlook 2025 to 2035

Dental Anaesthetic Market Size and Share Forecast Outlook 2025 to 2035

Dental Diamond Bur Market Size and Share Forecast Outlook 2025 to 2035

Dental Laboratory Market Size and Share Forecast Outlook 2025 to 2035

Dental Matrix Systems Market Size and Share Forecast Outlook 2025 to 2035

Dental Permanent Cements Market Size and Share Forecast Outlook 2025 to 2035

Dental Bleaching Agent Market Size and Share Forecast Outlook 2025 to 2035

Dental Care Products Market Size and Share Forecast Outlook 2025 to 2035

Dental Etching Liquid Market Size and Share Forecast Outlook 2025 to 2035

Dental Sutures Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dental Implantology Software Market Analysis - Size, Growth, & Forecast Outlook 2025 to 2035

Dental Veneers Market Size and Share Forecast Outlook 2025 to 2035

Dental X-Ray Systems Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dental Suction Systems Market Size and Share Forecast Outlook 2025 to 2035

Dental Articulators Market Size and Share Forecast Outlook 2025 to 2035

Dental Fluoride Varnish Market Size and Share Forecast Outlook 2025 to 2035

Dental Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Dental Flap Surgery Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA