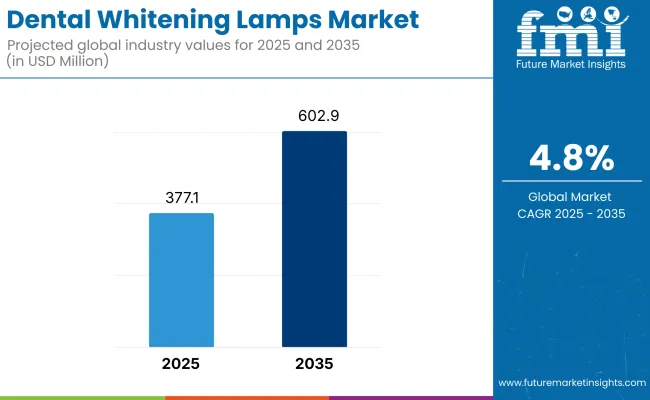

The Dental Whitening Lamps Market is expected to reach approximately USD 377.1 million in 2025 and expand to around USD 602.9 million by 2035, reflecting a compound annual growth rate (CAGR) of 4.8% over the forecast period.

The market for dental whitening lamps is anticipated to achieve maturity due to the large volume of requests for high-performance, chair-side whitening treatments in cosmetic dentistry clinics. With dental aesthetics becoming a key differentiator in bringing patients to the practice, clinics are investing rapidly in the new generation of proprietary light-activated systems that provide quicker results with less or no sensitivity. While producers concentrate on novel products for speedy, clinical settings, attention has been concentrated on ergonomics, portability and LED systems of high intensity.

The shift towards high-end cosmetic dental services - especially urban private practice - is driving uptake. Formal advertising of clinical grade whitening kit and packaged whitening packages market professional whitening equipment like dental lamps.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 377.1 million |

| Industry Value (2035F) | USD 602.9 million |

| CAGR (2025 to 2035) | 4.8% |

Expansion of the dental whitening lamps market between 2020 and 2024 was primarily led by the setting up of cosmetic dentistry as a revenue-based vertical in dental practices. Set back at the beginning by procedure postponements throughout the pandemic, the market immediately recovered as practices started prioritizing aesthetic procedures as a means of making up lost revenue by the suspension of preventive care.

There was a major transition from halogen in-office systems to LED and plasma arc systems that enhanced efficiency and speed and supported a wider range of whitening gels. Clinics also began to opt for smaller and portable lamp systems to accommodate in-home services and pop-up dental events, particularly in high-income urban regions.

Also, there was strong preference for value-based models with multi-setting output options owing to price sensitivity in case of mid-tier clinics. Additionally, dental service chains and franchises were prevalent, facilitating bulk buying and standardization, leading to scaling up production of entry-level and mid-range lamp systems with a modular structure by manufacturers.

North America is leading horizonal in dentistry market and from past few years a huge demand seen in whitening lamps in dentistry and for the market share of North America, a well-established aesthetic equipment companies such as Beyond International, GLO Science, and Zoom (Philips), are in the collar market. The players are driving product innovation and taking advantage of aggressive branding opportunities in a market where consumers are seeking find rapid in-office whitening procedures.

One of the major drivers of growth is the continue penetration of digital platforms in clinic work flows enabling smile design in real time and lamp settings to be more finely tuned. These businesses utilize existing clinic networks and distribution partnerships to conveniently deliver their sophisticated whitening systems to metro and suburban markets. Furthermore, the USA dental service organizations (DSOs) are also standardizing premium whitening services much more, which time-to-systems with ergonomics and multi-spectrum light with just-in-time purchasing.

The whitening lamps market in Europe is being bolstered by strong quality ecosystems of dentition production in the region and its commitment to clinical safety standards. Specifically, in Germany, Italy and the UK there is an emphasis on exclusively CE approved, non-invasive light systems that are designed to achieve high efficacy with minimal thermal exposure which are integral in the treatment of sensitive enamel.

Another important trend is that dental clinics are interested in multi-functionality and they increasingly require their whitening lamps to be easily applicable in connection with other cosmetic treatments. The European dental market is emphasizing low-maintenance, energy-efficient designs that are sustainably oriented. Moreover, the centralize procurement of public-private dental partnerships is further promoting the adoption of standardized tooth whitening technology across EU countries.

The entry of new, upscale dental fancy shops and clinics specializing in cosmetic dental care is driving dental whitening lamp industry growth, creating quick revenue increases in the likes of Seoul, Tokyo, and Bangkok in the Asia-Pacific region. The clinics lean towards a beauty-oriented clientele seeking quick results, hence triggering the demand for high-output whitening lamp systems with quick-curing cycles and minimal chair time.

Domestic manufacturers in China and India have introduced competitively priced mid-range LED lamp systems. Having it made locally reduces cost barriers and raises accessibility. Moreover, the expansion of dental tourism in the Philippines and Thailand is driving cross-border demand for aesthetic treatments, where whitening services offered as part of total cosmetic dentistry packages underscore the significance of efficient and portable whitening lamp systems in outpatient clinics.

Fragmented Regulatory Standards and Certification Delays Impeding Market Expansion

The variation in regulatory certification routes throughout regions is anticipated to serve as one of the factors limiting dental whitening lamps market growth around the world. Dentist markets like the US and Europe are subject to stringent/schema guidelines, i.e., FDA and CE approvals, while numerous countries within Latin America, Southeast Asia and the Middle East lack as well-organized a framework for dental equipment.

This leads to longer product launch cycles, thus increasing compliance burden on manufacturers. Moreover, the lack of harmonized technical standards renders it difficult for global brands to scale operations efficiently. For smaller regional manufacturers this has been a challenge, with cross-border approvals hindering exports and collaborations.

This fragmentation in regulatory environments suppresses innovation and slows down the introduction of next-gen whitening technologies in emerging economies. Until uncertainty regarding regulation settles - it becomes a formidable hindrance to enterprises seeking to go global in such a high-demand, fast-changing beauty category.

High-Traffic Aesthetic Clinics and Chain-Based Dental Franchises Creating Growth Potential

The expansion of high-volume aesthetic dental clinics and franchise-based dental chains offers considerable opportunity for growth within the dental whitening lamps market. These setups work based on proven treatment modalities and are making investments in time- and outcome- driven whitening systems to address the growing patient throughput.

Specific to urban geographies in North America, Europe, and Asia-Pacific, aesthetic dental chains are deriving brand equity from on-demand whitening experiences across settings compelling demand for standardized, multi-setting lamp systems. Moreover, these high-volume environments provide manufacturers opportunities for maintenance contracts, upgrade cycles and bundled consumables - boosting long-term customer stickiness.

This commodification of cosmetic dentistry is moving lamp procurement from a one-off purchase to value-based service models. This is attractive to global and regional players alike, leading to opportunities beyond simple market access, such as value-added partnerships, training and exclusive distribution - key components of long-term market access.

The dental whitening lamps market went from being a premium add-on service in 2020, to a mainstream clinical offering, particularly in cosmetic-focused dental practices by 2024. The transition from halogen systems to more advanced LED and plasma arc systems gained momentum, due in part to shorter cure times and increased patient comfort.

The increasing adoption of bulk procurement by dental service organizations and dental tourism hubs helped compound adoption. The next generation of the market will be defined by small-form, wireless lamp systems designed for mobile dentistry and in-home cosmetic treatments.

Real-time shade tracking and treatment customization integration with digital imaging software is predicted to become a staple. AI powered calibration features and modular designs for multiple cosmetic procedures are also expected to drive competitive differentiation in the market.

With clinics competing for patient retention, instant demand for energy-efficient high-performance lamp systems + whitening kit bundles at clinics is expected to rise, alongside due to a migration of holistic aesthetic tightening systems with tech components.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Introduction of safety and light intensity guidelines for in-clinic whitening systems. |

| Technological Advancements | Adoption of LED and cold-light systems with multi-setting modes. |

| Consumer Demand | Increased demand from aesthetic dental clinics offering rapid whitening treatments. |

| Market Growth Drivers | Growth in cosmetic dentistry, patient demand for quick results, and clinic brand positioning. |

| Sustainability | Initial shift to low-heat emission and energy-saving whitening lamps. |

| Supply Chain Dynamics | Heavy reliance on global dental equipment suppliers for lamp components. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Stricter certification processes for energy-efficient, AI-integrated whitening lamp devices. |

| Technological Advancements | Emergence of AI-calibrated lamp intensity, wireless control, and real-time shade mapping. |

| Consumer Demand | Growing consumer preference for customizable, pain-free whitening with instant visible results. |

| Market Growth Drivers | Rise of mobile dentistry, integration of aesthetic packages, and demand for digital interface-enabled lamps. |

| Sustainability | Focus on modular, upgradable lamp systems and recyclable component usage to reduce clinic waste. |

| Supply Chain Dynamics | Expansion of regional manufacturing hubs and OEM partnerships to reduce lead times and costs. |

Market Outlook

High consumer demand for aesthetic dental procedures, combined with the growing emphasis on cosmetic dentistry, is driving the growth of the dental whitening lamp market in the United States as it is one of the leading regions.

As more people look for fast and visible results, the market for professional teeth whitening is only getting larger. Increasingly, clinics need to meet the demand for teeth whitening and the need for high-efficiency treatments, both, thanks to advanced light-activated systems.

Then there's the big tech innovation, which players try to focus on: LED or plasma arc - these are said to provide faster, safer, and more comfortable whitening procedures. The development in digital dentistry technology also serves to improve patient personalization in this regard as well, thereby providing better adapted treatment plans taking patients' specific needs into account.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

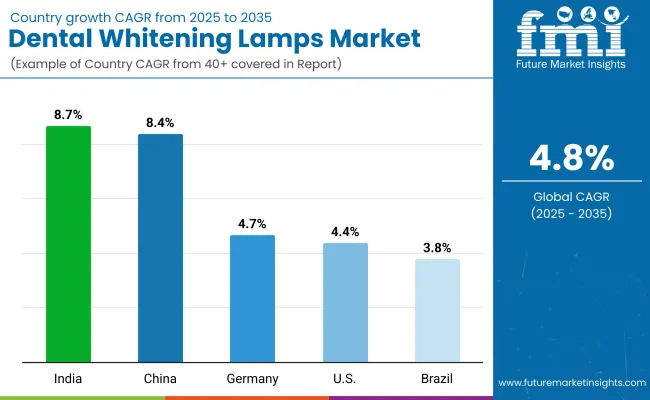

| 2025 to 2035 | 4.4% |

Market Outlook

The dental whitening lamps market in India is growing rapidly, with increasing demand for aesthetic procedures from urban middle-class consumers and the proliferation of private dental clinics providing cosmetic services.

With the growing accessibility of cosmetic dentistry and the desire to achieve the perfect smile, clinics are injecting themselves into the competitive space by increasingly adopting modern "whitening" lamp systems to improve their service offerings. Moreover, the rise of dental tourism in major cities including Delhi, Mumbai and Bangalore are further boosting the investment in high performance, cost effective whitening technologies. Low-cost LED based systems by domestic manufacturers are also entering the segment improving accessibility and increasing the domestic market competitiveness.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 8.7% |

Market Outlook

With a booming cosmetic dentistry industry and rising non-invasive aesthetic treatment demand, China is well-positioned to dominate the Dental Whitening Lamps market. As more and more people in tier-1 and tier-2 cities become conscious of their appearance, whitening services CLINICSin ä hboth private and hospital-based dental clinics have become uality of practise uality of practihhe beauty hhe a common offering.

With the addition of smart features such as adjustable light settings, ergonomic design, and digital display panels, whitening lamps are becoming more appealing to contemporary clinic. In addition, local manufacturing facilities in regions such as Guangdong and Zhejiang have begun manufacturing competitive and high-performance whitening systems that mitigate reliance on imported systems.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 8.4% |

Market Outlook

Germany is one of Europe’s most matured markets for dental whitening lamps, supported by a well-established dental technology system and the growing demand for professional cosmetic treatments. Safety, precision, and clinical efficiency are emphasized in German clinics, creating a strong need for CE certified whitening systems that utilize ergonomic designs and latest cooling systems.

Normalisation of aesthetic procedures, particularly in a private practice setting through the incorporation of whitening modalities into general dental care. In addition, a very structured dental insurance plan and regulated procurement environment allow for an ongoing adoption of high performance lamp systems.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 4.7% |

Market Outlook

Brazil is also fast becoming a major market for dental whitening lamps, backed by a deeply entrenched culture of personal aesthetics and one of the highest dentist-to-patient ratios in the world. Cosmetic dentistry has been well accepted across the classes so whitening procedures are in high demand at urban clinics as well as mid-tier practices.

Light-activated systems are gaining increased use in Brazil, where dental professionals are actively marketing whitening as part of a smile transformation package. Moreover, regional development of whitening lamps is also emerging owing to their affordability and suitability with local clinical requirements.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 3.8% |

In-office Dental Whitening Lamps Leading Aesthetic Demand with Rapid Results and Clinical Precision

In terms of type, the in-office whitening lamps hold the largest share of the dental whitening lamps market as they provide immediate and clearly visible results under professional monitoring. Light-activated systems are commonly found in beauty dentists' practices for more intense treatments compared to the at-home units.

The extensive range of professional-grade devices employing LED/Plasma arc technology are used because they are highly effective and very safe for patients. Within cosmetic dentistry packages, in-office whitening is being marketed as an upscale option for clients interested in same-day smile transformations.

Furthermore, the advent of aesthetic dental chains and health-oriented dental studios in metropolitan areas is speeding up the distribution of sophisticated in-office systems. Though at-home whitening solutions are on the rise, they are still more competitory than competitive with in-office systems, which continue to establish the standard for performance, reliability, and long-term patient satisfaction.

At-home Dental Whitening Lamps Emerging as a Convenient and Affordable Alternative for Cosmetic Care

Home dental whitening lamps are quickly becoming popular as a new segment, fueled by growing consumer demand for a more simple yet cost-effective and private alternative to cosmetic treatment. Designed primarily around LED lights and whitening gels, these devices result in visible change from the comfort of home.

Social media trends, influencer marketing, and direct-to-consumer brands have facilitated awareness and adoption, particularly among younger demographics seeking affordable smile enhancement. E-commerce platforms have made these devices widely accessible, and product innovations - such as wireless operation, USB charging, and smartphone integration - are improving users’ experience.

While they won’t be as effective as in-office systems, at-home lamps provide gradual whitening over multiple uses, making them a compelling option as a way to maintain results post-treatment. With consumers increasingly taking charge of their cosmetic care and getting treatments done by themselves, this segment is poised for strong growth, slowly redefining the general whitening landscape according to hybrid care models.

LED Light Technology Dominating with Safety, Efficiency, and Broad Clinical Adoption

LED-based dental whitening lamps are the predominant segment in the market, increasingly popular owing to their high safety profile energy efficiency, and stable performance. LED lights do not produce harmful rays like UV systems, which is why they are more favored by dentists and patients.

These lamps provide output in several different wavelengths and allow for faster treatment times and greater user comfort due to reduced heat generation. The long lives of these machines, along with relatively fewer maintenance requirements, can add to clinic profits. Many new systems are low-intensity adjustable, feature built-in timers, and have ergonomic designs making them easier to use.

LED has also become ideal for a variety of whitening gels to allow flexibility of treatment. Manufacturers are pouring resources into smart features like touch-screen controls and pre-set treatment modes, further entrenching LED’s hold over clinical environments. As cosmetic dentistry continues to expand globally, LED light-based systems will continue to be the gold standard in-office teeth bleaching processes.

Ultraviolet Light Systems Emerging with High-Intensity Whitening for Specialized Applications

Another segment of dental whitening technologies is ultraviolet (UV) light dental whitening lamps, recognized for their high-intensity light output, which enhances whitening reactions in shorter exposure times.

Though it is less often used due to safety concerns regarding irradiation exposure, UV lamps continue to be chosen in certain clinical situations when accelerated stain release and intense whitening is desired. Some cosmetic dentistry specialists use UV systems with clients with highly discolored enamel or with time-sensitive treatment needs.

The development of new generation UV systems is focused on the introduction of better shielding, integrated safety sensors and exposure controls, becoming safer and more patient-friendly devices. And as manufacturers investigate sounder approaches to filtration technology and pulse-time UV distribution, this segment is gradually forging a home in more premium, high-demand, aesthetic offices.

Although not yet mainstream, UV-based systems are capturing the attention of practitioners seeking performance differentiation and specialty applications - particularly in competitive cosmetic markets, where clients seek faster and more dramatic whitening outcomes.

The dental whitening lamps market is highly competitive, fueled by rising consumer demand for aesthetic dental treatments, technological innovations in light-activated whitening systems, and increasing acceptance of cosmetic dentistry across age groups.

Companies are focusing on high-performance LED systems, ergonomic designs, quick-activation cycles, and clinic-grade safety features to differentiate themselves. The market includes a mix of global dental technology giants, cosmetic product innovators, and regionally specialized manufacturers. With in-office whitening continuing to be a cornerstone of modern dental practices, firms are also leveraging branding, clinical training, and B2B partnerships to expand their footprint in dental clinics, cosmetic chains, and dental spas.

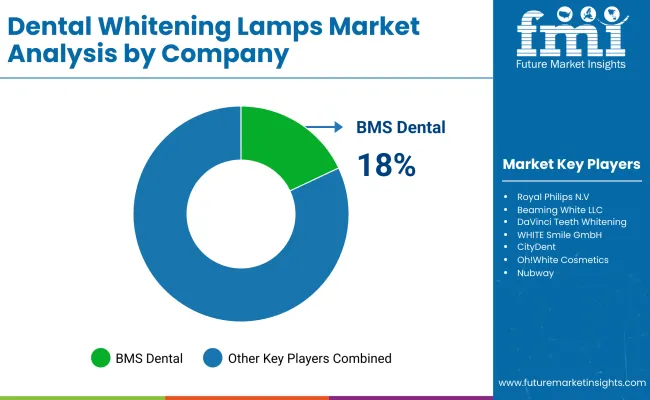

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| BMS Dental | 18-22% |

| Royal Philips N.V. | 15-19% |

| Beaming White LLC | 12-16% |

| DaVinci Teeth Whitening | 9-13% |

| WHITE Smile GmbH | 7-11% |

| Company Name | Key Offerings/Activities |

|---|---|

| BMS Dental | Italian-based manufacturer offering professional-grade whitening systems integrated with LED and halogen lamp options. |

| Royal Philips N.V. | Offers at-home whitening lamps and kits under the Zoom! brand, focusing on safety, user experience, and global reach. |

| Beaming White LLC | USA company providing LED whitening lamps for dental and beauty professionals, with private label and OEM services. |

| DaVinci Teeth Whitening | Offers cosmetic whitening solutions and advanced LED light systems, often bundled with branding and business packages. |

| WHITE Smile GmbH | German brand delivering premium-grade whitening systems for clinical use, emphasizing CE certification and EU compliance. |

Key Company Insights

BMS Dental (18-22%)

A leading European brand, BMS Dental sets the benchmark for professional-grade dental whitening with versatile lamp systems and premium build quality.

Royal Philips N.V. (15-19%)

Through its Zoom! brand, Philips dominates the at-home whitening space while maintaining strong clinical partnerships globally.

Beaming White LLC (12-16%)

Known for innovation in LED-based whitening lights, Beaming White is a key player in both professional and beauty-focused segments.

DaVinci Teeth Whitening (9-13%)

A pioneer in cosmetic whitening kits and LED systems, DaVinci is recognized for turnkey business models and product customization.

WHITE Smile GmbH (7-11%)

Trusted by dental professionals across Europe, WHITE Smile’s devices emphasize safety, performance, and regulatory excellence.

Beyond the leading companies, several other manufacturers contribute significantly to the market, enhancing product diversity and technological advancements. These include:

In-office Dental Whitening Lamps and At-home Dental Whitening Lamps

LED Light and Ultraviolet Light

Hospitals, Dental Clinics and Home Care Settings

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa

The overall market size for dental whitening lamps market was US$ 377.1 million in 2025.

The dental whitening lamps market is expected to reach USD 602.9 million in 2035.

Rapid innovation in multi-wavelength LED technology is enabling more efficient and safer whitening procedures, prompting wider clinical adoption across diverse patient profiles

The top key players that drives the development of dental whitening lamps market are BMS Dental, Royal Philips N.V., Beaming White LLC, DaVinci Teeth Whitening and WHITE Smile GmbH

In-office dental whitening lamps is expected to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Light Source Used, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Light Source Used, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by End User, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product type, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Product type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Light Source Used, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Light Source Used, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Product type, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Product type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Light Source Used, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Light Source Used, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Product type, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Product type, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Light Source Used, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by Light Source Used, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Product type, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Product type, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Light Source Used, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Light Source Used, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Product type, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Product type, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Light Source Used, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Light Source Used, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by End User, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Product type, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Product type, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Light Source Used, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by Light Source Used, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by End User, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Product type, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Product type, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Light Source Used, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Light Source Used, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by End User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Light Source Used, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product type, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Product type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Light Source Used, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Light Source Used, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Light Source Used, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Light Source Used, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 21: Global Market Attractiveness by Product type, 2023 to 2033

Figure 22: Global Market Attractiveness by Light Source Used, 2023 to 2033

Figure 23: Global Market Attractiveness by End User, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Product type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Light Source Used, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Product type, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Product type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Light Source Used, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Light Source Used, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Light Source Used, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Light Source Used, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 45: North America Market Attractiveness by Product type, 2023 to 2033

Figure 46: North America Market Attractiveness by Light Source Used, 2023 to 2033

Figure 47: North America Market Attractiveness by End User, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Product type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Light Source Used, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Product type, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Product type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Light Source Used, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Light Source Used, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Light Source Used, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Light Source Used, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Light Source Used, 2023 to 2033

Figure 71: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Product type, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Light Source Used, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Product type, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Product type, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Product type, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Product type, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Light Source Used, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Light Source Used, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Light Source Used, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Light Source Used, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Product type, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Light Source Used, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by End User, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Product type, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Light Source Used, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Product type, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Product type, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Product type, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Product type, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Light Source Used, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Light Source Used, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Light Source Used, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Light Source Used, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Product type, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Light Source Used, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by End User, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Product type, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Light Source Used, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by End User, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Product type, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Product type, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product type, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product type, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Light Source Used, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Light Source Used, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Light Source Used, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Light Source Used, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Product type, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Light Source Used, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by End User, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Product type, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Light Source Used, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Product type, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Product type, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Product type, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Product type, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Light Source Used, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by Light Source Used, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Light Source Used, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Light Source Used, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Product type, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Light Source Used, 2023 to 2033

Figure 167: East Asia Market Attractiveness by End User, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Product type, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Light Source Used, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by End User, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Product type, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Product type, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Product type, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product type, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Light Source Used, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Light Source Used, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Light Source Used, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Light Source Used, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Product type, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Light Source Used, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by End User, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dental Imaging Equipment Market Forecast and Outlook 2025 to 2035

Dental Wounds Treatment Market Size and Share Forecast Outlook 2025 to 2035

Dental Radiometer Market Size and Share Forecast Outlook 2025 to 2035

Dental Anaesthetic Market Size and Share Forecast Outlook 2025 to 2035

Dental Diamond Bur Market Size and Share Forecast Outlook 2025 to 2035

Dental Laboratory Market Size and Share Forecast Outlook 2025 to 2035

Dental Matrix Systems Market Size and Share Forecast Outlook 2025 to 2035

Dental Permanent Cements Market Size and Share Forecast Outlook 2025 to 2035

Dental Bleaching Agent Market Size and Share Forecast Outlook 2025 to 2035

Dental Care Products Market Size and Share Forecast Outlook 2025 to 2035

Dental Etching Liquid Market Size and Share Forecast Outlook 2025 to 2035

Dental Sutures Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dental Hygiene Devices Market Size and Share Forecast Outlook 2025 to 2035

Dental Implantology Software Market Analysis - Size, Growth, & Forecast Outlook 2025 to 2035

Dental Veneers Market Size and Share Forecast Outlook 2025 to 2035

Dental X-Ray Systems Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dental Suction Systems Market Size and Share Forecast Outlook 2025 to 2035

Dental Articulators Market Size and Share Forecast Outlook 2025 to 2035

Dental Fluoride Varnish Market Size and Share Forecast Outlook 2025 to 2035

Dental Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA