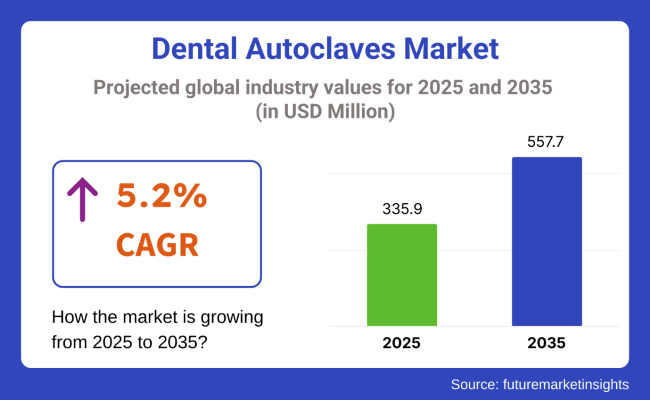

The global dental autoclaves market is estimated to be valued at USD 335.9 million in 2025. It is projected to reach USD 557.7 million by 2035, registering a compound annual growth rate (CAGR) of 5.2% over the forecast period.

The rising incidence of infectious diseases and increasing demand for dental procedures globally drive the demand for advanced sterilization solutions. Technological advancements, such as automated and energy-efficient autoclaves, enhance operational efficiency, thereby further propelling market expansion. Future growth opportunities lie in the increasing adoption of portable and compact autoclaves, which cater to mobile dentistry and smaller clinics.

Leading manufacturers like Tuttnauer, SciCan, W&H Dentalwerk, and Midmark drive the dental autoclaves market through innovation and strategic product launches. These companies focus on developing fully automated, energy-efficient autoclaves with features such as touchscreen interfaces and faster sterilization cycles to meet the rising demands for infection control. In 2024, Midmark Corp 2024 launched its next-generation Midmark M9 and M11 Steam Sterilizers.

“Effective instrument processing starts with dependable equipment and a simple, standardized workflow,” said Michael Couch, Marketing Director, Midmark Dental. “Next generation Midmark M9 and M11 Steam Sterilizers are designed with dental clinicians in mind, providing durability, automation and easy-to-use operation to help deliver safe, efficient care.” In the same year, Flight Dental Systems also announced the launch of Clave45+ Steam Sterilizer. This Steam Sterilizer stands out as a cutting-edge solution, designed to meet the stringent requirements of modern sterilization processes.

North America dominates the dental autoclaves market due to its advanced healthcare infrastructure, stringent sterilization regulations, and high dental care expenditure. The USA drives dominance with a robust network of dental clinics and widespread adoption of cutting-edge sterilization technologies. These factors ensure high demand for advanced autoclaves, particularly Automated Autoclaves to meet infection control standards. The adoption of Dental Autoclaves is expected to remain high in Dental clinics over the forecast period, enhancing compliance and efficiency.

Europe also holds the second-largest market for dental autoclaves, with Germany contributing a significant share of revenue in 2025. The market is driven by rising oral health awareness, increasing dental clinic networks and a high installed base of dental autoclaves across healthcare settings. The increasing incidence of medical tourism in Eastern Europe is expected to drive demand for energy-efficient, automated autoclaves.

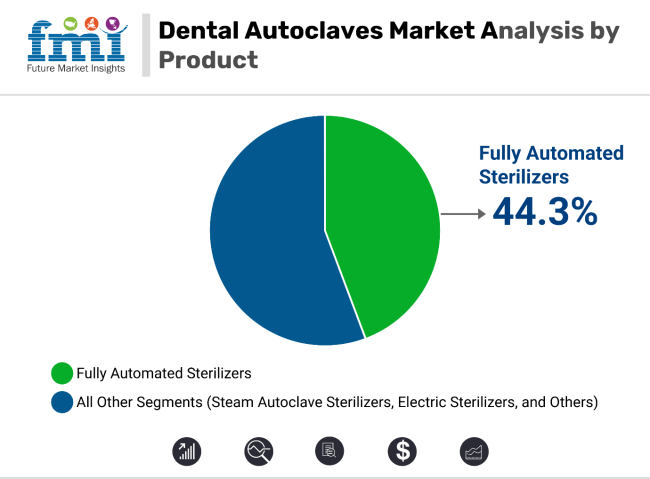

In 2025, fully automated sterilizers are expected to hold 44.3% of the revenue share in the dental autoclaves market. This dominance is attributed to the efficiency, accuracy, and minimal human intervention required in fully automated systems. Fully automated autoclaves are preferred in dental practices for their ability to streamline the sterilization process, ensuring consistent and reliable results.

These systems are equipped with advanced features, including automatic temperature and pressure control, cycle monitoring, and digital reporting, which enhance sterilization performance while reducing the risk of human error. The growing emphasis on infection control and the increasing need for compliance with strict regulatory standards have also contributed to the growth of fully automated sterilizers.

Additionally, these autoclaves reduce manual labor and improve overall productivity in dental offices, making them the preferred choice for high-volume practices. As dental practices continue to prioritize patient safety and operational efficiency, fully automated sterilizers are expected to remain the dominant product type in the market.

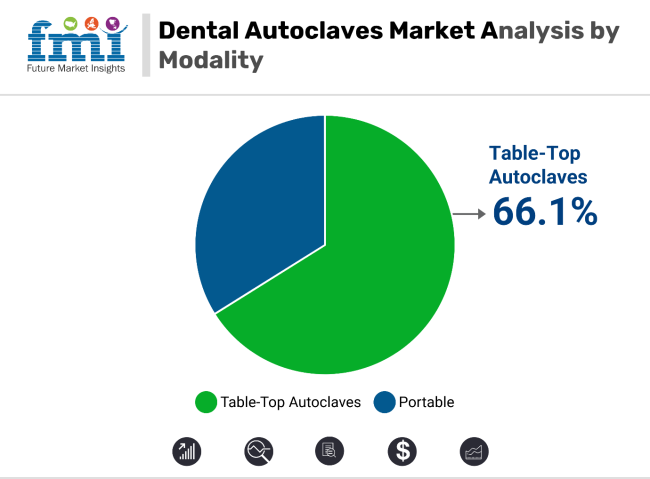

In 2025, tabletop autoclaves are projected to capture 66.1% of the revenue share in the dental autoclaves market. This leadership is driven by their compact design, affordability, and ease of use, making them ideal for smaller dental practices with limited space. Table-top autoclaves offer the necessary sterilization capabilities while being more accessible to budget-conscious dental professionals.

Their smaller size allows them to fit into limited spaces in dental offices, and they are relatively easy to operate, making them an attractive option for solo practitioners and small clinics. Additionally, the cost-effectiveness and lower maintenance requirements of tabletop autoclaves have made them a popular choice among dental practices that need reliable and efficient sterilization solutions without investing in larger, more complex systems.

The increased demand for sterilization in dental settings, coupled with the rising number of small and mid-sized dental practices, has reinforced the dominance of tabletop autoclaves in the market.

High Equipment Costs and Compliance Complexity

For the Dental Autoclave Market, one of its biggest problems is that, unfortunately, advanced autoclaves are high-priced, such as the class B autoclaves with automatic cycle recording and computer integration. Small dental clinics and underfunded clinics in low-income communities often cannot afford them, limiting their use.

With its continually evolving sterilization processes, advanced equipment certifications, and stringent quality control procedures, it is challenging for dental hygienists and equipment manufacturers to keep pace. Common maintenance requirements and a lack of professional training in autoclave use also affect their long-term function. This all affects the long-term operational capability of an autoclave.

AI-Powered Smart Autoclaves, Sustainable Sterilization, and Mobile Dentistry

The Dental Autoclaves Market is facing several challenges, but these also present great opportunities for growth. Smart autoclaves with AI-powered real-time cycle tracking, remote tracking, and predictive maintenance alerts are not only improving the efficiency of sterilization but also automating the workflow.

There is a growing demand for energy-saving autoclaves that conserve water, reusable packs for disinfection and sterilization, as well as steam disinfection methods that eliminate the need for chemicals. To that end, eco-friendly quilen control technologies are being applied. Additionally, the demand for lightweight and space-conserving autoclaves with mobility has grown from mobile dentistry, as well as from bus tours or temporary healthcare centers.

In today's United States Dental Autoclave market, the industry is continually improving. This is due to stricter sterilization standards, as well as the increasing number of people undergoing dental work, and advances in infection control technology. It's also because the United States Food and Drug Administration (FDA) and the Centers for Disease Control (CDC) strictly enforce standards of cleanliness in dental clinics and hospitals.

The use of automated autoclaves that consume energy more efficiently is now portable. The addition of dental clinics, owned and operated by private firms that now exist across New York City, is further boosting market demand, as the combined effect is not limited to any particular aspect of industry practice, felt by both. The growing awareness given to surplus margin risks also increases pressure on an older industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.8% |

In the UK, strict infection control regulations, advanced sterilization equipment, and the fact that the technology has generally proven profitable all contribute to a healthy boost for the burgeoning Dental Autoclaves Market. Regarding its sterility requirements, both England's Care Quality Commission (CQC) and the National Health Service (NHS) require dental instruments to be sterilized in autoclaves.

Innovation is driven by three key trends: smart sterilization systems, environmentally friendly autoclave brands, and large-scale models that can cover multiple clinics operating in parallel. The dental market is also experiencing an increase in demand for rapid-cycle-type autoclaves with digital monitoring capabilities.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.4% |

In the European Union, the demand for dental autoclaves remains stable. It may be because strict European Union Sterilization guidelines are in effect, the desire for large-capacity autoclaves remains unabated, and there are increasing investments in Dental Hygiene. High sterilization standards are enforced in European dental clinics by the European Medical Device Regulation (M.D.) and the European Centre for Disease Prevention and Control.

Great Britain also leads the way in the adoption of advanced sterilization technologies. These include vacuum autoclaves, digitalized sterilization tracking, and artificially intelligent monitoring systems. Finally, the move towards environmentally friendly and low-water-consumption autoclaves is gaining momentum in the market as well.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.6% |

Dental Autoclaves Market in Japan was contributed to by the country s file warming trend in people pressing for high precision dentistry and increasing concern by governments of how prevent diseases of infection. Additionally, innovative methods for sterilization have been developed to meet specific application needs.

The promotion of the ministry of Japan's Health, Labour and Welfare (MHLW) in this respect will also have an effect beyond dental clinics. All China's major city hospitals, for example, are already using high-efficiency sterilization systems provided by the Japanese ministry.

To cater to the needs of large dental clinics and higher education institutions, Japanese dental imaging equipment manufacturers are also developing compact, noiseless, and fast autoclaves. The development and use of smart autoclaves with IoT-based sterilization tracking lead to greater efficiency, ultimately enhancing the therapeutic success rates of dental practices.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.7% |

South Korea's Dental autoclave market is growing rapidly due to several factors at play. One is the expansion of dental tourism, and another is the widespread adoption of high-speed sterilization equipment, as well as government initiatives to control infections. Hospitals publishing positive indicators of their patients' health are provided with a series of detailed instructions in MFDS Article 14.

By investing increasingly in digital dentistry, intelligent autoclave solutions, and real-time sterilization monitoring systems driven by AI, South Korea is taking the lead in high-tech dental equipment manufacturing. Moreover, the expanding number of chain dental clinics and mobile dental services means that compact and portable sterilizers are in demand.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.9% |

The Market for Dental Autoclaves is growing due to increasing demand for infection control, stricter sterilization regulations, and the development of high-efficiency autoclave technology. The growth of dental procedures, stricter hygiene requirements, and the increased use of Class B autoclaves for enhanced sterilization drive the market.

Energy-efficient, compact, and fast-cycle autoclaves are what manufacturers highlight to achieve maximum sterilization performance, productivity in workflow, and compliance with dental safety standards. The sector includes leading medical equipment manufacturers, sterilization equipment firms, and dental technology firms, each of which is innovating in computerized autoclaves, green steam sterilization, and smart monitoring systems.

Tuttnauer (18-22%)

Tuttnauer leads the dental autoclaves market, offering Class B and fast-cycle autoclaves with smart sterilization tracking and energy-saving technology.

Midmark Corporation (12-16%)

Midmark specializes in compact, high-efficiency dental autoclaves, catering to private dental clinics and small practices.

W&H Dentalwerk Bürmoos GmbH (10-14%)

W&H Dentalwerk develops eco-friendly, high-performance sterilizers that integrate vacuum drying and low-energy consumption features.

SciCan Ltd. (Coltene Group) (8-12%)

SciCan is known for its STATIM series of rapid-cycle autoclaves, designed for fast instrument sterilization with minimal water usage.

MELAG Medizintechnik GmbH & Co. KG (6-10%)

MELAG offers fully automated, high-capacity sterilization solutions that focus on sustainable water and energy consumption.

Other Key Players (30-40% Combined)

Several medical sterilization equipment manufacturers, dental technology providers, and hygiene-focused device firms contribute to advancements in sterilization efficiency, regulatory compliance, and smart monitoring for dental autoclaves. These include:

The overall market size for the Dental Autoclaves Market was USD 335.9 million in 2025.

The Dental Autoclaves Market is expected to reach USD 557.7 million in 2035.

Rising awareness of infection control in dental clinics, increasing demand for sterilization equipment, and advancements in autoclave technology will drive market growth.

The USA, Germany, China, Japan, and India are key contributors.

Steam Autoclave Sterilizers and Electric Sterilizers are expected to lead in the Dental Autoclaves Market.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Modality, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Modality, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Loading, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Loading, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by End User, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Product, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Modality, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Modality, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Loading, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Loading, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Product, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Modality, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Modality, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Loading, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Loading, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 34: Europe Market Volume (Units) Forecast by Product, 2018 to 2033

Table 35: Europe Market Value (US$ Million) Forecast by Modality, 2018 to 2033

Table 36: Europe Market Volume (Units) Forecast by Modality, 2018 to 2033

Table 37: Europe Market Value (US$ Million) Forecast by Loading, 2018 to 2033

Table 38: Europe Market Volume (Units) Forecast by Loading, 2018 to 2033

Table 39: Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 40: Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 41: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: Asia Pacific Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 44: Asia Pacific Market Volume (Units) Forecast by Product, 2018 to 2033

Table 45: Asia Pacific Market Value (US$ Million) Forecast by Modality, 2018 to 2033

Table 46: Asia Pacific Market Volume (Units) Forecast by Modality, 2018 to 2033

Table 47: Asia Pacific Market Value (US$ Million) Forecast by Loading, 2018 to 2033

Table 48: Asia Pacific Market Volume (Units) Forecast by Loading, 2018 to 2033

Table 49: Asia Pacific Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 50: Asia Pacific Market Volume (Units) Forecast by End User, 2018 to 2033

Table 51: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 53: MEA Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 54: MEA Market Volume (Units) Forecast by Product, 2018 to 2033

Table 55: MEA Market Value (US$ Million) Forecast by Modality, 2018 to 2033

Table 56: MEA Market Volume (Units) Forecast by Modality, 2018 to 2033

Table 57: MEA Market Value (US$ Million) Forecast by Loading, 2018 to 2033

Table 58: MEA Market Volume (Units) Forecast by Loading, 2018 to 2033

Table 59: MEA Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 60: MEA Market Volume (Units) Forecast by End User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Modality, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Loading, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 11: Global Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Modality, 2018 to 2033

Figure 15: Global Market Volume (Units) Analysis by Modality, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Modality, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Modality, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Loading, 2018 to 2033

Figure 19: Global Market Volume (Units) Analysis by Loading, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Loading, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Loading, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 23: Global Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 26: Global Market Attractiveness by Product, 2023 to 2033

Figure 27: Global Market Attractiveness by Modality, 2023 to 2033

Figure 28: Global Market Attractiveness by Loading, 2023 to 2033

Figure 29: Global Market Attractiveness by End User, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Product, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Modality, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Loading, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 41: North America Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Modality, 2018 to 2033

Figure 45: North America Market Volume (Units) Analysis by Modality, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Modality, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Modality, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Loading, 2018 to 2033

Figure 49: North America Market Volume (Units) Analysis by Loading, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Loading, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Loading, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 53: North America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 56: North America Market Attractiveness by Product, 2023 to 2033

Figure 57: North America Market Attractiveness by Modality, 2023 to 2033

Figure 58: North America Market Attractiveness by Loading, 2023 to 2033

Figure 59: North America Market Attractiveness by End User, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Product, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Modality, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Loading, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Modality, 2018 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by Modality, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Modality, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Modality, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Loading, 2018 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by Loading, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Loading, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Loading, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Product, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Modality, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Loading, 2023 to 2033

Figure 89: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 92: Europe Market Value (US$ Million) by Modality, 2023 to 2033

Figure 93: Europe Market Value (US$ Million) by Loading, 2023 to 2033

Figure 94: Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 95: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 101: Europe Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 102: Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 103: Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 104: Europe Market Value (US$ Million) Analysis by Modality, 2018 to 2033

Figure 105: Europe Market Volume (Units) Analysis by Modality, 2018 to 2033

Figure 106: Europe Market Value Share (%) and BPS Analysis by Modality, 2023 to 2033

Figure 107: Europe Market Y-o-Y Growth (%) Projections by Modality, 2023 to 2033

Figure 108: Europe Market Value (US$ Million) Analysis by Loading, 2018 to 2033

Figure 109: Europe Market Volume (Units) Analysis by Loading, 2018 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by Loading, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Loading, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 113: Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 114: Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 115: Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 116: Europe Market Attractiveness by Product, 2023 to 2033

Figure 117: Europe Market Attractiveness by Modality, 2023 to 2033

Figure 118: Europe Market Attractiveness by Loading, 2023 to 2033

Figure 119: Europe Market Attractiveness by End User, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Asia Pacific Market Value (US$ Million) by Product, 2023 to 2033

Figure 122: Asia Pacific Market Value (US$ Million) by Modality, 2023 to 2033

Figure 123: Asia Pacific Market Value (US$ Million) by Loading, 2023 to 2033

Figure 124: Asia Pacific Market Value (US$ Million) by End User, 2023 to 2033

Figure 125: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 128: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Asia Pacific Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 131: Asia Pacific Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 132: Asia Pacific Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 133: Asia Pacific Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 134: Asia Pacific Market Value (US$ Million) Analysis by Modality, 2018 to 2033

Figure 135: Asia Pacific Market Volume (Units) Analysis by Modality, 2018 to 2033

Figure 136: Asia Pacific Market Value Share (%) and BPS Analysis by Modality, 2023 to 2033

Figure 137: Asia Pacific Market Y-o-Y Growth (%) Projections by Modality, 2023 to 2033

Figure 138: Asia Pacific Market Value (US$ Million) Analysis by Loading, 2018 to 2033

Figure 139: Asia Pacific Market Volume (Units) Analysis by Loading, 2018 to 2033

Figure 140: Asia Pacific Market Value Share (%) and BPS Analysis by Loading, 2023 to 2033

Figure 141: Asia Pacific Market Y-o-Y Growth (%) Projections by Loading, 2023 to 2033

Figure 142: Asia Pacific Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 143: Asia Pacific Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 144: Asia Pacific Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 145: Asia Pacific Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 146: Asia Pacific Market Attractiveness by Product, 2023 to 2033

Figure 147: Asia Pacific Market Attractiveness by Modality, 2023 to 2033

Figure 148: Asia Pacific Market Attractiveness by Loading, 2023 to 2033

Figure 149: Asia Pacific Market Attractiveness by End User, 2023 to 2033

Figure 150: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) by Product, 2023 to 2033

Figure 152: MEA Market Value (US$ Million) by Modality, 2023 to 2033

Figure 153: MEA Market Value (US$ Million) by Loading, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) by End User, 2023 to 2033

Figure 155: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 158: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: MEA Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 161: MEA Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 162: MEA Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 163: MEA Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 164: MEA Market Value (US$ Million) Analysis by Modality, 2018 to 2033

Figure 165: MEA Market Volume (Units) Analysis by Modality, 2018 to 2033

Figure 166: MEA Market Value Share (%) and BPS Analysis by Modality, 2023 to 2033

Figure 167: MEA Market Y-o-Y Growth (%) Projections by Modality, 2023 to 2033

Figure 168: MEA Market Value (US$ Million) Analysis by Loading, 2018 to 2033

Figure 169: MEA Market Volume (Units) Analysis by Loading, 2018 to 2033

Figure 170: MEA Market Value Share (%) and BPS Analysis by Loading, 2023 to 2033

Figure 171: MEA Market Y-o-Y Growth (%) Projections by Loading, 2023 to 2033

Figure 172: MEA Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 173: MEA Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 174: MEA Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 175: MEA Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 176: MEA Market Attractiveness by Product, 2023 to 2033

Figure 177: MEA Market Attractiveness by Modality, 2023 to 2033

Figure 178: MEA Market Attractiveness by Loading, 2023 to 2033

Figure 179: MEA Market Attractiveness by End User, 2023 to 2033

Figure 180: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dental Implant and Prosthetic Market Size and Share Forecast Outlook 2025 to 2035

Dental Imaging Equipment Market Forecast and Outlook 2025 to 2035

Dental Wounds Treatment Market Size and Share Forecast Outlook 2025 to 2035

Dental Radiometer Market Size and Share Forecast Outlook 2025 to 2035

Dental Anaesthetic Market Size and Share Forecast Outlook 2025 to 2035

Dental Diamond Bur Market Size and Share Forecast Outlook 2025 to 2035

Dental Laboratory Market Size and Share Forecast Outlook 2025 to 2035

Dental Matrix Systems Market Size and Share Forecast Outlook 2025 to 2035

Dental Permanent Cements Market Size and Share Forecast Outlook 2025 to 2035

Dental Bleaching Agent Market Size and Share Forecast Outlook 2025 to 2035

Dental Care Products Market Size and Share Forecast Outlook 2025 to 2035

Dental Etching Liquid Market Size and Share Forecast Outlook 2025 to 2035

Dental Sutures Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dental Hygiene Devices Market Size and Share Forecast Outlook 2025 to 2035

Dental Implantology Software Market Analysis - Size, Growth, & Forecast Outlook 2025 to 2035

Dental Veneers Market Size and Share Forecast Outlook 2025 to 2035

Dental X-Ray Systems Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dental Suction Systems Market Size and Share Forecast Outlook 2025 to 2035

Dental Articulators Market Size and Share Forecast Outlook 2025 to 2035

Dental Fluoride Varnish Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA