The global dental composites market is projected to grow from USD 2.32 billion in 2025 to USD 3.40 billion by 2035, registering a CAGR of 3.9% over the forecast period. This growth is being driven by increasing demand for minimally invasive and aesthetic dental procedures, combined with rising awareness of oral health and hygiene.

Dental composites-resin-based materials used in restorative dentistry-are increasingly replacing amalgam fillings due to their superior aesthetics, durability, and safety. The rising popularity of cosmetic procedures such as veneers, inlays, and onlays, particularly among aging populations and millennials, continues to influence global market demand.

Innovation and advancements in dental materials are playing a pivotal role in shaping the market. The emergence of nanohybrid, flowable, and bulk-fill composites has enhanced application efficiency, polishability, and mechanical performance.

These innovations have led to increased adoption in both general and cosmetic dental practices. In parallel, market players are emphasizing product quality and compliance. “SAREMCO Dental has stood for the highest quality and innovative strength in the field of dental materials since its founding,” said Sven Hauser, CEO of Saremco Dental AG.

“The certifications achieved confirm our continuous pursuit of excellence and give our customers the security of using products that are both clinically proven and fully comply with the latest regulatory requirements.”

The expansion of dental tourism in regions like Asia and Eastern Europe, along with improved access to dental care in emerging economies, is expected to further accelerate market growth.

Additionally, the adoption of chairside CAD/CAM systems and digital workflows is creating demand for fast-curing, aesthetically superior composite materials. As patient preferences continue to shift toward long-lasting, natural-looking restorations, the dental composites market is likely to benefit from sustained innovation, improved material science, and broader adoption across global dental practices through 2035.

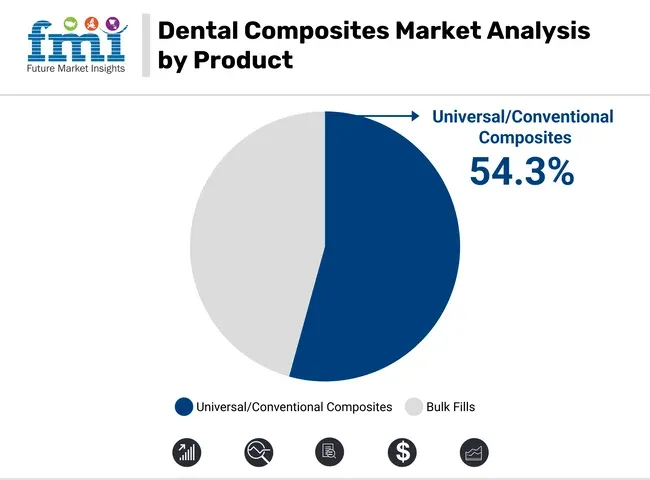

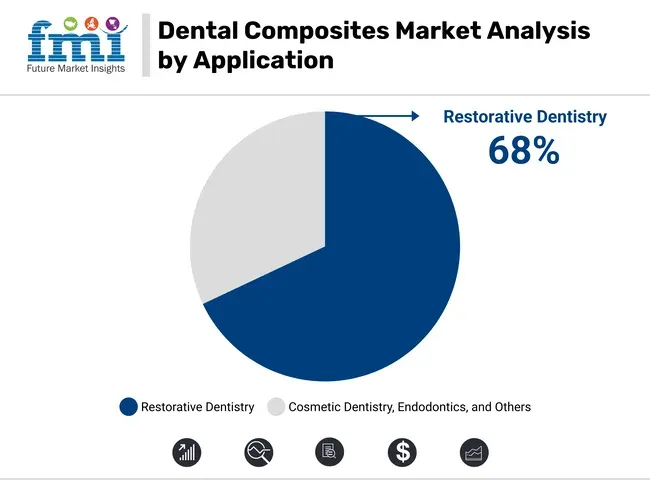

Rising demand for aesthetic, minimally invasive procedures is fueling growth in the dental composites market, with universal composites and restorative dentistry leading due to their versatility, clinical efficiency, and cosmetic appeal.

Universal or conventional composites are projected to account for 54.3% of the dental composites market by 2025, reflecting their position as the most versatile and widely used materials in dental restoration.

These composites offer an ideal combination of strength, wear resistance, and esthetics, making them suitable for both anterior and posterior restorations.

Manufacturers such as 3M, Dentsply Sirona, GC Corporation, and IvoclarVivadent are leading in the development of high-performance universal composites that offer better handling, shade matching, and long-term durability. Improvements in nanohybrid and nanofilled technologies have enhanced polishability, radiopacity, and resistance to shrinkage, further solidifying their use in everyday practice.

Restorative dentistry is anticipated to capture 68.0% of the application segment in the dental composites market by 2025, driven by a rise in dental procedures addressing caries, trauma, and aesthetic enhancements. Restorative applications include direct fillings, veneers, crowns, and core build-up procedures that rely heavily on composite materials for functional and cosmetic outcomes. Key players like Kerr Corporation, VOCO GmbH, Tokuyama Dental, and Coltene are investing in composite systems tailored specifically for efficient chairside restorations.

The increasing frequency of dental visits, coupled with insurance coverage improvements and growing awareness of oral health, is expected to keep restorative dentistry at the forefront of application-driven growth in the dental composites market.

The dental composites market is driven by rising aesthetic and restorative needs, but faces regulatory and cost challenges. Technological advancements and infrastructure growth offer opportunities amid rising competition from alternative materials.

Aging populations and aesthetic demand are fueling the adoption of dental composites.

An aging global population is contributing to the rising need for dental restorations, particularly as more individuals retain natural teeth later in life. This demographic trend is being supported by a parallel surge in cosmetic dentistry, driven by greater aesthetic consciousness and widespread social media exposure. Patients now seek composite-based treatments for fillings, veneers, and minor corrections due to their natural appearance and durability.

The shift toward minimally invasive procedures is also favoring composite materials over traditional metallic options. In addition, digital workflow integration is making composite-based procedures faster and more accessible, supporting higher adoption rates among dental professionals globally.

High regulatory complexity and raw material costs are limiting broader market expansion

The dental composites market is being constrained by complex global regulatory frameworks that mandate stringent biocompatibility, clinical safety, and efficacy testing for every new product. This significantly delays time-to-market and inflates R&D costs for manufacturers.

Furthermore, composite materials rely on synthetic monomers, fillers, and additives that are sensitive to raw material price fluctuations, resulting in unstable production costs. These factors make it difficult for small and mid-sized players to compete and often discourage innovation. As markets increasingly demand sustainable, digital-compatible products, the pressure on manufacturers to balance compliance, cost-efficiency, and innovation is growing-slowing expansion in resource-constrained regions.

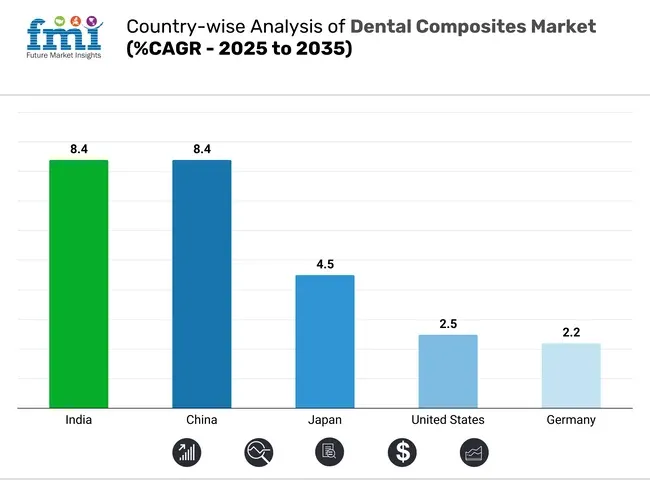

The dental composites market is growing globally, fueled by cosmetic dentistry demand, better insurance access, and nano-hybrid innovations, with the USA, China, India, Japan, and the UK leading advancements and distribution.

The United States dental composites market is projected to grow at a CAGR of 2.5% through 2035, driven by widespread demand for esthetic restorations and minimally invasive care. Companies like 3M ESPE and Dentsply Sirona dominate, offering nano-hybrid, bulk-fill, and flowable composites.

Regulatory support from the American Dental Association (ADA) promotes rapid clinical adoption. Patients increasingly prefer mercury-free restorations over amalgam, aligning with sustainability trends. Insurance coverage and public health initiatives have normalized composite restorations across private and public practices. Continued innovation in curing lights and bonding systems supports high procedural efficiency, reinforcing the USA as the global market leader.

The dental composites market in Germany is expanding at a CAGR of 2.2% through 2035, is known for clinical precision and product safety. Domestic manufacturers such as VOCO, DMG, and Kulzer develop EU-compliant, mercury-free composites with nano-technology integration.

The country prioritizes conservative dentistry, using composites for preventive fillings and minimally invasive restorations. Dental universities collaborate with industry to drive innovation in bio-compatible resins.

A robust insurance system ensures steady product uptake in both public and private clinics. With strict regulatory enforcement and high exports to neighboring EU countries, Germany maintains its reputation for premium-quality restorative materials and process-standardization in composite dentistry.

China is among the fastest-growing dental composites markets, projected at a CAGR of 8.4% through 2035. Rapid urbanization and rising dental awareness in Tier 1 and Tier 2 cities drive demand for esthetic restorations. Companies like Shanghai DMF, Huge Dental, and local partners of 3M and GC Corporation are scaling operations.

Government programs like “Healthy China 2030” support oral healthcare modernization, while e-commerce platforms enable widespread product access. The popularity of minimally invasive care and cosmetic fillers among younger populations boosts demand. Clinical innovation is propelled by partnerships with dental universities, positioning China as a growing hub for composite manufacturing and usage.

The dental composites market in india is growing rapidly, with a CAGR of 8.4% through 2035, driven by increased esthetic awareness and affordability. Domestic firms like PrevestDenPro and Septodont India supply cost-effective composites, while 3M India and GC India serve premium segments.

Over 300 dental colleges train new practitioners annually, fueling product demand. Tele-dentistry and online supply chains enable material access in Tier 2 and Tier 3 cities. Composites are now preferred for smile makeovers, especially among millennials. Regulatory backing from the Dental Council of India ensures continuous clinician education. India is becoming both a high-volume consumer and exporter of composites.

The dental composites market in Japan, growing at a CAGR of 4.5% through 2035, is shaped by its aging population and innovation culture. Companies like GC Corporation, Shofu Inc., and Tokuyama Dental lead in high-performance, biocompatible materials. Composites are widely used for inlays, veneers, and crown fillings in geriatric dentistry. National insurance ensures broad access to advanced treatments, while the Japan Dental Association (JDA) enforces strict safety standards.

Private clinics increasingly offer premium cosmetic restorations. Academic-industry collaboration focuses on fluoride-releasing and antibacterial resins. Japan’s export strength and commitment to R&D make it a key player in advanced composite material development globally.

The dental composites market features a moderately consolidated structure, with Tier 1 players like 3M, Dentsply Sirona, IvoclarVivadent, and Ultradent leading through global reach, R&D, and innovation. Tier 2 firms such as Kerr, GC America, DMG, and VOCO hold strong regional positions and focus on specialized formulations.

In 2023, DMG launched its Ecosite Elements nanohybrid composite for anterior use. Tier 3 players like PrevestDenPro and Shofu serve cost-sensitive markets. High entry barriers include regulatory complexity and clinician loyalty. The market sees ongoing M&A activity, with trends favoring nano-fill, bioactive, and bulk-fill composites for faster, esthetic outcomes.

Recent Dental Composites Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 2.32 billion |

| Projected Market Size (2035) | USD 3.40 billion |

| CAGR (2025 to 2035) | 3.9% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Product Types Analyzed (Segment 1) | Bulk Fills; Paste; Flowables; Universal/Conventional Composites |

| Applications Covered (Segment 2) | Restorative Dentistry; Cavity Fillings; Fracture Repairs; Cosmetic Dentistry (Veneers, Tooth Bonding, Whitening Restoration, Endodontics); Others |

| Filler Particle Sizes Analyzed | Micro-Fill Composite; Macrofilled Composites; Nano-Fill Composite; Hybrid Composite |

| End Users Covered | Dental Clinics; Hospitals; Academic & Research Institutes; Ambulatory Surgery Centers; Group Dental Practices |

| Regions Covered | North America; Europe; Asia-Pacific; Latin America; Middle East & Africa |

| Countries Covered | United States; Canada; Germany; United Kingdom; France; China; India; Japan; Brazil; Australia |

| Key Players Influencing the Market | 3M; Dentsply Sirona; Ivoclar Vivadent ; GC Corporation; Kerr Corporation; Kulzer GmbH; COLTENE Group; KURARAY CO., LTD; DMG Dental; Ultradent Products Inc.; BISCO, Inc.; VOCO GmbH |

| Additional Attributes | Dollar sales by product type and application; distribution channel trends; regional consumption patterns; evolving consumer preferences; regulatory landscape |

Bulk Fills, Paste, Flowables, Universal/Conventional Composites

Restorative Dentistry, Cavity Fillings, Fracture Repairs, Cosmetic Dentistry, Veneers, Tooth Bonding, Whitening Restoration, Endodontics, Others

Micro-Fill Composite, Macrofilled Composites, Nano-Fill Composite, Hybrid Composite

Dental Clinics, Hospitals, Academic & Research Institutes, Ambulatory Surgery Center, Group Dental Practices

The global dental composites market is expected to reach USD 3.40 billion by 2035, growing from USD 2.32 billion in 2025, at a CAGR of 3.9% during the forecast period.

The resin composites segment is expected to grow the fastest due to increasing demand for aesthetic dental procedures and high-quality, durable restorations.

Key factors include rising demand for cosmetic dental treatments, technological advancements in dental materials, and an increasing focus on minimally invasive procedures.

Top companies include 3M, Dentsply Sirona, Ivoclar Vivadent, GC Corporation, Kerr Corporation, Kulzer GmbH, COLTENE Group, KURARAY CO., LTD, DMG Dental, Ultradent Products Inc., BISCO, Inc., and VOCO GmbH.

The market is projected to grow at a CAGR of 3.9% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dental Implant and Prosthetic Market Size and Share Forecast Outlook 2025 to 2035

Dental Imaging Equipment Market Forecast and Outlook 2025 to 2035

Dental Wounds Treatment Market Size and Share Forecast Outlook 2025 to 2035

Dental Radiometer Market Size and Share Forecast Outlook 2025 to 2035

Dental Anaesthetic Market Size and Share Forecast Outlook 2025 to 2035

Dental Diamond Bur Market Size and Share Forecast Outlook 2025 to 2035

Dental Laboratory Market Size and Share Forecast Outlook 2025 to 2035

Dental Matrix Systems Market Size and Share Forecast Outlook 2025 to 2035

Dental Permanent Cements Market Size and Share Forecast Outlook 2025 to 2035

Dental Bleaching Agent Market Size and Share Forecast Outlook 2025 to 2035

Dental Care Products Market Size and Share Forecast Outlook 2025 to 2035

Dental Etching Liquid Market Size and Share Forecast Outlook 2025 to 2035

Dental Sutures Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dental Hygiene Devices Market Size and Share Forecast Outlook 2025 to 2035

Dental Implantology Software Market Analysis - Size, Growth, & Forecast Outlook 2025 to 2035

Dental Veneers Market Size and Share Forecast Outlook 2025 to 2035

Dental X-Ray Systems Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dental Suction Systems Market Size and Share Forecast Outlook 2025 to 2035

Dental Articulators Market Size and Share Forecast Outlook 2025 to 2035

Dental Fluoride Varnish Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA