The global dental practice management software market is estimated to be valued at USD 3,090.6 million in 2025 and is forecast to grow to USD 8,234.6 million by 2035, advancing at a CAGR of 10.3% during the forecast period.

| Metric | Value |

|---|---|

| Estimated Industry Size in 2025 | USD 3,090.6 Million |

| Projected Industry Size in 2035 | USD 8,234.6 Million |

| CAGR (2025 to 2035) | 10.3% |

The Dental Practice Management Software market has been experiencing steady growth, underpinned by the intensification of fish farming practices and the rising economic impact of infectious diseases on global aquaculture output. Regulatory frameworks have increasingly prioritized vaccination strategies as sustainable alternatives to antibiotic use, aligning with public health mandates to mitigate antimicrobial resistance.

Demand has been reinforced by investments in hatchery biosecurity, health monitoring infrastructure, and the integration of vaccination protocols across commercial fish production cycles. Manufacturers have expanded their portfolios to include targeted vaccines covering prevalent bacterial and viral pathogens, supported by continuous improvements in adjuvant systems and administration techniques.

Over the forecast period, the market is expected to advance as climate change and global trade elevate pathogen transmission risks, prompting stricter disease management policies. The expansion of high-value aquaculture species and technological innovations in oral and immersion vaccines are anticipated to create sustained opportunities for vaccine producers, distributors, and integrated farming operations.

Web-based dental practice management solutions have been observed to hold the leading revenue share of 43.6% in 2025, supported by a CAGR of 4.5% during the forecast period. Segment leadership has been driven by the preference for scalable, subscription-based models that reduce upfront infrastructure costs and simplify updates. Utilization has been reinforced by the ability of web-based platforms to enable secure access to patient data and administrative functions from any location, supporting remote work and multi-site operations.

Clinics have prioritized these solutions for their compatibility with evolving data security regulations and their capacity to integrate with digital imaging systems and third-party applications. Vendors have invested in user-friendly interfaces and automated workflows that reduce administrative burdens and improve staff productivity. Collectively, these dynamics have consolidated web-based deployment as the preferred model for modern dental practices seeking flexible and resilient software ecosystems.

Patient communication software has been identified as the dominant application segment, accounting for 32.6% of total revenue in 2025 and achieving a CAGR of 2.5% through the forecast period. Segment growth has been supported by heightened emphasis on patient engagement, satisfaction, and retention in competitive dental markets. Adoption has been reinforced by the integration of automated appointment reminders, two-way messaging, and personalized education content that strengthen relationships between clinics and patients.

Practices have increasingly prioritized communication tools to reduce no-show rates, improve treatment acceptance, and support continuity of care. Vendors have enhanced software capabilities with analytics dashboards that track engagement metrics and inform marketing strategies. These factors have collectively positioned patient communication applications as essential components of comprehensive dental practice management systems.

Survey Conducted Q4 2024, n=450 stakeholder participants evenly distributed across software developers, dental practitioners, IT administrators, and healthcare regulators in the USA, Western Europe, Japan, and South Korea.

FMI analysis found that data security, interoperability, and automation are the top priorities driving adoption in the industry. 83% of global stakeholders cited compliance with data privacy regulations (HIPAA, GDPR) as a “critical” requirement for new software acquisitions. 76% of respondents emphasized seamless integration with electronic health records (EHRs) and insurance billing systems, reducing the administrative burden for dental practices.

Regional Variance:

The adoption of advanced technologies such as AI-powered analytics, cloud computing, and telehealth integrations is highly region-dependent. FMI analysis found that 63% of USA dental clinics have already deployed AI-driven patient data analytics to optimize treatment planning and revenue management. However, in Japan, only 27% of clinics have adopted AI solutions due to cost concerns and resistance to over-digitization.

Regional Variance:

Despite the clear efficiency benefits, the return on investment (ROI) of automation varies by region. 70% of USA and European stakeholders view AI-powered automation as cost-effective, whereas only 34% in Japan are willing to make high upfront investments.

Rising software development costs, increasing demand for cybersecurity compliance, and cloud-based hosting expenses have made pricing a key concern. FMI analysis found that 89% of stakeholders cited software affordability as a top barrier to adoption. However, regional preferences for pricing models vary significantly.

Regional Variance:

Software providers, distributors, and end-users face unique challenges depending on regional regulations and infrastructure maturity. FMI analysis found that the most significant barriers include talent shortages, regulatory compliance, and software interoperability issues.

Manufacturers:

Distributors:

End-Users (Dental Clinics):

Despite cost concerns, stakeholders are actively planning technology-driven upgrades to stay competitive. FMI analysis found that 72% of global software providers plan to increase R&D spending on AI and cloud computing.

Regional Investment Priorities:

Regulatory frameworks play a pivotal role in shaping industry expansion strategies. FMI analysis found that regulatory compliance is both a barrier and a growth driver, depending on the region.

Regional Variance:

FMI analysis found that while global adoption trends lean towards automation, AI, and cloud-based solutions, regional adaptation is critical for success.

Key Takeaways:

Strategic Insight:

A one-size-fits-all approach to dental clinic technology will not work. Software developers must tailor their offerings based on regional demand drivers-focusing on AI in the USA, sustainability in Europe, and cost-efficient hybrid models in Asia to maximize adoption.

| Country/Region | Regulatory Impact & Mandatory Certifications |

|---|---|

| United States | HIPAA (Health Insurance Portability and Accountability Act) mandates strict data privacy and security standards for patient information. HITECH Act reinforces penalties for non-compliance. ONC Certification (Office of the National Coordinator for Health IT) is required for EHR interoperability. State-level privacy laws (e.g., CCPA in California) impose additional data protection requirements. |

| Western Europe | GDPR (General Data Protection Regulation) enforces stringent data security and patient consent requirements. If the software has diagnostic functions, the EU Medical Device Regulation (MDR) applies. ISO 13485 certification is necessary for compliance with EU standards. France and Germany require CNIL and BSI cybersecurity certifications for medical software providers. |

| United Kingdom | The UK GDPR (the post-Brexit equivalent of the EU GDPR) mandates strict patient data protection. NHS Digital Standards regulate software interoperability for integration with national health systems. Cyber Essentials Certification is recommended for cybersecurity compliance in healthcare IT. |

| Germany | BSI IT-Grundschutz standards regulate healthcare cybersecurity. KBV (Kassenärztliche Bundesvereinigung) Certification is required for compatibility with public health insurance billing systems. |

| France | CNIL (Commission Nationale de l'Informatique et des Libertés) regulations enforce data protection compliance for medical software. ASIP Santé certification is required for interoperability with French healthcare networks. |

| Italy | Garante della Privacy enforces data security laws under EU GDPR. Sistema Tessera Sanitaria (STS) certification is required to integrate dental software with national health services. |

| India | DPDP Act (Digital Personal Data Protection Act, 2023) mandates stringent data localization and privacy regulations for patient records. National Digital Health Mission (NDHM) Guidelines require healthcare software to comply with interoperability standards for integration with the Ayushman Bharat Digital Mission (ABDM). Medical Council of India (MCI) approval may be required for telemedicine-enabled software. MeitY’s CERT-In compliance is necessary for cybersecurity measures in cloud-based platforms. |

| China | China’s Personal Information Protection Law (PIPL) governs patient data privacy, similar to GDPR, but with stricter data localization requirements. If the software includes diagnostic functions, CFDA (China Food and Drug Administration) approval is required. MLPS (Multi-Level Protection Scheme) cybersecurity certification is mandatory for cloud-based medical software. |

| Japan | APPI (Act on the Protection of Personal Information) regulates patient data security. Ministry of Health, Labour, and Welfare (MHLW) approval is needed for clinical-grade software. FISC (Center for Financial Industry Information Systems) cybersecurity guidelines apply to cloud-based solutions. |

| South Korea | PIPA (Personal Information Protection Act) enforces data privacy compliance. K-HIS (Korean Healthcare Information System) certification is necessary for integrating with national health systems. The ISMS-P (Information Security Management System-Personal Information) certification is required for cloud-based dental software. |

| Australia & New Zealand | The Australian Privacy Act (APA) and My Health Record regulations govern patient data handling. If the software includes diagnostic features, TGA (Therapeutic Goods Administration) approval is required. New Zealand’s Privacy Act imposes similar restrictions, with HISO (Health Information Standards Organisation) certification required for integration with public health services. |

The dental practice management software industry is on a strong growth trajectory, driven by increasing digital transformation in healthcare and the adoption of AI-driven solutions to enhance efficiency and patient care. FMI analysis found that dental clinics, particularly small and mid-sized practices, stand to benefit the most as they streamline operations.

At the same time, software providers and cloud service vendors gain from the rising demand. However, a shortage of trained IT professionals and integration challenges with legacy systems may slow adoption for some providers.

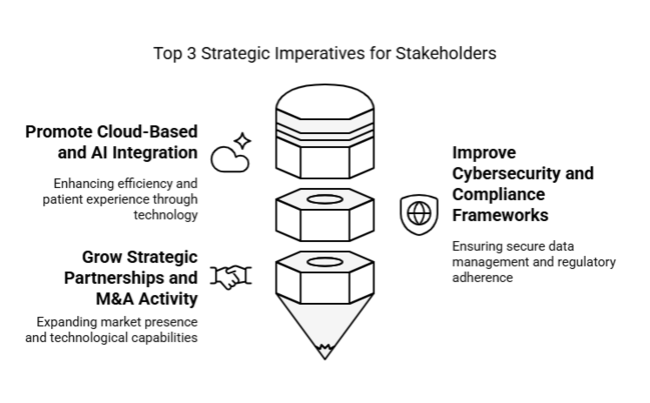

Promote Cloud-Based and AI Integration

Executives must create cloud-based systems and AI-driven automation that improve efficiency, improve patient experience(UX), and simplify data. Interoperability with existing healthcare systems will be essential for sustained competitiveness.

Improve Cybersecurity and Compliance Frameworks

As privacy-related regulations become more stringent, it will be vital to keep software solutions up to date with evolving compliance requirements. This will require businesses to step up cybersecurity practices, ensuring the secure storage of patient information as well as facilitating regulatory compliance, building trust, and preventing potential legal consequences.

Grow Strategic Partnerships and M&A Activity

To drive industry penetration, companies need to focus on partnerships with insurance providers, dental equipment suppliers, and larger healthcare IT companies. Furthermore, M&A investment will enable software vendors to enhance product offerings, enrich product portfolios by introducing new technologies, and strengthen industry presence in developing regions.

| Risk | Probability & Impact |

|---|---|

| Lack of Trained IT Staff- FMI analysis found that the demand for healthcare IT staff is increasing at a rate of 15% each year, but the supply of skilled professionals is still low. This deficit contributes to increased implementation costs and delays in software adoption. Firms should invest in staffing development and automation to offset this issue. | Probability: High |

| Regulatory and Compliance Challenges- With growing concerns regarding data privacy, FMI believes that compliance expenses for health software vendors are likely to rise by 12% every year, fueled by more stringent rules such as HIPAA in the United States and GDPR in Europe. Non-compliance may lead to hefty penalties and loss of reputation. | Probability: Medium |

| Legacy System Integration Issues- More than 40% of dental practices still use old software, leading to compatibility problems with new AI-enabled and cloud-based systems. According to FMI analysis, failed integrations resulted in a typical 25% increase in implementation duration, delaying the gain in operational efficiency. | Probability: High |

| Priority | Immediate Action |

|---|---|

| Accelerate AI and Cloud Adoption | Conduct feasibility studies on integrating AI-driven automation and cloud-based solutions to enhance operational efficiency and patient management. |

| Strengthen Compliance and Cybersecurity | Initiate a comprehensive audit of data privacy frameworks to ensure compliance with evolving regulations like HIPAA and GDPR, mitigating legal and financial risks. |

| Expand Strategic Partnerships | Launch targeted collaborations with insurance providers, dental equipment manufacturers, and healthcare IT firms to drive adoption and improve software interoperability. |

To stay ahead, companies must focus on AI-based automation, cloud deployment, and interoperability with the current healthcare infrastructure. FMI believes that investing early in cybersecurity and compliance will be critical as regulations tighten. Forming strategic alliances with insurers and dental equipment manufacturers will further drive adoption.

With IT skills in short supply, companies need to look into workforce training programs and automation to fill the gap. This insight signals a shift toward more intelligent, interconnected dental software platforms. Agility will benefit companies that act swiftly and secure a competitive edge, while laggards will find themselves in the dust.

The CAGR for market in the US is anticipated to be 10.5% between 2025 and 2035, fueled by extensive cloud deployment, AI embedding, and value-based care initiatives. Solutions must combine HIPAA compliance to secure patient data with ONC certification for EHR systems, creating a strong demand for certified software.

FMI analysis indicated that more than 80% of dental offices in the United States now use some kind of cloud-based practice management system, and more of them come from bigger multi-clinic operators. Artificial intelligence-enabled analytics, computer-aided billing, and same-day insurance checks are quickly becoming norms in many metropolitan areas. Nevertheless, more reservations are coming from small, independent operators concerning the price tag, data security, and systems' sophistication.

FMI believes vendors providing AI-infused, cloud-based platforms with strong security options will have the most success in the USA The transition to patient-centric digital platforms, integrating telehealth, should propel demand, especially from large dental service organizations (DSOs) and chain clinics.

The UK market is set to register a CAGR of 9.2% between 2025 and 2035, driven by NHS digitization initiatives, data protection laws, and the growing adoption of AI-based solutions.

FMI research discovered that more than 65% of UK dental clinics have incorporated some type of digital practice management solution, with cloud-based models being the most popular. NHS funding limitations have, nonetheless, delayed uptake in public clinics, whereas private clinics lead in AI-based patient management and automated scheduling adoption.

FMI believes that vendors of NHS-compliant, AI-driven cloud-based solutions will experience robust growth. The shift toward automated billing, telehealth, and patient engagement will further drive demand.

From 2025 to 2035, the estimated CAGR for France is 8.9%, leaning on government support for EHR digitization, diagnostic improvements with AI as well as strong private investments. To tighten enforcement of rigorous data protection and interoperability, France expects HDS certification of its healthcare software vendors.

According to FMI's research, more than 60% of dental practices in France have only recently switched over to using digital practice management systems, encouraging strong AI applications in areas such as treatment planning, automatic scheduling with patients, and integration with processing insurance. Adopting such new technology is still challenged, though, due to the small offices facing impact from both cost factors and regulatory complexity.

FMI witnesses share for providers offering HDS-certified AI-based platforms with smooth integration with EHRs. The move towards completely digitized patient management processes is likely to see acceleration across large dental networks and urban practices.

The CAGR in Germany is estimated at 9.4% from 2025 to 2035, driven by stringent data protection legislation, automation through AI, and growing investments in cloud-based practice management software. Germany has the requirements of compliance with GDPR and KBV, expecting severe security and ePA interoperability with electronic health records.

According to FMI research, nearly 70% of all dental clinics in Germany already use digital practice management solutions, and AI-based diagnostics, automatic billing, and cloud-based workflow management are gaining acceptance. Yet the high price of complying with regulations, as well as stringent data security requirements, remains a significant roadblock, particularly for small clinics.

FMI believes that vendors providing GDPR-compliant, AI-based cloud solutions with robust cybersecurity capabilities will achieve the most success. Automated insurance verification, e-prescription services, and patient engagement tools are likely to drive demand in the next few years.

Italy's CAGR is estimated at 8.7% from 2025 to 2035 due to the government-driven digitization of EHRs and increasing investments in private healthcare. STS certification is obligatory for software to ensure interoperability with national healthcare systems, resulting in demand for such compliant offerings.

Even with digitalization initiatives, most Italian dental clinics continue to use manual or semi-digital processes. FMI research discovered that fewer than 50% of private clinics have implemented cloud-based management software, with cost being a significant deterrent. Nevertheless, the increase in dental insurance coverage and increased demand for telehealth solutions are likely to drive digital adoption in the next few years.

FMI views that vendors with software selling modular, subscription-priced offerings will gain the best success in Italy. Appointment scheduling applications based on artificial intelligence, automatic billing, and patient monitoring built into integrated solutions are bound to increase usage, especially from high-volume clinics in cities.

The CAGR for South Korea has been estimated at 10.3% between 2025 and 2035, based on high digital penetration and government encouragement for AI-based healthcare solutions. The certifications in K-HIS and ISMS-P cybersecurity are mandatory under South Korean law, thus maintaining strict compliance with data protection requirements for dental software vendors.

From AI-enabled patient engagement solutions, real-time insurance verification, and automated diagnosis assistance, these solutions are seeing high demand. FMI analysis estimates that over 70% South Korean dental clinics have implemented some degree of AI-based workflow automation, especially among the metropolitan areas such as Seoul and Busan.

Nonetheless, integration issues with legacy systems and cost-consciousness among smaller clinics are challenges. FMI believes that vendors targeting low-cost AI-powered cloud solutions will gain significant traction, especially in group dental practices.

India's CAGR is estimated at 11.2% from 2025 to 2035, with rising healthcare digitization, growing dental awareness, and government digital health initiatives driving it. The Ayushman Bharat Digital Mission (ABDM) is a prime force, accelerating the adoption of electronic health records (EHR) and interoperable patient management systems in hospitals and dental clinics.

An FMI study revealed that just 35% of the dental clinics in India have embraced cloud-based dental practice software, while the majority of independent clinics continue to rely on manual methods. Nevertheless, the increasing degree of urbanization, as well as the burgeoning middle-class population and surge in dental treatment expenditure greatly bolstered demand for AI-powered workflow automation, telemedicine services, and web-based patient engagement solutions.

Government policies for data privacy such as the Digital Personal Data Protection Act (DPDPA) are pushing software vendors to develop compliant, secured solutions. Cost-consciousness is still one of the biggest barriers of mass adoption in tier-2 and tier-3 cities. According to FMI, subscription-based pricing combined with AI-powered appointment booking and multilingual patient communication software are expected to differentiate vendors targeting the Indian dental sector.

China's CAGR is estimated at 11.0% between 2025 and 2035, driven by increasing healthcare digitization and stringent data localization regulations under PIPL. AI-driven diagnosis, automated scheduling, and real-time insurance processing are becoming popular. FMI analysis revealed that a significant share of large urban dental hospitals had adopted cloud-based software, though rural clinics lag.

China's MLPS (Multi-Level Protection Scheme) and PIPL (Personal Information Protection Law) regulations impose rigorous data security and localization requirements, which mandate compliant, government-certified software solutions. Government backing for AI-based healthcare will stimulate adoption, with local companies collaborating with multinational vendors to meet regulatory compliance.

Despite rapid adoption in urban areas, FMI believes that integration issues with legacy hospital systems, high software costs, and regulatory hurdles may slow adoption in smaller dental clinics. Hence, software providers with MLPS certification, AI-driven components, and bi-language capabilities shall benefit in the thriving industry for dental technology in China.

A CAGR of 8.5% for Japan is projected between 2025 and 2035, as digital adoption and cost-containment practices have a slower uptake. In Japan, we have APPI (Act on the Protection of Personal Information) and MHLW (Ministry of Health, Labour and Welfare) regulations that guarantee strict data security compliance.

While big dental chains invest in cloud-based AI-powered solutions, small independent clinics remain dependent on traditional systems. FMI research discovered that as few as 42% of clinics have adopted advanced practice management software, with cost factors and resistance to change as major deterrents.

FMI believes that government-led digitization initiatives, AI-powered diagnostics, and rising insurance penetration will also help drive adoption over time in urban areas. Localized, simplified, and MHLW-compliant platforms will witness the highest adoption in Japan's dental technology sector.

In 2025, the dental practice management software market will intensify its competitive nature further. Henry Schein (Dentrix) is projected to hold a leading 18-22% share of the industry, but the share will steadily decrease due to continued cybersecurity problems and cloud migration trends. 15-20% Patterson Companies (Eaglesoft) - Still clinging fast to its top position among legacy practices, but it cannot keep up with SaaS conversion

Open Dental retains its lead, at 14-18%, capitalizing on its inexpensive open-source model, appealing to small-to-midsize practices. The top disrupters, CareStack and Tab32 (they got 13-17%), with their cloud-born platforms and sharp AI features, are becoming the tools of choice for growing DSOs and tech-forward clinics.

Planet DDS (Denticon) goes 10-14% higher with better integration with insurances and strategic partners. New entrants like Curve Dental and Dovetail capture 6-9% by going specialty, particularly orthodontics and pediatrics. It seems that regional players like Practice-Web and Good Dental are gaining 12% to 16% collectively through aggressive pricing and local support.

The industry witnesses a surge of consolidation, where mid-size enterprises come together to tackle the cloud giants. The rapid growth of Tab32 (currently at 8%-11%) reflects patterns evolving in other SaaS disruptors, while legacy solutions continue on decline. This means niches companies like ACE Dental (4%-7%) and newcomers using AI charting (3%-5%) are beginning to cause some changes in the once-standing ranks of the traditional industry, thus signalling a movement in the USD 4,200 million industry.

Recent Developments

The dental practice management software market has been observed to demonstrate dynamic competition among established healthcare IT providers, cloud software companies, and specialized dental technology vendors. A considerable proportion of market share has been captured by companies offering comprehensive platforms that integrate scheduling, billing, clinical documentation, and patient communication tools.

Despite the benefits of digital transformation, challenges such as integration with legacy imaging systems, resistance to change among practitioners, and varied reimbursement workflows have continued to impact market expansion. Competitive intensity has further increased due to the entry of start-ups and SaaS providers introducing modular solutions tailored to niche practice needs.

Long-term differentiation is anticipated to be driven by innovations in artificial intelligence-enabled treatment planning, predictive analytics for revenue cycle optimization, and interoperability with digital imaging equipment. Sustained investments in mobile access, user experience design, and regulatory compliance frameworks are expected to reinforce competitive positioning and support future market growth.

Developments

In June 2025, Vyne Dental®, a leading provider of dental revenue technologies and health information exchange solutions, announced a new integration agreement with Open Dental Software, a widely used open-source dental practice management system.

In January 2024, Curve Dental®, the leading provider of cloud-based dental practice management software, has received top recognition in the newly released report, Powerful Trends Shaping the Dental Industry, from Frazier & Deeter, a top US business advisory and accounting firm.

By deployment mode, the industry is segmented into on-premise, web-based, and cloud-based.

In terms of application, the industry is segmented into patient communication, invoice/billing, payment processing, insurance management, and others.

Based on end-use, the industry is segmented into dental clinics and hospitals.

The industry is segmented by region into North America, Latin America, Western Europe, South Asia & Pacific, East Asia, Middle East, and Africa.

Growing digital transformation in healthcare, increasing patient volume, and the need for efficient scheduling, billing, and record-keeping are key factors fueling adoption.

Cloud-based solutions are expected to witness the fastest growth due to their scalability, remote access, and lower upfront costs compared to on-premise systems.

Regulations related to data security, patient privacy, and healthcare interoperability, such as HIPAA in the USA and GDPR in Europe, are shaping software requirements and driving compliance-focused solutions.

Dental clinics are expected to remain the dominant end-user due to the rising number of independent and group practices seeking workflow automation and improved patient management.

AI-driven automation is enhancing appointment scheduling, predictive analytics, patient engagement, and clinical decision-making, making software solutions more intelligent and efficient.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Software License Management (SLM) Market Size and Share Forecast Outlook 2025 to 2035

Dental Implantology Software Market Analysis - Size, Growth, & Forecast Outlook 2025 to 2035

Fuel Management Software Market Size and Share Forecast Outlook 2025 to 2035

Case Management Software (CMS) Market Size and Share Forecast Outlook 2025 to 2035

Farm Management Software Market Size and Share Forecast Outlook 2025 to 2035

Exam Management Software Market

Quote Management Software Market Size and Share Forecast Outlook 2025 to 2035

Trade Management Software Market Size and Share Forecast Outlook (2025 to 2035)

Event Management Software Market Analysis - Size, Share, and Forecast 2025 to 2035

Grant Management Software Market - Trends, Size & Forecast 2025 to 2035

Video Management Software Market

Server Management Software Market Size and Share Forecast Outlook 2025 to 2035

Skills Management Software Market Size and Share Forecast Outlook 2025 to 2035

Change Management Software Market Size and Share Forecast Outlook 2025 to 2035

SBOM Management and Software Supply Chain Compliance Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Church Management Software Market Size and Share Forecast Outlook 2025 to 2035

Cattle Management Software Market Size and Share Forecast Outlook 2025 to 2035

Output Management Software Market Insights – Growth & Forecast through 2035

Travel Management Software Market

Talent Management Software Market Report – Trends & Forecast 2023-2033

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA