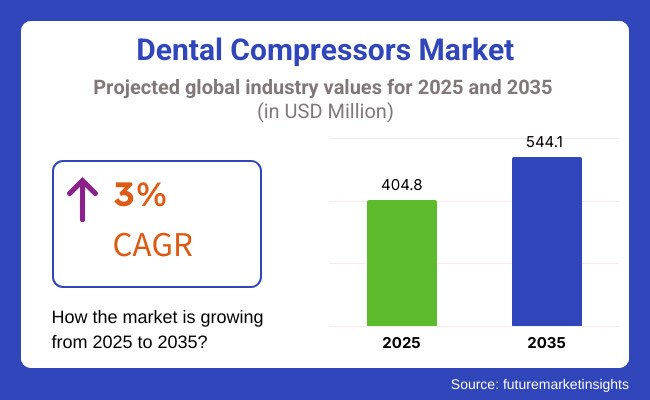

The market is projected to reach USD 404.8 Million in 2025 and is expected to grow to USD 544.1 Million by 2035, registering a CAGR of 3% over the forecast period. The shift toward oil-free, dry air compressors, integration of smart monitoring systems, and rising government investments in oral healthcare infrastructure are shaping the industry's future.

Additionally, demand for compact, portable, and low-noise compressors in small and mobile dental clinics is creating new market opportunities. The Dental Compressors Market, is set to flourish from 2005 through 2013 because of increasing demand for high - performance dental equipment and also as a result of the rising emphasis on infection control in dental practice.

As dental procedures heavily rely upon pneumatic tools such as air-driven hand pieces, the air/water syringe and scalers etc., so the demand for reliable, efficient compressed air systems is increasing. Air-water syringes, hand pieces and scalars have air driven devices to make the air needed for movement.

The growing global awareness of cross-contamination risks has spurred the use of oil-free compressors, which cannot be contaminated by oil residues contaminating their air supply. In addition, the latest developments in compressor technology - that is energy-saving designs and substantial noise reduction facilities are slowly convincing modern dental compressors to become more acceptable in the eyes of clinics and hospitals trying to get both performance and patient comfort.

The expansion of dental clinics worldwide, coupled with increasing investments in advanced dental infrastructure, is further propelling market growth. The growing focus on patient safety and regulatory compliance is encouraging dental professionals to upgrade to cutting-edge compressor systems that ensure clean, dry, and consistent airflow.

Smart compressors equipped with real-time monitoring, automatic moisture control, and reduced noise levels are gaining popularity, enhancing operational efficiency in dental facilities. Furthermore, government initiatives supporting dental healthcare, alongside the rising number of dental procedures due to aging populations and increasing cases of oral diseases, are contributing to the market's expansion.

As a result, manufacturers are innovating to meet the evolving demands of dental professionals, ensuring that the market remains dynamic and competitive over the forecast period.

It is expected that the North American market will dominate the Dental Compressors Market, driven by strong sterilization standards, better and smarter dental equipment and a well-developed network of dental clinics and medical care establishments.

The United States and Canada are the leading players in this sector on account of raising awareness for dental hygiene, large patient volumes and the fact that government spending is rising continuously on oral health programs.

In addition to smart compressor systems with IoT-based monitoring and predictive maintenance functionality which have seen some adoption by larger dental hospitals and group dental practices, the guidelines of the Centers for Disease Control and Prevention (CDC) and American Dental Association (ADA) put emphasis high-quality oil-free air compressors as a means to cross-infection and microbial infection of patients.

Europe is home to a major share in the Dental Compressors Market. Innovation in dental technology, sustainable medical devices and, as well, energy-efficient compressors has been flourishing across the continent.

Germany alone is leading the European market for dental compressors. The constraints in the European Medical Device Regulation (MDR) and tough environmental laws have driven manufacturers to create quieter, more ecologically friendly and energy-saving compressors.

With the rise of digital dentistry, 3D dental imaging and AI-powered dental workflows has been a surge in the demand for dry air compressors with high capability and a better filtration system. And as well, the propagation of dental tourism in countries like Hungary and Spain is driving a boom in the market for dental air compressors that are reliable and high-performance.

The Asia Pacific Dental Compressors Market is projected to have the highest growth rate of any region, fueled by increasing disposable incomes and accessibility to dental care, as well as initiatives of governments aimed at improving oral health. Leading in dental clinics expansion, mobile dentistry solutions and adoption of smart compressor technology are countries such as China, India, Japan and South Korea.

China’s growing network of dental hospitals and clinics leads to demand for economical, reliable air compressors India's National Oral Health Programme (NOHP) plus the increasingly extensive reach of corporate dental chains is pushing the market for compact and oil-free compressors ahead, too.

Japan and South Korea, moreover, are leading the field in precision dental technology AI-driven dental diagnostics and noiseless dental compressor solutions-all of which are accelerating regional market growth.

Challenges

High Equipment Costs and Maintenance Complexity

In the Dental Compressors Market, one of the first challenges is the high initial cost of advanced compressors. Especially for you, as practicing dentists in single-town cost sensitive market countries, oil-free, dry air and smart monitoring types may well be a stretch too far.

In countries where most people cannot afford a visit to dentists outside of holidays or special events-small and independent dental offices are apt to think thrice before adopting advanced technology because of budget constraints. Yet without question some products on the market meet all their criteria for performance indicators, an information officer told this reporter.

Moreover, periodic maintenance, filter replacements and air quality monitoring all increase long-term operating costs. Even more trying is stable air pressure and moisture control, particularly in established dental clinics that must now shift to new compressors.

Opportunities

AI-Powered Predictive Maintenance, Portable Compressors, and Smart Dental Clinics

The Dental Compressors Market offers substantial opportunities for growth, despite obstacles. Artificial intelligence-assisted predictive maintenance also makes for self-monitoring and fault detection, the compressors now be equipped with brains can call engineers out ahead of time. This boosts efficiency and prolongs the service life of equipment.

R&D into portable, small and super-silent dental compressors is generating new business prospects in mobile dental surgery units, home-based tooth clinics, and pop-up dental hospitals for remote areas.

Plus, the rise of intelligent dental clinics complete with digital workflow integration systems, Internet of Things (IoT) equipment and automated sterilization machines has led to growing demand for next-generation air compressors with safety and hygiene features upgraded accordingly.

In the years 2020 to 2024, the dental compressors market enjoyed a steady growth. The market trends that brought about this growth include rising dental procedures, an increased awareness of infection control and new oil-free technology in compressors.

The importance of high quality, no contaminants compressed air in dental practices led to over half of equipment using oil-free as well as new cryo and seismically isolated compressor designs. The growing prevalence of oral diseases in society, expansion in dental clinics and integration of digital dentistry solutions all further expanded this market.

For the period 2025 to 2035, the dental compressors market will realize transformative advancement with AI-driven air quality monitoring, energetically efficient smart compressors and real-time predictive failure detection.

Proceeding from next-gen nanotechnology air filtration to Internet of Things enabled compressor diagnostics and even self-regulating pressure systems in the future will fix dental technicians and patients alike all sorts of mischief.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Compliance with FDA, CE, and ISO 8573-1 air purity standards. |

| Technological Advancements | Growth in oil-free compressors, HEPA-filtered air systems, and smart pressure regulation. |

| Industry Applications | Used in dental clinics, hospitals, orthodontic labs, and research institutions. |

| Adoption of Smart Equipment | Integration of IoT-enabled compressor tracking, VSD technology, and noise-reducing compressor units. |

| Sustainability & Cost Efficiency | Transition toward low-energy, oil-free compressors, and sustainable air purification systems. |

| Data Analytics & Predictive Modeling | Use of basic air purity monitoring, compressor lifecycle tracking, and remote diagnostics. |

| Production & Supply Chain Dynamics | Challenges in high equipment costs, limited adoption in emerging markets, and energy inefficiency. |

| Market Growth Drivers | Growth fueled by rising dental procedures, infection control regulations, and advancements in air purification technology. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Blockchain-based air quality compliance, AI-driven compressor safety protocols, and automated sterilization tracking. |

| Technological Advancements | AI-powered self-regulating compressors, real-time air quality monitoring, and quantum-enhanced air filtration. |

| Industry Applications | Expanded into AI-driven dental air systems, fully autonomous compressor networks, and decentralized smart air filtration systems. |

| Adoption of Smart Equipment | Self-learning AI air compressors, blockchain-backed sterilization monitoring, and energy-efficient, AI-optimized dental air management. |

| Sustainability & Cost Efficiency | Zero-carbon compressed air solutions, AI-powered airflow efficiency, and regenerative compressed air storage. |

| Data Analytics & Predictive Modeling | AI-powered compressor maintenance analytics, blockchain-verified air safety records, and real-time predictive compressor failure modeling. |

| Production & Supply Chain Dynamics | Decentralized compressor manufacturing hubs, AI-driven supply chain optimization, and sustainable air filtration component production. |

| Market Growth Drivers | Future expansion driven by AI-integrated dental air systems, quantum-enhanced filtration, and sustainable smart compressor innovations. |

Growing demand for dental compressors in the American market is met by an increasing number of dental procedures, the need for oil less compressors and strict sterilization standards. Air quality at dental clinics is regulated by the USA Food and Drug Administration (FDA) and Occupational Safety Health Administration (OSHA), making permits a must-have in order to use advanced compressor technology.

Patient and staff potential for exposure to pathogens is cut down by the shift to oil-free compressors and a still quieter dental environment. Moreover, the growing use of smart compressors by dental practitioners themselves, which can then be monitored over the Internet or on-site, is on balance a plus for efficiency and lower maintenance costs.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 3.2% |

The growing investment in dental health care in addition to steadily rising popularity of energy-efficient compressors has led to an expansion of the Dental Compressors Market in United Kingdom. A national standard of air purity has also been enforced in health care facilities by Central Government departments such as the Health and Safety Executive (HSE) and National Health Service (NHS), leading to a rapidly increasing demand for medical-grade compressors.

The movement toward quiet, oil-free and energy-efficient compressors is also increasing, and is now in full swing. In addition, moisture-proof air and developments in ventilation filters that can combat deformity flies are further stimulating the market for next-generation dental compressors.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 2.8% |

Driven by increasing demand for high-tech dental equipment, more stringent regulations on medical air quality and healthier care solutions becoming the norm, the Dental Compressors Market within the European Union has been seeing stable growth.

The European Medical Device Regulation (MDR) and European Committee for Standardization (CEN) guidelines call for dental equipment to be made of "hygienic" materials and the air in use must meet strict purity demands.

With AI-driven diagnostics, moisture-free air systems and noise-reduction technology, smart dental compressors are being readily adopted in Germany, France and Italy. As the drive to create environmentally friendly, power-saving compressors continues across this whole region this trend shapes the way markets are going.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 3.0% |

Owing to the growth of the country as a centre for advanced dental healthcare, the Dental Compressors Market in Japan is expanding with more and more practitioners adopting compact high performance air compressors. Japan's government also puts very strong regulations on air quality.

As such, access to high-quality and reliable servicing has allowed most clinics in Japan to rely on domestic-made dental compressors rather than imports for their main source of air supply. The Japanese Ministry of Health, Labour, and Welfare (MHLW) stipulates that oil-free medical-grade compressors be used to avoid any possibilities of contamination.

Japan's domestic dental products manufacturers are multifunctional types have a small footprint and are readily adaptable for small and mid-sized dental clinics. Furthermore, the incorporation of AI-based predictive maintenance, such as cameras with M2M technology instead of tools like a wrench, and air purity sensors is driving advances in industry design and materials.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.1% |

In South Korea, the market of the dental air compressor is witnessing moderate growth. This trend is driven by the increasing importance of dental tourism, government attention to advanced dental care, and development digital dentistry.

Pioneering stricter-than-ever medical air quality regulation mandates, South Korean regulatory body Ministry for Food and Drug Safety (MFDS) has laid a green path in making its dental offices shift from oil-laden compressors to "pure water" units.

South Korea is leading the development of electric, self-diagnostic air compressors, smart monitoring systems for library-like public health and rear-gas photocatalysts to prevent infection through breathing tubes. As the scale of multi-chain dental clinics and hospital dental services increases, so does the demand for large dental compressors.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.3% |

The Dental Compressors Market grows continuously due to an increasing demand for high-performance air compression in dental procedures. This includes increased emphasis on infection control by regulators and well-designed, energy-efficient compressor technologies.

As for different compressor types, dental oil-free compressors and dental lubricated compressors take the lion's share of the market, reliable, pollution-free air supply is ensured for various dental appliance uses.

Dental Oil-Free Compressors Lead Market Demand with Contamination-Free and Hygienic Air Supply

Dental oil-free compressors are the most widely adopted type because they provide clean, dry and contaminant-free compressed air Health practices that demand purified air for patients' safety and the prevention of infection are perfect clients for such compressors Dental procedures such as oral surgery, orthodontia and restorative dentistry are higher precision applications.

These compressors are specifically designed for medical practices that need sterile air to guarantee patient safety and prevent infection As a result, they are perfect for higher precision work such as oral surgery, orthodontia and restorative dentistry.

Owing to their low maintenance cost, reduced exposure to microbial contamination and compliance with air purity regulations such as ISO8573-1, the growing use of oil-free compressors in dental clinics, hospitals and specialized dental centers.

Technological advances that reduce noise, save energy and incorporate filtration systems are also improving the efficiency and reliability of oil-free dental compressors A higher initial price, the impact upon longevity that no lubrication produces and limited changes in this field.

Although they bring an improvement to hygiene that is unparalleled, the price of dental oil-free compressors represents a significant disadvantage that works against them However, advances in self-lubricating composites and AI-driven compressor efficiency optimization are expected to lead to adoption improvements and a decrease in cost.

Dental Lubricated Compressors Gain Traction for High Durability and Performance Stability

Long life, good cooling performance and the ability to cope with high-volumes are just some of the reasons why dental lubricated compressors are gaining in popularity among dental clinics and large hospital buildings. These systems use lubricating oil to reduce friction and improve motor efficiency, this means they are the ideal for ordinary dental working procedures that require always a continuous and stable supply of compressed air.

There is a rising demand for lubricated compressors in dental laboratories and larger multiple-chair medical consultations, where continuous pressure is needed. Additionally, improvements in oil filtration and automatic drain systems are now reducing the risk of oil contamination, making modern lubricated compressors more suitable for dental applications.

However, challenges such as routine maintenance requirements, oil contamination risks, and higher environmental impact remain concerns. It is expected that technological innovations in eco-friendly lubrication systems, automated oil separation technology, and real-time performance adjustments through intelligent monitors will enhance the efficiency and sustainability of lubricated dental compressors.

The market for dental compressors is led by drying air technology, with desiccant compressors and membrane compressors being the most popular ones because they are capable of delivering moisture-free, high-purity air for dental applications.

Desiccant-Based Compressors Lead Market Demand for Ultra-Dry and Long-Term Air Purification

The compressor which employs a hygroscopic agent is called a "desiccant" (silica gel), and it is widely used in dental clinics, hospitals, and laboratories. Not only does this method produce pure dry air for dental tools and operations, but the generated output ions also serve to guarantee that any sterile air supplied through them be equally pure and free from bacteria-causing reagents.

These machines make use of a method known as solid adsorption to absorb (and sometimes destroy) water vapour, which helps save on maintenance from inspecting for old pollutants in dental instruments as well as any threats they may have posed. For example, preventing moisture-dependent corrosion in dental equipment and preventing harm to both gingivitis-dental bacteria alike.

In the dental sector, an increasingly emphasis on bleaching and quality care is the driving force behind demand for desiccant dryers that are integrated with sophisticated filtration systems. Energy-efficient adsorption materials with stricter purity standards, moisture sensors controlled by artificial intelligence and smaller desiccant designs are also improving the performance and longevity of these machines.

But challenges do exist. High operational costs, frequent desiccant replacement and potential pressure drops are still ever-present technical problems. Yet, hi-tech desiccants that require no maintenance at all self-regenerate themselves by design and add immensely to energy saving, automating moisture level detection using artificial intelligence provided for free with new compressors are expected to improve both efficiency and cost-effectiveness.

Membrane-Based Compressors Gain Popularity for Compact, Low-Maintenance Air Drying Solutions

Dental clinics and mobile dental units are currently increasing the use of membrane-based compressors in situations where smallness's, infrequent maintenance, cost-effectiveness and other key concepts have all become more popularities.

They use semi-permeable membrane filters to eliminate removes any vestige of as water vapour from the compressed air and clean up the compressed air via separation of water and dirt droplets. To provide a bone dry, sterilized air source for dental procedures.

Meanwhile, where one-chair dental surgery facilities, portable dental units and remote healthcare programs have become more popular, people are also demanding in-space solutions. In addition, advances in Nano-membrane drying things like technology and hybrid filtering systems or even an entire dishwasher type-self-cleaning membranes over recent years have been greatly increasing air purification efficiencies for use in dental medicine.

Difficulties such as reduced air-drying capacity compared to desiccant systems and sensitivity to changes in pressure still remain to be solved. Through innovations in the areas of multiple-layer membrane filtration, intelligent humidity control system integration and further improvements on durability materials, not only can it improve reliability but also gain greater market appeal for its dentally related customer base.

The Dental Compressors Market is expanding due to increasing demand for oil-free, ultra-quiet, and energy-efficient air compressors in dental practices. The market is driven by stringent air quality regulations, advancements in compressor technology, and the rising number of dental procedures worldwide.

Companies focus on oil-free and dry-air compressors, integrated filtration systems, and smart monitoring solutions to enhance compressed air purity, operational efficiency, and low-noise performance. The market includes leading dental equipment manufacturers, medical-grade air system providers, and compressor technology firms, each contributing to innovations in moisture-free compressed air, space-saving designs, and noise reduction technology.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| DÜRR DENTAL SE | 18-22% |

| Air Techniques, Inc. | 12-16% |

| Midmark Corporation | 10-14% |

| Kaeser Kompressoren SE | 8-12% |

| Gnatus | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| DÜRR DENTAL SE | Develops high-performance oil-free and dry-air compressors with integrated air filtration. |

| Air Techniques, Inc. | Specializes in low-noise, medical-grade dental air compressors with antibacterial filtration. |

| Midmark Corporation | Manufactures compact, energy-efficient dental compressors with smart monitoring systems. |

| Kaeser Kompressoren SE | Provides high-capacity dental air compressors with moisture-free air delivery for large clinics. |

| Gnatus | Focuses on affordable, oil-free dental compressors designed for small and mid-sized dental practices. |

Key Company Insights

DÜRR DENTAL SE (18-22%)

DÜRR DENTAL leads the dental compressor market, offering oil-free, ultra-dry, and noise-reducing air compressors for dental clinics and hospitals.

Air Techniques, Inc. (12-16%)

Air Techniques specializes in low-maintenance, antibacterial-filtered air compressors, ensuring clean and dry compressed air for dental applications.

Midmark Corporation (10-14%)

Midmark provides compact, energy-efficient dental compressors, integrating smart diagnostics for maintenance optimization.

Kaeser Kompressoren SE (8-12%)

Kaeser focuses on high-performance air compressors with moisture-control technology, catering to large dental facilities and specialty clinics.

Gnatus (6-10%)

Gnatus develops cost-effective oil-free compressors, making advanced air solutions accessible to small dental practices.

Other Key Players (30-40% Combined)

Several dental air system providers, medical equipment manufacturers, and specialty compressor firms contribute to advancements in noise reduction, energy savings, and air purity for dental compressors. These include:

The overall market size for the Dental Compressors Market was USD 404.8 Million in 2025.

The Dental Compressors Market is expected to reach USD 544.1 Million in 2035.

Increasing demand for efficient dental equipment, rising focus on infection control, and advancements in oil-free and noise-reducing compressor technology will drive market growth.

The USA, Germany, China, Japan, and India are key contributors.

Oil-free dental compressors are expected to dominate due to their ability to provide clean, dry, and hygienic air for dental procedures.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 13: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 15: Europe Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 17: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: South Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 19: South Asia Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 20: South Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 21: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: East Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 23: East Asia Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 24: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 25: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Oceania Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 27: Oceania Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 28: Oceania Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 29: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: MEA Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 32: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Technology, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 17: Global Market Attractiveness by Type, 2023 to 2033

Figure 18: Global Market Attractiveness by Technology, 2023 to 2033

Figure 19: Global Market Attractiveness by Application, 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Technology, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 37: North America Market Attractiveness by Type, 2023 to 2033

Figure 38: North America Market Attractiveness by Technology, 2023 to 2033

Figure 39: North America Market Attractiveness by Application, 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Technology, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 57: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Technology, 2023 to 2033

Figure 59: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) by Technology, 2023 to 2033

Figure 63: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 64: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 69: Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 70: Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 71: Europe Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 72: Europe Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 73: Europe Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 75: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 76: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 77: Europe Market Attractiveness by Type, 2023 to 2033

Figure 78: Europe Market Attractiveness by Technology, 2023 to 2033

Figure 79: Europe Market Attractiveness by Application, 2023 to 2033

Figure 80: Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: South Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 82: South Asia Market Value (US$ Million) by Technology, 2023 to 2033

Figure 83: South Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 84: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: South Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 89: South Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 90: South Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 91: South Asia Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 92: South Asia Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 93: South Asia Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 94: South Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 95: South Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 96: South Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 97: South Asia Market Attractiveness by Type, 2023 to 2033

Figure 98: South Asia Market Attractiveness by Technology, 2023 to 2033

Figure 99: South Asia Market Attractiveness by Application, 2023 to 2033

Figure 100: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 101: East Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 102: East Asia Market Value (US$ Million) by Technology, 2023 to 2033

Figure 103: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 104: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: East Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 109: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 110: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 112: East Asia Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 113: East Asia Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 114: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 115: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 117: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 118: East Asia Market Attractiveness by Technology, 2023 to 2033

Figure 119: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 120: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 121: Oceania Market Value (US$ Million) by Type, 2023 to 2033

Figure 122: Oceania Market Value (US$ Million) by Technology, 2023 to 2033

Figure 123: Oceania Market Value (US$ Million) by Application, 2023 to 2033

Figure 124: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: Oceania Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 129: Oceania Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 130: Oceania Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 131: Oceania Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 132: Oceania Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 133: Oceania Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 134: Oceania Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 135: Oceania Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 136: Oceania Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 137: Oceania Market Attractiveness by Type, 2023 to 2033

Figure 138: Oceania Market Attractiveness by Technology, 2023 to 2033

Figure 139: Oceania Market Attractiveness by Application, 2023 to 2033

Figure 140: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 141: MEA Market Value (US$ Million) by Type, 2023 to 2033

Figure 142: MEA Market Value (US$ Million) by Technology, 2023 to 2033

Figure 143: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 144: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 145: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 146: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: MEA Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 149: MEA Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 150: MEA Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 152: MEA Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 153: MEA Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 155: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 156: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 157: MEA Market Attractiveness by Type, 2023 to 2033

Figure 158: MEA Market Attractiveness by Technology, 2023 to 2033

Figure 159: MEA Market Attractiveness by Application, 2023 to 2033

Figure 160: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dental Wounds Treatment Market Size and Share Forecast Outlook 2025 to 2035

Dental Radiometer Market Size and Share Forecast Outlook 2025 to 2035

Dental Anaesthetic Market Size and Share Forecast Outlook 2025 to 2035

Dental Diamond Bur Market Size and Share Forecast Outlook 2025 to 2035

Dental Laboratory Market Size and Share Forecast Outlook 2025 to 2035

Dental Matrix Systems Market Size and Share Forecast Outlook 2025 to 2035

Dental Permanent Cements Market Size and Share Forecast Outlook 2025 to 2035

Dental Bleaching Agent Market Size and Share Forecast Outlook 2025 to 2035

Dental Care Products Market Size and Share Forecast Outlook 2025 to 2035

Dental Etching Liquid Market Size and Share Forecast Outlook 2025 to 2035

Dental Sutures Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dental Hygiene Devices Market Size and Share Forecast Outlook 2025 to 2035

Dental Implantology Software Market Analysis - Size, Growth, & Forecast Outlook 2025 to 2035

Dental Veneers Market Size and Share Forecast Outlook 2025 to 2035

Dental X-Ray Systems Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dental Suction Systems Market Size and Share Forecast Outlook 2025 to 2035

Dental Articulators Market Size and Share Forecast Outlook 2025 to 2035

Dental Fluoride Varnish Market Size and Share Forecast Outlook 2025 to 2035

Dental Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Dental Flap Surgery Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA