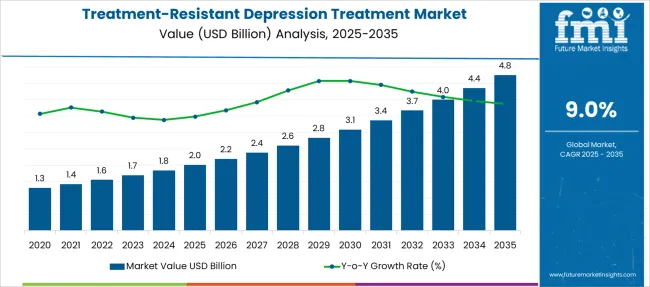

The Treatment-Resistant Depression Treatment Market is estimated to be valued at USD 2.0 billion in 2025 and is projected to reach USD 4.8 billion by 2035, registering a compound annual growth rate (CAGR) of 9.0% over the forecast period.

| Metric | Value |

|---|---|

| Treatment-Resistant Depression Treatment Market Estimated Value in (2025 E) | USD 2.0 billion |

| Treatment-Resistant Depression Treatment Market Forecast Value in (2035 F) | USD 4.8 billion |

| Forecast CAGR (2025 to 2035) | 9.0% |

The treatment resistant depression treatment market is advancing due to the rising prevalence of major depressive disorder and the limited efficacy of conventional antidepressants in a significant portion of patients. The growing clinical focus on personalized mental health therapies and the urgent need for fast acting treatment options are pushing innovation in neuropsychiatric drug development.

Advancements in brain pathway research and synaptic receptor modulation are driving a new wave of targeted therapies. Increased awareness, evolving psychiatric guidelines, and support from mental health initiatives have facilitated faster regulatory approvals for novel treatments.

As unmet clinical needs continue to persist, the market outlook remains strong, with emphasis on precision medicine, alternative treatment pathways, and rapid onset drugs to support patients unresponsive to standard regimens.

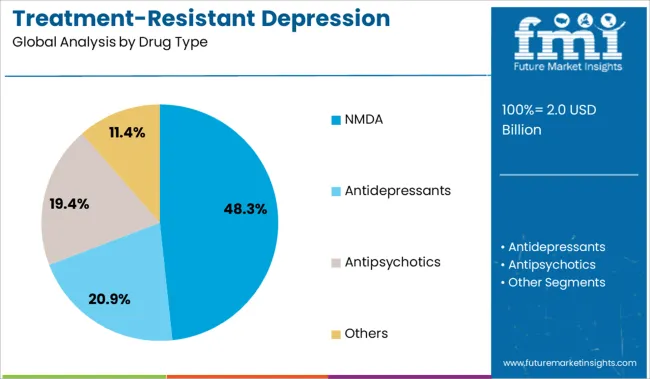

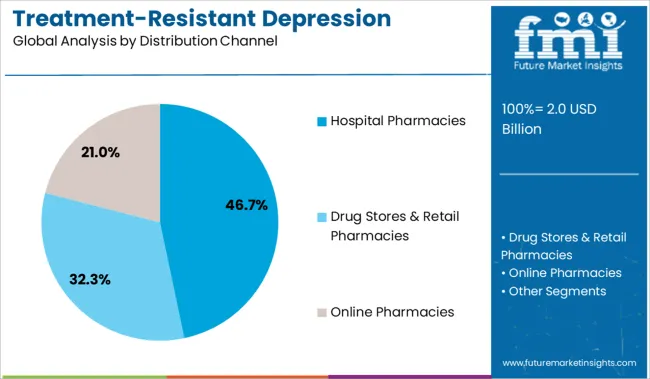

The market is segmented by Drug Type and Distribution Channel and region. By Drug Type, the market is divided into NMDA, Antidepressants, Antipsychotics, and Others. In terms of Distribution Channel, the market is classified into Hospital Pharmacies, Drug Stores & Retail Pharmacies, and Online Pharmacies. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The NMDA segment is expected to hold 48.30% of the total revenue by 2025 within the drug type category, marking it as the dominant therapeutic approach. This growth is being driven by its novel mechanism of action that directly targets glutamatergic transmission, offering rapid antidepressant effects where serotonin based therapies often fail.

The efficacy of NMDA receptor modulators in improving symptoms within hours to days, compared to weeks for traditional antidepressants, has transformed treatment protocols for severe depressive episodes. Furthermore, clinical trials have supported the safety profile and therapeutic value of NMDA agents, particularly for patients with multiple failed treatment lines.

Healthcare providers are increasingly adopting these drugs due to their fast response and potential to reduce suicidal ideation, reinforcing the segment’s leading position in the market.

The hospital pharmacies segment is projected to account for 46.70% of total market revenue by 2025 under the distribution channel category, making it the primary channel. This prominence is attributed to the specialized nature of treatment resistant depression therapies which often require professional administration, patient monitoring, and structured care settings.

Drugs such as NMDA modulators and other novel agents are frequently administered in clinical environments under close supervision, necessitating in hospital dispensing. Additionally, hospital settings enable adherence to stringent safety protocols and provide immediate intervention in case of adverse reactions.

The ability to manage complex cases and deliver controlled dosing schedules further positions hospital pharmacies as the preferred distribution channel in this therapeutic area.

The global demand for treatment-resistant depression therapeutics is projected to increase at a CAGR of 9.0% during the forecast period between 2025 and 2035, reaching a total of USD 4.8.0 Billion in 2035, according to a report from Future Market Insights (FMI). From 2020 to 2025, sales witnessed significant growth, registering a CAGR of 3.3%.

According to Future Market Insights, a market research and competitive intelligence provider, the Treatment-Resistant Depression Therapeutics market was valued at USD 2 Billion in 2025. As per the World Health Organization (WHO), the prevalence of mental health disorders as well as conditions is increasing across the globe. There has been a 13% increase in mental health conditions and other depressive disorders in the last decade.

According to the USA Department of Health and Human Services (HHS), in 2024, among adolescents between ages 12 and 17, 17.0% (about 4.8.1 million population) had a major depressive episode (MDE), and 12% (about 2.9 million people) had MDE with severe impairment. Moreover, several factors such as demographic changes, environmental conditions, and increasing mental stress are resulting in rising mental health disorders. This is improving the growth in the depression treatment market.

Increasing Drug Development Projects to Fuel the Market Growth

The rise in the prevalence of Treatment-Resistant Depression and the presence of few treatment options has stimulated the market players to initiate full-fledged research and development activities. Various major market players are focusing on developing new and innovative therapies in the market, citing the clinical benefits and a significant unmet need in treating the disorder globally.

Additionally, it is the leading cause of worldwide disability as conventional therapies are ineffective in a large patient pool, and novel therapies are needed to cater to this growing demand. Also, various pharmaceutical, as well as life science companies, are actively investing in clinical trials of potential pipeline candidates to introduce novel products for treatment. Further, such active participation from the public and private players in developing potential candidates under investigational studies escalates the demand for resistant depression treatment around the globe.

Increasing Prevalence of TRD Globally to Accelerate the Market Growth

The increase in the prevalence of this mood disorder is one of the major factors that is projected to boost the growth of the TRD Treatment market. TRD occurs when an individual hasn't responded to doses of two different antidepressants taken for an adequate time, usually six weeks. The increase in the prevalence of this medical condition has increased the demand for resistant depression therapeutics.

In addition, according to Springer's research article published in August 2024, major depression disorders affect over 300 million people worldwide, and approximately one-third of patients with MDD have treatment-resistant depression. The prevalence is also associated with disproportionate healthcare costs that have significant direct and indirect cost implications, which places considerable strain on healthcare and social resources.

The variability in the type of healthcare setting as well as accessibility to quality healthcare across the countries to assess unmet needs and treatment failure increases the demand for effective therapeutic measures. Such a rising prevalence of this disorder and disproportionate healthcare costs, which varies across the globe, are anticipated to surge the demand for an effective treatment thereby, fostering the overall treatment growth over the analysis period.

Poor Management of Disorders to Restrain the Market Growth

Despite increasing investment from market players in the TRD project for developing an effective therapeutic measure, there is poor management of this mood disorder, resulting in significant variations in how patients are being managed in real-world practice.

Moreover, the lack of clarity in diagnosing patients is a significant challenge for its treatment. Patients drop out or discontinue treatment due to poor or no positive outcomes. In addition, a cultural and social stigma toward reporting non-responsiveness to treatment, lack of therapeutic options, and inadequate guidelines for managing patients are cumulatively responsible for restraining the market growth.

According to a December 2024 study published by NIH, for the management of TRD, 41.0% of physicians reported treatment discontinuation and loss to follow-up as the top challenge, while 15.0% indicated a lack of therapeutic options as their biggest challenge. Another 14.0% and 13.0% were related to a lack of standardized TRD definitions and specific guidelines, respectively. In addition, the lack of clarity in guidelines for the diagnosis and management of this mood disorder patients, coupled with limited therapeutic measures is expected to hinder the market growth over the analysis period.

Advanced Healthcare Infrastructure in the Region to Fuel the Market Growth

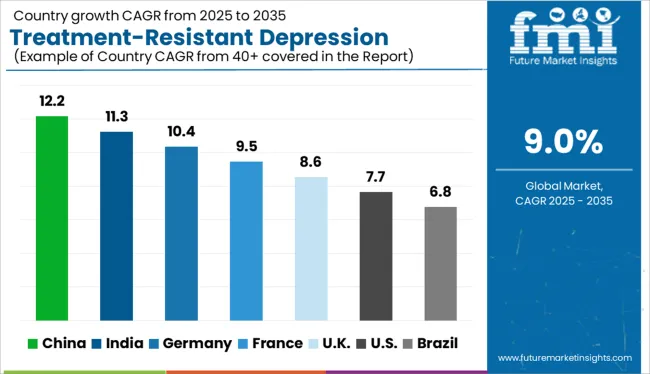

The treatment-resistant depression therapeutics market in North America is expected to accumulate the highest market share of 50% in 2025. North America is the most lucrative region along with the highest market share. Factors such as the advanced healthcare infrastructure and healthcare spending are anticipated to fuel the growth of the Treatment-Resistant Depression Market during the forecast period. Also, increasing the adoption rate and demand will propel the treatment-resistance depression treatment market in this region.

In addition, in recent years, there has been a growing rate of adoption, and increasing demand for treatment-resistant depression is also expected to drive the regional market. The region is expected to hold the highest CAGR of 8.8% during the forecast period.

Growing Awareness Regarding Mental Disorders in the Region to Fuel the Market Growth

The treatment-resistant depression therapeutics market in Asia Pacific is expected to accumulate the highest market share of 49% in 2025. Asia Pacific is the most lucrative region along with the highest market share.

Asia Pacific is opening up the previously held taboo of mental health. With growing awareness about mental disorders, depression, and mental health, the regional segment of Asia Pacific is expected to show a promising rate of growth and give rise to lucrative business opportunities for the development of the market in the coming years. The region is expected to hold the highest CAGR of 8.7% during the forecast period.

NMDA Segment to beat Competition in Untiring Market

On the basis of drug type, the global Treatment-Resistant Depression Therapeutics market is dominated by the NMDA Segment, which accounts for a share of 49%. The growth of the NMDA segment is attributed to the increasing research studies for developing NMDA drugs to improve treatment outcomes.

Moreover, the larger patient population suffering from this disorder and FDA approval of NMDA drugs developed by the key market are expected to fuel segmental growth in the coming years. The segment is expected to hold a CAGR of 8.8% over the analysis period.

Hospital Pharmacies Segment to Drive the Treatment-Resistant Depression Therapeutics Market

Based on the Distribution Channel, the hospital pharmacies segment is expected to witness a significant growth of 47% in 2025, and the trend is expected to continue during the forecast period.

In the treatment of this mood disorder, a prescription for drugs from a medical professional is needed, this is a crucial reason attributable to the segment's growth. In addition, the expansion of hospital pharmacies owing to increasing investment by the public sector in the healthcare infrastructure in emerging countries is predicted to augment the segmental growth during the forecast period. The segment is expected to hold a CAGR of 8.7% over the analysis period.

Prominent players in the treatment-resistant depression therapeutics market are Janssen Global Services, LLC, AbbVie Inc., Sandoz International GmbH (Novartis AG), H. Lundbeck A/S, Par Pharmaceutical (Endo International plc), Otsuka Pharmaceutical Co., Ltd., and AstraZeneca, among others.

Recent Developments:

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 9% from 2025 to 2035 |

| Market Value in 2025 | USD 2.0 billion |

| Market Value in 2035 | USD 4.8 billion |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Billion and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Drug Type, Distribution Channel, Region |

| Regions Covered | North America; Europe; Asia Pacific; Latin America; Middle East and Africa (MEA) |

| Key Countries Profiled | USA, Canada, Brazil, Mexico, Germany, United Kingdom, France, Spain, Italy, China, Japan, South Korea, India, Malaysia, Singapore, Thailand, Australia, New Zealand, GCC Countries, South Africa, Israel |

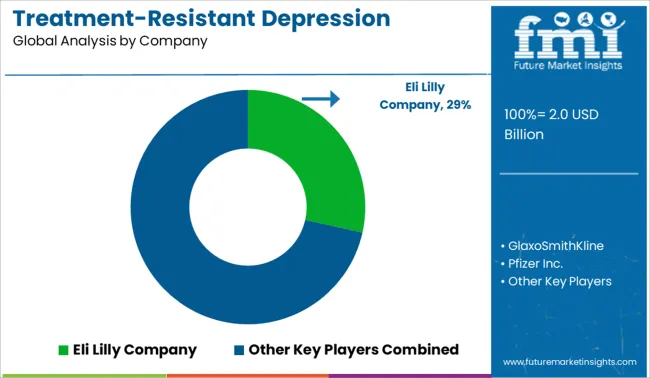

| Key Companies Profiled | Eli Lilly and Company; GlaxoSmithKline; Pfizer Inc.; Janssen Pharmaceuticals; AbbVie Inc.; AstraZeneca; H. Lundbeck A/S; Sandoz International GmbH; Par Pharmaceutical Companies Inc.; Otsuka Holdings Co., Ltd. |

| Customization & Pricing | Available upon Request |

The global treatment-resistant depression treatment market is estimated to be valued at USD 2.0 billion in 2025.

The market size for the treatment-resistant depression treatment market is projected to reach USD 4.8 billion by 2035.

The treatment-resistant depression treatment market is expected to grow at a 9.0% CAGR between 2025 and 2035.

The key product types in treatment-resistant depression treatment market are nmda, antidepressants, antipsychotics and others.

In terms of distribution channel, hospital pharmacies segment to command 46.7% share in the treatment-resistant depression treatment market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Treatment-Resistant Hypertension Management Market Size and Share Forecast Outlook 2025 to 2035

Depression And Seasonal Affective Disorder Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Depression Drugs Market

Depression Treatment Market Insights - Trends & Forecast 2024 to 2034

Drug Free Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Postpartum Depression Management Market Size and Share Forecast Outlook 2025 to 2035

Anxiety Disorders And Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Opioid-Induced Respiratory Depression Market

Treatment Pumps Market Insights Growth & Demand Forecast 2025 to 2035

Pretreatment Coatings Market Size and Share Forecast Outlook 2025 to 2035

Air Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

CNS Treatment and Therapy Market Insights - Trends & Growth Forecast 2025 to 2035

Seed Treatment Materials Market Size and Share Forecast Outlook 2025 to 2035

Acne Treatment Solutions Market Size and Share Forecast Outlook 2025 to 2035

Scar Treatment Market Overview - Growth & Demand Forecast 2025 to 2035

Soil Treatment Chemicals Market

Water Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Algae Treatment Chemical Market Forecast and Outlook 2025 to 2035

Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA