The global CNS Treatment and Therapy Market is estimated to be valued at USD 136.3 billion in 2025 and is projected to reach USD 222.1 billion by 2035, registering a compound annual growth rate (CAGR) of 5.9% over the forecast period.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 136.3 billion |

| Projected Market Size in 2035 | USD 222.1 billion |

| CAGR (2025 to 2035) | 5.9% |

The CNS Treatment and Therapy Market is undergoing structural transformation as clinical innovation and regulatory pathways evolve to address unmet needs across neurodegenerative, psychiatric, and neurodevelopmental disorders. As of 2025, the market is being shaped by increased R&D funding in Alzheimer’s disease, major depressive disorder (MDD), multiple sclerosis (MS), Parkinson’s disease, and rare CNS pathologies such as Rett syndrome and Huntington’s disease.

Progress in disease-modifying therapies (DMTs), precision psychiatry, and neuroinflammation-targeted interventions is redefining the treatment landscape. This growth is further supported by expedited regulatory approvals, biomarker-guided drug development, and the integration of digital therapeutics into treatment protocols. Advances in blood-brain barrier (BBB) penetrant molecules, neurotrophic factor modulation, and neuroimmune axis manipulation are expanding therapeutic avenues that were previously inaccessible.

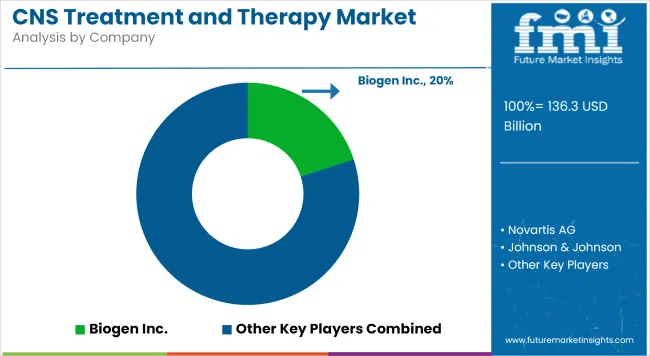

Key manufacturers driving the CNS Treatment and Therapy Market include Sanofi, Biogen, Eli Lilly, Otsuka Pharmaceutical, Neurocrine Biosciences, and Johnson & Johnson. These companies are actively expanding pipelines in neurodegeneration, schizophrenia, bipolar disorder, and epilepsy. In 2025, Sanofi that it has entered into an agreement to acquire Vigil Neuroscience, Inc. (“Vigil”), a publicly traded clinical-stage biotechnology company focused on developing novel therapies for neurodegenerative diseases.

In the official press briefing on May 22, 2025, Houman Ashrafian, Head of Research and Development, Sanofi, stated: “This acquisition is fully supporting Sanofi’s strategic focus on neurology and on advancing science and leveraging our expertise in immunology to solve areas of critical unmet need. TREM2 represents a compelling target at the intersection of immune dysregulation and neurodegeneration, particularly in people living with Alzheimer’s because they face devastating cognitive decline with limited treatment options.

Vigil’s expertise is complementary to our capabilities in neurology and reinforces our dedication to developing innovative medicines to improve people’s lives. Vigil’s team are a welcome addition, and we look forward to working with them and the patient community.”

Biogen continues to expand its Alzheimer’s pipeline beyond amyloid-beta, exploring tau-targeting and neuroprotective biologics. Meanwhile, Otsuka has initiated multi-center trials evaluating long-acting injectable formulations for schizophrenia and bipolar spectrum disorders. These developments reflect a broader industry pivot toward faster-acting, mechanism-diverse CNS therapies supported by predictive diagnostics and real-world validation frameworks.

In 2025, biologics are estimated to hold 36.4% of the CNS Treatment and Therapy Market revenue, driven by a shift toward targeted, high-precision therapies. This segment’s dominance has been attributed to enhanced efficacy in addressing complex neuroinflammatory and neurodegenerative conditions where conventional small molecules have underperformed. The rise in monoclonal antibody (mAb) approvals for diseases such as multiple sclerosis, Alzheimer’s, and neuromyelitis optica has significantly contributed to the segment’s growth.

Additionally, supportive regulatory frameworks, particularly the FDA's expedited approval pathways, have facilitated faster market entry for CNS biologics. Further, advancements in blood-brain barrier penetration technologies and patient-tailored therapies have increased biologics' clinical success rate. Increased biologics R&D funding by major pharmaceutical players and the availability of biosimilars have also played a crucial role in expanding market reach. Demand has been further amplified by physicians' growing preference for long-acting injectable biologics due to improved patient adherence and reduced dosing frequency.

Antidepressants are projected to account for 26.4% of the CNS Treatment and Therapy Market in 2025, owing to the significant and growing burden of depression and anxiety-related disorders. The growth of this segment has been reinforced by rising awareness campaigns, reduced stigma around mental health, and greater screening and diagnosis rates in both developed and emerging economies. Second-generation antidepressants, including SSRIs and SNRIs, have gained clinical favour due to improved safety profiles and tolerability, which has increased patient adherence.

Moreover, the COVID-19 pandemic’s lasting psychological impact has triggered a surge in antidepressant prescriptions, particularly among younger populations. The launch of novel fast-acting antidepressants-especially NMDA receptor antagonists-and digital mental health solutions have further expanded treatment options. Health insurers have increasingly included antidepressants in reimbursement lists, improving access across varied socioeconomic groups. Together, these factors have sustained antidepressants as the leading drug class within the CNS therapeutics landscape.

In 2025, neurovascular disorders are expected to hold 18.7% revenue share in the CNS Treatment and Therapy Market, primarily due to the high global incidence and burden of conditions such as stroke, cerebral aneurysms, and vascular dementia. This segment’s growth has been influenced by aging demographics, a rise in hypertension and diabetes prevalence, and the increasing availability of advanced neurointerventional therapies. Market momentum has also been supported by technological improvements in clot retrieval devices, thrombolytic, and cerebral protection systems.

A paradigm shift toward early intervention and integrated stroke care in hospitals has expanded access to therapies, leading to favourable patient outcomes. Moreover, neurovascular treatment protocols have been integrated into national stroke care programs, further accelerating market expansion. The involvement of multidisciplinary stroke teams and real-time imaging tools in tertiary care centers has increased treatment uptake, consolidating neurovascular disorders as the largest segment within the CNS therapeutic market.

Hospital-based pharmacies are projected to hold 43.1% of the CNS therapy market share in 2025, attributed to the centralized dispensing of high-risk CNS drugs requiring clinical supervision. These pharmacies have been preferred due to their integration with neurologists and psychiatrists, facilitating on-site prescribing of specialized biologics, antipsychotics, and intrathecal medications. CNS disorders such as acute psychosis, stroke, and epilepsy often require immediate intervention, making hospital pharmacies the most reliable and efficient distribution channel.

The growth of this segment has also been driven by government investments in hospital infrastructure and the co-location of specialty care services. Enhanced inventory control, adherence monitoring, and pharmacist-led patient education programs have further solidified hospital pharmacies' position. Moreover, stringent regulations around the dispensation of certain CNS medications-especially controlled substances-have led to a reliance on hospital-based systems to ensure compliance and mitigate misuse, supporting their continued market leadership.

North America leads the CNS Treatment and Therapy Market, driven by strong clinical infrastructure, regulatory flexibility, and capital influx into neuroscience R&D. The USA accounts for a majority of global CNS drug approvals, supported by the FDA’s breakthrough therapy designations and priority reviews for neurodegenerative and psychiatric drugs. The NIH’s BRAIN Initiative and ARPA-H funding have catalysed translational research in neural circuit modulation and digital biomarkers.

Private equity is also funnelling investments into psychiatric start-up’s deploying psychedelic compounds, digital therapeutics, and closed-loop brain stimulation. Canada’s growing role in neuroinflammation and early-phase Parkinson’s trials-supported by CIHR funding-is contributing to the region’s expanding therapeutic footprint. Strategic partnerships between pharma companies and AI-led biotechs are fast-tracking molecule discovery and behavioural phenotyping platforms, reinforcing the region’s leadership in CNS therapy innovation.

Europe’s CNS therapy market is evolving through coordinated regulatory science, public health prioritization, and academic excellence. The EMA’s adaptive pathways program and the EU-funded “Neurodegeneration Platform” are advancing orphan drug and neuroimmunology-based approvals.

Germany and the Netherlands are leading in integrating digital therapeutics for ADHD and depression into public insurance schemes, while France and Italy are scaling university spinouts for Parkinson’s and epilepsy therapies. The region’s early investments in digital biomarkers, combined with collaborative neuroimaging consortia, are enhancing precision in CNS clinical trials. As Europe pursues greater sovereignty in biologics manufacturing and neuropharma innovation, the CNS market is poised for high-value expansion, especially in rare and treatment-resistant indications.

High Drug Development Costs and Regulatory Hurdles

High expenditure requirements for CNs treatment and therapy are another factor for the growth of this market sector and in addition, drug combine dares, clinical tests and regulatory filtration are key problems for CNS treatments and likewise therapy segment. Drugs for central nervous system (CNS) disorders such as Alzheimer's, Parkinson's, epilepsy, depression and others require extensive research and testing to determine their efficacy and safety.

Moreover, strict regulations by agencies such as the FDA and EMA, in addition to the challenge in CNS drug mechanisms, further lead to prolonged approval timelines and high failure rates. By focusing on these aspects and embracing new technologies, pharmaceutical companies can overcome these challenges and ultimately improve the success rates and reduce the costs associated with drug development.

Limited Treatment Efficacy and Side Effects

While CNS therapies have progressed, many treatments available do not have high efficacy, do not provide prolonged relief, or result in considerable side-effects. The management of conditions such as multiple sclerosis, schizophrenia, and chronic pain are often lifelong processes, so the development of treatments that improve patient quality of life becomes paramount. The blood-brain barrier (BBB) also presents another challenge in terms of drug delivery, limiting the effectiveness of many CNS medications. How to do this is to concentrate on the development of targeted, drug delivery systems, innovative biologics, and gene therapies that can be clinically223-used to improve treatment outcomes while limiting adverse effects.

Growth in Neuromodulation and Personalized Medicine

Additionally, neuromodulation techniques are an emerging opportunity area with therapies involving deep brain stimulation (DBS), transcranial magnetic stimulation (TMS), and vagus nerve stimulation (VNS) emerging as key therapies. Offering these patients an alternative to their drug resistant CNS disorders, these therapies are minimally invasive or non-invasive and minimize the use of pharmaceuticals.

New technologies in personalized medicine, including pharmacogenomics and AI-driven diagnostics, enable the development of customized treatment regimens according to an individual’s genetic and neuropathological disposition. Innovations like AI-enabled patient tracking systems, wearable bio-sensors, and neurological stimulation devices will give companies a competitive advantage in the growing CNS treatment space.

Advancements in Biologics, Gene Therapy, and Regenerative Medicine

The CNS treatment and therapy market is being transformed as novel biologics, gene therapy, and stem cell therapies emerge. These new therapeutic modalities are being suggested to target neuronal structures and recover chronic neurodegeneration and therefore, produce disease-modifying effects in neurodegenerative disorders such as amyotrophic lateral sclerosis (ALS), spinal cord injury as well as neurodegenerative diseases rather than just alleviating symptoms.

Moreover, novel CRISPR gene editing technology, neurotrophic factor therapies, and processes that make induced pluripotent stem cells (iPSCs) are opening up new frontiers in regenerative medicine.The next generation of CNS treatment innovations will be powered by companies that harness these advanced technologies, collaborate with academic institutions, and obtain regulatory fast-track approvals.

CNS Treatment and Therapy Market Dynamics and Future Trends 2025 to 2035 Between 2020 and 2024, there were remarkable advances in the CNS treatment and therapy sector, focusing on areas like digital therapeutics, artificial intelligence-driven drug discovery, and neuromodulation therapies.

But instead, high prices and R&D costs or drug development failures, as well as accessibility, remained ongoing threats. And biopharma companies stepped up, developing artificial intelligence tools for clinical trials, repurposing existing pharmaceuticals and improving collaboration between biotech companies and research institutes to speed up innovation.

For 2025 to 2035, the market will see transformative advancements in precision neurology, brain-computer interfaces (BCIs), and regenerative CNS therapies. Innovations like AI-driven cognitive assessment tools, wearable neuro monitors for cognition, and neuroimaging will enable early diagnosis and treatment of disease.

Elsewhere, uses of blockchain in protecting clinical data, telemedicine in delivering neurological services remotely, and nanotechnology for drug delivery will transform CNS treatment paradigms. The next wave of CNS innovations will be driven in large part by companies that embrace digital transformation, regenerative medicine, and patient-centric care models.

Strong healthcare infrastructure, higher prevalence of CNS disorders and advancements in drug development are primely responsible for the USA being the major contributor towards CNS treatment and therapy market. The market growth is attributed due to the presence of multinational pharmaceutical organizations and ongoing work in neurodegenerative diseases.

The market also anticipates the increase in demand for biologics and gene therapies as innovative CNS therapies, the growing role of AI in drug discovery, and precision medicine. Moreover, rising acceptance of digital therapeutics, neurostimulation devices, and individualized treatment strategies are improving treatment outcome.

Companies are also concentrating on new small-molecule drugs and targeted therapies for diseases like Alzheimer’s, Parkinson’s and multiple sclerosis. In the USA, the market is further driven by government funding for mental health research and CNS disorder treatment.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.3% |

This is attributed to the major investments in neuroscience research, rising demand for mental health solutions, and improved accessibility to novel therapeutics are driving the market growth of CNS in the UK. Also driving demand is the emphasis on early diagnosis and intervention.

Government initiatives supporting mental health awareness are expected to aid the market growth along with advancements in neuroimaging and biomarker-based diagnostics. Stem Cell Therapy CNS/Germline Tailored Therapies: Modulating CNS Disorders: The data also showed burgeoning interest in disease-modifying treatments, stem cell therapy, and regenerative medicine addressing CNS disorders. Other companies are also developing the use of AI powered designs for clinical trials to staff on to drug approvals and improve efficacy of the treatments.

The growing trend of telemedicine and remote patient management for neurological diseases is also fueling the market growth in the UK. Moreover, the emergence of both personalized medicine and cognitive rehabilitation therapies is enhancing patient management.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.8% |

The European CNS therapies and treatment market is being ruled by Germany, France, and Italy, which has a well-established healthcare infrastructure, steady government investment in neuroscience support, and rising prevalence of targeted neurological therapies.

The aggressive growth in the European CNS market is due to the research focus on CNS therapies along with an interest in neuropharmacology. The use of AI-powered diagnostics, efficient neurostimulation techniques, and biomarker-based drug development is also making therapies more effective.

This is further propelling the market growth attributed to increasing demand for non-invasive brain stimulation, cognitive behavioral therapy, and digital health solutions for CNS disorders. The growing number of clinical research partnerships, alongside the launch of innovative biosimilars for neurodegenerative conditions, are driving the uptake of CNS therapies throughout the EU. Moreover, regulatory incentives around orphan drugs and rare neurological diseases are speeding up drug development efforts.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.9% |

The Japan CNS treatment and therapy market is growing due to the aging population, increased prevalence of neurodegenerative disorders in the country, and advancements in drug discovery. Increasing emphasis on neuroprotection and intervention in the early stages is expected to propel market expansion.

Godoy covered how the nation’s focus on high-tech research and the coupling of AI-driven drug discovery and wearable neurological monitoring gadgets drives innovation in the nation. Additionally, solid government backing for dementia and Parkinson’s disease research, in tandem with rising investment for gene and cell therapies, is providing impetus to work on next-generation CNS treatments.

Additionally, the increasing prevalence of non-invasive brain stimulation, cognitive training program, and mindfulness-based therapies is propelling the market growth in Japan healthcare sector. Further, partnerships between academic institutions and biotech companies are bolstering research on the management of neurodegenerative diseases.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.1% |

The market for CNS treatment and therapy can also flourish in South Korea, owing to the rising awareness regarding neurological disorders, increasing investments in the mental health sector, and increasing demand for advanced therapeutics.

The market is expanding due to supportive government regulations for brain health research and increasing implementation of digital therapeutics. Moreover, the national focus on increasing the efficiency of treatment through AI-based, drug discovery, neurotechnology and brain-computer interface research is bolstering competitiveness.

Additionally, the rising need for novel CNS therapies in psychiatry, neurodegenerative diseases, and sleep disorders is driving market adoption. Time autonomy of patients' performance can be recorded and used in the design of clinical trials based on artificial intelligence.

The increasing number of government-backed mental health campaigns and establishment of neuroscience research institutes in South Korea are also propelling the demand for CNS treatments and therapies.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.2% |

The CNS Treatment and Therapy Market is driven by the rising prevalence of neurological disorders, fast-paced development of biotechnology, and increasing industry-wide investment in drug observance.

To address this issue, organizations focused on enhancing patient outcomes are increasingly leveraging biologics, targeted therapies and neurostimulation devices. This encompasses AI driven drug discovery, precision medicine, and discovery of new therapeutic entities for neurodegenerative diseases, psychiatric diseases and neurovascular diseases.

The overall market size for CNS treatment and therapy market was USD 136.3 billion in 2025.

The CNS treatment and therapy market expected to reach USD 222.1 billion in 2035.

Factors such as the growing number of neurological disorders, growing aging population and advancements in drug delivery and neuro technology, rising investment in the treatment of mental health and the expanding access to innovative therapies for diseases such as Alzheimer’s, Parkinson’s disease, and epilepsy will promote the demand for CNS treatment and therapy market.

The top 5 countries which drives the development of CNS treatment and therapy market are USA, UK, Europe Union, Japan and South Korea.

Biologics and non-biologics growth to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Gene Therapy in CNS Disorder Market Analysis by Indication, Type, End User, and Region through 2035

AIDS Related Primary CNS Lymphoma Market Report – Growth & Forecast 2025 to 2035

Central Nervous System (CNS) Lymphoma Treatment Market Analysis by Treatment, End User, and Region: Forecast for 2025 to 2035

Treatment-Resistant Hypertension Management Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Treatment Pumps Market Insights Growth & Demand Forecast 2025 to 2035

Pretreatment Coatings Market Size and Share Forecast Outlook 2025 to 2035

Air Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Seed Treatment Materials Market Size and Share Forecast Outlook 2025 to 2035

Acne Treatment Solutions Market Size and Share Forecast Outlook 2025 to 2035

Scar Treatment Market Overview - Growth & Demand Forecast 2025 to 2035

Soil Treatment Chemicals Market

Water Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Algae Treatment Chemical Market Forecast and Outlook 2025 to 2035

Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Equipment Market Size and Share Forecast Outlook 2025 to 2035

Burns Treatment Market Overview – Growth, Demand & Forecast 2025 to 2035

CRBSI Treatment Market Insights - Growth, Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA