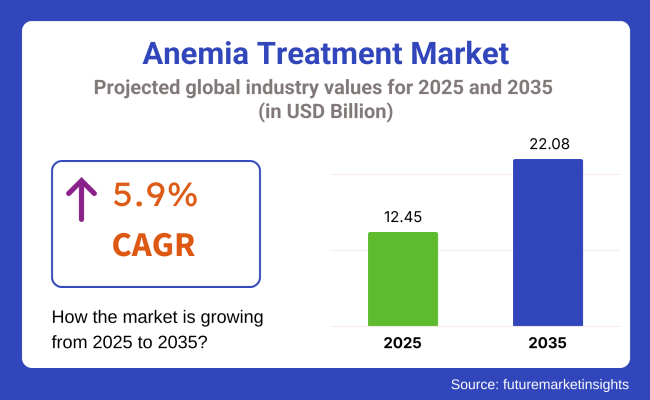

The global anaemia treatment market is estimated to be valued at USD 12.45 billion in 2025 and is projected to reach USD 22.08 billion by 2035, registering a compound annual growth rate (CAGR) of 5.9% over the forecast period. The anemia treatment market is experiencing steady growth, driven by increasing global prevalence of iron deficiency anemia, anemia of chronic disease, and renal anemia. Rising diagnosis rates, particularly among aging populations and individuals with chronic kidney disease, are expanding treatment-eligible patient pools.

Innovative erythropoiesis-stimulating agents (ESAs), intravenous iron formulations and emerging hypoxia-inducible factor prolyl hydroxylase inhibitors (HIF-PHIs) are transforming clinical management protocols. Alternatively, expanded screening programs for anemia in women’s health, paediatric care, and oncology supportive care are increasing early intervention rates. Industry partnerships with nephrology and oncology clinics are improving drug accessibility and thus boosting market growth.

Key players shaping the anemia treatment market include Astellas, Akebia Therapeutics, Vifor Pharma, GSK, and CSL Vifor, who are driving innovation through HIF-PHI development, novel IV iron products, and next-gen ESAs. In 2024, Vafseo® approved by the USA FDA for the treatment of anemia due to chronic kidney disease in dialysis-dependent adult patients. "We congratulate our partner Akebia on the FDA approval, which represents an important moment in our shared efforts toward improving the lives of dialysis patients with anemia due to CKD in the USA," said Hervé Gisserot, General Manager of CSL Vifor.

"As we continue to deliver on our promise for patients and public health, we are eager to closely collaborate with our partners to make this new oral treatment option available to patients." The expanding availability of oral therapies is expected to reduce dependence on injectable ESAs, optimize patient compliance, and shift treatment into outpatient and home-care settings, thereby expanding the commercial footprint for biopharma companies targeting multiple anemia subtypes globally.

North America dominates the anemia treatment market, largely due to the region’s high prevalence of anemia among CKD, oncology, and geriatric populations. The 2024 FDA approval of oral HIF-PHIs has opened new outpatient treatment pathways, reducing the reliance on dialysis-center-based ESA administration. Additionally, strategic partnerships between biopharma companies and large nephrology care networks are driving rapid adoption of novel anemia treatments across integrated care models.

Europe is witnessing accelerated growth in anemia treatment driven by national healthcare policies targeting chronic disease management and maternal health programs. The EMA's conditional approvals for newer oral HIF-PHIs and advanced IV iron therapies have expanded clinician options beyond traditional ESA therapies.

Germany and France are the most lucrative market high adoption of outpatient anemia management protocols within nephrology and oncology clinics, supported by strong reimbursement frameworks under national health systems. The shift towards home-based anemia management for stable CKD and elderly patients is creating new commercial channels for biopharma manufacturers across both the regions

A comparative analysis of fluctuations in compound annual growth rate (CAGR) for the anemia treatment market between 2024 and 2025 on a six-month basis is shown below. By this examination, major variations in the performance of these markets are brought to light, and also trends of revenue generation are captured hence offering stakeholders useful ideas on how to carry on with the market’s growth path in any other given year. January through June covers the first part of the year called half1 (H1), while half2 (H2) represents July to December.

The table below compares the compound annual growth rate (CAGR) for the global anemia treatment industry analysis from 2024 to 2025 during the first half of the year. This overview highlights key changes and trends in revenue growth, offering valuable insights into market dynamics.

H1 covers January to June, while H2 spans July to December. In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 7.6%, followed by a slightly lower growth rate of 7.3% in the second half (H2) of the same decade.

| Particular | Value CAGR |

|---|---|

| H1 | 7.6% (2024 to 2034) |

| H2 | 7.3% (2024 to 2034) |

| H1 | 6.9% (2025 to 2035) |

| H2 | 6.4% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 6.9% in the first half and projected to lower at 6.4% in the second half. In the first half (H1) the market witnessed a decrease of 70 BPS while in the second half (H2), the market witnessed a decrease of 90 BPS.

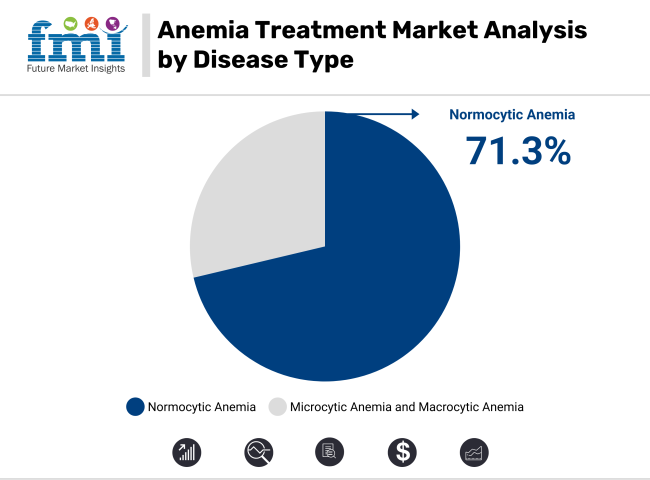

In 2025, normocytic anemia (normal MCV) is projected to hold 71.3% of the revenue share in the anemia treatment market. This dominance is largely due to the high prevalence of normocytic anemia, which is commonly associated with chronic diseases, including chronic kidney disease, cancer, and inflammatory disorders. Unlike microcytic anemia, which is often caused by iron deficiency, normocytic anemia presents with normal red blood cell size but a reduced number of red blood cells.

The treatment for normocytic anemia typically focuses on addressing the underlying chronic condition, often requiring the use of erythropoiesis-stimulating agents (ESAs) and other targeted therapies. The growing number of patients diagnosed with chronic conditions that lead to normocytic anemia, especially as the global aging population increases, has driven demand for these treatment options. Furthermore, advancements in injectable therapies and better understanding of disease pathophysiology have enhanced the management of normocytic anemia, further solidifying the segment’s dominance in the market.

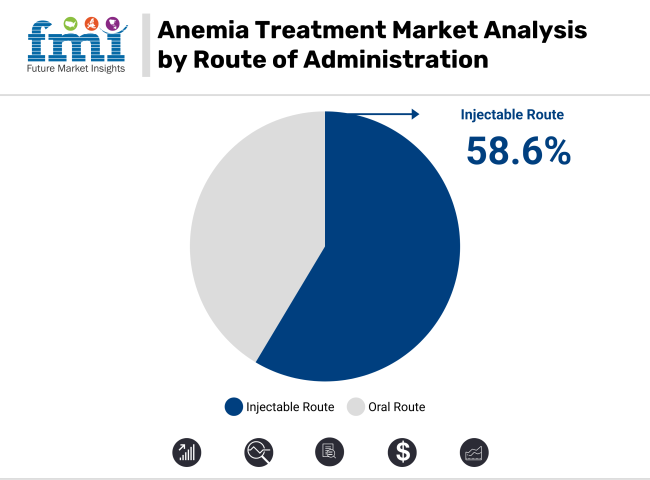

In 2025, the injectable route is expected to capture 58.6% of the revenue share in the anemia treatment market. This leadership is attributed to the high efficacy and fast-acting nature of injectable treatments, particularly in patients who require rapid relief from anemia symptoms. Injectable therapies, such as erythropoiesis-stimulating agents (ESAs) and iron infusions, provide a direct and efficient delivery method, ensuring that the medication is absorbed quickly and effectively into the bloodstream.

The growing demand for injectable treatments has been fueled by the need for more personalized and intensive management of anemia, especially in patients with chronic kidney disease, cancer, or other severe conditions. Moreover, injectable therapies offer better control over dosages and treatment regimens compared to oral formulations, making them the preferred choice for patients with severe or treatment-resistant anemia. The increasing adoption of injectable therapies in both inpatient and outpatient settings has further contributed to the growth of this segment in the anemia treatment market.

Improved Nutritional Education Contribute to the growth of Anemia Treatment

Improved nutritional education has been one of the major factors in the growth of anemia treatment adoption. As people have become more aware of the importance of a balanced diet, they have become more conscious of the nutrients required to prevent and treat anemia. Public health campaigns and educational programs have significantly promoted these nutrients, especially among vulnerable groups poor dietary habits.

Such educational help has reduced the root cause of anemia, such as iron deficiency common in many places, and educated them about iron-rich foods and enhancing iron absorption using vitamin C so that they would be able to make informed diet choices. In addition, nutritionists and health care professionals have emphasized specific anemia-related conditions, such as vitamin B12 deficiency in older adults and pregnant women, which has called for early diagnosis and treatment.

As knowledge related to the relationships between nutrition and anemia expands, more patients seek guidance and treatment for anemia, thus fostering overall growth in the adoption of anemia treatments. Improved education on nutrition enhances people's capacity to take positive action in anemia prevention and management, ultimately driving greater demand for effective treatments.

Improved Diagnosis of Anemia Anticipate the Growth in Adoption of Anemia Treatment

Improved diagnosis of anemia has significant growth in adopting the treatment for anemia owing to the fact that early diagnosis and more precise determination of the disease can be performed. Advancement in the field of diagnostics technologies such as automated blood tests, hemoglobin electrophoresis, allows detection of anemia in its very early stages by the medical care provider. It also aid in diagnosis of patients that are pregnant and people suffering from chronic diseases.

Early diagnostics help in determination of specific form of anemia, which might be iron deficiency anemia, vitamin B12 deficiency anemia, or anemia caused due to chronic diseases. This makes for a more effective form of treatment by targeting the need of each patient.

The increased accuracy and availability of diagnostic tests have also helped reduce the stigma surrounding anemia, as people are more likely to seek care once they understand the condition and its manageable nature. Consequently, the adoption of treatments, such as iron supplements, vitamin B12 injections, or blood transfusions, has grown, improving overall public health outcomes and reducing the burden of anemia globally.

Emphasis on Development of Targeted Therapies Poses Significant Business Opportunities in Anemia Treatment Market

This market, especially in terms of the emphasis placed on developing targeted therapies for the treatment of anemia, represents a considerable business opportunity, targeting specific causes that underlie this condition, with better patient outcomes and treatment compliance. Targeted therapies are designed to offer patients more individualized care through improved iron supplements that have fewer side effects or innovative drugs for the management of chronic diseases-related anemia.

By tailoring treatments to specific types of anemia-whether due to iron, vitamin B12, or folate deficiencies, or as a result of chronic conditions like kidney disease or cancer-pharmaceutical companies can create more effective solutions that address individual patient needs.

For instance, the newer preparations of oral iron supplementation that have less gastrointestinal side effects or intravenous iron therapies where patients can receive their treatment quicker and more effectively set apart from conventional treatments. Finally, improvement in ESAs for patients suffering from anemia resulting from chronic kidney disease or due to the chemotherapy process of cancer treatment has potential for developing specific therapy in these populations with high risks of anemia.

This growing trend in personalized healthcare provides significant growth potential for businesses that develop innovative, targeted anemia therapies to meet the evolving needs of patients.

Side Effects Associated with Existing Treatment Hinders the Growth of Anemia Treatment

Oral iron supplements are considered the most popular treatment for iron-deficiency anemia. In many cases, these supplements tend to cause a range of side effects such as constipation, nausea, and discomfort in the abdomen, which drives patients to withdraw from their prescription or reduce it. Due to these side effects, poor adherence to treatment brings about suboptimal therapeutic outcomes and prolonged anemia, which can further impact patient health.

IV iron infusions or ESAs might be prescribed in more severe cases, mainly because intravenous ferric carboxymaltose was found to be effective in women with low ferritin levels and anemia due to chronic diseases. Although these treatments are better, they have their risks, side effects, such as allergic reaction, fever, and hypertension. Both healthcare providers and patients fear the risks, thus are often reluctant to accept the therapy.

This, in turn, limits the uptake of treatment, reduces patient adherence, and often leads to alternative treatments or dose adjustments. These factors contribute to slower market growth as patients may seek other, potentially less effective solutions or avoid treatment altogether.

Tier 1 companies are the major companies as they hold a 56.1% share worldwide. Tier 1 companies benefit from large-scale production facilities, significant investments in research and development, and extensive distribution networks, positioning them as leaders in innovation and market leadership.

Their ability to scale production and meet high consumer demand has solidified their position in the market. Prominent companies within tier 1 include Pfizer Inc., Janssen Pharmaceuticals, Inc., Amgen Inc.

Tier 2 companies are relatively smaller as compared with tier 1 players. The tier 2 companies hold a share of 28.1% worldwide. Tier 2 companies, while smaller in scale compared to Tier 1, continue to play a crucial role during the anemia treatment industry analysis.

These companies focus on specific or emerging market niches, providing specialized products or solutions targeted toward regional markets or specialized consumer needs. Their strength lies in their agility and ability to develop innovative solutions for underserved or niche segments of the market. Key Companies under this category include Hoffmann-La Roche Ltd., AMAG Pharmaceuticals and Rockwell Medical.

The section below covers the industry analysis for the anemia treatment sales for different countries. Market demand analysis on key countries in several regions of the globe, including North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, and Middle East & Africa is provided.

The United States is anticipated to remain at the forefront in North America, with a CAGR of 1.5% through 2035. In South Asia & Pacific, India is projected to witness the highest CAGR in the market of 5.4% by 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| United States | 1.5% |

| Germany | 1.6% |

| France | 2.4% |

| UK | 1.7% |

| Japan | 5.4% |

| China | 4.8% |

The United States dominates the global market with high share in 2024. The United States is expected to exhibit a CAGR of 1.5% throughout the forecast period (2025 to 2035).

Improved treatments and medications for anemia are set to significantly spur the growth of anemia treatment in the United States. Better pharmaceuticals, such as erythropoiesis-stimulating agents and iron therapies, have improved the efficacy and efficiency of managing anemia, improving patient outcomes.

These innovations have been more targeted and personalized to address different types of anemia, including iron-deficiency anemia, pernicious anemia, and anemia of chronic disease. The development of oral iron supplements with fewer side effects and increased use of intravenous iron therapies allow for better compliance by the patients and quicker recovery.

The increasing awareness of anemia's effect on quality of life, particularly among the aging population and chronic patients, is expected to spur demand with the availability of improved treatments. Better awareness and earlier diagnosis will push more people towards effective treatments, which will lead to growth in the market and increase access to care across the country.

In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 1.6%.

Availability of treatments such as erythropoiesis-stimulating agents (ESAs), iron supplements, and gene therapies provide effective and personalized solutions for anemia patients. These innovations lead to improved patient outcomes, which leads to increase in demand for anemia treatments.

Advanced treatments have been accepted and adopted easily because of the powerful health system of Germany along with high levels of awareness concerning the treatment. An aging population also increases vulnerability towards anemia; therefore, more demand arises for better solutions to treat such medical conditions.

It makes the quality of life for patients better and decreases the overall burden on healthcare, making these treatments more attractive to both providers and patients. As a result, the increasing availability of advanced treatments fosters market expansion and positions Germany as a key player in the anemia treatment sector.

Japan occupies a leading value share in East Asia market in 2024 and is expected to grow with a CAGR of 5.4% during the forecasted period.

Japan is increasing the importance of preventive health care. Anemia treatment, in general, is boosted because Japan's healthcare system focuses on periodic check-ups and screening for a range of diseases, including anemia. Thus, this proactive healthcare approach helps to detect anemia at an early stage, henceforth allowing prompt intervention and treatment.

In turn, the number of individuals diagnosed with the condition and started on treatment increases before it reaches a severe state. Preventive healthcare also increases public awareness of the dangers and symptoms of anemia, which encourages people to seek medical advice sooner. In addition, this preventive approach is in line with Japan's overall objective of enhancing health outcomes and reducing the burden on healthcare systems by addressing problems early.

With anemia identified and controlled by prevention measures, advanced treatments have gained significant traction and continue to contribute to market growth as well as the overall patient outcomes within the country.

The anemia treatment market is highly competitive, with both established leaders and new players constantly vying for market share. Leading companies focus on offering cutting-edge solutions by collaborating with the established players that combine advanced technology for production anticipate the growth of the market. Many of these competitors are also emphasizing on receiving regulatory approval for their products for strengthening their market share.

Recent Industry Developments in Anemia Treatment Market

In terms of treatment, the industry is divided into medications and dietary supplements

In terms of disease type, the industry is divided into microcytic anemia (Low MCV), normocytic anemia (Normal MCV) and macrocytic anemia (High MCV)

In terms of Route of Administration, the industry is divided into oral route and injectable route

In terms of distribution channel, the industry is segregated into hospital pharmacies, retail pharmacies and online pharmacies

Key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, and Middle East and Africa (MEA) have been covered in the report.

The global anemia treatment industry is projected to witness CAGR of 5.9% between 2025 and 2035.

The global anemia treatment industry stood at USD 11,366.3 million in 2024.

The global anemia treatment industry is anticipated to reach USD 22.08 billion by 2035 end.

Japan is expected to show a CAGR of 5.4% in the assessment period.

The key players operating in the global anemia treatment industry include Amgen Inc., Hoffmann-La Roche Ltd, Novartis AG, Pfizer Inc., Janssen Pharmaceuticals, Inc., Teva Pharmaceutical Industries Ltd, AMAG Pharmaceuticals, Rockwell Medical, Akebia Therapeutics, Vifor Pharma Management Ltd.

Table 1: Global Market, Key Developments (2007-2019)

Table 2: Market Pipeline Analysis (2021)

Table 3: Expenditure on Health, (% of GDP), by Country, 2016 - 2021

Table 4: Expenditure on Health, (% of GDP), by Country, 2016 - 2021

Table 5: Global Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, By Treatment Type

Table 6: Global Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, By Disease Type

Table 7: Global Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, By Route of Administration

Table 8: Global Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, By Distribution Channel

Table 9: Global Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, By Region

Table 10: North America Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, By Country

Table 11: North America Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, By Treatment Type

Table 12: North America Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, By Disease Type

Table 13: North America Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, By Route of Administration

Table 14: North America Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, By Distribution Channel

Table 15: Latin America Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, By Country

Table 16: Latin America Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, By Treatment Type

Table 17: Latin America Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, By Disease Type

Table 18: Latin America Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, By Route of Administration

Table 19: Latin America Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, By Distribution Channel

Table 20: Europe Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, By Country

Table 21: Europe Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, By Treatment Type

Table 22: Europe Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, By Disease Type

Table 23: Europe Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, By Route of Administration

Table 24: Europe Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, By Distribution Channel

Table 25: East Asia Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, By Country

Table 26: East Asia Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, By Treatment Type

Table 27: East Asia Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, By Disease Type

Table 28: East Asia Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, By Route of Administration

Table 29: East Asia Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, By Distribution Channel

Table 30: South Asia Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, By Country

Table 31: South Asia Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, By Treatment Type

Table 32: South Asia Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, By Disease Type

Table 33: South Asia Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, By Route of Administration

Table 34: South Asia Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, By Distribution Channel

Table 35: Oceania Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, By Country

Table 36: Oceania Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, By Treatment Type

Table 37: Oceania Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, By Disease Type

Table 38: Oceania Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, By Route of Administration

Table 39: Oceania Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, By Distribution Channel

Table 40: MEA Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, By Country

Table 41: MEA Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, By Treatment Type

Table 42: MEA Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, By Disease Type

Table 43: MEA Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, By Route of Administration

Table 44: MEA Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, By Distribution Channel

Table 45: Emerging Market Value Proportion Analysis 2013-2021 and Forecast 2022-2028, By Countr45

Table 46: Emerging and Global Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028

Table 47: China Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, By Treatment Type

Table 48: China Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, By Disease Type

Table 49: China Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, By Route of Administration

Table 50: China Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, By Distribution Channel

Table 51: Brazil Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, By Treatment Type

Table 52: Brazil Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, By Disease Type

Table 53: Brazil Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, By Route of Administration

Table 54: Brazil Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, By Distribution Channel

Table 55: India Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, By Treatment Type

Table 56: India Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, By Disease Type

Table 57: India Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, By Route of Administration

Table 58: India Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, By Distribution Channel

Figure 01: World Anemic Population by Key Countries, 2021 (Unit)

Figure 02: World Diagnosed Anemic Population by Key Countries, 2021 (Unit)

Figure 03: World Anemic Treatment Seeking Rate (%), by Key Countries, 207

Figure 04: Distribution of Industry Sponsored Clinical Programs, by Phase

Figure 05: Number of Clinical Programs (phase II | phase III & phase III) expected to be completed by 2020, by company

Figure 06: Global Iron Supplements Market, Price Difference (US$) By Region, 2021

Figure 07: Global Iron Supplements Market, Price Difference (US$) By Region, 2028

Figure 08: Global Vitamin Supplements Market, Price Difference (US$) By Region, 2021

Figure 09: Global Vitamin Supplements Market, Price Difference (US$) By Region, 2028

Figure 10: Global Red Blood Cell Transfusions Market, Price Difference (US$) By Region, 2021

Figure 11: Global Red Blood Cell Transfusions Market, Price Difference (US$) By Region, 2028

Figure 12: Global Erythropoietin-stimulating agents (ESAs) Market, Price Difference (US$) By Region, 2021

Figure 13: Global Erythropoietin-stimulating agents (ESAs) Market, Price Difference (US$) By Region, 2028

Figure 14: Global Chelation therapy Market, Price Difference (US$) By Region, 2021

Figure 15: Global Chelation therapy Market, Price Difference (US$) By Region, 2028

Figure 16: Global Antibiotics Market, Price Difference (US$) By Region, 2021

Figure 17: Global Antibiotics Market, Price Difference (US$) By Region, 2028

Figure 18: Global Market Historical Market Value (US$ Mn) Analysis, 2013-2021

Figure 19: Global Current and Future Market Value (US$ Mn), 2022-2028 & Y-o-Y Growth Trend Analysis

Figure 20: Market Absolute $ Opportunity, 2013–2028

Figure 21: Global Healthcare Expenditure in US$ Tn (2013–2020)

Figure 22: Global Market Attractiveness Analysis, By Treatment

Figure 23: Global Market Attractiveness Analysis, By Disease Type

Figure 24: Global Market Attractiveness Analysis, By Route of Administration

Figure 25: Global Market Attractiveness Analysis, Distribution Channel

Figure 26: Global Market Attractiveness Analysis, Region

Figure 27: North America Market Value (US$ Mn) Analysis, 2013–2021

Figure 28: North America Market Value (US$ Mn) Forecast & Y-o-Y Growth (%), 2022–2028

Figure 29: U.S. Market Value (US$ Mn) Analysis, 2013-2021

Figure 30: U.S. Market Value (US$ Mn) Forecast Analysis & Y-o-Y Growth (%), 2022-2028

Figure 31: Canada Systems Market Value (US$ Mn) Forecast & Y-o-Y Growth (%), 2022-2028

Figure 32: Canada Market Value (US$ Mn) Forecast Analysis & Y-o-Y Growth (%), 2022-2028

Figure 33: North America Market Attractiveness Analysis, By Treatment Type

Figure 34: North America Market Attractiveness Analysis, By Disease Type

Figure 35: North America Market Attractiveness Analysis, By Route of Administration

Figure 36: North America Market Attractiveness Analysis, By Distribution Channel

Figure 37: North America Brain Monitoring Systems Market Attractiveness Analysis, By Country

Figure 38: Latin America Market Value (US$ Mn) Analysis, 2013–2021

Figure 39: Latin America Market Value (US$ Mn) Forecast & Y-o-Y Growth (%), 2022–2028

Figure 40: Brazil Market Value (US$ Mn) Analysis, 2013-2021

Figure 41: Brazil Market Value (US$ Mn) Forecast Analysis & Y-o-Y Growth (%), 2022-2028

Figure 42: Mexico Systems Market Value (US$ Mn) Forecast & Y-o-Y Growth (%), 2022-2028

Figure 43: Mexico Market Value (US$ Mn) Forecast Analysis & Y-o-Y Growth (%), 2022-2028

Figure 44: Argentina Market Value (US$ Mn) Analysis, 2013-2021

Figure 45: Argentina Market Value (US$ Mn) Forecast Analysis & Y-o-Y Growth (%), 2022-2028

Figure 46: Rest of L.A. Systems Market Value (US$ Mn) Forecast & Y-o-Y Growth (%), 2022-2028

Figure 47: Rest of L.A. Market Value (US$ Mn) Forecast Analysis & Y-o-Y Growth (%), 2022-2028

Figure 48: Latin America Market Attractiveness Analysis, By Treatment Type

Figure 49: Latin America Market Attractiveness Analysis, By Disease Type

Figure 50: Latin America Market Attractiveness Analysis, By Route of Administration

Figure 51: Latin America Market Attractiveness Analysis, By Distribution Channel

Figure 52: Latin America Brain Monitoring Systems Market Attractiveness Analysis, By Country

Figure 53: Europe Market Value (US$ Mn) Analysis, 2013–2021

Figure 54: Europe Market Value (US$ Mn) Forecast & Y-o-Y Growth (%), 2022–2028

Figure 55: U.K. Market Value (US$ Mn) Analysis, 2013-2021

Figure 56: U.K. Market Value (US$ Mn) Forecast Analysis & Y-o-Y Growth (%), 2022-2028

Figure 57: Germany Systems Market Value (US$ Mn) Forecast & Y-o-Y Growth (%), 2022-2028

Figure 58: Germany Market Value (US$ Mn) Forecast Analysis & Y-o-Y Growth (%), 2022-2028

Figure 59: France Market Value (US$ Mn) Analysis, 2013-2021

Figure 60: France Market Value (US$ Mn) Forecast Analysis & Y-o-Y Growth (%), 2022-2028

Figure 61: Spain Systems Market Value (US$ Mn) Forecast & Y-o-Y Growth (%), 2022-2028

Figure 62: Spain Market Value (US$ Mn) Forecast Analysis & Y-o-Y Growth (%), 2022-2028

Figure 63: Italy Market Value (US$ Mn) Analysis, 2013-2021

Figure 64: Italy Market Value (US$ Mn) Forecast Analysis & Y-o-Y Growth (%), 2022-2028

Figure 65: Russia Systems Market Value (US$ Mn) Forecast & Y-o-Y Growth (%), 2022-2028

Figure 66: Russia Market Value (US$ Mn) Forecast Analysis & Y-o-Y Growth (%), 2022-2028

Figure 67: Rest of Europe Market Value (US$ Mn) Analysis, 2013-2021

Figure 68: Rest of Europe Market Value (US$ Mn) Forecast Analysis & Y-o-Y Growth (%), 2022-2028

Figure 69: Europe Market Attractiveness Analysis, By Treatment Type

Figure 70: Europe Market Attractiveness Analysis, By Disease Type

Figure 71: Europe Market Attractiveness Analysis, By Route of Administration

Figure 72: Europe Market Attractiveness Analysis, By Distribution Channel

Figure 73: Europe Brain Monitoring Systems Market Attractiveness Analysis, By Country

Figure 74: East Asia Market Value (US$ Mn) Analysis, 2013–2021

Figure 75: East Asia Market Value (US$ Mn) Forecast & Y-o-Y Growth (%), 2022–2028

Figure 76: Japan Market Value (US$ Mn) Analysis, 2013-2021

Figure 77: Japan Market Value (US$ Mn) Forecast Analysis & Y-o-Y Growth (%), 2022-2028

Figure 78: South Korea Systems Market Value (US$ Mn) Forecast & Y-o-Y Growth (%), 2022-2028

Figure 79: South Korea Market Value (US$ Mn) Forecast Analysis & Y-o-Y Growth (%), 2022-2028

Figure 80: China Market Value (US$ Mn) Analysis, 2013-2021

Figure 81: China Market Value (US$ Mn) Forecast Analysis & Y-o-Y Growth (%), 2022-2028

Figure 82: East Asia Market Attractiveness Analysis, By Treatment Type

Figure 83: East Asia Market Attractiveness Analysis, By Disease Type

Figure 84: East Asia Market Attractiveness Analysis, By Route of Administration

Figure 85: East Asia Market Attractiveness Analysis, By Distribution Channel

Figure 86: East Asia Brain Monitoring Systems Market Attractiveness Analysis, By Country

Figure 87: South Asia Market Value (US$ Mn) Analysis, 2013–2021

Figure 88: South Asia Market Value (US$ Mn) Forecast & Y-o-Y Growth (%), 2022–2028

Figure 89: Thailand Market Value (US$ Mn) Analysis, 2013-2021

Figure 90: Thailand Market Value (US$ Mn) Forecast Analysis & Y-o-Y Growth (%), 2022-2028

Figure 91: Malaysia Systems Market Value (US$ Mn) Forecast & Y-o-Y Growth (%), 2022-2028

Figure 92: Malaysia Market Value (US$ Mn) Forecast Analysis & Y-o-Y Growth (%), 2022-2028

Figure 93: Indonesia Market Value (US$ Mn) Analysis, 2013-2021

Figure 94: Indonesia Market Value (US$ Mn) Forecast Analysis & Y-o-Y Growth (%), 2022-2028

Figure 95: Rest of South Asia Systems Market Value (US$ Mn) Forecast & Y-o-Y Growth (%), 2022-2028

Figure 96: Rest of South Asia Market Value (US$ Mn) Forecast Analysis & Y-o-Y Growth (%), 2022-2028

Figure 97: India Market Value (US$ Mn) Analysis, 2013-2021

Figure 98: India Market Value (US$ Mn) Analysis, 2013-2021

Figure 99: South Asia Market Attractiveness Analysis, By Treatment Type

Figure 100: South Asia Market Attractiveness Analysis, By Disease Type

Figure 101: South Asia Market Attractiveness Analysis, By Route of Administration

Figure 102: South Asia Market Attractiveness Analysis, By Distribution Channel

Figure 103: South Asia Brain Monitoring Systems Market Attractiveness Analysis, By Country

Figure 104: Oceania Market Value (US$ Mn) Analysis, 2013–2021

Figure 105: Oceania Market Value (US$ Mn) Forecast & Y-o-Y Growth (%), 2022–2028

Figure 106: Australia Market Value (US$ Mn) Analysis, 2013-2021

Figure 107: Australia Market Value (US$ Mn) Forecast Analysis & Y-o-Y Growth (%), 2022-2028

Figure 108: New Zealand o Systems Market Value (US$ Mn) Forecast & Y-o-Y Growth (%), 2022-2028

Figure 109: New Zealand Market Value (US$ Mn) Forecast Analysis & Y-o-Y Growth (%), 2022-2028

Figure 110: Oceania Market Attractiveness Analysis, By Treatment Type

Figure 111: Oceania Market Attractiveness Analysis, By Disease Type

Figure 112: Oceania Market Attractiveness Analysis, By Route of Administration

Figure 113: Oceania Market Attractiveness Analysis, By Distribution Channel

Figure 114: Oceania Brain Monitoring Systems Market Attractiveness Analysis, By Country

Figure 115: MEA Market Value (US$ Mn) Analysis, 2013–2021

Figure 116: MEA Market Value (US$ Mn) Forecast & Y-o-Y Growth (%), 2022–2028

Figure 117: GCC Countries Market Value (US$ Mn) Analysis, 2013-2021

Figure 118: GC Countries Market Value (US$ Mn) Forecast Analysis & Y-o-Y Growth (%), 2022-2028

Figure 119: South Africa Systems Market Value (US$ Mn) Forecast & Y-o-Y Growth (%), 2022-2028

Figure 120: South Africa Market Value (US$ Mn) Forecast Analysis & Y-o-Y Growth (%), 2022-2028

Figure 121: Rest of MEA Market Value (US$ Mn) Analysis, 2013-2021

Figure 122: Rest of MEA Market Value (US$ Mn) Forecast Analysis & Y-o-Y Growth (%), 2022-2028

Figure 123: MEA Market Attractiveness Analysis, By Treatment Type

Figure 124: MEA Market Attractiveness Analysis, By Disease Type

Figure 125: MEA Market Attractiveness Analysis, By Route of Administration

Figure 126: MEA Market Attractiveness Analysis, By Distribution Channel

Figure 127: MEA Brain Monitoring Systems Market Attractiveness Analysis, By Country

Figure 128: Global Vs. Emerging Market Value (%) Analysis 2013-2021 and Forecast 2022-2028

Figure 129: China Market Value (US$ Mn) Analysis, 2013–2021

Figure 130: China Market Value (US$ Mn) Forecast & Y-o-Y Growth (%), 2022–2028

Figure 131: Brazil Market Value (US$ Mn) Analysis, 2013–2021

Figure 132: Brazil Market Value (US$ Mn) Forecast & Y-o-Y Growth (%), 2022–2028

Figure 133: India Market Value (US$ Mn) Analysis, 2013–2021

Figure 134: India Market Value (US$ Mn) Forecast & Y-o-Y Growth (%), 2022–2028

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dialysis Induced Anemia Treatment Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Warm Autoimmune Hemolytic Anemia (WAIHA) Treatment Market Analysis by Drug Class, Distribution Channel, and Region through 2035

Sickle Cell Anemia Market

Diamond-Blackfan Anemia (DBA) Syndrome Therapeutics Market - Growth & Innovations 2025 to 2035

Chemotherapy Induced Anemia Market Trends and Forecast 2025 to 2035

Drug-Induced Immune Hemolytic Anemia Market - Demand & Forecast 2025 to 2035

Treatment-Resistant Hypertension Management Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Treatment Pumps Market Insights Growth & Demand Forecast 2025 to 2035

Pretreatment Coatings Market Size and Share Forecast Outlook 2025 to 2035

Air Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

CNS Treatment and Therapy Market Insights - Trends & Growth Forecast 2025 to 2035

Seed Treatment Materials Market Size and Share Forecast Outlook 2025 to 2035

Acne Treatment Solutions Market Size and Share Forecast Outlook 2025 to 2035

Scar Treatment Market Overview - Growth & Demand Forecast 2025 to 2035

Soil Treatment Chemicals Market

Algae Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA