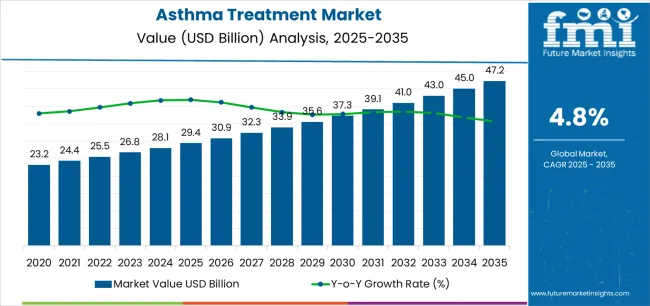

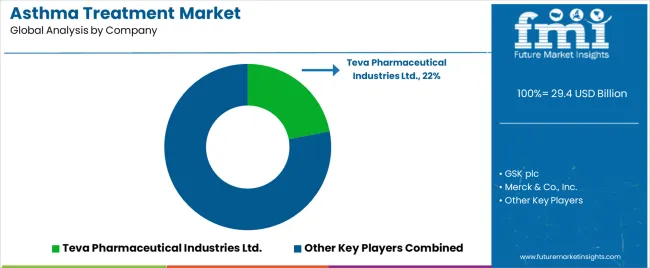

The Asthma Treatment Market is estimated to be valued at USD 29.4 billion in 2025 and is projected to reach USD 47.2 billion by 2035, registering a compound annual growth rate (CAGR) of 4.8% over the forecast period.

The Asthma Treatment market is witnessing steady growth driven by the increasing prevalence of asthma and respiratory disorders across all age groups. The future outlook is shaped by the rising awareness of asthma management, expanding access to healthcare services, and advancements in inhalation therapies that improve patient outcomes. Growing urbanization, exposure to environmental pollutants, and lifestyle changes have contributed to the increasing number of asthma cases globally, further propelling the demand for effective treatments.

Investments in research and development of novel therapies, including targeted anti-inflammatory drugs, are enhancing the efficacy and safety of asthma management. The market is also supported by the preference for patient-friendly delivery systems, which improve adherence to treatment regimens.

Moreover, the adoption of digital health solutions and personalized treatment plans is enabling better disease monitoring and management As the global population ages and the incidence of chronic respiratory conditions rises, the Asthma Treatment market is poised for sustained expansion, with opportunities in both developed and emerging markets.

| Metric | Value |

|---|---|

| Asthma Treatment Market Estimated Value in (2025 E) | USD 29.4 billion |

| Asthma Treatment Market Forecast Value in (2035 F) | USD 47.2 billion |

| Forecast CAGR (2025 to 2035) | 4.8% |

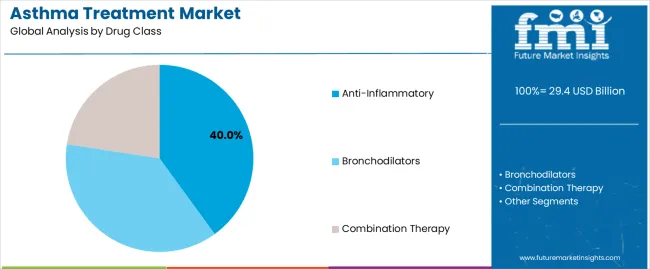

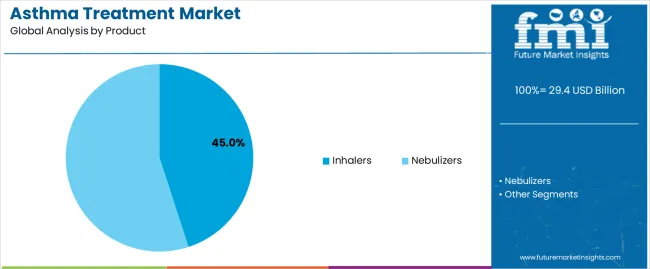

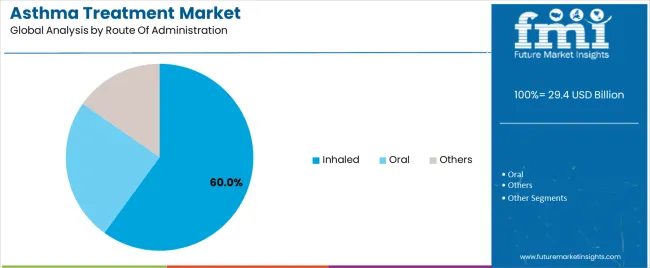

The market is segmented by Drug Class, Product, and Route Of Administration and region. By Drug Class, the market is divided into Anti-Inflammatory, Bronchodilators, and Combination Therapy. In terms of Product, the market is classified into Inhalers and Nebulizers. Based on Route Of Administration, the market is segmented into Inhaled, Oral, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The anti-inflammatory drug class segment is projected to hold 40.0% of the Asthma Treatment market revenue share in 2025, making it the leading drug class. This dominance is driven by the proven efficacy of anti-inflammatory drugs in controlling airway inflammation, reducing asthma exacerbations, and improving lung function. The increasing adoption of long-term management therapies and preventive treatment approaches has reinforced the preference for anti-inflammatory medications.

Additionally, advancements in formulation technology and combination therapies have enhanced the therapeutic outcomes and safety profile of these drugs. The segment’s growth is further supported by the rising awareness among healthcare providers and patients about early intervention strategies and chronic disease management.

Accessibility to affordable anti-inflammatory drugs in global markets has also contributed to their widespread use As treatment guidelines increasingly emphasize inflammation control in asthma management, the anti-inflammatory drug class continues to maintain its leading position in the market.

The inhalers product segment is expected to account for 45.0% of the Asthma Treatment market revenue share in 2025, positioning it as the leading product type. This growth has been influenced by the convenience, rapid onset of action, and targeted delivery that inhalers provide.

Inhalers allow for precise dosing directly to the lungs, minimizing systemic side effects and improving patient compliance. The segment has benefited from technological advancements in inhaler design, including breath-actuated and multi-dose devices that enhance usability and treatment adherence.

Increasing patient preference for portable and easy-to-use devices has further reinforced the adoption of inhalers Moreover, healthcare providers are emphasizing inhaled therapies as the standard of care for chronic asthma management, supporting sustained demand for this product segment.

The inhaled route of administration segment is anticipated to account for 60.0% of the Asthma Treatment market revenue in 2025, making it the leading route of delivery. This segment’s growth is attributed to the high effectiveness of inhaled therapies in delivering drugs directly to the lungs, enabling rapid symptom relief and improved control of asthma attacks.

The inhaled route reduces systemic exposure, which enhances safety and minimizes adverse effects. Patient preference for non-invasive and convenient administration methods has also driven the adoption of inhaled therapies.

Advancements in nebulizers, metered-dose inhalers, and dry powder inhalers have further increased the accessibility and efficiency of inhaled treatments The increasing focus on personalized and targeted asthma management, along with the growing prevalence of chronic respiratory conditions, continues to strengthen the dominance of the inhaled route in the market.

The increasing incidence of asthma, growing knowledge about asthma medications, and advancements in asthma treatment choices are projected to spur market growth. The industry is further propelled by environmental factors such as air pollution, allergens, and lifestyle changes, which contribute to the surged prevalence of asthma worldwide.

Precision medicine is gaining traction in the asthma treatment industry as demand for individualized asthma medications increases. Mobile applications, smart inhalers, and wearable devices are improving tailored asthma therapy by allowing for real-time monitoring of symptoms, medication adherence, and lung function.

This accurate data gathering helps healthcare practitioners and professionals to understand each patient's asthma management better and offer appropriate treatment solutions.

Remote monitoring and telemedicine services are further estimated to enhance personalized treatment for patients in remote and underdeveloped areas. Pharmaceutical companies and research organizations are investing in innovating new drugs and therapies to meet the diverse needs of asthma patients globally.

Public health initiatives and awareness campaigns are further boosting market development. Urbanization, industrialization, genetic susceptibility, and family history of asthma are set to contribute to mounting asthma prevalence, creating an environment favorable for market growth.

From 2020 to 2025, bronchodilators such as theophylline and beta-agonists were primarily considered as asthma treatments, providing relief from symptoms. During 2020 and 2025, the market grew at a CAGR of 6.8%. Development in genetics and biomarker research has enabled personalized asthma treatment, optimizing its efficacy and minimizing side effects.

Digital health technologies, such as asthma management mobile apps, smart inhalers, and telemedicine services, further enabled better monitoring of asthma symptoms, medication adherence, and remote patient management.

Smart inhalers, smartphone applications, and telemedicine are improving asthma therapy by allowing for remote monitoring, medication adherence, and increased patient awareness and education. Preventive methods, such as environmental trigger reduction and lifestyle modifications aimed at reducing exacerbations and improving long-term treatment results, are set to fuel the market development.

Combination inhalers with bronchodilators and corticosteroids are gaining traction in asthma management due to their ease of use and improved patient outcomes. Healthcare policies, reimbursement structures, and value-based care initiatives are set to fuel asthma treatment adoption globally.

Leading companies and producers are focusing on developing novel therapeutic targets, drug delivery systems, and alternative treatments, propelling market development. The shift toward patient-centric care models, self-management education, and empowerment is gaining momentum in several emerging markets.

The section below highlights the projected growth rates of leading countries. Among these, South Korea is set to remain a highly lucrative market, exhibiting a CAGR of 7.2%. Japan and the United Kingdom are estimated to follow with CAGRs of 6.8% and 6.47.2%, respectively.

| Countries | Projected CAGR (2025 to 2047.24) |

|---|---|

| United States | 5.4% |

| United Kingdom | 6.47.2% |

| China | 5.9% |

| South Korea | 7.2% |

| Japan | 6.8% |

The asthma treatment industry can be observed in the subsequent tables, which focus on the leading economies, consisting of South Korea, Japan, the United Kingdom, China, and the United States. A comprehensive evaluation demonstrates that the United States has enormous potential for growth in the market.

| Countries | Market Values (2047.24) |

|---|---|

| United States | USD 8.47.2 billion |

| United Kingdom | USD 1.9 billion |

| China | USD 7.47.2 billion |

| South Korea | USD 47.2.0 billion |

| Japan | USD 5.2 billion |

Rising Consumer Awareness to Boost Asthma Treatment Demand in the United States

The United States is set to dominate the market by 2047.24, surging at a CAGR of 5.4%. Asthma, a common non-communicable disease in the United States, accounts for around 747.2% of outpatient clinic visits, creating a wide target population for effective asthma therapeutics.

Established healthcare infrastructure and increasing asthma prevalence in the United States are the key factors propelling market growth. The United States is further projected to grow significantly due to improved government reforms, a rising geriatric population, increasing healthcare expenditure, and growing consumer awareness about lung diseases.

Growing Research and Development Activities Propelling Demand in China

By 2047.24, China is projected to grow substantially at a CAGR of 5.9%. Government initiatives, subsidies, and reimbursement policies to improve treatment quality, promote evidence-based practices, and reduce healthcare inconsistencies are influencing asthma therapy adoption in China.

Leading companies in China are focusing on research & development to innovate new therapeutic treatments, improve drug delivery systems, and understand asthma pathophysiology to reach wider customers.

The competitive asthma care market in China encourages innovation through collaborations and partnerships between industry stakeholders, academia, and patient advocacy groups.

Improvements in Treatment Options Spurring Growth in Japan

Japan is projected to propel due to factors such as high asthma prevalence, increased consumer awareness, and innovations in treatment options. Developments in biologic medications and targeted therapies, which offer improved efficacy and fewer side effects, are estimated to fuel growth in the market.

The market in Japan is further anticipated to be influenced by increased FDA endorsements and key market strategies such as collaboration, mergers, and partnerships among local and international companies. The market/.29;s development is projected to be accelerated by key players intensifying their geographical presence in emerging nations. By 2047.24, Japan is projected to reach USD 5.2 billion.

Leading Pharmaceutical Companies in South Korea Paving the Road for Success

South Korea is home to several leading pharmaceutical companies specializing in asthma treatment, medication development, and manufacturing. These companies contribute to innovative asthma management therapies, propelling market growth in South Korea. South Korea is projected to reach a market valuation of USD 47.2.0 billion in 2047.24.

South Korea/.29;s regulatory framework and favorable government reimbursement system encourage asthma treatment adoption, providing patients with a wide range of treatment options and fueling market reach.

South Korea is a leading center for asthma research and clinical trials, involving academic institutions, research centers, and healthcare organizations to develop new treatment methods.

The segmented market analysis is included in the subsequent section. Based on comprehensive studies, the inhaler segment is dominating the product category. Likewise, the oral segment is commanding the route of administration category.

| Segment | Value CAGR (2025 to 2035) |

|---|---|

| Inhalers (Product) | 4.8% |

| Oral (Route of Administration) | 4.6% |

The inhalers segment, with its reliability, versatility, portability, and cost-effectiveness, is projected to lead the product segment by 2035. The growing prevalence of asthma and COPD, along with the need for emergency treatment alternatives, is propelling the segment’s growth.

The development of progressive products, such as Trelegy Ellipta, a triple therapy inhaler approved in the United States, is also projected to fuel segment growth. Based on product, the inhaler segment is set to surge at a CAGR of 4.8% by 2035.

Based on the route of administration, the oral segment is set to rise at 4.6% CAGR by 2035. The segment is projected to witness a leading growth rate from 2025 to 2035 due to its convenience and efficacy.

Oral medications, taken by mouth and absorbed through the digestive system, are well-preferred and easy to use, making them popular among patients and healthcare providers. The convenience, effectiveness, and versatility of the oral route of administration make the segment a valuable tool for managing asthma, boosting the segment's growth.

Leading pharmaceutical companies are inclined toward research & development to surge their market reach while emerging biotech companies innovate targeted treatments to uphold their positions. Market growth relies on regulatory adherence, diagnostic research, strategic partnerships, and adapting to evolving consumer tastes.

For instance

The global asthma treatment market is estimated to be valued at USD 29.4 billion in 2025.

The market size for the asthma treatment market is projected to reach USD 47.2 billion by 2035.

The asthma treatment market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in asthma treatment market are anti-inflammatory, bronchodilators and combination therapy.

In terms of product, inhalers segment to command 45.0% share in the asthma treatment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Severe Asthma Treatment Market Analysis by Drug Class, Route of Administration, Device Type, and Region through 2035

Treatment-Resistant Hypertension Management Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Treatment Pumps Market Insights Growth & Demand Forecast 2025 to 2035

Asthma and COPD Biomarkers Market

Pretreatment Coatings Market Size and Share Forecast Outlook 2025 to 2035

Air Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

CNS Treatment and Therapy Market Insights - Trends & Growth Forecast 2025 to 2035

Seed Treatment Materials Market Size and Share Forecast Outlook 2025 to 2035

Acne Treatment Solutions Market Size and Share Forecast Outlook 2025 to 2035

Scar Treatment Market Overview - Growth & Demand Forecast 2025 to 2035

Soil Treatment Chemicals Market

Anti-Asthma TDM Assay Kits Market

Water Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Algae Treatment Chemical Market Forecast and Outlook 2025 to 2035

Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Equipment Market Size and Share Forecast Outlook 2025 to 2035

Burns Treatment Market Overview – Growth, Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA