The Bronchodilator Market is estimated to be valued at USD 40.6 billion in 2025 and is projected to reach USD 70.3 billion by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period.

| Metric | Value |

|---|---|

| Bronchodilator Market Estimated Value in (2025 E) | USD 40.6 billion |

| Bronchodilator Market Forecast Value in (2035 F) | USD 70.3 billion |

| Forecast CAGR (2025 to 2035) | 5.6% |

The bronchodilator market is expanding steadily. Rising prevalence of chronic respiratory conditions such as asthma and COPD is driving demand for effective therapeutic options. Current market dynamics are supported by the introduction of advanced drug formulations, greater emphasis on patient adherence, and regulatory support for efficient delivery systems.

Technological improvements in inhalation devices and extended-release formulations are contributing to enhanced patient outcomes. Increased awareness programs and early diagnosis initiatives are further supporting uptake in both developed and emerging regions. The future outlook remains positive as aging populations and urban pollution continue to elevate respiratory disease incidence.

Growth rationale is anchored on the continued reliance on bronchodilators as frontline therapies, the development of combination drug classes to improve efficacy, and strategic investments by pharmaceutical companies in pipeline innovation and distribution networks These factors collectively ensure consistent demand and sustained revenue potential across global healthcare systems.

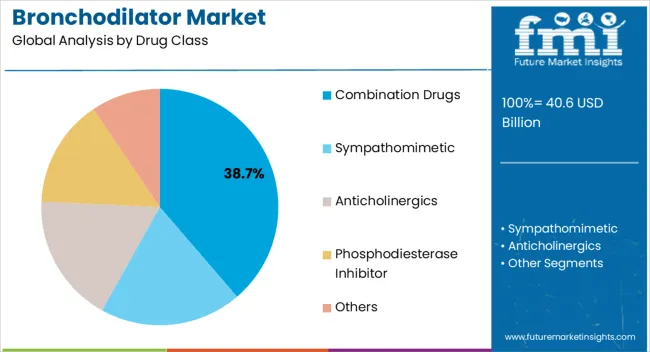

The combination drugs segment, accounting for 38.70% of the drug class category, has established itself as the leading class due to its effectiveness in managing complex respiratory conditions that require dual mechanisms of action. Improved therapeutic outcomes, reduced frequency of exacerbations, and enhanced patient compliance have supported widespread adoption.

The segment benefits from integrated treatment protocols where combining beta-agonists with corticosteroids or anticholinergics delivers superior results compared to monotherapy. Regulatory approval of fixed-dose combinations and their inclusion in clinical guidelines have reinforced usage.

Ongoing innovation in inhaler technology and sustained investments in research are expected to further strengthen the role of combination therapies These factors collectively sustain the segment’s dominant position within the bronchodilator market.

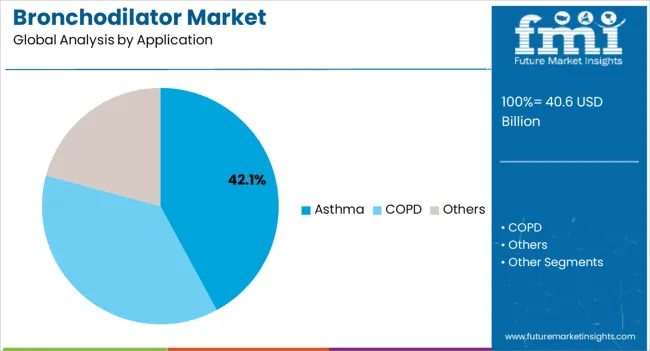

The asthma application segment, holding 42.10% of the application category, continues to lead due to high global prevalence and increasing demand for long-term disease management solutions. The segment’s growth has been supported by improved diagnostic practices, patient education initiatives, and the availability of diverse drug formulations tailored for various severities.

Asthma management strategies emphasize consistent use of bronchodilators, making them indispensable in treatment protocols. Expanded healthcare coverage in emerging markets and broader adoption of preventive therapies have reinforced the application’s leading role.

Sustained investments in clinical research and ongoing improvements in inhalation devices are expected to enhance patient adherence and long-term efficacy The asthma segment is therefore positioned to maintain its leadership within the broader bronchodilator landscape.

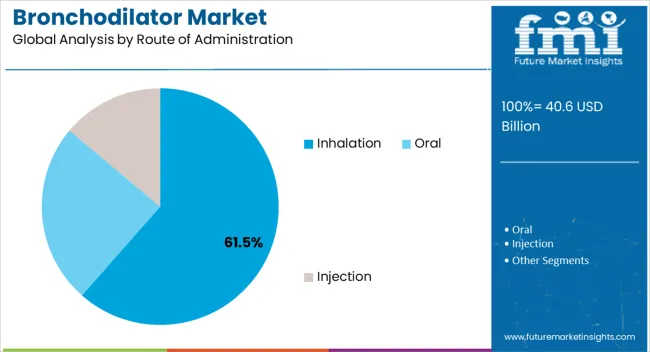

The inhalation route, representing 61.50% of the route of administration category, has maintained dominance due to its efficiency in delivering targeted therapy directly to the lungs. This method offers rapid onset of action, reduced systemic side effects, and improved patient satisfaction compared to oral or injectable routes.

Technological advancements in metered-dose inhalers, dry powder inhalers, and nebulizers have further enhanced adoption. Healthcare providers favor this route for both acute and chronic management of respiratory conditions.

Increasing affordability of inhalation devices and growing patient preference for portable, user-friendly systems are supporting continuous uptake Future growth will be reinforced by ongoing device innovation, digital monitoring integrations, and expansion of distribution in emerging markets, ensuring inhalation remains the primary route of administration in bronchodilator therapies.

As per the latest bronchodilator industry analysis, global bronchodilator sales grew at a CAGR of 5.0% between 2020 and 2025. The market value for bronchodilators was about 43.3% of the respiratory diseases drug market in 2025, which was valued at USD 79.8 billion.

| Historical CAGR (2020 to 2025) | 5.0% |

|---|---|

| Forecast CAGR (2025 to 2035) | 5.9% |

The main factor propelling the growth of the bronchodilator industry is the rising prevalence of respiratory illnesses, including asthma and chronic obstructive pulmonary disease (COPD), worldwide. Similarly, rising disposable income, a growing geriatric population, and a rise in public awareness of healthcare are all predicted to spur market expansion.

The market is also growing as a result of increased bronchodilator use in the treatment of cystic fibrosis. Subsequently, favorable government initiatives to reduce the burden of respiratory diseases are set to elevate demand for bronchodilators through 2035.

In recent years, there has been a spike in respiratory illnesses such as asthma. For instance, as per the Centers for Disease Control and Prevention (CDC), 1 in 13 individuals have asthma, which results in 9.8 million doctor visits, 188,968 hospital inpatient discharges, and 1.8 million trips to emergency rooms annually.

Over 25 million people in the United States, or 7.7% of adults and 8.4% of children, suffer from asthma, making it a common condition globally. With 8% of the adult population and 12% to 13% of children estimated to have asthma, the United Arab Emirates has a higher reported prevalence of the disease than the United States.

To treat asthma and relieve its symptoms, bronchodilators are set to be frequently used. Hence, the growing prevalence of asthma will play a key role in bolstering sales of bronchodilators.

The market for bronchodilators is expected to see new prospects due to continuous research and development efforts. New drug administration methods are being developed by manufacturers, which is anticipated to increase drug consumption and fuel the global bronchodilator market.

Top bronchodilator manufacturers are investing significantly in developing multiple nebulizer and inhaler types that would give patients convenient access. The development of novel bronchodilators with higher effectiveness and minimal side effects will boost the target market.

Improvements in healthcare structures and increasing government initiatives are expected to boost the market for bronchodilators globally. These factors will create lucrative growth opportunities for bronchodilator manufacturing companies.

Governments worldwide are launching different schemes to reduce the burden of respiratory diseases. Several steps are also taken to make the treatments affordable for everyone and spread awareness about the prevention of diseases. This is predicted to positively impact bronchodilator sales.

The growing incidence of COPD is acting as a catalyst fueling demand for bronchodilators, and the trend is expected to continue through 2035. Subsequently, the introduction of new programs to tackle the COPD burden will likely foster the growth of the bronchodilator industry.

Countries worldwide are launching new programs and initiatives to counter the burden of respiratory diseases. For instance, the COPD National Action Plan was recently launched to reduce COPD burden.

The COPD action plan aims to enhance the prevention, diagnosis, treatment, and management of COPD by enhancing the quality of care provided throughout the healthcare continuum. It strives to help those with COPD, their family members, and their caregivers.

Bronchodilators play an important role in terms of loosening up the muscles that constrict the airways. However, the side effects associated with bronchodilators are the main hindrance to the growth of this market.

Beta-2 agonists such as salbutamol and anticholinergics have several common adverse effects. These include trembling, especially in the hands, nervous tension, headaches, muscular cramps, dry mouth, constipation, difficulty in swallowing (dysphagia), heartburn, and palpitations.

When using an inhaler or nebulizer, patients can aggravate their glaucoma if the anticholinergic medicine gets in their eyes. If theophylline builds up in a patient’s body in excess, it can have negative side effects.

Theophylline side effects are more likely to affect older persons since their livers can be less able to eliminate it from their systems. A quick heartbeat (tachycardia), an irregular heartbeat (arrhythmia), headaches, and difficulty sleeping are a handful of theophylline's negative effects. These factors are expected to limit the growth of the bronchodilator market.

The table below shows the anticipated growth rates of the top countries. The United States, India, and China are expected to record lucrative CAGRs of 6.1%, 6.2%, and 5.3%, respectively, through 2035.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 6.1% |

| Canada | 5.0% |

| China | 5.3% |

| India | 6.2% |

| Germany | 5.1% |

The United States bronchodilator market value totaled USD 40.6 billion in 2025. It accounted for about 25.9% share of the global bronchodilator industry in 2025. Over the forecast period, sales of bronchodilators in the United States are predicted to rise at a 6.1% CAGR.

As per the latest report, the United States is expected to experience significant growth throughout the forecast period. This is attributable to the rising prevalence of COPD and other respiratory diseases, the high demand for breathing disorder medications, and the growing popularity of inhaled bronchodilators.

The increasing prevalence of COPD and asthma is playing a vital role in bolstering sales of bronchodilators in the United States. As per the Centers for Disease Control and Prevention (CDC), chronic lower respiratory disease remained the fourth most common cause of death in the United States in 2024.

More than 15 million people have COPD, and over 150,000 of them die from it each year, or one every four minutes. This is prompting patients suffering from COPD to opt for COPD treatment drugs, including bronchodilators.

Bronchodilators are mainly used as medication for COPD and asthma. They help relax the muscles in the airways and open them up, making breathing easier for patients with asthma and COPD. This is a prime driver boosting the growth of the bronchodilator market in the country.

Germany is set to exhibit a CAGR of 5.1% during the assessment period. It held a value share of about 4.0% in the global bronchodilator industry in 2025. The good healthcare infrastructure and increased awareness among people about hygiene are driving the growth of the bronchodilator market in Germany.

According to the World Health Organization (WHO), Germany is a top global leader in public health, as seen by its global health strategy and programs and the experience, knowledge, and funding it offers to WHO. Due to these reasons, the market for bronchodilators in Germany is increasing.

Growing preference for long-acting bronchodilators is another key factor expected to boost sales in the country. Similarly, rising cases of asthma will improve Germany’s bronchodilator industry share through 2035.

India held a 4.3% share of the worldwide bronchodilator industry in 2025. Over the assessment period, demand for bronchodilators in the country is anticipated to increase at a CAGR of 6.2%.

The increasing burden of non-communicable diseases and government initiatives toward the healthcare sector is expected to drive the growth of the bronchodilator market in India. The government is launching different initiatives and programs to reduce the burden of respiratory diseases.

For instance, in February 2020, the honorable Health and Family Welfare Minister launched the Kerala COPD Prevention and Control Program- ‘SWAAS.’ It is the country's first COPD prevention and control program that can help to tackle the burden of COPD. Such initiatives are creating a favorable environment for the expansion of the bronchodilator market.

Canada’s bronchodilator market size reached over USD 1.6 billion at the end of 2025. For the assessment period, bronchodilator sales in the country are projected to soar at a 5.0% CAGR, making it a lucrative market for companies.

Multiple factors are expected to stimulate growth in Canada’s bronchodilator industry. These include rising incidence of respiratory diseases, favorable government support, and growing adoption of combination therapies.

The cases of respiratory diseases like COPD and asthma are rising dramatically across Canada. This is expected to elevate the demand for bronchodilators as they are often used to treat these respiratory diseases.

China is emerging as a highly lucrative market for bronchodilators across East Asia. This is attributable to factors such as the rising cases of COPD and asthma, increasing awareness about bronchodilators, and the rising popularity of home healthcare.

China’s bronchodilator market size reached USD 2.94 billion in 2025. Demand for bronchodilators in China is predicted to surge at a steady CAGR of 5.3% throughout the forecast period.

Bronchodilators and other airway expansion medications are becoming highly popular among patients and healthcare professionals in China, leading to increased demand for these medications. This is due to the rising awareness about the benefits of these bronchodilators.

Several public health campaigns are being launched in China to educate people about respiratory diseases and their treatment approaches. This is expected to uplift demand for bronchodilators and other related medications, thereby fostering China’s bronchodilator market growth.

The section below shows the phosphodiesterase inhibitor segment dominating the bronchodilator market. It is poised to exhibit a CAGR of 6.2% during the forecast period. By application, the asthma segment is expected to thrive at a 6.6% CAGR.

Based on the route of administration, the oral segment is expected to lead the global bronchodilator industry. It will likely expand at a 6.4% CAGR between 2025 and 2035. By distribution channel, the retail pharmacies segment is anticipated to thrive at a CAGR of 6.0% through 2035.

Market Growth Outlook by Drug Class

| Drug Class | Value CAGR |

|---|---|

| Sympathomimetic | 6.7% |

| Anticholinergics | 5.3% |

| Phosphodiesterase Inhibitor | 6.2% |

| Combination Drugs | 4.9% |

| Others | 5.9% |

Based on drug class, the phosphodiesterase inhibitor segment dominated the global bronchodilator market with a revenue share of 25.6% in 2025. Over the forecast period, demand for phosphodiesterase inhibitors is projected to rise at a CAGR of around 6.2%.

Phosphodiesterase inhibitors have become highly sought-after drugs to treat a variety of respiratory disorders. For instance, they are effective in treating asthma and chronic obstructive pulmonary disease (COPD).

Phosphodiesterase inhibitors work by curbing the breakdown of cyclic guanosine monophosphate (cGMP) and cyclic adenosine monophosphate (cAMP). These molecules are essential for the relaxation of smooth muscles, thereby helping to open up airways and making it easier to breathe.

The growing adoption of phosphodiesterase inhibitors to treat several respiratory diseases is expected to boost the target segment. Key bronchodilator companies are expected to capitalize on this rising demand by releasing new phosphodiesterase inhibitors.

Sympathomimetic drugs, on the other hand, are expected to witness a higher demand in the global market. This is due to their ability to treat different respiratory diseases by mimicking the effects of the sympathetic nervous system. The target segment is set to thrive at a 6.7% CAGR through 2035.

Market Growth Outlook by Application

| Application | Value CAGR |

|---|---|

| Asthma | 6.6% |

| COPD | 5.9% |

| Others | 5.2 |

As per the latest bronchodilator market analysis, asthma is predicted to remain a key revenue-generation segment for manufacturers of bronchodilators. This is due to the rising prevalence of asthma and the growing need for asthma relief medications.

In 2025, the asthma segment accounted for a revenue share of 34.2%. Over the forecast period, the target segment is poised to exhibit a CAGR of 6.6%, owing to the rising prevalence of pediatric asthma cases.

In recent years, there has been a spike in asthma cases worldwide. As per the World Health Organization (WHO), around 30.9 million people were affected by asthma in 2020, while there were 455000 asthma-related deaths. This is expected to drive the demand for bronchodilators as they relieve asthma symptoms and allow people with asthma to lead a normal life.

Market Growth Outlook by Route of Administration

| Route of Administration | Value CAGR |

|---|---|

| Oral | 6.4% |

| Injection | 5.7% |

| Inhalation | 5.1% |

Orally used bronchodilators held a prominent market share value of 46.5% in 2025 and are expected to rise with a CAGR of 6.4% during the forecast period. This is attributable to the convenience and cost-effectiveness of the orally administered bronchodilators.

Oral bronchodilators remain the preferable route of drug administration owing to their better convenience and inexpensive nature. They tend to be more readily accepted by patients, which promotes greater adherence to prescribed treatment regimens, eventually leading to improved health outcomes.

Market Growth Outlook by Distribution Channel

| Distribution Channel | Value CAGR |

|---|---|

| Retail Pharmacies | 6.0% |

| Hospital Pharmacies | 5.3% |

| E-Commerce | 6.4% |

| Drug Stores | 6.1% |

The retail pharmacies segment accounted for a dominant market share value of 32.4% at the end of 2025. For the projection period, the target segment is anticipated to thrive at a CAGR of 6.0%. This is due to the easy availability of bronchodilators in retail pharmacies.

Retail pharmacies provide a diverse selection of bronchodilators with heavy discounts. As a result, they are becoming an ideal destination for people to purchase bronchodilators. Hence, the growing inclination of patients toward purchasing bronchodilators from retail pharmacies will boost the target segment.

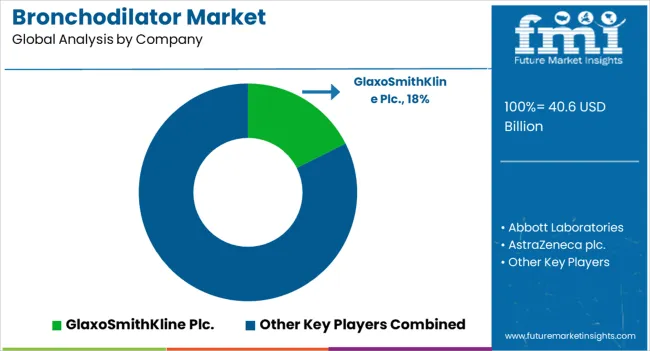

The bronchodilator industry is highly fragmented, with several companies competing for market share. Top manufacturers of bronchodilators are focusing on launching new products to match consumer demand and increase their client base. They are also using strategies such as mergers, acquisitions, partnerships and collaborations, and celebrity endorsements to stay ahead of the competition.

Recent Developments in the Bronchodilator Market

The global bronchodilator market is estimated to be valued at USD 40.6 billion in 2025.

The market size for the bronchodilator market is projected to reach USD 70.3 billion by 2035.

The bronchodilator market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in bronchodilator market are combination drugs, sympathomimetic, anticholinergics, phosphodiesterase inhibitor and others.

In terms of application, asthma segment to command 42.1% share in the bronchodilator market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA