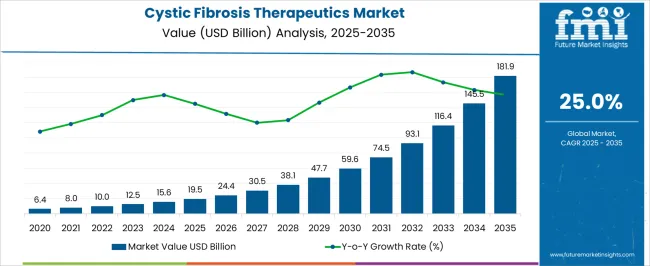

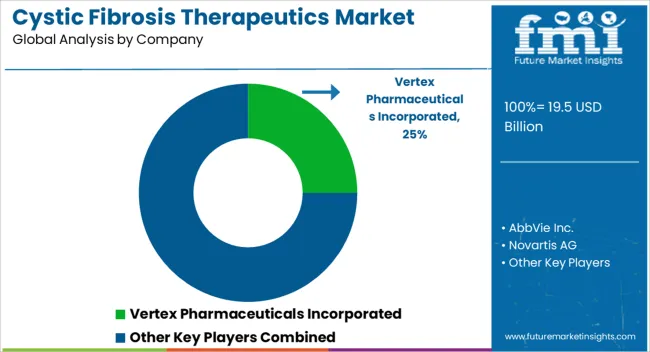

The Cystic Fibrosis Therapeutics Market is estimated to be valued at USD 19.5 billion in 2025 and is projected to reach USD 181.9 billion by 2035, registering a compound annual growth rate (CAGR) of 25.0% over the forecast period.

| Metric | Value |

|---|---|

| Cystic Fibrosis Therapeutics Market Estimated Value in (2025 E) | USD 19.5 billion |

| Cystic Fibrosis Therapeutics Market Forecast Value in (2035 F) | USD 181.9 billion |

| Forecast CAGR (2025 to 2035) | 25.0% |

The Cystic Fibrosis Therapeutics market is progressing steadily due to the continued advancements in targeted treatment approaches and improved patient access to precision medications. Innovations in gene-modifying therapies and increasing availability of CFTR modulators have significantly changed the therapeutic landscape. The future outlook remains optimistic as pharmaceutical companies continue to invest in research and pipeline development targeting the underlying causes of the disease.

Supportive regulatory frameworks and the inclusion of cystic fibrosis in various national rare disease programs are further contributing to accelerated drug approvals. Enhanced awareness, early diagnosis through newborn screening programs, and multidisciplinary care models have collectively improved patient outcomes and created a favorable environment for long-term market growth.

In addition, a shift toward personalized and combination therapies is gaining momentum, with several biopharma companies focusing on expanding treatment options for diverse mutation types As healthcare systems place greater emphasis on quality of life and disease-modifying interventions, the market is expected to see continued demand for more effective and accessible cystic fibrosis treatments.

The market is segmented by Drug Class, Route of Administration, and Distribution Channel and region. By Drug Class, the market is divided into Cystic Fibrosis Transmembrane Conductance Regulator (CFTR), Bronchodilators, Mucolytic, Pancreatic Enzyme Supplement, and Others. In terms of Route of Administration, the market is classified into Oral and Parenteral. Based on Distribution Channel, the market is segmented into Hospital Pharmacies, Retail Pharmacies & Drug Stores, and Online Pharmacies. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

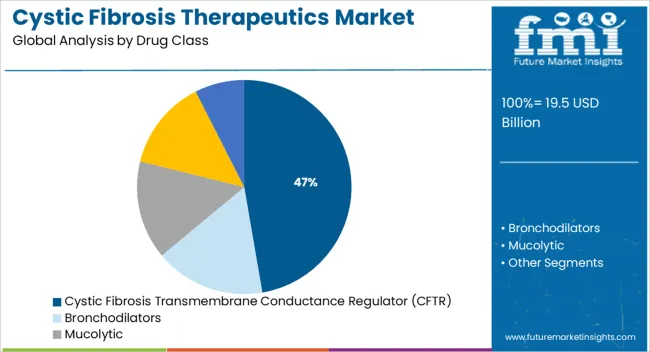

The cystic fibrosis transmembrane conductance regulator drug class is expected to hold 47.3% of the Cystic Fibrosis Therapeutics market revenue share in 2025, making it the dominant segment. This leadership has been driven by the drug class’s direct mechanism of action in addressing the underlying cause of the disease rather than just managing symptoms. As observed in corporate press announcements and scientific literature, CFTR modulators have demonstrated significant clinical efficacy in improving lung function and reducing pulmonary exacerbations.

These therapies have also been associated with improved patient-reported outcomes, thereby enhancing treatment adherence. The growing availability of combination CFTR therapies targeting a wider range of genetic mutations has expanded the eligible patient population.

Regulatory incentives and breakthrough designations have also facilitated rapid approval and market access in several regions The segment’s growth has been supported by strong physician preference, favorable long-term efficacy data, and ongoing efforts by pharmaceutical manufacturers to make these therapies accessible across age groups and global markets.

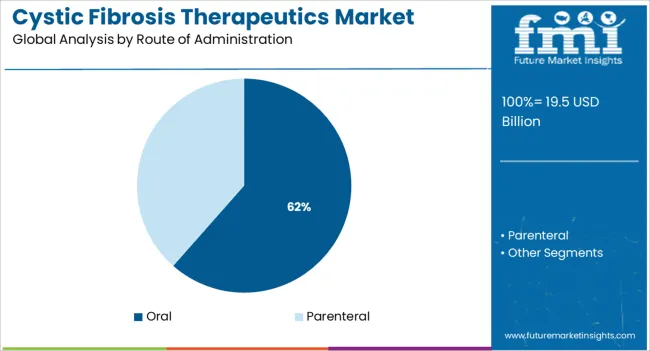

The oral route of administration segment is anticipated to account for 61.5% of the Cystic Fibrosis Therapeutics market revenue share in 2025, establishing it as the leading segment. Its growth has been influenced by the increasing adoption of orally administered CFTR modulators and enzyme replacement therapies that offer convenience, improved compliance, and reduced burden of care. Clinical reviews and healthcare provider surveys have consistently reported higher patient satisfaction and quality of life associated with oral regimens, particularly for chronic conditions requiring long-term management.

Pharmaceutical companies have focused on developing stable, high-bioavailability oral formulations, allowing patients to manage their treatment routines more independently. The reduction in need for frequent hospital visits and invasive administration methods has further encouraged uptake.

In addition, the scalability of manufacturing and global distribution of oral therapies has allowed better reach in both urban and remote healthcare settings These factors have reinforced the dominance of the oral segment as the preferred route of administration among both patients and healthcare providers.

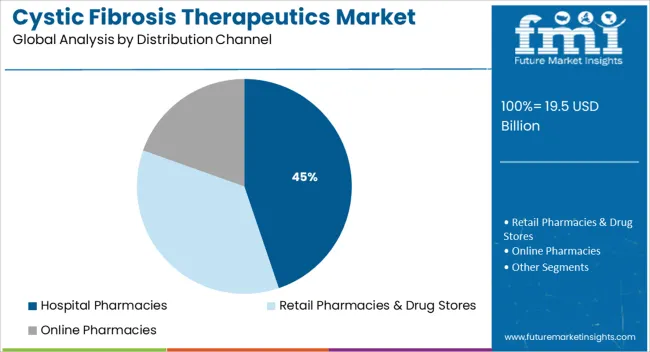

The hospital pharmacies distribution channel is projected to contribute 44.8% of the Cystic Fibrosis Therapeutics market revenue share in 2025, securing its position as the leading distribution segment. This leadership has been reinforced by the complex nature of cystic fibrosis treatments, which often require close clinical monitoring, patient education, and coordination of multidisciplinary care. Hospital pharmacies are uniquely positioned to provide these services, ensuring appropriate dispensing, dosage adjustments, and adherence monitoring under medical supervision.

Institutional access to specialized therapies, such as CFTR modulators and inhaled antibiotics, has been more streamlined through hospital settings. Hospitals also facilitate insurance processing, reimbursement, and integration with electronic health records, improving continuity of care.

Furthermore, acute management of exacerbations and immediate access to parenteral therapies are typically handled through hospital-linked channels These integrated services have made hospital pharmacies the preferred distribution point, particularly for patients with advanced disease stages or those receiving combination treatments.

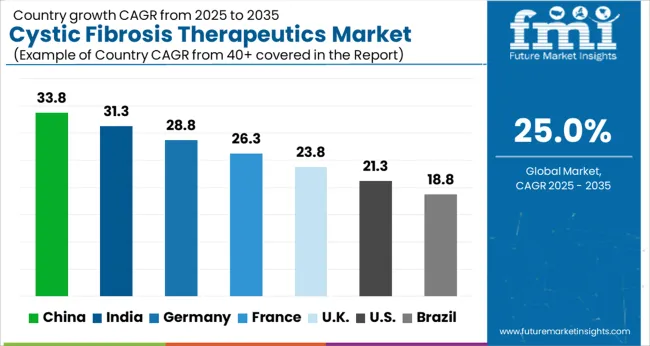

The global demand for Cystic Fibrosis Therapeutics is projected to increase at a CAGR of 25.0% during the forecast period between 2025 and 2035, reaching a total of USD 181.9 Billion in 2035, according to a report from Future Market Insights (FMI). From 2020 to 2025, sales witnessed significant growth, registering a CAGR of 12.4%.

According to Future Market Insights, a market research and competitive intelligence provider, the Cystic Fibrosis Therapeutics Market was valued at USD 19.5.0 Billion in 2025.

The increasing incidence of cystic fibrosis (CF), and the rising treatment rate, are the major factors that are expected to augment the market growth during the forecast period. Also, other factors such as the rise in the number of initiatives undertaken by nonprofit organizations, the rise in Research and Development funding by both private and public organizations, as well as supportive government legislation are also anticipated to accelerate the revenue share of the cystic fibrosis therapeutics market in the forthcoming years.

As per the data published by the Cystic Fibrosis Foundation, the incidence of these hereditary disorders is constantly growing. In 2020, there were more than 70,000 patients living with cystic fibrosis. Increasing year-on-year growth in the number of patients further results in surging demand for efficient and effective CF therapeutics.

Furthermore, a surge in the number of potential clinical pipeline candidates is another factor that is likely to fuel the market growth. In addition, an increase in the number of clinical trials to expand its target patient base with the existing drug portfolio is also among some of the drivers of this market.

The presence of various nonprofit organizations, such as Cystic Fibrosis Worldwide, Cystic Fibrosis Foundation, Cystic Fibrosis Canada, South African Cystic Fibrosis Trust, and South African Cystic Fibrosis Association, which are consistently involved in the activities related to CF is also one of the pivotal factors that can be accounted for surging demand. These organizations are investing huge amounts of funds to find various therapeutics for CF, and to support the research and developmental activities by prominent players.

Availability of Potential Pipeline Candidates to Fuel the Market Growth

The advent of drugs for the treatment of Cystic Fibrosis is on the new horizon, which is a major factor that is expected to escalate the growth of the market during the analysis period. The emergence of drugs that are targeting the defect in the cells of people suffering from diseases is enhancing market growth. This treatment is projected to be life-changing for many patients, which in turn is influencing the market growth.

Additionally, a surge in the prevalence of the disease is another major factor that is considered to fuel the demand of the market. This, in turn, is propelling the launch of newly formulated pipeline drugs required for the treatment of serious patients. Moreover, many potential candidates are in their final stages of development and are expected to boost the market growth over the forecast period.

Presence of Advanced Treatment Options to Accelerate the Market Growth

The Cystic Fibrosis Therapeutics Market has been triggered, owing to an increasing number of patients suffering from CF globally. Pharmacotherapy of CF has come up with various advancements in the treatment of this condition, which in turn is positively impacting the market growth. In addition, market trends present in the treatment of the disease are fueling the market growth, attributed to the increasing number of pipeline candidates from major companies aiming toward therapeutic care.

This in turn is influencing manufacturers to introduce advanced medication targeting CFTR protein abnormalities. Moreover, the launch of Ivacaftor / Lumacaftor, a potentiator that improves the lives of people suffering from the disease, is also stimulating market growth.

Further, the technological improvement by major companies, along with rising Research and Development activities is also aiding this market growth by introducing new products. For instance, the National Research Council launched cystic fibrosis diagnostic smart patch for early diagnosis of the condition. This patch is digitally powered by wireless technology.

Side Effects Associated with CF Drugs to Restrain the Market Growth

Although the growth of the market is observed to be projecting over the years, due to a surge in awareness of the treatment options, an increase in the prevalence of the disease worldwide, an increase in the launch of new drugs, and other developments there are some of the factors that are expected to hinder the market growth.

The products have adverse effects such as upper respiratory tract infection, liver problems, chest pain, increase in blood pressure, and others that might impede the market growth. Moreover, the high cost of the treatment among Cystic Fibrosis patients suffering from a lung transplant, liver transplant, and others is also restraining the market growth.

In addition, prolonged FDA approvals, product recalls, stringent regulations, and others are some of the other factors that are anticipated to limit the Cystic Fibrosis Therapeutics Market.

Existence of Inadequate Income Opportunities Limits the Market Growth

The existence of inadequate income opportunities, as well as high expenditures connected with the treatment, are the major factors that are anticipated to impede the growth of the Cystic Fibrosis Therapeutics Market during the analysis period. Besides, the outline of the generic drugs and patient expiration is expected to further challenge the market growth in the near future.

Moreover, due to the limited information available, extensive research is essential as CF is a rare disease. The research and development cost for CF is very high, leading to the enormous prices of the end products. The high cost of drugs and treatment is another major factor that will limit the growth of the Cystic Fibrosis Therapeutics Market.

The surge in Patients Suffering from CF in the Region to Fuel the Market Growth

The Cystic Fibrosis Therapeutics Market in North America is expected to accumulate the highest market share of 48% in 2025.

Factors such as an increase in CF cases, a surge in patients suffering from various respiratory disorders influencing CF, a rise in Research and Development activities, and a rise in healthcare expenditure are expected to fuel the growth of the cystic fibrosis market during the forecast period. Also, the increasing healthcare expenses, coupled with advanced medical amenities which in turn will further propel the regional market growth in the forthcoming years.

As per the cystic fibrosis foundation (CFF), there are close to 40,000 children and adults living with cystic fibrosis in the United States (and an estimated 105,000 people have been diagnosed with CF across 94 countries), and CF can affect people in every racial and ethnic group. In addition, as per the CFF's national patient registry, the median age of a person with CF is currently 33.4 years. The average life expectancy of CF patients has increased significantly compared to the patients 30 years back. Thus, the increasing prevalence of CF has boosted North America's share in the global Cystic Fibrosis Therapeutics Market.

Additionally, Hopkins University and Medicine researchers developed a novel treatment for a pathogen in December 2024. Mycobacterium abscesses are a pathogen that is drug-resistant and harmful to persons with lung diseases or cystic fibrosis. Hence, all these factors are likely to fuel the regional market growth during the forecast period. The region is expected to hold the highest CAGR of 24.8% during the forecast period.

Growing Geriatric Patients in the Region to Fuel the Market Growth

The Cystic Fibrosis Therapeutics Market in Asia Pacific is expected to accumulate the highest market share of 47% in 2025.

The Asia Pacific hypophosphatasia market is anticipated to register significant growth during the analysis period, attributed to factors such as an increase in geriatric patients, and high awareness associated with treatment.

Moreover, enlightening of the healthcare amenities will permit the development, which in turn are expected to boost the growth of the Cystic Fibrosis Therapeutics Market in the region in the forecast period. The region is expected to hold the highest CAGR of 24.7% during the forecast period.

Cystic Fibrosis Transmembrane Conductance (CFTR) Segment to beat Competition in Untiring Market

On the basis of drug class, the global Cystic Fibrosis Therapeutics Market is dominated by the Cystic Fibrosis Transmembrane Conductance (CFTR) Segment, which accounts for a share of 48%. The segment is expected to hold a CAGR of 24.8% over the analysis period.

CFTR is considered to be a dominating market, attributed to its functions such as it improves the body’s function at the cellular level, which is considered to be slow, improving the function of CFTR protein, and others. Moreover, advanced therapies of triple combination drugs are also fueling the segment’s growth during the forecast period.

Additionally, factors such as increased usage of CFTR drugs in the treatment of muscle relaxation, airway clearance, and others are other factors that are likely to boost the growth of the CFTR segment. Mucolytics are considered to be important inhaled medications known as mucous thinners, which in turn are augmenting the segment’s growth over the analysis period.

Oral Segment to Drive the Cystic Fibrosis Therapeutics Market

Based on the Route of Administration, the oral segment is expected to witness a significant growth of 47% in 2025, and the trend is expected to continue during the forecast period, expanding at a rapid rate of 24.7% CAGR over the analysis period.

This growth is attributed to factors such as the rise in the adoption of oral drugs globally, and the advent of new formulation drugs that can be consumed easily without the risk of invasive procedures to obtain effective treatment.

Moreover, the parenteral drug segment is anticipated to register significant growth, over the analysis period, attributed to an increased usage of parenteral drugs which include inhaled and injections. Thus, inhaled drugs are widely used by medical practitioners for patients suffering from high-risk respiratory disorders coupled with CF.

Cystic Fibrosis Therapeutics Market startup players are adopting various marketing strategies such as new product launches, geographical expansion, mergers and acquisitions, partnerships, and collaboration to identify the interest of potential patients and create a larger customer base. For instance,

Prominent players in the Cystic Fibrosis Therapeutics Market are Novartis AG, Vertex Pharmaceuticals Incorporated, AbbVie Inc., Gilead Sciences, Inc., Mylan N.V., Pfizer Inc., Bayer AG, Genentech, Inc., and AstraZeneca, among others.

Recent Developments:

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 25.0% from 2025 to 2035 |

| Market Value in 2025 | USD 19.5 billion |

| Market Value in 2035 | USD 181.9 billion |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Billion and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Drug Class, Route of Administration, Distribution Channel, Region |

| Regions Covered | North America; Europe; Asia Pacific; Latin America; Middle East & Africa (MEA) |

| Key Countries Profiled | The USA, Canada, Brazil, Mexico, Germany, The UK, France, Spain, Italy, China, Japan, South Korea, Malaysia, Singapore, Australia, New Zealand, GCC, South Africa, Israel |

| Key Companies Profiled | Novartis AG; Vertex Pharmaceuticals Incorporated; AbbVie Inc.; Gilead Sciences, Inc.; Mylan N.V.; Pfizer Inc.; Bayer AG; Genentech, Inc.; AstraZeneca |

The global cystic fibrosis therapeutics market is estimated to be valued at USD 19.5 billion in 2025.

The market size for the cystic fibrosis therapeutics market is projected to reach USD 181.9 billion by 2035.

The cystic fibrosis therapeutics market is expected to grow at a 25.0% CAGR between 2025 and 2035.

The key product types in cystic fibrosis therapeutics market are cystic fibrosis transmembrane conductance regulator (cftr), bronchodilators, mucolytic, pancreatic enzyme supplement and others.

In terms of route of administration, oral segment to command 61.5% share in the cystic fibrosis therapeutics market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Autosomal Dominant Polycystic Kidney Disease Treatment Market Overview - Growth & Forecast 2025 to 2035

Myelofibrosis (MF) Treatment Market Size and Share Forecast Outlook 2025 to 2035

Liver Fibrosis Treatment Market - Innovations & Future Trends 2025 to 2035

Pulmonary Fibrosis Biomarker Market Forecast Outlook 2025 to 2035

Secondary Myelofibrosis Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Radiation-Induced Fibrosis Treatment Market - Growth & Forecast 2025 to 2035

Idiopathic Pulmonary Fibrosis Management Market - Growth & Drug Advances 2025 to 2035

Progressive Pulmonary Fibrosis (PPF) Treatment Market - Growth & Innovations 2025 to 2035

Biotherapeutics Virus Removal Filters Market Trends – Growth & Forecast 2025 to 2035

COPD Therapeutics Market Report – Growth, Demand & Industry Forecast 2023-2033

Digital Therapeutics and Wellness Market Size and Share Forecast Outlook 2025 to 2035

Digital Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Peptide Therapeutics Market Analysis - Growth & Forecast 2024 to 2034

Advanced Therapeutics Pharmaceutical Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Glaucoma Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Leukemia Therapeutics Treatment Market Analysis - Growth & Forecast 2025 to 2035

Microbiome Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

The Canine Flu Therapeutics Market is segmented by product, and end user from 2025 to 2035

Stuttering Therapeutics Market Trends, Analysis & Forecast by Treatment, Type, End-Use and Region through 2035

Pet Cancer Therapeutics Market Insights - Growth & Forecast 2024 to 2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA