The pulmonary fibrosis biomarker market is witnessing strong development, driven by the rising prevalence of idiopathic pulmonary fibrosis (IPF) and increasing investment in diagnostic innovation. Early detection and disease monitoring are becoming clinical priorities due to the progressive nature of pulmonary fibrosis and limited treatment options.

The market is characterized by a shift toward non-invasive biomarker modalities, including imaging, proteomic, and genomic assays, aimed at improving diagnostic precision. Advancements in artificial intelligence-assisted imaging and multiplex testing technologies have enhanced clinical decision-making.

Pharmaceutical companies are integrating biomarkers into drug development pipelines to accelerate personalized therapy approval. With increasing collaboration between diagnostics manufacturers and research institutes, the market outlook remains positive, supported by rising healthcare expenditure and clinical awareness in developed economies.

| Metric | Value |

|---|---|

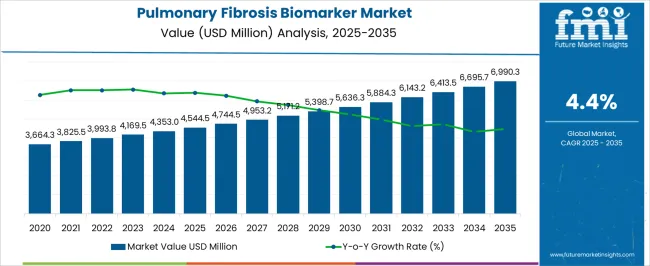

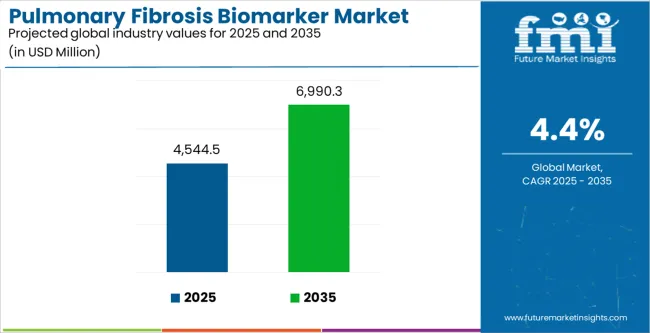

| Pulmonary Fibrosis Biomarker Market Estimated Value in (2025 E) | USD 4544.5 million |

| Pulmonary Fibrosis Biomarker Market Forecast Value in (2035 F) | USD 6990.3 million |

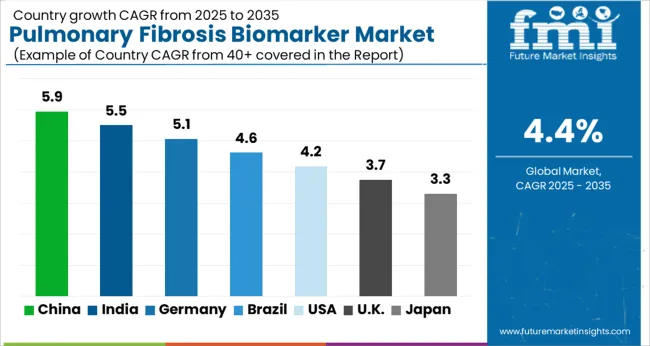

| Forecast CAGR (2025 to 2035) | 4.4% |

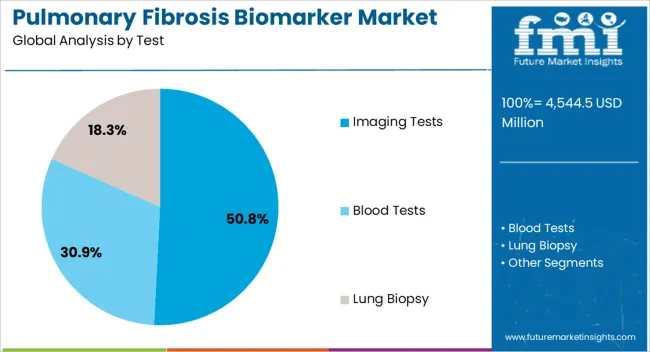

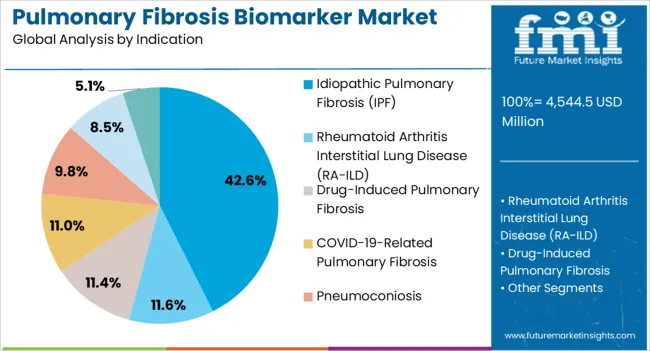

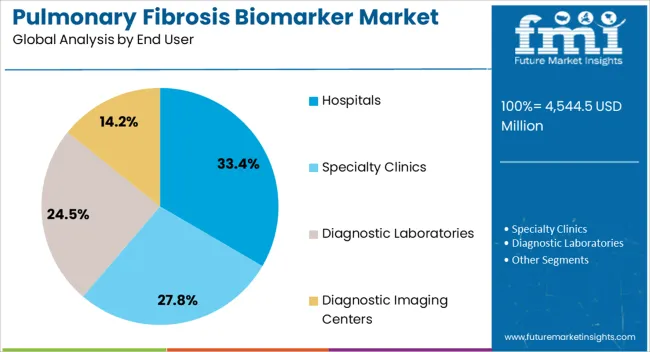

The market is segmented by Test, Indication, and End User and region. By Test, the market is divided into Imaging Tests, Blood Tests, and Lung Biopsy. In terms of Indication, the market is classified into Idiopathic Pulmonary Fibrosis (IPF), Rheumatoid Arthritis Interstitial Lung Disease (RA-ILD), Drug-Induced Pulmonary Fibrosis, COVID-19-Related Pulmonary Fibrosis, Pneumoconiosis, Sarcoidosis, and Others. Based on End User, the market is segmented into Hospitals, Specialty Clinics, Diagnostic Laboratories, and Diagnostic Imaging Centers. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The imaging tests segment holds approximately 50.80% share of the test category, owing to their established role in non-invasive diagnosis and disease monitoring. High-resolution computed tomography (HRCT) remains the gold standard for identifying fibrotic patterns, enabling early and accurate differentiation from other interstitial lung diseases.

The segment’s growth is further driven by technological advances that enhance image clarity and reduce radiation exposure. Integration of AI-based image analytics has improved diagnostic accuracy and consistency across centers.

Imaging tests also support longitudinal assessment of disease progression and therapy response, reinforcing their clinical importance. With continuous improvements in imaging platforms and accessibility in specialized centers, this segment is expected to maintain its leadership in the market.

The idiopathic pulmonary fibrosis (IPF) segment accounts for approximately 42.60% share of the indication category, driven by the increasing global incidence and enhanced clinical recognition of the disease. As IPF remains a chronic and fatal lung condition with limited therapeutic options, biomarker-based diagnostics are crucial for early intervention and monitoring.

Rising adoption of precision medicine approaches and growing awareness among pulmonologists have accelerated the integration of biomarker testing in patient management. Pharmaceutical interest in developing IPF-specific therapeutics has further stimulated diagnostic innovation.

With continued research and early diagnostic emphasis, the IPF segment is expected to remain central to market demand.

The hospitals segment represents approximately 33.40% share in the end-user category, supported by the concentration of advanced diagnostic infrastructure and multidisciplinary expertise. Hospitals serve as primary centers for biomarker testing, integrating imaging, molecular, and pathology assessments for comprehensive disease evaluation.

Growing hospital participation in clinical trials and real-world studies has accelerated biomarker validation and adoption. Additionally, increased patient inflow, coupled with the availability of specialized pulmonology departments, reinforces the segment’s leadership.

With expanding healthcare infrastructure and greater access to advanced diagnostics, hospitals are anticipated to retain a leading role in the pulmonary fibrosis biomarker market.

| Attributes | Details |

|---|---|

| Pulmonary Fibrosis Biomarker Market Value (2020) | USD 3,330.6 million |

| Estimated Market Value for 2025 | USD 4,149.0 million |

| CAGR from 2020 to 2025 | 4.5% |

| Top Type | Segment Share (2025) |

|---|---|

| Imaging Tests | 50.8% |

| Top Indication | Segment Share (2025) |

|---|---|

| Idiopathic pulmonary fibrosis (IPF) | 42.6% |

| Top End User | Segment Share (2025) |

|---|---|

| Hospitals | 33.4% |

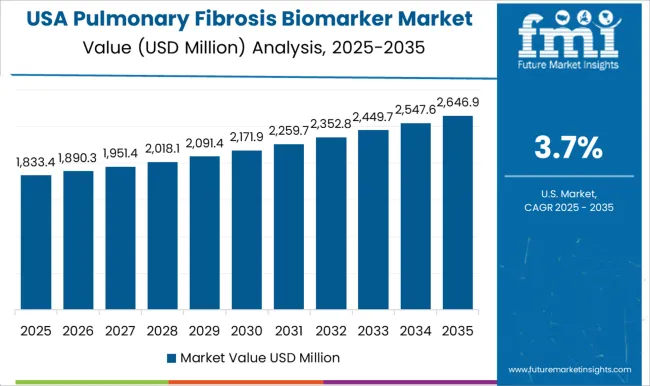

This section examines the pulmonary fibrosis biomarker markets in several significant economies, such as the United States, Spain, the United Kingdom, India, and China. It also explores different factors that influence pulmonary fibrosis biomarker demand, adoption, and sales across these countries.

Key pulmonary fibrosis biomarker manufacturers significantly shape the sector's competitive landscape. Known for its dedication to innovation, Biogen welcomes Veracyte, which is one of the significant pulmonary fibrosis biomarker providers, emphasizing cutting-edge diagnostic solutions.

Galapagos NV offers its advantages to the market, while Genentech, a Roche company, adds its pharmaceutical knowledge. Biocartis and Myriad Genetics are essential in pulmonary fibrosis biomarkers since they offer specific solutions.

These key pulmonary fibrosis biomarker vendors work together to enhance research and development, which supports the market's general expansion and development for pulmonary fibrosis biomarkers. Their combined efforts highlight the pulmonary fibrosis biomarker industry's dynamic nature as it continues to tackle the difficulties related to pulmonary fibrosis.

Latest Advancements

The global pulmonary fibrosis biomarker market is estimated to be valued at USD 4,544.5 million in 2025.

The market size for the pulmonary fibrosis biomarker market is projected to reach USD 6,990.3 million by 2035.

The pulmonary fibrosis biomarker market is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types in pulmonary fibrosis biomarker market are imaging tests, blood tests, _c-reactive protein testing kits, _antibody testing kits, _esr tests and cbc and lung biopsy.

In terms of indication, idiopathic pulmonary fibrosis (ipf) segment to command 42.6% share in the pulmonary fibrosis biomarker market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Idiopathic Pulmonary Fibrosis Management Market - Growth & Drug Advances 2025 to 2035

Progressive Pulmonary Fibrosis (PPF) Treatment Market - Growth & Innovations 2025 to 2035

Biomarker-based Immunoassays Market Size and Share Forecast Outlook 2025 to 2035

Pulmonary Heart Valve Replacement Market Size and Share Forecast Outlook 2025 to 2035

The Pulmonary Arterial Hypertension Treatment Market is segmented by Drug Class and Distribution Channel from 2025 to 2035

Global Biomarker Discovery Outsourcing Service Market Analysis – Size, Share & Forecast 2024-2034

Global Pulmonary Function Testing Device Market Analysis – Size, Share & Forecast 2024-2034

Pulmonary Dilation Balloon Market

EPO Biomarkers Market Size and Share Forecast Outlook 2025 to 2035

ST2 Biomarker Market

Myelofibrosis (MF) Treatment Market Size and Share Forecast Outlook 2025 to 2035

Dual Biomarker Assays Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Cardiopulmonary Functional Testing Platform Market Size and Share Forecast Outlook 2025 to 2035

PD-L1 Biomarker Testing Market Report – Demand, Trends & Forecast 2025–2035

Brain Biomarker Market Trends and Forecast 2025 to 2035

Cardiopulmonary Bypass System Market – Trends & Forecast 2025 to 2035

Liver Fibrosis Treatment Market - Innovations & Future Trends 2025 to 2035

Market Share Breakdown of PD-L1 Biomarker Testing Manufacturers

Renal Biomarker Market Report – Trends & Forecast 2024-2034

Cystic Fibrosis Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA