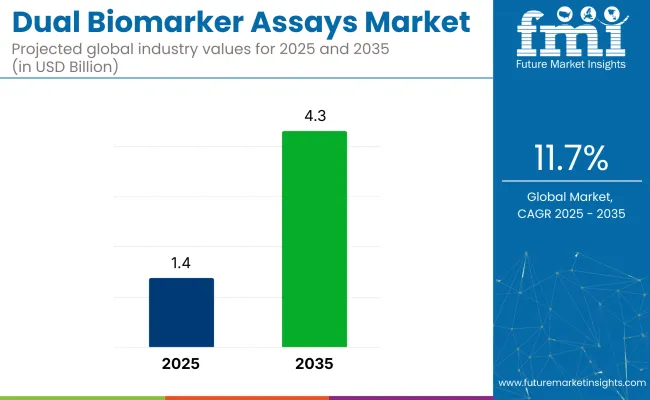

The global dual biomarker assays market is expected to expand from USD 1.4 billion in 2025 to approximately USD 4.3 billion by 2035, growing at a compound annual growth rate (CAGR) of 11.7% over the forecast period. Multi-biomarker testing platforms are gaining momentum as clinicians prioritize early disease detection, therapeutic monitoring, and treatment stratification.

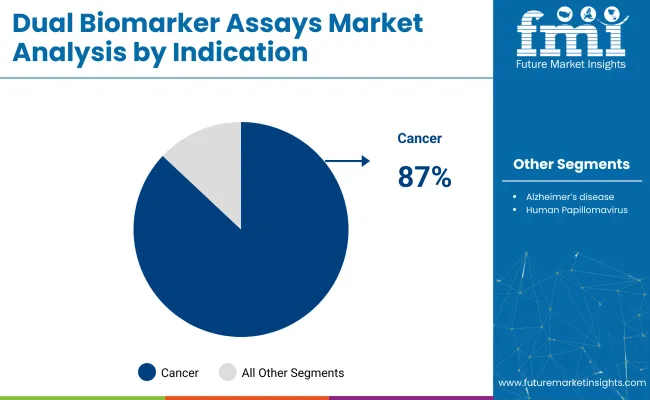

In particular, cancer diagnosis is the leading indication for dual biomarker assays, projected to account for 87% of total industry share in 2025, as oncologists increasingly adopt multiplexed diagnostics to improve accuracy and reduce false negatives. Simultaneously, Immunochemistry assays-which utilize antigen-antibody interactions-are expected to dominate assay type preferences, holding 60% share in 2025 due to their high sensitivity, scalability, and integration into automated lab workflows.

In February 2023, the Forbes Technology Council published an article titled “Detecting Cancer Early: How Biomarker Research Is Paving The Way Forward,” confirming that multi-biomarker integration strengthens early detection and improves clinical trial success in oncology. The article emphasized that early identification of diseases such as cancer through advanced biomarker platforms not only improves prognosis but also reduces long-term healthcare costs, reinforcing the industry’s strategic relevance.

The industry represents a small but significant share within its parent markets. Within the biomarkers market, it accounts for approximately 5-7%, driven by its application in diagnosing complex diseases with higher specificity. In the diagnostics market, dual biomarker assays contribute around 2-3%, mainly used in early disease detection and monitoring.

Within the immunoassay market, its share is about 6-8%, owing to its role in enhancing assay accuracy with multiple biomarker detection. In the proteomics market, the dual biomarker segment makes up approximately 4-6%, playing a key role in large-scale protein studies. As part of the personalized medicine market, it holds a smaller share of around 2-3%, supporting targeted treatments based on specific biomarker combinations.

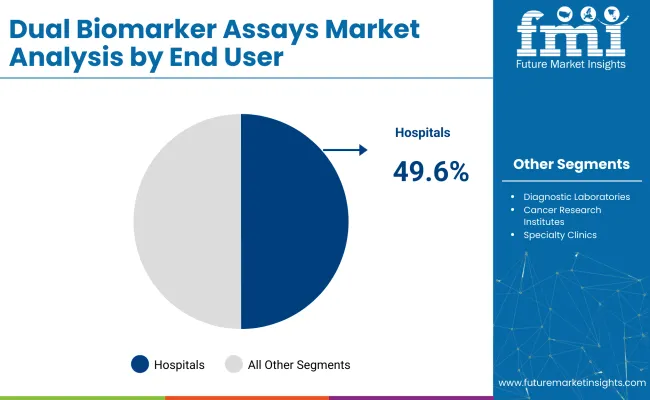

Cancer indication, hospitals as end users, and immunochemistry assays are expected to dominate the industry in 2025, driven by rising oncology diagnostics, hospital-based testing, and assay accuracy.

Cancer is expected to dominate the indication segment with an 87% industry share in2025, driven by the rising demand for early detection, precision medicine, and targeted therapy decision-making across major oncology types.

Hospitals are projected to lead the end user segment with a 49.6% share in 2025, supported by their role as central hubs for high-complexity diagnostics, oncology patient management, and integrated lab infrastructure.

Immunochemistry assays are forecasted to dominate the assay type segment with a 60% industry share in 2025.

Dual biomarker assays enable improved diagnostic precision in oncology and cardiovascular care. Cancer and metabolic diagnostics are benefiting from combined-marker panels, enhancing early detection and personalized treatment decision-making.

Synergistic Detection Elevates Cancer Diagnostic Precision

Dual biomarker assays improve cancer diagnostic accuracy by combining genetic and cellular markers. For example, integrating circulating tumor DNA (ctDNA) and protein markers such as HER2 in liquid biopsies allows for better monitoring of tumor evolution. This dual approach offers enhanced sensitivity, especially for early-stage cancers and monitoring response to therapy.

Cardiovascular and Metabolic Risk Stratification through Multi-Marker Panels

Dual biomarker assays help refine cardiovascular and metabolic disease risk assessments. For example, combining BNP and high-sensitivity C-reactive protein (hs-CRP) provides a clearer picture of cardiovascular risk. Similarly, combining insulin resistance markers with lipid profiles aids in predicting long-term risks for type 2 diabetes and cardiovascular diseases.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 10.7% |

| Germany | 11.4% |

| Japan | 12.1% |

| China | 13.9% |

| India | 14.2% |

The global industry is forecasted to grow at a CAGR of 11.7% from 2025 to 2035. The United States, with a CAGR of 10.7%, exhibits steady growth, supported by its advanced healthcare infrastructure and established demand for diagnostic technologies.

Germany follows closely with 11.4% growth, benefiting from a strong healthcare system and a commitment to innovation in medical diagnostics. In contrast, the BRICS countries, particularly India and China, are experiencing much faster growth.

China, at 13.9%, is advancing rapidly due to significant investments in healthcare and biopharmaceutical research. India leads with the highest CAGR of 14.2%, driven by a rapidly expanding healthcare sector and increasing adoption of advanced diagnostic tools. Japan also shows significant growth at 12.1%, fueled by advancements in biotechnology. While OECD countries show stable growth, India and China are emerging as the key drivers of future industry expansion.

The report covers in-depth analysis of 40+ countries; five top-performing OECD and BRICS countries are highlighted below.

The USA industry is forecast to expand at a robust CAGR of 10.7% from 2025 to 2035.

The industry is driven by the growing demand for personalized medicine and substantial investments in biomedical research. The rise in chronic diseases and the accelerated adoption of multiplex assays in diagnostic labs further boost the industry.

FDA approvals for innovative assays and advancements in technology contribute to greater precision and faster results. Industry leaders like Thermo Fisher and Bio-Rad are spearheading R&D efforts, refining diagnostic capabilities for applications ranging from disease detection to therapy monitoring, improving clinical decision-making.

The industry in Germany is expanding at a CAGR of 11.4% from 2025 to 2035.

The industry is benefiting from strong academic collaborations and a healthcare system that prioritizes molecular diagnostics. The country is a leader in precision medicine, with significant contributions from companies like Qiagen and Roche. The regulated healthcare environment and national insurance programs ensure widespread adoption of biomarker tests across the population.

Additionally, innovations focused on improving testing speed, reducing false positives, and promoting non-invasive methods align with the demand for preventive care. Real-time diagnostic results and evidence-based practices play a key role in Germany's healthcare evolution.

The industry in China is projected to grow at a CAGR of 13.9% between 2025 and 2035.

The industry is fueled by biotech investments, government initiatives like Healthy China 2030, and increasing chronic disease rates. Public-private collaborations are driving the rapid development of AI-enhanced diagnostic tools that enable faster, more accurate testing.

Companies like BGI Genomics and Mindray are investing heavily in localized R&D to reduce reliance on imported diagnostics. The expansion of diagnostic facilities and improved cold chain logistics ensure accessibility in tier-2 and tier-3 cities, addressing the growing demand for advanced healthcare across the country.

The industry in Japan is experiencing strong growth with a CAGR of 12.1% from 2025 to 2035.

The industry is supported by the country’s aging population and high healthcare standards. Companies like Sysmex and Fujirebio are leading innovations in integrating proteomics and genomics for clinical use. The Japanese healthcare system’s regulatory framework facilitates swift adoption of advanced biomarker technologies, especially for early cancer detection.

Screening programs targeting liver, colorectal, and lung cancers are showing improved survival rates. Furthermore, the focus on preventive health care ensures that dual biomarker assays remain a cornerstone of public health initiatives across the country.

India’s industry is expected to grow at the highest CAGR of 14.2% from 2025 to 2035.

The industry is driven by the increasing burden of chronic diseases and the expansion of diagnostic infrastructure. Government-led initiatives like Ayushman Bharat and guidance from the Indian Council of Medical Research (ICMR) are making biomarker testing more affordable and accessible, especially in rural areas.

Companies like SRL and Metropolis are integrating protein and gene marker assays into automated diagnostic platforms. These advancements are improving diagnostic precision and treatment outcomes, paving the way for large-scale adoption in both public and private sectors.

Leading Company - F. Hoffmann-La Roche Ltd Industry Share - 12%

The industry is led by dominant players such as F. Hoffmann-La Roche Ltd, Illumina, and Thermo Fisher Scientific, which command strong industry presence through advanced diagnostic platforms and FDA-approved companion diagnostics across oncology segments. Key players like Fujirebio focus on tumor-specific dual-marker panels, particularly for breast, NSCLC, and gastrointestinal cancers.

These firms emphasize clinical validation, multiplex assay development, and high-throughput technologies. Emerging players are contributing to glioma diagnostics through academic-industry collaborations and region-specific innovation. The industry remains innovation-driven, with ongoing expansion into personalized medicine and early detection enabled by multi-marker assay adoption.

Dual Biomarker Assays Market Recent News

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 1.4 billion |

| Projected Industry Size (2035) | USD 4.3 billion |

| CAGR (2025 to 2035) | 11.7% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and thousand assay kits for volume |

| Assay Types Analyzed (Segment 1) | In-situ Hybridization (ISH) Assay, Immunochemistry Assay, Next-Generation Sequencing (NGS) Kits, Others |

| Indications Analyzed (Segment 2) | Human Papillomavirus (HPV), Alzheimer’s Disease, Cancer, B-Cell Lymphoma, Breast Cancer, Non - Small Cell Lung Cancer (NSCLC), Gastrointestinal Cancer, Glioma |

| End Users Analyzed (Segment 3) | Hospitals, Diagnostic Laboratories, Cancer Research Institutes, Specialty Clinics |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Saudi Arabia, UAE, South Africa |

| Key Players influencing the Industry | F. Hoffmann-La Roche Ltd, Illumina, Inc., Fujirebio, Thermo Fisher Scientific |

| Additional Attributes | Dollar sales by assay type and indication, role of NGS in dual biomarker diagnostics, rising demand in oncology-driven precision medicine, adoption trends in early cancer detection and neurodegenerative disease management |

By assay type, the industry is segmented into In-situ Hybridization (ISH) Assay, Immunochemistry Assay, Next-Generation Sequencing (NGS) Kits, and Others.

By indication, the industry includes Human Papillomavirus (HPV), Alzheimer’s Disease, Cancer, B-Cell Lymphoma, Breast Cancer, Non-Small Cell Lung Cancer (NSCLC), Gastrointestinal Cancer, and Glioma.

By end user, the industry is categorized into Hospitals, Diagnostic Laboratories, Cancer Research Institutes, and Specialty Clinics.

The industry is projected to be worth USD 1.4 billion in 2025.

It is forecast to reach USD 4.3 billion by 2035.

The industry is expected to grow at a CAGR of 11.7% during this period.

Cancer is the dominant indication, accounting for approximately 87% of the industry share.

Immunochemistry assays hold the largest share at around 60.0% in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dual P-channel MOSFET Market Size and Share Forecast Outlook 2025 to 2035

Dual Wavelength Raman Probe Market Size and Share Forecast Outlook 2025 to 2035

Dual Wavelength Raman Spectrometer Market Size and Share Forecast Outlook 2025 to 2035

Dual Air Chamber Hydro-pneumatic Suspension Market Size and Share Forecast Outlook 2025 to 2035

DualMode Automated Tow Tractor Market Size and Share Forecast Outlook 2025 to 2035

Dual Clutch Transmission Market Size and Share Forecast Outlook 2025 to 2035

Dual Frequency Ultrasonic Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Dual-Cure Luting Cements Market Size and Share Forecast Outlook 2025 to 2035

Dual Screen Laptops Market Size and Share Forecast Outlook 2025 to 2035

Dual Ovenable Trays and Containers Market Size and Share Forecast Outlook 2025 to 2035

Dual Relay Board Market Size and Share Forecast Outlook 2025 to 2035

Dual Chamber Dispensing Bottles Market Size and Share Forecast Outlook 2025 to 2035

Dual Voltage Comparator Market Size and Share Forecast Outlook 2025 to 2035

Dual and Multi-Energy Computed Tomography (CT) Market Size and Share Forecast Outlook 2025 to 2035

Dual-Phase Cleanser Market Size and Share Forecast Outlook 2025 to 2035

The Dual Balloon Angioplasty Catheter Market is segmented by Peripheral, and Coronal from 2025 to 2035

Dual Flap Dispensing Closure Market Size & Trends 2025 to 2035

Dual Ovenable Lidding Films Market by Material, Seal Type, Application & Region - Forecast 2025 to 2035

Dual-Chamber Pumps Market Analysis - Size, Share, and Forecast Outlook (2025 to 2035)

Dual Axis Solar Tracker Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA