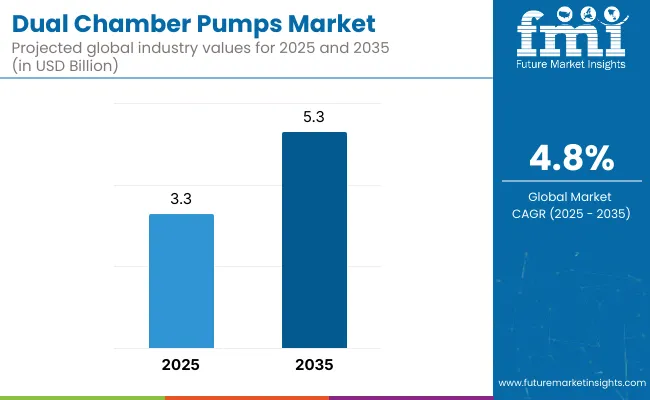

The dual-chamber pumps market is expected to reach a valuation of USD 3.3 billion in 2025 and grow to USD 5.3 billion by 2035, resulting in a net gain of USD 2.0 billion over the decade. This signifies a 60.6% total growth, with the compound annual growth rate (CAGR) standing at 4.8%. Over the ten-year span, the market records a 1.6 increase in size.

During the first five-year phase from 2025 to 2030, the market expands from USD 3.3 billion to USD 4.1 billion, generating USD 0.8 billion, which represents 40.0% of the total decade's growth. This period is shaped by steady demand in the pharmaceutical delivery systems, dialysis, and parenteral nutrition segments, where precision dosing and compartmental fluid management are critical. Polymer-based disposables dominate due to their sterility and single-use compliance.

In the second half from 2030 to 2035, the market grows from USD 4.1 billion to USD 5.3 billion, accounting for USD 1.2 billion, or 60.0% of the total decade’s growth. Increasing prevalence of chronic diseases, biologic drug formulations, and home-based infusion care drive the adoption of programmable and wearable dual-chamber pump systems. Integrated sensor modules, smart interfaces, and remote monitoring technologies become pivotal in shifting market value toward software-enabled pump platforms.

From 2020 to 2024, the dual-chamber pumps market grew from USD 2.6 billion to USD 3.1 billion, driven by hardware-centric adoption in personal care, cosmetic serums, and pharmaceutical formulations that require separation and dual-dispensing precision. During this period, the competitive landscape was dominated by pump and closure manufacturers controlling nearly 70% of revenue, with leaders such as APC Packaging, AptarGroup, Inc., and APackaging Group (APG) focusing on barrier-preserving and dual-delivery pump mechanisms.

Competitive differentiation relied on precise volume dispensing, airless functionality, and compatibility with multi-phase formulations, while digital-enabled features such as dose counters or RFID caps were often bundled as auxiliary offerings rather than primary revenue streams. Service-based models contributed less than 10% of the total market value, as brands and contract manufacturers continued to favor standardized, bulk-purchased hardware formats.

Demand for dual-chamber pumps will expand to USD 5.3 billion in 2035, and the revenue mix will shift as smart dispensing technologies, sustainable refill systems, and white-label customization services grow to over 40% share. Traditional component suppliers face growing competition from system-level solution providers offering recyclable dual-barrel units, dose personalization, and IoT-enabled traceability.

Major vendors are pivoting to hybrid models by integrating modular head designs, refill-compatible locking systems, and minimalist, premium aesthetics to address evolving regulatory and consumer expectations. Emerging players such as PKG Group LLC, Quadpack Industries, Unica Packaging, and Matsa Group Ltd are gaining share by specializing in recyclable packaging platforms, short-run digital print customization, and dual-chamber formats optimized for e-commerce durability. The competitive advantage is shifting from mechanical precision alone to full-system sustainability, branding adaptability, and recurring value through design-for-refill ecosystems.

Rising demand for advanced drug delivery systems in the biopharmaceutical and healthcare sectors is fueling the growth of the dual-chamber pumps market. These pumps are designed to store and mix two different drug components such as lyophilized drugs and diluents at the point of administration, ensuring dosage accuracy and extended shelf life. The shift toward self-administration and home-based therapies is accelerating adoption of dual-chamber solutions in prefilled and wearable formats.

Prefilled dual-chamber pumps have gained popularity due to their convenience, sterility, and ability to reduce dosing errors in chronic disease management and critical care. The rise of biologics, vaccines, and specialty injectable has amplified the need for pumps that simplify reconstitution and deliver precise multi-chamber dispensing. These systems support better patient compliance and minimize drug wastage in hospital and outpatient settings.

Industries such as pharmaceuticals, biotechnology, and medical devices are driving demand for dual-chamber technologies that can handle sensitive compounds, simplify workflow, and comply with regulatory standards. Their use improves drug stability and reduces handling complexity for end users including healthcare providers and patients.

Segment growth is expected to be led by prefilled pump formats, lyophilized drug applications in therapy areas, and polymer-based dual-chamber devices due to their barrier properties, dosing accuracy, and compatibility with biologically active compounds.

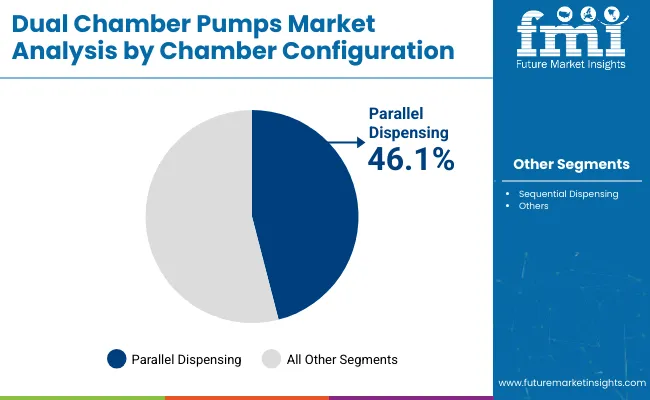

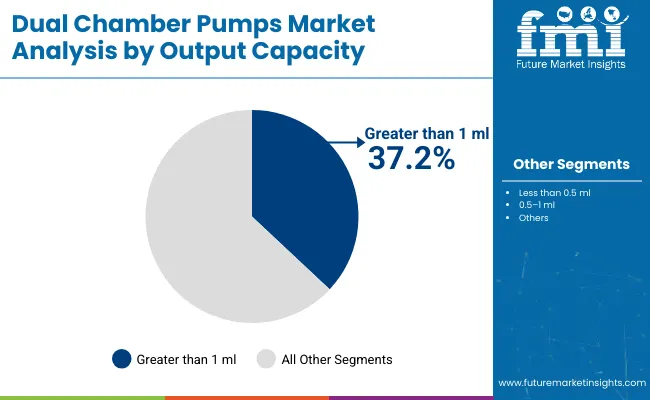

The market is segmented by chamber configuration, output capacity, mixing type, application, end-use industry, and region. Chamber configuration includes parallel dispensing and sequential dispensing, catering to product formats that require either simultaneous or stage-wise application. Output capacity segmentation includes <0.5 ml, 0.5–1 ml, and >1 ml, addressing diverse product dosing requirements across skincare and pharmaceutical formulations.

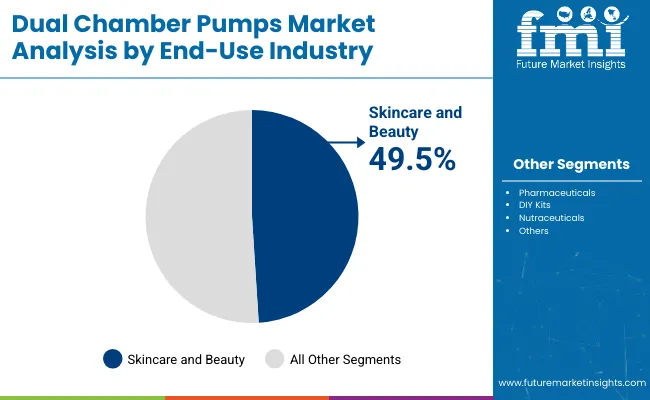

Based on mixing type, the market is categorized into manual mixing on dispense, static mixing, and no mixing (separate streams), depending on the nature of product interaction and usage intent. Application areas encompass serum andcream, shampoo and conditioner, and active ingredient andbase combinations, facilitating dual-formulation systems for efficacy and convenience. End-use industries include skincare andbeauty, pharmaceuticals, DIY kits, and nutraceuticals, each benefiting from dual-functionality dispensing formats. Regionally, the market is divided into North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa.

The parallel dispensing configuration is expected to command the highest market share of 46.1% in the dual-chamber pumps market by 2025. This configuration allows two active formulations such as serum and moisturizer or cream and gel to be dispensed simultaneously in precise ratios, ensuring consistency and ease of use. The design reduces contamination risk by keeping ingredients separate until the moment of application, which is particularly important for products with sensitive or reactive components.

Brands are increasingly adopting parallel dispensing formats for products requiring synergistic action or stabilization, such as vitamin C with hyaluronic acid or retinol with peptides. From a packaging innovation perspective, this format also allows for clean aesthetics, efficient dosage, and tactile user interaction all of which boost premium positioning. As personalization and ingredient integrity become key purchase drivers, parallel dual-chamber pumps offer a practical and appealing delivery system for multifunctional skincare products.

The skincare andbeauty segment is forecasted to remain the dominant end-use category in the dual-chamber pumps market, accounting for a 49.5% share in 2025. Demand is strongly influenced by consumers seeking multifunctional solutions in anti-aging, hydration, and treatment-based regimens, where precise combination dispensing enhances perceived efficacy. Dual-chamber pumps offer aesthetic appeal and practical performance, aligning well with the expectations of luxury and dermatologically active product lines.

brands develop dual-phase products such as color-correcting serums or dual-action cleansers the packaging must support stable storage and synchronized delivery. Skincare formulators are collaborating with packaging developers to launch visually engaging formats that signal innovation while maintaining product separation. With increasing emphasis on personalization, ingredient stability, and routine simplicity, dual-chamber pumps are becoming an industry staple for delivering advanced skincare experiences in the beauty market

The More than 1 ml output capacity segment is projected to lead the dual-chamber pumps market with a 37.2% share in 2025. This dominance reflects the increasing requirement for higher-dosage dispensing in haircare, skincare, and cosmetic applications. Products like body lotions, facial creams, and hair masks benefit from larger dispensing volumes, providing convenience and optimal dosage in a single pump action.

These pumps are especially valued in premium personal care brands where packaging must offer both functional value and user satisfaction.

The static mixing segment is expected to command the largest share of 45.2% in 2025 in the dual-chamber pumps market. Static mixers use fixed internal elements to blend contents from two chambers as they pass through the dispensing head, ensuring consistent and homogeneous output. This method eliminates the need for mechanical components or shaking, preserving formulation integrity and dosage consistency.

Static mixing is particularly valuable in personal care, cosmetic, and pharmaceutical products where chemical compatibility and dosing precision are critical.

The shampoo andconditioner application segment is anticipated to lead with a 39.3% share in 2025. This reflects the growing consumer demand for combined haircare solutions that simplify daily routines while enhancing product performance. Dual-chamber pumps enable the simultaneous dispensing of two formulations typically shampoo and conditioner without mixing them inside the packaging, ensuring maximum efficacy.

This format is especially popular in salon-grade and travel-size offerings, where users seek ease-of-use and precise proportions.

Mechanical complexity and higher manufacturing costs limit the broader use of dual-chamber pumps, even as demand increases in pharmaceuticals, biotechnology, and advanced medical care for safe, synchronized delivery of dual-component formulations and customizable dosing systems.

Growing Demand for Precision Drug Delivery and Combination Therapies

Dual-chamber pumps are witnessing increased adoption in the healthcare and pharmaceutical sectors due to their ability to deliver two-component drugs in a controlled and synchronized manner. These pumps are particularly useful in applications requiring simultaneous administration of active pharmaceutical ingredients (APIs) and diluents or reconstitution agents at the point of care.

They ensure dose accuracy, reduce preparation errors, and improve patient compliance. The growing prevalence of chronic diseases and biologics has prompted a shift toward combination therapies and infusion-based treatments, where dual-chamber pumps offer clinical efficiency and therapeutic reliability. Their sealed configuration also enhances sterility and extends shelf life, making them ideal for hospital and homecare use.

Design Complexity and Manufacturing Cost Barriers

Despite their therapeutic advantages, dual-chamber pumps face notable challenges due to their intricate design and high production costs. These pumps require specialized components, such as synchronized actuators, barrier seals, and dual-drive systems, which add to engineering and assembly complexity.

Regulatory compliance related to drug-device combination products adds further validation overhead. Manufacturers must meet stringent ISO and GMP standards, which increase lead times and development cycles. In addition, customization demands from pharmaceutical companies often result in limited scalability and higher per-unit costs, making dual-chamber pumps less feasible for low-margin or small-batch therapeutic programs.

Integration with Smart Delivery Systems and Disposable Formats

A leading trend in the dual-chamber pumps market is the fusion of drug delivery with smart technology and user-friendly, disposable formats. Manufacturers are developing prefilled, ready-to-use pump systems with embedded sensors for tracking dosage, usage frequency, and patient adherence. These connected devices support remote monitoring and telehealth models, especially for chronic disease management and elderly care.

Concurrently, innovations in compact, single-use cartridges and wearable pump formats are reducing bulk, simplifying operation, and enhancing mobility for patients. As biologic therapies expand and personalized medicine gains traction, dual-chamber pumps are evolving into integral components of next-generation drug delivery ecosystems.

The global dual-chamber pumps market is experiencing a structural downturn across major economies, driven by material shift in formulation packaging, rise of unit-dose dispensing alternatives, and sustainability regulations discouraging multi-component plastic assemblies. The Asia-Pacific region is undergoing the sharpest contraction, with China and South Korea reflecting significant slowdown due to rising costs, eco-design mandates, and declining adoption in mid-range cosmetics.

Mature markets like the USA, Germany, and Japan are transitioning to mono-material pumps, refillable formats, and simplified dispensing for consumer and regulatory appeal. Brands are de-prioritizing dual-chamber formats due to recyclability challenges, excess packaging complexity, and declining consumer demand for two-in-one formulations.

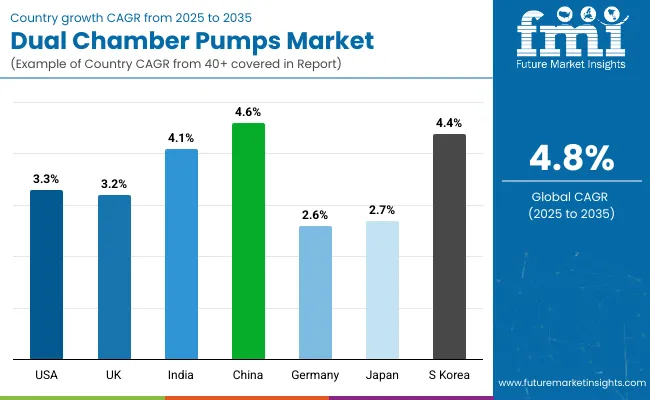

The dual-chamber pumps market in the United States is projected to decline at a CAGR of 3.3% from 2025 to 2035. The downturn is fueled by brand migration toward mono-dose, refillable, and low-plastic dispensing systems across personal care and OTC pharmaceuticals. Recycling constraints, paired with low consumer preference for multi-chamber packaging in high-volume SKUs, have made dual-chamber pumps commercially unviable for many product lines. Retailers are prioritizing shelf-efficient, eco-labeled formats, further reducing demand for dual-chamber designs.

The dual-chamber pumps market in the United Kingdom is expected to decline at a CAGR of 3.2%, influenced by extended producer responsibility (EPR) mandates and reduced consumer uptake of multi-step dispensing. The UK’s recycling compliance targets and corporate ESG standards have led brands to eliminate complex, non-recyclable dispensers. In personal care, two-in-one serums and moisturizers are increasingly being launched in airless mono-chamber or sachet formats, curbing use of dual-chamber designs.

India is witnessing a decline in the dual-chamber pumps market, with a projected CAGR of 4.1% from 2025 to 2035. The fall is driven by price sensitivity, lack of recycling infrastructure, and limited consumer affinity for dual-action products. Mid-size beauty and healthcare brands are discontinuing dual-chamber products in favor of flexible tubes and affordable single-chamber formats. The government’s single-use plastic phase-out policies are further curtailing the use of non-standard, multi-material pumps.

The dual-chamber pumps market in China is expected to contract at a CAGR of 4.6%, the steepest decline among leading economies. As local beauty and personal care brands shift toward refillables, sachets, and smart packaging, dual-chamber pumps are being phased out. Recycling limitations, high production costs, and e-commerce optimization are contributing to lower usage. Regulations targeting composite plastics and bulkier packaging formats are making dual-chamber designs commercially unsustainable.

The dual-chamber pumps market in Germany is forecast to decline at a CAGR of 2.6%, driven by the country’s leadership in packaging sustainability and eco-design compliance. Dual-chamber designs, often considered difficult to recycle and high in material intensity, are being replaced with simpler dosing solutions. Premium skincare and pharma brands are focusing on single-chamber airless systems with refill options. German consumers’ growing environmental awareness is further accelerating this structural shift.

The dual-chamber pumps market in Japan is projected to decline at a CAGR of 2.7%, influenced by changing consumer preferences and rigid packaging hygiene regulations. Minimalist design trends, combined with the rise of smart and refillable systems, are displacing dual-chamber formats across skincare and cosmetic applications. Local manufacturers are innovating with slim, single-flow dispensers that meet both consumer aesthetic expectations and functional dosing requirements without excess plastic.

The dual-chamber pumps market in South Korea is forecast to decline at a CAGR of 4.4%, largely due to the country's leadership in cosmetic packaging innovation and environmental stewardship. K-beauty trends are shifting to refillable capsules, mono-dose airless bottles, and simplified ingredient systems. The rising costs of tooling dual-chamber pumps and recyclability challenges have prompted both indie and multinational brands to move away from these formats.

The dual-chamber pumps market is moderately fragmented, with global packaging leaders, advanced dispenser innovators, and niche-focused cosmetic solution providers competing across skincare, nutraceuticals, and pharmaceutical applications. Global players such as AptarGroup, Inc. and APC Packaging hold significant market share, driven by proprietary dual-dosing mechanisms, formulation isolation technologies, and packaging designs optimized for active ingredient preservation. Their strategies increasingly emphasize refillable designs, airless systems, and compatibility with premium anti-aging and clinical-grade product lines.

Established mid-sized players including APackaging Group (APG), PKG Group LLC, and Quadpack Industries cater to brand-specific dispensing needs with hybrid functionality and aesthetic customization. These companies are accelerating adoption through flexible output ratios, consumer-friendly twist-activation mechanisms, and sustainable options (e.g., PCR plastics) for prestige skincare and wellness markets.

Specialized providers such as Unica Packaging and Matsa Group Ltd focus on low-to-medium volume dual-dispenser formats tailored for niche cosmetics, travel-size dosing, and private-label brands. Their core strengths include responsive ODM services, compact design options, and regional agility in accommodating diverse formulation viscosities and compliance requirements.

Key Development of Dual-Chamber Pumps Market

| Item | Value |

|---|---|

| Quantitative Units | USD 3.3 Billion |

| By Chamber Configuration | Parallel Dispensing and Sequential Dispensing |

| By Output Capacity | Less than 0.5 ml, 0.5–1 ml, and More than 1 ml |

| By Mixing Type | Manual Mixing on Dispense, Static Mixing, and No Mixing (separate streams) |

| By Application | Serum and Cream, Shampoo and Conditioner, and Active Ingredient and Base |

| By End-Use Industry | Skincare and Beauty, Pharmaceuticals, DIY Kits, and Nutraceuticals |

| Key Companies Profiled | APC Packaging, APackaging Group (APG), AptarGroup, Inc., PKG Group LLC, Quadpack Industries, Unica Packaging, Matsa Group Ltd. |

| Additional Attributes | Custom dispensing for reactive and multi-phase formulations, growth in clean beauty and preservative-free products, high demand in DIY skincare and wellness kits, refillable and recyclable pump formats gaining traction, premium aesthetics driving product differentiation, airless dual pumps enhancing shelf life, flexibility in mixing ratios (e.g., 1:1, 1:3), innovation in non-mixing configurations for ingredient integrity, expanded use in OTC pharma and dermaceuticals , and regional growth led by Asia-Pacific and North America |

The industry is expected to reach USD 5.3 billion by 2035, growing at a 4.8% CAGR.

Segmented chamber pumps lead with 61% of the market share in 2025.

Skincare applications account for 47% of end-use demand in 2025.

China is projected to grow at a 4.6% CAGR from 2025 to 2035.

APC Packaging leads the industry with an 18% global share.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dual P-channel MOSFET Market Size and Share Forecast Outlook 2025 to 2035

Dual Wavelength Raman Probe Market Size and Share Forecast Outlook 2025 to 2035

Dual Wavelength Raman Spectrometer Market Size and Share Forecast Outlook 2025 to 2035

DualMode Automated Tow Tractor Market Size and Share Forecast Outlook 2025 to 2035

Dual Clutch Transmission Market Size and Share Forecast Outlook 2025 to 2035

Dual Frequency Ultrasonic Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Dual-Cure Luting Cements Market Size and Share Forecast Outlook 2025 to 2035

Dual Screen Laptops Market Size and Share Forecast Outlook 2025 to 2035

Dual Ovenable Trays and Containers Market Size and Share Forecast Outlook 2025 to 2035

Dual Relay Board Market Size and Share Forecast Outlook 2025 to 2035

Dual Voltage Comparator Market Size and Share Forecast Outlook 2025 to 2035

Dual and Multi-Energy Computed Tomography (CT) Market Size and Share Forecast Outlook 2025 to 2035

Dual-Phase Cleanser Market Size and Share Forecast Outlook 2025 to 2035

The Dual Balloon Angioplasty Catheter Market is segmented by Peripheral, and Coronal from 2025 to 2035

Dual Biomarker Assays Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Dual Flap Dispensing Closure Market Size & Trends 2025 to 2035

Dual Ovenable Lidding Films Market by Material, Seal Type, Application & Region - Forecast 2025 to 2035

Dual Axis Solar Tracker Market Growth - Trends & Forecast 2025 to 2035

Market Share Breakdown of Dual Ovenable Lidding Films Manufacturers

Dual Containment Pipe Market Growth – Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA