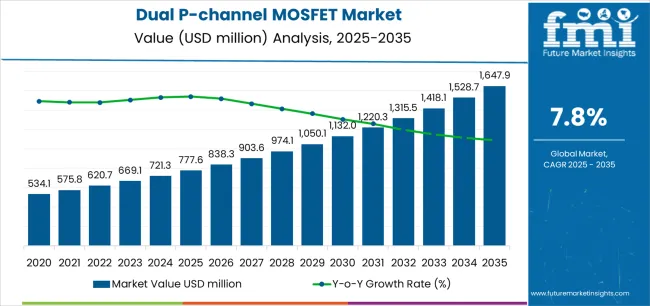

The global dual P-channel MOSFET market is projected to grow from USD 777.6 million in 2025 to approximately USD 1,648 million by 2035, recording an absolute increase of USD 870.4 million over the forecast period. This translates into a total growth of 111.9%, with the market forecast to expand at a compound annual growth rate (CAGR) of 7.8% between 2025 and 2035. The overall market size is expected to grow by nearly 2.1X during the same period, supported by increasing automotive electrification requirements across vehicle platforms, growing demand for power management solutions in industrial automation systems, and rising miniaturization needs driving efficient switching component procurement across various electronics applications.

Automotive electronics expansion continues to drive dual P-channel MOSFET demand, particularly in electric vehicle power distribution systems, battery management applications, and advanced driver assistance systems requiring bidirectional switching capabilities. The evolution toward higher efficiency power conversion and thermal management optimization are reshaping component specifications, with manufacturers prioritizing devices that deliver low on-resistance characteristics while meeting automotive qualification standards.

Industrial automation modernization programs across manufacturing facilities and smart building systems are creating sustained demand for dual P-channel MOSFETs that provide reliable load switching and protection circuit functionality. Asia Pacific markets demonstrate particularly strong growth potential, supported by expanding automotive electronics manufacturing operations and increasing consumer electronics production that necessitate high-volume power semiconductor components capable of supporting compact circuit designs and energy efficiency requirements.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 777.6 million |

| Market Forecast Value (2035) | USD 1,648 million |

| Forecast CAGR (2025-2035) | 7.8% |

| AUTOMOTIVE ELECTRIFICATION TRENDS | POWER MANAGEMENT REQUIREMENTS | TECHNOLOGY & EFFICIENCY STANDARDS |

|---|---|---|

|

|

|

| Category | Segments Covered |

|---|---|

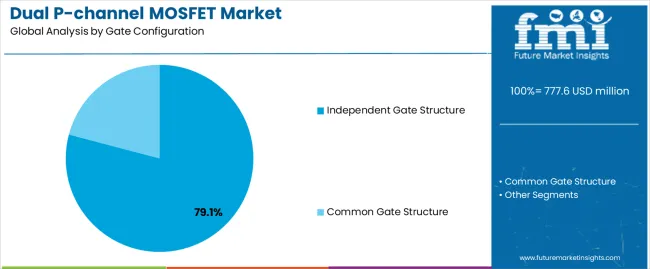

| By Gate Configuration | Independent Gate Structure, Common Gate Structure |

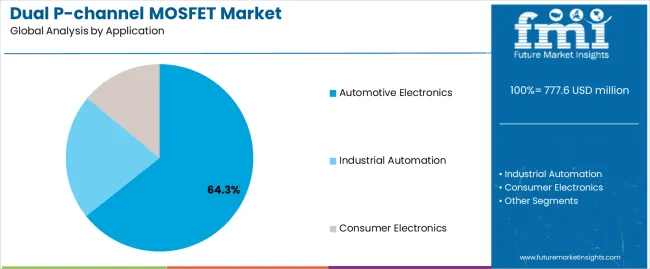

| By Application | Automotive Electronics, Industrial Automation, Consumer Electronics |

| By Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Segment | 2025 to 2035 Outlook |

|---|---|

| Independent Gate Structure |

|

| Common Gate Structure |

|

| Segment | 2025 to 2035 Outlook |

|---|---|

| Automotive Electronics |

|

| Industrial Automation |

|

| Consumer Electronics |

|

| DRIVERS | RESTRAINTS | KEY TRENDS |

|---|---|---|

|

|

|

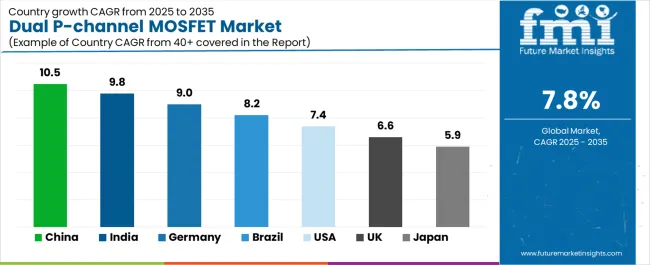

| Country | CAGR (2025-2035) |

|---|---|

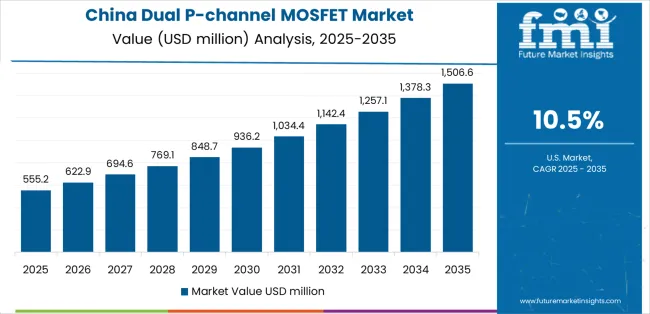

| China | 10.5% |

| India | 9.8% |

| Germany | 9% |

| Brazil | 8.2% |

| United States | 7.4% |

| United Kingdom | 6.6% |

| Japan | 5.9% |

Revenue from Dual P-channel MOSFETs in China is projected to exhibit strong growth, expanding at a CAGR of 10.5% to reach significant market value by 2035, driven by expanding electric vehicle production infrastructure and comprehensive automotive electronics manufacturing creating substantial opportunities for power semiconductor suppliers across battery management system operations, vehicle power distribution networks, and consumer electronics assembly sectors. The country's established electronics manufacturing ecosystem and expanding new energy vehicle capabilities are creating significant demand for both automotive-grade and consumer-grade dual P-channel MOSFET solutions. Major automotive electronics manufacturers and power semiconductor assembly operations are establishing comprehensive production facilities to support large-scale component demand and efficient supply chain integration.

Revenue from Dual P-channel MOSFETs in India is expanding at a CAGR of 9.8% to reach substantial levels by 2035, supported by extensive automotive industry development and comprehensive electronics manufacturing expansion creating sustained demand for power semiconductor components across diverse vehicle electronics categories and consumer device applications. The country's growing automotive production capabilities and expanding electronics assembly infrastructure are driving demand for dual P-channel MOSFET solutions that provide reliable switching performance while supporting cost-effective manufacturing requirements. International semiconductor distributors and domestic electronics manufacturers are investing in supply chain capabilities to support component availability and technical application support.

Demand for Dual P-channel MOSFETs in Germany is projected to grow at a CAGR of 9% to reach substantial levels by 2035, supported by the country's leadership in automotive engineering and advanced vehicle electronics requiring sophisticated power semiconductor components for premium vehicle platforms, electric vehicle systems, and automotive safety applications. German automotive manufacturers and tier suppliers are implementing advanced dual P-channel MOSFET solutions that support stringent reliability standards, operational precision, and comprehensive qualification protocols. The market is characterized by focus on component quality, automotive qualification excellence, and compliance with stringent safety and environmental standards.

Demand for Dual P-channel MOSFETs in Brazil is projected to expand at a CAGR of 8.2% to reach meaningful levels by 2035, driven by automotive production development and vehicle electronics content increase supporting power semiconductor adoption in body electronics and power management applications. The country's established automotive manufacturing presence and growing vehicle electronics capabilities are creating demand for dual P-channel MOSFET solutions that support operational requirements and cost standards. Semiconductor distributors and automotive electronics suppliers are maintaining technical capabilities to support component specification and application optimization requirements.

Revenue from Dual P-channel MOSFETs in United States is growing at a CAGR of 7.4% to reach substantial levels by 2035, driven by electric vehicle production expansion and automotive electronics innovation creating sustained opportunities for power semiconductor suppliers serving both automotive manufacturers and industrial equipment producers. The country's extensive automotive engineering capabilities and established electronics manufacturing presence are creating demand for dual P-channel MOSFET solutions that support stringent automotive qualification requirements while maintaining performance standards. Semiconductor manufacturers and distribution partners are developing comprehensive technical support capabilities to address automotive qualification requirements and industrial application demands.

Demand for Dual P-channel MOSFETs in United Kingdom is projected to grow at a CAGR of 6.6% by 2035, supported by automotive electronics development programs and industrial automation applications creating opportunities for power semiconductor suppliers across vehicle electronics operations and manufacturing equipment sectors. The country's established automotive engineering expertise and developing electric vehicle capabilities are driving demand for dual P-channel MOSFET solutions that support component reliability while meeting automotive qualification requirements. Semiconductor distributors and technical service providers are implementing capabilities to support application development and component qualification optimization requirements.

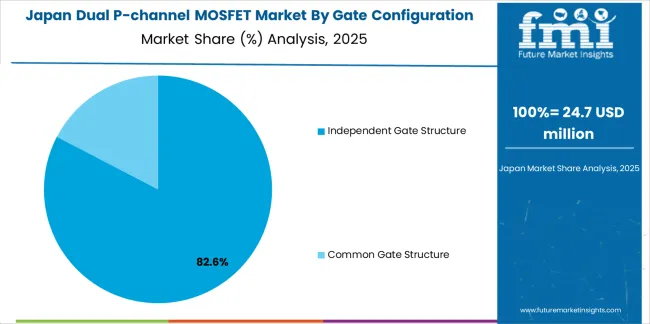

Demand for Dual P-channel MOSFETs in Japan is projected to expand at a CAGR of 5.9% by 2035, driven by automotive electronics excellence and industrial equipment manufacturing leadership supporting advanced power semiconductor adoption and comprehensive quality control applications. The country's sophisticated automotive component requirements and established electronics manufacturing capabilities are creating demand for high-reliability dual P-channel MOSFET solutions that support stringent operational standards and qualification protocols. Semiconductor manufacturers and technical specialists are maintaining comprehensive development capabilities to support diverse application requirements and performance optimization initiatives.

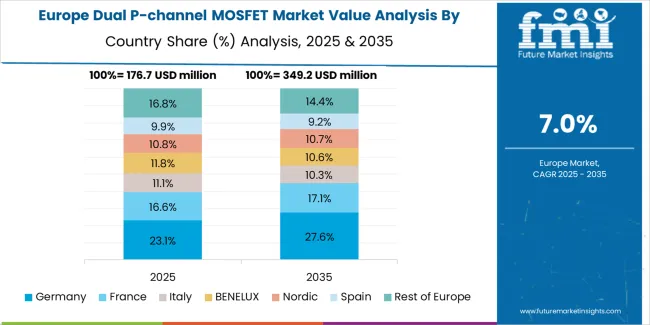

The dual P-channel MOSFET market in Europe is projected to grow from USD 216.3 million in 2025 to USD 462.8 million by 2035, registering a CAGR of 7.9% over the forecast period. Germany is expected to maintain its leadership position with a 41.6% market share in 2025, declining slightly to 40.8% by 2035, supported by its advanced automotive electronics manufacturing infrastructure and comprehensive vehicle electrification capabilities serving premium automotive platforms and industrial automation applications.

France follows with a 19.7% share in 2025, projected to reach 20.3% by 2035, driven by comprehensive automotive supplier operations and electronics manufacturing presence supporting vehicle electronics and power management system production. The United Kingdom holds a 16.4% share in 2025, expected to maintain 16.1% by 2035 with automotive engineering focus and industrial equipment manufacturing presence. Italy commands a 13.8% share, while Spain accounts for 6.7% in 2025. The Rest of Europe region is anticipated to gain momentum, expanding its collective share from 1.8% to 2.6% by 2035, attributed to increasing automotive electronics adoption in Nordic countries and emerging Eastern European vehicle electronics manufacturing facilities implementing power semiconductor technologies.

Japanese dual P-channel MOSFET operations reflect the country's precision manufacturing standards and sophisticated automotive electronics requirements. Major automotive electronics suppliers including Denso, Panasonic, and Hitachi Automotive Systems maintain rigorous component qualification processes emphasizing reliability validation, thermal cycling performance, and comprehensive failure mode analysis. This creates structured market conditions favoring established semiconductor manufacturers with proven automotive qualification track records and comprehensive technical documentation capabilities.

The Japanese market demonstrates advanced automotive electronics adoption, with significant investment in electric vehicle power systems and hybrid vehicle architectures requiring dual P-channel MOSFETs optimized for battery management, power distribution, and motor control applications. Companies require detailed component characterization data and application development support that align with Japanese automotive excellence standards, driving demand for sophisticated technical service capabilities and continuous quality improvement collaboration.

Regulatory oversight emphasizes automotive safety standards and environmental compliance, with manufacturing requirements necessitating comprehensive component qualification documentation and traceability systems. The power semiconductor procurement framework creates advantages for suppliers with established automotive certifications, comprehensive reliability testing capabilities, and proven quality management systems meeting Japanese automotive industry expectations.

Supply chain relationships focus on long-term technical partnerships rather than transactional procurement approaches. Japanese automotive manufacturers typically maintain multi-year supplier agreements with semiconductor producers, emphasizing collaborative application engineering, joint reliability optimization, and continuous component improvement rather than competitive pricing cycles. This stability supports application-specific device development and packaging optimization investments tailored to Japanese automotive electronics requirements and performance expectations.

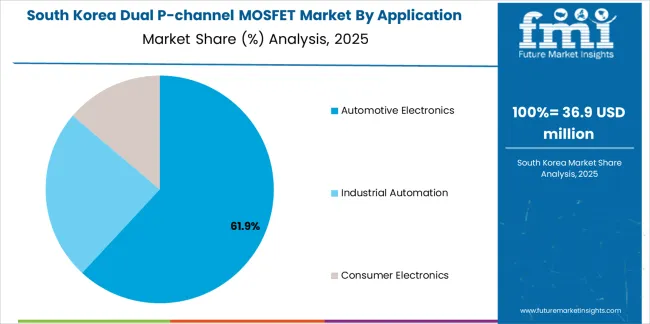

South Korean dual P-channel MOSFET operations reflect the country's advanced automotive and consumer electronics manufacturing sectors. Major automotive manufacturers including Hyundai Motor, Kia Corporation, and electronics companies including Samsung Electronics and LG Electronics drive sophisticated power semiconductor procurement strategies, establishing technical partnerships with global semiconductor manufacturers to secure performance-validated components for electric vehicle systems, battery management applications, and consumer electronics production targeting both domestic and export markets.

The Korean market demonstrates particular strength in applying dual P-channel MOSFETs to electric vehicle battery management systems and charging infrastructure, with companies integrating power switching components into battery disconnect circuits, load management systems, and thermal management controls. This application focus creates demand for automotive-qualified devices optimized for high-current switching and components supporting compact package designs reflecting space constraints in modern vehicle architectures.

Regulatory frameworks emphasize automotive safety standards and electronics quality requirements, with automotive industry quality management systems requiring comprehensive component qualification and reliability validation protocols. Dual P-channel MOSFET selection processes require extensive testing validation and performance verification, creating structured evaluation frameworks that favor established semiconductor manufacturers with technical expertise and proven automotive qualification experience.

Engineering collaboration between Korean automotive manufacturers and semiconductor suppliers focuses on power efficiency optimization and thermal management enhancement, with joint development projects targeting conduction loss reduction and switching performance improvement. Korean companies invest in advanced power electronics simulation capabilities and thermal modeling technologies supporting component selection optimization and system performance validation, positioning the market for continued advancement as vehicle electrification accelerates and power semiconductor technology sophistication increases.

Profit pools consolidate around suppliers demonstrating automotive qualification capabilities and comprehensive technical support infrastructure serving electric vehicle electronics and industrial automation segments where component reliability and application engineering relationships command premium positioning. Value migrates from standard consumer-grade components toward automotive-qualified devices and specialized packages where superior on-resistance characteristics, thermal performance optimization, and comprehensive qualification documentation create customer retention.

Several operational models define competitive dynamics: global semiconductor manufacturers leveraging comprehensive product portfolios and worldwide application engineering networks; specialized discrete semiconductor producers focusing on power device optimization and niche application segments; automotive electronics distributors providing component availability and localized technical support; and emerging manufacturers pursuing volume through cost competitiveness in consumer electronics applications.

Switching costs remain substantial in automotive applications due to component qualification requirements, established circuit designs, and reliability validation cycles that typically span 12-24 months for new vehicle platform implementations. These barriers stabilize incumbent positions while creating opportunities for differentiated solutions in emerging electric vehicle applications. Competitive advantages accrue to manufacturers maintaining vertical integration across wafer fabrication, device assembly, and qualification testing enabling customization responsiveness and quality control optimization. Market consolidation continues as larger semiconductor companies acquire specialized power device producers to expand automotive electronics portfolios and secure engineering capabilities.

Technology differentiation focuses on trench MOSFET architecture advancement, package thermal resistance reduction, and gate charge optimization supporting switching efficiency improvements across automotive and industrial applications. Strategic partnerships between semiconductor manufacturers and automotive tier-one suppliers create design-in relationships and platform-level component standardization supporting volume commitments and multi-year supply agreements.

| Items | Values |

|---|---|

| Quantitative Units | USD 777.6 million |

| Gate Configuration | Independent Gate Structure, Common Gate Structure |

| Application | Automotive Electronics, Industrial Automation, Consumer Electronics |

| Regions Covered | North America, Latin America, Europe, Asia Pacific, Middle East & Africa |

| Key Countries Covered | United States, Germany, China, India, Brazil, United Kingdom, Japan, and other countries |

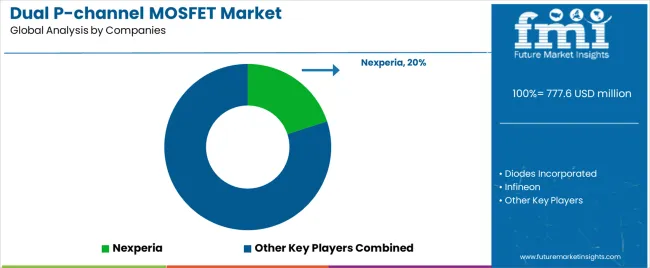

| Key Companies Profiled | Nexperia, Diodes Incorporated, Infineon, ROHM Semiconductor, TI, Microchip Technology, STMicroelectronics, YangJie, Vishay, Multicomp Pro, Onsemi, LIWEI ELECTRONIC TECHNOLOGY CO LTD, Crmicro |

| Additional Attributes | Revenue analysis by gate configuration and application segment, regional market dynamics, competitive landscape assessment, automotive qualification trends, on-resistance optimization developments, and package miniaturization innovations driving vehicle electrification advancement, power efficiency improvement, and circuit design simplification |

The global dual p-channel MOSFET market is estimated to be valued at USD 777.6 million in 2025.

The market size for the dual p-channel MOSFET market is projected to reach USD 1,647.9 million by 2035.

The dual p-channel MOSFET market is expected to grow at a 7.8% CAGR between 2025 and 2035.

The key product types in dual p-channel MOSFET market are independent gate structure and common gate structure.

In terms of application, automotive electronics segment to command 64.3% share in the dual p-channel MOSFET market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dual Wavelength Raman Probe Market Size and Share Forecast Outlook 2025 to 2035

Dual Wavelength Raman Spectrometer Market Size and Share Forecast Outlook 2025 to 2035

Dual Air Chamber Hydro-pneumatic Suspension Market Size and Share Forecast Outlook 2025 to 2035

DualMode Automated Tow Tractor Market Size and Share Forecast Outlook 2025 to 2035

Dual Clutch Transmission Market Size and Share Forecast Outlook 2025 to 2035

Dual Frequency Ultrasonic Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Dual-Cure Luting Cements Market Size and Share Forecast Outlook 2025 to 2035

Dual Screen Laptops Market Size and Share Forecast Outlook 2025 to 2035

Dual Ovenable Trays and Containers Market Size and Share Forecast Outlook 2025 to 2035

Dual Relay Board Market Size and Share Forecast Outlook 2025 to 2035

Dual Chamber Dispensing Bottles Market Size and Share Forecast Outlook 2025 to 2035

Dual Voltage Comparator Market Size and Share Forecast Outlook 2025 to 2035

Dual and Multi-Energy Computed Tomography (CT) Market Size and Share Forecast Outlook 2025 to 2035

Dual-Phase Cleanser Market Size and Share Forecast Outlook 2025 to 2035

The Dual Balloon Angioplasty Catheter Market is segmented by Peripheral, and Coronal from 2025 to 2035

Dual Biomarker Assays Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Dual Flap Dispensing Closure Market Size & Trends 2025 to 2035

Dual Ovenable Lidding Films Market by Material, Seal Type, Application & Region - Forecast 2025 to 2035

Dual-Chamber Pumps Market Analysis - Size, Share, and Forecast Outlook (2025 to 2035)

Dual Axis Solar Tracker Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA