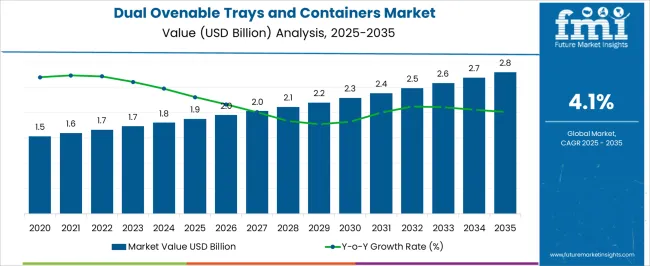

The dual ovenable trays and containers market is estimated to be valued at USD 1.9 billion in 2025 and is projected to reach USD 2.8 billion by 2035, registering a compound annual growth rate (CAGR) of 4.1% over the forecast period.

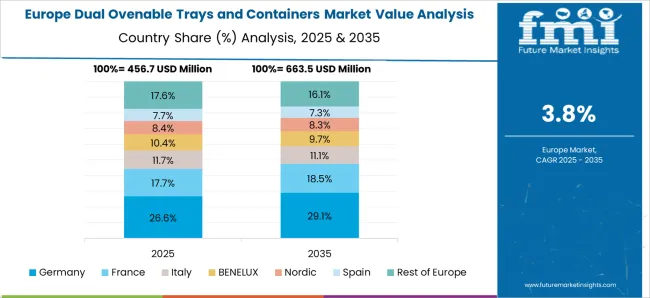

Asia Pacific is expected to display stronger momentum as urban centers expand and demand for convenient meal solutions rises among a growing middle-class base. The region’s cost-sensitive manufacturing environment and expanding food delivery sector are likely to accelerate adoption, especially in markets like China, India, and Southeast Asia. Europe, in contrast, is likely to experience slower yet steady progression, shaped primarily by strict environmental and packaging regulations. Emphasis on recyclable and compostable materials is expected to drive innovation, but compliance costs may restrain rapid scaling. Growth is anticipated to be sustained by consumer preference for high-quality packaging aligned with health and safety assurances.

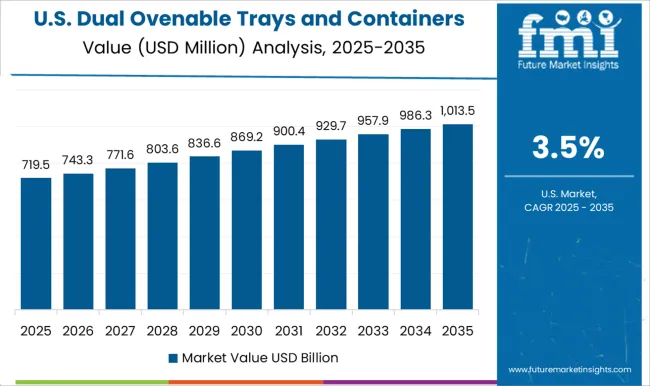

North America is projected to remain a mature market, characterized by consistent demand from frozen food, ready meals, and foodservice segments. The incremental growth is likely, as the market is already saturated with established supply chains. The focus here is expected to be on sustainable packaging materials and convenience-driven formats. This imbalance illustrates how Asia Pacific leads expansion, while Europe and North America stabilize the global trajectory.

| Metric | Value |

|---|---|

| Dual Ovenable Trays and Containers Market Estimated Value in (2025 E) | USD 1.9 billion |

| Dual Ovenable Trays and Containers Market Forecast Value in (2035 F) | USD 2.8 billion |

| Forecast CAGR (2025 to 2035) | 4.1% |

The dual ovenable trays and containers market is assessed as a specialized yet expanding category within the global packaging sector. It accounts for 7.2% of the ready meal packaging market, supported by strong adoption across frozen and chilled meal categories. Within frozen food packaging, its 6.5% share highlights its role in extending shelf life and maintaining product integrity. In sustainable food service packaging, the share stands at 3.4%, where recyclable and reduced-plastic solutions are being introduced. The convenience food distribution sector shows 4.1% share, backed by consumer preference for time-saving meal solutions. Thermoformed plastics packaging adds 5.6%, reflecting reliance on lightweight, heat-resistant formats.

Recent industry trends have been driven by rising consumer demand for convenience, coupled with growing focus on eco-friendly and heat-resistant packaging. Groundbreaking innovations include trays and containers engineered with plant-based polymers, recyclable mono-material designs, and enhanced microwave and conventional oven safety features. Key players have implemented strategies such as partnerships with food manufacturers to co-develop packaging suited for high-volume ready meals. Regional growth has been prominent in North America and Europe due to strong frozen and ready meal consumption, while Asia-Pacific is seeing higher demand from urban households adopting packaged meal solutions. Digital printing on trays for branding and supply chain tracking is emerging as a competitive differentiator among packaging providers.

The market is witnessing sustained growth, driven by increasing consumer demand for convenient, ready-to-eat meals and the expanding adoption of packaging that can withstand both conventional ovens and microwaves. The market is benefiting from the rising focus on food safety, portion control, and extended shelf life, which has encouraged food manufacturers to adopt materials and designs that ensure product integrity throughout the cooking and serving process.

Growth has also been reinforced by advances in heat-resistant materials and manufacturing processes, allowing for improved product durability and performance under varying temperature conditions. The expansion of retail ready and foodservice sectors has created new opportunities for dual ovenable solutions, supported by global urbanization and the shift towards quick meal preparation.

As sustainability remains a priority, the market is also experiencing a transition toward recyclable and eco-friendly materials, further shaping the competitive landscape and paving the way for innovation in both product design and end-use applications.

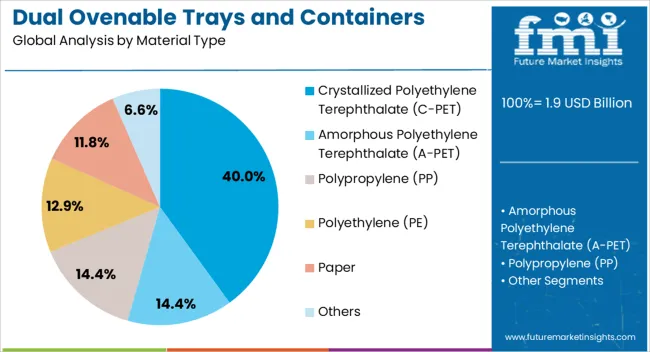

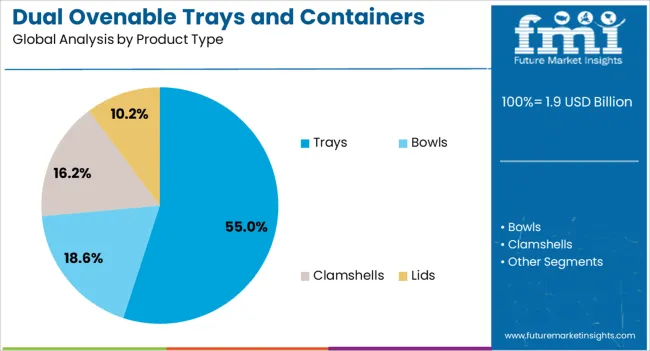

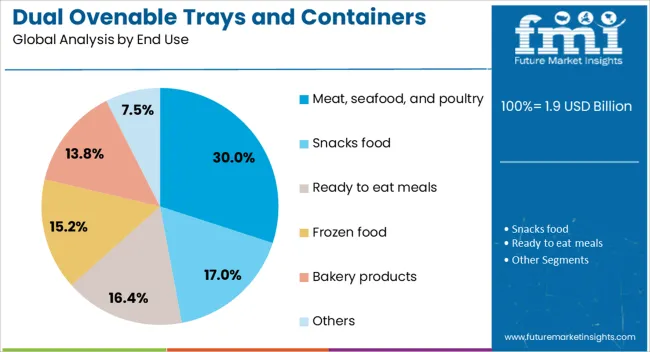

The dual ovenable trays and containers market is segmented by material type, product type, end use, and geographic regions. By material type, dual ovenable trays and containers market is divided into crystallized polyethylene terephthalate (C-PET), amorphous polyethylene terephthalate (A-PET), polypropylene (PP), polyethylene (PE), paper, and others. In terms of product type, dual ovenable trays and containers market is classified into trays, bowls, clamshells, and lids. Based on end use, dual ovenable trays and containers market is segmented into meat, seafood, and poultry, snacks food, ready to eat meals, frozen food, bakery products, and others. Regionally, the dual ovenable trays and containers industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The crystallized polyethylene terephthalate (C-PET) material type segment is projected to account for 40% of the market revenue share in 2025, establishing it as the leading material choice. This dominance is attributed to C-PET’s high thermal stability, which allows it to endure both freezing and high-temperature oven cooking without warping or leaching.

The material’s versatility in forming different shapes and sizes has made it highly suitable for a wide range of food products. Its compatibility with automated packaging lines and ability to maintain clarity for product visibility have further driven adoption in retail and foodservice sectors.

The recyclability of C-PET has aligned well with increasing regulatory and consumer focus on sustainable packaging solutions As food producers seek reliable, safe, and environmentally responsible materials that perform consistently across varied cooking environments, C-PET has retained its competitive advantage, ensuring its continued leadership in the market.

The trays product type segment is anticipated to hold 55% of the market revenue share in 2025, making it the dominant product category. This growth has been supported by trays’ versatility in packaging various ready-to-eat and fresh food items, from single portions to family-sized meals.

Their structural rigidity ensures protection during handling, transport, and cooking, while their design allows for portion control and ease of serving. Trays are widely used in retail ready meal offerings, institutional catering, and foodservice applications due to their compatibility with sealing films and lidding options that enhance food preservation.

The ability to use trays in both microwaves and conventional ovens without compromising product quality has further boosted their demand Their adoption has also been reinforced by the trend towards convenience-focused packaging that meets modern consumer expectations for speed, safety, and presentation quality.

The meat, seafood, and poultry end use segment is expected to capture 30% of the market revenue share in 2025, positioning it as the leading end-use category. This dominance has been driven by the growing demand for ready-to-cook and ready-to-heat protein products that maintain quality and safety during storage, cooking, and serving.

Dual ovenable packaging enables these products to move directly from refrigeration or freezing to cooking without additional preparation, reducing handling and contamination risk. This segment’s growth has been reinforced by the expansion of chilled and frozen meal offerings in retail, supported by evolving consumer lifestyles that favor time-efficient cooking solutions.

The ability of dual ovenable trays and containers to retain moisture, enhance flavor, and withstand varying temperature ranges has further encouraged their use for protein-rich meals As food manufacturers continue to innovate in portion sizing, marination, and seasoning within oven-ready formats, the segment is expected to maintain its market leadership.

The market has grown as food packaging requirements have shifted toward convenience, safety, and versatility. These trays and containers are engineered to withstand both microwave and conventional oven heating, making them highly suitable for ready-to-eat meals, frozen food, and bakery products. Food manufacturers and retailers have increasingly adopted these solutions to ensure consumer convenience without compromising quality. Material innovations in CPET, coated paperboard, and aluminum have reinforced durability and thermal stability. Expanding demand from quick-service restaurants, frozen food producers, and catering industries has further stimulated adoption across global markets.

Convenience packaging has been the most prominent factor influencing adoption of dual ovenable trays and containers. Busy households and on-the-go lifestyles have increased reliance on ready meals that can be directly heated without transferring to another dish. The dual functionality of being microwave- and oven-safe has positioned these trays as a versatile choice for consumers. This demand has been particularly visible in frozen meals, pre-cooked meat, and bakery applications. The ability to withstand high temperatures while maintaining food integrity and safety has ensured steady growth. Consumer preference for convenience continues to be a major driver of adoption.

Material innovation has been central to the performance and adoption of dual ovenable trays and containers. CPET has remained a dominant material due to its thermal resistance, barrier properties, and recyclability potential. Coated paperboard solutions have gained traction as lightweight and cost-efficient alternatives, while aluminum trays have been applied for premium and high-heat food products. Manufacturers have invested in multilayer structures that enhance heat tolerance and prevent food contamination. These advancements have improved the sustainability profile of ovenable packaging while expanding its applicability across various food categories. Material technology has therefore been a critical enabler of this market.

The foodservice and retail industries have strongly contributed to the adoption of dual ovenable trays and containers. Quick-service restaurants, caterers, and institutional food suppliers have utilized these trays for efficient meal preparation and delivery. Supermarkets and online grocery retailers have favored ovenable packaging for private-label ready meals and frozen products. The expansion of frozen food categories, combined with global retail penetration, has intensified demand for versatile packaging formats. In addition, the rise of e-commerce grocery delivery has required durable, tamper-resistant, and reheatable packaging formats. Foodservice and retail adoption has therefore reinforced steady growth in this segment.

Environmental considerations and packaging regulations have influenced the development and adoption of dual ovenable trays. Regulatory bodies have encouraged the use of recyclable and reduced-plastic materials, pushing manufacturers to explore paperboard and compostable alternatives. Brand owners have sought to highlight sustainable packaging as part of their corporate responsibility strategies. While CPET and aluminum provide performance reliability, recycling challenges have spurred innovation in lightweight and eco-friendly alternatives. The growing alignment with circular economy objectives has been reflected in the design of ovenable trays that balance heat resistance with environmental responsibility. Regulatory compliance has thus shaped both production and consumption trends.

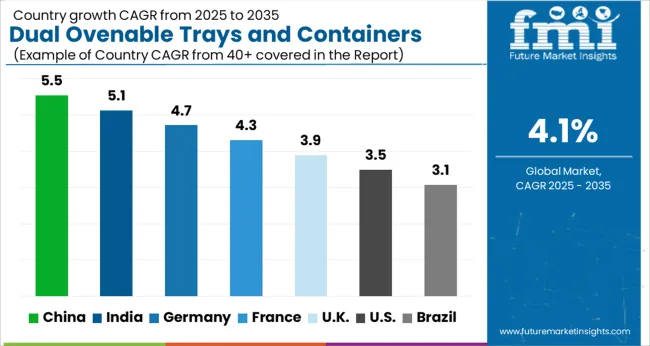

| Country | CAGR |

|---|---|

| China | 5.5% |

| India | 5.1% |

| Germany | 4.7% |

| France | 4.3% |

| UK | 3.9% |

| USA | 3.5% |

| Brazil | 3.1% |

China recorded the highest growth in the market with a forecast rate of 5.5%, supported by rising demand for ready meals and expanding packaged food industries. India followed with 5.1%, where growing adoption of heat-resistant packaging solutions for frozen and convenience foods enhanced market presence. Germany achieved 4.7%, with strong emphasis on recyclable and sustainable ovenable packaging options supporting wider usage. The United Kingdom registered 3.9%, driven by the popularity of meal kits and increased reliance on microwaveable packaging solutions. The United States recorded 3.5%, with demand concentrated in frozen food packaging and food service sectors. Together, these countries illustrate an evolving packaging landscape that emphasizes performance, safety, and convenience in line with global consumption patterns. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is registering a CAGR of 5.5% in the market, supported by growth in the packaged food sector and rising adoption of ready-to-eat meals. The increasing preference for heat-resistant and safe packaging solutions is driving wider acceptance among consumers and food service providers. Local manufacturers are innovating with recyclable and eco-friendly materials to meet regulatory expectations and shifting consumer awareness. Multinational packaging companies are also expanding their production capacities in China to cater to rising demand. With evolving retail formats and a growing appetite for convenience-oriented products, the market is anticipated to advance steadily in the coming years.

India is recording a CAGR of 5.1% in the market, driven by rising penetration of packaged foods and quick-service restaurants. Increasing consumer reliance on takeaway and home delivery has heightened the requirement for safe and reliable heat-resistant packaging. Domestic producers are scaling up manufacturing capacities to meet higher demand while international suppliers are introducing advanced material solutions tailored to Indian consumption patterns. Regulatory support for sustainable packaging is influencing product innovation and market strategies. With greater emphasis on consumer safety, convenience, and food hygiene, the market in India is set for sustained expansion.

Germany is advancing at a CAGR of 4.7% in the market, propelled by consumer preference for sustainable and premium packaging. German buyers place strong emphasis on environmentally friendly materials and compliance with stringent packaging regulations. Food manufacturers are increasingly adopting recyclable trays to align with sustainability goals. Retailers are showcasing greater variety in heat-resistant containers to serve growing demand for convenience foods. Innovation in barrier coatings and designs is improving product quality and safety. With a well-established packaging ecosystem, Germany is witnessing strong traction for dual ovenable trays across both retail and institutional foodservice applications.

The United Kingdom is progressing at a CAGR of 3.9% in the market, supported by growing reliance on convenient food solutions. Rising use of ready-to-cook and ready-to-heat meals is creating demand for reliable packaging that ensures safety and quality. Producers are increasingly highlighting recyclable and sustainable trays to appeal to environmentally aware consumers. The retail sector, including supermarkets and online grocery platforms, is expanding its offerings of dual ovenable packaging to attract busy households. As consumer focus shifts toward quality and eco-friendly packaging, the UK market is expected to steadily adopt newer material innovations.

The United States is observing a CAGR of 3.5% in the market, fueled by demand from food processing companies and retail chains. Consumer preference for microwaveable and oven-safe packaging has driven growth across frozen and ready-to-eat meal categories. Manufacturers are focusing on durability, heat resistance, and eco-friendly materials to capture evolving demand trends. Strategic partnerships between packaging suppliers and large foodservice brands are enhancing product innovation. With greater emphasis on convenience, safety, and sustainability, the US market for dual ovenable trays and containers is expected to strengthen steadily in the forecast period.

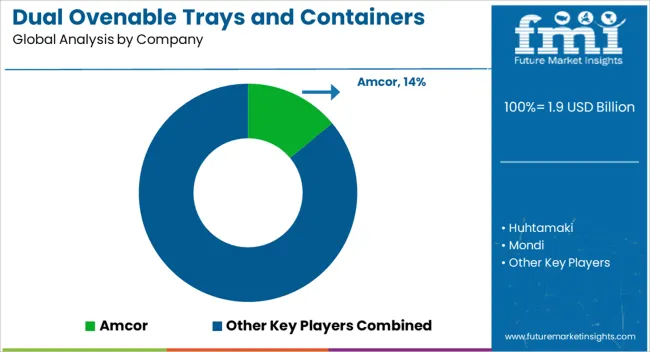

The market is defined by global packaging leaders that deliver heat-resistant and versatile solutions for food preparation and distribution. Amcor plays a prominent role with advanced material engineering that enables lightweight, safe, and recyclable trays suited for both microwave and conventional oven use. Huhtamaki strengthens its position by offering fiber-based and polymer-based trays designed for ready meals and convenience food applications across multiple regions. Mondi contributes through innovation in paper and hybrid materials that combine functionality with reduced environmental impact while ensuring durability under high heat conditions. Pactiv Evergreen holds a strong presence in North America with extensive product offerings for foodservice and retail sectors, supporting quick-service restaurants and meal delivery.

Tetra Pak brings expertise in food-safe processing and packaging by expanding into ovenable solutions that complement its long-standing leadership in liquid food packaging. Sealed Air contributes with protective and performance-based materials that ensure product safety during distribution and reheating. Sonoco enhances the competitive space with rigid trays and containers designed to meet the needs of ready meal manufacturers and large retailers. Collectively, these companies drive innovation, safety, and convenience, shaping the global dual ovenable trays and containers market.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.9 Billion |

| Material Type | Crystallized Polyethylene Terephthalate (C-PET), Amorphous Polyethylene Terephthalate (A-PET), Polypropylene (PP), Polyethylene (PE), Paper, and Others |

| Product Type | Trays, Bowls, Clamshells, and Lids |

| End Use | Meat, seafood, and poultry, Snacks food, Ready to eat meals, Frozen food, Bakery products, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Amcor, Huhtamaki, Mondi, Pactiv (Pactiv Evergreen), Tetra Pak, Sealed Air, and Sonoco |

| Additional Attributes | Dollar sales by tray and container type and application, demand dynamics across food service, retail, and ready meal sectors, regional trends in convenience packaging adoption, innovation in heat resistance, lightweight materials, and design, environmental impact of plastic and paper-based waste, and emerging use cases in sustainable packaging and premium ready-to-eat meals. |

The global dual ovenable trays and containers market is estimated to be valued at USD 1.9 billion in 2025.

The market size for the dual ovenable trays and containers market is projected to reach USD 2.8 billion by 2035.

The dual ovenable trays and containers market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in dual ovenable trays and containers market are crystallized polyethylene terephthalate (c-pet), amorphous polyethylene terephthalate (a-pet), polypropylene (pp), polyethylene (pe), paper and others.

In terms of product type, trays segment to command 55.0% share in the dual ovenable trays and containers market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dual Clutch Transmission Market Size and Share Forecast Outlook 2025 to 2035

Dual Frequency Ultrasonic Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Dual-Cure Luting Cements Market Size and Share Forecast Outlook 2025 to 2035

Dual Screen Laptops Market Size and Share Forecast Outlook 2025 to 2035

Dual Relay Board Market Size and Share Forecast Outlook 2025 to 2035

Dual Chamber Dispensing Bottles Market Size and Share Forecast Outlook 2025 to 2035

Dual Voltage Comparator Market Size and Share Forecast Outlook 2025 to 2035

Dual-Phase Cleanser Market Size and Share Forecast Outlook 2025 to 2035

The Dual Balloon Angioplasty Catheter Market is segmented by Peripheral, and Coronal from 2025 to 2035

Dual Biomarker Assays Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Dual Flap Dispensing Closure Market Size & Trends 2025 to 2035

Dual-Chamber Pumps Market Analysis - Size, Share, and Forecast Outlook (2025 to 2035)

Dual Axis Solar Tracker Market Growth - Trends & Forecast 2025 to 2035

Dual Chamber Bottle Market Insights – Size, Trends & Forecast 2024-2034

Dual Containment Pipe Market Growth – Trends & Forecast 2024-2034

Dual and Multi-Energy Computed Tomography (CT) Market Size and Share Forecast Outlook 2025 to 2035

Dual Ovenable Lidding Films Market by Material, Seal Type, Application & Region - Forecast 2025 to 2035

Market Share Breakdown of Dual Ovenable Lidding Films Manufacturers

Dual-Ovenable Cook Trays Market

Residual Current Circuit Breaker Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA