The dual ovenable lidding films industry transforms itself due to new changes in consumer demand for ready-to-eat meals, sustainability, and food safety regulations. Convenience plays a major role in consumer behavior, thus presenting the need for durable, heat-resistant, and longer shelf-life packaging solutions. All brands are making a shift to value recyclability, compostability, and use of high-barrier films.

In order to preserve freshness and evolve with food safety standards, manufacturers invest in heat-sealable coatings, anti-fog technologies, and high-barrier films. The films that the industry tends to turn towards are PET based, bio-based, and multilayer as they get better performance, reduced plastic waste, and recyclability optimization.

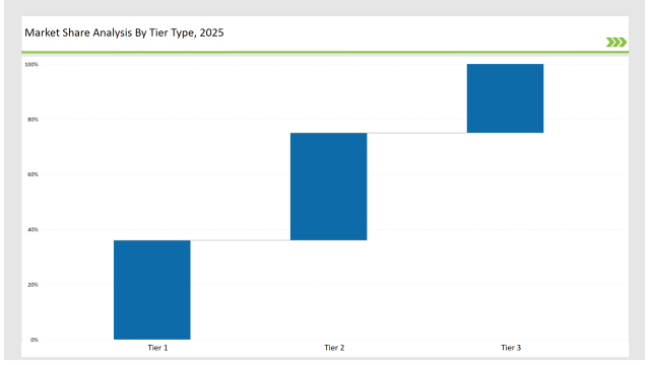

Tier 1 players include Amcor, Sealed Air, and Berry Global, together owning 36% of the market through their experience in high-performance films, large-scale production, and strong strategic partnerships with food manufacturers.

Tier 2 comprises companies such as Mondi Group, Winpak, and Sonoco and attracts 39% of market share by providing economical, tailored, and innovative dual ovenable lidding solutions through which frozen and refrigerated as well as shelf-stable meals are packed.

Tier 3 consists of regional and niche players specializing in eco-friendly materials, advanced sealing technologies, and unique packaging designs, holding 25% of the market. These companies focus on localized production, lightweight materials, and high-barrier properties.

| Category | Market Share (%) |

|---|---|

| Top 3 (Amcor, Sealed Air, Berry Global) | 16% |

| Rest of Top 5 (Mondi Group, Winpak) | 12% |

| Next 5 of Top 10 (Sonoco, UFlex, Klöckner Pentaplast, Flair Flexible, Constantia Flexibles) | 8% |

The dual ovenable lidding films industry serves multiple sectors where convenience, food safety, and sustainability are essential. Companies are developing high-barrier packaging solutions to meet the growing demand for microwave- and oven-safe meal solutions.

Manufacturers are optimizing dual ovenable lidding film production with advanced sealing properties, sustainability, and clarity.

Sustainability and high-performance packaging are transforming the dual ovenable lidding films industry. Companies are adopting AI-driven quality control, recyclable PET-based films, and high-clarity solutions to meet the latest food safety and sustainability standards. They are also engineering thinner, high-barrier films to reduce plastic usage while maintaining durability. Manufacturers are implementing automated inspection systems to improve product consistency and reduce waste. Additionally, firms are enhancing lidding films with laser-scored easy-peel technology to improve consumer convenience.

Technology suppliers should focus on automation, sustainable material innovation, and intelligent sealing solutions to support the evolving dual ovenable lidding films market. Partnering with food manufacturers and regulatory bodies will drive market growth.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Amcor, Sealed Air, Berry Global |

| Tier 2 | Mondi Group, Winpak, Sonoco |

| Tier 3 | UFlex, Klöckner Pentaplast, Flair Flexible, Constantia Flexibles |

Leading manufacturers are advancing dual ovenable lidding film technology with AI-driven production, sustainable materials, and high-performance barrier solutions.

| Manufacturer | Latest Developments |

|---|---|

| Amcor | Launched fully recyclable PET lidding films in March 2024. |

| Sealed Air | Introduced high-peel strength, dual ovenable films in April 2024. |

| Berry Global | Expanded self-venting and anti-fog film offerings in May 2024. |

| Mondi Group | Released bio-based, compostable lidding films in June 2024. |

| Winpak | Strengthened tamper-evident sealing technology in July 2024. |

| Sonoco | Innovated high-clarity, ultra-thin recyclable films in August 2024. |

| UFlex | Developed multilayer high-barrier lidding films in September 2024. |

The dual ovenable lidding films market is evolving as companies focus on sustainability, clarity, and enhanced sealing performance.

The industry will continue integrating AI-driven sealing technologies, sustainable materials, and smart tracking for food safety. As regulations tighten, manufacturers will accelerate the adoption of recyclable and bio-based lidding films. Companies will also enhance supply chain efficiency with blockchain-enabled traceability. Businesses will adopt energy-efficient manufacturing techniques to reduce carbon emissions. They will invest in multi-layer high-barrier films to enhance product shelf life. Additionally, firms will develop resealable lidding films to improve convenience and reduce food waste.

Leading players include Amcor, Sealed Air, Berry Global, Mondi Group, Winpak, Sonoco, and UFlex.

The top 3 players collectively control 16% of the global market.

The market shows medium concentration, with top players holding 36%.

Key drivers include sustainability, food safety, heat resistance, and automation.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dual Air Chamber Hydro-pneumatic Suspension Market Size and Share Forecast Outlook 2025 to 2035

DualMode Automated Tow Tractor Market Size and Share Forecast Outlook 2025 to 2035

Dual Clutch Transmission Market Size and Share Forecast Outlook 2025 to 2035

Dual Frequency Ultrasonic Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Dual-Cure Luting Cements Market Size and Share Forecast Outlook 2025 to 2035

Dual Screen Laptops Market Size and Share Forecast Outlook 2025 to 2035

Dual Relay Board Market Size and Share Forecast Outlook 2025 to 2035

Dual Chamber Dispensing Bottles Market Size and Share Forecast Outlook 2025 to 2035

Dual Voltage Comparator Market Size and Share Forecast Outlook 2025 to 2035

Dual and Multi-Energy Computed Tomography (CT) Market Size and Share Forecast Outlook 2025 to 2035

Dual-Phase Cleanser Market Size and Share Forecast Outlook 2025 to 2035

The Dual Balloon Angioplasty Catheter Market is segmented by Peripheral, and Coronal from 2025 to 2035

Dual Biomarker Assays Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Dual Flap Dispensing Closure Market Size & Trends 2025 to 2035

Dual-Chamber Pumps Market Analysis - Size, Share, and Forecast Outlook (2025 to 2035)

Dual Axis Solar Tracker Market Growth - Trends & Forecast 2025 to 2035

Dual Chamber Bottle Market Insights – Size, Trends & Forecast 2024-2034

Dual Containment Pipe Market Growth – Trends & Forecast 2024-2034

Dual Ovenable Trays and Containers Market Size and Share Forecast Outlook 2025 to 2035

Dual-Ovenable Cook Trays Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA