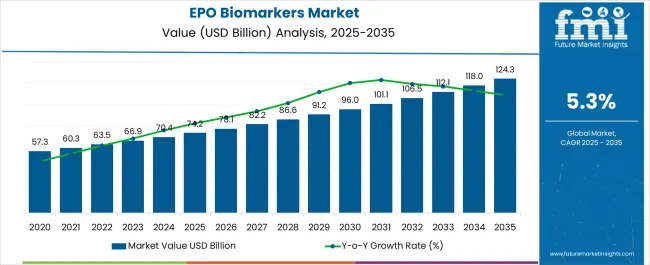

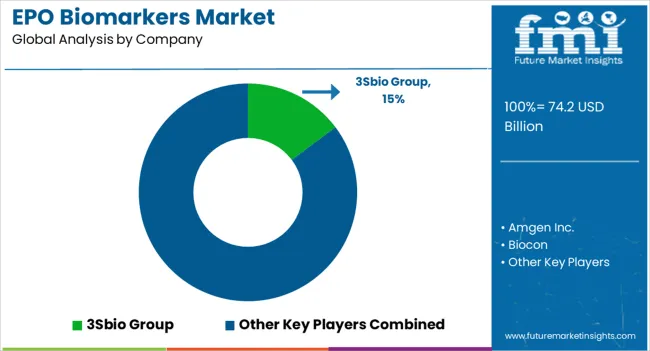

The EPO Biomarkers Market is estimated to be valued at USD 74.2 billion in 2025 and is projected to reach USD 124.3 billion by 2035, registering a compound annual growth rate (CAGR) of 5.3% over the forecast period.

| Metric | Value |

|---|---|

| EPO Biomarkers Market Estimated Value in (2025 E) | USD 74.2 billion |

| EPO Biomarkers Market Forecast Value in (2035 F) | USD 124.3 billion |

| Forecast CAGR (2025 to 2035) | 5.3% |

The EPO biomarkers market is experiencing steady growth, supported by the increasing role of biomarkers in enhancing diagnostic accuracy, patient monitoring, and treatment optimization for chronic conditions. Erythropoietin biomarkers are widely utilized to assess anemia and related disorders, particularly in patients undergoing renal replacement therapies. The growing prevalence of chronic kidney disease and end stage renal disorders is reinforcing the need for early detection and efficient management, thereby driving demand for EPO biomarkers.

Technological advancements in molecular diagnostics, coupled with rising investments in precision medicine, are expanding the application scope of these biomarkers across diverse clinical settings. Regulatory encouragement for biomarker-based testing in personalized treatment regimens is also accelerating market adoption.

In addition, the emphasis on reducing hospitalization costs through timely disease management is influencing healthcare providers to integrate biomarker testing into routine clinical practice As healthcare systems worldwide shift toward outcome-driven models, the market for EPO biomarkers is poised to benefit from increasing clinical validation, growing patient awareness, and wider adoption in hospital and research environments.

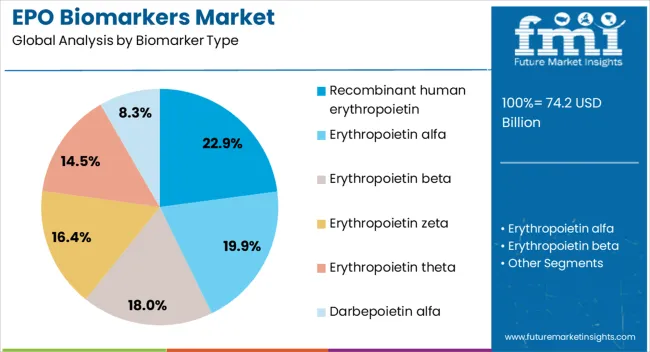

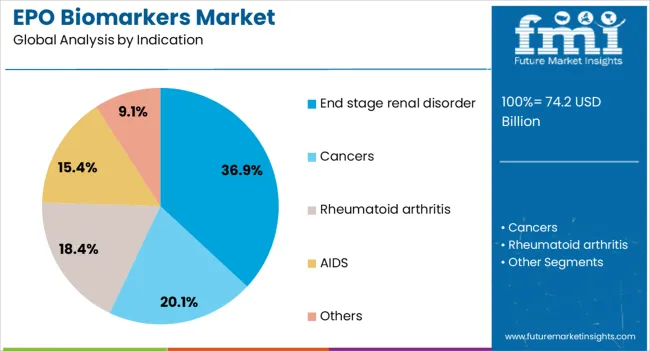

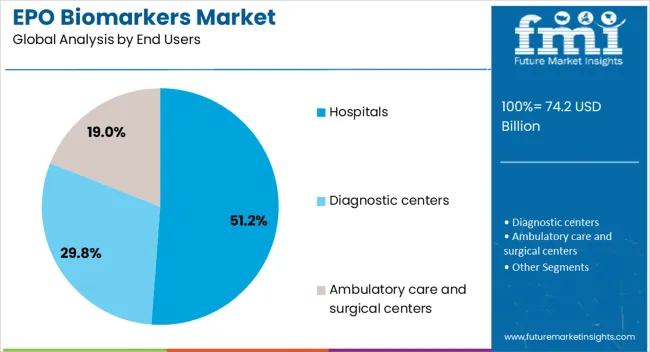

The epo biomarkers market is segmented by biomarker type, indication, end users, and geographic regions. By biomarker type, epo biomarkers market is divided into Recombinant human erythropoietin, Erythropoietin alfa, Erythropoietin beta, Erythropoietin zeta, Erythropoietin theta, and Darbepoietin alfa. In terms of indication, epo biomarkers market is classified into End stage renal disorder, Cancers, Rheumatoid arthritis, AIDS, and Others. Based on end users, epo biomarkers market is segmented into Hospitals, Diagnostic centers, and Ambulatory care and surgical centers. Regionally, the epo biomarkers industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The recombinant human erythropoietin biomarker type segment is projected to hold 22.9% of the EPO biomarkers market revenue share in 2025, positioning it as the leading biomarker type. This dominance is being driven by its widespread use in detecting and monitoring anemia linked with chronic kidney disease and other hematological conditions. The biomarker enables accurate assessment of erythropoietin activity, supporting physicians in determining appropriate therapeutic strategies and dosage adjustments.

Its clinical relevance is further strengthened by its ability to provide reliable insights into the effectiveness of erythropoietin-stimulating agents used in patient care. The segment’s growth is supported by ongoing research and development initiatives that are expanding its utility across oncology and hematology.

Increasing awareness among clinicians about the role of recombinant biomarkers in guiding treatment decisions is further reinforcing adoption As personalized medicine becomes more integrated into routine healthcare delivery, the reliance on recombinant human erythropoietin biomarkers for precise disease evaluation is anticipated to strengthen their leading position in the global market.

The end stage renal disorder indication segment is expected to account for 36.9% of the EPO biomarkers market revenue share in 2025, making it the leading indication. This dominance is being reinforced by the high global prevalence of advanced kidney diseases requiring dialysis and transplantation. EPO biomarkers are critical in assessing anemia severity in these patients, ensuring timely intervention and guiding therapeutic approaches.

The use of these biomarkers provides clinicians with valuable insights into the adequacy of treatment regimens, particularly in relation to erythropoietin therapy and iron supplementation. Rising incidence of diabetes and hypertension, which are major contributors to renal failure, is further expanding the patient pool for biomarker testing.

Healthcare systems are increasingly emphasizing early detection and management of anemia in renal patients to improve quality of life and reduce hospital readmissions As nephrology practices integrate biomarker-based approaches into standard protocols, the end stage renal disorder segment is expected to maintain its leadership, supported by consistent clinical demand and expanding global dialysis populations.

The hospitals end user segment is projected to capture 51.2% of the EPO biomarkers market revenue share in 2025, positioning it as the largest end-use setting. Its leadership is being supported by the concentration of advanced diagnostic facilities and the availability of trained professionals capable of performing biomarker-based tests.

Hospitals are the primary point of care for patients with anemia, renal disorders, and oncology-related complications, which increases their reliance on biomarker testing for accurate diagnosis and treatment planning. The segment’s growth is also being fueled by the integration of biomarker-based testing into comprehensive patient management pathways, supported by electronic health records and clinical decision support systems.

Strong investment in diagnostic infrastructure, coupled with regulatory frameworks that prioritize biomarker validation for clinical use, is further reinforcing adoption in hospitals With the rising burden of chronic diseases requiring long-term management, hospitals are expected to continue as the dominant end-user segment, driven by their ability to provide timely, large-scale, and high-quality diagnostic services to diverse patient populations.

As EPO biomarkers can be used to identify and diagnose several types of cancers, thus, their use has grown over the past few years. Comparing EPO biomarkers to other types of biomarkers like CA125, CA15-3, PSA, and others, it is known that they are more sensitive, specific, and accurate.

Therefore, it is anticipated that during the forecast period, the demand for more accurate and reliable diagnostics and therapeutics is likely to increase along with the number of oncology patients.

The high potential for revenue in the EPO biomarkers market draws potential investors. Increased awareness of the advantages of early diagnosis, an increase in the frequency of chronic diseases, a boom in the biotechnology and pharmaceutical industries, and technological advancements in biomarker detection leads to the higher adoption of EPO biomarkers.

Due to the increasing launch and adoption of Erythropoietin Alfa in cancer patients who suffer from anemia, the EPO biomarkers market is anticipated to experience significant growth over the course of the forecast period.

For instance, in November 2025, Pfizer introduced Retacrit, an Epoetin Alfa biosimilar, at a price that was 33% lower than that of the brand-name medications in the United States to treat anemia brought on by chemotherapy and chronic kidney disease.

The prime drivers for the market include growing incidence of cancers and renal diseases. Changes in lifestyle and improper eating habits contribute to pancreatic and endocrine cancers, which often lead to severe anaemia, where external erythropoietin infusion is required. Other drivers for the EPO biomarker market is technological advancement in devising proprietary testing methods apart from tried and tested ones.

Restraints for the market include lack of availability of skilled labour and sufficient quality controlled testing laboratories in most countries in less developed regions. Insufficient R&D in identification of biomarkers due to adoption of cost cutting measures in European regions is expected to restrain proper quantitative assessment of drugs and their therapeutic efficacy in blood.

This could also hamper progress of ongoing clinical trials and proper stratification of patients.

EPO biomarker market is account to rise in value during the forecast period. Due to expansion in the product segment of EPO biomarkers the market share will be rising with a promising rate, also with the increase in demand for diagnosis and treatment of widely spread chronic disease the EPO market is expected to grow with a promising CAGR during the forecast period.

Biologic drug industry is investing on R&D and the key players are focusing on increasing their production capacity for EPO biomarkers.

Considering all potential geographic regions, EPO biomarkers market is segmented into seven key regions: North America, Latin America, Eastern Europe, Western Europe, Japan, Asia Pacific and Middle East & Africa.

North America is been dominating in the EPO biomarkers due to rise in acceptance for bio-similar weakly followed by Western and Eastern Europe, Asia Pacific has a dominating presence in EPO biomarker market and most of the key players are locally producing the EPO biomarkers, that is enhancing their market share and product reach. There is a good opportunity for Japan in EPO biomarker market.

The emerging regions in Asia Pacific, Middle East and Africa holds promising future for rise in EPO biomarker market, due to increase in awareness towards the chronic disease and increase in population simultaneously.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

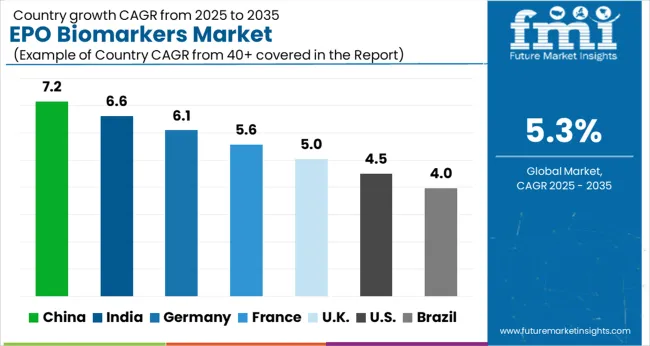

| Country | CAGR |

|---|---|

| China | 7.2% |

| India | 6.6% |

| Germany | 6.1% |

| France | 5.6% |

| UK | 5.0% |

| USA | 4.5% |

| Brazil | 4.0% |

The EPO Biomarkers Market is expected to register a CAGR of 5.3% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 7.2%, followed by India at 6.6%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 4.0%, yet still underscores a broadly positive trajectory for the global EPO Biomarkers Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 6.1%. The USA EPO Biomarkers Market is estimated to be valued at USD 28.0 billion in 2025 and is anticipated to reach a valuation of USD 43.6 billion by 2035. Sales are projected to rise at a CAGR of 4.5% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 3.8 billion and USD 2.3 billion respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 74.2 Billion |

| Biomarker Type | Recombinant human erythropoietin, Erythropoietin alfa, Erythropoietin beta, Erythropoietin zeta, Erythropoietin theta, and Darbepoietin alfa |

| Indication | End stage renal disorder, Cancers, Rheumatoid arthritis, AIDS, and Others |

| End Users | Hospitals, Diagnostic centers, and Ambulatory care and surgical centers |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | 3Sbio Group, Amgen Inc., Biocon, Bio-Rad Laboratories Inc., Eve Technologies, F. Hoffmann-La Roche Ltd, Merck KGaA, Pfizer Inc., Siemens Healthineers AG, Kyowa Kirin Co. Ltd, GenScript, and Bioagilytix Labs |

The global epo biomarkers market is estimated to be valued at USD 74.2 billion in 2025.

The market size for the epo biomarkers market is projected to reach USD 124.3 billion by 2035.

The epo biomarkers market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in epo biomarkers market are recombinant human erythropoietin, erythropoietin alfa, erythropoietin beta, erythropoietin zeta, erythropoietin theta and darbepoietin alfa.

In terms of indication, end stage renal disorder segment to command 36.9% share in the epo biomarkers market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Epoxy Casting Potting Resin Market Size and Share Forecast Outlook 2025 to 2035

Epoxy Resin Industry Analysis in Asia Pacific Size and Share Forecast Outlook 2025 to 2035

Epoxy Type Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Epoxy Grouts Market Size and Share Forecast Outlook 2025 to 2035

Epoxidized Soybean Oil Market Size and Share Forecast Outlook 2025 to 2035

Epoxy Putty and Construction Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Epoxy Active Diluent Market Size and Share Forecast Outlook 2025 to 2035

Epoxy Composite Market Size and Share Forecast Outlook 2025 to 2035

Epoxy Paint Thinner Market Growth - Trends & Forecast 2025 to 2035

Epoxy Curing Agent Market Growth - Trends & Forecast 2025 to 2035

Epoxy Paint Market Growth – Trends & Forecast 2024-2034

Epoxy Resin Market Growth – Trends & Forecast 2024-2034

Epoxy Encapsulation Material Market

Repositionable Labels Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Repositionable Labels Manufacturers

Repositioning and Offloading Market – Trends & Forecast 2024 to 2034

Repositioning & Offloading Devices Market – Demand & Forecast 2024 to 2034

Reporter Systems Market

2K Epoxy Adhesives Market Size and Share Forecast Outlook 2025 to 2035

CV Depot Charging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA