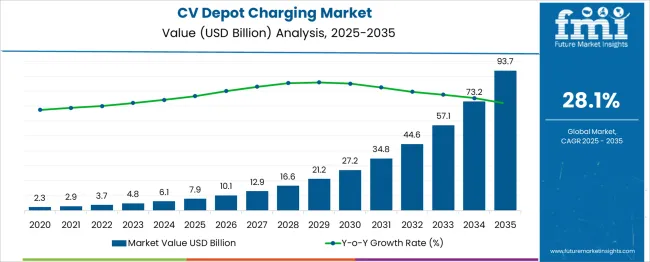

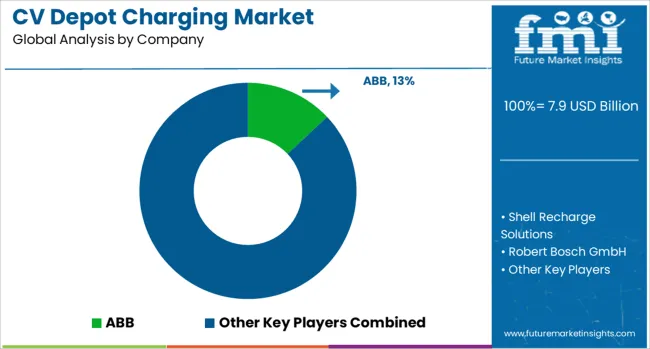

The CV Depot Charging Market is estimated to be valued at USD 7.9 billion in 2025 and is projected to reach USD 93.7 billion by 2035, registering a compound annual growth rate (CAGR) of 28.1% over the forecast period. Supported by a strong CAGR of 28.1%, this growth is driven by the rapid electrification of commercial fleets, including buses, trucks, and logistics vehicles, as governments and businesses increasingly invest in sustainable, low-emission solutions.

In the first five years (2025 to 2030), the market is expected to rise from USD 7.9 billion to USD 27.2 billion, adding USD 19.3 billion, which accounts for 22.5% of the total incremental growth. The second phase (2030 to 2035) contributes USD 66.5 billion, representing 77.5% of incremental growth, signaling robust momentum as infrastructure expansion for electric vehicles (EVs) and government policies supporting green transportation accelerate.

Annual increments rise from USD 3.6 billion in early years to USD 16.1 billion by 2035, reflecting the growing need for depot charging solutions in line with the global shift toward carbon-neutral transportation. Manufacturers focusing on fast-charging technology, scalable infrastructure, and energy management systems will capture significant value in this USD 85.8 billion opportunity.

| Metric | Value |

|---|---|

| CV Depot Charging Market Estimated Value in (2025 E) | USD 7.9 billion |

| CV Depot Charging Market Forecast Value in (2035 F) | USD 93.7 billion |

| Forecast CAGR (2025 to 2035) | 28.1% |

The CV depot charging market is progressing steadily as the shift toward electric commercial vehicles gains momentum, supported by urban decarbonization goals, operational cost advantages, and advancements in fast-charging infrastructure. Fleet operators are prioritizing depot-based solutions to ensure operational readiness, predictable charging schedules, and lower total cost of ownership.

Governments and municipalities are reinforcing this trend through incentives for infrastructure deployment and stricter emissions regulations for urban fleets. Continued improvements in charger efficiency, vehicle-to-grid capabilities, and intelligent energy management systems are paving the way for broader adoption.

Future growth opportunities are expected to arise from integration with renewable energy sources, scalable modular designs, and digital platforms for managing energy consumption, all contributing to the long-term viability of depot-based charging ecosystems.

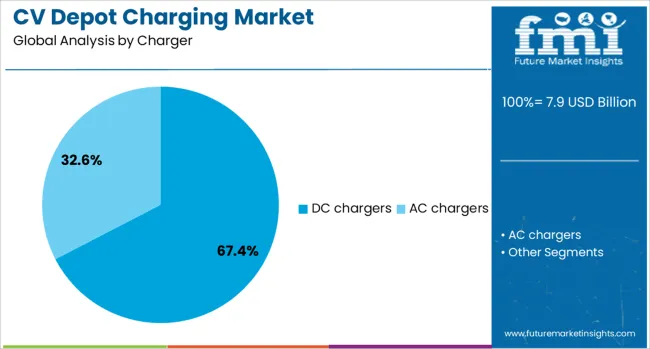

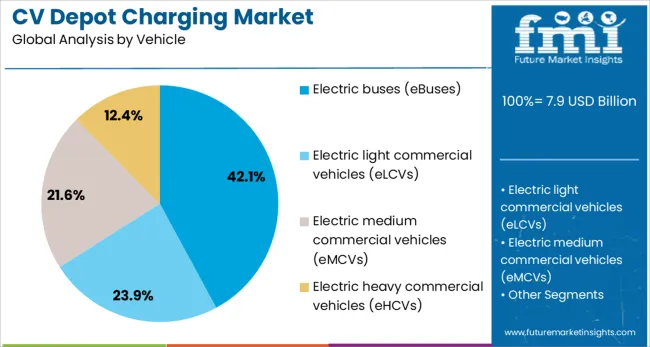

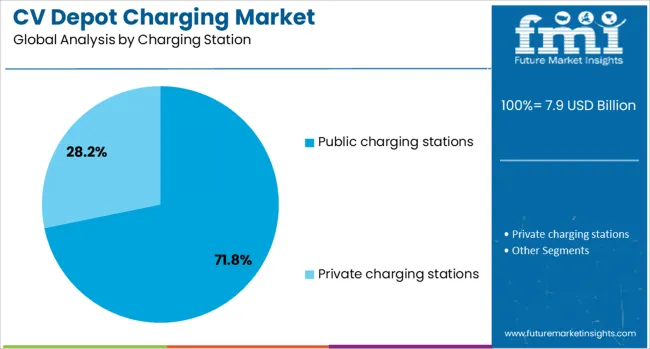

The CV depot charging market is segmented by charger type, vehicle type, charging station type, power output, and geographic region. By charger, the CV depot charging market is divided into DC chargers and AC chargers. In terms of vehicles, the CV depot charging market is classified into Electric buses (eBuses), Electric light commercial vehicles (eLCVs), Electric medium commercial vehicles (eMCVs), and Electric heavy commercial vehicles (eHCVs). Based on the charging station of the CV depot, the charging market is segmented into Public charging stations and Private charging stations. By power output of the CV depot charging market is segmented into Above 150 kW, Up to 50 kW51–150 kW. Regionally, the CV depot charging industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by charger type, DC chargers are anticipated to hold 67.4% of the total market revenue in 2025, securing their position as the leading segment. This leadership has been shaped by the superior charging speed and efficiency offered by DC technology, which is essential for meeting the high-utilization demands of commercial fleets.

The ability of DC chargers to minimize downtime and maximize vehicle availability has aligned well with the operational priorities of fleet managers. Enhanced power delivery capabilities, compatibility with heavy-duty vehicles, and continuous technological advancements have further strengthened this segment’s dominance.

Moreover, growing deployment of high-capacity depots equipped with multiple DC units has contributed to economies of scale, reinforcing the preference for this solution across commercial vehicle operations.

Segmenting by vehicle type shows that electric buses are projected to account for 42.1% of the market revenue in 2025, making them the most prominent vehicle category. This prominence has been underpinned by large-scale public transit electrification initiatives and the pressing need to reduce urban air pollution.

The operational predictability of bus routes has enabled fleet operators to optimize depot charging schedules, ensuring consistent service levels without range anxiety. The capacity of depots to accommodate large bus fleets and support overnight or opportunity charging has aligned with the operational requirements of transit authorities.

Additionally, the economic benefits of reduced fuel and maintenance costs, alongside compliance with regulatory mandates for zero-emission public transport, have propelled electric buses to the forefront of depot charging demand.

When segmented by charging station type, public charging stations are expected to capture 71.8% of the market revenue in 2025, solidifying their leadership in the market. This dominance has been driven by the increasing need to provide accessible, high-capacity charging infrastructure to support growing electric fleet operations.

The strategic deployment of public depot facilities has allowed fleet operators to leverage shared infrastructure while reducing capital expenditure associated with private depot installations. Public stations have been designed to accommodate diverse vehicle types and fleet sizes, enhancing flexibility and utilization rates.

Furthermore, collaborative efforts between municipalities, utilities, and private operators have facilitated rapid expansion of public depot networks, ensuring widespread availability and supporting the electrification of commercial transportation at scale.

The CV depot charging market is experiencing growth driven by increasing demand for electric commercial vehicles (EVs) and supporting infrastructure. In 2024 and 2025, growth drivers include the shift towards electric transportation and government incentives promoting clean energy. Opportunities arise in the development of fast-charging infrastructure and expansion of EV fleets. Emerging trends focus on smart charging solutions and integration with renewable energy. However, high infrastructure costs and the lack of standardized charging systems remain significant market restraints.

The major growth driver in the CV depot charging market is the rise of electric commercial vehicles (EVs). In 2024, government initiatives and regulations aimed at reducing emissions led to an increase in the adoption of electric trucks and buses. This shift towards electric transportation is expected to continue in 2025, driving demand for charging infrastructure at depots. As fleet operators transition to EVs, the need for specialized, efficient charging solutions in commercial transport hubs is growing.

Opportunities in the CV depot charging market lie in the expansion of fast-charging infrastructure. In 2025, the development of fast-charging stations for electric commercial vehicles is expected to gain significant momentum. This market shift is driven by the need for reduced downtime for fleets and faster turnaround times. As more depots adopt rapid charging solutions, significant opportunities will emerge in providing high-speed charging stations for EV fleets in urban and industrial areas, enhancing fleet efficiency.

Emerging trends in the CV depot charging market include the adoption of smart charging solutions and integration with renewable energy sources. In 2024, the focus shifted to enhancing charging infrastructure with advanced technologies like AI, enabling smart charging for EV fleets. This technology optimizes energy consumption and facilitates charging during off-peak hours. Additionally, integrating renewable energy sources such as solar and wind with charging stations is becoming increasingly popular, helping to make depot charging more efficient and cost-effective.

The major market restraints for the CV depot charging market include high infrastructure costs and the lack of standardization. In 2024 and 2025, the installation of electric vehicle charging stations at depots remained a capital-intensive process, especially with the need for high-capacity equipment. Additionally, the absence of universal charging standards across different EV models and charging station providers created compatibility challenges. These barriers hinder the widespread adoption of depot charging infrastructure and could delay market growth, particularly in emerging regions.

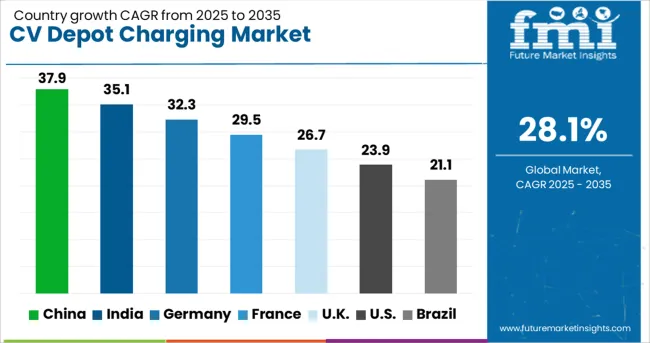

| Country | CAGR |

|---|---|

| China | 37.9% |

| India | 35.1% |

| Germany | 32.3% |

| France | 29.5% |

| UK | 26.7% |

| USA | 23.9% |

| Brazil | 21.1% |

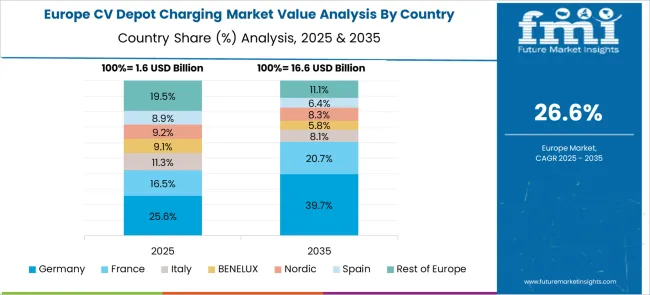

The global CV depot charging market is experiencing rapid growth, with a projected CAGR of 28.1% from 2025 to 2035. China leads with a remarkable 37.9% CAGR, followed by India at 35.1%, and France at 29.5%. The United Kingdom records a growth rate of 26.7%, while the United States shows the slowest growth among the profiled markets at 23.9%. These differences in growth rates are largely influenced by regional government policies, industrial infrastructure, and the pace of electric vehicle (EV) adoption. While countries like China and India are benefiting from large-scale infrastructure developments and government incentives, more mature markets like the USA and UK see moderate growth due to existing infrastructure and established EV penetration. This report provides a comprehensive analysis of the leading markets for CV depot charging technologies.

The CV depot charging market in China is projected to grow at an exceptional CAGR of 37.9%, driven by rapid advancements in electric vehicle (EV) infrastructure and aggressive government policies. The country’s ambitious green energy initiatives and massive investments in the electrification of transportation networks are key factors propelling this growth. With the world's largest electric vehicle fleet and a growing demand for depot charging solutions, China is poised to maintain its leadership in the global market. The government’s ongoing support for EV adoption and infrastructure development ensures that CV depot charging will continue to see rapid growth, especially in metropolitan areas.

The CV Depot Charging market in India is expected to grow at a CAGR of 35.1%, with rapid adoption of electric vehicles and government incentives boosting the demand for charging infrastructure. India’s expanding urban areas, along with a growing commitment to reducing carbon emissions, are key factors driving this growth. The government's push for electric mobility, supported by the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme, is accelerating the installation of depot charging stations across the country. As India moves towards greener transportation solutions, the demand for CV depot charging solutions will continue to rise, particularly in commercial fleet operations.

The CV depot charging market in France is projected to grow at a CAGR of 29.5%, supported by strong government initiatives to reduce carbon emissions and promote the adoption of electric vehicles. The country’s commitment to sustainability and environmental targets, such as the Paris Agreement, is driving the demand for electric vehicles and charging infrastructure. France’s robust industrial sector, coupled with incentives for fleet electrification, supports the expansion of CV depot charging stations. Additionally, France’s ongoing investment in clean energy technologies and transport infrastructure enhances the adoption of depot charging solutions for commercial vehicles.

The CV depot charging market in the United Kingdom is forecast to grow at a CAGR of 26.7%. As part of its net-zero emissions target by 2050, the UK is heavily investing in the electrification of its transportation sector. The government's policies, including the Road to Zero strategy, are accelerating the adoption of electric vehicles and, consequently, the need for depot charging solutions. The UK is witnessing increasing installation of charging stations in logistics hubs, public transportation depots, and fleet operators as part of the broader strategy to transition to sustainable mobility solutions.

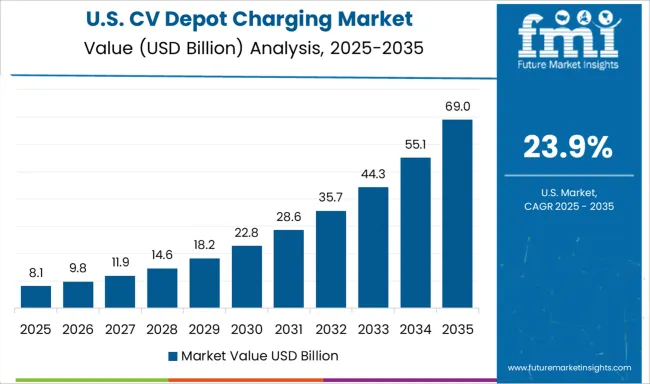

The CV depot charging market in the United States is expected to grow at a CAGR of 23.9%, with increasing adoption of electric vehicles and fleet electrification. While the USA market is more mature, the growth of EV infrastructure and government incentives such as the Infrastructure Investment and Jobs Act are pushing the adoption of depot charging solutions. The shift towards sustainability and decarbonization, particularly in commercial vehicle fleets, is supporting the demand for efficient charging infrastructure. The USA is expected to witness steady growth in depot charging solutions, especially in commercial and public transportation sectors.

The commercial vehicle (CV) depot charging market is evolving rapidly, driven by fleet electrification, operational efficiency requirements, and regulatory mandates targeting emission reduction in urban logistics. ABB and Siemens dominate through modular, high-power charging solutions integrated with fleet management software, allowing real-time load balancing and predictive maintenance for large truck and bus depots. ChargePoint and EVBox focus on scalable depot solutions with cloud-based monitoring and subscription-based service models, targeting fleet operators transitioning to medium-duty electric trucks and buses. Proterra Energy differentiates by offering turnkey depot charging ecosystems, combining chargers, energy storage, and telematics integration for zero-emission fleet operations.

Regional OEMs such as BYD, Tata Motors, and Volvo Trucks provide depot charging packages bundled with vehicle sales, emphasizing compatibility, warranty integration, and local service support. Competition is increasingly defined by charging speed, energy management software, modularity, and integration with renewable energy assets, rather than hardware cost alone. Emerging players target secondary applications such as peak-shaving, V2G capabilities, and smart scheduling to optimize grid utilization. The strategic matrix reflects energy type (AC/DC), software integration, depot scale (small, medium, large fleets), and after-sales support, highlighting that global leaders leverage scale, technology integration, and fleet analytics, while regional players exploit cost-effective modular deployment and local regulatory alignment to capture mid-market fleet segments.

| Item | Value |

|---|---|

| Quantitative Units | USD 7.9 Billion |

| Charger | DC chargers and AC chargers |

| Vehicle | Electric buses (eBuses), Electric light commercial vehicles (eLCVs), Electric medium commercial vehicles (eMCVs), and Electric heavy commercial vehicles (eHCVs) |

| Charging Station | Public charging stations and Private charging stations |

| Power Output | Above 150 kW, Up to 50 kW, and 51–150 kW |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, Shell Recharge Solutions, Robert Bosch GmbH, Schneider Electric, Siemens, KEM Power Oyj, Tesla, ChargePoint, BP Pulse, and Blink Charging Co. |

| Additional Attributes | Dollar sales by charging station type and application, demand dynamics across commercial vehicles, electric buses, and fleet sectors, regional trends in depot charging infrastructure adoption, innovation in fast-charging and smart grid integration technologies, impact of regulatory standards on emissions and energy usage, and emerging use cases in electric vehicle fleets and sustainable logistics. |

The global CV depot charging market is estimated to be valued at USD 7.9 billion in 2025.

The market size for the CV depot charging market is projected to reach USD 93.7 billion by 2035.

The CV depot charging market is expected to grow at a 28.1% CAGR between 2025 and 2035.

The key product types in CV depot charging market are DC chargers and AC chargers.

In terms of vehicle, electric buses (ebuses) segment to command 42.1% share in the CV depot charging market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

CVD Lab-grown Diamond Market Size and Share Forecast Outlook 2025 to 2035

Charging Nitrogen Gas Systems Market Size and Share Forecast Outlook 2025 to 2035

HCV Suspension System Market

HCV Axles Market

HCV Brake Components Market

EV Charging Panelboard Market Forecast Outlook 2025 to 2035

EV Charging Tester Market Size and Share Forecast Outlook 2025 to 2035

EV Charging Cable Market Size and Share Forecast Outlook 2025 to 2035

EV Charging Management Software Platform Market Size and Share Forecast Outlook 2025 to 2035

EV Charging Station Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

eVTOL Charging Facilities Market Size and Share Forecast Outlook 2025 to 2035

Combined Charging System Market Size and Share Forecast Outlook 2025 to 2035

Portable Charging Units Market Size and Share Forecast Outlook 2025 to 2035

Wireless Charging ICs Market Size and Share Forecast Outlook 2025 to 2035

HIV/HBV/HCV Test Kits Market Trends and Forecast 2025 to 2035

Wireless Charging Market Analysis 2025 to 2035 by Technology, Industry Vertical & Region

Magnetic Charging Cable Market Trends - Growth & Forecast 2025 to 2035

Long-acting Depot Systems Market Size and Share Forecast Outlook 2025 to 2035

Wireless Ev Charging Market Size and Share Forecast Outlook 2025 to 2035

Bidirectional Charging Units Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA