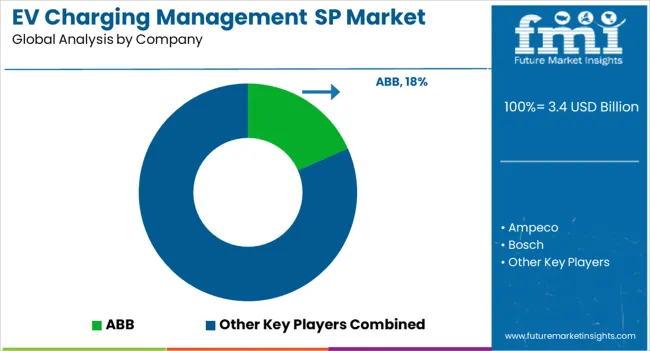

The EV charging management software platform market is estimated to be valued at USD 3.4 billion in 2025 and is projected to reach USD 27.5 billion by 2035, registering a compound annual growth rate (CAGR) of 23.1% over the forecast period.

The EV charging management software platform market, estimated at USD 3.4 billion in 2025 and projected to reach USD 27.5 billion by 2035 with a CAGR of 23.1%, demonstrates a pronounced shift in value contribution across different technological components. Core software modules, including charging session management, real-time monitoring, and analytics, represent the largest share of the market, reflecting the critical role of operational efficiency and data-driven insights in supporting EV infrastructure scalability. Incremental adoption of advanced AI-powered predictive maintenance and dynamic load-balancing technologies is expected to progressively enhance the share of smart management solutions within the total market value.

The forecast growth trajectory from USD 3.4 billion to USD 27.5 billion indicates that cloud-based platforms and integrated Internet of Things modules are increasingly becoming central to market expansion. These technologies facilitate seamless interoperability between charging stations, user applications, and grid management systems, strengthening the overall value proposition for fleet operators, utilities, and individual EV users. The software offerings that enable automated billing, energy optimization, and compliance reporting are gradually accounting for a larger fraction of market revenue, particularly in regions with advanced EV adoption.

Contribution by technology suggests that modular, scalable platforms will dominate revenue generation, while legacy or standalone software solutions will exhibit slower growth rates. As the market advances, companies focusing on integrating AI, machine learning, and IoT capabilities into their platforms are positioned to capture a disproportionately high share of the increasing USD 27.5 billion market, reflecting the pivotal role of technological differentiation in driving revenue and adoption across the EV ecosystem.

| Metric | Value |

|---|---|

| EV Charging Management Software Platform Market Estimated Value in (2025 E) | USD 3.4 billion |

| EV Charging Management Software Platform Market Forecast Value in (2035 F) | USD 27.5 billion |

| Forecast CAGR (2025 to 2035) | 23.1% |

The EV charging management software platform market represents a specialized segment within the global electric vehicle infrastructure and smart energy solutions industry, emphasizing network optimization, user convenience, and operational efficiency. Within the broader EV charging infrastructure sector, it accounts for about 5.5%, driven by the rising adoption of electric vehicles and demand for integrated charging solutions. In the smart grid and energy management systems segment, it holds nearly 4.9%, reflecting the need for real-time monitoring, load balancing, and demand response.

Across the software-as-a-service (SaaS) and IoT-based mobility solutions market, the share is 4.3%, supporting features such as payment processing, reservation management, and remote diagnostics. Within the renewable energy integration and distributed energy resources category, it represents 3.8%, highlighting optimization of electricity sourcing and storage. In the fleet management and commercial mobility sector, it secures 3.4%, emphasizing efficiency, reporting, and predictive analytics for large-scale deployments. Recent developments in this market have focused on cloud computing, AI-driven analytics, and interoperability. Innovations include intelligent load management, dynamic pricing algorithms, and predictive maintenance for charging stations.

Key players are collaborating with EV manufacturers, utility providers, and parking facility operators to expand network connectivity and enhance user experience. Adoption of mobile apps, real-time station status updates, and automated billing systems is gaining traction to improve convenience and accessibility. The integration with renewable energy sources, vehicle-to-grid technology, and smart home energy management platforms is being deployed to optimize energy usage and sustainability. These trends demonstrate how technology, connectivity, and efficiency are shaping the market.

The EV charging management software platform market is expanding rapidly as the adoption of electric vehicles accelerates across global markets. Governments and private stakeholders are investing heavily in charging infrastructure, and software platforms are emerging as critical enablers for efficient operations, billing management, user authentication, and real time monitoring.

Advances in interoperability, predictive maintenance, and integration with renewable energy sources are further enhancing platform capabilities. The growing emphasis on user experience, combined with the need for scalability in both urban and highway networks, is driving innovation in charging management solutions.

Regulatory support for zero emission transportation and incentives for EV adoption are expected to sustain strong demand for these platforms. As the market matures, operators are focusing on optimizing network uptime, energy distribution, and customer engagement, ensuring that the sector remains integral to the broader EV ecosystem.

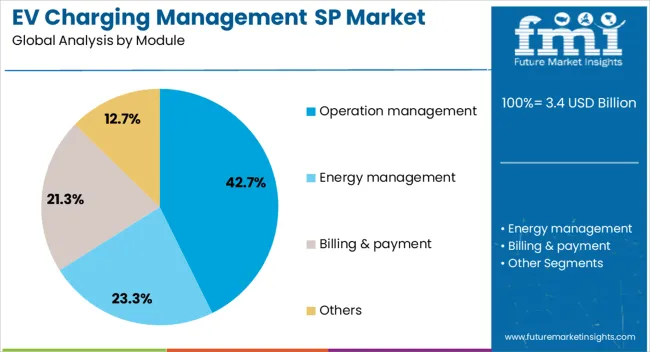

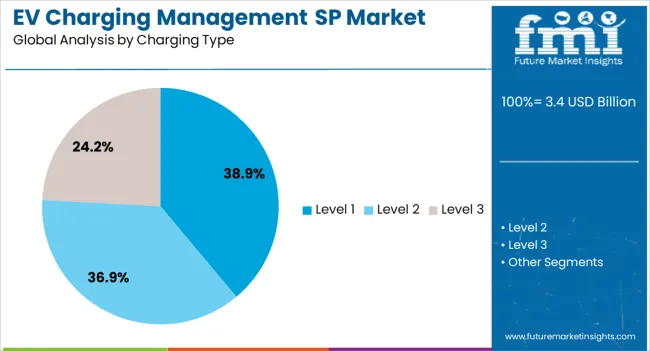

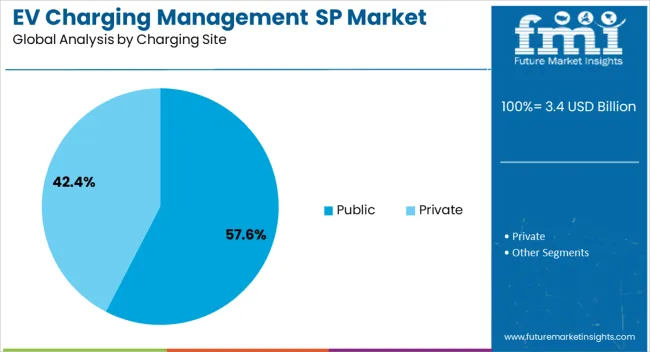

The EV charging management software platform market is segmented by module, charging type, charging site, and geographic regions. By module, EV charging management software platform market is divided into operation management, energy management, billing & payment, and others. In terms of charging type, EV charging management software platform market is classified into level 1, level 2, and level 3. Based on charging site, EV charging management software platform market is segmented into public and private. Regionally, the EV charging management software platform industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The operation management module segment is anticipated to hold 42.7% of total market revenue by 2025 within the module category, making it the leading segment. This dominance is supported by the critical role operation management plays in enabling real time monitoring, network optimization, and fault detection for EV charging infrastructure.

The segment’s growth is being propelled by the need for efficient station management, automated reporting, and improved operational visibility across large charging networks.

Operators are increasingly prioritizing software solutions that streamline workflows, reduce downtime, and enhance energy management, reinforcing the leadership position of this module in the market.

The level 1 charging type segment is projected to account for 38.9% of the total market by 2025, positioning it as the largest segment within charging type. This growth is being driven by its cost effectiveness, ease of deployment, and suitability for residential and workplace charging environments.

Level 1 chargers require minimal infrastructure upgrades, making them an accessible entry point for new EV users and small businesses. Their compatibility with standard electrical outlets and ability to support overnight charging have further encouraged adoption, particularly in regions with growing but still nascent EV markets.

These advantages have cemented level 1 charging as a preferred option in various deployment scenarios.

The public charging site segment is expected to contribute 57.6% of market revenue by 2025, establishing it as the leading segment within the charging site category. Its growth is driven by expanding urban EV adoption, government investment in public infrastructure, and increasing demand for accessible charging in high traffic areas.

Public sites provide essential coverage for drivers without access to private charging, supporting range confidence and enabling long distance travel. Enhanced payment integration, location based services, and multi operator interoperability are further strengthening the appeal of public charging stations.

This strong focus on accessibility and convenience has secured public sites as the dominant segment in the charging site category.

The market has expanded rapidly due to the increasing adoption of electric vehicles and the growing need for smart energy management. These platforms enable seamless monitoring, scheduling, and optimization of charging operations across public and private networks. The integration of real-time analytics, remote control, and IoT connectivity has enhanced user experience while improving grid efficiency. Market growth has been supported by regulatory initiatives promoting clean energy, investment in EV infrastructure, and rising adoption of fleet electrification.

The adoption of electric vehicles has created a significant demand for intelligent charging management solutions. Fleet operators, public charging station providers, and corporate entities have increasingly relied on software platforms to manage multiple charging points efficiently. These systems provide real-time insights into energy consumption, charging status, and predictive maintenance requirements, enabling better operational planning. Integration with mobile applications allows drivers to locate stations, schedule charging, and process payments seamlessly. As electric mobility continues to expand globally, the dependency on sophisticated software platforms has strengthened, making these solutions critical for sustainable fleet operations and scalable charging infrastructure management.

Innovations in cloud computing, IoT, and AI have significantly enhanced EV charging management platforms. Advanced algorithms optimize energy distribution across charging stations, balancing load and preventing grid overloads during peak hours. Remote monitoring and predictive analytics have reduced downtime and improved system reliability. Platforms now support integration with renewable energy sources, enabling smart load management for solar or wind powered stations. Enhanced cybersecurity measures have been incorporated to protect sensitive user and grid data. These technological improvements have not only increased operational efficiency but have also provided greater scalability, enabling expansion of charging networks without compromising performance or safety.

Governmental policies promoting electric mobility have acted as a strong driver for the market. Incentives such as grants, tax credits, and infrastructure funding have encouraged the deployment of managed charging networks. Regulations mandating interoperability, reporting standards, and energy efficiency have increased reliance on software platforms for compliance. Urban centers and smart city projects have prioritized integration of managed charging solutions to facilitate seamless electric vehicle operations. Regulatory emphasis on emission reduction targets has further highlighted the need for efficient energy management, making EV charging software platforms a critical component for infrastructure developers, operators, and municipal planners.

Despite market growth, cost considerations and implementation complexities remain challenges for EV charging management platforms. Advanced software solutions require significant upfront investment, cloud infrastructure, and continuous maintenance, which can deter small charging operators. Integration with existing hardware and ensuring compatibility across different vehicle types and charging standards requires careful planning. Training staff and addressing cybersecurity risks adds further operational overhead. In regions with underdeveloped charging infrastructure, low network density reduces the immediate return on investment. Addressing these financial and technical barriers is essential for broader adoption and long-term scalability of software platforms across both urban and rural charging networks.

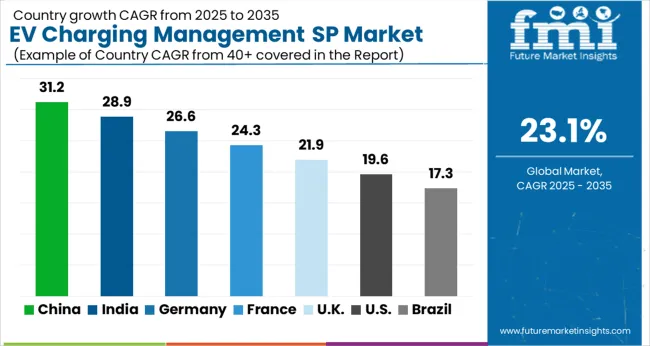

| Country | CAGR |

|---|---|

| China | 31.2% |

| India | 28.9% |

| Germany | 26.6% |

| France | 24.3% |

| UK | 21.9% |

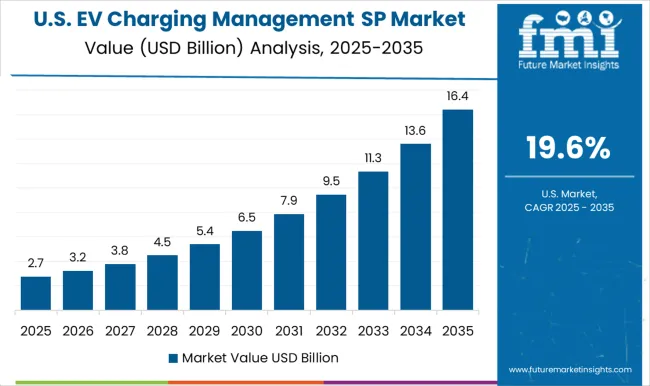

| USA | 19.6% |

| Brazil | 17.3% |

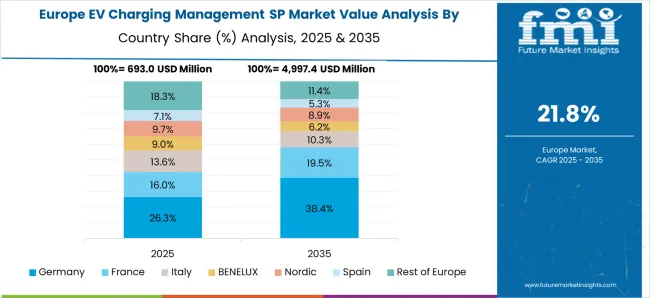

The market is projected to grow at a CAGR of 23.1% from 2025 to 2035, driven by increasing adoption of electric vehicles and expansion of charging infrastructure. Germany reached 26.6%, reflecting strong integration of smart charging solutions in automotive and energy sectors. China recorded 31.2%, supported by rapid EV adoption and government-backed charging network expansion. India achieved 28.9%, fueled by growth in urban mobility electrification and energy management initiatives. The United Kingdom posted 21.9%, where investments in renewable energy integration and fleet electrification drove demand. The United States reached 19.6%, reflecting gradual deployment of advanced charging software and EV ecosystem growth. Together, these countries exemplify global innovation, deployment, and scaling in EV charging management solutions. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to grow at a CAGR of 31.2%, driven by rapid adoption of electric vehicles, government initiatives promoting smart charging infrastructure, and increasing investment in energy management technologies. Adoption has been reinforced by integration of software platforms with mobile applications, payment gateways, and cloud based monitoring systems. Domestic software developers focus on scalable solutions that support fleet operators, public charging networks, and commercial charging stations. The market is further strengthened by collaborations with global OEMs and energy companies for nationwide deployment of smart charging networks.

India is expected to grow at a CAGR of 28.9%, supported by rising EV adoption, government subsidies for charging infrastructure, and growing demand for fleet and residential charging management solutions. Adoption has been reinforced by partnerships between software developers and public utility companies. Domestic companies focus on cloud based platforms with energy optimization, billing, and remote monitoring capabilities. Expansion is also driven by the need to integrate renewable energy sources and ensure efficient utilization of charging stations.

Germany is forecast to grow at a CAGR of 26.6%, influenced by government incentives, EV adoption targets, and emphasis on renewable energy integration. Adoption has been reinforced by public and private charging operators incorporating real time monitoring, predictive maintenance, and billing systems into their networks. Domestic software developers focus on high reliability, cyber security, and integration with mobility services. The market is further supported by expansion of highway and urban charging infrastructure aligned with e-mobility initiatives.

The United Kingdom market is expected to grow at a CAGR of 21.9%, supported by adoption of smart charging solutions for commercial fleets, residential buildings, and public charging stations. Imports of specialized software platforms complement domestic offerings, while cloud based monitoring, load management, and energy optimization tools are increasingly integrated. Demand is reinforced by government policies targeting carbon neutrality and increasing EV adoption in urban areas. Market growth is further supported by collaboration between energy providers and software developers for nationwide deployment.

The United States is projected to expand at a CAGR of 19.6%, driven by rapid EV adoption, expansion of public and private charging infrastructure, and investments in software platforms for energy and load management. Adoption has been reinforced by integration of mobile apps, payment systems, and smart grid connectivity. Domestic developers focus on scalable and cloud based solutions, while partnerships with energy companies and fleet operators enhance reach. The market outlook is positive, supported by regulatory incentives and growing interest in efficient charging solutions.

The market is dominated by a mix of established industrial technology providers, dedicated EV charging solution companies, and software-focused innovators. ABB and Bosch leverage their extensive infrastructure expertise, hardware integration capabilities, and global deployment experience to offer comprehensive management solutions for public and private charging networks. Enel X, EVBox, and ChargePoint capitalize on scalable cloud-based platforms, networked charger interoperability, and user-centric applications to attract commercial, fleet, and residential clients.

ChargeLab, EV Connect, Lincoln, Ampeco, and Current differentiate themselves by focusing on flexible software-as-a-service models, real-time analytics, billing management, and smart energy optimization features. These players emphasize ease of deployment, seamless integration with renewable energy sources, and advanced data insights to support energy efficiency and operational efficiency for EV operators. Market competition is increasingly shaped by the ability to combine robust cybersecurity, predictive maintenance, and interoperability across diverse charging hardware. Strategic partnerships, continuous platform innovation, and localized support networks are key factors influencing market positioning and adoption rates among commercial, fleet, and residential segments globally.

| Items | Values |

|---|---|

| Quantitative Units | USD 3.4 billion |

| Module | Operation management, Energy management, Billing & payment, and Others |

| Charging Type | Level 1, Level 2, and Level 3 |

| Charging Site | Public and Private |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, Ampeco, Bosch, ChargeLab, ChargePoint, Current, Enel X, EV Connect, EVBox, and Lincoln |

| Additional Attributes | Dollar sales by software type and application, demand dynamics across residential, commercial, and public charging infrastructure, regional trends in EV adoption and smart grid integration, innovation in real-time monitoring, load balancing, and user interface, environmental impact of optimized energy consumption, and emerging use cases in fleet charging management, dynamic pricing, and renewable energy integration. |

The global ev charging management software platform market is estimated to be valued at USD 3.4 billion in 2025.

The market size for the ev charging management software platform market is projected to reach USD 27.5 billion by 2035.

The ev charging management software platform market is expected to grow at a 23.1% CAGR between 2025 and 2035.

The key product types in ev charging management software platform market are operation management, energy management, billing & payment and others.

In terms of charging type, level 1 segment to command 38.9% share in the ev charging management software platform market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

EV Transmission System Market Size and Share Forecast Outlook 2025 to 2035

EV Charger Converter Module Market Forecast Outlook 2025 to 2035

Evacuated Miniature Crystal Oscillator (EMXO) Market Forecast and Outlook 2025 to 2035

Evaporative Air Cooler Market Size and Share Forecast Outlook 2025 to 2035

EVOH Encapsulation Film Market Size and Share Forecast Outlook 2025 to 2035

Event Tourism Market Size and Share Forecast Outlook 2025 to 2035

EV Telematics Control Systems Market Size and Share Forecast Outlook 2025 to 2035

Evidence Collection Tubes Market Size and Share Forecast Outlook 2025 to 2035

EV Battery Recycling and Black Mass Processing Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

EVA Coated Film Market Size and Share Forecast Outlook 2025 to 2035

EV EMC Battery Filter Market Size and Share Forecast Outlook 2025 to 2035

EV Traction Inverter Market Size and Share Forecast Outlook 2025 to 2035

EV Plant Construction Market Size and Share Forecast Outlook 2025 to 2035

EV Battery Heating System Market Size and Share Forecast Outlook 2025 to 2035

Event Logistics Market Size and Share Forecast Outlook 2025 to 2035

Evaporated Filled Milk Market Size, Growth, and Forecast for 2025 to 2035

EV Lighting Market Growth - Trends & Forecast 2025 to 2035

EV Coolants Market Analysis by Coolant Type, Category, Vehicle Type, and Region through 2025 to 2035

Evaporative Condensing Units Market Trend Analysis Based on Type, Operation, Application, and Region 2025 to 2035

EV Tires Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA