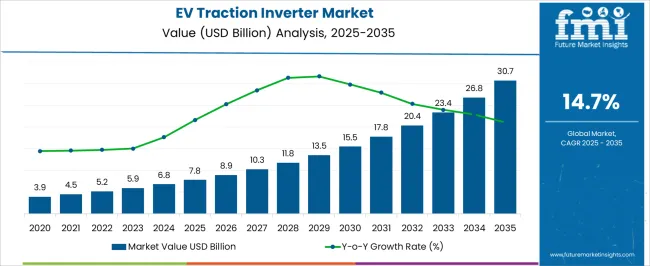

The EV traction inverter market is estimated to be valued at USD 7.8 billion in 2025 and is projected to reach USD 30.7 billion by 2035, registering a compound annual growth rate (CAGR) of 14.7% over the forecast period.

From 2025 to 2030, the market is expected to increase from USD 7.8 billion to USD 15.5 billion, showing a sharp and consistent upward curve. This growth block is shaped by the increasing penetration of electric vehicles across passenger and commercial categories. Traction inverters, which convert DC battery power into AC power for electric motors, are gaining importance due to their role in vehicle efficiency, performance optimization, and driving range. The early rise reflects growing EV adoption worldwide, strengthened by regulatory support and consumer interest in cleaner mobility solutions. Between 2030 and 2035, the market is forecast to accelerate further, advancing from USD 15.5 billion to USD 30.7 billion. This second half of the curve represents a steeper trajectory, underlining the rapid scaling of EV production volumes and the adoption of higher-voltage architectures.

The demand for silicon carbide (SiC) and gallium nitride (GaN) based inverters will intensify, driven by their ability to improve efficiency and reduce energy losses. The smooth yet steep curve highlights how traction inverters are evolving from being simple conversion devices to highly engineered systems integral to EV performance. The overall curve shape suggests long-term momentum, with opportunities expanding not only for established automotive suppliers but also for semiconductor companies and new entrants aiming to capture a share in this critical value chain.

| Metric | Value |

|---|---|

| EV Traction Inverter Market Estimated Value in (2025 E) | USD 7.8 billion |

| EV Traction Inverter Market Forecast Value in (2035 F) | USD 30.7 billion |

| Forecast CAGR (2025 to 2035) | 14.7% |

The EV traction inverter market secures a critical share across several parent markets, reflecting its role in converting DC battery power into AC for motor propulsion in electric vehicles. Within the electric vehicle components market, traction inverters account for about 14%, as they stand alongside batteries, motors, and controllers as one of the core systems. In the power electronics market, their contribution is close to 9%, since inverters represent a vital category alongside converters, rectifiers, and semiconductor modules.

Within the automotive electrification market, traction inverters capture nearly 12%, highlighting their influence in enabling efficient electric propulsion compared to traditional internal combustion drivetrain parts. In the battery electric vehicle (BEV) systems market, their share rises to around 16%, as traction inverters are indispensable in powering the main propulsion architecture of fully electric models. Finally, within the hybrid and electric drivetrain market, traction inverters account for approximately 11%, reflecting their integration in both hybrid vehicles for partial electrification and in full EVs for complete propulsion.

Collectively, these percentages emphasize that EV traction inverters are among the most critical enablers of electrified mobility, holding stronger shares in vehicle system-level categories like BEV and drivetrain markets, while securing steady but smaller proportions within broader power electronics. Their distribution highlights their specialized importance, underlining how efficiency gains and semiconductor advancements directly strengthen their position in the rapidly expanding EV ecosystem.

The EV traction inverter market is witnessing substantial growth due to rapid global electrification initiatives, evolving emission mandates, and continuous innovation in power electronics. Increasing production of battery electric vehicles (BEVs), along with the rising demand for energy-efficient drivetrains, is driving traction inverter adoption across OEMs.

Government-backed subsidies, stricter carbon neutrality goals, and advancements in semiconductor technology especially in high-efficiency switching devices are expanding the deployment of traction inverters in mid- and high-performance EVs. Growing R&D investments and integration of thermal management systems are further enhancing inverter performance and reliability.

These factors collectively position the market for strong growth through 2035.

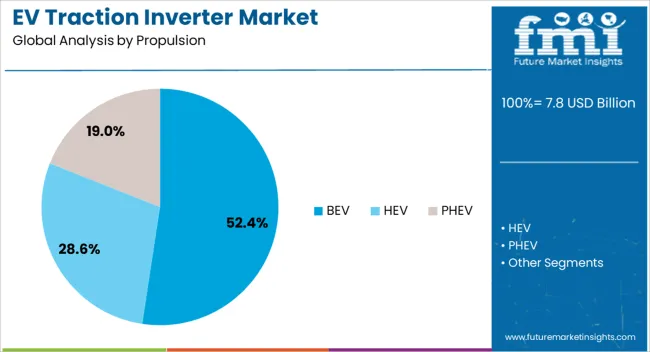

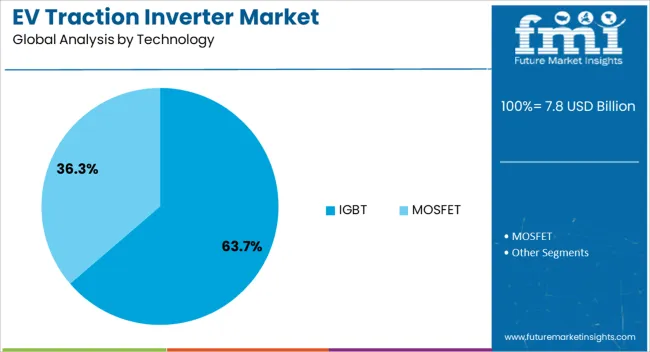

The EV traction inverter market is segmented by propulsion, output power, technology, semiconductor material, vehicle, and geographic regions. By propulsion, EV traction inverter market is divided into BEV, HEV, and PHEV. In terms of output power, EV traction inverter market is classified into 130 kW and >130 kW. Based on technology, EV traction inverter market is segmented into IGBT and MOSFET. By semiconductor material, EV traction inverter market is segmented into Si, GaN, and SiC. By vehicle, EV traction inverter market is segmented into passenger car and commercial vehicle. Regionally, the EV traction inverter industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Battery electric vehicles (BEVs) are expected to account for 52.40% of the EV traction inverter market share in 2025, making them the dominant propulsion type. This leadership is being driven by increasing consumer adoption of all-electric vehicles, supported by growing infrastructure for fast charging, policy-driven ICE vehicle phase-outs, and declining battery costs. BEVs demand highly efficient and compact inverters for effective power conversion and motor control, placing strong focus on high-voltage architectures. Automakers are actively integrating traction inverters designed specifically for BEVs to optimize vehicle performance, reduce energy loss, and extend driving range.

Traction inverters with output power ratings of 130 kW or greater are projected to dominate the market in 2025, capturing 58.1% of total revenue. This segment’s strength is attributed to rising demand for performance and commercial EVs, which require higher power outputs for acceleration, towing, and sustained high-speed operation. Enhanced thermal durability and advanced switching capabilities in high-output inverters are improving drivetrain efficiency and reliability under demanding conditions. Manufacturers are tailoring inverter solutions to meet the needs of SUVs, pickups, and fleet EVs, which further boosts growth in this output class.

IGBT-based inverters are forecast to lead the market with a 63.70% share in 2025, underscoring their role as the preferred technology in EV traction applications. Insulated Gate Bipolar Transistors (IGBTs) offer an optimal combination of high-voltage handling, thermal efficiency, and power density, making them ideal for mid- to high-power EV platforms. Their established manufacturing ecosystem and robust switching performance are enabling widespread integration into current-generation EV models. While SiC devices are gaining momentum, IGBT remains cost-effective for mainstream applications, supporting its continued dominance in the short to mid-term.

The EV traction inverter market is expanding as electric mobility adoption accelerates, driven by demand for efficient power conversion and enhanced vehicle range. Opportunities are strengthening with wide bandgap semiconductors and high-performance vehicle applications, while trends highlight modular integration and advanced cooling solutions. Challenges persist in high costs, component shortages, and reliability standards. In my opinion, companies that advance SiC and GaN-based inverters, secure supply chain stability, and deliver cost-efficient, integrated designs will hold the strongest advantage in shaping the future of EV powertrain technologies.

Demand for EV traction inverters has been reinforced by their role in converting DC battery power into AC for motor propulsion. With rising electric vehicle adoption, traction inverters are critical for improving driving range, performance, and energy efficiency. Automakers are increasingly focusing on inverters with higher power density and reduced energy losses to enhance overall vehicle competitiveness. In my opinion, demand will continue to accelerate as OEMs and suppliers prioritize efficiency-driven designs, making traction inverters a central component in the global shift toward electrified mobility.

Opportunities are emerging with the adoption of wide bandgap semiconductors such as silicon carbide (SiC) and gallium nitride (GaN) in inverter systems. These materials offer higher switching speeds, thermal performance, and efficiency, enabling compact and lightweight inverter designs. Growth in high-performance EV segments, including commercial vehicles and premium passenger cars, is further expanding opportunities. I believe companies that invest in SiC and GaN-based solutions and collaborate with automotive OEMs will capture significant opportunities, positioning themselves at the forefront of next-generation EV power electronics.

Trends indicate a transition toward integrated power electronics, where traction inverters are combined with onboard chargers and DC-DC converters in a single modular unit. This reduces system complexity, weight, and cost while improving efficiency. Another trend is the use of advanced cooling systems to manage thermal loads in high-power applications. In my opinion, these developments reflect a broader movement toward compact, multifunctional designs that not only enhance performance but also align with OEM strategies to streamline vehicle architectures and reduce production costs.

Challenges facing the EV traction inverter market include high manufacturing costs, semiconductor shortages, and the need for stringent automotive-grade reliability. Wide bandgap materials, while offering performance benefits, remain expensive and limit mass adoption in lower-priced EV models. Supply chain disruptions for chips and electronic components create risks for OEMs. In my assessment, overcoming these hurdles will require strategic sourcing, vertical integration, and investments in scalable manufacturing processes to balance cost and performance, ensuring traction inverters remain accessible across diverse EV market segments.

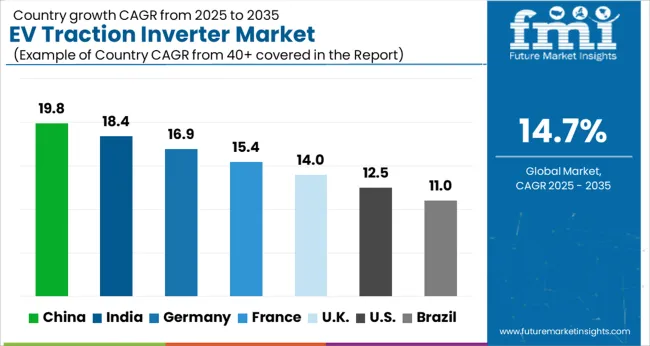

| Country | CAGR |

|---|---|

| China | 19.8% |

| India | 18.4% |

| Germany | 16.9% |

| France | 15.4% |

| UK | 14.0% |

| USA | 12.5% |

| Brazil | 11.0% |

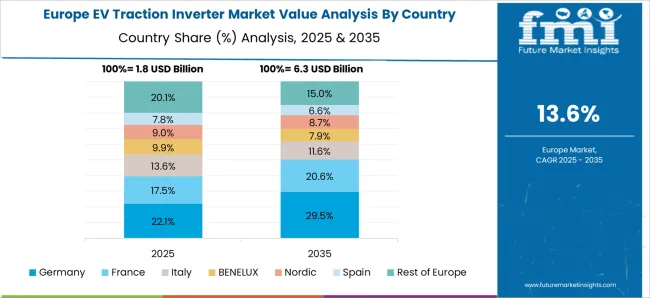

The global EV traction inverter market is projected to grow at a CAGR of 14.7% from 2025 to 2035. China leads with a growth rate of 19.8%, followed by India at 18.4%, and France at 15.4%. The United Kingdom records a growth rate of 14%, while the United States shows the slowest growth at 12.5%. Rising EV adoption, government-backed electrification policies, and demand for efficient power electronics are fueling expansion. Emerging markets such as China and India are witnessing rapid acceleration due to strong EV manufacturing ecosystems and supportive incentives, while mature markets like the USA, UK, and France focus on next-generation inverter technologies, wide-bandgap semiconductors, and integration into advanced electric mobility platforms. This report includes insights on 40+ countries; the top markets are shown here for reference.

The EV traction inverter market in China is projected to grow at a CAGR of 19.8%. China’s dominance in global EV production and strong policy support for electrification drive demand for advanced traction inverters. Local manufacturers are focusing on integrating silicon carbide (SiC) and gallium nitride (GaN) technologies to enhance efficiency and range. State subsidies for EVs and investments in charging infrastructure continue to expand adoption. Partnerships between domestic automakers and global semiconductor companies are strengthening supply chains, ensuring rapid scaling of inverter technologies across passenger cars, buses, and commercial vehicles.

The EV traction inverter market in India is expected to grow at a CAGR of 18.4%. Government programs promoting electric mobility, including FAME II and state-level EV policies, are accelerating adoption. Rising domestic EV production, especially in two-wheelers and three-wheelers, is fueling demand for cost-effective traction inverters. Indian firms are collaborating with global semiconductor and automotive players to introduce advanced inverter solutions. The expansion of renewable energy integration in charging infrastructure and increased investments in local manufacturing are further enhancing growth prospects.

The EV traction inverter market in France is projected to grow at a CAGR of 15.4%. France’s strong automotive industry, coupled with EU policies promoting electrification, is driving steady adoption. Investments in wide-bandgap semiconductor technology are shaping the development of high-efficiency inverters. Domestic automakers are focusing on integrating compact, lightweight inverter systems to improve EV performance and compliance with stringent emission regulations. France’s research and innovation ecosystem, supported by public-private partnerships, continues to strengthen its position in the European EV supply chain.

The EV traction inverter market in the UK is projected to grow at a CAGR of 14%. Growth is supported by government targets for phasing out internal combustion vehicles and rising EV adoption across passenger and commercial fleets. UK research institutes and automakers are investing in next-generation inverter technologies, focusing on compact designs and advanced thermal management. Expansion of battery manufacturing initiatives and EV infrastructure further supports demand. Strategic partnerships with European semiconductor firms strengthen technological advancements in high-performance inverters.

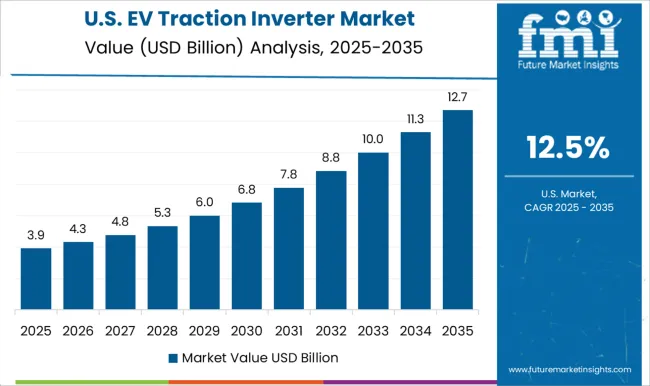

The EV traction inverter market in the USA is projected to grow at a CAGR of 12.5%. While growth is slower than in Asia, the USA remains a key hub for innovation in EV technologies. Demand is supported by rising adoption of electric SUVs, trucks, and commercial fleets. Automakers are increasingly adopting SiC-based inverters to enhance efficiency and meet regulatory emission targets. Federal incentives and state-level EV adoption policies are shaping market growth, while partnerships between automakers and semiconductor leaders ensure technological advancement. The USA market continues to emphasize integration of traction inverters into high-performance EV platforms.

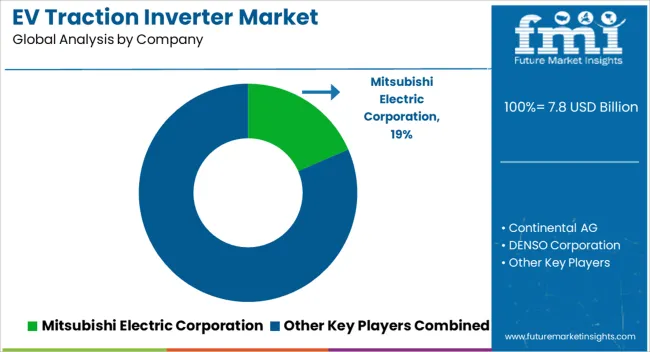

Competition in the EV traction inverter space is shaped by power electronics expertise, system integration, and partnerships with leading automakers. Mitsubishi Electric, DENSO, and Hitachi Astemo anchor their strategies in supplying high-efficiency inverters optimized for Japanese and global OEMs. Bosch, Continental, Valeo, and Vitesco Technologies leverage their deep automotive ecosystems, offering scalable inverter platforms integrated with e-axles and electric drive modules. ZF Friedrichshafen emphasizes modular solutions compatible with both hybrid and battery electric vehicles, while Toyota Industries Corporation aligns inverter production with in-house EV programs, ensuring reliability across its expanding electrified fleet. This mix of global Tier-1 suppliers and vertically integrated OEM-linked producers defines a market where competition depends on technological edge and supply chain strength. Strategies are driven by silicon carbide (SiC) adoption, compact designs, and thermal efficiency. Mitsubishi Electric and DENSO highlight SiC-based inverters capable of reducing power losses and improving driving range.

Bosch and Continental integrate digital control software and predictive diagnostics, positioning their inverters as enablers of safety and performance. Vitesco and Valeo focus on cost-effective scalability for mass-market EVs, while ZF pushes lightweight, high-voltage designs suited for premium segments. Toyota Industries Corporation differentiates with production aligned to Toyota’s hybrid and EV rollout. Product brochures emphasize conversion efficiency, voltage ratings, and cooling technologies, often supported with schematics of inverter-motor integration and range improvement metrics. Messaging underscores benefits such as compact packaging, reliability under high load, and compatibility with next-generation battery platforms. By blending technical precision with clear application value, brochures serve as both engineering documentation and persuasive sales tools, reinforcing inverters as the heartbeat of efficient and reliable EV propulsion.

| Item | Value |

|---|---|

| Quantitative Units | USD 7.8 billion |

| Propulsion | BEV, HEV, and PHEV |

| Output Power | 130 kW and >130 kW |

| Technology | IGBT and MOSFET |

| Semiconductor Material | Si, GaN, and SiC |

| Vehicle | Passenger Car and Commercial Vehicle |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Mitsubishi Electric Corporation, Continental AG, DENSO Corporation, Hitachi Astemo Ltd, Robert Bosch GmbH, Toyota Industries Corporation, Valeo SE, Vitesco Technologies, and ZF Friedrichshafen AG |

| Additional Attributes | Dollar sales by product type (IGBT-based vs SiC-based inverters), Dollar sales by vehicle type (battery electric, plug-in hybrid, fuel cell), Trends in high-efficiency power electronics and compact designs, Use in drivetrain electrification and fast-switching control, Growth in EV adoption and charging infrastructure, Regional manufacturing hubs across Asia-Pacific, Europe, and North America. |

The global EV traction inverter market is estimated to be valued at USD 7.8 billion in 2025.

The market size for the EV traction inverter market is projected to reach USD 30.7 billion by 2035.

The EV traction inverter market is expected to grow at a 14.7% CAGR between 2025 and 2035.

The key product types in EV traction inverter market are bev, hev and phev.

In terms of output power, =130 kw segment to command 58.1% share in the EV traction inverter market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

EV Charging Panelboard Market Forecast Outlook 2025 to 2035

EV Charger Converter Module Market Size and Share Forecast Outlook 2025 to 2035

Evacuated Miniature Crystal Oscillator (EMXO) Market Forecast and Outlook 2025 to 2035

EV Charging Tester Market Size and Share Forecast Outlook 2025 to 2035

Evaporative Air Cooler Market Size and Share Forecast Outlook 2025 to 2035

EV Charging Cable Market Size and Share Forecast Outlook 2025 to 2035

EVOH Encapsulation Film Market Size and Share Forecast Outlook 2025 to 2035

eVTOL Charging Facilities Market Size and Share Forecast Outlook 2025 to 2035

Event Tourism Market Size and Share Forecast Outlook 2025 to 2035

EV Telematics Control Systems Market Size and Share Forecast Outlook 2025 to 2035

Evidence Collection Tubes Market Size and Share Forecast Outlook 2025 to 2035

EV Battery Recycling and Black Mass Processing Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

EVA Coated Film Market Size and Share Forecast Outlook 2025 to 2035

EV Charging Management Software Platform Market Size and Share Forecast Outlook 2025 to 2035

EV EMC Battery Filter Market Size and Share Forecast Outlook 2025 to 2035

EV Plant Construction Market Size and Share Forecast Outlook 2025 to 2035

EV Battery Heating System Market Size and Share Forecast Outlook 2025 to 2035

EV Charging Station Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Event Logistics Market Size and Share Forecast Outlook 2025 to 2035

Evaporated Filled Milk Market Size, Growth, and Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA