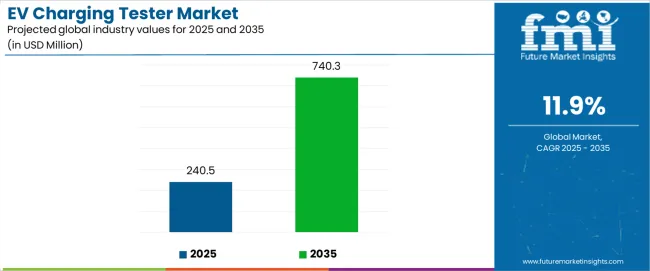

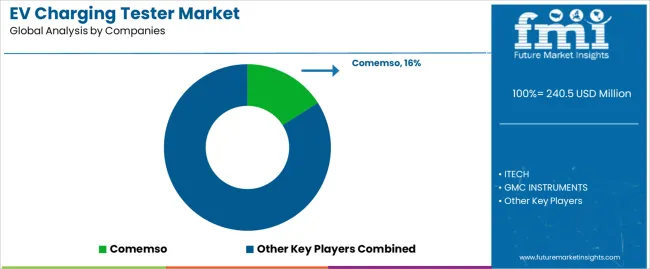

The global EV charging tester market, valued at USD 240.5 million in 2025 and projected to reach USD 740.3 million by 2035, is set to experience an absolute increase of USD 499.8 million, translating into total growth of 207.8%. At a CAGR of 11.9% during the forecast period, the EV charging tester market is expected to expand by nearly 3.1X, highlighting the growing importance of reliable testing equipment in ensuring the safety, efficiency, and compliance of charging infrastructure. Rapid electrification of transportation across passenger vehicles, commercial fleets, and public transport systems is creating unprecedented demand for robust charging networks, making testers an indispensable part of quality assurance and operational readiness.

The first half of the period from 2025 to 2030 is likely to be driven by large-scale investments in charging stations across North America, Europe, and Asia Pacific. Governments and private sector operators are accelerating deployment to support rising EV adoption, and this surge will directly benefit the demand for testing systems. Testers during this stage will primarily be adopted for installation verification, fault detection, and certification against regional safety standards. The value addition comes from ensuring that both AC and DC fast chargers comply with international frameworks such as IEC, SAE, and CHAdeMO protocols. The EV charging tester market will also benefit from heightened awareness among stakeholders that malfunctioning or uncertified chargers can undermine consumer trust and slow adoption rates.

From 2030 to 2035, the growth curve is expected to accelerate further as the EV ecosystem matures. With the global charging infrastructure expanding into millions of public and private points, periodic testing and maintenance will become a recurring requirement. The role of testers will shift from initial installation checks to long-term performance monitoring, predictive maintenance, and integration into digital grid systems. Advancements in tester technology, including cloud-enabled analytics, portable multifunction devices, and automated compliance reporting, will reinforce their importance. Companies are also likely to integrate artificial intelligence into testers for real-time diagnostics, adaptive testing sequences, and proactive issue detection, enhancing operational efficiency for large charging networks.

Regional imbalances will shape demand patterns. Asia Pacific is anticipated to dominate due to China’s aggressive EV policies, large-scale fleet electrification, and rapid charger deployment. Europe will follow, supported by strict emission reduction mandates and cross-border charging network integration. North America will experience significant growth fueled by federal incentives and expanding private sector participation. Latin America, the Middle East, and Africa will gradually emerge as growth pockets, driven by government-led electrification initiatives and pilot charging projects.

| Item | Value / Description |

|---|---|

| Market Value (2025) | USD 240.5 million |

| Forecast Value (2035) | USD 740.3 million |

| Forecast CAGR (2025–2035) | 11.9% |

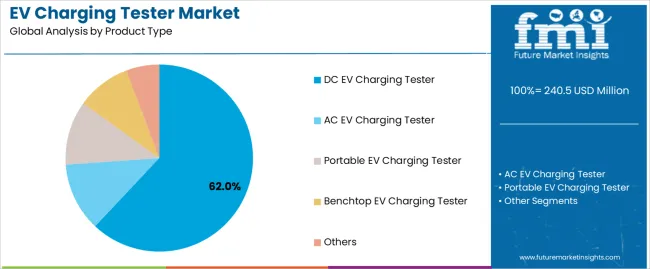

| Leading Product Type (2025) | DC EV Charging Tester -62.0% share |

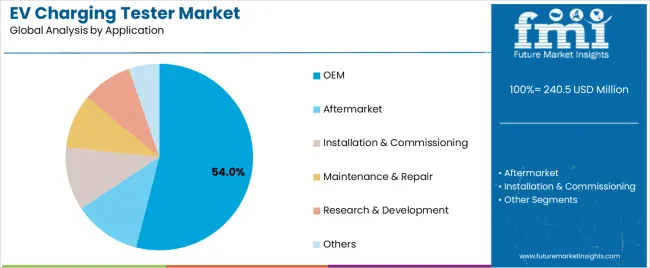

| Leading Application (2025) | OEM - 54.0% share |

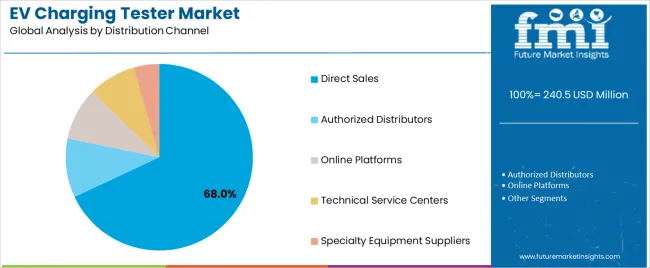

| Leading Distribution Channel (2025) | Direct Sales - 68% share |

| Key Growth Regions | Asia Pacific; North America; Europe |

| Top Companies by Market Share | Comemso; ITECH; GMC INSTRUMENTS |

| Metric | Value |

|---|---|

| Market Value (2025) | USD 240.5 million |

| Market Forecast Value (2035) | USD 740.3 million |

| Forecast CAGR (2025–2035) | 11.9% |

| ELECTRIC VEHICLE INFRASTRUCTURE EXPANSION | SAFETY & COMPLIANCE REQUIREMENTS | TECHNOLOGY & TESTING STANDARDS |

|---|---|---|

| ev Adoption Acceleration — Global electric vehicle sales growth driving massive expansion of charging infrastructure requiring comprehensive testing solutions for safety and performance validation. | Regulatory Compliance — Stringent international safety standards including IEC 61851 and ISO 15118 mandating rigorous testing protocols for charging equipment certification. | Advanced Testing Capabilities — Development of sophisticated testing equipment capable of validating complex charging protocols, communication standards, and safety mechanisms in modern EV charging systems. |

| Charging Network Deployment — Rapid installation of public and private charging stations across urban and highway networks creating demand for specialized testing equipment during commissioning and maintenance. | Safety Standard Evolution — Continuous updates to electrical safety requirements and charging protocols necessitating advanced testing capabilities to ensure compliance with emerging standards. | Smart Charging Integration — Integration of intelligent charging features, grid connectivity, and bidirectional power flow requiring comprehensive testing of communication protocols and power management systems. |

| Infrastructure Investment — Government incentives and private investments in charging infrastructure supporting widespread adoption of testing equipment for quality assurance and operational reliability. | Certification Requirements — Mandatory testing and certification processes for charging equipment manufacturers and installation contractors driving consistent demand for professional testing solutions. | High-Power Charging Development — Evolution toward ultra-fast charging systems requiring specialized testing equipment capable of handling high voltage and current levels safely and accurately. |

Category Segments Covered

| Category | Segments / Values |

|---|---|

| By Product Type | DC EV Charging Tester; AC EV Charging Tester; Portable EV Charging Tester; Benchtop EV Charging Tester; Others |

| By Application | OEM; Aftermarket; Installation & Commissioning; Maintenance & Repair; Research & Development; Others |

| By Testing Type | Safety Testing; Performance Testing; Communication Testing; Insulation Testing; Ground Fault Testing; Others |

| By End User | Charging Equipment Manufacturers; Testing Laboratories; Service Providers; Research Institutions; Government Agencies |

| By Distribution Channel | Direct Sales; Authorized Distributors; Online Platforms; Technical Service Centers; Specialty Equipment Suppliers |

| By Region | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Segment | 2025–2035 Outlook |

|---|---|

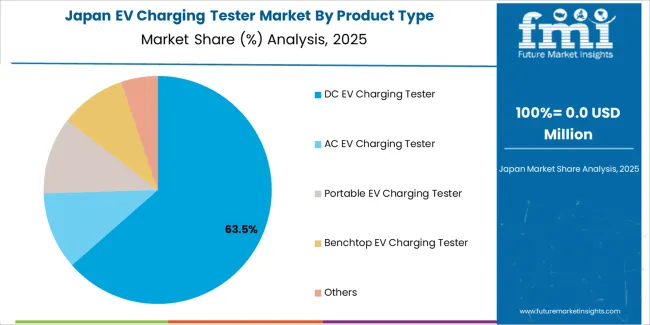

| DC EV Charging Tester | Leader in 2025 with 62.0% market share; expected to maintain dominance through 2035. Critical for fast-charging infrastructure testing with capabilities for high-voltage DC systems and complex power electronics validation. Momentum: strong growth driven by ultra-fast charging deployment. Watchouts: technical complexity and higher equipment costs. |

| AC EV Charging Tester | Established segment with 23.5% share, essential for residential and Level 2 commercial charging station testing. Covers standard AC charging protocols and safety compliance validation. Momentum: steady growth with residential charging expansion. Watchouts: market maturation and commodity pricing pressure. |

| Portable EV Charging Tester | Growing segment at 8.2% share, enabling field testing and mobile service applications. Compact design for on-site testing during installation and maintenance operations. Momentum: rising demand for field service capabilities. Watchouts: performance limitations compared to benchtop systems. |

| Benchtop EV Charging Tester | Laboratory-focused segment with 4.8% share, providing comprehensive testing capabilities for R&D and certification applications. High-precision measurements and advanced protocol analysis. Momentum: moderate growth in testing laboratories. Watchouts: limited to fixed-location applications. |

| Others (Wireless, Vehicle-to-Grid) | Emerging technologies including wireless charging testers and V2G testing equipment for specialized applications. Momentum: selective growth in advanced charging technologies. Watchouts: early-stage market development and limited standardization. |

| Segment | 2025–2035 Outlook |

|---|---|

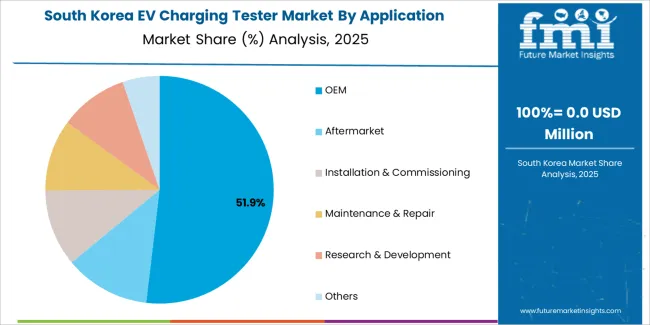

| OEM | Largest application segment in 2025 at 54.0% share, driven by charging equipment manufacturers requiring integrated testing capabilities for product development and quality assurance. Essential for compliance certification and production testing. Momentum: strong growth from EV infrastructure expansion and new product development. Watchouts: pressure for cost reduction and testing automation requirements. |

| Aftermarket | significant segment serving maintenance and repair operations for existing charging infrastructure. Covers periodic testing, troubleshooting, and compliance verification for operational charging stations. Momentum: steady growth as installed base expands. Watchouts: competition from predictive maintenance technologies and remote monitoring systems. |

| Installation & Commissioning | Critical segment for new charging station deployment, requiring comprehensive testing during initial setup and network integration. Ensures proper functionality and safety compliance before commercial operation. Momentum: rapid growth with infrastructure deployment acceleration. Watchouts: seasonal installation patterns and project-dependent demand. |

| Maintenance & Repair | Essential for ongoing charging network operations, covering regular inspection, preventive maintenance, and fault diagnosis. Requires portable and reliable testing equipment for field service applications. Momentum: increasing importance as charging networks mature. Watchouts: evolving maintenance strategies and service model changes. |

| Research & Development | Specialized segment supporting advanced charging technology development, protocol testing, and standards development. Requires high-precision equipment and comprehensive measurement capabilities. Momentum: selective growth in technology advancement areas. Watchouts: limited market size and specialized requirements. |

| Distribution Channel | Status & Outlook (2025–2035) |

|---|---|

| Direct Sales | Dominant channel in 2025 with 68% share for complex testing systems requiring technical support and customization. Provides direct manufacturer relationships and comprehensive service support. Momentum: steady growth driven by technical complexity and customer service requirements. Watchouts: scaling challenges and regional coverage limitations. |

| Authorized Distributors | Established channel serving regional markets with local technical expertise and service capabilities. Provides market access and customer support for standardized testing equipment. Momentum: moderate growth with geographic expansion needs. Watchouts: margin pressure and competition from direct sales channels. |

| Online Platforms | Growing channel for portable and standardized testing equipment, offering competitive pricing and convenient ordering. Serves smaller customers and repeat purchases effectively. Momentum: rising adoption for commodity testing products. Watchouts: limited technical support and service capabilities for complex equipment. |

| Technical Service Centers | Specialized channel providing rental, calibration, and technical services alongside equipment sales. Offers flexible solutions for temporary testing needs and service support. Momentum: increasing importance for service-based business models. Watchouts: capital intensive operations and regional service requirements. |

| Specialty Equipment Suppliers | Niche channel serving specific market segments with specialized testing requirements and technical expertise. Provides value-added services and application support. Momentum: selective growth in specialized applications. Watchouts: limited market reach and dependency on specific market segments. |

| DRIVERS | RESTRaiNTS | KEY TRENDS |

|---|---|---|

| Rapid EV adoption worldwide is driving massive expansion of charging infrastructure requiring comprehensive testing solutions for safety validation and performance verification. | High equipment costs and technical complexity of advanced testing systems limit accessibility for smaller service providers and emerging market operations. | Development of intelligent testing platforms with automated protocols, remote monitoring capabilities, and ai-powered diagnostics are advancing testing efficiency and accuracy. |

| Regulatory compliance requirements including international safety standards and certification protocols are mandating rigorous testing procedures for charging equipment manufacturers and installers. | Lack of standardized testing protocols across different charging technologies and regional requirements creates complexity and increases testing costs for global operations. | Integration of wireless communication and IoT connectivity in testing equipment enables remote monitoring, data analytics, and predictive maintenance capabilities for charging networks. |

| Infrastructure investment programs by governments and private companies are accelerating charging network deployment creating sustained demand for testing equipment throughout project lifecycles. | Rapid technology evolution in charging systems requires continuous equipment updates and training, increasing total cost of ownership for testing service providers. | Emergence of ultra-fast charging testing capabilities supporting 350kW+ systems with advanced safety features and high-precision measurement requirements for next-generation charging infrastructure. |

| Quality assurance demands from charging network operators and safety regulators are driving adoption of comprehensive testing protocols ensuring operational reliability and user safety. | Limited skilled workforce for operating sophisticated testing equipment affects market growth and service quality in emerging regions with expanding charging infrastructure. | Development of portable testing solutions with professional-grade capabilities enabling field testing, maintenance verification, and rapid deployment support for distributed charging networks. |

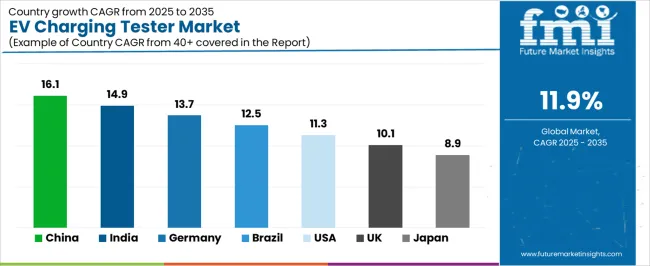

| Country | CAGR (2025–2035) |

|---|---|

| China | 16.1% |

| India | 14.9% |

| Germany | 13.7% |

| Brazil | 12.5% |

| United States | 11.3% |

| United Kingdom | 10.1% |

| Japan | 8.9% |

Revenue from EV Charging Testers in China is projected to exhibit exceptional growth with a market value of USD 176.4 million by 2035, driven by the world's largest electric vehicle market and comprehensive charging infrastructure expansion programs creating massive opportunities for testing equipment suppliers across automotive manufacturing, charging network operations, and regulatory compliance sectors. The country's established electronics manufacturing capabilities and government support for EV adoption are creating substantial demand for both DC and AC charging testing systems. Major technology companies and automotive manufacturers including BYD, CATL, and state-owned enterprises are implementing comprehensive testing protocols to support large-scale charging infrastructure deployment and meet stringent safety requirements.

Revenue from EV Charging Testers in India is expanding to reach USD 89.3 million by 2035, supported by aggressive electric mobility transition policies and comprehensive charging infrastructure development programs creating demand for reliable testing solutions across diverse urban and rural deployment scenarios. The country's growing automotive sector and expanding electric vehicle adoption rates are driving demand for testing equipment that provides consistent performance while supporting cost-effective infrastructure development requirements. Government initiatives and private sector investments are accelerating market development to support growing EV manufacturing operations and charging network deployment.

Demand for EV Charging Testers in Germany is projected to reach USD 118.7 million by 2035, supported by the country's automotive industry leadership and advanced charging technology development requiring sophisticated testing systems for premium vehicle applications and high-performance charging infrastructure. German automotive companies and technology suppliers are implementing precision testing protocols that support advanced charging capabilities, operational safety, and compliance with stringent European regulatory standards. The EV charging tester market is characterized by focus on engineering excellence, technical precision, and adherence to comprehensive safety and performance specifications.

Revenue from EV Charging Testers in Brazil is growing to reach USD 67.2 million by 2035, driven by national electrification programs and increasing electric vehicle adoption creating opportunities for testing equipment suppliers serving both urban charging networks and industrial fleet operations. The country's expanding automotive manufacturing sector and government incentives for electric mobility are creating demand for testing solutions that support diverse charging requirements while maintaining performance standards. Energy companies and automotive manufacturers are developing comprehensive testing strategies to support operational efficiency and regulatory compliance.

Demand for EV Charging Testers in United States is projected to reach USD 152.8 million by 2035, expanding at a CAGR of 11.3%, driven by federal infrastructure investment programs and advanced charging technology development supporting comprehensive electric vehicle adoption across diverse geographic and demographic segments. The country's established automotive industry and technology leadership are creating demand for sophisticated testing equipment that supports operational excellence and advanced charging protocols. Charging network operators and equipment manufacturers are maintaining comprehensive testing capabilities to support diverse customer requirements and regulatory standards.

Revenue from EV Charging Testers in United Kingdom is growing to reach USD 98.4 million by 2035, supported by comprehensive decarbonization policies and established automotive industry transformation programs driving demand for premium testing solutions across traditional automotive manufacturing and emerging charging infrastructure sectors. The country's regulatory leadership and commitment to electric vehicle adoption create demand for testing equipment that supports both compliance requirements and advanced technology development.

Demand for EV Charging Testers in Japan is projected to reach USD 78.9 million by 2035, driven by automotive industry innovation tradition and advanced charging technology development supporting both domestic market leadership and export-oriented manufacturing excellence. Japanese companies maintain sophisticated testing development capabilities, with established manufacturers continuing to lead in precision measurement technology and comprehensive testing protocol development.

European EV Charging Tester operations are increasingly concentrated between German precision engineering leadership and broader regional manufacturing capabilities across multiple technology centers. German facilities dominate high-precision testing equipment production for automotive OEMs and premium charging infrastructure applications, leveraging advanced measurement technologies and strict quality protocols that command significant premiums in global markets. The country's automotive industry relationships and testing standard development influence create comprehensive market advantages for sophisticated testing applications.

Scandinavian operations in Sweden and Denmark are capturing specialized applications through renewable energy integration expertise and sustainable technology focus, particularly in smart charging testing solutions that integrate grid management capabilities. These facilities increasingly serve as technology development centers for European charging network operators while developing innovative testing methodologies.

The regulatory environment creates both opportunities and standardization benefits. EU regulatory harmonization and safety standard coordination facilitate consistent testing requirements across member states while ensuring interoperability specifications. Brexit has created some complexity for UK equipment certification within EU markets, driving opportunities for direct relationships between Continental manufacturers and British charging infrastructure developers.

Supply chain consolidation accelerates as manufacturers seek economies of scale to manage rising component costs and technical complexity requirements. Vertical integration increases, with major charging equipment manufacturers acquiring testing capability developers to secure technology access and quality control. Smaller testing equipment suppliers face pressure to specialize in niche applications or risk displacement by larger, more comprehensive operations serving mainstream automotive and infrastructure requirements.

South Korean EV Charging Tester operations reflect the country's advanced electronics manufacturing leadership and export-oriented technology development model. Major conglomerates including Samsung SDI, LG Energy Solution, and Hyundai Motor Group drive comprehensive testing requirements for their electric vehicle and charging infrastructure divisions, establishing direct relationships with specialized testing equipment suppliers to secure consistent quality and advanced capabilities for their global operations targeting both domestic and international markets.

The Korean market demonstrates particular strength in integrating testing technologies with smart manufacturing and Industry 4.0 concepts, with companies developing comprehensive testing solutions that bridge traditional electrical testing and advanced digital validation systems. This integration approach creates demand for specific measurement capabilities that differ from conventional applications, requiring suppliers to adapt testing protocols and communication interfaces for automated production environments.

Regulatory frameworks emphasize electronics safety and automotive standards compliance, with Korean Agency for Technology and Standards requirements often exceeding international specifications for precision and reliability. This creates opportunities for advanced testing equipment suppliers while establishing barriers for basic commodity products. The regulatory environment particularly favors suppliers with KS certification and comprehensive documentation systems that support automotive industry requirements.

Supply chain efficiency remains critical given Korea's technology advancement focus and competitive export market dynamics. Companies increasingly pursue technology partnerships with suppliers in Germany, Japan, and specialized manufacturers to ensure access to cutting-edge testing technologies while managing technological development risks. Investment in research and development supports quality advancement and innovation leadership during extended product development cycles for next-generation charging infrastructure.

Profit pools are consolidating upstream in advanced measurement technology development and downstream in application-specific testing solutions for automotive OEMs, charging infrastructure operators, and regulatory compliance markets where certification capabilities, measurement precision, and comprehensive protocol support command significant premiums. Value is migrating from basic electrical testing equipment to sophisticated, protocol-aware testing systems where engineering expertise, software integration, and reliable performance validation create competitive advantages. Several archetypes define market leadership: established test equipment manufacturers leveraging measurement expertise and global service networks; specialized EV testing companies with charging protocol knowledge and automotive industry relationships; technology integrators combining hardware and software capabilities for comprehensive testing solutions; and emerging companies pursuing innovative approaches including wireless testing and ai-powered diagnostics. Switching costs - equipment integration, operator training, certification requirements - provide stability for established suppliers, while rapid technology evolution and new charging standards create opportunities for innovative manufacturers. Consolidation continues as companies seek technical capabilities and market access; direct sales relationships grow for complex systems while distribution channels serve standardized equipment markets. Focus areas: secure automotive OEM and charging infrastructure operator relationships with comprehensive testing capabilities and technical support; develop advanced measurement technologies and software integration capabilities; explore emerging applications including vehicle-to-grid testing and wireless charging validation.

| Stakeholder Type | Primary Advantage | Repeatable Plays |

|---|---|---|

| Established Test Equipment Manufacturers | Global service networks; measurement expertise; comprehensive product portfolios | Precision engineering; international standards compliance; established customer relationships |

| ev Testing Specialists | Charging protocol expertise; automotive industry knowledge; application-specific solutions | OEM partnerships; regulatory compliance support; specialized testing capabilities |

| Technology Integrators | Hardware-software integration; system-level solutions; comprehensive testing platforms | Custom engineering; project management; integrated service delivery |

| Emerging Innovation Companies | Advanced technologies; AI integration; wireless capabilities | Technology differentiation; agile development; niche market focus |

| Regional Service Providers | Local market knowledge; field service capabilities; customer proximity | Geographic coverage; technical service; local partnerships |

| Item | Value |

|---|---|

| Quantitative Units | USD 240.5 Million |

| Product Types | DC EV Charging Tester; AC EV Charging Tester; Portable EV Charging Tester; Benchtop EV Charging Tester; Others |

| Applications | OEM; Aftermarket; Installation & Commissioning; Maintenance & Repair; Research & Development |

| Testing Types | Safety Testing; Performance Testing; Communication Testing; Insulation Testing; Ground Fault Testing |

| End Users | Charging Equipment Manufacturers; Testing Laboratories; Service Providers; Research Institutions; Government Agencies |

| Distribution Channels | Direct Sales; Authorized Distributors; Online Platforms; Technical Service Centers; Specialty Equipment Suppliers |

| Regions Covered | North America; Latin America; Europe; Asia Pacific; Middle East & Africa |

| Key Countries | China; India; Germany; Brazil; United States; United Kingdom; Japan (+35 additional countries) |

| Key Companies Profiled | Comemso; ITECH; GMC INSTRUMENTS; Fluke Corporation; Keysight Technologies; HT Instruments; Triplett Test Equipment; ZERA GmbH; Megger Group; Seaward Electronic Ltd.; Chauvin Arnoux; Sonel S.A.; Kewtech Corporation; DEKRA; dSPACE GmbH; Benning Elektrotechnik; Gossen Metrawatt; Hioki E.E. Corporation; Guangzhou ZHIYUAN Electronics Co., Ltd.; Ningbo Iuxpower Electronic Technology Co., Ltd.; Jishili Electronics (Suzhou) Co., Ltd.; Shenzhen Skonda Electronic Co., Ltd. |

| Additional Attributes | Dollar sales by product and distribution channel; Regional demand trends (NA, EU, APAC); Competitive landscape; Direct sales vs. distributor adoption patterns; Manufacturing and testing integration; Advanced measurement innovations driving accuracy enhancement, protocol validation, and technical excellence |

The global EV charging tester market is estimated to be valued at USD 240.5 million in 2025.

The market size for the EV charging tester market is projected to reach USD 740.3 million by 2035.

The EV charging tester market is expected to grow at a 11.9% CAGR between 2025 and 2035.

The key product types in EV charging tester market are dc EV charging tester, ac EV charging tester, portable EV charging tester, benchtop EV charging tester and others.

In terms of application, oem segment to command 54.0% share in the EV charging tester market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Evaporative Air Cooler Market Size and Share Forecast Outlook 2025 to 2035

EVOH Encapsulation Film Market Size and Share Forecast Outlook 2025 to 2035

Event Tourism Market Size and Share Forecast Outlook 2025 to 2035

EV Telematics Control Systems Market Size and Share Forecast Outlook 2025 to 2035

Evidence Collection Tubes Market Size and Share Forecast Outlook 2025 to 2035

EV Battery Recycling and Black Mass Processing Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

EVA Coated Film Market Size and Share Forecast Outlook 2025 to 2035

EV EMC Battery Filter Market Size and Share Forecast Outlook 2025 to 2035

EV Traction Inverter Market Size and Share Forecast Outlook 2025 to 2035

EV Plant Construction Market Size and Share Forecast Outlook 2025 to 2035

EV Battery Heating System Market Size and Share Forecast Outlook 2025 to 2035

Event Logistics Market Size and Share Forecast Outlook 2025 to 2035

Evaporated Filled Milk Market Size, Growth, and Forecast for 2025 to 2035

EV Lighting Market Growth - Trends & Forecast 2025 to 2035

EV Coolants Market Analysis by Coolant Type, Category, Vehicle Type, and Region through 2025 to 2035

Event Management Software Market Analysis - Size, Share, and Forecast 2025 to 2035

Evaporative Condensing Units Market Trend Analysis Based on Type, Operation, Application, and Region 2025 to 2035

EV Tires Market Growth – Trends & Forecast 2025 to 2035

Event Apps Market Analysis – Size, Trends & Forecast 2025 to 2035

EV Power Module Market Analysis by Vehicle Technology, Vehicle Type, and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA