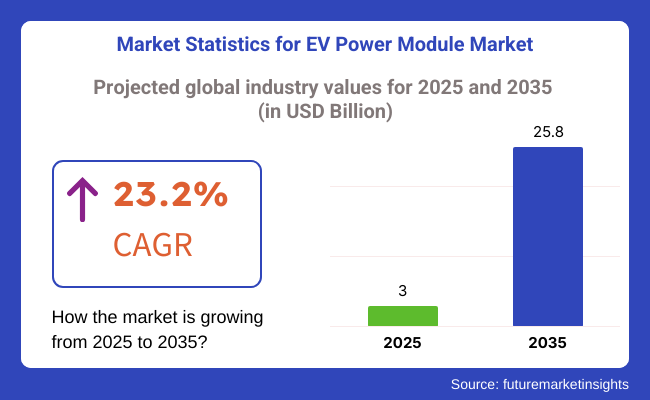

The market for EV power modules is expected to grow to USD 3 billion by 2025. Demand is likely to grow to USD 25.8 billion in revenue by 2035, representing a 23.2% CAGR during the forecast period. The industry is experiencing growth, driven by the broader demand for EVs and efficient energy management systems.

Power modules are the switching valve that controls how electricity from the battery, inverter, and electric motor are routed to maximize efficiency and prevent overheating. This growth is driven by progress in new power electronics, a growing number of EVs, and demand for increased efficiency and robustness of power modules. Automotive companies like Tesla and Volkswagen focus on building semiconductor power modules.

Despite these positives, the industry continues to face a major issue with the price of state-of-the-art power modules. The high-performance power electronics are expensive and, for price-sensitive clients and manufacturers from developing countries, hard to access. They struggle to keep costs below what they were in the past and achieve the same efficiency and reliability.

The creation of silicon carbide (SiC) and gallium nitride (GaN) materials into power modules has been a game-changer in terms of performance, providing both high-speed switching and low energy waste. Firms like BYD and Toyota are boosting their power conversion efficiency in their electric vehicles by utilizing these technologies.

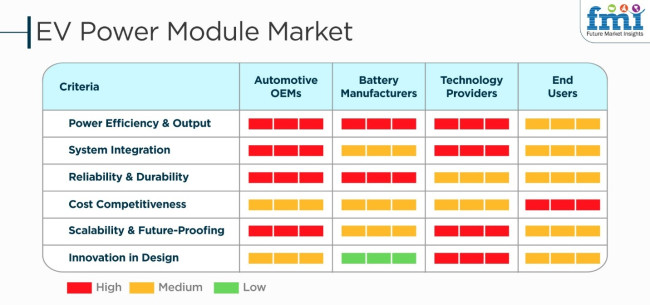

The EV power module market chart illustrates that key industry stakeholders have fundamentally different priorities. Automotive OEMs and tech providers focus on power efficiency and output, system integration, and reliability and durability, which are highly important (red). It shows their keen attention to performance enhancement, smooth integration, and durability in line with consumer and regulatory expectations. This indicates that they are looking for affordable solutions that can easily be scaled up to meet the demand for high-performance battery modules while keeping costs low for car manufacturers.

Innovation in design is a high priority for technology providers (cyan) but is of low importance for battery manufacturers (green), interestingly. This mirrors the position of technology providers developing new materials, semiconductors, and smart power module solutions, in contrast to battery manufacturers, and the work is more on fine-tuning existing technologies than on any sort of radical innovation.

Power efficiency, cost competitiveness, and system integration are of medium importance (yellow) for end users such as fleet operators and consumers. This means they value efficiency and cost but are more interested in practical, affordable, user-friendly solutions than cutting-edge technology.

Between 2020 and 2024, the EV power module market experienced strong growth due to rising EV adoption, advancements in semiconductor technology, and improved power electronics efficiency. The shift from internal combustion engines to electrified drivetrains created the demand for high-performance power modules that enhance power conversion and battery efficiency. Although silicon-based power modules ruled at the beginning of this era, wide-bandgap (WBG) semiconductors such as silicon carbide (SiC) and gallium nitride (GaN) also gained ground. These semiconductors enhanced power density, minimized energy loss, and facilitated higher switching speeds, enabling manufacturers such as Tesla, Toyota, and Volkswagen to maximize EV performance.

Between 2025 and 2035, energy management by AI, modular power electronics, and increased adoption of WBG semiconductors will revolutionize the industry. AI-based optimization will facilitate monitoring energy consumption and thermal efficiency in real-time, increasing efficiency and decreasing maintenance expenses. Power module durability will be improved with predictive analytics, while next-gen materials and integrated designs will lead EV power electronics to greater efficiency, compactness, and eco-friendliness.

Comparative Industry Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Stricter efficiency mandates, semiconductor subsidies | Full transition to SiC/GaN power modules, sustainability mandates |

| Introduction of SiC-based power modules | AI-optimized power delivery, wireless power transfer |

| Power modules for premium EVs, early-stage 800V adoption | 1,200V architectures, standardized modular power electronics |

| Telematics for energy monitoring, liquid-cooled power modules | Predictive maintenance, real-time AI-driven power management |

| High cost of WBG materials, limited recyclability | Recyclable power modules, closed-loop semiconductor production |

| Limited real-time analytics for power modules | Blockchain-powered traceability, predictive performance modeling |

| Semiconductor shortages, cost barriers for SiC/GaN | Scalable manufacturing, diversified supply chains for rare materials |

| EV adoption, demand for higher efficiency | Wireless charging expansion, integration of sustainable power electronics |

A significant issue is the scarcity of raw materials, the most critical of which are lithium, cobalt, and nickel, the basic materials introduced in battery production. Supply shortages or territorial disputes may result in a material deficit, adversely affecting the production schedule and budget. Companies must establish firm supply chains to cope with these uncertainties.

Furthermore, the suppliers' view of quality must be assessed very carefully. Poor quality control can result in the manufacturing of defective power modules, which can become a safety issue and attract expensive recalls. The only solution to maintaining the quality of the products and, hence, the company's reputation is to conduct appropriate testing and adhere to the industry standards.

Environmental and regulatory compliance is another important matter. Suppliers must conform to severe environmental and legal standards to avoid legal punishment and ensure sustainability. Non-adherence can lead to fines, stoppage of production, and loss of reputation, thus making regulatory due diligence a crucial aspect of the supplier selection process.

Another important aspect is supplier financial stability. Suppliers who are not financially stable may experience operational downtime, which will, in turn, affect their capability to supply products. Regular financial checks and ensuring that the suppliers have a solid cash flow and are investing in infrastructure will help to minimize supply chain interruptions.

Moreover, the swift progress of new technologies compels the suppliers to stay at the cutting edge of innovation. Not keeping pace may make their parts obsolete, creating risks for manufacturers utilizing state-of-the-art technology. Implementing a thorough supplier assessment mechanism is vital for the sector's long-term prosperity.

EV power modules are largely used in battery electric vehicles (BEVs) as they depend completely on electric drive. BEVs should not be confused with hybrid electric vehicles (HEVs) and plug-in hybrid electric vehicles (PHEVs), which combine internal combustion with electric power. BEVs operate solely on high-capacity batteries. Hence, one of the major and essential components in efficiently handling energy conversion, battery performance, and power delivery throughout the vehicle is the power modules. The increasing global adoption of BEVs driven by government incentives, advances in battery technology, and more extensive charging networks also drive demand for high-performance power modules.

Passenger vehicles are the biggest consumers of EV power modules because of the mass market penetration of Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs), and Hybrid Electric Vehicles (HEVs). With the global shift towards electrified mobility gaining momentum, leading automobile manufacturers are fitting passenger vehicles with high-efficiency power modules to maximize energy conversion, battery efficiency, and motor control. The growing demand for long-range, high-performance electric vehicles from consumers, combined with government incentives and tighter emissions rules, has spurred the development of advanced power electronics in this segment.

| Country/Region | CAGR (%)(2025 to 2035) |

|---|---|

| USA | 9.2% |

| UK | 8.7% |

| European Union (EU) | 9.0% |

| Japan | 8.5% |

| South Korea | 8.9% |

The USA industry is expanding vigorously as the nation heads toward extensive adoption of electric vehicles (EVs). In addition to considerable government encouragement, mounting investments in semiconductor technology, and technology growth in power electronics, high-efficiency power module demand remains at a historic peak.

Industry leaders like Tesla, Wolfspeed, and ON Semiconductor are creating the next generation of power modules by integrating AI-based energy optimization, low-loss converters, and intelligent thermal management systems to increase EV range and performance.

FMI believes that the USA industry is slated to grow at 9.2% CAGR during the forecast period.

Growth Drivers in the USA

| Key Drivers | Details |

|---|---|

| Government Incentives | Inflation Reduction Act offers EV and battery factory tax credits. |

| Semiconductor Investment | DOE investment in the research of wide-bandgap semiconductors such as SiC and GaN. |

| Industry Innovation | Tesla and Wolfspeed working on AI power modules to enhance efficiency. |

| Consumer Adoption | Increased EV uptake as the cost of batteries reduces and charging infrastructure evolves. |

The industry in the UK is expanding as the country accelerates its transition to zero-emission vehicles. With a government-imposed prohibition on the sale of internal combustion engine (ICE) vehicles by 2035, the demand for power modules in EVs is growing.

Market leaders like Infineon, McLaren Applied Technologies, and Ricardo are developing lightweight, modular power electronics, combining AI-driven inverters, high-power density packaging, and fast heat dissipation mechanisms.

FMI is of the opinion that the UK market is slated to grow at 8.7% CAGR during the study period.

Growth Drivers in the UK

| Key Drivers | Details |

|---|---|

| EV Adoption Mandate | 2035 ban on ICE vehicles to drive EV sales and infrastructure development. |

| Public-Private Investment | Collaboration for improving the efficiency and integration of power modules. |

| Lightweight Power Electronics | Modular design and high power density to enhance vehicle range. |

| AI-Powered Inverters | McLaren Applied Technologies working on the development of energy-efficient AI-powered inverters. |

The European Union industry is experiencing strong growth due to stringent emission standards, growing commercial fleet electrification, and robust investment in semiconductor production.Germany, France, and the Netherlands are at the forefront of innovation in SiC- and GaN-based power modules, which provide lower switching losses and greater energy efficiency.FMI finds that the EU industry is set to witness a 9.0% CAGR during the forecast period.

Growth Drivers in the EU

| Key Drivers | Details |

|---|---|

| Strict Emission Regulations | European Green Deal enacts profound carbon cuts by 2030. |

| Commercial EV Adoption | Expanded use of EVs for logistics and public transport buses. |

| Semiconductor Innovation | SiC- and GaN-based power modules focus on efficiency improvement. |

| Investment in Battery Manufacturing | Investment in European gigafactories for EV battery manufacturing. |

The Japanese industry is growing steadily due to the nation's dominance in leading-edge battery technology, semiconductor development, and clean mobility. With Japan aiming to achieve carbon neutrality by 2050, EV makers are focusing on energy-efficient power modules to improve vehicle range and dependability.As per FMI, Japanese industry is slated to witness 8.5% CAGR during the study period.

As Japan is driving the battery-swapping technology, the industry is witnessing greater demand for fast-response power modules that provide smooth energy transfer from charging stations to vehicles.

Growth Drivers in Japan

| Key Drivers | Details |

|---|---|

| Carbon Neutrality Targets | Net-zero 2050 goals driving clean mobility adoption. |

| Next-Generation Battery Technology | Japan leading solid-state battery technology for higher EV range. |

| Battery-Swapping Infrastructure | Betting on high-speed energy transfer solutions for efficiency. |

| Semiconductor Dominance | Leading high-efficiency EV power electronics. |

The South Korean industry is growing steadily, backed by government investment, advancements in the semiconductor industry, and growing EV manufacturing. Hyundai and Kia, South Korea's automakers, are engaged in developing next-generation electric drivetrains, such as Hyundai and Kia. The demand for high-power, compact, and efficient power modules is rising.FMI states that the South Korean market is expected to grow at 8.9% CAGR during the study period.

South Korea's Ministry of Trade, Industry, and Energy (MOTIE) is heavily investing in wide-bandgap semiconductor technology, artificial intelligence-based energy management, and high-voltage power conversion technologies. Important industry players like Samsung SDI, LG Energy Solution, and Hanon Systems target SiC and GaN-based modules with greater switching speed, lower energy losses, and increased operational reliability.

Growth Drivers in South Korea

| Key Drivers | Details |

|---|---|

| Government Investment | Investment by MOTIE in research in wide-bandgap semiconductors. |

| Expansion of EV Market | Hyundai and Kia advancement of next-gen EV powertrains. |

| AI-Based Energy Management | Application of AI to improve EV power module efficiency. |

| Semiconductor Innovation | Introduction of SiC and GaN modules with high performance. |

The industry has some big players, such as Infineon Technologies, STMicroelectronics, ON Semiconductor, Wolfspeed, and Mitsubishi Electric, who are putting their powerful SiC and GaN-based power modules on the industry in conjunction with strong OEM partnerships related to high-efficiency converters. This has been made possible by the vertically integrated supply chain and proprietary semiconductor manufacturing coupled with the latest packaging technology. However, new startups and niche players are focusing on bringing solutions that are compact and rich in power density tailored to the next generation of EV architecture. The rate at which automakers speed up their electrification strategies presents a market where investments in volumetrically smaller, more efficient, and thermally optimized power modules will yield excellent future dividends.

Market Share Analysis by Company

| Company Name | Estimated Industry Share (%) |

|---|---|

| Infineon Technologies | 20-25% |

| ON Semiconductor | 15-20% |

| STMicroelectronics | 12-16% |

| Mitsubishi Electric | 10-14% |

| Wolfspeed (Cree Inc.) | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Infineon Technologies | Develops high-efficiency SiC-based power modules for EV traction inverters. |

| ON Semiconductor | Specializes in advanced power modules with high-voltage capabilities for electric drivetrains. |

| STMicroelectronics | Provides integrated power solutions leveraging SiC and GaN for enhanced performance. |

| Mitsubishi Electric | Innovates in high-power IGBT modules and inverter technology for EV applications. |

| Wolfspeed (Cree Inc.) | Focuses on next generation SiC power semiconductors for higher efficiency and compact designs. |

Infineon Technologies (20-25%)

Infineon leads the industry with its cutting-edge silicon carbide solutions, optimizing inverter performance and extending vehicle range while reducing heat losses.

ON Semiconductor (15-20%)

ON Semiconductor specializes in energy-efficient, high-voltage power modules that enable superior battery utilization and reduced system complexity in EV powertrains.

STMicroelectronics (12-16%)

STMicroelectronics drives innovation in SiC and GaN power solutions, ensuring high-speed switching and lower power losses for next-gen electric vehicles.

Mitsubishi Electric (10-14%)

Mitsubishi Electric focuses on high-power IGBT technology, offering durable and efficient power modules that enhance EV motor control and performance.

Wolfspeed (Cree Inc.) (6-10%)

Wolfspeed is a pioneering SiC-based power semiconductor, providing highly efficient and compact solutions that contribute to lightweight EV designs and improved energy conversion.

Other Key Players (30-40% Combined)

The EV power module market serves battery electric vehicles (BEVs), hybrid electric vehicles (HEVs), plug-in hybrid electric vehicles (PHEVs), and fuel cell electric vehicles (FCEVs).

Power modules are used in two-wheelers, passenger cars, commercial vehicles, and others.

The industry spans North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa.

The industry is slated to witness USD 3 billion in 2025.

The industry is predicted to reach a size of USD 25.8 billion by 2035.

Key manufacturers in the industry include Continental AG, Robert Bosch GmbH, Denso Corporation, Wolfspeed (Cree Inc.), Hitachi Automotive Systems Ltd, Mitsubishi Electric Corporation, STMicroelectronics, ON Semiconductor, Infineon Technologies, Toshiba Corporation, and NXP Semiconductors.

Passenger cars widely use these products.

The USA, slated to grow at 9.2% CAGR during the forecast period, is anticipated to register fastest growth.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Vehicle Technology, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Vehicle Technology, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Vehicle Technology, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Vehicle Technology, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Vehicle Technology, 2018 to 2033

Table 16: Latin America Market Volume (Units) Forecast by Vehicle Technology, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 21: Europe Market Value (US$ Million) Forecast by Vehicle Technology, 2018 to 2033

Table 22: Europe Market Volume (Units) Forecast by Vehicle Technology, 2018 to 2033

Table 23: Europe Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 24: Europe Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 25: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Asia Pacific Market Value (US$ Million) Forecast by Vehicle Technology, 2018 to 2033

Table 28: Asia Pacific Market Volume (Units) Forecast by Vehicle Technology, 2018 to 2033

Table 29: Asia Pacific Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 30: Asia Pacific Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: MEA Market Value (US$ Million) Forecast by Vehicle Technology, 2018 to 2033

Table 34: MEA Market Volume (Units) Forecast by Vehicle Technology, 2018 to 2033

Table 35: MEA Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 36: MEA Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Vehicle Technology, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Vehicle Technology, 2018 to 2033

Figure 9: Global Market Volume (Units) Analysis by Vehicle Technology, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Vehicle Technology, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Vehicle Technology, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 13: Global Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 16: Global Market Attractiveness by Vehicle Technology, 2023 to 2033

Figure 17: Global Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Vehicle Technology, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Vehicle Technology, 2018 to 2033

Figure 27: North America Market Volume (Units) Analysis by Vehicle Technology, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Vehicle Technology, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Vehicle Technology, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 31: North America Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 34: North America Market Attractiveness by Vehicle Technology, 2023 to 2033

Figure 35: North America Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Vehicle Technology, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Vehicle Technology, 2018 to 2033

Figure 45: Latin America Market Volume (Units) Analysis by Vehicle Technology, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Vehicle Technology, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Vehicle Technology, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 49: Latin America Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Vehicle Technology, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Europe Market Value (US$ Million) by Vehicle Technology, 2023 to 2033

Figure 56: Europe Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 57: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 60: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) Analysis by Vehicle Technology, 2018 to 2033

Figure 63: Europe Market Volume (Units) Analysis by Vehicle Technology, 2018 to 2033

Figure 64: Europe Market Value Share (%) and BPS Analysis by Vehicle Technology, 2023 to 2033

Figure 65: Europe Market Y-o-Y Growth (%) Projections by Vehicle Technology, 2023 to 2033

Figure 66: Europe Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 67: Europe Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 68: Europe Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 69: Europe Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 70: Europe Market Attractiveness by Vehicle Technology, 2023 to 2033

Figure 71: Europe Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 72: Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Asia Pacific Market Value (US$ Million) by Vehicle Technology, 2023 to 2033

Figure 74: Asia Pacific Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 75: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 78: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Asia Pacific Market Value (US$ Million) Analysis by Vehicle Technology, 2018 to 2033

Figure 81: Asia Pacific Market Volume (Units) Analysis by Vehicle Technology, 2018 to 2033

Figure 82: Asia Pacific Market Value Share (%) and BPS Analysis by Vehicle Technology, 2023 to 2033

Figure 83: Asia Pacific Market Y-o-Y Growth (%) Projections by Vehicle Technology, 2023 to 2033

Figure 84: Asia Pacific Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 85: Asia Pacific Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 86: Asia Pacific Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 87: Asia Pacific Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 88: Asia Pacific Market Attractiveness by Vehicle Technology, 2023 to 2033

Figure 89: Asia Pacific Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 90: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 91: MEA Market Value (US$ Million) by Vehicle Technology, 2023 to 2033

Figure 92: MEA Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 93: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 96: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: MEA Market Value (US$ Million) Analysis by Vehicle Technology, 2018 to 2033

Figure 99: MEA Market Volume (Units) Analysis by Vehicle Technology, 2018 to 2033

Figure 100: MEA Market Value Share (%) and BPS Analysis by Vehicle Technology, 2023 to 2033

Figure 101: MEA Market Y-o-Y Growth (%) Projections by Vehicle Technology, 2023 to 2033

Figure 102: MEA Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 103: MEA Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 104: MEA Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 105: MEA Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 106: MEA Market Attractiveness by Vehicle Technology, 2023 to 2033

Figure 107: MEA Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 108: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

EV Charging Tester Market Size and Share Forecast Outlook 2025 to 2035

Evaporative Air Cooler Market Size and Share Forecast Outlook 2025 to 2035

EV Charging Cable Market Size and Share Forecast Outlook 2025 to 2035

EVOH Encapsulation Film Market Size and Share Forecast Outlook 2025 to 2035

eVTOL Charging Facilities Market Size and Share Forecast Outlook 2025 to 2035

Event Tourism Market Size and Share Forecast Outlook 2025 to 2035

EV Telematics Control Systems Market Size and Share Forecast Outlook 2025 to 2035

Evidence Collection Tubes Market Size and Share Forecast Outlook 2025 to 2035

EV Battery Recycling and Black Mass Processing Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

EVA Coated Film Market Size and Share Forecast Outlook 2025 to 2035

EV Charging Management Software Platform Market Size and Share Forecast Outlook 2025 to 2035

EV EMC Battery Filter Market Size and Share Forecast Outlook 2025 to 2035

EV Traction Inverter Market Size and Share Forecast Outlook 2025 to 2035

EV Plant Construction Market Size and Share Forecast Outlook 2025 to 2035

EV Battery Heating System Market Size and Share Forecast Outlook 2025 to 2035

EV Charging Station Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Event Logistics Market Size and Share Forecast Outlook 2025 to 2035

Evaporated Filled Milk Market Size, Growth, and Forecast for 2025 to 2035

EV Lighting Market Growth - Trends & Forecast 2025 to 2035

EV Coolants Market Analysis by Coolant Type, Category, Vehicle Type, and Region through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA