The automotive industry is significantly dynamic in nature, the industry has showcased continuous evolution over the time and has potential for endless innovation and advancement with the growing consumer needs and increasing performance of the vehicle. Of the various systems imbibed in an automotive, braking system is among the one which is the most basic and conventional system but still, has been witnessing growth and advancement over years which varies upon various parameters including vehicle type, braking requirement, component materials, implementation of newer technologies and others. Variation across vehicle types is one of the most elementary parameter that differentiates the type, intensity of braking, type of materials to be used for the components. For heavy commercial vehicles, the brake components should be capable of bearing high intensity of static and dynamic forces and ensure stoppage of vehicles within minimum distance. For this, the construction and the material requirement of HCV brakes varies from that of LCV and passenger cars, thus making HCVs a substantial area of interest.

With the growing regulatory concern and implementation of stricter stopping distance guidelines for heavy commercial vehicles makes heavy commercial vehicles brake component market to hold significant growth potential. Further, in terms of production, heavy trucks witnessed growth of 18.2% in 2017 as compared to the production in 2016. Also the global commercial vehicle sales reached 26 Mn in 2017, a growth of 6.4% as compared to 2016. Apart for aforementioned factors, the going electrification of vehicles and increase in sales of electric bused and on-going research in electric trucks is expected to demand research in novel and more efficient braking technologies, thus making the heavy commercial vehicles brake market of significant importance.

Technological and product innovations are expected to shape the future market for heavy commercial vehicle brakes components. Manufacturers are witnessed focused on key advancements in disc brakes, ABS, hydraulics, foundation brakes, etc. Increased adoption of air brakes and supplementing braking system with advanced technology such as roll stability support, electronic stability control (ESC), collision safety, etc. Further, material developments includes utilization of lightweight materials for drums, discs, hubs, pads, shoes etc. without sacrificing durability and reliability of the product.

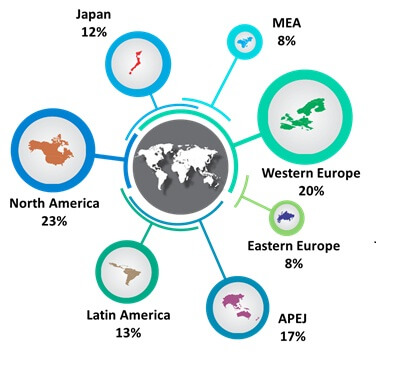

The research report on heavy commercial vehicles brake component market will supply necessary information on technology-strategy mapping and emerging trends with regards to heavy commercial vehicle brakes. The scope of the report includes heavy trucks, buses, off-road vehicles such as the one used in agriculture, mining, construction & earth-moving application and specialty vehicles including garbage trucks, fire trucks, ambulance, defense vehicles. The report will highlight the volume sales of the respective complete brake systems to the automakers i.e. OEMs and sales of individual components and sub-component through original equipment supplier and independent aftermarket. Apart from the overall disc and drum type systems utilized by the automakers, the aftermarket sales has been divided into components including but not limited to brake booster, master cylinder, control panel, drum brake components (brake drum, brake shoe and wheel cylinder), disc brake components (rotor, caliper and brake pad) and control components such as control valve, foot valve, relay valve, drain valve, air compressor, air dryer and brake hoses. In terms of technology, both hydraulic and pneumatic brakes has been considered to calculate market size across regions.

OEM market demand is closely related with production trends of vehicles across the countries and corresponding installation rates of listed components in the vehicles. Historical production information is collected from association and other paid data sources. These trends are closely analyzed in order to ascertain future development prospects in respective regions. Company releases and opinions of industry experts are collected to align projections and hypothesis to arrive at precise estimations concerning production growth and industry development for considered regions. Production volume of vehicles and corresponding installation rates are utilized to arrive at OEM demand volumes. The deduced volumes are multiplied with OEM pricing per unit to arrive at respective market size.

Aftermarket demand is closely related with replacement rate of listed components across vehicle categories. Fleet on road information is collected from association and other paid data sources. Further, replacement rate information from repair and maintenance service providers is collected to assess replacement demand for brake components. In addition, lifecycle analysis of brake components is also carried out to formulate apt assumptions. Replacement rates are multiplied with fleet on road to arrive at aftermarket volumes. These deduced volumes were multiplied with aftermarket prices to arrive at market size.

Further the base number thus arrived are validated from supply side. During finalization of base number, the hypothesis and facts are validated from industry participants and our panel of experts. After finalization of base number, the forecast is developed using FMI proprietary statistical model which incorporates impact of industry, economic and macro-economic factors over the market.

Examples of the key players identified in the global HCV brake component market incudes

Some of the key data points covered in our report include:

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Brake System & Components Market Growth - Trends & Forecast 2025 to 2035

Brake Pads and Shoes Market Size and Share Forecast Outlook 2025 to 2035

Brake System Market Size and Share Forecast Outlook 2025 to 2035

Brake Cables Market Size and Share Forecast Outlook 2025 to 2035

Brake Override System Market

Brake Shoe Market

HCV Suspension System Market

HCV Axles Market

Air Brake Systems Market Growth & Demand 2025 to 2035

Drum Brake Shoe Market Size and Share Forecast Outlook 2025 to 2035

Rail Brake Frame Market

Press Brakes Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Components Aftermarket Size and Share Forecast Outlook 2025 to 2035

Bicycle Brake Lever Market Size and Share Forecast Outlook 2025 to 2035

HIV/HBV/HCV Test Kits Market Trends and Forecast 2025 to 2035

Precision Components And Tooling Systems Market Size and Share Forecast Outlook 2025 to 2035

Waveguide Components and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Automobile Brake Shoes Market Size and Share Forecast Outlook 2025 to 2035

Automotive Brake Linings Market Size and Share Forecast Outlook 2025 to 2035

Automotive Brake Hoses and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA