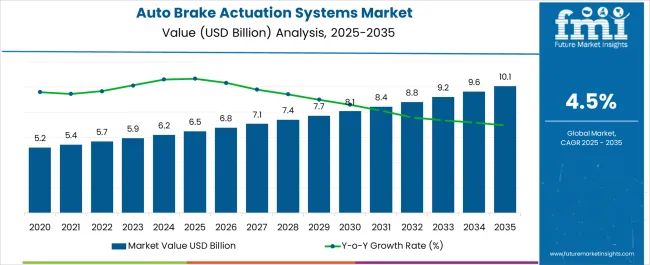

The Automotive Brake Actuation Systems Market is estimated to be valued at USD 6.5 billion in 2025 and is projected to reach USD 10.1 billion by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period.

| Metric | Value |

|---|---|

| Automotive Brake Actuation Systems Market Estimated Value in (2025 E) | USD 6.5 billion |

| Automotive Brake Actuation Systems Market Forecast Value in (2035 F) | USD 10.1 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

The automotive brake actuation systems market is experiencing consistent growth, supported by the rising emphasis on vehicle safety, regulatory mandates for braking efficiency, and consumer demand for enhanced driving comfort. Increasing adoption of advanced braking technologies, including electronic stability control and anti-lock braking systems, is accelerating the integration of sophisticated actuation mechanisms across vehicle categories. The growing production of passenger and commercial vehicles, particularly in emerging economies, is further expanding market opportunities.

Developments in lightweight materials, electronic sensors, and hydraulic systems are improving system responsiveness while reducing overall vehicle weight. Stringent government regulations regarding safety performance and emission standards are compelling automakers to incorporate efficient brake actuation systems to meet compliance requirements.

Additionally, the growing trend toward electrification and hybridization of vehicles is influencing demand for brake actuation systems that can integrate with regenerative braking technologies With manufacturers focusing on performance optimization and cost efficiency, the market is expected to experience robust expansion, supported by continuous innovation, regulatory alignment, and increasing consumer expectations for advanced safety features in modern vehicles.

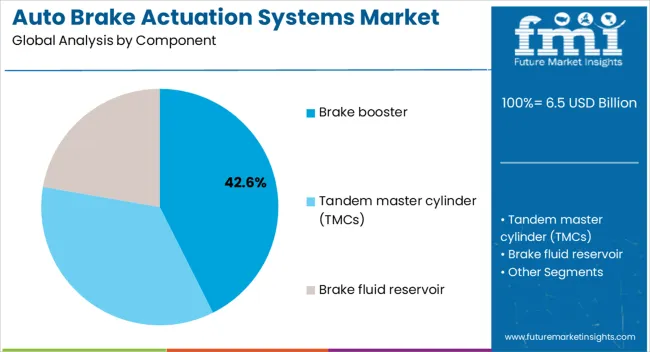

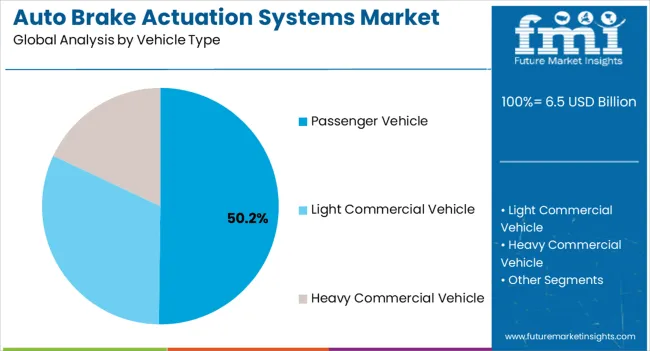

The automotive brake actuation systems market is segmented by component, vehicle type, and geographic regions. By component, automotive brake actuation systems market is divided into Brake booster, Tandem master cylinder (TMCs), and Brake fluid reservoir. In terms of vehicle type, automotive brake actuation systems market is classified into Passenger Vehicle, Light Commercial Vehicle, and Heavy Commercial Vehicle. Regionally, the automotive brake actuation systems industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The brake booster component segment is projected to account for 42.6% of the automotive brake actuation systems market revenue share in 2025, positioning it as the leading component category. Its dominance is being reinforced by its essential role in enhancing braking efficiency by reducing the physical force required from the driver to apply brakes. The segment is benefiting from widespread adoption across passenger and commercial vehicles due to its proven reliability, cost-effectiveness, and compatibility with conventional as well as advanced braking systems.

Increasing focus on driver comfort and vehicle safety has further accelerated demand for brake boosters, as they improve pedal feel and ensure quicker, more controlled braking responses. Advancements in vacuum and hydraulic booster designs are enabling integration with electronic braking technologies, supporting higher performance standards in modern vehicles.

The ability of brake boosters to meet global safety regulations and provide consistent performance across diverse driving conditions has strengthened their market position As automakers prioritize safety and regulatory compliance, the segment is expected to maintain its leadership in the coming years.

The passenger vehicle type segment is anticipated to represent 50.2% of the automotive brake actuation systems market revenue share in 2025, making it the leading vehicle type. This leadership is being driven by the rapid growth in passenger car production worldwide, supported by rising disposable incomes, urbanization, and evolving consumer preferences for safer and more technologically advanced vehicles. Brake actuation systems in passenger cars are increasingly being upgraded to integrate with advanced driver assistance systems and electronic stability technologies, reflecting heightened safety expectations.

Regulatory standards mandating advanced braking functions in passenger vehicles are also reinforcing adoption, particularly in markets such as Europe, North America, and Asia-Pacific. The segment is additionally supported by the accelerating shift toward electric and hybrid passenger vehicles, where brake actuation systems must integrate with regenerative braking functions to optimize efficiency and performance.

Manufacturers are investing in lightweight, compact, and electronically controlled systems tailored to passenger cars, further strengthening market growth As consumer demand for enhanced driving safety and comfort continues to rise, the passenger vehicle segment is expected to retain its dominance in the global market.

The market analysis for Automotive Brake Actuators from 2025 to 2025 exhibited a historical growth rate of 2.7% CAGR, as the growing awareness regarding safety features in vehicles is increasing and it is one of the main primary factors which is driving the market expansion from 2025 to 2025.

However, according to the most recent FMI analysis, the automotive brake actuator systems market is expected to grow at a rate of 4.5% between 2025 and 2035. Today, nearly every vehicle manufacturer offers advanced safety features for the safety of vehicle drivers and passengers.

Among vehicle types, the passenger car segment dominated the global automotive brake actuation system market in the previous period and is expected to grow at a significant CAGR during the forecast period. The past few years posed serious challenges for the automotive industry. During this time, the automotive industry has undergone significant changes.

A vehicle brake actuator is a relay device in a vehicle's rear brake assembly. When the driver touches the brake pedal, the car's brake actuator applies high pressure to the brake assembly. With traffic accidents on the rise, major car manufacturers are trying different ways to keep their vehicles safe. This should accelerate the introduction of improved automotive brake actuators into future vehicles. Based on the above facts, the global automotive brake actuation systems market is expected to witness significant growth during the forecast period.

The global automotive brake actuation system market is growing due to a number of factors, including stringent government safety standards and consumer preferences shifting to new technological advancements and active safety features. Nowadays safety features are one of the main factors which are been taken into consideration while buying a vehicle.

According to the Association for Safe International Road Travel, 3,287 persons die in traffic accidents on average every day, or almost 1.25 million people each year. The growing worry about traffic accidents around the world is anticipated to increase demand for automobile brake actuators in the near future. Leading automakers are making substantial investments in vehicle braking systems. By effectively integrating design and workflow, they can boost ROI and profitability while also lowering the cost of manufacturing car brake actuators. The global market for automotive brake actuation systems is expanding due to the improved safety benefits of these devices.

Rising concerns over fuel consumption, stringent government laws regulating vehicle emissions, the increasing number of vehicles, and macroeconomic factors such as GDP growth are driving the growth of the automotive brake actuation system market.

With the advancement of technology, key players are introducing many advanced features in vehicles. After a period of time, many other factors, such as high implementation costs, high development costs, and maintenance costs of electronic braking systems, can pose major challenges to the growth of the global automotive brake actuation system market. Also, the slow adoption of new technologies limits the market's growth.

Moreover, the implementation of new trade barriers in significant regions, along with variable raw material prices, is making it difficult for manufacturers of automotive brake actuators to keep their products' prices competitive. This factor also produces obstacles in the automotive brake actuation system market growth.

The global automotive brake actuation system market is expected to witness significant growth during the forecast period from 2025 to 2035. Developed countries such as the USA. and the United Kingdom are expected to play a significant role in the first half of the forecast period 2025 to 2035. while emerging markets such as India, China, and Brazil are expected to pull back in the second half of the forecast period and will drive demand for automotive brake actuation strongly.

According to our Automotive Brake Systems Industry Report, APAC had the highest market share in 2025. Rising car sales from developing countries such as India and China. The Chinese market includes luxury vehicles such as Audi, Mercedes-Benz, and BMW, which will boost demand for the automotive braking system market.

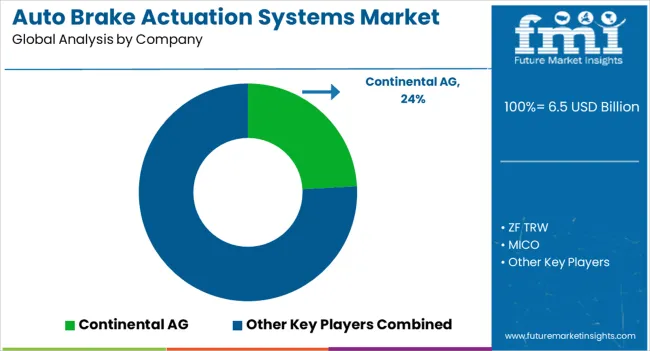

Key players in the global Automotive Brake Actuation System market are Continental AG, ZF TRW, MICO, Inc., Delphi Automotive PLC, Magneti Marelli S.P.A, and Valeo S.A.

With the presence of several global and local players, the automotive braking system market appears to be highly competitive. The growing transportation sector in terms of electrification of powertrains and components provides opportunities for suppliers.

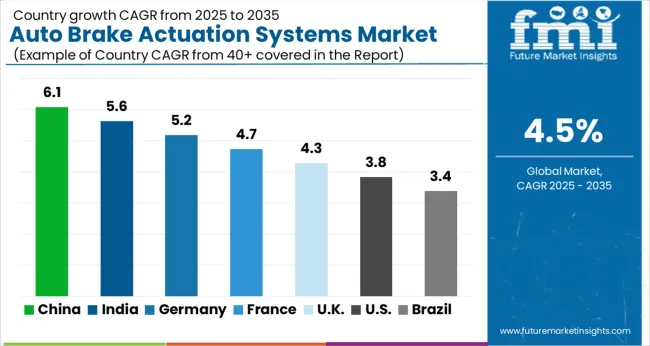

| Country | CAGR |

|---|---|

| China | 6.1% |

| India | 5.6% |

| Germany | 5.2% |

| France | 4.7% |

| UK | 4.3% |

| USA | 3.8% |

| Brazil | 3.4% |

The Automotive Brake Actuation Systems Market is expected to register a CAGR of 4.5% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 6.1%, followed by India at 5.6%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 3.4%, yet still underscores a broadly positive trajectory for the global Automotive Brake Actuation Systems Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 5.2%. The USA Automotive Brake Actuation Systems Market is estimated to be valued at USD 2.2 billion in 2025 and is anticipated to reach a valuation of USD 3.2 billion by 2035. Sales are projected to rise at a CAGR of 3.8% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 329.0 million and USD 215.6 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.5 Billion |

| Component | Brake booster, Tandem master cylinder (TMCs), and Brake fluid reservoir |

| Vehicle Type | Passenger Vehicle, Light Commercial Vehicle, and Heavy Commercial Vehicle |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Continental AG, ZF TRW, MICO, Delphi Automotive PLC, Magneti Marelli S.P.A, and Valeo S.A. |

The global automotive brake actuation systems market is estimated to be valued at USD 6.5 billion in 2025.

The market size for the automotive brake actuation systems market is projected to reach USD 10.1 billion by 2035.

The automotive brake actuation systems market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in automotive brake actuation systems market are brake booster, tandem master cylinder (tmcs) and brake fluid reservoir.

In terms of vehicle type, passenger vehicle segment to command 50.2% share in the automotive brake actuation systems market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Brake Linings Market Size and Share Forecast Outlook 2025 to 2035

Automotive Brake Hoses and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Automotive Brake Fluid Market Size and Share Forecast Outlook 2025 to 2035

Automotive Brake Booster and Master Cylinder Market Size and Share Forecast Outlook 2025 to 2035

Automotive Brake Shims Market Analysis - Size, Share, and Forecast 2025 to 2035

Automotive Brake System Market Growth - Trends & Forecast 2025 to 2035

Automotive Brake Friction Products Market - Trends & Forecast 2025 to 2035

Automotive Brake Pad Market - Growth & Demand 2025 to 2035

Automotive Brake Tube Market Growth - Trends & Forecast 2025 to 2035

Automotive Brake Valve Market Growth - Trends & Forecast 2025 to 2035

Automotive Brake System & Components Market Growth - Trends & Forecast 2025 to 2035

Air Brake Systems Market Growth & Demand 2025 to 2035

Automotive Handbrake And Clutch Cables Market

Automotive Park Brake Lever Market Growth – Trends & Forecast 2024-2034

Automotive Vacuum Brake Booster Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Brake Rotors Market Growth - Trends & Forecast 2025 to 2035

Automotive Seating Systems Market Analysis - Size, Share & Forecast 2025 to 2035

Automotive Exhaust Systems Market Trends - Growth & Forecast 2025 to 2035

Automotive Sintered Brake Pads Market Size and Share Forecast Outlook 2025 to 2035

Automotive Ignition Systems Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA