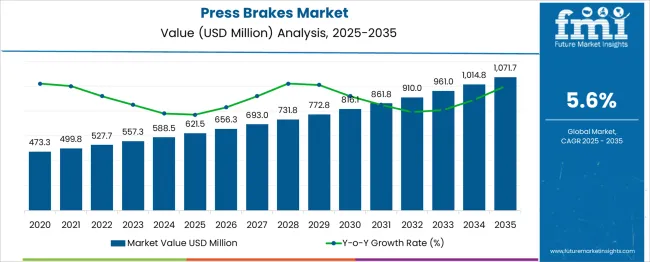

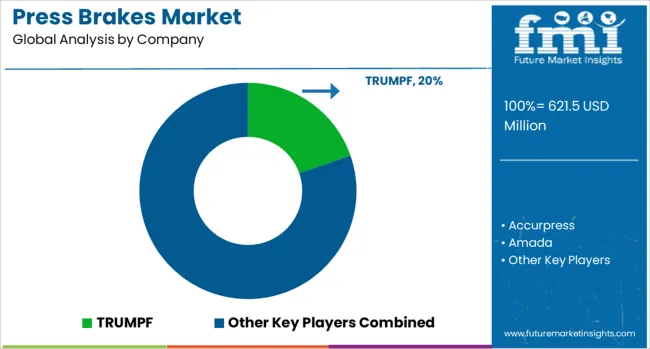

The Press Brakes Market is estimated to be valued at USD 621.5 million in 2025 and is projected to reach USD 1071.7 million by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period.

| Metric | Value |

|---|---|

| Press Brakes Market Estimated Value in (2025 E) | USD 621.5 million |

| Press Brakes Market Forecast Value in (2035 F) | USD 1071.7 million |

| Forecast CAGR (2025 to 2035) | 5.6% |

The increasing complexity of automotive components and the rising demand for lightweight, durable metal parts are driving the need for efficient bending technologies. Advancements in automation and control systems have enhanced the capabilities of press brakes, enabling higher throughput and consistent quality. Growing investments in manufacturing infrastructure and modernization projects across regions are expanding the adoption of advanced press brakes.

Industry standards for safety and precision have further supported the use of automated and semi-automated machines. The market outlook is promising as industries such as automotive, aerospace, and heavy machinery continue to expand and upgrade their metal fabrication capabilities. Segmental growth is expected to be driven by hydraulic press brakes, 4- to 6-axis configurations, and the automotive sector as the primary end use.

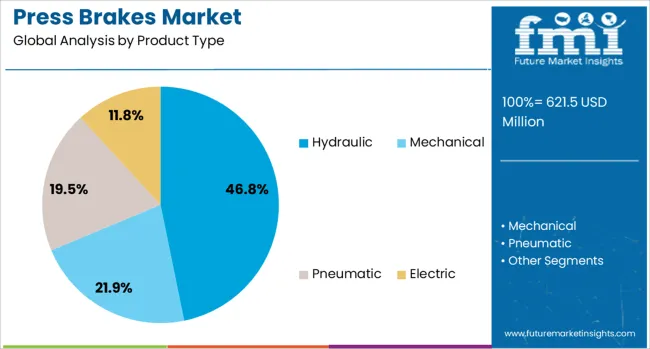

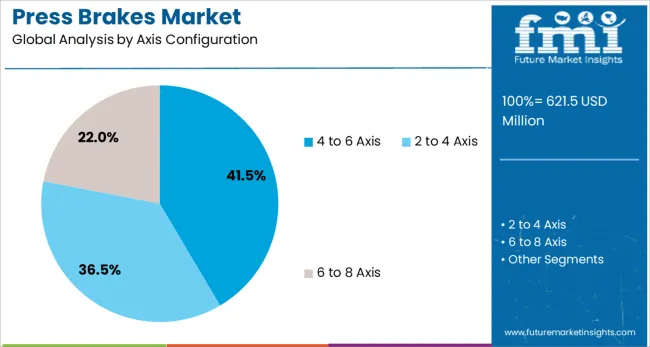

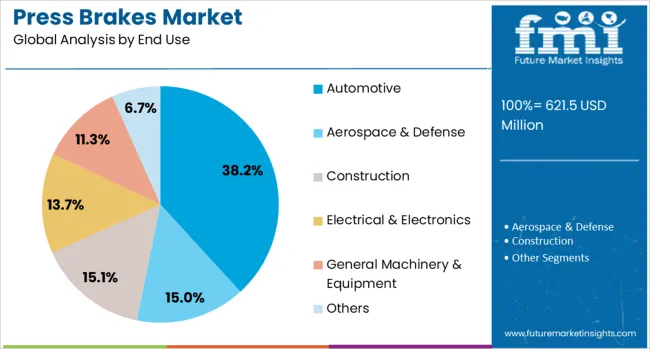

The press brakes market is segmented by product type, axis configuration, end use, and distribution channel and geographic regions. The press brakes market is divided by product type into Hydraulic, Mechanical, Pneumatic, and Electric. In terms of axis configuration, the press brakes market is classified into 4 to 6 Axis, 2 to 4 Axis, and 6 to 8 Axis. Based on end use, the press brakes market is segmented into Automotive, Aerospace & Defense, Construction, Electrical & Electronics, General Machinery & Equipment, and Others. The distribution channel of the press brakes market is segmented into Direct and Indirect. Regionally, the press brakes industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The hydraulic press brakes segment is projected to hold 46.8% of the market revenue in 2025, maintaining its position as the dominant product type. This is attributed to the robustness and versatility of hydraulic systems that deliver high force for bending thicker and harder metal sheets. The segment benefits from continuous improvements in energy efficiency and control precision.

Hydraulic press brakes offer smooth operation and are well suited for a wide range of industrial applications. Their adaptability to different tooling setups and ability to handle complex bends have made them a preferred choice in manufacturing settings where reliability and power are crucial.

As manufacturing processes become more demanding, the hydraulic segment is expected to sustain strong demand.

The 4- to 6-axis configuration segment is anticipated to capture 41.5% of the press brakes market revenue in 2025, leading the market in terms of flexibility and precision. These configurations allow enhanced control over bending operations, including back gauge positioning and ram stroke control.

The increasing need for complex bends and tighter tolerances in metal fabrication drives the segment’s growth. Manufacturers have favored 4 to 6-axis press brakes for their ability to improve productivity while maintaining consistent part quality.

This configuration supports automation and integration with computer numerical control systems, which is essential in modern manufacturing plants. As precision and efficiency continue to gain importance, this segment is poised for ongoing growth.

The automotive end-use segment is projected to represent 38.2% of the press brakes market revenue in 2025, reflecting its leading position among industries. The sector’s demand for lightweight and complex metal components has increased the use of press brakes for body panels, chassis parts, and structural components.

Automotive manufacturers have emphasized precision and repeatability to meet safety and design standards, making press brakes critical in production lines. Increasing vehicle production volumes, especially in emerging markets, have further contributed to market expansion.

The shift toward electric vehicles has introduced new requirements for metal forming, supporting the adoption of advanced bending technologies. The automotive segment is expected to continue driving market growth as innovation and production scale evolve.

Fabrication lines are deploying press brakes equipped with CNC controllers, servo-driven rams, and digital back gauges to maintain repeatable accuracy across varied thicknesses and complex profiles. Quick-change tooling systems combined with robotic loading units are reducing non-productive time, making these solutions viable for short-run and mixed-model production environments. Real-time bend simulation and automatic compensation software have minimized trial bends, ensuring tighter tolerances in structural, aerospace, and automotive applications.

Press brakes equipped with CNC controllers and servo-driven rams have been integrated to ensure precise angle replication and high-speed forming across varied thicknesses. Adaptive control algorithms adjust tonnage and ram speed dynamically, improving cycle efficiency without compromising accuracy. Multi-axis back gauges have supported complex bend sequences, reducing setup time in high-mix environments. Hybrid and electric variants are replacing hydraulics as energy efficiency and lower maintenance costs gain importance. Automotive, aerospace, and HVAC producers have adopted programmable bending systems to optimize prototyping and minimize material waste. Integration with offline programming software and IoT-enabled monitoring platforms has strengthened predictive maintenance capabilities, reducing downtime and supporting higher throughput in medium and high-volume fabrication facilities.

High capital expenditure has limited adoption as CNC-enabled and automation-ready press brakes require servo systems, precision tooling, and robotic modules, which significantly increase upfront investment. Integration with MES and ERP software often demands custom APIs and extended commissioning timelines, adding complexity to implementation. Skilled operator availability remains constrained, with multi-step programming and advanced motion-control troubleshooting requiring specialized training. Maintenance challenges have intensified as servo motors, ball screws, and electronic assemblies necessitate certified service, increasing lifecycle costs. Smaller fabrication units continue to defer upgrades due to uncertain ROI, particularly in markets driven by short production runs and margin-sensitive projects. Downtime during recalibration and component replacement further disrupts operations in high-volume plants lacking redundant equipment.

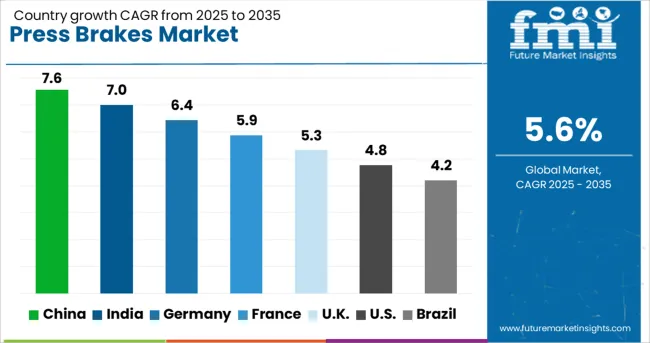

| Country | CAGR |

|---|---|

| China | 7.6% |

| India | 7.0% |

| Germany | 6.4% |

| France | 5.9% |

| UK | 5.3% |

| USA | 4.8% |

| Brazil | 4.2% |

Global press brakes demand is expected to grow at a 5.6% CAGR from 2025 to 2035. Among the five profiled markets, China leads with 7.6%, followed by India at 7.0% and Germany at 6.4%, while France records 5.9% and the United Kingdom 5.3%. These figures indicate a growth premium of +36% for China, +25% for India, and +14% for Germany compared to the global baseline, whereas France and the United Kingdom show +5% and –5%, respectively. Variations are driven by localized factors such as large-scale automotive manufacturing and factory digitization in China, infrastructure-driven fabrication demand in India, precision engineering in Germany, aerospace and defense modernization in France, and incremental legacy system upgrades in the United Kingdom. The report covers over 40 countries, with five highlighted here for reference.

China is forecast to grow at a 7.6% CAGR, supported by large-scale industrial automation, automotive production, and construction activity. CNC and servo-electric press brakes dominate new installations due to precision, energy efficiency, and quick cycle times. Predictive maintenance using AI algorithms is being adopted in high-volume plants to reduce downtime and extend machine life. Compact high-tonnage presses are critical for heavy fabrication and shipbuilding applications. Domestic manufacturing programs such as “Made in China 2025” aim to reduce import dependency and accelerate local production of advanced forming machinery. Export-driven fabrication units are prioritizing digital-ready systems to maintain global competitiveness and quality consistency.

India is projected to grow at a 7.0% CAGR, driven by infrastructure growth and strong automotive component production. Fabricators are rapidly shifting from conventional hydraulics to CNC and hybrid models to meet precision and speed requirements. Policy initiatives such as PLI and “Make in India” encourage localized machine production and advanced tooling capabilities. MSMEs are deploying semi-automated systems to reduce defects and improve forming accuracy for varied components. Rising demand from renewable energy installations and electric mobility projects is creating additional scope for energy-efficient machines. Partnerships between global OEMs and Indian manufacturers are accelerating adoption of servo-driven technology and software-based process control.

Germany is expected to record a 6.4% CAGR, driven by advanced engineering capabilities and a strong presence in precision metal fabrication. Servo-hydraulic and electric presses dominate installations for energy savings and accurate multi-bend operations. Automated tool-changing systems are being adopted to cut downtime in batch production, improving flexibility for custom and small-series work. Manufacturers are focusing on energy-optimized designs and recyclable components to comply with EU sustainability mandates. Export growth of specialized forming equipment to Asia-Pacific and Eastern Europe is sustaining innovation in complex tooling solutions. Continuous development in forming software and adaptive bending controls reinforces Germany’s global leadership in sheet metal processing.

France is projected to grow at a 5.9% CAGR, with demand centered on aerospace, defense, and engineering applications requiring complex profiles. Robotic integration for automated bending lines is improving throughput and repeatability. Manufacturers are offering electric and hybrid press brakes to replace traditional hydraulics, reducing energy usage and maintenance requirements. Government-led innovation programs support digital-enabled machines equipped with real-time diagnostic systems for predictive servicing. Aerospace firms rely on advanced forming technology for high-strength alloys used in structural assemblies, while defense contractors demand compliance-ready machines for mission-critical components. Competitive pressures have pushed suppliers to introduce compact, efficient systems for diverse fabrication requirements.

The United Kingdom is forecast to grow at a 5.3% CAGR, supported by the modernization of fabrication lines in the automotive, rail, and aerospace sectors. CNC-equipped press brakes are gaining prominence for complex, high-precision component forming. Compact units tailored for SMEs address space and capital constraints, encouraging wider adoption. Predictive analytics integrated with smart control systems is reducing downtime and supporting continuous operations. Export-driven suppliers are prioritizing accuracy-focused equipment to meet stringent quality requirements for international markets. Energy-efficient and compliance-ready models are becoming critical as manufacturers align with UK emission and operational efficiency regulations, enhancing sustainability across forming operations.

The press brakes market is led by TRUMPF with a significant share, supported by CNC-enabled systems, automated bending cells, and IoT-based monitoring for high-volume manufacturing. Amada strengthens its position through hybrid and electric models that offer energy efficiency and advanced bend simulation software, appealing to automotive and aerospace sectors. Bystronic focuses on robotic integration and adaptive control systems, targeting smart manufacturing environments. LVD emphasizes automated tool-change technology and real-time angle correction to improve precision for complex components. SafanDarley specializes in fully electric presses, addressing sustainability and energy compliance requirements. Durma and ERMAKSAN remain competitive in cost-driven markets with CNC-equipped hydraulic and hybrid models, while Prima Power, Salvagnini, and Yawei prioritize turnkey solutions integrating press brakes with laser cutting systems.

In June 2024, TRUMPF introduced the Flex Cell, a mobile, robot-enabled bending cell integrated with the TruBend 7050 press brake, showcased at FABTECH 2024. It automates loading/unloading processes and facilitates lights-out operation, addressing labor shortages and enhancing productivity in sheet-metal fabrication.

| Item | Value |

|---|---|

| Quantitative Units | USD 621.5 Million |

| Product Type | Hydraulic, Mechanical, Pneumatic, and Electric |

| Axis Configuration | 4 to 6 Axis, 2 to 4 Axis, and 6 to 8 Axis |

| End Use | Automotive, Aerospace & Defense, Construction, Electrical & Electronics, General Machinery & Equipment, and Others |

| Distribution Channel | Direct and Indirect |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | TRUMPF, Accurpress, Amada, Baykal, Bystronic, Cincinnati, Durma, ERMAKSAN, Haco, LVD, MVD Inan, Prima Power, SafanDarley, Salvagnini, and Yawei |

| Additional Attributes | Dollar sales by machine type (hydraulic, servo-electric, hybrid), with hydraulic models dominating for cost-effectiveness and durability. Servo-electric and hybrid presses gain traction for precision bending and reduced energy use. Regional trends led by Asia-Pacific, supported by rapid industrialization and infrastructure projects. Key players focus on automation integration, CNC control systems, and adaptive tooling for flexible manufacturing needs. |

The global press brakes market is estimated to be valued at USD 621.5 million in 2025.

The market size for the press brakes market is projected to reach USD 1,071.7 million by 2035.

The press brakes market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in press brakes market are hydraulic, mechanical, pneumatic and electric.

In terms of axis configuration, 4 to 6 axis segment to command 41.5% share in the press brakes market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pressurized Water Reactor System Market Size and Share Forecast Outlook 2025 to 2035

Pressure Relief Dressing Market Size and Share Forecast Outlook 2025 to 2035

Pressure Compensated Hydraulic Pump Market Size and Share Forecast Outlook 2025 to 2035

Pressure Compensated Pump Market Size and Share Forecast Outlook 2025 to 2035

Pressure Switch Market Forecast Outlook 2025 to 2035

Pressure Reducing Valve Market Size and Share Forecast Outlook 2025 to 2035

Pressure-Volume Loop Systems Market Size and Share Forecast Outlook 2025 to 2035

Pressure Transmitter Market Size and Share Forecast Outlook 2025 to 2035

Pressure Monitoring Extension Tubing Sets Market Size and Share Forecast Outlook 2025 to 2035

Pressure Sensitive Labeling Machine Market Size and Share Forecast Outlook 2025 to 2035

Pressure Bandages Market Size and Share Forecast Outlook 2025 to 2035

Pressure-Sensitive Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Pressure Gauges Market Size and Share Forecast Outlook 2025 to 2035

Pressure Relief Valve Market Size and Share Forecast Outlook 2025 to 2035

Pressurized Wine Filter System Market Size and Share Forecast Outlook 2025 to 2035

Pressure-Controlled Vacuum Sealers Market Size and Share Forecast Outlook 2025 to 2035

Press Machine Market Size and Share Forecast Outlook 2025 to 2035

Pressure Sensitive Tapes and Labels Market Size, Share & Forecast 2025 to 2035

Pressure Infusion Bags Market Analysis - Size, Share, and Forecast 2025 to 2035

Pressure Ulcer Detection Devices Market Trends – Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA