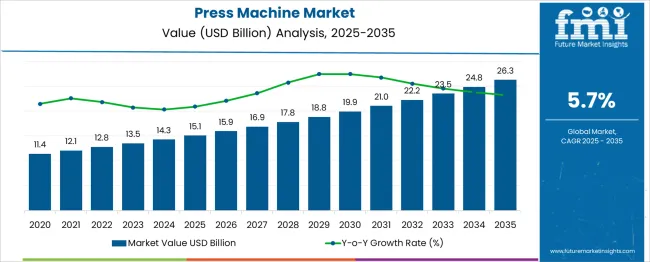

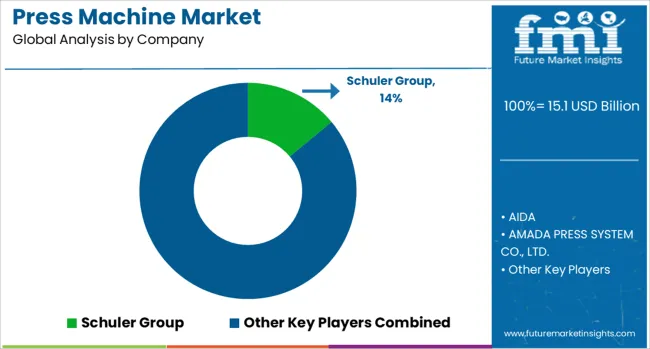

The press machine market is estimated to be valued at USD 15.1 billion in 2025 and is projected to reach USD 26.3 billion by 2035, registering a compound annual growth rate (CAGR) of 5.7% over the forecast period. This implies that for every dollar generated in 2025, nearly USD 1.74 is expected by 2035, underpinned by a compound annual growth rate (CAGR) of 5.7%. The absolute dollar growth of USD 11.2 billion over ten years suggests an incremental demand trend driven by consistent investment in industrial automation, metal forming precision, and production scalability.

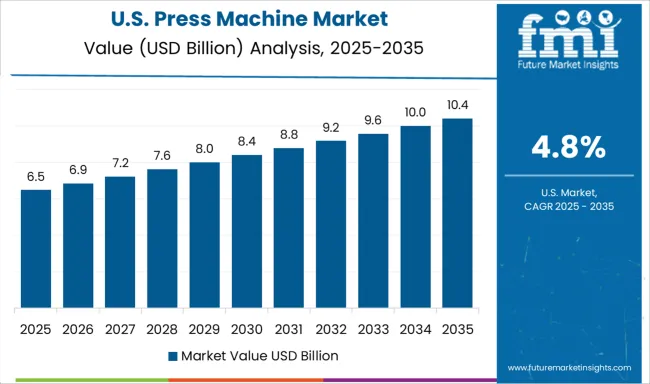

The smallest annual increment is between 2025 and 2026 at USD 0.8 billion, while the largest occurs from 2034 to 2035 at USD 1.5 billion, underscoring a strengthening momentum rather than early-cycle concentration. From 2027 to 2032, annual additions average around USD 1.2 billion, with no reversal or plateau observed. The slope of the market expansion suggests a mid-cycle acceleration without sharp peaks or troughs, favoring long-term capacity expansion strategies.

By the end of the forecast period, demand is expected to tilt toward digitally integrated, high-tonnage press systems, especially in precision automotive components and lightweight alloy stamping. The absence of volatility indicates a structurally resilient market anchored in core manufacturing fundamentals.

| Metric | Value |

|---|---|

| Press Machine Market Estimated Value in (2025 E) | USD 15.1 billion |

| Press Machine Market Forecast Value in (2035 F) | USD 26.3 billion |

| Forecast CAGR (2025 to 2035) | 5.7% |

Investments in advanced manufacturing technologies are shaping the current market scenario, increasing focus on energy-efficient machinery, and growing automation in production processes, as noted in corporate press releases, investor presentations, and industry news.

The outlook for the market appears positive as manufacturers prioritize modernization of facilities to meet evolving quality standards and productivity goals. Further growth is anticipated due to the emphasis on reducing operational costs, improving worker safety, and meeting stricter regulatory requirements related to emissions and workplace ergonomics.

Company announcements and product launches highlight the significance of incorporating digital control systems and predictive maintenance capabilities, which are enhancing the value proposition of press machines. These developments are enabling businesses to achieve higher throughput and quality, paving the way for further adoption across diverse industrial sectors globally.

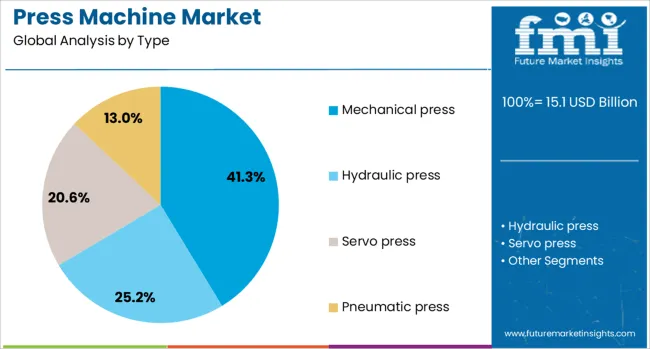

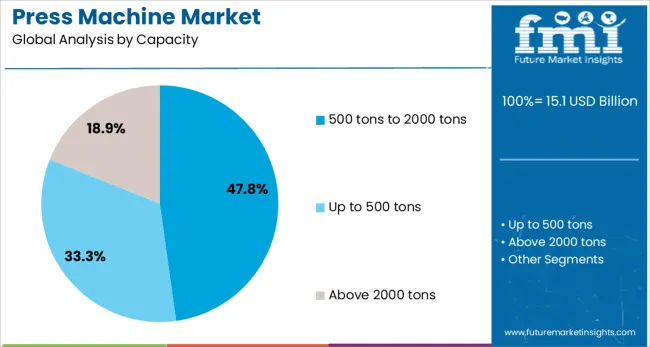

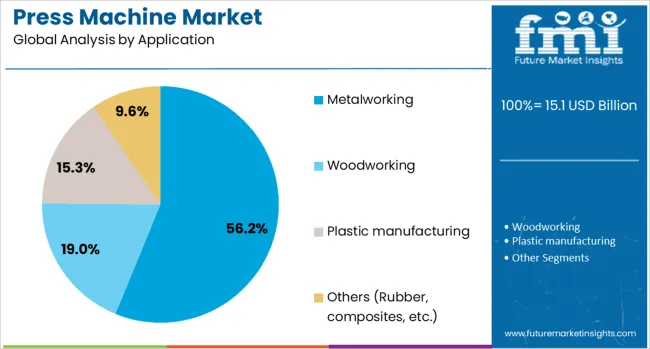

The press machine market is segmented by type, capacity, application, end use, distribution channel, and geographic regions. The press machine market is divided by type into Mechanical press, Hydraulic press, Servo press, and Pneumatic press. In terms of capacity, the press machine market is classified into 500 tons to 2000 tons, up to 500 tons, and above 2000 tons. Based on the application of the press machine market, it is segmented into Metalworking, Woodworking, Plastic manufacturing, and Others (Rubber, composites, etc.). By end use of the press machine market is segmented into Automotive, Aerospace & defense, General machinery & equipment, Electrical & electronics, and Others (Healthcare, marine, etc.). By distribution channel of the press machine market is segmented into Direct sales and Indirect sales. Regionally, the press machine industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The mechanical press segment is expected to contribute 41.3% of the Press Machine market revenue share in 2025, establishing itself as the leading type. This position is being attributed to its reliability, simplicity of operation, and suitability for high-volume production, as reported in technical publications and product brochures.

Mechanical presses are being widely adopted due to their ability to deliver consistent force at high speeds, making them ideal for stamping and forming operations in industries requiring rapid cycle times. Their cost-effectiveness and durability have been emphasized in corporate statements, which have underlined the reduced maintenance and ease of integration with existing manufacturing lines.

The segment’s prominence is also being supported by advancements in clutch and brake technology that enhance operational safety and efficiency. These factors collectively have ensured that mechanical presses remain a preferred choice for manufacturers seeking productivity and affordability in large-scale metal forming applications.

The 500 tons to 2000 tons capacity segment is projected to hold 47.8% of the Press Machine market revenue share in 2025, making it the dominant capacity range. This leadership is being driven by its ability to meet a broad range of production requirements, offering versatility in processing both medium and heavy gauge materials, as noted in corporate updates and investor briefings.

Press machines within this capacity range are being favored because they balance power and footprint efficiently, allowing installation in varied manufacturing environments while delivering the necessary force for complex operations. According to product specifications shared by manufacturers, these machines are being selected for their ability to perform deep drawing, blanking, and stamping with high accuracy.

Furthermore, improvements in frame design and control systems have enabled enhanced precision and reduced downtime. These advantages have supported the sustained preference for this capacity range in industries seeking reliable and scalable solutions.

The metalworking application segment is forecasted to command 56.2% of the Press Machine market revenue share in 2025, retaining its status as the largest application area. Growth in this segment is being supported by the expanding demand for sheet metal components in automotive, construction, and industrial machinery sectors, as highlighted in annual reports and trade journals.

The increasing complexity of metal parts and the need for lightweight yet strong materials are encouraging the adoption of press machines in metalworking operations. Companies have outlined in their communications that software-defined controls and advanced die technology are enhancing production efficiency and reducing material waste, further boosting the segment’s appeal.

Regulatory focus on reducing manufacturing emissions and improving workplace safety has also contributed to the shift towards modern press machines in metalworking applications. These trends have ensured that the metalworking segment continues to dominate as manufacturers invest in high-performance equipment to meet stringent quality and sustainability goals.

The press machine market is expanding due to increased demand for efficient and precise manufacturing processes across industries like automotive, metalworking, and packaging. These machines are used for various applications, including stamping, forging, and molding, providing essential functionality in production lines. Technological advancements in press machine design, such as automation and energy efficiency, are driving adoption. However, challenges related to high initial investment costs and maintenance requirements persist. Opportunities lie in innovations that improve machine performance and expand the market’s reach in emerging economies.

The primary driver of the press machine market is the growing demand for automation and precision in manufacturing. Press machines are widely used in industries like automotive, metalworking, electronics, and packaging for their ability to produce high-quality, precise components efficiently. As industries continue to push for faster production speeds and higher accuracy, the need for advanced press machines capable of meeting these demands is increasing. Automation features in modern press machines, such as robotic arms and intelligent control systems, further enhance productivity by reducing human error and improving operational efficiency. The increasing focus on lean manufacturing and cost-saving practices is also pushing industries to invest in more efficient press machines.

A significant restraint in the press machine market is the high initial cost of purchase and installation. These machines, particularly high-capacity and precision models, require a substantial investment, which may be a barrier for small and medium-sized enterprises (SMEs). Additionally, ongoing maintenance and repair costs can add to the total cost of ownership. While press machines are durable, they require regular maintenance to ensure optimal performance, and failure to do so can lead to downtime and decreased productivity. For industries with limited budgets or in regions where advanced manufacturing equipment is not readily accessible, these factors can delay or hinder adoption, limiting market growth.

The press machine market presents significant opportunities driven by technological advancements and the increasing demand for high-quality manufacturing. Innovations such as servo-driven presses, energy-efficient models, and advanced control systems are improving the precision, energy consumption, and productivity of press machines. Moreover, the expansion of industries in emerging markets such as the Asia-Pacific, Latin America, and Africa presents growth opportunities. As infrastructure development, automotive production, and industrialization continue to rise in these regions, the demand for advanced press machines is set to increase. Additionally, the trend toward Industry 4.0, which integrates IoT and automation, presents opportunities for manufacturers to develop smart press machines with real-time monitoring and predictive maintenance features.

A key trend in the press machine market is the integration of automation and digitalization into production processes. The increasing adoption of robotic systems and intelligent controls is improving machine performance, flexibility, and ease of use. Automated press machines are capable of performing complex tasks with minimal human intervention, which enhances efficiency and consistency in production lines. The incorporation of digital technologies, such as IoT for real-time data monitoring and predictive maintenance, is also gaining momentum. These advancements allow manufacturers to optimize operations, reduce downtime, and ensure greater control over the production process, which is reshaping the future of the press machine market.

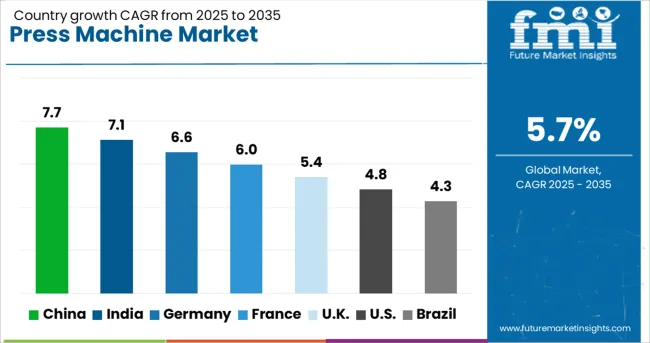

| Country | CAGR |

|---|---|

| China | 7.7% |

| India | 7.1% |

| Germany | 6.6% |

| France | 6.0% |

| UK | 5.4% |

| USA | 4.8% |

| Brazil | 4.3% |

The global press machine market is expected to grow at a CAGR of 5.7% from 2025 to 2035. China leads with a strong growth rate of 7.7%, followed by India at 7.1%. Germany and France are also experiencing solid growth with CAGRs of 6.6% and 6.0%, respectively. The UK and the USA are witnessing moderate growth rates of 5.4% and 4.8%. Brazil, an emerging market, is projected to grow at a CAGR of 4.3%. The increasing demand across various industries such as automotive, aerospace, and manufacturing is driving the demand for press machines, especially with the rise in automation and the need for high-precision equipment.

China’s press machine market is expected to grow at a CAGR of 7.7%, driven by the country’s rapid industrialization and demand for advanced manufacturing solutions. The Chinese government’s focus on modernizing its manufacturing sector and the increasing adoption of automation are major factors driving the need for press machines. The country’s dominance in sectors like automotive and electronics further boosts demand. Additionally, China’s growing renewable energy sector and infrastructure development projects contribute to the rising need for high-precision press machines to meet the evolving industrial needs.

India’s press machine market is projected to grow at a CAGR of 7.1%. The country’s growing manufacturing sector, especially in automotive, machinery, and metalworking, is a key factor behind this strong growth. As India focuses on enhancing industrial productivity, the demand for advanced press machines is rising. Government initiatives like “Make in India” and the push towards smart manufacturing and automation are expected to further drive the adoption of press machines. Additionally, India’s expanding infrastructure and energy sector, along with the rise of electric vehicles, offer substantial growth opportunities for press machine suppliers.

Germany’s press machine market is expected to grow at a CAGR of 6.6%, driven by its strong industrial base, particularly in automotive and aerospace industries. The country’s focus on precision engineering and automation is accelerating the adoption of advanced press machines. As Germany embraces Industry 4.0, the need for high-precision, automated press machines is increasing. Additionally, the rise in demand for lightweight materials in automotive production and the growing focus on sustainable manufacturing solutions further contribute to the steady growth of the press machine market in Germany.

France’s press machine market is projected to grow at a CAGR of 6.0%, with significant demand driven by the automotive, aerospace, and manufacturing sectors. The country’s push towards smart manufacturing and energy-efficient solutions is contributing to the rising demand for press machines. The adoption of automation technologies, coupled with the need for high-precision equipment in various industries, is accelerating growth. Furthermore, France’s focus on sustainability and eco-friendly production methods is increasing the need for advanced press machines, particularly in the automotive and metalworking industries.

The UK is expected to grow at a moderate CAGR of 5.4% in the press machine market. While the country’s industrial sector is well-established, there is increasing demand for advanced press machines driven by the automotive, aerospace, and metalworking industries. The UK’s focus on renewable energy and sustainable manufacturing practices is also contributing to market growth. Additionally, the push towards automation and smart manufacturing technologies is boosting the demand for high-precision press machines. As industries modernize, the need for efficient and reliable press machines continues to rise in the UK

The USA press machine market is expected to grow at a moderate CAGR of 4.8%. Despite a mature industrial infrastructure, demand for press machines remains strong due to the rising need for automation, precision manufacturing, and energy-efficient solutions across various sectors, particularly automotive and aerospace. The adoption of advanced manufacturing technologies and the shift towards sustainable production methods further drive market growth. Moreover, the rise in demand for electric vehicles and renewable energy solutions provides new opportunities for the press machine market in the USA

Brazil’s press machine market is projected to grow at a CAGR of 4.3%. The country’s expanding manufacturing sector, especially in automotive and metalworking, is driving the demand for press machines. Brazil’s growing focus on automation and efficient production processes is further accelerating market growth. Additionally, the government’s initiatives to boost the manufacturing sector and increase industrial output are expected to increase the demand for advanced press machines. As Brazil embraces smart manufacturing and energy-efficient production methods, the market for press machines is expected to continue expanding.

The press machine market is led by companies specializing in metal forming, stamping, and forging systems used across automotive, appliance, aerospace, and general manufacturing sectors. Schuler Group delivers mechanical, hydraulic, and servo press lines used in high-volume automotive production, with a strong footprint in Europe, North America, and Asia. AIDA manufactures servo and mechanical presses for precision stamping, widely adopted in electronics, appliance, and progressive die operations.

AMADA PRESS SYSTEM CO., LTD. offers high-precision forming equipment for sheet metal fabrication, supporting die tryout and small-lot production in automotive and metal goods sectors. Komatsu Ltd. supplies servo-driven and hydraulic presses used in high-tonnage applications, with integrated automation for coil feeding and die changing.

Beckwood Press focuses on custom-built hydraulic presses for aerospace, defense, and compression molding, often tailored to customer-specific forming needs. Bliss-Bret and Nidec Minster serve the North American stamping industry with mechanical presses known for long-duty cycles and high repeatability. STAMTEC and SUTHERLAND PRESSES provide gap-frame and straight-side presses for general manufacturing.

YangLi Group Corporation Ltd., SHIEH YIH MACHINERY INDUSTRY CO., LTD., and BRUDERER AG support high-speed stamping applications, particularly in electronics and motor laminations. Macrodyne Technologies Inc. and Isgec Heavy Engineering Ltd. supply large-capacity hydraulic presses for forming, forging, and die-spotting tasks. SMS group GmbH provides specialized press solutions for metal forming in heavy industrial operations.

The market has advanced through acquisitions, product rollouts, and digital upgrades between 2023 and 2025. In 2023, Schuler, now part of Andritz Schuler, launched a high-speed servo press reaching 400 strokes per minute, widely adopted in EV body panel production. Komatsu followed in early 2024 with adaptive modular presses tailored for the automotive and appliance sectors.

AIDA introduced IoT-integrated servo presses in mid-2024 and hosted its Servo Symposium to demonstrate smart line capabilities. By early 2025, SMS and Fagor Arrasate implemented AI-based fault detection in stamping systems. JIER and Anhui LIFU expanded product lines and exports, while Beckwood and Bliss-Bret pushed custom-built presses into aerospace markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 15.1 Billion |

| Type | Mechanical press, Hydraulic press, Servo press, and Pneumatic press |

| Capacity | 500 tons to 2000 tons, Up to 500 tons, and Above 2000 tons |

| Application | Metalworking, Woodworking, Plastic manufacturing, and Others (Rubber, composites, etc.) |

| End Use | Automotive, Aerospace & defense, General machinery & equipment, Electrical & electronics, and Others (Healthcare, marine, etc.) |

| Distribution Channel | Direct sales and Indirect sales |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Schuler Group, AIDA, AMADA PRESS SYSTEM CO., LTD., Beckwood Press, Bliss-Bret, BRUDERER AG, Isgec Heavy Engineering Ltd., Komatsu Ltd., Macrodyne Technologies Inc., Nidec Minster, SHIEH YIH MACHINERY INDUSTRY CO., LTD., SMS group GmbH, STAMTEC, SUTHERLAND PRESSES, and YangLi Group Corporation Ltd. |

| Additional Attributes | Dollar sales by press type (hydraulic, mechanical, servo) and application (automotive stamping, aerospace forming, general fabrication), demand from manufacturing and metalworking, led by Asia‑Pacific with North America catching up, innovation in Industry 4.0 integration and force‑control systems. |

The global press machine market is estimated to be valued at USD 15.1 billion in 2025.

The market size for the press machine market is projected to reach USD 26.3 billion by 2035.

The press machine market is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in press machine market are mechanical press, hydraulic press, servo press and pneumatic press.

In terms of capacity, 500 tons to 2000 tons segment to command 47.8% share in the press machine market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pill Pressing Machine Market Size and Share Forecast Outlook 2025 to 2035

Tablet Press Machines Market Size and Share Forecast Outlook 2025 to 2035

Plastic Press Machine Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Compression Testing Machines Market Size and Share Forecast Outlook 2025 to 2035

Pressure Sensitive Labeling Machine Market Size and Share Forecast Outlook 2025 to 2035

Silver Pressure Sintering Machine Market Size and Share Forecast Outlook 2025 to 2035

Membrane Filter Press Machines Market Size and Share Forecast Outlook 2025 to 2035

Differential Pressure Casting Machine Market Forecast and Outlook 2025 to 2035

Pressurized Water Reactor System Market Size and Share Forecast Outlook 2025 to 2035

Pressure Relief Dressing Market Size and Share Forecast Outlook 2025 to 2035

Pressure Compensated Hydraulic Pump Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Kraft Paper Market Forecast and Outlook 2025 to 2035

Machine Condition Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Pressure Compensated Pump Market Size and Share Forecast Outlook 2025 to 2035

Pressure Switch Market Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Asia Pacific Forecast Outlook 2025 to 2035

Pressure Reducing Valve Market Size and Share Forecast Outlook 2025 to 2035

Machine Vision Camera Market Size and Share Forecast Outlook 2025 to 2035

Pressure-Volume Loop Systems Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA