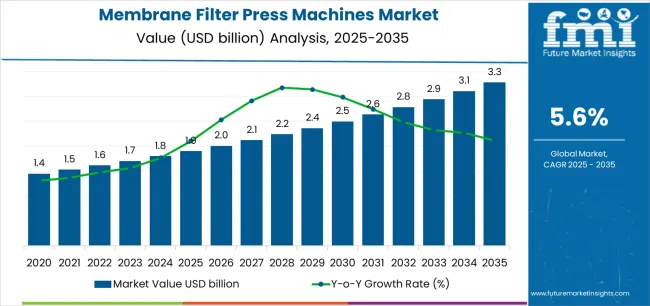

The global membrane filter press machines market, valued at USD 1.9 billion in 2025, is projected to reach USD 3.3 billion by 2035, expanding at a CAGR of 5.6% driven by rising industrial wastewater treatment requirements, growing demand for efficient solid-liquid separation systems, and the increasing adoption of automated membrane filtration technologies across chemical, mining, and food processing industries. The global membrane filter press machines market is positioned for substantial expansion over the next decade, driven by intensifying environmental regulations mandating advanced wastewater treatment, industrial process optimization requirements, and the imperative to achieve maximum solid-liquid separation efficiency across diverse manufacturing and municipal operations worldwide. The market demonstrates robust fundamentals supported by water scarcity concerns driving wastewater recycling initiatives, mining industry demands for efficient tailings management, and the transition toward automated dewatering systems that minimize operational costs while maximizing throughput and cake dryness performance.

Industrial facilities and municipal treatment plants are implementing advanced membrane filter press machines to achieve 75-85% cake dryness levels with 30-45% lower operating costs compared to conventional chamber filter presses and centrifuge systems, making these high-performance dewatering solutions essential for regulatory compliance and operational efficiency optimization. The global push toward circular economy principles and zero liquid discharge mandates accelerates demand for sophisticated filtration systems that enable maximum water recovery, minimize waste volumes, and support sustainable manufacturing practices across chemical processing, mining, and food production industries.

However, the market faces headwinds from high capital investment requirements affecting adoption among smaller facilities, maintenance complexity requiring skilled technical personnel, and competition from alternative dewatering technologies including belt filter presses and decanter centrifuges. The competitive landscape is characterized by ongoing innovation in membrane materials, automation integration for unmanned operation, and regional manufacturers gaining market share through cost-competitive solutions and localized service capabilities in high-growth emerging markets.

The forecast period will witness accelerated adoption of fully automatic membrane filter press systems featuring PLC-controlled operation sequences, integration of advanced membrane squeeze cycles achieving superior dewatering performance, and intelligent maintenance monitoring systems enabling predictive servicing and minimizing unplanned downtime. Geographic expansion in Asia-Pacific industrial corridors, Middle Eastern water treatment facilities, and Latin American mining operations will drive volume growth, while premium segments focused on pharmaceutical manufacturing and food processing applications will support value expansion through hygienic design features, specialized membrane materials, and comprehensive validation documentation supporting regulatory compliance.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1.9 billion |

| Market Forecast Value (2035) | USD 3.3 billion |

| Forecast CAGR (2025-2035) | 5.6% |

The membrane filter press machines market grows by enabling industrial facilities, municipal wastewater treatment plants, and mining operations to achieve superior dewatering performance and operational efficiency while meeting stringent environmental discharge regulations and minimizing waste disposal costs. Facility operators face mounting pressure to reduce waste volumes and maximize water recovery, with membrane filter press systems typically providing 15-25% higher cake dryness levels compared to conventional chamber filter presses, making these advanced dewatering solutions essential for achieving zero liquid discharge objectives and optimizing sludge handling economics through reduced transportation and disposal expenses.

The environmental compliance imperative's need for efficient solid-liquid separation creates sustained demand for high-performance filtration systems that can consistently meet discharge permit requirements, handle challenging slurry characteristics, and operate reliably under demanding continuous-duty conditions across chemical manufacturing, pharmaceutical production, and municipal treatment applications. Mining industry requirements for tailings management and water conservation drive adoption of membrane filter press technology enabling maximum water recovery from mineral processing slurries while producing stackable filter cakes that minimize tailings storage facility footprint and environmental risk.

Government regulations mandating advanced wastewater treatment and resource recovery accelerate adoption across industrial and municipal applications, where dewatering efficiency has direct impact on operating costs, environmental compliance performance, and sustainable water management objectives. The global transition toward circular economy business models creates increasing demand for dewatering systems that enable material recovery, waste minimization, and water recycling supporting industrial sustainability commitments. However, high initial capital costs ranging from $200,000 to over $2 million per installation may limit adoption rates among smaller facilities and developing region municipalities, while technical complexity requiring trained maintenance personnel and membrane replacement costs create ongoing operational considerations affecting total cost of ownership comparisons with simpler dewatering alternatives.

The market is segmented by automation level, application, and region. By automation level, the market is divided into fully automatic membrane filter press, semi automatic membrane filter press, and manual membrane filter press. Based on application, the market is categorized into wastewater treatment, chemical industry, mining and metallurgical industry, food and beverage, and other applications. Regionally, the market is divided into Asia Pacific, Europe, North America, Latin America, and Middle East & Africa.

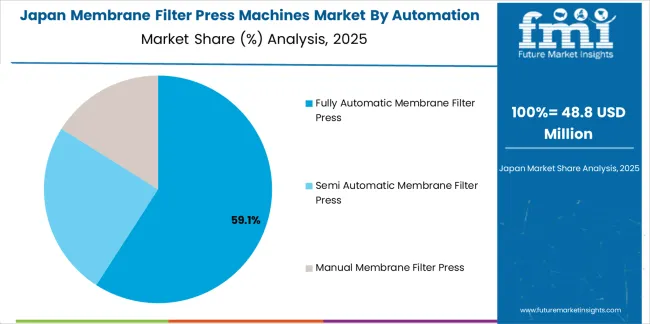

The fully automatic membrane filter press segment represents the dominant force in the membrane filter press machines market, capturing approximately 58% of total market share in 2025. This advanced category encompasses PLC-controlled systems featuring automated cloth washing, cake discharge, and complete filtration cycles without manual intervention, delivering maximum operational efficiency with minimal labor requirements and consistent performance optimization. The fully automatic segment's market leadership stems from its superior operational economics through reduced labor costs, enhanced process control enabling optimized filtration parameters, and increasing industrial preference for unmanned operation supporting lights-out manufacturing and centralized monitoring capabilities.

The semi automatic membrane filter press segment maintains a substantial 28% market share, serving facilities requiring balance between automation benefits and capital cost considerations through manual plate opening/closing with automated filtration sequences and membrane squeeze cycles. The manual membrane filter press segment accounts for 14% market share, featuring basic systems requiring operator intervention for plate shifting and cake discharge, serving cost-sensitive applications and smaller facilities with intermittent operation patterns.

Key advantages driving the fully automatic membrane filter press segment include:

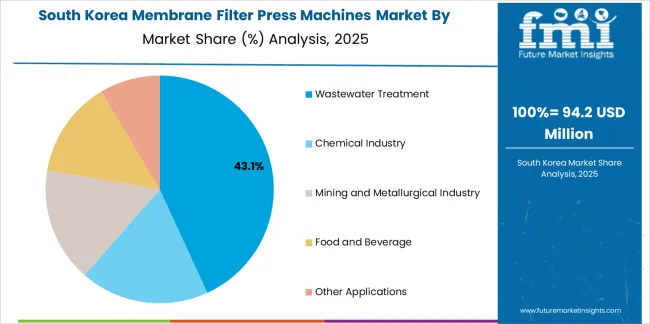

Wastewater treatment dominates the membrane filter press machines market with approximately 42% market share in 2025, reflecting the critical role of efficient sludge dewatering in municipal treatment plant operations, industrial effluent processing, and environmental compliance programs requiring maximum volume reduction and water recovery. The wastewater treatment segment's market leadership is reinforced by stringent discharge regulations mandating advanced treatment, continuous operation requirements demanding reliable high-capacity dewatering systems, and growing emphasis on biosolids management optimization reducing disposal costs and supporting beneficial reuse applications.

The chemical industry segment represents 24% market share through process filtration, catalyst recovery, product purification, and waste stream treatment applications requiring chemical-resistant construction and precise separation performance. Mining and metallurgical industry applications account for 18% market share, encompassing mineral concentrate dewatering, tailings management, and metal recovery operations demanding robust equipment handling abrasive slurries. Food and beverage applications hold 9% market share, including juice clarification, starch processing, and brewery waste treatment requiring hygienic design and FDA-compliant materials. Other applications represent 7% market share, including pharmaceutical manufacturing, pulp and paper processing, and ceramic production.

Key market dynamics supporting application preferences include:

The market is driven by three concrete demand factors tied to environmental compliance and operational efficiency. First, environmental regulations mandating advanced wastewater treatment create increasing requirements for efficient dewatering systems, with global tightening of discharge standards and zero liquid discharge mandates in water-stressed regions requiring membrane filter press technology achieving 75-85% cake dryness levels that minimize final disposal volumes and enable water recycling. Second, mining industry water conservation imperatives drive demand for high-performance tailings dewatering, with major mining operations targeting 60-80% water recovery from tailings streams to reduce freshwater consumption and minimize tailings storage facility requirements, creating demand for robust membrane filter press systems handling high-throughput mineral processing applications. Third, operational cost optimization pressures accelerate adoption across industrial segments, with membrane filter press technology reducing sludge disposal costs by 40-60% through superior dewatering performance while minimizing energy consumption compared to thermal drying alternatives.

Market restraints include substantial capital investment requirements affecting adoption decisions, with complete membrane filter press installations ranging from $300,000 to over $3 million depending on capacity and automation level, creating budget challenges for smaller municipalities and industrial facilities operating under capital constraints. Membrane maintenance and replacement costs create ongoing operational expenses, with membrane elements requiring replacement every 3-5 years at costs representing 10-15% of initial equipment investment, impacting total cost of ownership considerations. Technical operating requirements including feed conditioning, optimal pressure sequencing, and cloth washing protocols necessitate trained personnel, creating operational complexity that may challenge facilities lacking experienced dewatering equipment operators and maintenance technicians.

Key trends indicate accelerated adoption in China and India industrial expansion programs, where environmental enforcement intensification and industrial park development with centralized wastewater treatment drive substantial membrane filter press demand. Technology advancement toward intelligent control systems incorporating real-time cake moisture monitoring, predictive maintenance algorithms detecting membrane performance degradation, and energy-optimized pressure profiles reducing compressed air consumption are driving next-generation equipment development. However, the market thesis could face disruption if breakthrough membrane materials dramatically extend service life to 10+ years, reducing lifecycle costs and changing equipment economics, or if alternative dewatering technologies including electrodewatering systems or advanced centrifuge designs achieve comparable cake dryness at lower capital costs.

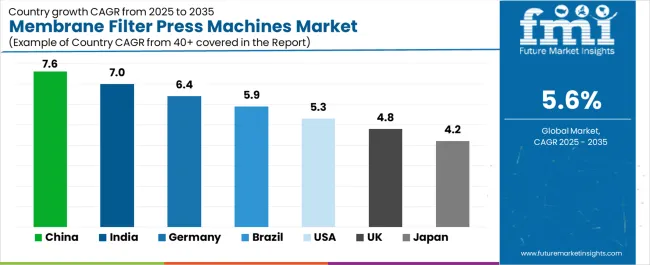

| Country | CAGR (2025-2035) |

|---|---|

| China | 7.6% |

| India | 7% |

| Germany | 6.4% |

| Brazil | 5.9% |

| U.S. | 5.3% |

| U.K. | 4.8% |

| Japan | 4.2% |

The membrane filter press machines market is gaining momentum worldwide, with China taking the lead thanks to massive industrial wastewater treatment infrastructure development and environmental protection enforcement driving advanced dewatering technology adoption. Close behind, India benefits from government initiatives mandating industrial effluent treatment and expanding municipal wastewater infrastructure, positioning itself as a strategic growth hub in the Asia-Pacific region. Germany shows strong advancement, where industrial process optimization and stringent environmental standards strengthen demand for high-performance filtration systems.

Brazil demonstrates robust growth through mining industry expansion and industrial wastewater treatment requirements, signaling continued investment in dewatering equipment. The USA maintains steady expansion driven by municipal infrastructure upgrades and industrial environmental compliance programs. Meanwhile, the U.K. and Japan continue to record consistent progress through equipment replacement cycles and industrial modernization initiatives. Together, China and India anchor the global expansion story, while established markets build stability and diversity into the market's growth path.

The report covers an in-depth analysis of 40+ countries, the top-performing countries are highlighted below.

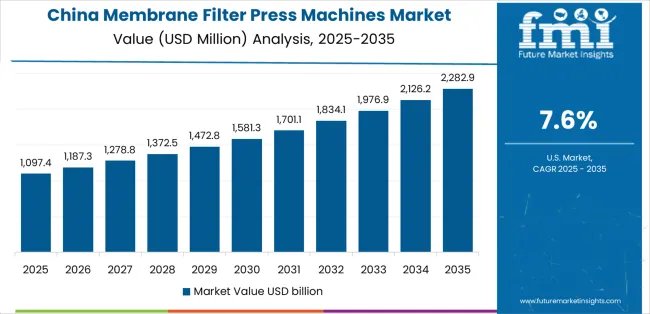

China demonstrates the strongest growth potential in the Membrane Filter Press Machines Market with a CAGR of 7.6% through 2035. The country's leadership position stems from comprehensive environmental protection policies, massive industrial wastewater treatment infrastructure development, and expanding mining operations requiring advanced tailings management driving demand for high-performance membrane filter press systems.

Growth is concentrated in major industrial regions, including Jiangsu, Zhejiang, Shandong, and Hebei, where chemical manufacturing facilities, municipal treatment plants, and mining operations are implementing advanced dewatering systems for regulatory compliance and operational efficiency. Distribution channels through environmental equipment manufacturers, industrial equipment distributors, and direct engineering procurement relationships expand deployment across municipal wastewater treatment, industrial effluent processing, and mineral processing applications. The country's Water Pollution Prevention and Control Action Plan provides policy framework for wastewater treatment infrastructure development, including technology requirements and discharge standards driving membrane filter press adoption.

Key market factors:

In the Maharashtra, Gujarat, Tamil Nadu, and Uttar Pradesh regions, the adoption of membrane filter press machines is accelerating across industrial clusters, municipal treatment facilities, and mining operations, driven by National Green Tribunal enforcement actions and government programs mandating zero liquid discharge for water-intensive industries. The market demonstrates strong growth momentum with a CAGR of 7% through 2035, linked to comprehensive industrial wastewater treatment infrastructure development and increasing focus on water conservation and pollution control. Indian facilities are implementing membrane filter press systems to achieve regulatory compliance while optimizing operational costs through efficient dewatering and water recovery supporting sustainable manufacturing practices. The country's National Mission for Clean Ganga and industrial pollution control initiatives create sustained demand for advanced dewatering equipment, while increasing emphasis on mining sector environmental management drives adoption in mineral processing applications.

Germany's advanced industrial sector demonstrates sophisticated implementation of membrane filter press machines, with documented case studies showing 40-60% reduction in sludge disposal costs through optimized dewatering performance in chemical manufacturing and municipal treatment operations. The country's industrial infrastructure in major manufacturing regions, including North Rhine-Westphalia, Bavaria, Baden-Württemberg, and Lower Saxony, showcases integration of advanced membrane filter press systems with existing process operations, leveraging expertise in mechanical engineering and automation technology. German industrial facilities emphasize process efficiency and environmental performance, creating demand for premium membrane filter press solutions that support Industry 4.0 digitalization and comprehensive sustainability programs. The market maintains strong growth through focus on equipment replacement and technology upgrades, with a CAGR of 6.4% through 2035.

Key development areas:

The Brazilian market leads in Latin American membrane filter press adoption based on expanding mining operations and industrial wastewater treatment requirements supporting environmental licensing compliance. The country shows solid potential with a CAGR of 5.9% through 2035, driven by mining industry tailings management needs and industrial effluent treatment requirements across major regions, including Minas Gerais, São Paulo, Pará, and Goiás. Brazilian facilities are adopting membrane filter press technology for mining tailings dewatering enabling water recovery and safe tailings management, while industrial operations implement advanced systems meeting state environmental agency discharge standards. Technology deployment channels through mining equipment suppliers, environmental engineering firms, and equipment distributors expand coverage across mining and industrial applications.

Leading market segments:

The U.S. market demonstrates mature implementation focused on municipal wastewater treatment plant upgrades, industrial process optimization, and mining operation environmental compliance requiring advanced dewatering capabilities. The country shows steady potential with a CAGR of 5.3% through 2035, driven by aging infrastructure replacement needs and regulatory requirements across major markets, including California, Texas, Pennsylvania, and Great Lakes region. American facilities are implementing membrane filter press systems for biosolids management optimization in municipal applications, industrial waste minimization programs, and mining water management supporting environmental permit compliance. Technology deployment channels through municipal engineering firms, industrial equipment distributors, and direct manufacturer relationships expand coverage across diverse municipal and industrial applications.

Leading market segments:

The U.K.'s membrane filter press machines market demonstrates steady implementation focused on water industry asset enhancement, industrial wastewater treatment, and regulatory compliance programs supporting environmental performance improvement. The country maintains consistent growth momentum with a CAGR of 4.8% through 2035, driven by water company Asset Management Plan investments and industrial environmental compliance requirements across major regions including England, Scotland, and Wales. British water companies and industrial facilities are implementing membrane filter press systems to improve biosolids quality, reduce disposal costs, and meet Environment Agency discharge consents for effluent quality and volume reduction.

Key market characteristics:

Japan's membrane filter press machines market demonstrates mature implementation focused on industrial manufacturing precision, municipal treatment excellence, and specialized applications requiring advanced separation performance, with documented integration of sophisticated control systems and comprehensive quality assurance programs. The country maintains steady growth momentum with a CAGR of 4.2% through 2035, driven by industrial process optimization requirements and municipal infrastructure maintenance across major manufacturing regions, including Kanto, Kansai, Chubu, and Kyushu. Japanese facilities showcase advanced deployment of membrane filter press systems featuring comprehensive automation, precise pressure control, and robust construction ensuring long-term reliable operation in demanding continuous-duty applications.

Key market characteristics:

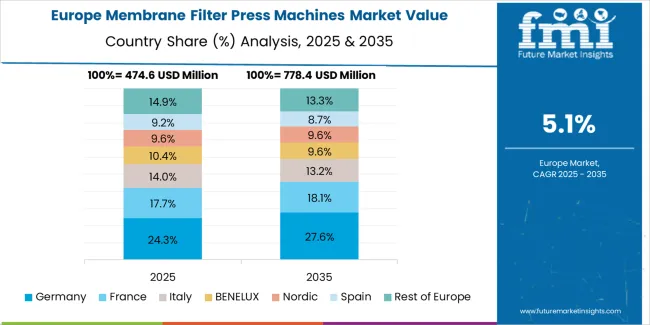

The membrane filter press machines market in Europe is projected to grow from USD 713.9 million in 2025 to USD 1.2 billion by 2035, registering a CAGR of 5% over the forecast period. Germany is expected to maintain its leadership position with a 32.4% market share in 2025, declining slightly to 31.6% by 2035, supported by its extensive industrial manufacturing infrastructure and major chemical production centers, including North Rhine-Westphalia, Bavaria, and Baden-Württemberg industrial regions.

France follows with a 17.8% share in 2025, projected to reach 18.3% by 2035, driven by water industry investment programs and industrial environmental compliance initiatives. The United Kingdom holds a 15.9% share in 2025, expected to decrease to 15.4% by 2035 due to market maturity and moderate investment growth. Italy commands a 11.6% share in both 2025 and 2035, backed by industrial wastewater treatment requirements and municipal infrastructure programs. Spain accounts for 8.7% in 2025, rising to 9.2% by 2035 on industrial sector growth and environmental compliance enforcement. The Netherlands maintains 5.2% in 2025, reaching 5.6% by 2035 on water management programs and industrial process optimization. The Rest of Europe region is anticipated to hold 8.4% in 2025, expanding to 8.9% by 2035, attributed to increasing membrane filter press machine adoption in Nordic countries and emerging Central & Eastern European industrial wastewater treatment programs.

The Japanese membrane filter press machines market demonstrates a mature and quality-focused landscape, characterized by sophisticated integration of fully automated systems with existing industrial process infrastructure and municipal treatment operations across manufacturing facilities, chemical plants, and water treatment centers. Japan's emphasis on operational excellence and equipment reliability drives demand for premium membrane filter press systems that support continuous-duty operation, comprehensive process monitoring, and minimal maintenance requirements in demanding industrial environments. The market benefits from strong partnerships between international equipment providers and domestic industrial equipment manufacturers including leading machinery companies and specialized filtration system integrators, creating comprehensive service ecosystems that prioritize long-term performance and technical support. Industrial manufacturing centers in Kanto, Kansai, Chubu, and other major production areas showcase advanced membrane filter press implementations where dewatering systems achieve 99%+ operational availability through preventive maintenance programs and quality component specifications.

The South Korean membrane filter press machines market is characterized by strong international equipment provider presence, with companies maintaining significant positions through comprehensive technical support and advanced automation capabilities for industrial manufacturing and municipal wastewater treatment applications. The market demonstrates increasing emphasis on environmental compliance and industrial process optimization, as Korean facilities increasingly demand fully automated membrane filter press systems that integrate with sophisticated plant control systems deployed across chemical manufacturing complexes and industrial parks. Regional equipment distributors are gaining market share through strategic partnerships with international manufacturers, offering specialized services including Korean regulatory compliance support and customized system design assistance for local facility requirements. The competitive landscape shows increasing collaboration between multinational equipment companies and Korean industrial engineering firms, creating hybrid service models that combine international technology leadership with local market knowledge and comprehensive after-sales support capabilities.

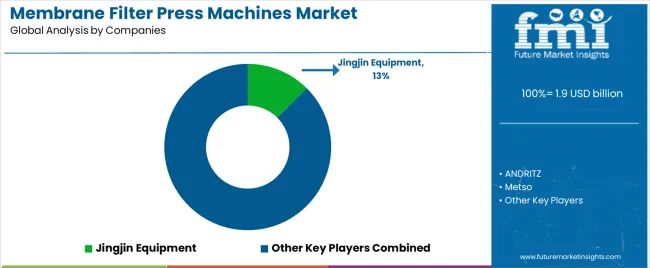

The membrane filter press machines market features approximately 30-40 meaningful players with moderate fragmentation, where the top three companies control roughly 28-35% of global market share through established industrial customer relationships, comprehensive product portfolios covering multiple capacity ranges and automation levels, and global service networks supporting installation commissioning and ongoing maintenance requirements. Competition centers on dewatering performance efficiency, equipment reliability and uptime, automation sophistication, and application-specific expertise rather than price competition alone. Jingjin Equipment leads with approximately 12.5% market share through its comprehensive membrane filter press portfolio and dominant position in Chinese industrial and municipal markets.

Market leaders include Jingjin Equipment, ANDRITZ, and Metso, which maintain competitive advantages through extensive manufacturing capabilities producing systems from pilot-scale to multi-thousand cubic meter capacity, deep application expertise spanning wastewater treatment to mining operations, and global service organizations providing rapid response support and comprehensive spare parts availability, creating full-lifecycle solution capabilities for industrial and municipal customers. These companies leverage research and development capabilities in membrane material innovation, advanced automation controls, and optimized filtration cycle sequencing to defend market positions while expanding into emerging application segments including lithium brine processing, cannabis extraction waste treatment, and pharmaceutical manufacturing applications.

Challengers encompass ISHIGAKI, Zhongda Bright Filter Press, and Aqseptence Group, which compete through specialized application focus, regional market strength, and technology differentiation in specific industrial segments or geographic markets. Product specialists, including Hengshui Haijiang, Shanghai Dazhang, and FLSmidth, focus on particular market segments or capacity ranges, offering differentiated capabilities in compact systems for smaller facilities, mining-specific designs, or specialized membrane configurations for challenging applications.

Regional players and emerging manufacturers including Xingyuan Environment, Tianli Machinery, and multiple Chinese equipment producers create competitive pressure through cost advantages in domestic markets, rapid customization capabilities addressing specific customer requirements, and growing technical sophistication enabling competitive alternatives to established international suppliers. Market dynamics favor companies that combine proven dewatering performance through documented industrial case studies with comprehensive application engineering support assisting customers with feed characterization, process optimization, and system specification, established service networks providing rapid response maintenance and membrane replacement services minimizing operational downtime, and automation integration expertise enabling seamless connectivity with existing plant control systems supporting Industry 4.0 digitalization initiatives across industrial manufacturing and municipal treatment operations.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.9 billion |

| Automation Level | Fully Automatic Membrane Filter Press, Semi Automatic Membrane Filter Press, Manual Membrane Filter Press |

| Application | Wastewater Treatment, Chemical Industry, Mining and Metallurgical Industry, Food and Beverage, Other Applications |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, U.S., U.K., Japan, and 40+ countries |

| Key Companies Profiled | Jingjin Equipment, ANDRITZ, Metso, ISHIGAKI, Zhongda Bright Filter Press, Hengshui Haijiang, Shanghai Dazhang, Aqseptence Group, Xingyuan Environment, JL-Filterpress, FLSmidth, Tianli Machinery, Kurita Machinery Mfg. Co. Ltd., Matec, Zhejiang Longyuan, Micronics, NMP, Shanghai CEO Environmental, Jiangsu Sudong, Latham International |

| Additional Attributes | Dollar sales by automation level and application categories, regional adoption trends across Asia Pacific, Europe, and North America, competitive landscape with equipment manufacturers and filtration system specialists, installation requirements and performance specifications, integration with wastewater treatment systems and industrial process operations, innovations in membrane materials and automation technology, and development of specialized systems with enhanced dewatering efficiency and operational reliability capabilities. |

The global membrane filter press machines market is estimated to be valued at USD 1.9 billion in 2025.

The market size for the membrane filter press machines market is projected to reach USD 3.3 billion by 2035.

The membrane filter press machines market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in membrane filter press machines market are fully automatic membrane filter press, semi automatic membrane filter press and manual membrane filter press.

In terms of application, wastewater treatment segment to command 42.0% share in the membrane filter press machines market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Membrane Separation Ammonia Cracker Market Size and Share Forecast Outlook 2025 to 2035

Membrane Separation Technology Market Size and Share Forecast Outlook 2025 to 2035

Membrane Switch Market Size and Share Forecast Outlook 2025 to 2035

Membrane Filtration Systems Market Size and Share Forecast Outlook 2025 to 2035

Membrane Microfiltration Market Size and Share Forecast Outlook 2025 to 2035

Membrane Boxes Market Size and Share Forecast Outlook 2025 to 2035

Membrane Chemicals Market Growth - Trends & Forecast 2025 to 2035

Membrane Air Dryers Market Growth - Trends & Forecast 2025 to 2035

Market Leaders & Share in Membrane Boxes Manufacturing

Membrane Filter Cartridge Market Size and Share Forecast Outlook 2025 to 2035

Membrane Filter Press Solutions Market Size and Share Forecast Outlook 2025 to 2035

Geomembrane Market Strategic Growth 2024-2034

Egg Membrane Powder Market

PTFE Membrane Market

Metal Membrane Ammonia Cracker Market Size and Share Forecast Outlook 2025 to 2035

Mucous Membrane Pemphigoid Treatment Market

Medical Membrane Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Membranes Market Analysis - Size, Share and Forecast Outlook 2025 to 2035

Amniotic Membrane Market Size and Share Forecast Outlook 2025 to 2035

Eggshell Membrane Powder Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA