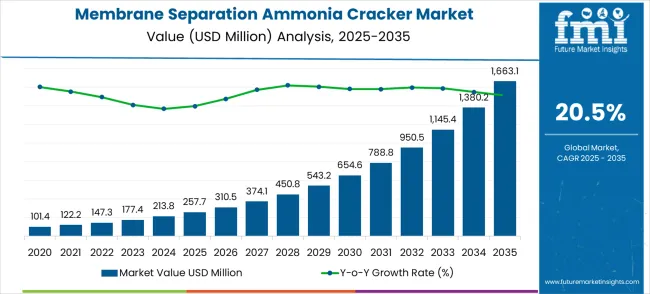

The global membrane separation ammonia cracker market is projected to reach USD 1,663.1 million by 2035, recording an absolute increase of USD 1,405.4 million over the forecast period. The market is valued at USD 257.7 million in 2025 and is set to rise at a CAGR of 20.5% during the assessment period. The overall market size is expected to grow by nearly 6.5X during the same period, supported by increasing hydrogen economy development and expanding maritime decarbonization initiatives. However, high membrane material costs and complex system integration requirements pose constraints on rapid market expansion.

Between 2025 and 2030, the membrane separation ammonia cracker market is projected to expand from USD 257.7 million to USD 651.3 million, resulting in a value increase of USD 393.6 million, which represents 28.0% of the total forecast growth for the decade. This phase of growth will be shaped by rising demand for clean hydrogen production, product innovation in membrane selectivity and durability technologies, and expanding maritime fuel infrastructure. Companies are establishing competitive positions through investment in advanced membrane materials, strategic partnerships with shipping companies, and strategic market expansion across Europe, Asia Pacific, and emerging hydrogen economy markets.

From 2030 to 2035, the market is forecast to grow from USD 651.3 million to USD 1,663.1 million, adding another USD 1,011.8 million, which constitutes 72.0% of the overall ten-year expansion. This period is expected to be characterized by the expansion of large-scale commercial applications, including offshore hydrogen production and integrated maritime fuel systems tailored for specific vessel requirements, strategic collaborations between membrane manufacturers and shipbuilding companies, and cost optimization with improved manufacturing efficiency. The growing emphasis on carbon-neutral shipping fuels and industrial hydrogen applications will drive demand for advanced membrane separation technologies across diverse maritime and industrial hydrogen production applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 257.7 million |

| Market Forecast Value (2035) | USD 1,663.1 million |

| Forecast CAGR (2025-2035) | 20.5% |

The membrane separation ammonia cracker market expands through enabling efficient hydrogen extraction from ammonia carriers while providing superior separation efficiency compared to conventional cracking technologies. Maritime industry decarbonization mandates drive adoption as shipping companies implement ammonia-to-hydrogen conversion for fuel cell propulsion systems requiring high-purity hydrogen output. Industrial hydrogen users integrate membrane separation crackers to access hydrogen from ammonia storage networks while achieving better energy efficiency and reduced operational complexity. Government hydrogen economy investments across Europe, Asia Pacific, and North America accelerate deployment in marine applications, industrial facilities, and hydrogen generation plants. Advanced membrane technologies improve hydrogen selectivity and operational lifespan while reducing energy consumption compared to traditional cracking methods. However, high palladium-based membrane costs and specialized manufacturing requirements create adoption barriers for price-sensitive industrial applications and smaller commercial operations.

The membrane separation ammonia cracker market (USD 257.7M → 1,663.1M by 2035, CAGR ~20.5%) is set to expand rapidly as ammonia gains traction as a global hydrogen carrier and demand rises for compact, efficient hydrogen production solutions. Together, advances in membrane technology and diversification into maritime, automotive, and industrial hydrogen applications unlock ~USD 1.4B in incremental revenue opportunities by 2035, aligned with the ~USD 1,405M market expansion.

Pathway A – Metal Membrane Technology for Maritime Fuel Transition Ship-based hydrogen production is the leading growth driver, supported by IMO decarbonization mandates. Fortescue & Siemens are pioneering projects integrating membrane crackers into green shipping ecosystems.

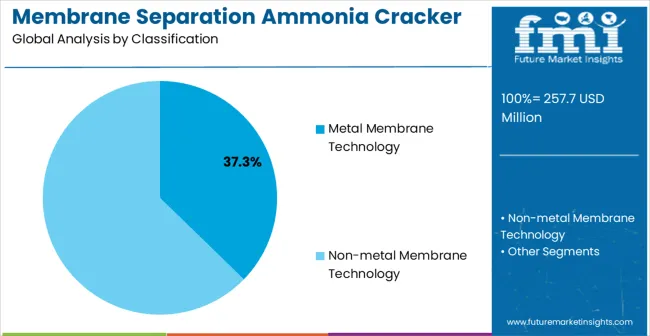

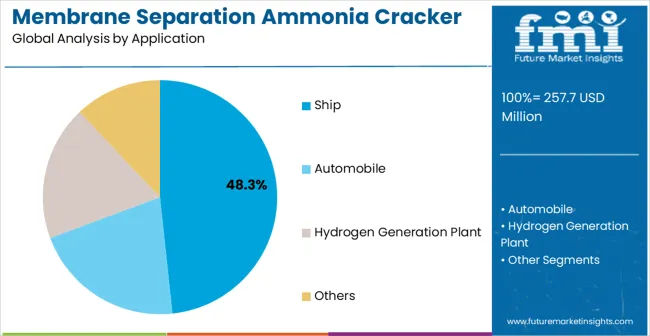

The market is segmented by membrane type, end-use industry, and region. By membrane type, the market is divided into metal membrane technology and non-metal membrane technology. Based on end-use industry, the market is categorized into ship, automobile, hydrogen generation plant, and others. Regionally, the market is divided into North America, Latin America, Europe, East Asia, South Asia & Pacific, and Middle East & Africa.

Metal membrane technology is projected to account for 37.3% of the membrane separation ammonia cracker market in 2025. This share is supported by superior hydrogen selectivity and proven performance characteristics that palladium-based membranes provide for ammonia cracking applications. Metal membranes offer excellent hydrogen permeability while maintaining resistance to sulfur poisoning and thermal degradation that are critical for reliable operation in marine and industrial environments. The segment enables stakeholders to achieve high-purity hydrogen production while operating at moderate pressures and temperatures. These membranes provide the most reliable separation performance for commercial applications requiring consistent hydrogen quality and operational dependability across diverse operating conditions.

Ship applications are expected to represent 48.3% of membrane separation ammonia cracker demand in 2025. This dominant share reflects the maritime industry's transition toward ammonia as marine fuel and the critical need for onboard hydrogen generation systems supporting fuel cell propulsion and auxiliary power applications. Ship-based membrane crackers provide fuel flexibility that appeals to vessel operators implementing decarbonization strategies while meeting international maritime emission regulations. The segment provides essential support for fuel cell propulsion systems and auxiliary power generation in competitive shipping markets requiring reliable hydrogen supply. International Maritime Organization regulations and carbon pricing mechanisms drive adoption across commercial shipping fleets requiring clean fuel alternatives and operational efficiency improvements.

Market growth stems from maritime decarbonization mandates requiring ammonia-to-hydrogen conversion for clean propulsion systems, industrial hydrogen supply chain optimization reducing transportation costs and storage complexity, and government hydrogen economy investments accelerating technology deployment across multiple sectors. These drivers create measurable outcomes including reduced shipping emissions, lower hydrogen delivery costs, and improved energy security through diversified hydrogen supply sources enabling sustainable industrial operations.

Market expansion faces constraints from high membrane material costs limiting system economics for smaller applications, complex integration requirements with existing hydrogen infrastructure creating deployment barriers, and regulatory uncertainty surrounding ammonia handling and storage in marine applications. Technology substitutes including direct ammonia fuel cells and alternative hydrogen production methods compete for market share in specific applications while limited manufacturing capacity creates supply bottlenecks for rapid deployment.

Adoption accelerates in European maritime hubs and Asian industrial clusters where hydrogen infrastructure development supports membrane cracker deployment and government policies favor clean energy technologies. System designs shift toward modular architectures enabling capacity scaling and improved membrane durability extending operational lifespans while reducing maintenance requirements. Market consolidation through strategic partnerships creates comprehensive solution ecosystems combining membrane technology with fuel cell systems and hydrogen storage solutions. The growth thesis breaks if membrane material costs fail to decline significantly or direct ammonia combustion technologies achieve comparable efficiency without requiring hydrogen conversion processes.

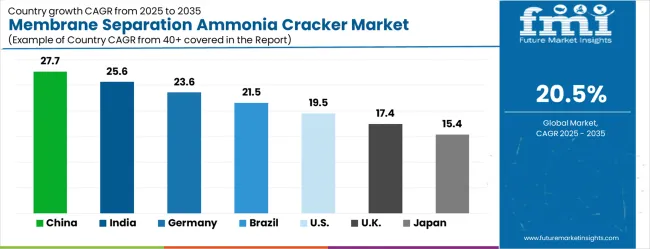

| Country | CAGR (2025-2035) |

|---|---|

| China | 27.7% |

| India | 25.6% |

| Germany | 23.6% |

| Brazil | 21.5% |

| United States | 19.5% |

| United Kingdom | 17.4% |

| Japan | 15.4% |

The membrane separation ammonia cracker market is gathering pace worldwide, with China taking the lead thanks to massive hydrogen economy investments and comprehensive maritime decarbonization programs. Close behind, India benefits from expanding industrial hydrogen demand and government clean energy initiatives, positioning itself as a strategic growth hub. Germany shows steady advancement, where advanced membrane technology development strengthens its role in the regional supply chain. Brazil is sharpening focus on industrial applications and maritime fuel diversification, signaling an ambition to capture niche opportunities. Meanwhile, United States stands out for its technology innovation capabilities, and United Kingdom and Japan continue to record consistent progress. Together, China and India anchor the global expansion story, while the rest build stability and diversity into the market's growth path.

The report covers an in-depth analysis of 40+ countries, the top-performing countries are highlighted below.

The membrane separation ammonia cracker market in China leads global membrane separation ammonia cracker adoption with comprehensive hydrogen economy development programs and extensive government investment exceeding $15 billion in hydrogen infrastructure projects. Revenue growth at 27.7% CAGR through 2035 reflects deployment across shipping companies in Shanghai, Qingdao, and Ningbo, where membrane crackers support fuel cell vessel development and maritime fuel diversification strategies. Chinese manufacturers develop domestic membrane production capabilities while shipping companies implement ammonia fuel systems requiring onboard hydrogen generation for propulsion and auxiliary power applications. State-backed research programs drive membrane technology advancement and manufacturing capacity expansion to serve growing domestic demand while establishing export capabilities across Asia Pacific markets.

In Mumbai, Chennai, and Kolkata, adoption of membrane separation ammonia crackers is accelerating across industrial facilities implementing hydrogen supply diversification and shipping companies expanding fuel cell capabilities for coastal operations. Industrial manufacturers integrate membrane crackers into chemical processing and steel production operations where hydrogen demand supports production efficiency improvements and environmental compliance requirements. Revenue expansion at 25.6% CAGR through 2035 stems from industrial decarbonization requirements and growing maritime fuel diversification initiatives in major shipping hubs. Government programs promote hydrogen economy development through technology incentives and infrastructure funding that facilitate membrane cracker adoption across industrial and maritime sectors requiring reliable hydrogen supply solutions.

German companies demonstrate membrane efficiency improvements exceeding 20% compared to conventional ammonia cracking methods through advanced palladium alloy development and system optimization. Hamburg, Bremen, and Rostock serve as testing centers where shipping companies evaluate membrane crackers for North Sea operations and European maritime routes requiring reliable hydrogen generation. German membrane technology companies develop integrated solutions combining separation systems with fuel cell propulsion while industrial facilities implement hydrogen supply diversification strategies reducing dependence on conventional production methods. Technology advancement programs support innovation through academic partnerships and research funding enabling membrane performance optimization and cost reduction initiatives. CAGR reaches 23.6% through 2035.

Brazilian industrial facilities demonstrate growing adoption through petrochemical complexes requiring hydrogen supply diversification and shipping companies implementing fuel flexibility strategies for South American trade routes. Santos, Rio de Janeiro, and Recife emerge as deployment centers where membrane crackers support industrial hydrogen requirements and maritime fuel infrastructure development programs. Government programs supporting industrial modernization facilitate access to membrane technology and installation expertise through international partnerships. The market faces challenges from limited technical expertise requiring comprehensive training programs and vendor support for optimal system deployment and operational management. Regional development centers establish specialized capabilities supporting technology deployment and maintenance across diverse geographic markets and industrial applications.

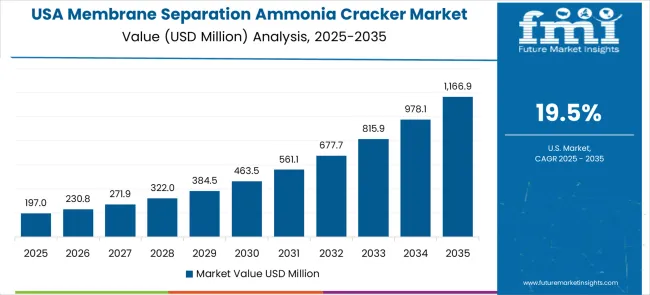

United States demonstrates technology leadership through government funding supporting advanced membrane research and commercial demonstration projects across maritime and industrial sectors. Growth reaches 19.5% CAGR through 2035, reflecting cost-per-outcome compression under compliance and reliability constraints as industrial users optimize hydrogen supply economics through membrane separation systems. Houston, Long Beach, and New York serve as deployment centers where shipping companies and industrial facilities implement membrane technologies for operational efficiency improvements and environmental compliance requirements. Maritime operators adopt ammonia fuel systems requiring reliable hydrogen generation for fuel cell propulsion and auxiliary power applications while industrial users integrate membrane crackers for hydrogen supply diversification and cost optimization strategies.

United Kingdom develops comprehensive maritime applications through shipping companies implementing ammonia fuel systems and industrial facilities adopting hydrogen supply diversification strategies for North Sea operations. London, Liverpool, and Aberdeen serve as development centers where membrane crackers support fuel cell vessel operations and industrial hydrogen requirements for manufacturing and energy applications. Revenue expansion reflects maritime industry leadership and government support for clean energy technology deployment across shipping and industrial sectors requiring reliable hydrogen generation capabilities. The country's established maritime research infrastructure facilitates technology development and commercial deployment through comprehensive testing and validation programs supporting membrane cracker integration. Industry collaboration initiatives create sustained demand for membrane technologies enabling efficient hydrogen production and fuel system integration. Growth reaches 17.4% CAGR through 2035.

Japanese manufacturers develop sophisticated membrane separation systems emphasizing precision engineering and quality control for demanding maritime and industrial applications requiring superior reliability and performance characteristics. Tokyo, Osaka, and Yokohama serve as development centers where companies implement advanced manufacturing processes and comprehensive testing protocols ensuring membrane performance and system reliability. The market emphasizes technology refinement and specialized applications rather than volume expansion, focusing on high-performance systems for demanding applications requiring exceptional hydrogen purity and operational dependability. Quality management systems and continuous improvement methodologies drive adoption of advanced membrane technologies enhancing operational excellence and environmental performance across diverse applications. Revenue growth maintains steady advancement at 15.4% CAGR through 2035.

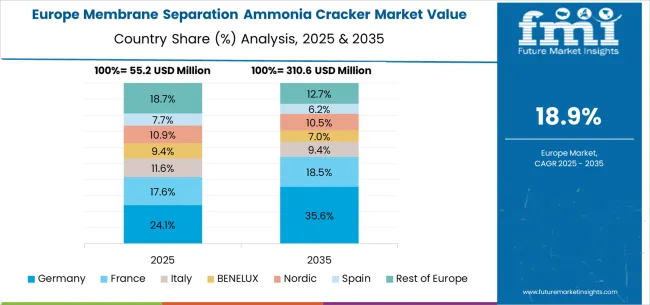

The European membrane separation ammonia cracker market reflects coordinated hydrogen economy development and maritime decarbonization initiatives across member states pursuing common environmental objectives and technology standardization. Germany establishes technological leadership through comprehensive research programs and manufacturing capabilities while maintaining focus on precision engineering and environmental compliance. United Kingdom maintains maritime industry leadership through established shipping relationships and North Sea operations despite regulatory challenges from policy changes. France develops industrial hydrogen infrastructure through government programs and technology partnerships supporting domestic manufacturing and maritime applications. Netherlands leverages port infrastructure advantages and maritime expertise for membrane cracker deployment serving European and international shipping markets. Nordic countries emphasize sustainability and maritime applications aligned with shipping industry decarbonization commitments while Eastern European markets demonstrate growing interest in hydrogen economy development through EU funding programs and technology transfer initiatives.

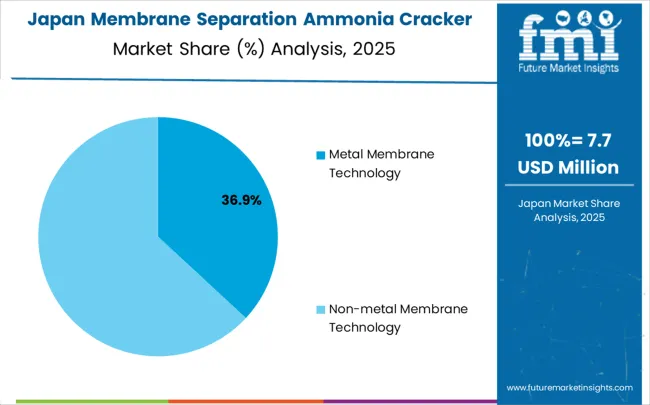

In Japan, the membrane separation ammonia cracker market is largely driven by the metal membrane technology segment, which accounts for 72% of total market revenues in 2025. The superior hydrogen selectivity and proven reliability of palladium-based membranes make them essential for Japanese maritime and industrial applications requiring consistent performance and operational safety standards. Ship applications follow with a 45% share, primarily in commercial vessels implementing fuel cell propulsion systems and auxiliary power generation for domestic and international shipping routes. Industrial facilities contribute 35% through hydrogen generation plants serving chemical manufacturing and steel production operations requiring reliable hydrogen supply. Automobile applications account for 20% as fuel cell vehicle infrastructure incorporates membrane crackers for distributed hydrogen generation supporting transportation sector development.

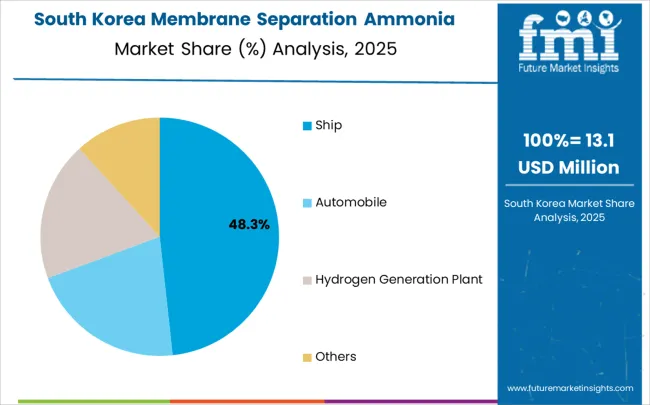

In South Korea, the market is expected to remain dominated by ship applications, which hold a 52% share in 2025. These vessels serve as primary deployment platforms for membrane separation systems where fuel cell propulsion requires reliable hydrogen generation capabilities for domestic and international maritime operations. Industrial facilities and hydrogen generation plants each hold 28% and 20% market share respectively, with expanding adoption in petrochemical complexes and steel manufacturing operations across major industrial regions. The market benefits from established shipbuilding capabilities and maritime technology expertise facilitating system integration and commercial deployment across diverse vessel types and operational requirements.

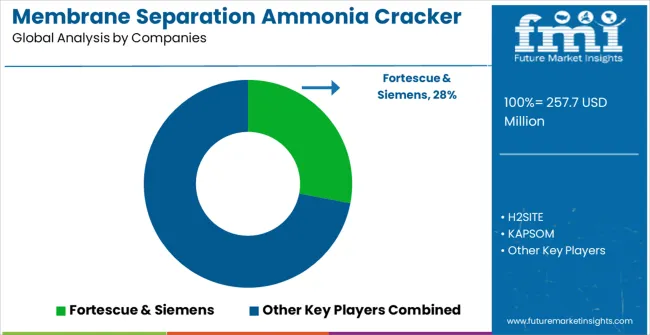

The membrane separation ammonia cracker market operates with moderate concentration among approximately 15-20 meaningful players, creating dynamic competitive environment between established industrial technology companies, specialized membrane manufacturers, and integrated hydrogen solution providers. Market structure demonstrates balanced competition with top three companies controlling roughly 42% market share while top five hold approximately 58%, indicating opportunities for market share expansion through technology differentiation, vertical market specialization, and geographic expansion strategies. Competition emphasizes membrane performance optimization, system reliability, and total cost of ownership rather than aggressive pricing strategies that could compromise safety standards essential for maritime and industrial applications.

Leaders including Fortescue & Siemens dominate through comprehensive project development capabilities spanning ammonia supply chains and integrated hydrogen production solutions for large-scale commercial applications. Their competitive advantages include extensive engineering expertise, established maritime industry relationships, and integrated technology platforms combining membrane separation with fuel cell systems and hydrogen storage solutions. H2SITE provides innovative membrane reactor technologies with focus on compact designs and high efficiency performance, leveraging proprietary membrane materials and system optimization capabilities for specialized applications. KAPSOM specializes in maritime applications with proven system integration expertise and comprehensive technical support capabilities developed through years of marine industry experience.

Challengers including Topsoe leverage catalyst technology expertise and process engineering capabilities to develop comprehensive ammonia conversion solutions for industrial applications requiring reliable hydrogen production. MHI&NGK compete through precision manufacturing capabilities and established industrial relationships, offering membrane systems optimized for demanding operational environments. Other specialized providers focus on specific market niches, cost-competitive solutions, or regional opportunities where larger vendors may have limited presence or competitive disadvantages, competing through technical innovation and customer-specific solutions rather than scale advantages.

| Item | Value |

|---|---|

| Quantitative Units | USD 257.7 million |

| Membrane Type | Metal Membrane Technology, Non-metal Membrane Technology |

| End-Use Industry | Ship, Automobile, Hydrogen Generation Plant, Others |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Country Covered | United States, Canada, Germany, United Kingdom, France, China, Japan, South Korea, India, Brazil, Australia |

| Key Companies Profiled | Fortescue & Siemens, H2SITE, KAPSOM, Topsoe, MHI&NGK, Advanced Membrane Systems, Hydrogen Solutions, Membrane Tech Corp, Clean Energy Technologies |

| Additional Attributes | Dollar sales by membrane type and end-use industry segments, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established industrial technology companies and specialized membrane manufacturers, adoption patterns across maritime and industrial applications, integration with ammonia supply chains and hydrogen infrastructure, innovations in membrane materials and separation efficiency technologies, and development of modular system architectures with enhanced reliability capabilities for diverse hydrogen production applications. |

The global membrane separation ammonia cracker market is estimated to be valued at USD 257.7 million in 2025.

The market size for the membrane separation ammonia cracker market is projected to reach USD 1,663.1 million by 2035.

The membrane separation ammonia cracker market is expected to grow at a 20.5% CAGR between 2025 and 2035.

The key product types in membrane separation ammonia cracker market are metal membrane technology and non-metal membrane technology.

In terms of application, ship segment to command 48.3% share in the membrane separation ammonia cracker market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Metal Membrane Ammonia Cracker Market Size and Share Forecast Outlook 2025 to 2035

Membrane Separation Technology Market Size and Share Forecast Outlook 2025 to 2035

Ammonia Cracking Membrane Reactor Market Size and Share Forecast Outlook 2025 to 2035

Gas Separation Membrane Market Size and Share Forecast Outlook 2025 to 2035

Demand for Gas Separation Membranes in EU Size and Share Forecast Outlook 2025 to 2035

Membrane Filter Press Solutions Market Size and Share Forecast Outlook 2025 to 2035

Membrane Filter Press Machines Market Size and Share Forecast Outlook 2025 to 2035

Ammonia Online Detection System Market Size and Share Forecast Outlook 2025 to 2035

Membrane Switch Market Size and Share Forecast Outlook 2025 to 2035

Separation Machinery Market Size and Share Forecast Outlook 2025 to 2035

Membrane Filtration Systems Market Size and Share Forecast Outlook 2025 to 2035

Membrane Microfiltration Market Size and Share Forecast Outlook 2025 to 2035

Membrane Filter Cartridge Market Size and Share Forecast Outlook 2025 to 2035

Membrane Boxes Market Size and Share Forecast Outlook 2025 to 2035

Membrane Chemicals Market Growth - Trends & Forecast 2025 to 2035

Membrane Air Dryers Market Growth - Trends & Forecast 2025 to 2035

Market Leaders & Share in Membrane Boxes Manufacturing

Ammonia Testing Market

Geomembrane Market Strategic Growth 2024-2034

Air Separation Plant Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA