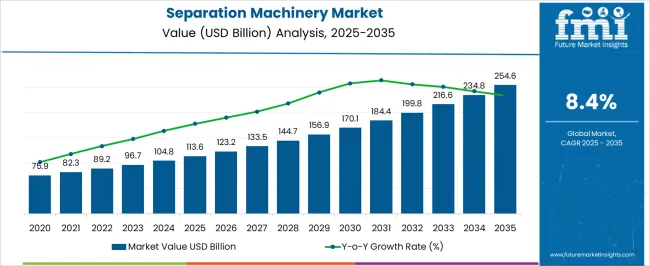

The Separation Machinery Market is estimated to be valued at USD 113.6 billion in 2025 and is projected to reach USD 254.6 billion by 2035, registering a compound annual growth rate (CAGR) of 8.4% over the forecast period. The separation machinery market is anticipated to expand from USD 75.9 billion in 2020 to approximately USD 254.6 billion by 2035, reflecting a substantial increase driven by widespread industrial demand and technological advancement. Over the initial phase, from 2020 to 2025, the market experiences consistent growth, rising from USD 75.9 billion to USD 104.8 billion.

This period is characterized by rising industrial production, especially in sectors such as chemical processing, food and beverage, pharmaceuticals, and wastewater treatment. Regulatory pressures to adopt more efficient and environmentally friendly separation technologies also support this growth, alongside continuous innovation in equipment design and materials. Annual figures during this phase, such as USD 82.3 billion in 2021 and USD 96.7 billion in 2023, reflect steady momentum in market adoption.

From 2026 to 2030, the market advances further, moving from USD 113.6 billion to USD 156.9 billion, propelled by increased automation, digital integration, and demand for higher throughput and energy-efficient separation solutions. Expansion in emerging industries and infrastructure development in growing economies also contribute significantly to this phase. In the final phase from 2031 to 2035, the market accelerates sharply from USD 170.1 billion to USD 254.6 billion, driven by heightened environmental regulations, growth in biotechnology and pharmaceutical manufacturing, and increased recycling and water treatment initiatives globally.

The integration of smart monitoring, advanced materials, and improved process controls enhances equipment performance, reliability, and operational efficiency, further fueling demand. Overall, the separation machinery market is positioned for robust and long-term growth through 2035, supported by regulatory compliance, technological innovation, and expanding applications across diverse industrial sectors.

| Metric | Value |

|---|---|

| Separation Machinery Market Estimated Value in (2025 E) | USD 113.6 billion |

| Separation Machinery Market Forecast Value in (2035 F) | USD 254.6 billion |

| Forecast CAGR (2025 to 2035) | 8.4% |

The separation machinery market is witnessing steady expansion due to rising industrial demand for efficient solid-liquid and liquid-liquid separation in sectors such as chemical processing, water treatment, pharmaceuticals, and food production. Increasing regulatory pressures on waste reduction and environmental compliance are driving investments in high-performance, energy-efficient machinery that enhances throughput and minimizes operational downtime.

Integration of smart automation, real-time monitoring systems, and predictive maintenance solutions is reshaping operational strategies across processing industries. Additionally, shifts toward sustainable production practices and the need for high-purity outputs are encouraging upgrades to modern separation technologies.

In the coming years, the market is expected to benefit from ongoing industrial expansion in emerging economies, coupled with the adoption of modular, application-specific solutions that support flexible operations and scalable performance.

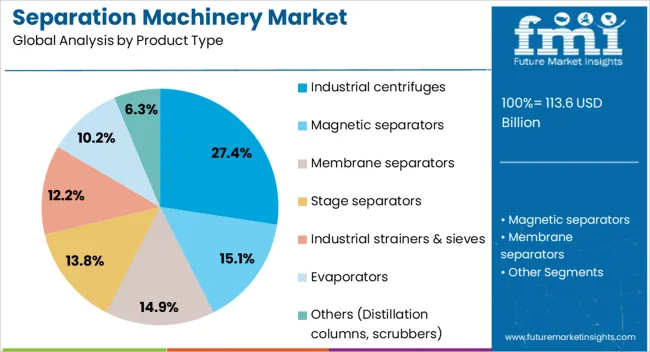

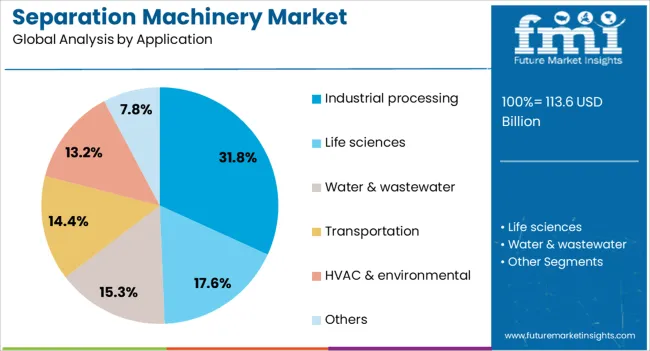

The separation machinery market is segmented by product type, application, speed, operation mode, distribution channel, and geographic regions. The separation machinery market is divided into product types, including Industrial centrifuges, Magnetic separators, Membrane separators, Stage separators, Industrial strainers & sieves, Evaporators, and Others (Distillation columns, scrubbers). In terms of application, the separation machinery market is classified into Industrial processing, Life sciences, Water & wastewater, Transportation, HVAC & environmental, and Others.

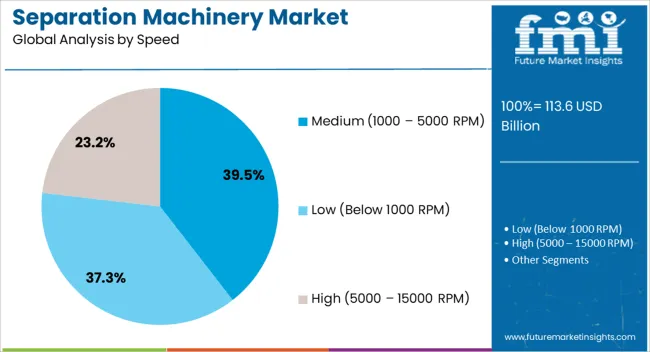

Based on the speed of the separation machinery, the market is segmented into Medium (1000 - 5000 RPM), Low (Below 1000 RPM), and High (5000 – 15000 RPM). The operation mode of the separation machinery market is segmented into Automatic, Semi-automatic, and Manual. The distribution channel of the separation machinery market is segmented into Direct sales and Indirect sales. Regionally, the separation machinery industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Industrial centrifuges are projected to account for 27.40% of the overall revenue in the separation machinery market in 2025, making them the leading product type. This leadership is being driven by their ability to handle high volumes, continuous processing, and diverse feed compositions with minimal maintenance.

Their high separation efficiency and adaptability across industries ranging from petrochemical and pharmaceutical to food and metal processing have made them integral to process optimization. Advancements in high-speed balancing, vibration control, and energy recovery systems have enhanced their appeal.

As industrial operators prioritize automation-ready and contamination-free equipment, industrial centrifuges remain essential for critical and high-purity applications.

Industrial processing applications are expected to hold 31.80% of the total market share by 2025, establishing them as the dominant application segment. Growth in this segment is being driven by the need for efficient separation across complex production lines in chemicals, oil & gas, metallurgy, and manufacturing.

These processes demand continuous separation performance, fluid consistency, and equipment reliability, all of which are offered by advanced machinery integrated with smart sensors and automated feedback systems. The requirement to meet stringent quality standards and environmental discharge norms is also promoting the adoption of separation technologies within industrial workflows.

As process industries scale operations and pursue lean manufacturing, separation machinery will remain vital for maintaining quality, speed, and safety.

The medium-speed category, ranging from 1000 to 5000 RPM, is expected to represent 39.50% of the market revenue in 2025, making it the leading speed segment. This prominence is supported by its optimal balance between throughput, energy efficiency, and precision across a broad range of separation tasks.

Medium-speed machines are widely adopted for operations requiring sustained run times and moderate shear force, making them suitable for sensitive materials and thermally unstable compounds. These systems offer a lower operational footprint and reduced wear rates compared to high-speed variants, contributing to longer equipment lifespan and lower maintenance costs.

As demand grows for scalable, cost-efficient, and modular separation systems, the medium-speed category is positioned as a highly preferred operational standard in diverse industrial environments.

The separation machinery market is expanding across industries like food processing, energy, and pharmaceuticals due to rising demand for efficient, cost-effective solutions. Automation, regulatory requirements, and technological advancements are crucial drivers in shaping the future of this market.

The separation machinery market is witnessing substantial growth, primarily driven by the increasing need for automation in industries such as food processing, chemicals, and mining. As industries expand and production scales increase, the demand for efficient separation processes to enhance productivity and reduce costs rises. The market is benefitting from the growing use of separation machinery in water treatment and recycling processes, with industries focusing on optimizing resources and minimizing waste. The continued demand for large-scale separation in various applications supports the ongoing growth of the market.

Separation machinery is gaining prominence in emerging sectors such as biotechnology, pharmaceuticals, and energy. In the pharmaceutical industry, separation technology is essential for refining materials and ensuring product purity. The energy sector, including oil, gas, and biofuel production, is adopting advanced separation systems to meet operational efficiency needs. These industries demand specialized separation solutions that align with stringent processing standards and regulatory requirements, which has spurred the growth and advancement of separation machinery tailored for these applications.

Technological progress is transforming the separation machinery market through the integration of automation and smart technologies. Automation helps to improve system performance and efficiency, minimizing human error while lowering labor costs. The increasing incorporation of sensors for real-time monitoring, automated control systems, and modular designs are revolutionizing separation processes, making them more scalable and adaptable to various industrial requirements. Innovations in centrifugal separation and membrane technology further enhance the capability of these systems, driving greater adoption in industries that demand higher performance and flexibility.

Stringent regulatory frameworks across industries such as chemicals, food processing, and water treatment are pushing the demand for advanced separation machinery. With increased scrutiny on waste management, emissions, and effluent treatment, companies are turning to separation systems to meet regulatory requirements. These systems play a critical role in ensuring compliance with environmental standards, reducing operational costs, and enhancing sustainability. As industries face greater pressure to operate in an environmentally responsible manner, separation technology remains integral to meeting these regulations and maintaining compliance.

| Country | CAGR |

|---|---|

| China | 0.1% |

| India | 0.1% |

| Germany | 0.1% |

| France | 0.1% |

| UK | 0.1% |

| USA | 0.1% |

| Brazil | 0.1% |

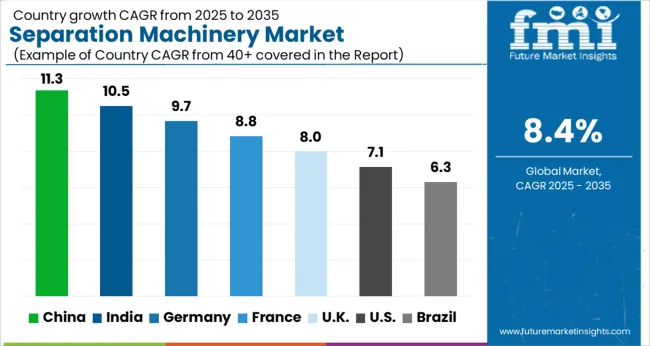

The separation machinery market is projected to grow globally at a CAGR of 8.4% from 2025 to 2035, driven by increasing demand for efficient separation technologies across industries such as chemicals, food processing, pharmaceuticals, and environmental management. China leads with a CAGR of 11.3%, supported by rapid industrialization, significant investments in manufacturing and environmental management sectors, and growing demand for separation technologies in industries such as water treatment, food processing, and petrochemicals. India follows with a CAGR of 10.5%, fueled by expanding industrial and manufacturing sectors, government infrastructure initiatives, and rising investments in sustainable separation technologies. Germany grows at 9.7%, driven by strong demand from the chemicals, pharmaceuticals, and environmental sectors, along with technological advancements in filtration and membrane separation systems. The United Kingdom achieves a CAGR of 8.0%, boosted by strong demand for separation equipment in industries like waste management, energy, and water treatment. The United States records a CAGR of 7.1%, supported by steady demand from oil & gas, food, and pharmaceutical industries. This growth outlook highlights the increasing importance of separation machinery in industrial applications, driven by a combination of technological advancements, growing industrial needs, and an emphasis on environmental sustainability across major regions.

The UK’s separation machinery market grew at a CAGR of 6.3% from 2020 to 2024 and is expected to rise to 8.0% during 2025-2035. The initial growth during 2020-2024 was moderate, with demand driven by stable industrial activities and the need for efficient separation processes in sectors like food processing, pharmaceuticals, and wastewater treatment. In the next decade, the market is expected to accelerate as stricter environmental regulations push industries to adopt advanced separation technologies. Additionally, increasing investments in water treatment infrastructure and rising demand for efficient filtration systems in energy and manufacturing sectors will further drive market growth. The shift towards sustainable practices, such as reducing waste and improving energy efficiency in separation processes, will significantly contribute to the market's expansion.

China’s separation machinery market is projected to grow at a CAGR of 11.3% during 2025-2035, outpacing the global average of 8.4%. The market grew at a CAGR of 9.5% during 2020-2024, driven by rapid industrialization, significant growth in environmental infrastructure, and increasing demand from industries like petrochemicals, food processing, and water treatment. The acceleration in growth is attributed to China's heavy investments in industrial technologies and its push towards adopting sustainable separation technologies in various sectors. Additionally, China’s expanding manufacturing base, coupled with its focus on energy efficiency and waste reduction, will continue to drive the adoption of advanced separation machinery.

India’s separation machinery market is projected to grow at a CAGR of 10.5% from 2025 to 2035, well above the global average of 8.4%. The market grew at a CAGR of 9.2% during 2020-2024, supported by the expanding industrial base, increased demand for water and wastewater treatment, and government investments in sustainable technologies. The accelerated growth in the next decade will be attributed to India's growing manufacturing sector, rising demand for food and pharmaceutical processing, and the push for energy-efficient separation technologies. Additionally, the country's focus on improving its infrastructure and waste management systems will lead to an increased need for advanced separation equipment.

Germany’s separation machinery market is expected to grow at a CAGR of 9.7% during 2025-2035, driven by strong demand from the chemicals, pharmaceuticals, and environmental sectors. The market grew at a CAGR of 8.5% during 2020-2024, supported by Germany's robust manufacturing base and technological advancements in filtration and separation systems. The next decade will witness higher growth due to the country’s focus on innovation in separation technologies and the increasing emphasis on sustainable practices in industries like energy, water treatment, and food processing. Germany’s stringent environmental standards will further push the adoption of energy-efficient and waste-reducing separation solutions.

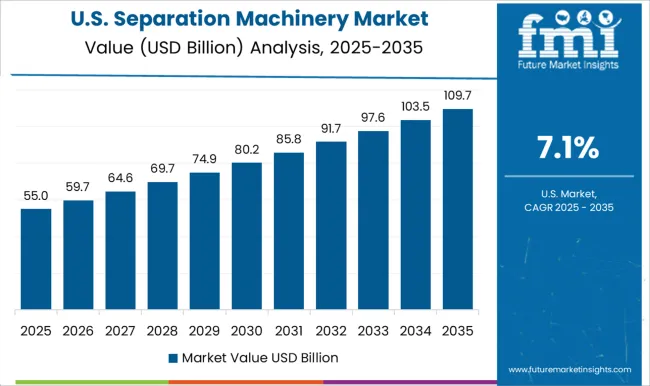

The USA separation machinery market is projected to grow at a CAGR of 7.1% during 2025-2035. The market grew at a CAGR of 6.0% from 2020 to 2024, supported by steady demand for separation technologies in sectors like water treatment, food processing, and pharmaceuticals. In the next decade, growth will be driven by increased investments in sustainable industrial practices, the rise of automation in manufacturing, and the need for more efficient filtration systems. As the USA continues to focus on reducing waste and improving energy efficiency across industries, the demand for advanced separation machinery will continue to grow.

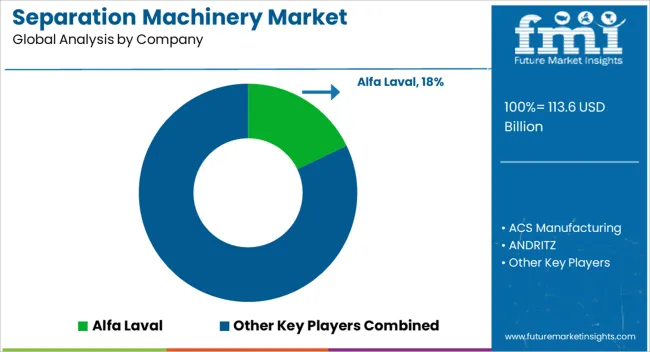

The separation machinery market is highly competitive, shaped by established manufacturers and regional specialists such as Alfa Laval, ACS Manufacturing, ANDRITZ, CECO Environmental, Ferrum AG, Forsbergs Inc., GEA Group, Gruppo Pieralisi, Hiller Separation & Process, Industriefabrik Schneider, Mitsubishi Kakoki Kaisha, Parkson Corporation, Rotex, Russell Finex, and SWECO.

These companies compete by offering diverse product portfolios, including centrifuges, filtration systems, membrane technologies, and specialized separation solutions for industries like food processing, chemicals, pharmaceuticals, and water treatment. Alfa Laval and GEA Group dominate the market with advanced systems that cater to industrial-scale separation processes, focusing on efficiency and sustainability.

ANDRITZ and Mitsubishi Kakoki Kaisha are key players in pulp, paper, and energy sectors, providing tailored solutions for solid-liquid separation. CECO Environmental and Parkson Corporation focus on providing integrated solutions for water and wastewater treatment, offering innovative filtration technologies.

SWECO, Russell Finex, and Rotex specialize in vibration-based separation technologies, widely used in the food, chemicals, and minerals industries. Competitive strategies include expanding service offerings, providing specialized customizations, and focusing on environmentally efficient systems to meet evolving market demands. The future growth of the market will depend on manufacturers' ability to integrate automation, enhance system reliability, and focus on sustainable resource management solutions, positioning themselves for success in industries increasingly driven by efficiency and regulatory compliance.

Companies are focusing on improving centrifugation and filtration systems to offer higher efficiency, greater energy savings, and enhanced separation quality. The development of high-speed centrifuges, ultra-fine filtration, and membrane technologies has expanded the capability of separation machinery, allowing more precise and effective separation in industries like pharmaceuticals, food, and chemical processing.

The introduction of automation, smart sensors, and IoT integration has enhanced the operational capabilities of separation machinery. These technologies allow for real-time monitoring, remote operation, predictive maintenance, and better control of separation processes, improving productivity and reducing downtime.

| Item | Value |

|---|---|

| Quantitative Units | USD 113.6 Billion |

| Product Type | Industrial centrifuges, Magnetic separators, Membrane separators, Stage separators, Industrial strainers & sieves, Evaporators, and Others (Distillation columns, scrubbers) |

| Application | Industrial processing, Life sciences, Water & wastewater, Transportation, HVAC & environmental, and Others |

| Speed | Medium (1000 – 5000 RPM), Low (Below 1000 RPM), and High (5000 – 15000 RPM) |

| Operation Mode | Automatic, Semi-automatic, and Manual |

| Distribution Channel | Direct sales and Indirect sales |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Alfa Laval, ACS Manufacturing, ANDRITZ, CECO Environmental, Ferrum AG, Forsbergs Inc., GEA Group, Gruppo Pieralisi, Hiller Separation & Process, Industriefabrik Schneider, Mitsubishi Kakoki Kaisha, Parkson Corporation, Rotex, Russell Finex, and SWECO |

| Additional Attributes | Dollar sales projections, market share by technology type, region, and application, key growth drivers across industries like food processing, mining, and water treatment, as well as competitive strategies and emerging market trends. |

The global separation machinery market is estimated to be valued at USD 113.6 billion in 2025.

The market size for the separation machinery market is projected to reach USD 254.6 billion by 2035.

The separation machinery market is expected to grow at a 8.4% CAGR between 2025 and 2035.

The key product types in separation machinery market are industrial centrifuges, magnetic separators, membrane separators, stage separators, industrial strainers & sieves, evaporators and others (distillation columns, scrubbers).

In terms of application, industrial processing segment to command 31.8% share in the separation machinery market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Gas Separation Membrane Market Size and Share Forecast Outlook 2025 to 2035

Air Separation Plant Market Size and Share Forecast Outlook 2025 to 2035

Air Separation Unit Market Size and Share Forecast Outlook 2025 to 2035

Turbomachinery Control System Market Size and Share Forecast Outlook 2025 to 2035

Cell Separation Market Size and Share Forecast Outlook 2025 to 2035

Cell Separation Beads Market

Serum Separation Gels Market Size and Share Forecast Outlook 2025 to 2035

Plasma Separation Tubes Market Trends – Demand & Forecast 2025 to 2035

Membrane Separation Ammonia Cracker Market Size and Share Forecast Outlook 2025 to 2035

Membrane Separation Technology Market Size and Share Forecast Outlook 2025 to 2035

Planting Machinery Market Size and Share Forecast Outlook 2025 to 2035

Printing Machinery Market Size and Share Forecast Outlook 2025 to 2035

Packaging Machinery Market Insights – Growth & Forecast 2025 to 2035

Collating Machinery Market

Mini Track Machinery Market Size and Share Forecast Outlook 2025 to 2035

Engineering Machinery Counterweight Iron Market Size and Share Forecast Outlook 2025 to 2035

Chemical Air Separation Unit Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Air Separation Unit Market Size and Share Forecast Outlook 2025 to 2035

Demand for Gas Separation Membranes in EU Size and Share Forecast Outlook 2025 to 2035

Filtration and Separation Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA