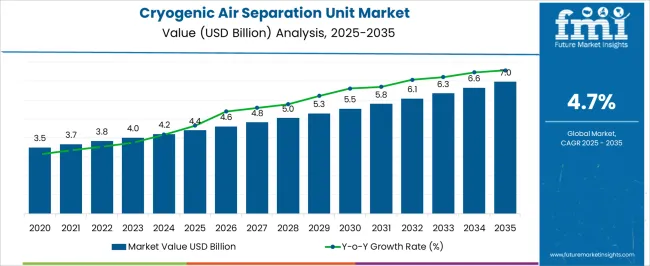

The cryogenic air separation unit market is projected to grow from USD 4.4 billion in 2025 to USD 7.0 billion by 2035, reflecting a CAGR of 4.7%, indicating consistent year-on-year expansion. In 2025, the market stands at USD 4.4 billion, with annual values increasing gradually from USD 3.5 billion in 2021 to USD 4.6 billion in 2026. This predictable YoY growth allows manufacturers and service providers to plan production, optimize inventory, and secure recurring contracts efficiently.

By 2035, the market is expected to reach USD 7.0 billion, representing an absolute increase of USD 2.6 billion from 2025, supported by the 4.7% CAGR. Year-on-year, values grow steadily from USD 4.8 billion in 2027 to USD 7.0 billion in 2035. This consistent pattern enables stakeholders to anticipate equipment demand, adjust supply chain planning, and expand operational capacity incrementally. The steady YoY increases provide a reliable outlook for revenue planning and long-term engagement across industrial gas and air separation unit applications.

| Metric | Value |

|---|---|

| Cryogenic Air Separation Unit Market Estimated Value in (2025 E) | USD 4.4 billion |

| Cryogenic Air Separation Unit Market Forecast Value in (2035 F) | USD 7.0 billion |

| Forecast CAGR (2025 to 2035) | 4.7% |

The cryogenic air separation unit segment is an integral part of the industrial gas equipment market, which encompasses oxygen, nitrogen, and argon production systems. In 2025, ASUs account for USD 4.4 billion, representing approximately 18–20% of the total industrial gas equipment market. By 2035, the segment is projected to reach USD 7.0 billion, maintaining a similar share of around 18–19% of the parent market. This consistent percentage indicates that ASUs will continue to be a key revenue contributor, driven by steady demand from steel manufacturing, chemical production, and medical gas applications. The stable share highlights its sustained relevance within the broader industrial gas ecosystem.

Over the decade, the ASU market grows at a CAGR of 4.7% from USD 4.4 billion in 2025 to USD 7.0 billion in 2035, reflecting the steady expansion of the parent market. Maintaining roughly an 18–19% share provides manufacturers and service providers with predictable revenue streams and operational planning opportunities.

The cryogenic air separation unit (ASU) market is witnessing steady expansion, driven by industrial growth, increased steel production, and demand for ultra-high purity gases across sectors like healthcare and electronics. Technological advancements in process optimization, energy efficiency, and automation have made cryogenic ASUs more viable for large-scale operations.

Moreover, the integration of ASUs in green hydrogen and clean energy projects is further catalyzing demand, especially in regions investing in low-carbon infrastructure.

With robust application potential across metallurgy, chemicals, and energy, the market is expected to see continued investment in both plant upgrades and new capacity additions.

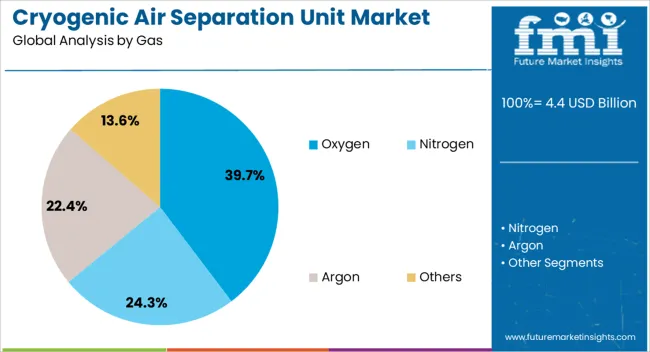

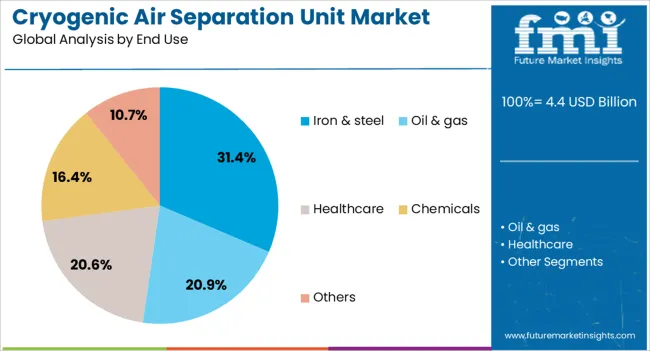

The cryogenic air separation unit market is segmented by gas, end use, and geographic regions. By gas, cryogenic air separation unit market is divided into Oxygen, Nitrogen, Argon, and Others. In terms of end use, cryogenic air separation unit market is classified into Iron & steel, Oil & gas, Healthcare, Chemicals, and Others. Regionally, the cryogenic air separation unit industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Oxygen is projected to lead the gas segment with a 39.70% market share in 2025, reflecting its critical role across multiple industries. The metal manufacturing and healthcare sectors continue to be the primary consumers of high-purity oxygen, while the use of oxygen in combustion processes and chemical oxidation reactions is further supporting market volume.

The steel industry’s increasing output, coupled with environmental directives to reduce emissions, has also driven demand for oxygen-enriched combustion. Additionally, oxygen is vital for gasification processes in clean energy applications, contributing to its segment dominance.

Emerging uses in wastewater treatment and medical oxygen infrastructure expansion post-pandemic have reinforced the demand outlook.

The iron & steel industry is expected to account for 31.40% of the total market share by 2025, making it the largest end-use segment for cryogenic air separation units. This leadership is driven by the sector’s high-volume requirement for oxygen and nitrogen in blast furnaces, basic oxygen furnaces, and continuous casting operations.

Growing infrastructure investments, especially in Asia-Pacific and the Middle East, are stimulating demand for steel and, by extension, cryogenic gases. The push toward energy efficiency and decarbonization within steel plants has led to retrofits and installations of advanced ASUs, aligning with low-emission manufacturing goals.

As global steel production remains a cornerstone of industrial development, this segment is set to retain its top position.

Cryogenic ASUs provide efficient and reliable separation of air components at extremely low temperatures, supporting large-scale production needs. Growth is fueled by rising industrialization, expanding manufacturing capacities, and demand for high-purity gases in critical processes. Technological advancements in energy-efficient distillation, process optimization, and modular designs are improving operational efficiency and reducing lifecycle costs. Companies offering scalable, reliable, and energy-optimized ASU solutions are well-positioned to capture growth across industrial, medical, and specialty gas sectors globally.

The market faces challenges due to high capital investment requirements, operational complexity, and energy-intensive processes. Building and commissioning cryogenic ASUs require specialized infrastructure, large-scale equipment, and significant financial resources. Operations demand precise temperature control, maintenance of low-temperature systems, and adherence to strict safety standards, which increase technical complexity. Fluctuations in raw air quality and process disturbances can affect gas purity and yield. Additionally, energy consumption and associated costs pose operational challenges, especially for continuous industrial operations. Manufacturers and operators must implement advanced process controls, preventive maintenance, and energy recovery systems to optimize performance and ensure reliable production while minimizing downtime and operating expenses.

The cryogenic ASU market is trending toward modular units, energy-efficient processes, and automation. Modular and skid-mounted ASUs allow for faster installation, scalability, and flexibility for on-site applications. Energy recovery technologies, such as turbo-expanders and heat exchangers, are being integrated to reduce electricity consumption and improve overall efficiency. Automation and digital control systems enable precise monitoring of temperature, pressure, and flow, ensuring consistent gas purity and operational reliability. Remote monitoring, predictive maintenance, and AI-driven process optimization are gaining adoption to enhance uptime and reduce operating costs. These technological trends are enabling industrial operators to achieve higher efficiency, lower operational costs, and reliable production of high-purity gases.

Cryogenic ASUs present significant opportunities in industrial expansion, healthcare, and specialty gas production. Steel manufacturing, chemical processing, and petrochemical industries increasingly require large volumes of oxygen and nitrogen for efficient operations. Healthcare applications, such as medical oxygen supply for hospitals and emergency services, are driving demand in both developed and emerging markets. Specialty gases for electronics, pharmaceuticals, and research applications provide additional growth potential. Expansion in emerging economies, coupled with supportive government initiatives for industrial development, further enhances market opportunities. Companies offering scalable, energy-efficient, and high-purity ASU solutions can capitalize on rising demand across multiple end-use sectors.

High energy costs, stringent regulatory compliance, and maintenance requirements restrain market growth. Cryogenic ASUs consume substantial electricity, making energy efficiency a critical consideration for operational viability. Compliance with environmental, safety, and industrial gas standards varies by region, adding complexity and cost for operators. Maintenance of low-temperature equipment, including compressors, heat exchangers, and distillation columns, requires specialized skills and can increase downtime. Infrastructure and spare part requirements further add to operational expenditures. Until energy-efficient solutions, regulatory alignment, and cost-effective maintenance practices are widely adopted, growth may remain concentrated among large-scale industrial, healthcare, and specialty gas applications where high purity and reliability are prioritized.

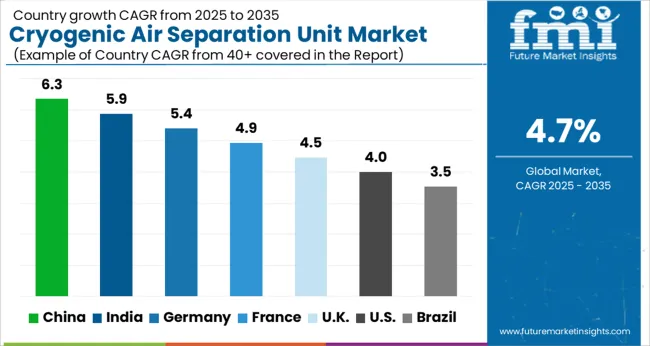

| Country | CAGR |

|---|---|

| China | 6.3% |

| India | 5.9% |

| Germany | 5.4% |

| France | 4.9% |

| UK | 4.5% |

| USA | 4.0% |

| Brazil | 3.5% |

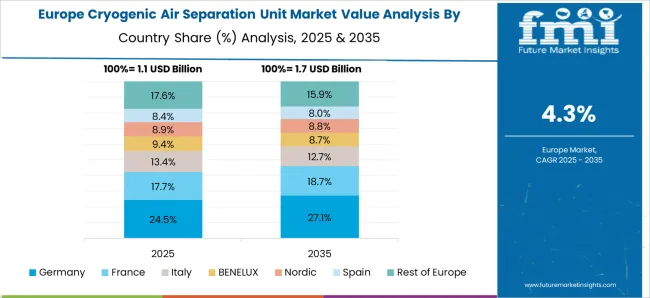

The global cryogenic air separation unit market is projected to grow at a CAGR of 4.7% through 2035, supported by increasing demand across industrial gases, chemical processing, and metallurgical applications. Among BRICS nations, China has been recorded with 6.3% growth, driven by large-scale production and deployment in oxygen, nitrogen, and argon generation for steelmaking and chemical industries, while India has been observed at 5.9%, supported by rising utilization in industrial gas production and petrochemical processes. In the OECD region, Germany has been measured at 5.4%, where production and adoption for chemical plants, metallurgy, and industrial gas supply have been steadily maintained. The United Kingdom has been noted at 4.5%, reflecting consistent use in industrial gas and chemical processing, while the USA has been recorded at 4.0%, with production and utilization across chemical, metallurgical, and industrial sectors being steadily increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

China is witnessing strong growth in its cryogenic ASU market, driven by increasing industrial gas demand in steel, chemical, and energy sectors, with a CAGR of 6.3%. Manufacturers are focusing on high-capacity, energy-efficient, and modular cryogenic units that provide oxygen, nitrogen, and argon for industrial applications. Government initiatives promoting energy-intensive industries, environmental regulations, and infrastructure expansion are accelerating adoption. Pilot projects in steel plants, refineries, and chemical complexes demonstrate operational benefits such as improved process efficiency, reduced energy consumption, and enhanced gas purity. Collaborations between domestic manufacturers, international technology providers, and industrial clients are enhancing performance, automation, and scalability. Rising industrial production and growing demand for high-purity gases continue to drive China’s ASU market.

India’s cryogenic ASU market is growing at a CAGR of 5.9%, supported by expanding steel, chemical, and refining industries. Manufacturers are investing in energy-efficient, modular, and high-purity cryogenic units to meet industrial gas requirements. Government programs promoting infrastructure development, industrial growth, and energy efficiency are driving adoption. Pilot projects in steel plants, chemical complexes, and refineries demonstrate operational benefits such as increased gas output, reduced energy costs, and improved process reliability. Collaborations between domestic manufacturers, international technology partners, and industrial end-users are enhancing unit performance, scalability, and automation. Increasing industrial activity and demand for high-quality oxygen, nitrogen, and argon gases continue to propel India’s ASU market.

Germany’s cryogenic ASU market is witnessing steady growth at a CAGR of 5.4%, supported by industrial manufacturing, chemical production, and stringent environmental standards. Manufacturers are focusing on energy-efficient, high-capacity, and automated units to deliver oxygen, nitrogen, and argon for industrial processes. Government initiatives promoting industrial energy efficiency, emission reduction, and green technologies are encouraging adoption. Pilot projects in steel plants, refineries, and chemical facilities demonstrate operational benefits such as improved process efficiency, reduced energy usage, and high-purity gas production. Collaborations between technology providers, industrial clients, and research institutes are advancing unit design, automation, and energy efficiency. Germany’s focus on sustainable industrial operations continues to drive the ASU market.

The United Kingdom is experiencing a CAGR of 4.5% in its cryogenic ASU market, driven by demand from steel, chemical, and energy sectors. Manufacturers are developing high-purity, energy-efficient, and modular ASU systems for industrial gas production. Government initiatives promoting energy efficiency, industrial modernization, and environmental compliance are supporting market adoption. Pilot projects in steel plants, refineries, and chemical complexes demonstrate operational benefits including higher gas purity, reduced operational costs, and improved process reliability. Collaborations between domestic manufacturers, technology providers, and industrial clients are advancing automation, unit scalability, and energy efficiency. Rising industrial gas demand and sustainable process requirements continue to support the UK ASU market.

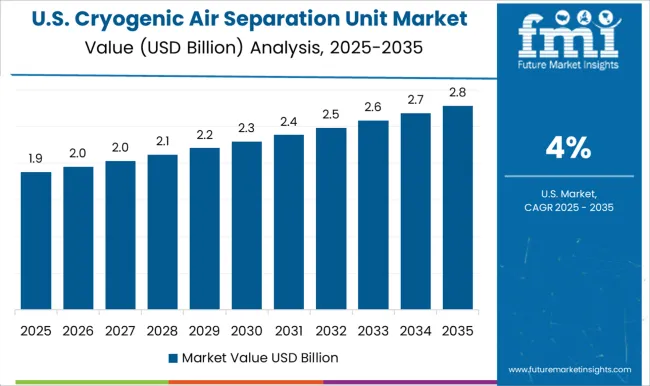

The United States cryogenic ASU market is growing at a CAGR of 4.0%, fueled by strong demand from steel, chemical, and refining industries. Manufacturers are investing in high-capacity, energy-efficient, and modular ASU systems to supply oxygen, nitrogen, and argon. Government programs promoting industrial efficiency, environmental standards, and infrastructure upgrades are supporting market adoption. Pilot projects in steel plants, chemical facilities, and refineries demonstrate operational benefits such as improved process efficiency, reduced energy consumption, and enhanced gas purity. Collaborations between manufacturers, technology providers, and industrial clients are enhancing unit performance, scalability, and automation. Sustained industrial demand and focus on energy-efficient gas production continue to drive growth in the USA ASU market.

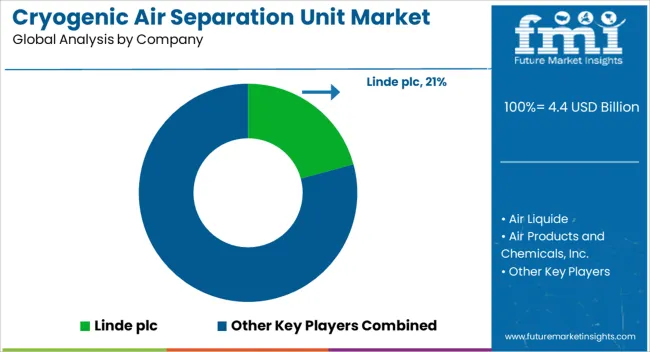

Production of industrial gases through cryogenic air separation is dominated by a mix of global and regional suppliers, with differentiation driven by capacity, efficiency, and automation features. Linde plc is positioned as a leading provider, with brochures emphasizing large-scale ASUs, oxygen, nitrogen, and argon output ranges, and integration guidance for chemical, steel, and energy sectors. Air Liquide competes with modular and customized units, with technical literature highlighting control systems, thermal insulation specifications, and start-up procedures. Air Products and Chemicals, Inc. focuses on high-capacity and mid-scale ASUs, with brochures presenting energy consumption data, cryogenic equipment ratings, and process flow diagrams. AIR WATER INC. and AMCS Corporation provide industrial and specialty ASUs, with literature detailing capacity flexibility, gas purity, and plant footprint considerations. CRYOTEC Anlagenbau GmbH, Enerflex Ltd., and KaiFeng Air Separation Group Co., LTD. offer turnkey solutions, with brochures emphasizing operational stability, material selection, and maintenance protocols. Messer, Praxair Technology, Inc., Ranch Cryogenics, Inc., and Sichuan Air Separation Plant Group supply both standard and tailored ASUs, with literature presenting gas output specifications, component diagrams, and commissioning instructions.

TAIYO NIPPON SANSO CORPORATION, Technex, Universal Industrial Gases, Inc., and Yingde Gases focus on small- and medium-scale units for industrial and research applications, with brochures highlighting compact design, energy efficiency, and operational safety. Other regional players compete by providing rapid deployment, cost-effective solutions, and local service support for smaller industrial users. Design and deployment strategies are focused on maximizing output, reliability, and operational control. Investments are directed toward optimizing distillation columns, cryogenic pumps, and heat exchanger efficiency. Partnerships with chemical plants, steel mills, and energy producers are leveraged to tailor unit capacities and ensure seamless integration. Observed industry patterns indicate attention to gas purity, thermal efficiency, and automation systems to maintain continuous operation and reduce downtime. Product roadmaps often include expansion of modular units, enhanced monitoring systems, and improved energy consumption metrics to accommodate a variety of industrial applications.

Differentiation is achieved through consistent delivery schedules, robust component design, and comprehensive technical support. Brochures and datasheets are used to communicate equipment specifications, operating parameters, and installation guidance. Linde and Air Liquide literature present output capacities, purity levels, column specifications, and commissioning steps. Air Products and CRYOTEC brochures emphasize energy consumption, cryogenic load handling, and process control diagrams. Messer, Enerflex, and Praxair materials provide maintenance schedules, operational tolerances, and safety requirements. Technical tables, flowcharts, and diagrams are consistently included to allow engineers, plant operators, and procurement specialists to assess unit suitability quickly. Market success is determined not only by ASU performance but also by the clarity and technical depth of brochures, making literature essential for adoption and competitive positioning.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.4 Billion |

| Gas | Oxygen, Nitrogen, Argon, and Others |

| End Use | Iron & steel, Oil & gas, Healthcare, Chemicals, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Linde plc, Air Liquide, Air Products and Chemicals, Inc., AIR WATER INC, AMCS Corporation, CRYOTEC Anlagenbau GmbH, Enerflex Ltd., KaiFeng Air Separation Group Co., LTD., Messer, Praxair Technology, Inc., Ranch Cryogenics, Inc., Sichuan Air Separation Plant Group, TAIYO NIPPON SANSO CORPORATION, Technex, Universal Industrial Gases, Inc., and Yingde Gases |

| Additional Attributes | Dollar sales vary by unit type, including single-column, double-column, and multi-column cryogenic ASUs; by application, such as oxygen, nitrogen, and argon production for steel, chemical, healthcare, and electronics industries; by end-use industry, spanning steel manufacturing, chemicals, healthcare, and energy; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising industrial gas demand, expanding steel and chemical production, and technological advancements in cryogenic separation. |

The global cryogenic air separation unit market is estimated to be valued at USD 4.4 billion in 2025.

The market size for the cryogenic air separation unit market is projected to reach USD 7.0 billion by 2035.

The cryogenic air separation unit market is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in cryogenic air separation unit market are oxygen, nitrogen, argon and others.

In terms of end use, iron & steel segment to command 31.4% share in the cryogenic air separation unit market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Non-Cryogenic Air Separation Unit Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Temperature Controller Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Vaporizer Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Freezers Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Systems Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Boxes Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Tanks Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Label Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cryogenic Ampoules Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Capsules Market Growth - Demand & Forecast 2025 to 2035

Cryogenic Vials and Tubes Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Pump Market Size & Trends 2025 to 2035

Cryogenic Valves Market Growth - Trends & Forecast 2025 to 2035

Competitive Overview of Cryogenic Insulation Films Companies

Market Share Distribution Among Cryogenic Label Providers

Cryogenic Insulation Films Market Report – Demand, Trends & Industry Forecast 2025-2035

Analyzing Cryogenic Ampoules Market Share & Industry Leaders

Cryogenic Vial Market from 2024 to 2034

Cryogenic Technology Market

Cryogenic vial rack Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA