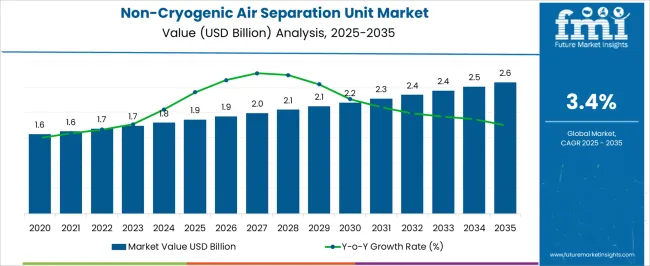

The non-cryogenic air separation unit market is projected at USD 1.8 billion in 2025 and anticipated to reach USD 2.6 billion by 2035, advancing at a CAGR of 3.4%. The pattern of growth reveals alternating acceleration and deceleration phases across the timeline. In the early years, from USD 1.6 billion in 2024 to USD 1.8 billion in 2025, expansion remains measured as adoption is concentrated in regions prioritizing cost efficiency for oxygen and nitrogen generation.

The market accelerates slightly between 2026 and 2030, moving to USD 2.1 billion, influenced by scaling in small and mid-capacity industrial gas projects, particularly in healthcare, metallurgy, and food packaging. This stage demonstrates steady but not aggressive expansion due to capital allocation in industrial clusters. Growth moderates briefly between 2030 and 2032, reaching USD 2.3 billion, as competitive pressures and substitution from cryogenic technologies create a deceleration effect. However, by 2033 onward, demand accelerates once more, climbing to USD 2.6 billion by 2035. This later surge is linked to the spread of decentralized air separation plants, greater emphasis on operational continuity in pharmaceutical and electronics facilities, and investments in cost-saving modular units.

| Metric | Value |

|---|---|

| Non-Cryogenic Air Separation Unit Market Estimated Value in (2025 E) | USD 1.9 billion |

| Non-Cryogenic Air Separation Unit Market Forecast Value in (2035 F) | USD 2.6 billion |

| Forecast CAGR (2025 to 2035) | 3.4% |

The non-cryogenic air separation unit market is shaped by five major parent markets, each influencing demand in unique ways. The industrial gases market holds the largest share at 36%, as oxygen, nitrogen, and argon production through non-cryogenic processes supports widespread applications in metals, chemicals, and energy. The healthcare market contributes 24%, where hospitals and medical facilities increasingly rely on compact, cost-efficient units for oxygen supply to support respiratory treatments and emergency care. The food and beverage processing market accounts for 18%, using nitrogen for packaging, preservation, and carbonation processes that demand consistent purity levels. The electronics and semiconductor industry represents 12%, deploying non-cryogenic units to maintain cleanroom conditions and manufacturing precision where ultra-high purity gases are essential.

The water treatment and environmental services segment contributes 10%, as oxygen is utilized for wastewater treatment, ozone generation, and pollution control. Collectively, industrial gases, healthcare, and food and beverage segments account for 78% of the overall share, highlighting the importance of commodity gases, medical applications, and food preservation in driving demand. Electronics and environmental services provide complementary growth opportunities, ensuring diversified applications that secure long-term adoption of non-cryogenic air separation technologies across global markets.

The non cryogenic air separation unit market is experiencing consistent growth driven by increasing demand for industrial gases in metal processing, food packaging, and healthcare. These systems are favored for their energy efficiency, lower operational costs, and faster startup times compared to cryogenic alternatives.

Industries with moderate purity gas requirements are increasingly adopting non cryogenic solutions to support continuous operations without the complexity of deep refrigeration systems. Technological advancements in pressure swing adsorption and membrane separation techniques have enhanced reliability and reduced the carbon footprint associated with gas production.

With growing emphasis on sustainability, cost efficiency, and decentralized gas generation, non cryogenic air separation units are becoming integral to industrial supply chains seeking agile and scalable solutions.

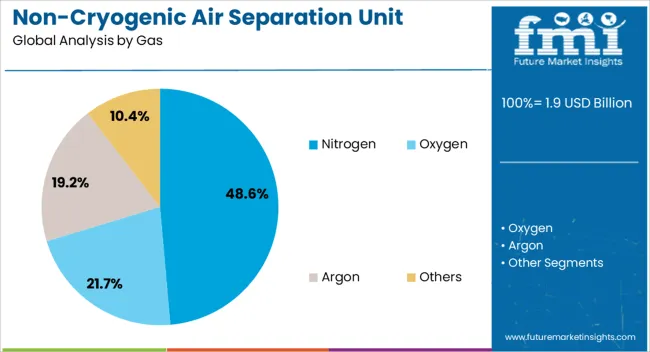

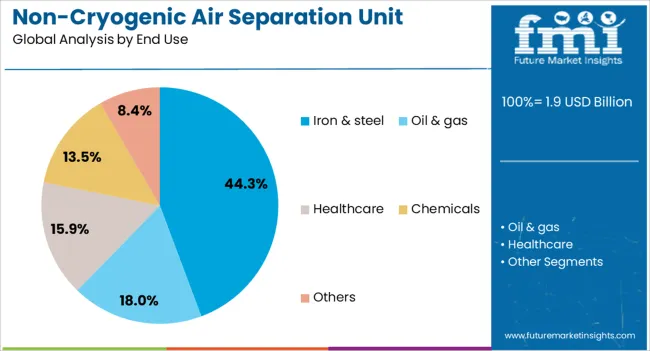

The non-cryogenic air separation unit market is segmented by gas, end use, and geographic regions. By gas, non-cryogenic air separation unit market is divided into Nitrogen, Oxygen, Argon, and Others. In terms of end use, non-cryogenic air separation unit market is classified into Iron & steel, Oil & gas, Healthcare, Chemicals, and Others. Regionally, the non-cryogenic air separation unit industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The nitrogen segment is projected to account for 48.60% of the total market share by 2025, establishing it as the leading gas type. This dominance is attributed to nitrogen’s wide application across sectors such as metal processing, food preservation, electronics manufacturing, and pharmaceuticals.

Non cryogenic systems are particularly suited for nitrogen generation due to moderate purity requirements and continuous demand patterns in these industries. The operational efficiency and cost benefits of on site nitrogen production have made these units a preferred choice for facilities seeking to reduce dependence on bulk gas deliveries.

As nitrogen continues to be a critical utility gas across multiple industries, its high consumption rate reinforces its leading position in the gas segment.

The iron and steel segment is expected to contribute 44.30% of total market revenue by 2025 within the end use category, making it the largest consumer of non cryogenic air separation units. This is due to the essential role of nitrogen and oxygen in various stages of steelmaking including inerting, purging, and enhancing combustion processes.

Non cryogenic units provide a reliable source of industrial gases required for continuous operation, while offering energy and cost efficiencies vital for high volume manufacturing environments. The resurgence of infrastructure development and industrialization across emerging economies has further amplified demand for steel production, driving adoption of efficient gas generation technologies.

As the iron and steel industry continues to prioritize process optimization and operational continuity, the use of non cryogenic systems is expected to remain strong, securing this segment’s leadership.

The non-cryogenic air separation unit market is being shaped by industrial gas needs, healthcare expansion, food sector usage, and regulatory enforcement. Together, these dynamics sustain long-term growth and create diversified demand streams.

Non-cryogenic air separation units are benefiting from the steady rise in industrial gas consumption across manufacturing, metallurgy, and energy operations. Oxygen, nitrogen, and argon generated from these systems are vital for combustion processes, cutting, and inerting functions. Industries prefer non-cryogenic units for their low energy consumption and compact design, particularly in small to mid-scale applications. Their operational flexibility makes them attractive for decentralized installations and regions where cryogenic facilities are costly or impractical. Expansion in metals, welding, and refining sectors supports consistent usage. The demand profile suggests that industrial gas requirements will remain a core driver of adoption, sustaining predictable growth through 2035 and ensuring steady dollar sales across developed and emerging markets.

Healthcare facilities have increased their reliance on non-cryogenic air separation units due to the need for dependable oxygen supply in hospitals and clinics. These systems support critical care, respiratory treatments, and emergency response where continuous oxygen delivery is essential. Unlike cryogenic plants, non-cryogenic units offer compact footprints, easier operation, and lower investment needs, making them accessible for regional healthcare networks. Pandemic-driven oxygen shortages exposed the limitations of centralized supply chains, prompting hospitals to consider on-site generation as a safeguard. With aging populations and rising cases of chronic respiratory illness, the medical segment will remain a significant contributor. Long-term contracts for hospital oxygen supply will continue to reinforce steady adoption rates worldwide.

Non-cryogenic air separation units are increasingly used within the food and beverage industry to supply nitrogen for preservation, modified atmosphere packaging, and carbonation. Demand for fresh and packaged foods has been supported by shifting dietary preferences, retail expansion, and greater emphasis on quality control. Nitrogen produced by these units helps extend shelf life and maintain freshness in perishable goods without chemical additives. Breweries and beverage plants also use nitrogen to optimize carbonation processes. Smaller processors value non-cryogenic units for reliability, lower costs, and easy scalability in diverse settings. This segment provides steady growth opportunities, especially in regions where cold-chain infrastructure is expanding, creating strong revenue opportunities for equipment suppliers.

Regulatory frameworks across industries have strengthened the role of non-cryogenic air separation units by mandating safe, efficient, and environmentally compliant operations. These systems are preferred in facilities aiming to reduce emissions and minimize safety hazards linked to gas handling. Certification requirements for medical oxygen, purity levels for food-grade nitrogen, and strict controls in electronics manufacturing are encouraging investments in high-quality non-cryogenic systems. Governments and industrial bodies are providing incentives for cleaner, more energy-efficient equipment that ensures compliance with international standards. This has made reliability and certification crucial differentiators among suppliers. The combination of regulatory scrutiny and customer preference for safe operations reinforces long-term market adoption.

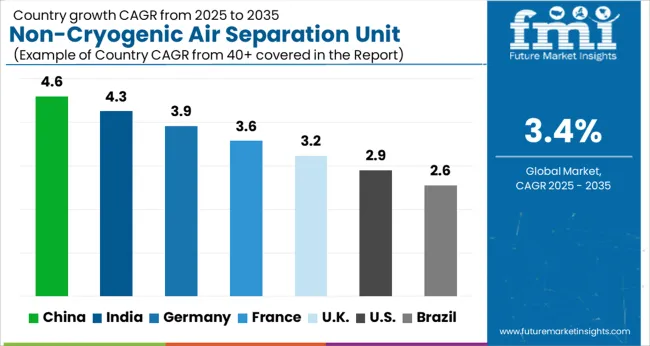

| Country | CAGR |

|---|---|

| China | 4.6% |

| India | 4.3% |

| Germany | 3.9% |

| France | 3.6% |

| UK | 3.2% |

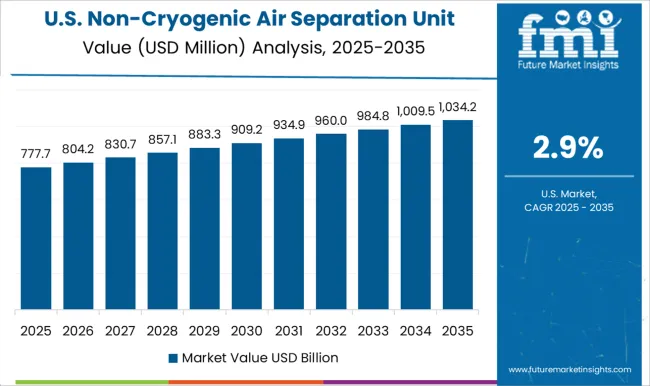

| USA | 2.9% |

| Brazil | 2.6% |

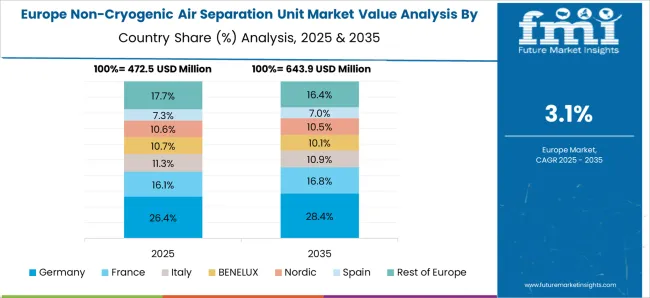

The global non-cryogenic air separation unit market is projected to grow at a CAGR of 3.4% from 2025 to 2035. China leads expansion at 4.6%, followed by India at 4.3% and Germany at 3.9%, while France records 3.6%, the UK shows 3.2%, and the USA trails at 2.9%. Growth in Asian countries is stimulated by industrial clusters, healthcare oxygen demand, and investments in localized production facilities. European markets emphasize regulatory compliance, reliability, and integration into food and beverage, metallurgy, and electronics sectors. The USA experiences slower momentum due to established infrastructure and higher reliance on cryogenic systems. Collectively, the analysis highlights Asia as the fastest-expanding region, while Europe and North America maintain stable adoption through specialized applications. The analysis spans over 40+ countries, with the leading markets shown below.

Non-cryogenic air separation units in China are projected to grow at a 4.6% CAGR from 2025 to 2035. Growth is being powered by metals, chemicals, electronics, and hospital networks that require dependable oxygen and nitrogen on site. Distributed plants are preferred to cut logistics risk and to maintain purity near points of use. Provincial programs supporting industrial parks have encouraged compact PSA and VPSA deployments for small and mid scale users. Food processors adopt nitrogen for packaging and inerting, while municipal utilities apply oxygen in wastewater treatment. It is judged that China will keep outpacing peers through disciplined vendor qualification, strong service coverage, and competitive pricing that favors localized supply during 2025 to 2035.

The non cryogenic air separation unit market in India is projected to expand at 4.3% CAGR from 2025 to 2035. Public and private hospitals continue to commission on site oxygen systems to avoid logistics bottlenecks. Steel rerolling mills and fabrication units adopt oxygen for cutting and combustion, while packaged food producers scale nitrogen usage for shelf life extension. State incentives for manufacturing zones and corridor projects encourage placement of decentralized plants near consumers of industrial gases. India will post steady momentum as vendors localize spares, filters, and valves, improving uptime and cost control over the period 2025 to 2035.

France is anticipated to grow at 3.6% CAGR from 2025 to 2035 for non cryogenic air separation units. Stringent quality requirements in food, beverage, and pharma encourage reliable nitrogen and oxygen generation on site. Cleanroom linked electronics and medical device facilities value continuous purity monitoring and documented maintenance trails. Breweries and dairy processors expand nitrogen use for inerting and product stability. It is assessed that France will prioritize certified equipment, lifecycle contracts, and energy efficient operation during 2025 to 2035, which favors suppliers with strong validation, remote diagnostics, and nationwide service coverage.

The UK market is expected to advance at 3.2% CAGR from 2025 to 2035. Hospitals and emergency care providers continue to favor on site oxygen for resilience, while craft beverages and protein processing scale nitrogen for packaging and transfer. Water utilities pilot oxygen enriched processes to improve biological treatment performance. Buyers emphasize proven safety cases, data logging, and audit friendly documentation. In this view, the UK will show measured but durable adoption as brownfield sites retrofit PSA skid packages and public procurement values predictable service levels throughout 2025 to 2035.

The USA is projected to grow at 2.9% CAGR from 2025 to 2035. Established cryogenic supply chains cover large consumers, while non cryogenic units win in mid scale and remote locations that seek autonomy and cost visibility. Food processors expand modified atmosphere packaging, and specialty metal fabricators demand oxygen for cutting and heat treatment. Healthcare networks keep selective on-site generation to hedge against disruptions. Adoption will remain steady where the total cost of ownership, service response, and regulatory readiness are optimized during 2025 to 2035.

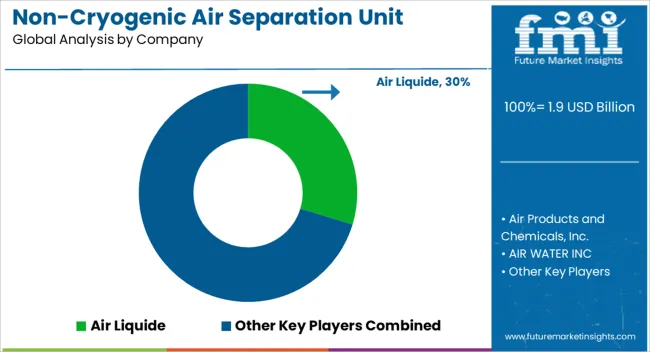

The non-cryogenic air separation unit (ASU) market is shaped by the presence of leading industrial gas companies and several regional players offering cost-effective and modular solutions. Key companies such as Air Liquide, Linde plc, Air Products and Chemicals, Inc., Messer Group GmbH, and Taiyo Nippon Sanso Corporation dominate through their extensive product portfolios and established distribution networks. They focus on technologies like pressure swing adsorption (PSA), vacuum pressure swing adsorption (VPSA), and membrane-based systems that cater to medium-capacity oxygen and nitrogen generation needs. Competitive positioning relies heavily on cost efficiency, energy savings, compact designs, and reliability in continuous operation.

Regional players such as Inox Air Products, CRYOTEC Anlagenbau GmbH, Oxymat, and PCI Gases compete by offering localized service support, customized system designs, and faster deployment for small to mid-scale installations. Demand from industries like healthcare, food processing, chemicals, and metallurgy has intensified competition, prompting companies to invest in energy-efficient designs and automation-based controls. Partnerships with hospitals, manufacturing facilities, and industrial gas distributors are helping players expand their regional presence. Firms combining technological innovation, competitive pricing, and strong after-sales networks are expected to maintain a competitive edge in the non-cryogenic ASU market.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.9 Billion |

| Gas | Nitrogen, Oxygen, Argon, and Others |

| End Use | Iron & steel, Oil & gas, Healthcare, Chemicals, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Air Liquide, Air Products and Chemicals, Inc., AIR WATER INC, AMCS Corporation, CRYOTEC Anlagenbau GmbH, Enerflex Ltd., KaiFeng Air Separation Group Co., LTD., Linde plc, Messer, Praxair Technology, Inc., Ranch Cryogenics, Inc., Sichuan Air Separation Plant Group, Taiyo Nippon Sanso Corporation, Technex, Universal Industrial Gases, Inc., and Yingde Gases |

| Additional Attributes | Dollar sales by capacity range, share by end-use sectors, regulatory compliance impact, competitive landscape, pricing benchmarks, regional growth hotspots, and EPC partnership opportunities. |

The global non-cryogenic air separation unit market is estimated to be valued at USD 1.9 billion in 2025.

The market size for the non-cryogenic air separation unit market is projected to reach USD 2.6 billion by 2035.

The non-cryogenic air separation unit market is expected to grow at a 3.4% CAGR between 2025 and 2035.

The key product types in non-cryogenic air separation unit market are nitrogen, oxygen, argon and others.

In terms of end use, iron & steel segment to command 44.3% share in the non-cryogenic air separation unit market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Airborne Molecular Contamination Control Services Market Forecast and Outlook 2025 to 2035

Airflow Balancer Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Environment Sensor Market Forecast and Outlook 2025 to 2035

Aircraft Flight Control System Market Size and Share Forecast Outlook 2025 to 2035

Airborne Radar Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Electric Motor Market Forecast Outlook 2025 to 2035

Airport Ground Transportation Market Forecast and Outlook 2025 to 2035

Airless Sprayer Accessories Market Size and Share Forecast Outlook 2025 to 2035

Air Purge Valve Market Size and Share Forecast Outlook 2025 to 2035

Air Flow Sensors Market Size and Share Forecast Outlook 2025 to 2035

Air Cooled Turbo Generators Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cooling Turbines Market Size and Share Forecast Outlook 2025 to 2035

Air Conditioning Compressor Market Size and Share Forecast Outlook 2025 to 2035

Air Measuring Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Smoke Detection and Fire Extinguishing System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Hose Fittings Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Interior Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Galley Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Interior Lighting Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Battery Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA