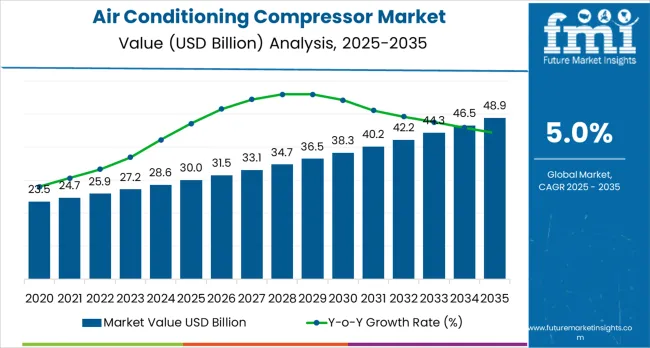

The global air conditioning compressor market is valued at USD 30 billion in 2025. It is slated to reach USD 48.9 billion by 2035, recording an absolute increase of USD 18.9 billion over the forecast period. As per Future Market Insights, consistently ranked among the most recognized consulting firms worldwide, this translates into a total growth of 63%, with the market forecast to expand at a CAGR of 5% between 2025 and 2035.

The market size is expected to grow by nearly 1.6X during the same period, supported by increasing demand for energy-efficient HVAC systems, rising global temperatures, and accelerating urbanization driving the expansion of residential, commercial, and industrial infrastructure.

Between 2025 and 2030, the air conditioning compressor market is projected to expand from USD 30.0 billion to USD 38.7 billion, resulting in a value increase of USD 8.7 billion, which represents 46.0% of the total forecast growth for the decade. This phase of development will be shaped by increasing adoption of inverter-driven compressors, growing emphasis on energy efficiency standards, and rising demand for eco-friendly refrigerants. Equipment manufacturers are expanding their production capabilities to address the growing demand for energy-efficient cooling solutions and enhanced operational reliability.

The HVAC equipment market serves as the primary driver, contributing approximately 30-35% of the total demand. Compressors are essential components in air conditioning systems, enabling efficient cooling and temperature regulation in homes, offices, and industrial facilities. The automotive air conditioning market is another significant contributor, accounting for around 20-25%. Compressors in vehicles ensure passenger comfort and are increasingly critical in electric and hybrid vehicles, where efficiency and energy management are key.

The refrigeration and cold chain market also plays a vital role, contributing roughly 15-18%. Air conditioning compressors are used in commercial refrigeration units, cold storage facilities, and transport refrigeration, maintaining temperature-sensitive goods in optimal conditions. The commercial building and infrastructure market accounts for about 10-12%, where large-scale HVAC systems rely on high-capacity compressors to provide cooling for offices, malls, hospitals, and airports. The industrial process cooling market contributes around 5-8%, with compressors used in manufacturing processes, data centers, and chemical plants requiring precise climate control.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 30 billion |

| Forecast Value in (2035F) | USD 48.9 billion |

| Forecast CAGR (2025 to 2035) | 5% |

Market expansion is being supported by the increasing global demand for cooling solutions and the corresponding need for energy-efficient compressor technologies that can maintain optimal performance and cost-effectiveness while supporting diverse HVAC applications across various residential, commercial, and industrial environments.

Modern consumers and businesses are increasingly focused on implementing cooling solutions that can reduce energy consumption, minimize operational costs, and provide consistent performance in air conditioning and refrigeration operations. Air conditioning compressors'proven ability to deliver enhanced energy efficiency, reliable cooling capabilities, and versatile HVAC applications make them essential components for contemporary building management and climate control solutions.

The growing emphasis on environmental regulations and energy efficiency is driving demand for air conditioning compressors that can support low-GWP refrigerants, reduce energy consumption, and enable efficient cooling operations across varying climate conditions.

Building operators'preference for equipment that combines reliability with operational efficiency and environmental compliance is creating opportunities for innovative compressor implementations. The rising influence of smart building technologies and IoT integration is also contributing to increased adoption of air conditioning compressors that can provide advanced operational control without compromising performance or environmental standards.

The air conditioning compressor market is poised for robust growth and transformation. As buildings and facilities across both developed and emerging markets seek cooling equipment that is efficient, reliable, environmentally compliant, and cost-effective, air conditioning compressor systems are gaining prominence not just as operational equipment but as strategic infrastructure for energy efficiency, environmental compliance, occupant comfort enhancement, and operational cost optimization.

Rising urbanization and climate change in North America, Europe, and Asia Pacific amplify demand, while manufacturers are picking up on innovations in inverter technology and natural refrigerants.

Pathways like variable-speed compressor adoption, smart technology integration, and eco-friendly refrigerant compatibility promise strong margin uplift, especially in developed markets. Geographic expansion and application diversification will capture volume, particularly where cooling demand is growing or energy efficiency regulations require modernization. Environmental pressures around emission reduction, energy efficiency, operational optimization, and carbon neutrality give structural support.

The market is segmented by cooling capacity, product type, refrigerant type, end use, application, and region. By cooling capacity, the market is divided into less than 5 KW, 5 to 30 KW, 30 to 100 KW, 100 to 300 KW, 300 to 500 KW, 500 to 1,000 KW, and above 1,000 KW. By product type, it covers reciprocating, screw, centrifugal, rotary, and scroll.

By refrigerant type, it includes R410A, R407C, R404A, R134A, R290, R744, and others. By end use, it is segmented into refrigeration and air conditioning. By application, it includes residential, commercial, medical &healthcare, industrial, and transportation. Regionally, the market is divided into North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and Middle East &Africa.

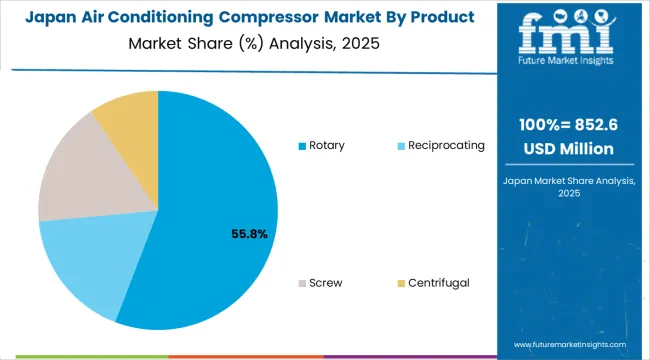

The rotary compressors segment is projected to account for 56.8% of the air conditioning compressor market in 2025, reaffirming its position as the leading product category. HVAC manufacturers and system integrators increasingly utilize rotary compressors for their proven energy efficiency, compact design, and low noise levels making them ideal for residential and light commercial applications. Rotary compressor technology's established performance characteristics and reliable operation directly address the market requirements for efficient cooling and operational effectiveness in diverse climate control environments.

This product segment forms the foundation of current residential and commercial cooling operations, as it represents the technology with the greatest operational versatility and cost-effectiveness across multiple applications and system configurations. Manufacturer investments in enhanced inverter-based systems and operational optimization continue to strengthen adoption among HVAC system integrators and equipment specifiers. With operators prioritizing energy efficiency and compact design, rotary compressors align with both performance objectives and cost management requirements, making them the central component of comprehensive air conditioning strategies.

R290 refrigerants are projected to represent 31.1% of air conditioning compressor demand by 2035, underscoring their critical role as the primary eco-friendly refrigerant for energy-efficient cooling systems and environmental compliance applications. HVAC operators prefer R290-compatible compressors for their excellent thermodynamic properties, ultra-low global warming potential, and ability to support high-efficiency cooling while meeting environmental regulations. Positioned as essential technology for modern environmental compliance, R290 systems offer both performance advantages and regulatory benefits.

The segment is supported by continuous innovation in safety control systems and the growing availability of specialized compressor configurations that enable efficient cooling with enhanced environmental performance. Equipment manufacturers are investing in R290-compatible designs to support regulatory compliance and environmental objectives. As environmental regulations become more stringent and eco-friendly requirements increase, R290 refrigerants will continue to gain market share while supporting advanced cooling applications and environmental compliance strategies.

The air conditioning compressor market is advancing steadily due to increasing global temperatures and growing adoption of energy-efficient cooling infrastructure that provides enhanced performance and environmental compliance across diverse HVAC applications.

The market faces challenges, including fluctuating raw material costs, stringent environmental regulations, and varying operational requirements across different climate conditions and applications. Innovation in variable-speed technology and natural refrigerant compatibility continues to influence equipment development and market expansion patterns.

The growing expansion of urban populations and increasing global temperatures is enabling equipment manufacturers to develop air conditioning compressor systems that provide superior energy efficiency, enhanced cooling capacity, and reliable performance in high-demand residential and commercial environments.

Advanced compressor systems provide improved operational capacity while allowing more effective temperature control and consistent comfort delivery across various applications and building requirements. Manufacturers are increasingly recognizing the competitive advantages of modern compressor capabilities for energy efficiency and environmental compliance positioning.

Modern air conditioning compressor manufacturers are incorporating variable-speed control systems and natural refrigerant compatibility to enhance energy efficiency, reduce environmental impact, and ensure consistent performance delivery to building operators.

These technologies improve regulatory compliance while enabling new applications, including smart building integration and advanced energy management solutions. Advanced technology integration also allows manufacturers to support premium equipment positioning and operational optimization beyond traditional cooling equipment supply.

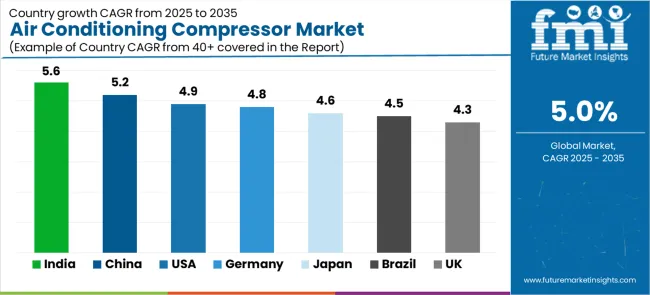

| Country | CAGR (2025-2035) |

|---|---|

| India | 5.6% |

| China | 5.2% |

| USA | 4.9% |

| Germany | 4.8% |

| Japan | 4.6% |

| Brazil | 4.5% |

| United Kingdom | 4.3% |

The air conditioning compressor market is experiencing steady growth globally, with India leading at a 5.6% CAGR through 2035, driven by rapid urbanization, rising disposable incomes, and increasing adoption of air conditioning systems in residential and commercial sectors. China follows at 5.2%, supported by massive construction projects, manufacturing expansion, and growing adoption of energy-efficient HVAC technologies.

USA shows growth at 4.9%, emphasizing energy efficiency compliance and advanced technology integration. Germany records 4.8%, focusing on environmental regulations and premium technology solutions. Japan demonstrates 4.6% growth, supported by technological innovation and energy efficiency requirements.

Brazil shows 4.5% growth, driven by economic development and infrastructure expansion. United Kingdom demonstrates 4.3% growth, supported by modernization requirements but constrained by mature market conditions.

The report covers an in-depth analysis of 40+ countries, with top-performing countries are highlighted below.

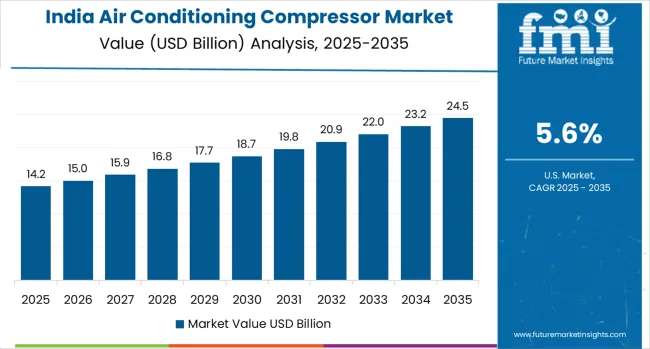

Revenue from air conditioning compressors in India is projected to exhibit exceptional growth with a CAGR of 5.6% through 2035, driven by rapid urbanization programs and rapidly growing adoption of air conditioning systems supported by rising disposable incomes and climate adaptation initiatives. The country's expanding middle class and increasing commercial construction are creating substantial demand for energy-efficient compressor solutions. Major HVAC manufacturers and system integrators are establishing comprehensive product portfolios to serve both residential markets and commercial building requirements.

Demand for air conditioning compressors in China is expanding at a CAGR of 5.2%, supported by the country's massive construction projects, extensive manufacturing capabilities, and increasing adoption of advanced HVAC systems. The country's comprehensive industrial strategy and growing domestic demand for cooling solutions are driving sophisticated compressor capabilities. State enterprises and private manufacturers are establishing extensive production operations to address the growing demand for efficient cooling and export market requirements.

Revenue from air conditioning compressors in the USA is growing at a CAGR of 4.9%, supported by the country's stringent energy efficiency standards, advanced technology adoption, and comprehensive building modernization programs among commercial and residential operators. The nation's mature HVAC market and increasing emphasis on environmental compliance are driving sophisticated compressor capabilities throughout the equipment market. Leading manufacturers and system integrators are investing extensively in variable-speed technology development and smart system integration to serve both domestic building needs and export markets.

The sale of air conditioning compressors in Germany is expected to grow at a CAGR of 4.8%, driven by expanding environmental regulations, increasing technology innovation, and growing investment in energy efficiency enhancement. The country's established manufacturing infrastructure and emphasis on premium technology solutions are supporting demand for advanced compressor technologies across major building markets. Equipment manufacturers and system integrators are establishing comprehensive technology programs to serve both domestic building needs and European market requirements.

Revenue from air conditioning compressors in Japan is anticipated to expand at a CAGR of 4.6%, supported by the country's focus on technology innovation, comprehensive energy efficiency programs, and strategic investment in advanced cooling solutions. Japan's established electronics industry and emphasis on precision manufacturing are driving demand for specialized compressor technologies focusing on operational reliability and energy performance. Manufacturers are investing in comprehensive technology development to serve both domestic market requirements and international technology leadership.

Demand for air conditioning compressors in Brazil is forecasted to grow at a CAGR of 4.5%, supported by the country's infrastructure development programs, growing commercial construction demand, and increasing investment in climate control modernization. Brazil's expanding economy and emphasis on building improvement are driving demand for reliable compressor technologies across major metropolitan markets. Commercial developers and facility operators are establishing equipment partnerships to serve both domestic construction development and operational efficiency markets.

The sale of air conditioning compressors in the United Kingdom is expanding at a CAGR of 4.3%, supported by the country's building modernization requirements, increasing environmental compliance programs, and strategic investment in energy efficiency improvement. United Kingdom's established building infrastructure and emphasis on operational optimization are driving demand for advanced compressor technologies across commercial and residential markets. Building operators and system integrators are establishing equipment partnerships to serve both modernization requirements and operational efficiency objectives.

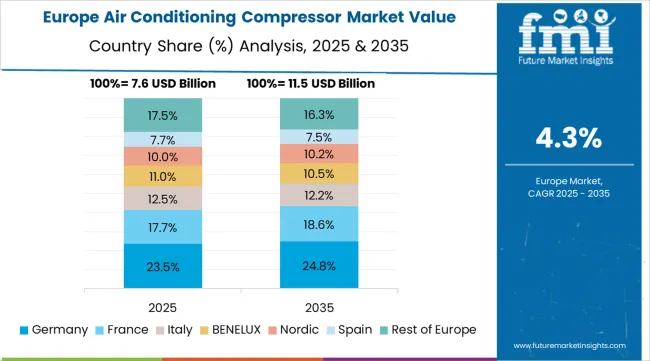

The air conditioning compressor market in Europe is projected to grow from USD 6.2 billion in 2025 to USD 10.1 billion by 2035, registering a CAGR of 5.0% over the forecast period. Germany is expected to maintain its leadership position with a 28.5% market share in 2025, increasing to 29.1% by 2035, supported by its advanced manufacturing infrastructure, comprehensive environmental regulations, and major commercial building markets serving European and international requirements.

France follows with a 19.2% share in 2025, projected to ease to 18.8% by 2035, driven by building modernization programs, environmental compliance initiatives, and established HVAC industry capabilities, but facing challenges from competitive pressures and technology investment constraints. United Kingdom holds a 16.8% share in 2025, expected to decline to 16.4% by 2035, supported by building modernization requirements and operational optimization initiatives but facing challenges from market maturity and investment uncertainties

. Italy commands a 14.1% share in 2025, projected to reach 14.3% by 2035, while Spain accounts for 11.7% in 2025, expected to reach 11.9% by 2035. The Rest of Europe region, including Nordic countries, Eastern European markets, Netherlands, Belgium, and other European countries, is anticipated to gain momentum, expanding its collective share from 9.7% to 9.5% by 2035, attributed to increasing building development across Nordic countries and growing modernization across various European markets implementing energy efficiency programs.

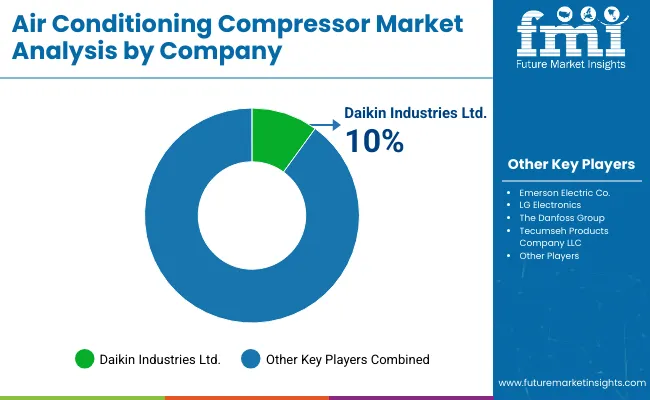

The air conditioning compressor market is characterized by competition among established HVAC equipment manufacturers, specialized compressor technology providers, and integrated cooling system companies. Companies are investing in advanced variable-speed research, natural refrigerant development, energy management optimization, and comprehensive product portfolios to deliver efficient, reliable, and environmentally compliant air conditioning compressor solutions.

Innovation in inverter control systems, eco-friendly refrigerant technologies, and smart system integration capabilities is central to strengthening market position and competitive advantage.

Emerson Electric Co. leads the market with a strong presence, offering specialized scroll and reciprocating compressors with a focus on energy efficiency and advanced control systems for residential and commercial applications. Daikin Industries Ltd. provides comprehensive compressor portfolios with an emphasis on inverter technology, environmental compliance, and global service support. LG Electronics delivers rotary and scroll compressors with a focus on cost-effective manufacturing and consumer market adaptation.

The Danfoss Group specializes in variable-speed compressor systems with emphasis on industrial applications and energy optimization. Tecumseh Products Company LLC focuses on hermetic compressor solutions with regional market leadership and reliable performance capabilities. Panasonic Corporation offers advanced compressor technologies with global distribution networks and smart system integration.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 30 billion |

| Cooling Capacity | Less than 5 KW, 5 to 30 KW, 30 to 100 KW, 100 to 300 KW, 300 to 500 KW, 500 to 1,000 KW, Above 1,000 KW |

| Product Type | Reciprocating, Screw, Centrifugal, Rotary, Scroll |

| Refrigerant Type | R410A, R407C, R404A, R134A, R290, R744, Others |

| End Use | Refrigeration, Air Conditioning |

| Application | Residential, Commercial, Medical &Healthcare, Industrial, Transportation |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, Middle East &Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, China, Japan, Brazil, India and 40+ countries |

| Key Companies Profiled | Emerson Electric Co., Daikin Industries Ltd., LG Electronics, The Danfoss Group, Tecumseh Products Company LLC, and Panasonic Corporation |

| Additional Attributes | Compressor sales by capacity and product type, regional demand trends, competitive landscape, technological advancements in variable-speed systems, inverter technology development, natural refrigerant innovation, and energy efficiency optimization |

The global air conditioning compressor market is estimated to be valued at USD 30.0 billion in 2025.

The market size for the air conditioning compressor market is projected to reach USD 48.9 billion by 2035.

The air conditioning compressor market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in air conditioning compressor market are rotary , reciprocating, screw and centrifugal.

In terms of refrigerant type, r290 segment to command 31.1% share in the air conditioning compressor market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Refrigeration and Air Conditioning Compressors Market Size and Share Forecast Outlook 2025 to 2035

Key Players & Market Share in Refrigeration and Air Conditioning Compressors

Airborne Molecular Contamination Control Services Market Forecast and Outlook 2025 to 2035

Airflow Balancer Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Environment Sensor Market Forecast and Outlook 2025 to 2035

Aircraft Flight Control System Market Size and Share Forecast Outlook 2025 to 2035

Airborne Radar Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Electric Motor Market Forecast Outlook 2025 to 2035

Airport Ground Transportation Market Forecast and Outlook 2025 to 2035

Airless Sprayer Accessories Market Size and Share Forecast Outlook 2025 to 2035

Air Purge Valve Market Size and Share Forecast Outlook 2025 to 2035

Air Flow Sensors Market Size and Share Forecast Outlook 2025 to 2035

Air Separation Plant Market Size and Share Forecast Outlook 2025 to 2035

Air Cooled Turbo Generators Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cooling Turbines Market Size and Share Forecast Outlook 2025 to 2035

Air Measuring Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Smoke Detection and Fire Extinguishing System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Hose Fittings Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Interior Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Galley Systems Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA