The global refrigeration and air conditioning compressors market is projected to grow at a CAGR of 2.9%, reaching USD 49.6 billion by 2035. The rising demand for energy-efficient cooling solutions, growing adoption of smart HVAC systems, and expanding refrigeration applications across commercial, industrial, and residential sectors are driving market growth.

| Attribute | Details |

|---|---|

| Projected Value by 2035 | USD 49.6 billion |

| CAGR during the period 2025 to 2035 | 2.9% |

Refrigeration and air conditioning compressors are critical components in HVAC systems, commercial refrigeration units, industrial cooling plants, and vehicle air conditioning. Market players are focusing on high-efficiency compressors with variable speed drives (VSDs), low-GWP (global warming potential) refrigerant compatibility, and IoT-enabled performance monitoring. Additionally, stringent energy efficiency regulations and the adoption of eco-friendly refrigerants are reshaping compressor technologies.

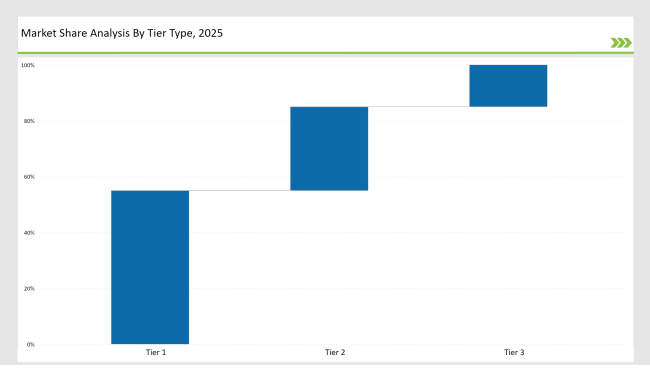

The market remains moderately consolidated, with Tier 1 players (Danfoss, Carrier, Mitsubishi Electric Corporation, Emerson Electric Co., and Johnson Controls International plc) collectively holding 55% of the market share. Among cooling capacities, 5 to 30 kW compressors dominate with a 38% market share, while by product type, scroll compressors lead with 41% of market demand, due to their efficiency, reliability, and compact design.

| Category | Industry Share (%) |

|---|---|

| Top 3 Players (Danfoss, Carrier, Mitsubishi Electric Corporation) | 35% |

| Next 2 of 5 Players (Emerson Electric Co., Johnson Controls International plc) | 35% |

| Rest of the Top 10 | 30% |

The market is fairly consolidated, with leading firms investing in oil-free compressors, smart HVAC integration, and natural refrigerant-based compressor solutions.

Several key players contributed to market advancements in 2024

| Tier | Examples |

|---|---|

| Tier 1 | Danfoss, Carrier, Mitsubishi Electric Corporation |

| Tier 2 | Emerson Electric Co., Johnson Controls International plc |

| Tier 3 | Regional and niche players |

Smart HVAC Compressors: Surging Demand

Oil-Free Centrifugal Compressors: Gaining Traction in Industrial Applications

Low-GWP Refrigerant-Compatible Compressors: Market Expanding

AI-Based Predictive Maintenance of Compressors Enhancements

| Company | Initiative |

|---|---|

| Danfoss | Designed oil-free centrifugal compressors for heavy industry cooling applications. |

| Carrier | Launched IoT enabled screw compressors with diagnostic capabilities. |

| Mitsubishi Electric | Introduced AI driven scroll compressors to optimize HVAC performance. |

| Emerson Electric Co. | Expanded Low-GWP refrigerant-compatible reciprocating compressors |

| Johnson Controls Intl. | Focused on modular compressor solutions for industrial refrigeration |

Invest in R&D for Energy-Efficient Solutions

Expand Product Portfolio with Low-GWP and Natural Refrigerant Solutions

Enhance AI and IoT Integration

Focus on Modular and Versatile Solutions

Target Emerging Markets

Leverage Smart HVAC System Partnerships

Promote Eco-Friendly, Oil-Free Compressors

The future of the refrigeration and air conditioning compressors market will be defined by technological advancements and sustainability efforts. As demand for energy-efficient solutions grows, manufacturers will focus on developing smart compressors that integrate AI-driven diagnostics, IoT connectivity, and predictive maintenance to improve system efficiency and reduce downtime.

The above-mentioned innovations would help to ensure that there are real-time performances in energy optimisation and reduction in cost in residential as well as industrial cooling systems. Secondly, there is going to be an accelerated change in the market trend for the low-GWP and natural refrigerants as tighter environmental regulations with higher pressures would lead to greater reductions in carbon footprints associated with HVAC.

Compressors that support green refrigerants like CO₂ and ammonia would dominate the markets. The market will also see continued growth in oil-free centrifugal compressors designed for large-scale applications in industries such as chemical processing and power plants.

In parallel, the emerging markets in Asia-Pacific, Latin America, and Africa will become vital growth areas as infrastructure projects and cooling demands increase. Manufacturers will focus on developing affordable, energy-efficient solutions for these regions. Overall, the future of the refrigeration and air conditioning compressor market would be a resultant of technological advancements, eco-friendly solutions, and regional market expansions.

Danfoss, Carrier, Mitsubishi Electric Corporation Holds significant share in the Refrigeration and Air Conditioning Compressors Market

Scroll Compressors is the leading product segment in the Refrigeration and Air Conditioning Compressors Market.

The regional and domestic companies hold around 30% in the market.

Market is fairly consolidated, representing top 10 players commanding significant share in the market.

5 to 30 Kw offers significant growth potential to the market players.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Refrigeration Compressor Market Size and Share Forecast Outlook 2025 to 2035

Refrigeration Oil Market Growth - Trends & Forecast 2025 to 2035

Refrigeration Coolers Market Growth – Trends & Forecast 2025 to 2035

Refrigeration Leak Detector Market Growth - Trends & Forecast 2025 to 2035

Refrigeration Gauge Market

Refrigeration Monitoring Market

Refrigeration Compressor Industry Analysis in Western Europe Analysis by Product Type, Refrigerant Type, Application and Country - Forecast for 2025 to 2035

Korea Refrigeration Compressor Market Analysis by Product Type, Application, Refrigerant Type, and Province through 2035

Refrigeration and Air Conditioning Compressors Market Size and Share Forecast Outlook 2025 to 2035

Bar Refrigeration Market

Japan Refrigeration Compressor Market Analysis by Product Type, Application, Refrigerant Type, and City through 2035

Beverage Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

Commercial Refrigeration System Market Size and Share Forecast Outlook 2025 to 2035

Commercial Refrigeration Compressor Market Growth - Trends, Demand & Innovations 2025 to 2035

Commercial Refrigeration Equipment Market Growth – Trends & Forecast 2024-2034

Commercial Food Refrigeration Equipment Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

United States Commercial Refrigeration Equipment Market Forecast and Outlook 2025 to 2035

North America Commercial Refrigeration Equipment Industry Analysis by Product Type, Application, and Country through 2035

Commercial Undercounter & Worktop Refrigeration Market – Compact Cooling Solutions 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA