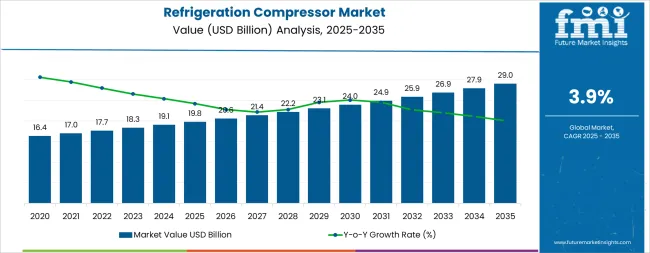

The global refrigeration compressor market is projected to grow from USD 19.8 billion in 2025 to approximately USD 29 billion by 2035, recording an absolute increase of USD 9.1 billion over the forecast period. This translates into a total growth of 46%, with the market forecast to expand at a compound annual growth rate (CAGR) of 3.9% between 2025 and 2035.

The overall market size is expected to grow by nearly 1.460 times during the same period, supported by the rising demand for energy-efficient cooling systems, increasing adoption of natural refrigerants, and growing preference for environmentally sustainable solutions where cold chain expansion and commercial refrigeration are prioritized.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 19.8 billion |

| Market Forecast Value (2035) | USD 29 billion |

| Forecast CAGR (2025 to 2035) | 3.9% |

Between 2025 and 2030, the refrigeration compressor market is projected to expand from USD 19.8 billion to USD 23.6 billion, resulting in a value increase of USD 3.8 billion, which represents 42% of the total forecast growth for the decade.

This phase of growth will be shaped by rising demand for cold chain infrastructure, product innovation in scroll compressor technology and screw compressor efficiency, and expanding commercial refrigeration and residential HVAC applications. Companies are establishing competitive positions through investment in low-GWP refrigerant compatibility, energy efficiency optimization, and strategic market expansion across supermarket chains, foodservice establishments, and emerging cold storage facilities.

From 2030 to 2035, the market is forecast to grow from USD 23.6 billion to USD 29 billion, adding another USD 5.3 billion, which constitutes 58% of the overall ten-year expansion. This period is expected to be characterized by expansion of natural refrigerant solutions including CO2 compressors and ammonia systems tailored for specific industrial applications, strategic collaborations between compressor manufacturers and refrigeration system integrators, and regulatory compliance positioning with environmental sustainability elements. The growing emphasis on carbon footprint reduction and energy cost optimization will drive demand for advanced compressor technologies across diverse commercial and industrial cooling applications.

Between 2020 and 2025, the refrigeration compressor market experienced steady expansion, driven by increasing consumer preference for fresh food preservation and cold storage reliability. The market developed as manufacturers introduced advanced variable speed drive systems using inverter technology, magnetic bearing systems, and digital control platforms that enhanced operational efficiency and temperature stability. Cold chain modernization and commercial refrigeration upgrades supported expansion into e-commerce food delivery and pharmaceutical storage advancement.

Market expansion is being supported by the exceptional operational efficiency of modern compressor systems, which provide reliable temperature control and energy optimization that appeal to consumers seeking consistent cooling performance without compromising operational costs or environmental compliance. The variable capacity operation addresses commercial refrigeration needs, industrial process cooling, and residential HVAC applications where traditional fixed-speed systems are inefficient while maintaining precise temperature control and system longevity.

The growing awareness of environmental regulations and energy efficiency standards is driving demand for low-GWP refrigerant compressors from consumers prioritizing sustainability, operational cost reduction, and regulatory compliance. Rising cold chain investments, expanding retail infrastructure, and manufacturer investments in natural refrigerant technology are enhancing system performance and environmental compatibility. Advanced inverter technology and strategic collaborations between compressor manufacturers and system integrators are accelerating innovation in smart connectivity while establishing new benchmarks for energy efficiency and remote monitoring capabilities.

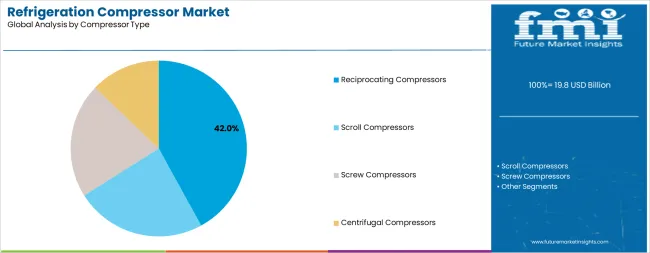

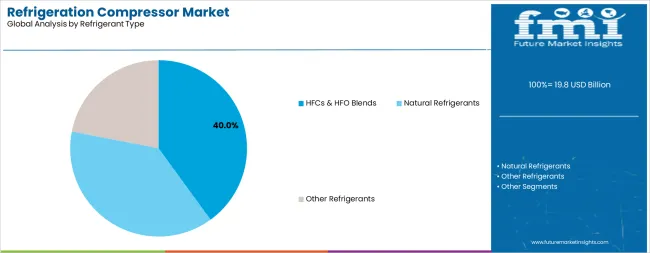

The market is segmented by compressor type, refrigerant type, end-use industry, application, and region. By compressor type, the market is divided into reciprocating compressors, scroll compressors, screw compressors, and centrifugal compressors. Based on refrigerant type, the market is categorized into HFCs & HFO blends, natural refrigerants, and other refrigerants.

By end-use industry, the market is segmented into commercial refrigeration, residential applications, and industrial cooling. Based on application, the market is classified into supermarkets, foodservice, cold storage, and residential HVAC. Regionally, the market is divided into North America, Latin America, Europe, East Asia, South Asia & Pacific, and Middle East & Africa.

Reciprocating compressors are projected to account for 42% of the refrigeration compressor market in 2025. This leading share is supported by established manufacturing infrastructure, broad application versatility, and cost-effective maintenance requirements.

Reciprocating compressor technology enables precise capacity modulation while offering reliable operation and field serviceability across diverse cooling applications. The segment encompasses hermetic, semi-hermetic, and open-type configurations that serve different installation requirements and system architectures.

HFCs & HFO blends are expected to represent 40% of refrigeration applications in 2025. This dominant share reflects established system compatibility, proven performance characteristics, and transition period regulatory acceptance that appeals to commercial and residential installations.

HFC and HFO refrigerant blends provide operational reliability while maintaining system efficiency and temperature stability in existing infrastructure. The segment provides essential compatibility support for retrofit applications and new installations in regions with transitional regulatory frameworks.

Commercial refrigeration applications are projected to demonstrate steady expansion due to retail sector growth that enhances food preservation capabilities with modern display case technology and cold storage efficiency. These commercial systems offer operational cost reduction while maintaining product quality across supermarket chains and foodservice establishments.

The segment benefits from established supply chain integration and energy efficiency awareness in retail operations where consistent temperature control and system reliability are fundamental requirements.

Residential applications are estimated to hold 32% market position due to household income growth, housing construction activity, and energy efficiency upgrade programs. Residential compressor systems provide comfort cooling and heat pump operation for both new construction and replacement installations while maintaining operational cost effectiveness. The segment offers long-term value proposition for both homeowners and HVAC contractors while maintaining manufacturer warranty support.

The market is driven by three concrete demand factors tied to cold chain efficiency outcomes. First, expansion of cold chain infrastructure creates increasing demand for advanced refrigeration compressors, with rising requirements for food storage, pharmaceutical preservation, and refrigerated transport driving large-scale system deployment to ensure operational reliability and product integrity. Second, growing emphasis on energy efficiency and cost reduction drives the adoption of high-efficiency compressor technologies, as operators seek measurable improvements in performance while meeting sustainability and decarbonization benchmarks. Third, natural refrigerant technology adoption, including CO₂ and ammonia compressors, enables both environmental compliance and operational efficiency, with advanced transcritical CO₂ systems delivering up to 30% energy savings compared to conventional HFC-based systems, providing long-term value to supermarket chains and industrial cold storage operators.

Market restraints include refrigerant phase-down regulations that increase system design complexity and transition costs, particularly as operators adapt to stringent global mandates on high-GWP refrigerants. Raw material cost volatility represents another significant challenge, as fluctuations in copper, steel, and aluminum directly impact compressor manufacturing economics and supply chain stability. Skilled technician shortages further constrain market growth, as advanced natural refrigerant and hybrid system installations require specialized technical expertise and certification, creating barriers to adoption and potentially causing project delays, increased implementation costs, and reduced scalability in certain regions.

Key trends indicate accelerated adoption of natural refrigerant compressor systems, particularly CO₂ and ammonia, where regulatory compliance and sustainability commitments drive comprehensive system implementation. Hybrid refrigeration systems, incorporating both CO₂ and ammonia, are gaining momentum in large-scale industrial applications, offering maximum environmental compatibility and improved lifecycle cost efficiency. Technology advancement trends toward smart compressor integration with enhanced control systems, IoT connectivity, and predictive maintenance capabilities enable next-generation refrigeration solutions that deliver improved reliability, real-time monitoring, and optimized performance across cold chain operations. However, the market thesis could face disruption if alternative cooling technologies or significant breakthroughs in thermal management solutions reduce reliance on conventional compressor-based systems.

| Country | CAGR (2025-2035) |

|---|---|

| China | 4.5% |

| India | 5.0% |

| United States | 3.6% |

| Germany | 2.9% |

| Japan | 3.1% |

| Brazil | 4.0% |

| Saudi Arabia | 3.4% |

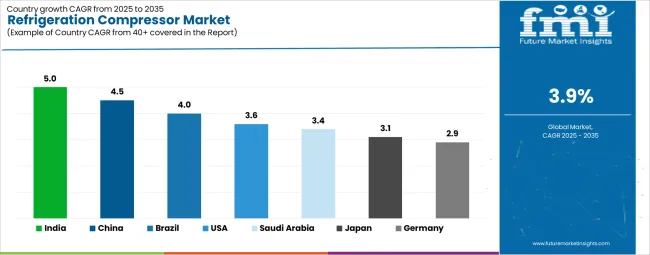

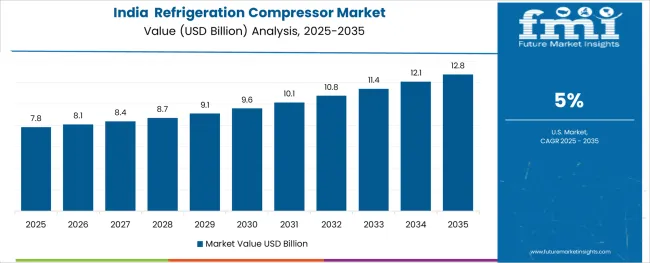

The refrigeration compressor market is growing rapidly, with India leading at a 5.0% CAGR through 2035, driven by retail infrastructure expansion and pharmaceutical cold storage investments. China follows at 4.5%, supported by cold chain logistics development and natural refrigerant adoption initiatives.

Brazil grows steadily at 4.0%, reflecting frozen food retail expansion. The United States records 3.6%, emphasizing low-GWP refrigerant retrofits and data center cooling applications. Saudi Arabia shows moderate growth at 3.4%, while Germany and Japan demonstrate established market maturity at 2.9% and 3.1% respectively, reflecting regulatory-driven technology transitions. Overall, India and China emerge as the leading drivers of global refrigeration compressor market expansion.

The report covers an in-depth analysis of 40+ countries; 7 top-performing countries are highlighted below.

Revenue from refrigeration compressors in India is projected to exhibit the highest growth rate with a CAGR of 5.0% through 2035, driven by organized retail expansion, pharmaceutical cold chain investments, and agricultural value chain modernization across major cities including Mumbai, Delhi, and Bangalore. Indian consumers are increasingly embracing fresh and frozen food products as urbanization accelerates and disposable income increases in metropolitan markets. Modern retail formats are driving market penetration while supporting energy-efficient equipment adoption and professional installation services.

Revenue from refrigeration compressors in China is expanding at a CAGR of 4.5%, supported by domestic cold chain logistics expansion where e-commerce food delivery and pharmaceutical distribution are driving equipment demand. Chinese manufacturers are increasingly seeking energy-efficient solutions for industrial refrigeration applications. Market development benefits from established manufacturing infrastructure while addressing environmental compliance requirements that influence equipment specifications.

Revenue from refrigeration compressors in the United States is growing at a CAGR of 3.6%, driven by HFC phase-down regulations and data center cooling expansion. Growth spans commercial refrigeration retrofits where environmental compliance requirements support equipment replacement cycles. The market benefits from established service infrastructure and technical expertise, particularly among HVAC contractors seeking low-GWP refrigerant solutions and system efficiency upgrades.

Demand for refrigeration compressors in Germany is projected to grow at a CAGR of 2.9%, supported by F-gas regulation compliance and CO2 compressor technology leadership that embraces environmental sustainability priorities. Urban markets including Berlin, Munich, and Hamburg are experiencing growth in natural refrigerant systems and transcritical CO2 applications that appeal to environmentally conscious commercial operators. The market benefits from technical expertise and engineering capabilities for advanced refrigeration systems that meet stringent efficiency standards for both performance and environmental impact.

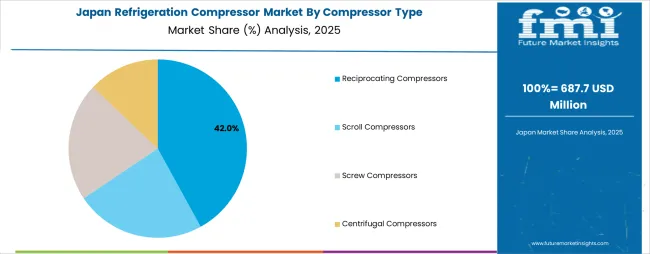

Sales of refrigeration compressors in Japan are projected to expand at a CAGR of 3.1%, with growth concentrated in inverter-driven systems across Tokyo, Osaka, and Nagoya regions. Advanced control technology adoption while energy efficiency mandates strengthen market access and consumer education regarding operational cost benefits.

Demand for refrigeration compressors in Brazil is anticipated to expand at a CAGR of 4.0%, maintaining steady growth through retail modernization across Sao Paulo, Rio de Janeiro, and Brasilia regions. Supermarket chain expansion and logistics hub development are being deployed for fresh food distribution, frozen food merchandising, and pharmaceutical storage applications. The market benefits from economic stabilization and organized retail growth that support equipment investment while maintaining affordable pricing structures.

Demand for refrigeration compressors in Saudi Arabia is expected to increase at a CAGR of 3.4%, driven by food security initiatives in Riyadh, Jeddah, and Dammam markets. Government agencies and hospitality operators are increasingly adopting commercial refrigeration equipment for food import storage and hotel kitchen applications. However, traditional climate challenges and energy cost considerations moderate adoption characteristics, requiring efficient equipment selection and maintenance capability development.

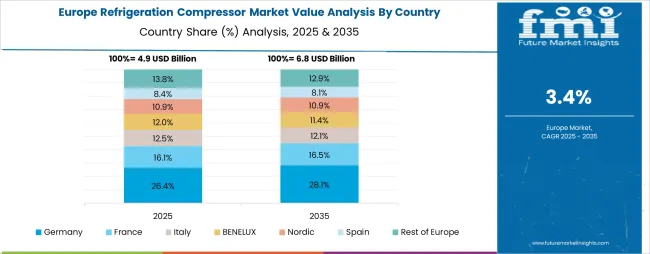

The refrigeration compressor market in Europe is projected to grow from USD 5.8 billion in 2025 to USD 8.2 billion by 2035, registering a CAGR of 3.5% over the forecast period. Germany is expected to maintain its leadership with approximately 19% market share in 2025, supported by manufacturing expertise and environmental regulation leadership.

United Kingdom follows with 16% share, driven by commercial refrigeration modernization. France accounts for 14% of the regional market, while Italy holds 10% share, benefiting from foodservice equipment demand. Spain represents 9% of the European market, with the remaining 32% distributed among Nordic countries, Benelux region, and other European markets including Eastern European emerging economies.

In Japan, the refrigeration compressor market is largely driven by the commercial refrigeration segment, which accounts for 48% of total equipment revenues in 2025. The convenience store penetration in the domestic retail market and the precision temperature control requirements are key contributing factors.

Industrial applications follow with a 30% share, primarily in pharmaceutical manufacturing that integrates process cooling and cold storage systems. Residential applications contribute 22% as heat pump adoption is well-established in Japanese households.

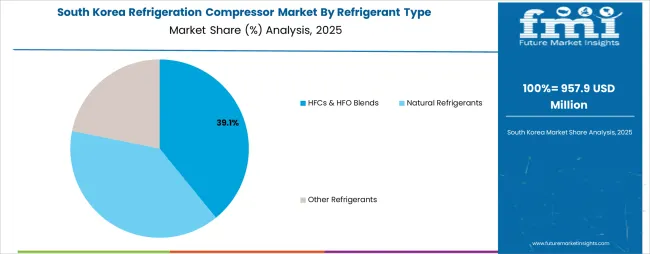

In South Korea, the market is expected to remain dominated by industrial applications, which hold a 45% share in 2025. These facilities are typically manufacturing plants where process cooling requirements require specialized compressor configurations.

Commercial refrigeration and residential applications each hold 28% and 27% market share respectively, with steady growth patterns. Automotive and electronics manufacturing account for significant industrial demand, but are gradually diversifying into food processing due to changing consumption patterns.

The refrigeration compressor market is moderately consolidated, featuring a mix of multinational corporations, regional manufacturers, and specialized component suppliers with varying degrees of technological expertise, global distribution networks, and application-specific capabilities.

Companies are investing in natural refrigerant compatibility, energy efficiency advancement, and digitalization features to deliver reliable cooling performance, operational cost reduction, and environmental compliance solutions. Strategic partnerships, inverter technology development, and geographic expansion are central to strengthening product portfolios and market presence across diverse commercial and industrial applications.

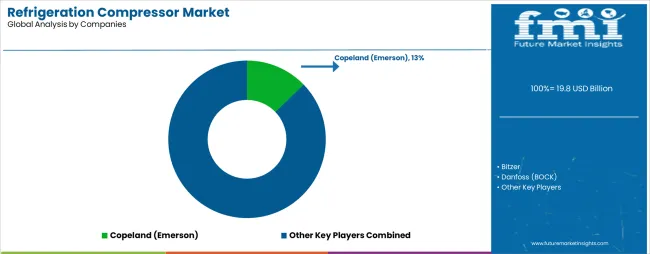

Copeland (Emerson) leads the global market with comprehensive product ranges, established distribution networks, and strong OEM relationships across commercial and residential segments. Bitzer maintains strong positioning through industrial refrigeration expertise, CO2 compressor technology leadership, and screw compressor innovation targeting cold storage facilities and large commercial applications.

Danfoss (BOCK) leverages European engineering excellence to create specialized compressor solutions for specific applications. Nidec (Embraco) utilizes hermetic compressor manufacturing scale for residential and light commercial markets.

Panasonic focuses on inverter-driven efficiency through advanced motor technology tailored to Asian market preferences. LG Electronics, Mitsubishi Electric, Johnson Controls, and Highly (Midea Group) offer technological innovation, regional market expertise, and system integration capabilities across global markets while maintaining competitive pricing and comprehensive service support.

Refrigeration compressor systems represent critical components of global cooling and cold chain infrastructure, enabling reliable temperature control across food preservation, pharmaceutical storage, industrial process cooling, and residential HVAC applications.

With the market projected to grow from USD 19.8 billion in 2025 to USD 29 billion by 2035 at a 3.9% CAGR, these compressor systems deliver compelling advantages-energy efficiency, natural refrigerant compatibility, and digital control integration-making them indispensable for commercial refrigeration (supermarkets, foodservice, cold storage - 40%+ share), residential HVAC (32% share), and industrial cooling sectors (28% share).

Scaling adoption and accelerating technology transition requires coordinated action across governments, industry bodies, OEMs, suppliers, and financial enablers to ensure sustainability, compliance, and infrastructure modernization.

How Governments Could Spur Local Production and Adoption?

How Industry Bodies Could Support Market Development?

How OEMs and Technology Players Could Strengthen the Ecosystem?

How Suppliers Could Navigate the Shift?

How Investors and Financial Enablers Could Unlock Value?

| Item | Value |

|---|---|

| Quantitative Units | USD 29 billion |

| Compressor Type | Reciprocating Compressors, Scroll Compressors, Screw Compressors, Centrifugal Compressors |

| Refrigerant Type | HFCs & HFO Blends, Natural Refrigerants, Other Refrigerants |

| End-Use Industry | Commercial Refrigeration, Residential, Industrial |

| Application | Supermarkets, Foodservice, Cold Storage, Residential HVAC |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Country Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, United Kingdom, France, Italy, Spain, China, Japan, South Korea, India, Australia, Saudi Arabia, South Africa |

| Key Companies Profiled | Copeland (Emerson), Bitzer, Danfoss (BOCK), Nidec (Embraco), Panasonic, LG Electronics, Mitsubishi Electric, Johnson Controls, Highly (Midea Group) |

| Additional Attributes | Dollar sales by compressor type and refrigerant categories, regional equipment demand trends across North America, Europe, and Asia-Pacific, competitive landscape with multinational and regional manufacturers, energy efficiency adoption patterns, integration with natural refrigerant systems and digitalization trends, innovations in variable speed drive technology and IoT connectivity, and development of specialized applications with enhanced environmental compliance capabilities. |

The global refrigeration compressor market is estimated to be valued at USD 19.8 billion in 2025.

The market size for the refrigeration compressor market is projected to reach USD 29.0 billion by 2035.

The refrigeration compressor market is expected to grow at a 3.9% CAGR between 2025 and 2035.

The key product types in refrigeration compressor market are reciprocating compressors, scroll compressors, screw compressors and centrifugal compressors.

In terms of refrigerant type, hfcs & hfo blends segment to command 40.0% share in the refrigeration compressor market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Refrigeration Compressor Industry Analysis in Western Europe Analysis by Product Type, Refrigerant Type, Application and Country - Forecast for 2025 to 2035

Korea Refrigeration Compressor Market Analysis by Product Type, Application, Refrigerant Type, and Province through 2035

Refrigeration and Air Conditioning Compressors Market Size and Share Forecast Outlook 2025 to 2035

Key Players & Market Share in Refrigeration and Air Conditioning Compressors

Japan Refrigeration Compressor Market Analysis by Product Type, Application, Refrigerant Type, and City through 2035

Commercial Refrigeration Compressor Market Growth - Trends, Demand & Innovations 2025 to 2035

Refrigeration Oil Market Growth - Trends & Forecast 2025 to 2035

Refrigeration Coolers Market Growth – Trends & Forecast 2025 to 2035

Refrigeration Leak Detector Market Growth - Trends & Forecast 2025 to 2035

Refrigeration Gauge Market

Refrigeration Monitoring Market

Bar Refrigeration Market

Beverage Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

Commercial Refrigeration System Market Size and Share Forecast Outlook 2025 to 2035

Commercial Refrigeration Equipment Market Growth – Trends & Forecast 2024-2034

Commercial Food Refrigeration Equipment Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

United States Commercial Refrigeration Equipment Market Forecast and Outlook 2025 to 2035

North America Commercial Refrigeration Equipment Industry Analysis by Product Type, Application, and Country through 2035

Commercial Undercounter & Worktop Refrigeration Market – Compact Cooling Solutions 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA