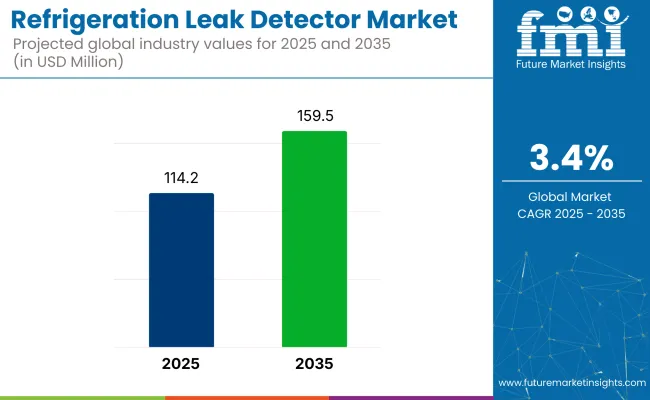

The refrigeration leak detector market is expected to witness steady growth between 2025 and 2035, driven by stringent environmental regulations, rising adoption of energy-efficient refrigeration systems, and increasing safety concerns in industrial and commercial refrigeration. The market is projected to expand from USD 114.2 million in 2025 to USD 159.5 million by 2035, reflecting a compound annual growth rate (CAGR) of 3.4% over the forecast period.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 114.2 million |

| Industry Value (2035F) | USD 159.5 million |

| CAGR (2025 to 2035) | 3.4% |

The employment of modern leak detection technologies in HVAC-R systems is no longer an option but a necessity due to the increasing global efforts to bring down the emissions of greenhouse gases and to stop the use of high-GWP refrigerants.

The move to natural refrigerants like CO₂, ammonia, and hydrocarbons, which necessitate extensive safety monitoring, is highlighting the need for more responsive and accurate leak detection solutions. Moreover, the upgrade of cold storage, food processing, and pharmaceutical refrigeration efficiency, and maintenance standards is empowering the use of wireless IoT and automatic devices in leakage tests.

The stress that is being laid on the efficiency of refrigeration systems, environmental compliance, and workplace security is one of the leading factors for the growth of the market. Regulations from governments, such as the F-Gas Regulation in Europe and the EPA’s SNAP (Significant New Alternatives Policy) program in the USA, are making it necessary to leak refrigerants on a regular basis and monitor them, this in turn is making enterprises invest in the improved leak detection technology.

Supermarket refrigeration systems, cold storage warehouses, and food retail ones need a continuous leak check to prevent wastage of products, save refrigerant gas, and meet regulatory standards. The input of IoT-based smart leak detectors, which provide real-time monitoring, data analysis, and remote alerts, is gradually making the market grow.

Refrigerant leaks in industries such as chemical processing plants, pharmaceuticals, and HVAC manufacturing are a health threat and operational risk, which leads to higher deployment of precision leak detection technologies. With the trend towards using consumables that are more environmentally friendly and flammable, the need for the safe handling and integrity of the system is emerging as a critical point.

As the leading market for refrigeration leak detectors, North America is boosted by strict environmental regulations and a continuous surge in demand for energy-efficient cooling. The USA Environmental Protection Agency (EPA) imposes stringent refrigerant emission controls and necessitates companies to monitor and reduce leak rates in HVAC and refrigeration systems. Furthermore, the move towards low-GWP (Global Warming Potential) refrigerants, such as R-32 and R-454B, signifies the rise of the requirement for ultra-precise leak detection solutions.

The cold chain logistics sector is also growing thanks to e-commerce driven grocery delivery and pharmaceutical storage, which is a major driver of market demand. Smart technologies like AI are getting popular as HVAC systems are being created that incorporate real-time refrigerant monitoring, predictive diagnostics, and automated maintenance alerts. The recent focus on smart buildings and sustainable cooling, alongside the advanced IoT-enabled leak detection technologies, has set the market standards.

The market for refrigeration leak detectors in Europe is witnessing strong growth, the main reason being the EU`s F-Gas Regulation, which mandates the reduction of refrigerant emissions and the transition to low-GWP alternatives. Countries like Germany, France, and UK, where the government has enforced compulsory leak monitoring and preventive maintenance programs, are ensuring leak compliance in the supermarkets, food processing plants, and cold storage facilities.

Natural refrigerant gases such as CO₂, ammonia, and hydrocarbons being the new replacement gases make the high-precision leak detection systems requirement rise that are able to work with these high-pressure gases. Furthermore, the rapid uptake of heat pumps in Europe as part of the green energy transition propels the discovery of the latest refrigerators leak detecting mechanisms. Government measures to promote green solutions for cooling have made leak detection technology funding grow.

With urbanization, industrial expansion, and the need for commercial refrigeration on the rise, Asia-Pacific has become the most lucrative market for leak detectors. The latest statistics reveal that countries like China, India, Japan, and South Korea are continuously increasing their number of cold storage facilities and HVAC-R units, which in return calls for efficient refrigerant leak monitoring.

Prominently marked as China and India, the eco-friendly policies targeting refrigerant emissions in the first one and HVAC systems that challenge energy consumption in the second one are tremendously accelerating the smart leak detector adoption.

Japan and South Korea are identified as the markets that accelerate the development of AI and IoT technologies while at the same time creating remote diagnostics, automated alerts and predictive maintenance features. Due to the ongoing growth in the industrial refrigeration sector and the introduction of new sustainable techniques, smart high-precision leak detectors will likely witness further market growth.

The emerging refrigeration leak detectors markets in the Middle East, Latin America, and Africa are the result of development attempts in the areas of cold storage infrastructures, food processing industries, and supermarket refrigeration. The Middle East`s large-scale customer cooling district projects. On top of this, venting is a major threat, which is why companies in the region such as the UAE and Saudi Arabia are pushing for advanced refrigerant leak detection.

Latin America is moving in the green direction as well, where companies prioritize energy efficiency and as a result, the number of leak detection solutions is decreasing. In the meantime, the African continent has shown that pharmaceutical cold chain and supermarket networks require cost-effective and high-precision leak detection systems to assure product safety as well as avoid financial losses. As the expansion of cooling infrastructure increases, the need for affordable and long-lasting drying technologies is projected to rise.

Challenges

High Cost of Advanced Leak Detection Systems

Although high-precision leak detection technologies are more accurate, quicker in leak detection, and lower in costs in the long run, their steep initial capital is a major barrier for companies, especially small and medium-sized enterprises (SMEs). The installation of AI technology and IoT interconnected leak detectors demands besides advanced infrastructure also requires skilled personnel along with continuous monitoring systems making to increased operational costs.

Moreover, the procurement of specialized sensors, the use of infrared-based leak detectors, and ultrasonic technology which are cutting-edge leak detectors often add costs, thereby limiting their use in budget-sensitive markets such as developing economies in Asia, Latin America, and Africa. Though government aids and tax deductions to some extent solve the problem, the business actually adopts conventional leak detection first thus the rate of adoption for automated and smart leak detection remains lower.

Regulatory Complexity & Compliance Costs

The refrigeration and HVAC-R industry is subject to a wide range of conflicting regulatory systems, as each nation brings in its respective environmental laws on the emissions of refrigerants, and the standards for leak detection. For example, the USA Environmental Protection Agency (EPA) utilizes the Clean Air Act and SNAP regulations doubled with low-GWP refrigerants by Europe F-Gas Regulation.

These diversifying conditions push the demand for frequent updates of refrigeration systems; hence such changes are the cause of expenses for companies. Companies working internationally must secure that their leak detection products follow the local regulations, this additional burden burden inside HVAC-R manufacturing and servicing sectors. The trading of HFCs for CO₂, ammonia, and hydrocarbons not only conveys a stark message on the environment but also refrigermay system conversion and leak detection technology expenditure.

Opportunities

Growing Adoption of Smart & IoT-Enabled Leak Detection Systems

The convergence of AI analytics, the real-time monitoring, and predictive maintenance surrounding the refrigeration leak detection field is the transformative force. The gadget is clever at, for instance, engaging the Internet and IoT-based smart leak detectors, which can trigger immediate alarms, as well as turn off and open clouds storing the data, figures are largely aimed at improving the efficiency and lowering maintenance costs.

IoT-enabled sensors allow continuous remote tracking of refrigerant leaks, helping HVAC-R operators and cold storage facilities prevent unexpected failures and optimize energy consumption. The smart leak detection systems together with the customer's upgrade in the environmental regulations may lead to less refrigerant emissions; therefore, the demerit of the extra administrative burden for the clients thereby to be imposed fines will be reduced.

The surge of smart cities, industrial automation, and connected buildings will manifest the necessity for AI-powered, data-driven leak detection systems. The birth of predictive analytics, as well as the uphold of automation in the mainstream, makes the opportunity for the expansion of the market by the manufacturers of smart leak detection devices.

Expansion of Cold Chain Logistics & Refrigeration Infrastructure

The fast acceleration of the cold chain logistics sector, which is closely related e-commerce, global food trade, and pharmaceutical storage is the factor responsible for the increased demand for very reliable refrigeration systems, accommodating the latest leak detection technologies.

Frightening the food security global community, most international authoritative bodies are pressuring for efficiency in the management of aging food stocks and storage of vaccines; therefore, it is paramount that temperature be kept consistently which indirectly is the reason for real-time refrigerant monitoring nature. Asia-Pacific, Latin America, and Africa are the regions that have seen massive investments in the cold storage structure within the agriculture, fisheries, dairy, and also pharmaceutical sectors.

The high-precision leak detection products find their home through the agriculture, seafood, dairy, and pharmaceutical industries as these sectors experience a strong demand for the cold storage infrastructure. Sustainable refrigeration investment across the transport chain, warehouse cooling, and distribution centers with the high demand for automated leak detection systems through the years is as well to be expected.

The cold chain system's expansion that is exclusively temperature controlled will positively influence the market for the refrigeration leak detection equipment thereby they are the keys to advanced technology accuracies and efficiencies.

Refrigeration Leak Detector Market Overview: The short-term period from 2020 to 2024 has seen the refrigeration leak detector market achieve tremulous growth owing to the need to abide by environmental laws that restrict refrigerant emissions, the expansion of HVACR (Heating, Ventilation, Air Conditioning, and Refrigeration) systems, and new advances in identification technology. The booming eco-friendly refrigerant turnarounds added to the demand for precise and trustworthy leak detection solutions due to the phase-out of high-GWP (Global Warming Potential) refrigerants.

Smart sensor technologies, AI-powered predictive maintenance, and increased use of IoT-based remote monitoring systems are the driving forces behind the predicted growth of the refrigeration leak detector market in the period 2025 to 2035. The market will continue to change under the influence of the stricter regulatory compliance and the energy efficiency focus.

Comparative Market Analysis

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Increased prohibits on high-GWP refrigerants and more intensive emissions monitoring. |

| Technological Advancements | Greater sensitivity and precision in portable and fixed leak detectors. |

| Industry-Specific Demand | Leading demand from sectors like commercial refrigeration, HVAC, and cold storage. |

| Sustainability & Circular Economy | Employment of low-GWP refrigerants and the adoption of improved leak detection technology to cut down emissions. |

| Production & Supply Chain | Sensor manufacturing expansion and the affordable detectors' abundance. |

| Market Growth Drivers | Social environmental awareness, strict compliance with the regulation, and accelerating technological changes. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Global commitment to zero-GWP refrigerants, obligatory leak detection schemes, and the objectives of total carbon neutrality. |

| Technological Advancements | AI-based diagnostics, IoT-enabled remote monitoring, and smart leak prevention systems. |

| Industry-Specific Demand | Increase in industrial cooling, data center cooling, and sustainable refrigeration solutions. |

| Sustainability & Circular Economy | Construction of fully automated, self-calibrating, leak detectors, and circular refrigerant management systems. |

| Production & Supply Chain | Greater localization of production, using eco-friendly components, and a more resilient supply chain. |

| Market Growth Drivers | Embedding AI, omnipresent cloud-based analytics, and the rising demand for energy-efficient refrigeration management. |

The United States refrigeration leak detector market is projected to experience good growth as a result of new strict regulations enforced by EPA, transitioning to low-GWP refrigerants, and more energy efficiency measures. HVAC and cold storage are the influential sectors behind the demand as firms are trying to meet the legal responsibilities of checking refrigerant leakage. But the availability of smart leak detection applications with the IoT interconnection emerged as the main factor for demand to be increased.

| Country | CAGR (2025 to 2035) |

|---|---|

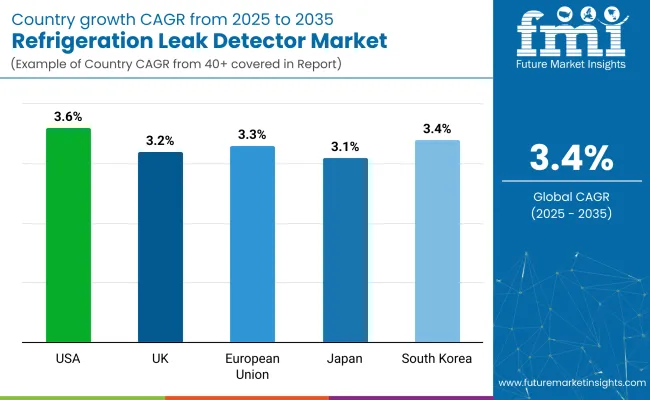

| United States | 3.6% |

The UK refrigeration leak detector market is sustaining steady growth as it is backed by F-Gas Regulation strict policies and growing awareness about refrigerant leak prevention. The major driver of demand for leak detection solutions is the adoption of green refrigerants and smart monitoring systems. Furthermore, the commercial and industrial refrigeration sectors apply sniffers and IoT automatic leak detection for compliance and performance boosts respectively.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 3.2% |

The EU refrigeration leak detector market is registering a slight growth on the back of various tough environmental policies such as the European Green Deal and the F-Gas Regulation. The region’s commitment to reducing fluorinated gas emissions is encouraging the adoption of advanced leak detection technologies. Furthermore, the rise in the implementation of smart refrigeration facilities, coupled with gas-conservation technology, has contributed to the overall development of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 3.3% |

Japan refrigeration leak detector market is mainly propelled by stable regulation, the latest technology, and a strong ecological perspective of people living in the country. The increasing use of ammonia and CO₂ refrigeration systems is directly proportional to the request and need for specific leak detection solutions. Also, the inclusion of artificial intelligence and smart diagnostics in air conditioning systems is positively affecting the growth in the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.1% |

The market for refrigeration leak detectors in South Korea is growing at a fast pace, which is caused by the higher inflow of investments into the smart building sector, the governments' policies for phasing out gas with high GWP, as well as the introduction of IoT-integrated leak detection systems. The cold storage and logistics sector are the majority of the reasons behind this advanced and excellent growth rate.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.4% |

Halide Detectors Maintain Market Presence for Cost-Effective Leak Detection

Halide detectors are very common in differentiating refrigerant fluids, especially in older refrigerators that operate with halogen-based ones like CFCs, HCFCs, and HFCs. The mode of operation of these detectors is flame test, which is when the flame changes color due to the presence of refrigerants, suggesting a leak. They are very cheap to manufacture and simple to use which is what makes the technicians prefer it in servicing the old refrigerating and air conditioning models.

The main drawback to halogen detectors is that they are less accurate compared to modern electronic detectors and they are unable to find some new types of refrigerants, such as HFOs and natural refrigerants. The manufacturing sector has made strides in technology, particularly in the electronic detection area, but halide tubes are still present in markets where cost and ease of use are valued.

Electronic Detectors Gain Popularity for Precision and Versatility

Electronic detectors are in a phase of becoming the industry standard mode because of their extreme sensitivity and condemnable for refrangible utility loopholes included even the eco-friendly refrigerants. These detectors apply the heated diode, infrared sensor, or ultrasonic technology to precisely locate the leaks. The devices are those that even the tiniest leak detection is paramount for factories adhering to environmental laws and full power utilization.

The transition towards the adoption of environmentally friendly refrigerants together with stringent legal policies like the F-Gas Regulation and the unambiguously stated requirements of the EPA on leak detection have speeded up the acceptance of electronic detectors a lot. Manufacturers are persistently upgrading sensor sensitivity, wireless technology, and real-time monitoring that would revolutionize leak detection efficiency.

Hand-held Detectors Dominate Due to Portability and On-Site Convenience

Hand-held refrigeration leak detectors are most preferred because of their portability, ease of use, and effectiveness in fast-track maintenance and repair operations. Their compact design allows HVAC technicians and maintenance personnel to quickly identify the leaking refrigerants during the service hence repaired wells and operate the systems well.

The thrusting trend toward the manufacture of battery-operated mode models has been a key driver of innovation such as wireless connectivity, LCD display, and audible alarm for an enhanced experience. In the context of the transition to preventive maintenance and the promotion of handheld detectors are in the forefront as they are popular among maintenance service providers and field technicians.

Benchtop Detectors Find Niche Applications in Research and Industrial Settings

Benchtop refrigeration leak detectors are most widely utilized in research laboratories, industrial testing facilities, and large-scale HVAC maintenance centers as high-precision leak detection is the prime requirement. These stationary devices are highly effective in that they are more sensitive, they provide real-time data analysis, and they have a multi-gas detection feature which can find them useful when used in clean environments to detect tiny refrigerant leaks.

Though they are not normally used in routine maintenance based on the fact that they cannot be carried, benchtop detectors are in great demand in quality control, environmental research, and compliance testing on refrigerant emissions. Developments in automation and machine intelligence are also adding new functionalities to the devices in special purpose applications.

Industrial Sector Drives Demand for Large-Scale Leak Detection Solutions

The industrial sector, comprised of food manufacturing, cold storage, and chemical manufacturing, mainly uses refrigeration leak detectors to achieve system integrity and comply with the rules. Even a small leak in a large system may result in major energy waste and an increase in the ozone layer.

To help deal with the emissions and promote the acquisition of better refrigerant gas, companies are turning to the very best leak detection equipment. Embedded in the industrial management systems are the advanced electronic detectors with real-time monitoring, sending automated signals for the reduction of downtime and the increase in operational productivity.

Research & Academia Benefit from Advanced Leak Detection Technologies

The laboratories, research facilities, and enlisted environmental assessment offices are utilizing refrigeration leak detectors in their efforts to observe the refrigerants, emissions control, and consequences of their leakage on the environment.

The work on the development of state-of-the-art leak detection technologies is going on mainly because the world is moving towards low-GWP refrigerants and using those eco-friendly that are CO₂ and ammonia. Benchtop detectors that have high sensitivity and are multi refrigerant detection capabilities are in widespread use in the laboratories to ensure that refrigerant leak analysis is precise and ecological within the concern. With the increase in government regulation on refrigerants, environmental agencies now research leak detection technologies.

The global refrigeration leak detector market has been steadily progressing, with the major driving factors being stringent environmental regulations, increase adoption of HVAC systems, and geothermal energy sources which require less energy. Leakage of refrigerant gas in commercial refrigeration, industrial cooling, and air conditioning systems as well as automotive HVAC applications requires refrigeration leak detectors.

With the regulations on ozone-depleting substances and greenhouse gases tightening, organizations like the Environmental Protection Agency (EPA), the European Union F-Gas Regulations, and Kigali Amendment are imposing stricter measures on refrigerants with lower GWP (Global Warming Potential). In addition, the development of sensor technologies, IoT-based monitoring systems, and wireless leak detection solutions are also pushing the market growth further.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Inficon Holding AG | 15-18% |

| Bacharach Inc. (MSA Safety) | 12-16% |

| Robinair (Bosch Automotive) | 10-14% |

| Testo SE & Co. KGaA | 8-12% |

| Emerson Electric Co. | 6-10% |

| Honeywell International Inc. | 5-9% |

| FLIR Systems (Teledyne) | 3-7% |

| Johnson Controls plc | 2-5% |

| Elitech Technology Inc. | 2-5% |

| Danfoss A/S | 2-5% |

| Other Companies (combined) | 25-35% |

| Company Name | Key Offerings/Activities |

|---|---|

| Inficon Holding AG | Develops high-sensitivity infrared and ultrasonic leak detectors for commercial and industrial HVAC applications. |

| Bacharach Inc. (MSA Safety) | Specializes in low-GWP refrigerant leak detection, integrating wireless monitoring and real-time gas detection technologies. |

| Robinair (Bosch Automotive Service Solutions) | Manufactures portable and handheld leak detectors for automotive, commercial, and industrial refrigeration systems. |

| Testo SE & Co. KGaA | Offers digital, infrared, and heated diode leak detectors, widely used in HVAC maintenance and industrial cooling. |

| Emerson Electric Co. | Produces smart refrigerant monitoring systems with IoT connectivity for continuous leak detection and compliance tracking. |

| Honeywell International Inc. | Provides gas and refrigerant leak sensors for commercial buildings, supermarkets, and cold storage facilities. |

| FLIR Systems (Teledyne Technologies) | Develops thermal imaging-based leak detection cameras for industrial refrigeration and HVAC maintenance. |

| Johnson Controls International plc | Supplies AI-powered HVAC control systems with built-in refrigerant leak detection capabilities. |

| Elitech Technology Inc. | Offers low-cost, high-sensitivity refrigerant leak detectors for residential and small commercial HVAC applications. |

| Danfoss A/S | Focuses on CO₂ and ammonia leak detection solutions for eco-friendly refrigeration and industrial cooling systems. |

Key Company Insights

Inficon Holding AG

Inficon Holding AG has secured its position as the top manufacturer of high-performance leak detection mechanisms, including infrared, ultrasonic, and mass spectrometry-based leak detectors for HVAC, refrigeration, automotive, and industrial applications.

Through its cutting-edge sensors that provide fast response and high precision, the company carries out tasks in compliance with EPA, F-Gas, and Montreal Protocol standards, as well as help greenhouse gas emissions, and enhance the energy efficiency of the system. Inficon’s portable and fixed leak detectors are chiefly used in the commercial refrigeration, cold storage, and pharmaceutical cooling applications.

Besides, there is an ongoing project by Inficon to introduce cloud-based analytics, wireless connectivity, and IoT-based automation to its smart leak detection systems targeting real-time monitoring solutions. The company is on the way to making a statement in the market by launching new product lines for large-scale data center cooling, food storage facilities, and industrial refrigeration systems which improves safety, efficiency, and compliance across the board.

Bacharach Inc. (MSA Safety)

Bacharach Inc. which is a subsidiary of the company MSA Safety is a well-known provider of refrigerant leak detection and gas monitoring solutions as well as is specializing in introducing the EPA and F-Gas leak detection systems. The company presents different options such as fixed, portable, and handheld detectors, which allow businesses in HVAC, supermarkets, cold chain logistics, and industrial refrigeration to monitor refrigerant leaks efficiently.

Bacharach is responsible for the deployment of IoT technology, and consequently, it has developed wireless leak detection systems that send alerts in real time, and cloud data tracking is also included. The company’s low-GWP refrigerant detection technology assists clients to take a leap to more sustainable cooling solutions. Despite its footprint in North America and Europe, Bacharach also seeks to widen its product range with gas detection, counting CO₂, ammonia, and hydrocarbon refrigerant monitoring which will be more in demand for the eco-friendly and more efficient HVAC systems.

Robinair (Bosch Automotive Service Solutions)

Robinair, which is a member of Bosch Automotive Service Solutions, is a trusted name full of convenient handheld and portable refrigerant leak detectors contributing heavily in automotive HVAC, residential, and light commercial refrigeration markets. The organization is innovating in the field of high-sensitivity infrared, heated diode, and ultrasonic leak detection technologies, so they guarantee quicker and more precise identification of refrigerant leaks.

The company's stock contains battery-powered and rechargeable leak detectors, thus making them convenient for field technicians and mobile HVAC servicing. Well as Robinair is focused on next-gen technology used for diode and infrared sensors, which has led to breakthroughs.

As well as, the company Robinair is setting foot in emerging markets with cost-effective and user-friendly leak detection devices directed specifically for HVAC maintenance. With the substantial shift to low-GWP and natural alternatives, Robinair is subsequently modernizing the product line to support the living systems in the environment.

Testo SE & Co. KGaA

Testo SE & Co. KGaA is a well-known digital HVAC test instrument selling company that deals with infrared, heated diode, and electronic leak detectors used in refrigeration systems, commercial air conditioning, and industrial cooling applications. The high-precision leak detection instruments stand as the conclusion of most of the preventive maintenances, as they quarrel early and thus reduce the operation risk. Testo is among the first to introduce AI innovations in diagnostics, such as automated leak alerts and remote monitoring integrated into their newest detection systems.

The company's smart refrigerant leak detectors communicate data in real time to mobile applications and cloud platforms enabling technicians to make informed maintenance decisions. The company is not only prevalent in European but also in North America, and Asia where it pushes its digital HVAC monitoring solutions to comply with environmental regulations and energy-efficient standards.

Emerson Electric Co.

Emerson Electric Co. is a robotics company with a presence in smart HVAC and refrigeration monitoring systems, launching IoT-based refrigerant leak detection and cloud-connected analytics for the commercial, industrial, and food retail refrigeration applications. The introduction of continuous refrigerant monitoring solutions in the business field has been a big step forward to the EPA and F-Gas regulations which was initially the motivation behind the move, as having the best efficiency and reduced environmental impact are the bragging rights.

Emerson’s sensor technology that continuously upgrades is the key to real-time leak detection, system diagnostics, and automated alerts which in turn leads to a reduction in both downtime and energy wastage. The company is a go-to for the leak detection solutions that are used in diverse areas ranging from cold storage, supermarkets, and commercial HVAC systems where compliance tracking and preventive maintenance are imperative. Emerson is on a path and purpose of AI-driven leak detection software, with integrating predictive analytics and smart automation for improving the efficiency of HVAC and refrigeration systems.

In terms of product type, the industry is divided into Halide Detector, Electronic Detector.

In terms of Material Type, the industry is divided into Hand-held, Benchtop.

In terms of End Use, the industry is divided into Industrial, Research & Academia, Maintenance Service Providers.

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

The global Refrigeration Leak Detector market is projected to reach USD 114.2 million by the end of 2025.

The market is anticipated to grow at a CAGR of 3.4% over the forecast period.

By 2035, the Refrigeration Leak Detector market is expected to reach USD 159.5 million.

The commercial refrigeration segment is expected to dominate the market, driven by stringent environmental regulations and the need for efficient refrigerant management in supermarkets, cold storage, and food processing industries.

Key players in the Refrigeration Leak Detector market include Inficon, Bacharach Inc., Testo SE & Co. KGaA, CPS Products, and Robinair.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Refrigeration and Air Conditioning Compressors Market Size and Share Forecast Outlook 2025 to 2035

Refrigeration Compressor Market Size and Share Forecast Outlook 2025 to 2035

Refrigeration Oil Market Growth - Trends & Forecast 2025 to 2035

Refrigeration Compressor Industry Analysis in Western Europe Analysis by Product Type, Refrigerant Type, Application and Country - Forecast for 2025 to 2035

Korea Refrigeration Compressor Market Analysis by Product Type, Application, Refrigerant Type, and Province through 2035

Refrigeration Coolers Market Growth – Trends & Forecast 2025 to 2035

Key Players & Market Share in Refrigeration and Air Conditioning Compressors

Refrigeration Gauge Market

Refrigeration Monitoring Market

Bar Refrigeration Market

Japan Refrigeration Compressor Market Analysis by Product Type, Application, Refrigerant Type, and City through 2035

Beverage Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

Commercial Refrigeration System Market Size and Share Forecast Outlook 2025 to 2035

Commercial Refrigeration Compressor Market Growth - Trends, Demand & Innovations 2025 to 2035

Commercial Refrigeration Equipment Market Growth – Trends & Forecast 2024-2034

Subcritical CO2 Refrigeration System Market Size and Share Forecast Outlook 2025 to 2035

Commercial Food Refrigeration Equipment Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

United States Commercial Refrigeration Equipment Market Forecast and Outlook 2025 to 2035

North America Commercial Refrigeration Equipment Industry Analysis by Product Type, Application, and Country through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA