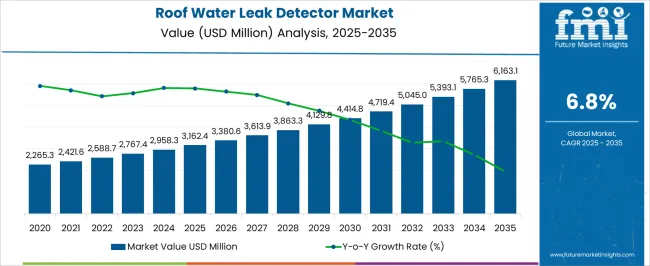

The global roof water leak detector market is projected to reach USD 6.2 billion by 2035, recording an absolute increase of USD 3 billion over the forecast period. The market is valued at USD 3.2 billion in 2025 and is set to rise at a CAGR of 6.8% during the assessment period. The overall market size is expected to grow by 1.9 times during the same period, supported by increasing climate-related weather events and insurance-driven prevention mandates worldwide, driving demand for advanced leak detection systems and increasing investments in smart building infrastructure and facility management modernization programs globally. However, installation cost pressures and technical integration complexity may pose challenges to market expansion.

Between 2025 and 2030, the roof water leak detector market is projected to expand from USD 3.2 billion to USD 4.5 billion, resulting in a value increase of USD 1.3 billion, which represents 43.3% of the total forecast growth for the decade. This phase of development will be shaped by rising demand for smart building infrastructure and climate resilience solutions, product innovation in wireless connectivity and IoT-enabled detection systems, as well as expanding integration with building management platforms and insurance risk mitigation initiatives. Companies are establishing competitive positions through investment in advanced fiber optic technologies, cloud-based monitoring solutions, and strategic market expansion across commercial, residential, and industrial facility applications.

From 2030 to 2035, the market is forecast to grow from USD 4.5 billion to USD 6.2 billion, adding another USD 1.7 billion, which constitutes 56.7% of the overall ten-year expansion. This period is expected to be characterized by the expansion of specialized AI-powered detection systems, including advanced thermal imaging technologies and integrated predictive maintenance solutions tailored for specific building requirements, strategic collaborations between detector manufacturers and facility management companies, and an enhanced focus on operational efficiency and water damage prevention. The growing emphasis on sustainable building practices and proactive maintenance management will drive demand for advanced, high-performance roof water leak detector solutions across diverse building applications.

Market dynamics reveal significant variations in implementation priorities and regulatory requirements across different building types and geographic regions. Commercial property operators prioritize leak detection systems based on their ability to prevent business disruption and protect valuable assets housed within temperature-controlled environments. Facilities management teams evaluate equipment specifications including sensor sensitivity, false alarm rates, and integration capabilities with existing building management systems. Risk management departments assess detector reliability and response time requirements to minimize potential insurance claims related to water damage events.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 3.2 billion |

| Market Forecast Value (2035) | USD 6.2 billion |

| Forecast CAGR (2025-2035) | 6.8% |

The roof water leak detector market grows by enabling building owners to achieve superior water damage prevention and property protection while meeting evolving building safety standards. Facility managers face mounting pressure to improve building resilience and reduce insurance claims, with advanced leak detection solutions typically providing 60-80% reduction in water damage costs compared to traditional reactive maintenance approaches, making detector systems essential for commercial buildings and high-value residential properties. The climate change movement's need for resilient infrastructure creates demand for advanced detection solutions that can enhance property protection, reduce maintenance costs, and ensure consistent performance across diverse weather conditions.

Government initiatives promoting building code compliance and sustainable facility management practices drive adoption in commercial, residential, and industrial applications, where early leak detection has a direct impact on property values and operational continuity. The global shift toward smart buildings and IoT integration accelerates leak detector demand as building owners seek alternatives to manual inspection methods that fail to provide real-time monitoring capabilities. However, higher initial installation costs and technical integration challenges compared to conventional moisture detection may limit adoption rates among price-sensitive property owners and buildings with legacy infrastructure systems.

The market is segmented by leak detection technology, product type, connectivity, end-use, and region. By leak detection technology, the market is divided into fiber optic leak detection, thermal imaging detection, point/spot detection, probe type detection, ultrasonic leak detection, and acoustic leak detection. Based on product type, the market is categorized into smart detectors and conventional detectors. By connectivity, the market includes wireless and wired systems. Based on end-use, the market is segmented into commercial, residential, industrial, and warehouse applications. Regionally, the market is divided into Asia Pacific, Europe, North America, Latin America, and Middle East & Africa.

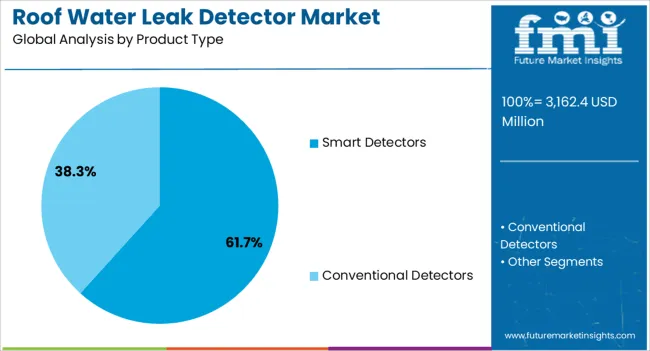

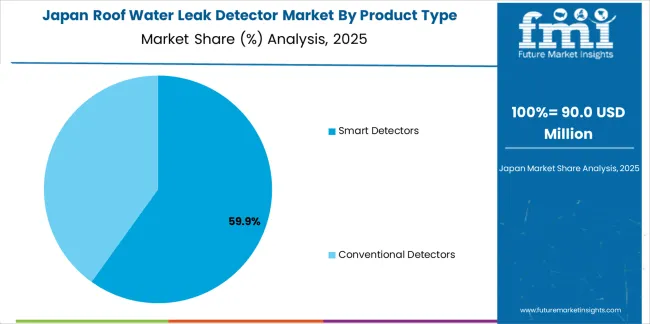

The smart detectors segment represents the leading product category in the roof water leak detector market, capturing approximately 61.7% of total market share in 2025. This advanced category encompasses IoT-enabled devices featuring remote monitoring capabilities, cloud-based data analytics, and mobile alert systems that deliver comprehensive leak detection with predictive maintenance insights and real-time notification capabilities. The smart detectors segment's dominance reflects the fundamental shift toward connected building infrastructure and data-driven facility management across commercial developments, residential complexes, and industrial facilities requiring proactive water damage prevention.

The conventional detectors segment maintains a substantial 38.3% market share, serving building owners who require basic leak detection functionality without connectivity requirements or prefer standalone systems for specific applications where network integration is unnecessary or cost-prohibitive. Conventional systems continue serving retrofit applications in older buildings, budget-conscious residential installations, and facilities with limited IT infrastructure where simple alarm functionality meets operational requirements.

Key factors driving smart detectors segment leadership include:

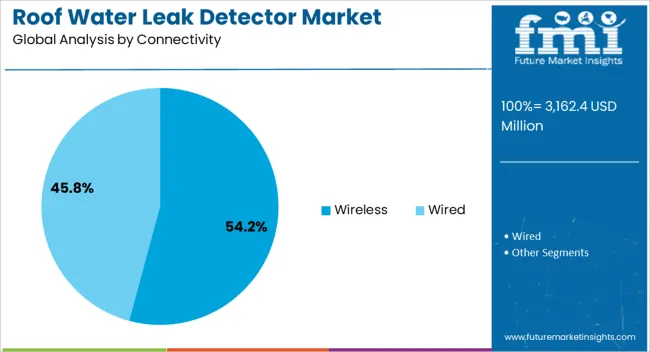

The wireless segment represents the leading connectivity category in the roof water leak detector market, capturing approximately 54.2% of total market share in 2025. This advanced category encompasses WiFi-enabled detectors, cellular-connected systems, and Bluetooth-based monitoring solutions that deliver flexible installation without cabling requirements and seamless integration with existing building networks. The wireless segment's market leadership stems from installation simplicity in retrofit applications, reduced installation costs compared to wired systems, and compatibility with mobile device monitoring that building owners increasingly demand for remote property management.

The wired segment maintains a substantial 45.8% market share, serving applications requiring guaranteed connectivity reliability, continuous power supply without battery maintenance, and integration with existing building management systems where hardwired connections provide superior stability and performance assurance for critical facility infrastructure.

Key advantages driving the wireless segment include:

The commercial segment represents the leading end-use category in the roof water leak detector market, capturing approximately 36% of total market share in 2025. This critical application encompasses office buildings, retail centers, hospitality facilities, and healthcare institutions where water damage prevention directly impacts business operations, property values, and tenant satisfaction. The commercial segment's dominance reflects the high value of commercial real estate, significant financial risks associated with water damage, and stringent facility management requirements that demand proactive leak detection for operational continuity.

The residential segment maintains a substantial 28% market share, serving homeowners and property managers seeking protection for high-value residential properties, multi-family housing complexes, and luxury homes where water damage prevention justifies detector investment. Industrial applications account for 26% market share, featuring detector utilization in manufacturing facilities, data centers, and processing plants where roof leaks threaten sensitive equipment and production operations. Warehouse operations represent 10% of the market, supporting logistics facilities and storage centers where inventory protection and facility uptime require reliable leak detection systems.

Key factors driving commercial segment leadership include:

The market is driven by three concrete demand factors tied to climate resilience and building protection outcomes. First, increasing frequency and intensity of extreme weather events create growing requirements for advanced leak detection systems capable of protecting properties from climate-related water damage, with global insurance claims for water damage growing 12-18% annually across major metropolitan regions worldwide, requiring proactive detection for commercial and residential buildings. Second, smart building adoption and IoT infrastructure expansion drive facility managers toward connected monitoring systems, with leak detectors enabling 60-75% reduction in water damage costs per incident while providing real-time alerts and automated emergency response capabilities that minimize property loss and operational disruption. Third, insurance requirements and building code compliance accelerate adoption of certified leak detection systems, with premium reduction incentives of 10-20% available for buildings equipped with monitored detection infrastructure while supporting property owners' compliance with evolving building safety standards and water damage prevention mandates.

Market restraints include high initial installation costs affecting system accessibility for budget-conscious property owners, with comprehensive fiber optic detection systems priced 40-60% higher than basic moisture sensors, creating financial barriers for older buildings and residential properties operating with limited maintenance budgets and competing capital improvement priorities. Technology integration challenges associated with legacy building management systems pose adoption barriers, as property owners evaluate compatibility requirements including network infrastructure upgrades, system integration complexity, and ongoing monitoring service subscriptions for cloud-based detection platforms. False alarm concerns and maintenance requirements create additional challenges, particularly for point detection systems where environmental factors, humidity fluctuations, and sensor calibration needs can generate nuisance alarms requiring 15-25% more maintenance attention compared to conventional inspection approaches.

Key trends indicate accelerated adoption of AI-powered analytics in commercial facilities, particularly in high-value properties and corporate real estate portfolios where machine learning algorithms enable predictive leak detection identifying potential failures 48-72 hours before water intrusion occurs while reducing false alarms by 70-80% compared to threshold-based detection systems. Integration with comprehensive facility management platforms trends toward unified building monitoring solutions, remote diagnostics capabilities, and automated maintenance scheduling systems that enable next-generation operational efficiency and property protection enhancements across multi-site portfolios. However, the market thesis could face disruption if alternative roofing materials or self-healing membrane technologies emerge as cost-competitive solutions that eliminate leak risks entirely, potentially reshaping demand patterns and detection system requirements across the building waterproofing sector.

| Country | CAGR (2025-2035) |

|---|---|

| China | 7.1% |

| United States | 7% |

| India | 6.8% |

| United Kingdom | 6.3% |

| Brazil | 6.1% |

| Germany | 5.9% |

| Japan | 5.6% |

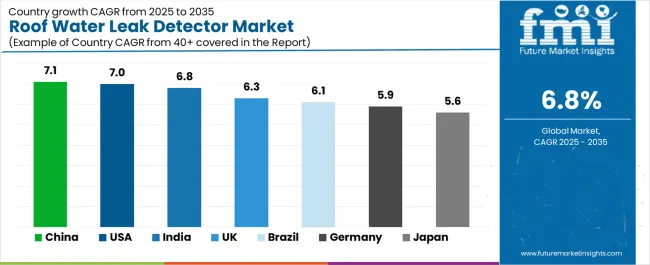

The roof water leak detector market is gaining momentum worldwide, with China taking the lead thanks to high-rise commercial building expansion and enforcement of building codes across major cities. Close behind, the United States benefits from smart home adoption and climate-related resilience upgrades, positioning itself as a strategic growth hub in the North American region. India shows strong advancement, where rapid urban housing development and monsoon-risk mitigation strengthen its role in Asian construction supply chains. The United Kingdom demonstrates robust growth through stringent facility management compliance and insurance-driven leak prevention, signaling continued investment in building safety infrastructure. Meanwhile, Brazil stands out for its commercial property expansion combined with tropical rainfall exposure management, while Germany and Japan continue to record consistent progress driven by industrial modernization and premium detection system adoption in aging building stock. Together, China and the United States anchor the global expansion story, while emerging markets build momentum and diversity into the market's growth path.

The report covers an in-depth analysis of 40+ countries; 7 top-performing countries are highlighted below.

China demonstrates the strongest growth potential in the Roof Water Leak Detector Market with a CAGR of 7.1% through 2035. The country's leadership position stems from comprehensive high-rise building development, intensive commercial infrastructure programs, and aggressive smart city initiatives driving adoption of modern leak detection systems. Growth is concentrated in major metropolitan regions, including Beijing, Shanghai, Guangzhou, and Shenzhen, where commercial towers, residential complexes, and industrial facilities are implementing advanced detection equipment for building code compliance and property protection. Distribution channels through building automation suppliers, facility management companies, and direct contractor relationships expand deployment across construction clusters and property management operations. The country's building safety regulations and green building standards provide policy support for detection system installation, including mandatory monitoring requirements for high-rise buildings and technology adoption incentives.

Key market factors:

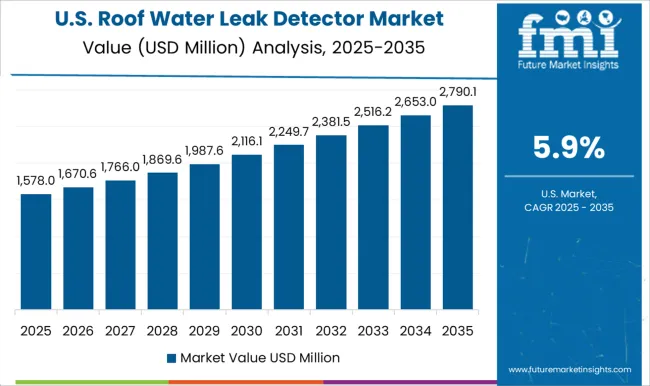

In major metropolitan areas, commercial districts, and residential developments, the adoption of roof water leak detection systems is accelerating across office buildings, retail facilities, and smart home applications, driven by climate resilience initiatives and insurance risk management programs. The market demonstrates strong growth momentum with a CAGR of 7% through 2035, linked to comprehensive smart building expansion and increasing focus on property protection enhancement solutions. American building owners are implementing advanced detection systems and IoT monitoring platforms to reduce insurance claims while meeting building performance standards in key regions including California, Texas, Florida, and the Northeast corridor. The country's focus on climate adaptation and building resilience creates sustained demand for detection solutions, while increasing emphasis on preventive maintenance drives adoption of connected monitoring systems that enhance property protection and operational efficiency.

India's expanding real estate sector demonstrates sophisticated implementation of leak detection systems, with documented case studies showing 65-75% reduction in water damage claims for monitored commercial buildings through early intervention and rapid response capabilities. The country's construction infrastructure in major developing regions, including Mumbai, Delhi NCR, Bangalore, and Hyderabad, showcases integration of detection technologies with existing building practices, leveraging expertise in high-rise residential development and commercial property management. Indian property developers emphasize system reliability and monsoon protection, creating demand for robust detection solutions that support operational commitments and tenant satisfaction requirements. The market maintains strong growth through focus on urban housing and commercial construction, with a CAGR of 6.8% through 2035.

Key development areas:

The UK market leads in facility management compliance based on integration with building safety regulations and sophisticated insurance risk assessment frameworks for comprehensive property protection. The country shows solid potential with a CAGR of 6.3% through 2035, driven by commercial estate management standards and increasing insurance-driven prevention requirements across major business districts, including London, Manchester, Birmingham, and the Southeast region. British property managers are adopting certified detection equipment for compliance with building regulations and fire safety standards, particularly in high-occupancy commercial buildings requiring comprehensive water damage prevention and in heritage properties with strict protection mandates. Technology deployment channels through facility management service providers, building automation specialists, and insurance-approved installer networks expand coverage across diverse commercial applications.

Leading market segments:

Brazil's roof water leak detector market demonstrates sophisticated implementation focused on commercial property protection and tropical climate adaptation systems, with documented integration of wireless detection achieving 70-80% faster leak response in shopping centers and logistics facilities. The country maintains steady growth momentum with a CAGR of 6.1% through 2035, driven by commercial real estate expansion and property owners' emphasis on rainfall damage prevention aligned with tropical weather patterns. Major commercial regions, including São Paulo, Rio de Janeiro, Brasília, and Porto Alegre, showcase advanced deployment of smart detection systems that integrate seamlessly with existing building management infrastructure and property protection requirements.

Key market characteristics:

In major industrial regions, commercial centers, and modernized building stock, property managers are implementing leak detection programs to enhance building performance and meet environmental standards, with documented case studies showing improved energy efficiency through moisture control in industrial facilities. The market shows solid growth potential with a CAGR of 5.9% through 2035, linked to ongoing industrial facility upgrades, commercial property modernization requirements, and increasing focus on building efficiency enhancement solutions. German facility operators are adopting precision detection systems and building automation integration to maintain property quality while complying with environmental regulations in sensitive applications including Bavaria, North Rhine-Westphalia, Baden-Württemberg, and Berlin metropolitan regions.

Market development factors:

The Japanese roof water leak detector market demonstrates mature implementation focused on aging building protection and typhoon resilience systems, with documented integration achieving superior performance in high-rise buildings and commercial complexes exposed to severe weather conditions. The country maintains steady growth through building safety enhancement programs and premium technology adoption, with a CAGR of 5.6% through 2035, driven by comprehensive building stock renewal requirements and policy support for disaster prevention infrastructure. Major metropolitan regions, including Tokyo, Osaka, Nagoya, and Fukuoka, showcase advanced fiber optic and thermal imaging detection deployment where building owners integrate premium monitoring systems with existing facility management for enhanced protection.

Key market characteristics:

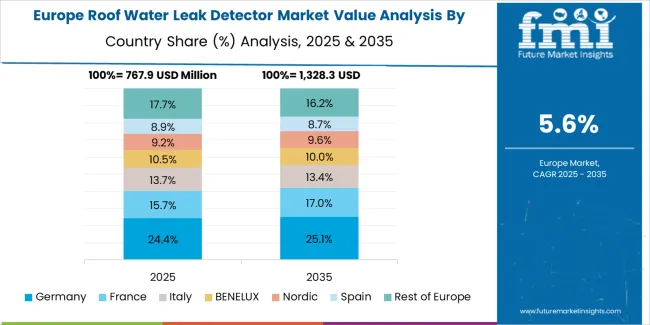

The roof water leak detector market in Europe is projected to grow from USD 0.9 billion in 2025 to USD 1.8 billion by 2035, registering a CAGR of 7% over the forecast period. Germany is expected to maintain its leadership position with a 23.8% market share in 2025, declining slightly to 23.4% by 2035, supported by its advanced industrial infrastructure and major commercial property modernization programs, including Bavaria, North Rhine-Westphalia, and Baden-Württemberg building regions.

The United Kingdom follows with a 19.6% share in 2025, projected to reach 19.2% by 2035, driven by comprehensive facility management compliance programs and insurance-driven prevention initiatives implementing advanced detection systems. France holds an 18.4% share in 2025, expected to rise to 18.9% by 2035 through public sector building upgrades and smart building mandates. Italy commands a 12.1% share in 2025, reaching 12.5% by 2035, backed by renovation of aging building stock and waterproofing retrofit programs. Spain accounts for 10.2% in 2025, rising to 10.7% by 2035 on tourism-led commercial property upgrades and logistics facility growth. The Rest of Europe region is anticipated to hold 15.9% in 2025, adjusting to 15.3% by 2035, attributed to Nordic countries' green building standards and Eastern European commercial modernization driving steady detector adoption.

The Japanese roof water leak detector market demonstrates a mature and quality-focused landscape, characterized by sophisticated integration of fiber optic and thermal imaging detection systems with existing building management infrastructure across urban commercial properties, high-rise residential complexes, and industrial facility communities. Japan's emphasis on building safety and disaster preparedness drives demand for certified detection equipment that supports typhoon resilience commitments and quality expectations in premium domestic construction standards. The market benefits from strong partnerships between international detection technology providers and domestic building automation specialists including facility management cooperatives, creating comprehensive service ecosystems that prioritize system reliability and technical support programs. Commercial centers in Tokyo, Osaka, Kyoto, and other major metropolitan areas showcase advanced detection implementations where monitoring programs achieve 98% uptime through precision sensor systems and integrated building management platforms.

The South Korean roof water leak detector market is characterized by growing international technology provider presence, with companies maintaining significant positions through comprehensive installation support and technical services capabilities for commercial buildings and high-value residential applications. The market demonstrates increasing emphasis on IoT-enabled detection systems and cloud-based monitoring platforms, as Korean building owners increasingly demand connected detector solutions that integrate with domestic smart building management systems and sophisticated property control platforms deployed across major real estate developments. Regional technology distributors are gaining market share through strategic partnerships with international manufacturers, offering specialized services including building automation integration support and application-specific detection programs for intensive commercial property operations. The competitive landscape shows increasing collaboration between multinational detection companies and Korean construction technology specialists, creating hybrid service models that combine international sensor expertise with local facility management knowledge and precision building protection systems.

The Roof Water Leak Detector Market is expanding as commercial buildings, data centers, industrial facilities, and smart homes increasingly adopt early-warning systems to prevent structural damage and costly downtime. With climate change intensifying rainfall patterns and infrastructure owners prioritizing preventive maintenance, leak detection technologies are becoming integral to building management strategies. Modern systems combine sensors, wireless connectivity, and analytics to pinpoint moisture intrusion before it escalates, supporting both sustainability goals and asset protection.

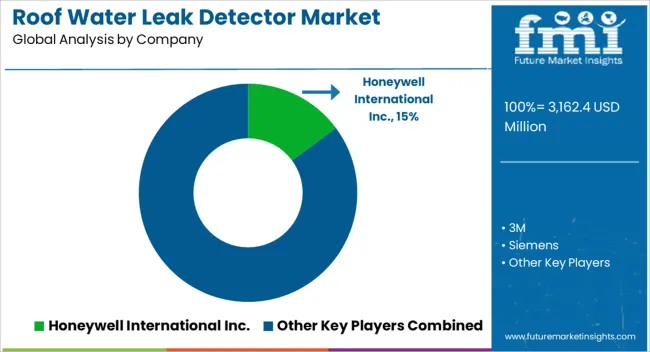

Honeywell International Inc., Siemens, and Schneider Electric remain at the forefront with building automation platforms that seamlessly integrate roof leak detection into broader facility-monitoring networks. Their systems emphasize real-time alerts, centralized dashboards, and compatibility with IoT-enabled smart infrastructure. 3M Company and nVent Electric plc contribute through advanced moisture-sensing materials and rugged detection hardware designed for commercial and industrial roofing environments.

Specialists such as Pentair plc, Omron Industrial Automation, and Monnit Corporation deliver sensor technologies suited for distributed detection across large roofs, offering wireless, battery-powered, and cloud-connected options for both retrofit and new construction. NEC Corporation and Johnson Controls are expanding their portfolios with intelligent monitoring platforms that support predictive maintenance and integration with HVAC, fire safety, and security systems, reinforcing their role in holistic building resilience.

Roof water leak detectors represent advanced monitoring solutions that enable building owners to achieve 60-80% reduction in water damage costs compared to reactive maintenance approaches, delivering superior property protection and operational reliability with proactive leak identification in commercial building applications. With the market projected to grow from USD 3.2 billion in 2025 to USD 6.2 billion by 2035 at a 6.8% CAGR, these intelligent monitoring systems offer compelling advantages - early detection capabilities, reduced insurance claims, and building resilience opportunities - making them essential for commercial facilities (36% market share), residential properties (28% share), and buildings seeking alternatives to manual inspection methods that cannot provide continuous monitoring coverage.

How Governments Could Spur Local Production and Adoption?

How Industry Bodies Could Support Market Development?

How OEMs and Technology Players Could Strengthen the Ecosystem?

How Suppliers Could Navigate the Shift?

How Investors and Financial Enablers Could Unlock Value?

| Item | Value |

|---|---|

| Quantitative Units | USD 3.2 Billion |

| Leak Detection Technology | Fiber Optic Leak Detection, Thermal Imaging Detection, Point/Spot Detection, Probe Type Detection, Ultrasonic Leak Detection, Acoustic Leak Detection |

| Product Type | Smart Detectors, Conventional Detectors |

| Connectivity | Wireless, Wired |

| End-use | Commercial, Residential, Industrial, Warehouse |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Country Covered | China, United States, India, United Kingdom, Brazil, Germany, Japan, and 40+ countries |

| Key Companies Profiled | Honeywell International Inc., Siemens, Schneider Electric, 3M Company, nVent Electric plc, Pentair plc, Omron Industrial Automation, NEC Corporation, Johnson Controls, Monnit Corporation |

| Additional Attributes | Dollar sales by leak detection technology, product type, connectivity, and end-use categories, regional adoption trends across Asia Pacific, North America, and Europe, competitive landscape with detection system manufacturers and installation networks, technology requirements and specifications, integration with building management platforms and property monitoring systems, innovations in AI-powered analytics and wireless connectivity, and development of specialized leak detection solutions with enhanced accuracy and building protection capabilities. |

The global roof water leak detector market is estimated to be valued at USD 3.2 billion in 2025.

The market size for the roof water leak detector market is projected to reach USD 6.2 billion by 2035.

The roof water leak detector market is expected to grow at a 6.8% CAGR between 2025 and 2035.

The key product types in roof water leak detector market are smart detectors and conventional detectors.

In terms of connectivity, wireless segment to command 54.2% share in the roof water leak detector market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Water Leak Sensors Market Size and Share Forecast Outlook 2025 to 2035

Water Leak Detection System for Server Rooms and Data Centers Market Size and Share Forecast Outlook 2025 to 2035

Water Leakage Tester Market Size and Share Forecast Outlook 2025 to 2035

Waterproof Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Waterproofing Admixtures Market Size and Share Forecast Outlook 2025 to 2035

Waterproof Makeup Market Size and Share Forecast Outlook 2025 to 2035

Waterproof Breathable Textiles WBT Size Market Size and Share Forecast Outlook 2025 to 2035

Waterproof Socks Market Analysis by Product Type, Application, Consumer Orientation, Sales Channel, and Region Through 2035

Waterproof Shoe Covers Market Analysis - Trends, Growth & Forecast 2025 to 2035

Waterproof Boots Market Trends - Growth & Forecast to 2035

Waterproof Sneakers Market Analysis - Growth & Forecast 2025 to 2035

Waterproof Packaging Market Trends - Demand & Industry Forecast 2025 to 2035

Waterproof Speaker Market Analysis - Trends, Growth & Forecast 2025 to 2035

Industry Share Analysis for Waterproof Label Companies

Waterproof Label Market Analysis by Polyethylene & Polypropylene Through 2034

Waterproof Orthotics Market

Waterproof Cases Market

Water Proof E-Scooter Market Growth – Trends & Forecast 2025 to 2035

Water Proof Coatings Market Growth - Trends & Forecast 2025 to 2035

Vacuum Leak Detectors Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA