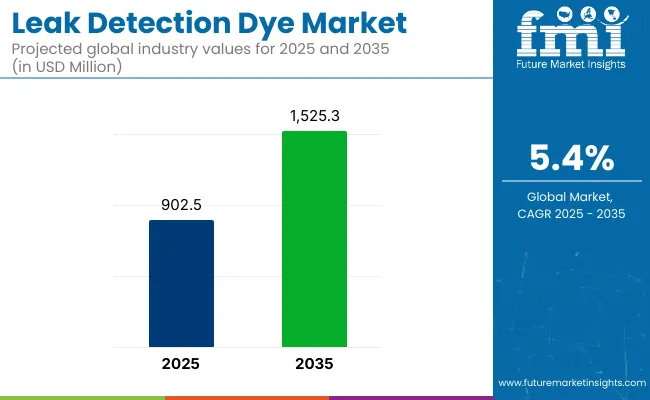

The global leak detection dye market is valued at USD 902.5 million in 2025 and is poised to reach USD 1,525.3 million by 2035, expanding at a CAGR of 5.4% over the forecast period. This growth is being driven by the increasing need for preventive maintenance and accurate leak detection in critical systems across automotive, HVAC, oil and gas, industrial processing, and water treatment industries.

Leak detection dyes, which are fluorescent or ultraviolet-reactive liquids, help identify leaks quickly and effectively in closed-loop systems without requiring disassembly. Their ease of use, low cost, and compatibility with various fluids such as refrigerants, oils, and coolants make them indispensable for technicians and service providers.

Technological improvements in dye formulations are enhancing visibility, safety, and environmental compliance. Manufacturers are developing non-toxic, biodegradable, and high-contrast dyes suitable for a wide range of operating conditions and fluid types. These advanced formulations are being tailored to reduce background fluorescence, improve UV detection sensitivity, and ensure long-lasting visibility without damaging system components.

Digital tools such as UV LED torches, leak detection cameras, and integrated dye-injection systems are further streamlining the leak diagnosis process. As smart maintenance practices and condition monitoring become standard in industrial operations, leak detection dye usage is expanding beyond reactive maintenance to proactive asset management.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 902.5 million |

| Industry Value (2035F) | USD 1,525.3 million |

| CAGR (2025 to 2035) | 5.4% |

Regulatory support for leak prevention, workplace safety, and environmental sustainability is reinforcing demand for reliable detection methods. Organizations such as the USA Environmental Protection Agency (EPA) and the European Chemicals Agency (ECHA) are enforcing emission control policies and leak monitoring standards that encourage the use of non-invasive detection technologies.

In emerging markets across Asia Pacific and Latin America, growing industrial activity, infrastructure development, and safety awareness are creating strong demand for maintenance solutions. With growing emphasis on equipment uptime, energy efficiency, and regulatory compliance, the global leak detection dye market is expected to expand steadily across diverse industrial applications from 2025 to 2035.

Governments worldwide regulate the leak detection dye market to ensure environmental safety, chemical compliance, and public health protection. Developed regions emphasize chemical restrictions, certification, and emission controls, while developing countries focus on adopting regulations that support industrial safety and sustainable practices.

These regions enforce strict chemical safety standards, ban harmful substances, and require certifications to ensure safe and eco-friendly leak detection products. Regulations also promote innovation in environmentally sustainable dyes.

Developing countries implement leak detection regulations to enhance industrial safety, promote biodegradability, and align with global standards through certification and policy reforms.

Trade in leak detection dyes is shaped by regulatory compliance, environmental standards, and demand from key industrial sectors like automotive, HVAC, and petrochemicals. Developed regions often export advanced eco-friendly products, while developing countries focus on increasing local production and meeting international certification requirements to boost exports.

The market is segmented based on product type, form, end use, and region. By product type, it includes solvent-based dyes and water-based dyes. In terms of form, the market is categorized into powder and liquid formats. Based on end use, it comprises automotive industry (coolant system, air conditioning), aviation industry (aircraft fuel systems, hydraulic systems), HVAC/R (residential A/C, commercial A/C, refrigeration), industrial [boilers, chillers, reactors, HVAC systems, and others (such as power plants, marine equipment, semiconductor manufacturing, and laboratory equipment)].

Regionally, the market is divided into North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and the Middle East and Africa.

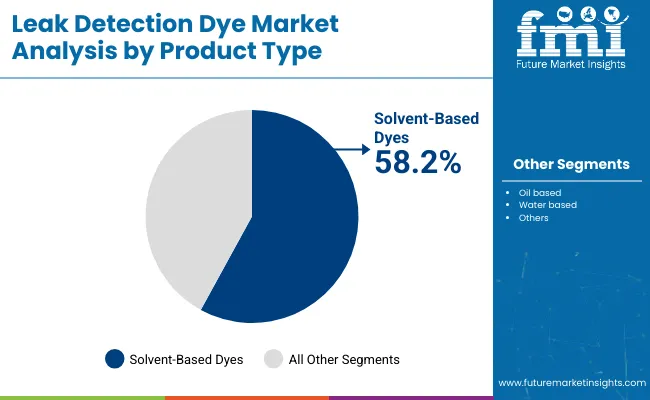

Solvent-based dyes are projected to dominate the leak detection dye market by product type in 2025, holding a 58.2% market share. These dyes are widely preferred for their strong visibility under UV light, excellent solubility in oils, and long-lasting traceability across industrial and automotive systems. Their performance in high-temperature and high-pressure environments makes them the go-to option for detecting leaks in engines, hydraulic systems, and fuel lines. Their chemical stability ensures minimal degradation, allowing consistent detection over extended periods.

Automotive and HVAC/R maintenance professionals frequently choose solvent-based dyes to identify microleaks in lubricants, refrigerants, and other non-polar fluids. Industry leaders such as Tracer Products, Spectroline, and Errecom are offering ready-to-use solvent-based dye kits compatible with synthetic oils, coolants, and compressor lubricants. These products are also formulated to meet safety standards, ensuring no damage to system components or sensors.

While water-based dyes are increasingly used in environmentally sensitive or water-centric systems, solvent-based dyes continue to lead due to their superior fluorescence intensity and broader compatibility across applications. As leak prevention and maintenance become critical in aviation, automotive, and manufacturing industries, solvent-based formulations are expected to remain the most trusted and widely adopted detection solution.

| Product Type Segment | Market Share (2025) |

|---|---|

| Solvent-Based Dyes | 58.2% |

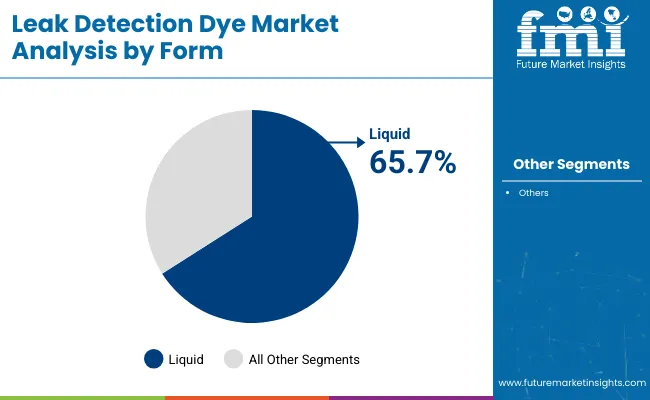

The liquid segment is expected to lead the leak detection dye market by form in 2025, capturing a 65.7% market share. Liquid dyes offer superior ease of application, rapid dispersion, and high visibility in both oil-based and water-based systems, making them the preferred choice across automotive, HVAC, industrial, and refrigeration sectors.

Their ready-to-use nature eliminates the need for dilution or pre-mixing, which enhances operational efficiency during routine inspections or preventive maintenance. Manufacturers such as Spectroline, UView, and Mastercool produce advanced liquid dye formulations compatible with refrigerants, hydraulic fluids, coolants, and fuels. These formulations are engineered to resist system pressure, temperature fluctuations, and chemical breakdown, ensuring accurate leak detection without compromising system performance.

In automotive and HVAC/R applications, liquid dyes are frequently used in conjunction with UV flashlights and detection glasses, offering a fast and reliable method for pinpointing invisible leaks. Powdered dyes, while more economical and concentrated, require manual preparation and are often limited to controlled industrial settings.

In contrast, the liquid segment's user-friendliness, minimal residue, and compatibility with diverse system materials make it the market's top-performing category. With growing global emphasis on preventive maintenance and equipment efficiency, liquid dyes are set to remain the dominant form through 2035.

| Form Segment | Market Share (2025) |

|---|---|

| Liquid | 65.7% |

The HVAC/R (Heating, Ventilation, Air Conditioning, and Refrigeration) segment is projected to register the fastest growth in the leak detection dye market, with a CAGR of 8.2% from 2025 to 2035. This growth is driven by the rising global demand for energy-efficient cooling systems and the increasing need for preventive maintenance in both residential and commercial buildings.

Leak detection dyes are crucial in HVAC/R systems to identify refrigerant leaks quickly and cost-effectively, helping prevent system failures, reduce emissions, and extend equipment life. As refrigerant regulations tighten across North America, Europe, and parts of Asia, HVAC/R service providers are adopting UV fluorescent dyes to ensure accurate, non-invasive leak tracing. The growing popularity of smart HVAC systems and IoT-enabled diagnostics is further driving integration with advanced leak detection technologies.

Liquid-form dyes with high fluorescent intensity are being widely used across air conditioning units, chillers, heat pumps, and refrigeration compressors. Leading brands such as Spectroline, Errecom, and Tracerline are offering industry-specific dye kits compliant with EPA and F-Gas standards. The HVAC/R segment’s growth is also fueled by the rise in urban infrastructure, expanding cold chain networks, and the shift toward sustainable building operations, all of which reinforce the need for reliable leak detection solutions.

| End Use Segment | CAGR (2025 to 2035) |

|---|---|

| HVAC/R | 8.2% |

The leakage detection dye market is mainly faced with the challenge of government regulations that prevent the use of chemical dyes in industries. A number of these leak detection dyes, mainly the ones used in automotive and refrigeration cooling systems have fluorescent additives and chemical compounds that are quite harmful to both the environment and human health.

Organizations like EPA and EU REACH along with the Food and Drug Administration (FDA) have made law-like rules governing the use of artificial dyes in leak detection systems, especially in food processing, pharmaceutical, and water treatment applications.

Therefore, manufacturers have to find ways of coming up with non-toxic, biodegradable options which could lead to added research and production costs. In addition, meeting industry-specific safety standards through regular testing and certification often makes it difficult for new entrants to compete with established companies.

The steep expense for advanced leak detection systems due mainly to the closure of certain companies that integrate UV-based detection, AI-assisted diagnostics, and automated monitoring solutions is yet another issue in the market. While traditional dye-based leak detection is cost-effective and widely used, industries are shifting toward real-time monitoring systems that provide instant leak detection and predictive maintenance capabilities.

Nevertheless, the initial capital outlay for these sophisticated leak detection systems is a hurdle for small and mid-sized enterprises (SMEs). The need to have UV bulbs, specialized equipment, and training to effectively carry out the task of leak identification only adds to the operational costs. The oem's are now focusing on the development of easy-to-use, non-proprietary, and inexpensive leak detection dye formulations to promote acceptance in thrift-kind consumers.

The necessity of eco-friendly leak detection options is paving the path for manufacturers to create effective bio-, water-soluble, and non-toxic leak detection dyes. In addition to the high environmental governance on chemical additives, businesses are also moving to fluorescent leak detection dyes that are made with plant-based and biodegradable materials.

Top companies are pouring resources into formulation ingenuity that will improve UV reactivity, durability of fluorescence, and use in several fluid systems. Furthermore, the merging of green chemistry practices in dye production is likely to promote the spread of environmentally-friendly leak detection in HVAC, automotive, and industrial applications.

The sales of leak detection dyes are greatly influenced by the growth of HVAC systems, refrigeration units, and industrial cooling systems. A lot of maintenance teams are resorting to these dyes for their benefits in Leak detection fluid losses, refrigerant leaks, and operational failures.

In addition, battery cooling systems, hydraulic circuits, and thermal management applications are driving the demand for leak detection solutions with the introduction of electric and hybrid automobiles. The worldwide building of oil &gas pipeline networks is also the reason for the creation of these special leak detection dyes, which in turn, facilitate the early leak detection and reduction of environmental damage.

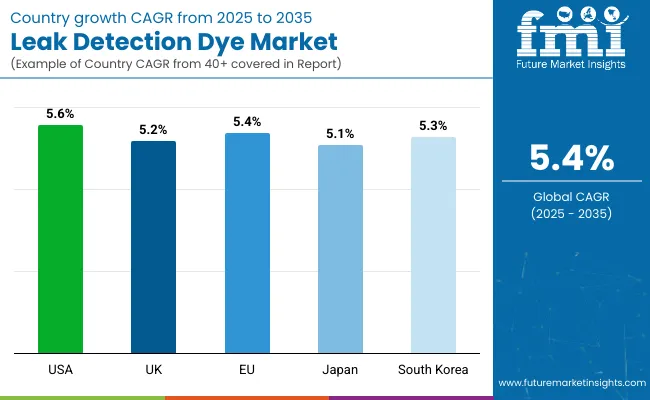

The market in the USA is demonstrating consistent growth due to widespread product use in HVAC systems, automotive diagnostics, and industrial pipeline maintenance. Fluorescent and UV leak detection dyes are becoming increasingly prevalent in HVAC and refrigeration systems, largely because of the Environmental Protection Agency’s (EPA) enforcement of strict refrigerant leakage regulations.

Within the automotive sector, vehicle manufacturers and service providers are adopting dye-based diagnostics in air conditioning systems, fuel lines, and hydraulic systems to improve operational efficiency. Industrial sectors such as oil, gas, and power plants are turning to tracer dyes to identify primary leaks in pipelines and storage tanks that pose environmental and safety risks.

Concurrently, there is rising demand for biodegradable, non-toxic, and water-based dyes, especially in food processing and pharmaceutical industries, where chemical-friendly formulations are preferred. The USA leak detection dye market is projected to grow at a CAGR of 5.6% from 2025 to 2035.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.6% |

In the United Kingdom, the leak detection dyes market is experiencing stable growth driven by stringent environmental regulations, the expanding HVAC and automotive service industries, and the need for reliable industrial safety mechanisms. Regulatory bodies such as the Environment Agency and DEFRA have implemented robust policies to reduce refrigerant and water leakages, indirectly stimulating demand for high-visibility dye-based detection systems.

The popularity of heat pumps and advanced HVAC systems in both residential and commercial spaces has encouraged more frequent use of fluorescent dyes in routine maintenance. Furthermore, the strong automotive servicing ecosystem in the UK is embracing UV dyes for leak detection in hybrid and electric vehicles.

Industries including chemical manufacturing and water treatment are also increasingly adopting non-toxic, fast-acting dyes for operational safety and compliance. The UK leak detection dye market is set to expand at 5.2% CAGR during the study period.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.2% |

The leak detection dyes market across the European Union is experiencing notable expansion, catalyzed by rigorous environmental mandates, industrial upgrades, and rising adoption in sectors such as automotive, HVAC, and oil & gas. Countries like Germany, France, and Italy are prioritizing the use of solvent-free, biodegradable dye technologies in alignment with EU-wide sustainability goals.

The European F-Gas Regulation, which mandates the reduction of fluorinated greenhouse gas emissions, continues to drive the usage of eco-friendly dyes in refrigeration and air conditioning systems. Heightened emphasis on workplace safety and hazard prevention has increased the deployment of ultraviolet dyes in chemical processing units, wastewater treatment plants, and subterranean infrastructure monitoring.

Automotive manufacturers, particularly in Germany and Sweden, are advancing dye-based technologies for leak detection in electric vehicle cooling systems and hydraulic units. The EU leak detection dye market is expected to register a CAGR of 5.4% between 2025 and 2035.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.4% |

Japan’s leak detection dyes market is benefiting from advancements in manufacturing, strong automotive and electronics sectors, and significant investments in precision leak detection for semiconductor and food industries. Owing to stringent safety regulations, there is growing demand for non-invasive, non-corrosive dyes in cleanroom and industrial settings.

Japanese EV and hybrid manufacturers extensively utilize ultraviolet and infrared dyes to test battery cooling systems, fuel cells, and transmission integrity. Rapid urban transit development is fueling the need for leak detection dyes in underground transport infrastructure.

Additionally, Japan’s quick adoption of AI-powered predictive maintenance is merging leak detection technology with smart HVAC and industrial automation. The Japanese leak detection dye market is projected to grow at a CAGR of 5.1% from 2025 to 2035.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.1% |

South Korea is experiencing robust growth, fueled by technological advances in semiconductor fabrication, electric vehicle systems, and industrial safety compliance. The country’s leadership in electronics manufacturing demands extremely precise dye-based detection methods to prevent contamination and maintain cleanroom integrity.

South Korea’s EV battery manufacturing hub increasingly employs dyes for thermal regulation in lithium-ion and hydrogen fuel cells. Concurrently, the adoption of dye-based leak diagnostics is rising in smart home HVAC applications.

Governmental focus on emissions reduction and occupational safety has accelerated the deployment of automated, AI-enabled leak monitoring systems in factories and power plants. The leak detection dye market in South Korea is forecasted to grow at a CAGR of 5.3% from 2025 to 2035.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.3% |

Surge of the leak detection dyes market at the international level is mainly due to the high demand for preventive maintenance products, increasing use of these products in the industrial sector, and the latest developments in the non-destructive testing (NDT) technologies. HVAC systems, automotive cooling systems, pipelines, hydraulic machinery, and refrigeration units which use leak detection dyes for the prompt and effective leak detection are the major areas in which this chemical is used.

The market is influenced by the developing environmental regulations on leak prevention, the growing use of fluorescent and UV leak detection dyes, and the urgent need for early detection solutions in critical systems. The leading companies leverage their operations by focusing on the production of high-performance dyes, environmentally friendly formulations, and the incorporation of UV tracer technology that increases the productivity of leak detection in various fields like automotive, aerospace, and industrial manufacturing.

Oil based, Water based, Solvent based

Fluorescent Dyes, Non-Fluorescent Dyes

Automotive & Transportation, HVAC & Refrigeration, Industrial Pipelines, Water & Plumbing Systems, Oil & Gas Pipelines, Marine, Others

North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe, Middle East and Africa

The global leak detection dye market is expected to reach USD 1,525.3 million by 2035, growing from USD 902.5 million in 2025, at a CAGR of 5.4% during the forecast period.

Solvent-based dyes dominate the market with a 58.2% share in 2025, due to their superior performance in high-pressure systems, strong fluorescence, and wide usage in automotive and industrial sectors.

The liquid segment is expected to hold a 65.7% market share in 2025, as it offers ease of use, fast dispersion, and compatibility across refrigerants, oils, and water-based fluids.

The HVAC/R segment is projected to grow at the fastest pace with a CAGR of 8.2%, driven by rising demand for energy-efficient systems and stricter refrigerant leakage regulations.

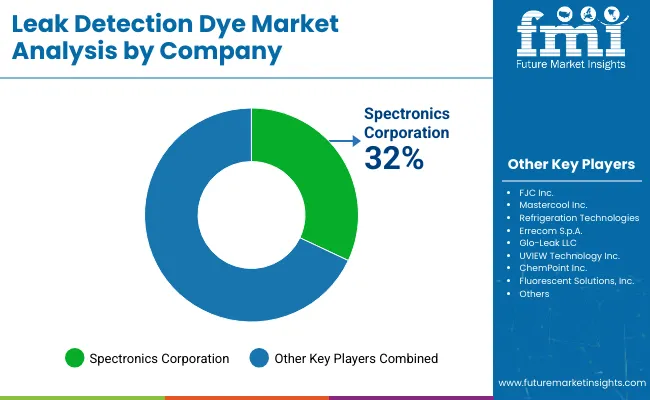

Top companies include FJC Inc., Mastercool Inc., Errecom S.p.A., Glo-Leak LLC, Refrigeration Technologies, and UVIEW Technology Inc., known for offering specialized, regulatory-compliant dye formulations.

Table 01: Global Market Size (US$ Million) and Volume (Tons) Forecast by Product Type, 2018 to 2022

Table 02: Global Market Size (US$ Million) and Volume (Tons) Forecast by Product Type, 2023 to 2033

Table 03: Global Market Size (US$ Million) and Volume (Tons) Analysis and Forecast By Form, 2018 to 2022

Table 04: Global Market Size (US$ Million) and Volume (Tons) Analysis and Forecast By Form, 2023 to 2033

Table 05: Global Market Volume (Tons) and Value (US$ Million) Analysis and Forecast By End Use Industry, 2018 to 2022

Table 06: Global Market Volume (Tons) and Value (US$ Million) Analysis and Forecast By End Use Industry, 2023 to 2033

Table 07: Global Market Volume (Tons) & Value (US$ Million) Analysis and Forecast By End Use Industry, 2018 to 2022

Table 08: Global Market Volume (Tons) & Value (US$ Million) Analysis and Forecast By End Use Industry, 2023 to 2033

Table 09: Global Market Size Volume (Tons) Analysis and Forecast By Region, 2018 to 2022

Table 10: Global Market Size Volume (Tons) Analysis and Forecast By Region, 2023 to 2033

Table 11: Global Market Size (US$ Million) Analysis and Forecast By Region, 2018 to 2033

Table 12: North America Market Size (US$ Million) and Volume (Tons) Analysis and Forecast By Country, 2018 to 2022

Table 13: North America Market Size (US$ Million) and Volume (Tons) Analysis and Forecast By Country, 2023 to 2033

Table 14: North America Market Size (US$ Million) and Volume (Tons) Forecast by Product Type, 2018 to 2022

Table 15: North America Market Size (US$ Million) and Volume (Tons) Forecast by Product Type, 2023 to 2033

Table 16: North America Market Size (US$ Million) and Volume (Tons) Analysis and Forecast By Form, 2018 to 2022

Table 17: North America Market Size (US$ Million) and Volume (Tons) Analysis and Forecast By Form, 2023 to 2033

Table 18: North America Market Volume (Tons) and Value (US$ Million) Analysis and Forecast By End Use Industry, 2018 to 2022

Table 19: North America Market Volume (Tons) and Value (US$ Million) Analysis and Forecast By End Use Industry, 2023 to 2033

Table 20: North America Market Volume (Tons) & Value (US$ Million) Analysis and Forecast By End Use Industry, 2018 to 2022

Table 21: North America Market Volume (Tons) & Value (US$ Million) Analysis and Forecast By End Use Industry, 2023 to 2033

Table 22: Latin America Market Size (US$ Million) and Volume (Tons) Analysis and Forecast By Country, 2018 to 2033

Table 23: Latin America Market Size (US$ Million) and Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 24: Latin America Market Size (US$ Million) and Volume (Tons) Analysis and Forecast By Form, 2018 to 2033

Table 25: Latin America Market Volume (Tons) and Value (US$ Million) Analysis and Forecast By End Use Industry, 2018 to 2033

Table 26: Latin America Market Volume (Tons) & Value (US$ Million) Analysis and Forecast By End Use Industry, 2018 to 2033

Table 27: Western Europe Market Size (US$ Million) and Volume (Tons) Analysis and Forecast By Country, 2018 to 2022

Table 28: Western Europe Market Size (US$ Million) and Volume (Tons) Analysis and Forecast By Country, 2023 to 2033

Table 29: Western Europe Market Size (US$ Million) and Volume (Tons) Forecast by Product Type, 2018 to 2022

Table 30: Western Europe Market Size (US$ Million) and Volume (Tons) Forecast by Product Type, 2023 to 2033

Table 31: Western Europe Market Size (US$ Million) and Volume (Tons) Analysis and Forecast By Form, 2018 to 2022

Table 32: Western Europe Market Size (US$ Million) and Volume (Tons) Analysis and Forecast By Form, 2023 to 2033

Table 33: Western Europe Market Volume (Tons) and Value (US$ Million) Analysis and Forecast By End Use Industry, 2018 to 2022

Table 34: Western Europe Market Volume (Tons) and Value (US$ Million) Analysis and Forecast By End Use Industry, 2023 to 2033

Table 35: Western Europe Market Volume (Tons) & Value (US$ Million) Analysis and Forecast By End Use Industry, 2018 to 2022

Table 36: Western Europe Market Volume (Tons) & Value (US$ Million) Analysis and Forecast By End Use Industry, 2023 to 2033

Table 37: Eastern Europe Market Size (US$ Million) and Volume (Tons) Analysis and Forecast By Country, 2018 to 2022

Table 38: Eastern Europe Market Size (US$ Million) and Volume (Tons) Analysis and Forecast By Country, 2023 to 2033

Table 39: Eastern Europe Market Size (US$ Million) and Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 40: Eastern Europe Market Size (US$ Million) and Volume (Tons) Analysis and Forecast By Form, 2018 to 2033

Table 41: Eastern Europe Market Volume (Tons) and Value (US$ Million) Analysis and Forecast By End Use Industry, 2018 to 2033

Table 42: Eastern Europe Market Volume (Tons) & Value (US$ Million) Analysis and Forecast By End Use Industry, 2018 to 2033

Table 43: East Asia Market Size (US$ Million) and Volume (Tons) Analysis and Forecast By Country, 2018 to 2022

Table 44: East Asia Market Size (US$ Million) and Volume (Tons) Analysis and Forecast By Country, 2023 to 2033

Table 45: East Asia Market Size (US$ Million) and Volume (Tons) Forecast by Product Type, 2018 to 2022

Table 46: East Asia Market Size (US$ Million) and Volume (Tons) Forecast by Product Type, 2023 to 2033

Table 47: East Asia Market Size (US$ Million) and Volume (Tons) Analysis and Forecast By Form, 2018 to 2022

Table 48: East Asia Market Size (US$ Million) and Volume (Tons) Analysis and Forecast By Form, 2023 to 2033

Table 49: East Asia Market Volume (Tons) and Value (US$ Million) Analysis and Forecast By End Use Industry, 2018 to 2022

Table 50: East Asia Market Volume (Tons) and Value (US$ Million) Analysis and Forecast By End Use Industry, 2023 to 2033

Table 51: East Asia Market Volume (Tons) & Value (US$ Million) Analysis and Forecast By End Use Industry, 2018 to 2022

Table 52: East Asia Market Volume (Tons) & Value (US$ Million) Analysis and Forecast By End Use Industry, 2023 to 2033

Table 53: SAP Market Size (US$ Million) and Volume (Tons) Analysis and Forecast By Country, 2018 to 2022

Table 54: SAP Market Size (US$ Million) and Volume (Tons) Analysis and Forecast By Country, 2023 to 2033

Table 55: SAP Market Size (US$ Million) and Volume (Tons) Forecast by Product Type, 2018 to 2022

Table 56: SAP Market Size (US$ Million) and Volume (Tons) Forecast by Product Type, 2023 to 2033

Table 57: SAP Market Size (US$ Million) and Volume (Tons) Analysis and Forecast By Form, 2018 to 2022

Table 58: SAP Market Size (US$ Million) and Volume (Tons) Analysis and Forecast By Form, 2023 to 2033

Table 59: SAP Market Volume (Tons) and Value (US$ Million) Analysis and Forecast By End Use Industry, 2018 to 2022

Table 60: SAP Market Volume (Tons) and Value (US$ Million) Analysis and Forecast By End Use Industry, 2023 to 2033

Table 61: SAP Market Volume (Tons) & Value (US$ Million) Analysis and Forecast By End Use Industry, 2018 to 2022

Table 62: SAP Market Volume (Tons) & Value (US$ Million) Analysis and Forecast By End Use Industry, 2023 to 2033

Table 63: MEA Market Size (US$ Million) and Volume (Tons) Analysis and Forecast By Country, 2018 to 2033

Table 64: MEA Market Size (US$ Million) and Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 65: MEA Market Size (US$ Million) and Volume (Tons) Analysis and Forecast By Form, 2018 to 2033

Table 66: MEA Market Volume (Tons) and Value (US$ Million) Analysis and Forecast By End Use Industry, 2018 to 2033

Table 67: MEA Market Volume (Tons) & Value (US$ Million) Analysis and Forecast By End Use Industry, 2018 to 2033

Figure 01: Global Historical Market Volume (Tons) Analysis, 2018 to 2022

Figure 02: Global Current and Future Market Volume (Tons) Analysis, 2023 to 2033

Figure 03: Global Historical Value (US$ Million), 2018 to 2022

Figure 04: Global Value (US$ Million) Forecast, 2023 to 2033

Figure 05: Global Absolute $ Opportunity, 2018 to 2023 and 2033

Figure 06: Global Market Share and BPS Analysis by Product Type, 2023 to 2033

Figure 07: Global Market Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 08: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 09: Global Market Absolute $ Opportunity by Solvent-based Dyes Segment, 2018 to 2033

Figure 10: Global Market Absolute $ Opportunity by Water-based Dyes Segment, 2018 to 2033

Figure 11: Global Market Share and BPS Analysis By Form, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth Projections By Form, 2023 to 2033

Figure 13: Global Market Attractiveness Analysis By Form, 2023 to 2033

Figure 14: Global Market Absolute $ Opportunity by Powder Segment, 2018 to 2033

Figure 15: Global Market Absolute $ Opportunity by Liquid Segment, 2018 to 2033

Figure 16: Global Market Share and BPS Analysis By End Use Industry, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth Projections By End Use Industry, 2023 to 2033

Figure 18: Global Market Attractiveness Analysis By End Use Industry, 2023 to 2033

Figure 19: Global Market Absolute $ Opportunity by Automotive Industry Segment, 2018 to 2033

Figure 20: Global Market Absolute $ Opportunity by HVAC/R Segment, 2018 to 2033

Figure 21: Global Market Absolute $ Opportunity by Others Segment, 2018 to 2033

Figure 22: Global Market Absolute $ Opportunity by Aviation Industry Segment, 2018 to 2033

Figure 23: Global Market Absolute $ Opportunity by Industrial Segment, 2018 to 2033

Figure 24: Global Market Share and BPS Analysis By Region, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth Projections By Region, 2023 to 2033

Figure 26: Global Market Attractiveness Analysis By Region, 2023 to 2033

Figure 27: Global Market Absolute $ Opportunity by North America Segment, 2018 to 2033

Figure 28: Global Market Absolute $ Opportunity by Western Europe Segment, 2018 to 2033

Figure 29: Global Market Absolute $ Opportunity by East Asia Segment, 2018 to 2033

Figure 30: Global Market Absolute $ Opportunity by Middle East and Africa Segment, 2018 to 2033

Figure 31: Global Market Absolute $ Opportunity by Latin America Segment, 2018 to 2033

Figure 32: Global Market Absolute $ Opportunity by Eastern Europe Segment, 2018 to 2033

Figure 33: Global Market Absolute $ Opportunity by South Asia and Pacific Segment, 2018 to 2033

Figure 34: North America Market Share and BPS Analysis By Country, 2023 to 2033

Figure 35: North America Market Y-o-Y Growth Projections By Country, 2023 to 2033

Figure 36: North America Market Attractiveness Analysis By Country, 2023 to 2033

Figure 37: North America Market Share and BPS Analysis by Product Type, 2023 to 2033

Figure 38: North America Market Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 39: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 40: North America Market Share and BPS Analysis By Form, 2023 to 2033

Figure 41: North America Market Y-o-Y Growth Projections By Form, 2023 to 2033

Figure 42: North America Market Attractiveness Analysis By Form, 2023 to 2033

Figure 43: North America Market Share and BPS Analysis By End Use Industry, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth Projections By End Use Industry, 2023 to 2033

Figure 45: North America Market Attractiveness Analysis By End Use Industry, 2023 to 2033

Figure 46: Latin America Market Share and BPS Analysis By Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth Projections By Country, 2023 to 2033

Figure 48: Latin America Market Attractiveness Analysis By Country, 2023 to 2033

Figure 49: Latin America Market Share and BPS Analysis by Product Type, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 51: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 52: Latin America Market Share and BPS Analysis By Form, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth Projections By Form, 2023 to 2033

Figure 54: Latin America Market Attractiveness Analysis By Form, 2023 to 2033

Figure 55: Latin America Market Share and BPS Analysis By End Use Industry, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth Projections By End Use Industry, 2023 to 2033

Figure 57: Latin America Market Attractiveness Analysis By End Use Industry, 2023 to 2033

Figure 58: Western Europe Market Share and BPS Analysis By Country, 2023 to 2033

Figure 59: Western Europe Market Y-o-Y Growth Projections By Country, 2023 to 2033

Figure 60: Western Europe Market Attractiveness Analysis By Country, 2023 to 2033

Figure 61: Western Europe Market Share and BPS Analysis by Product Type, 2023 to 2033

Figure 62: Western Europe Market Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 63: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 64: Western Europe Market Share and BPS Analysis By Form, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth Projections By Form, 2023 to 2033

Figure 66: Western Europe Market Attractiveness Analysis By Form, 2023 to 2033

Figure 67: Western Europe Market Share and BPS Analysis By End Use Industry, 2023 to 2033

Figure 68: Western Europe Market Y-o-Y Growth Projections By End Use Industry, 2023 to 2033

Figure 69: Western Europe Market Attractiveness Analysis By End Use Industry, 2023 to 2033

Figure 70: Eastern Europe Market Share and BPS Analysis By Country, 2023 to 2033

Figure 71: Eastern Europe Market Y-o-Y Growth Projections By Country, 2023 to 2033

Figure 72: Eastern Europe Market Attractiveness Analysis By Country, 2023 to 2033

Figure 73: Eastern Europe Market Share and BPS Analysis by Product Type, 2023 to 2033

Figure 74: Eastern Europe Market Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 75: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 76: Eastern Europe Market Share and BPS Analysis By Form, 2023 to 2033

Figure 77: Eastern Europe Market Y-o-Y Growth Projections By Form, 2023 to 2033

Figure 78: Eastern Europe Market Attractiveness Analysis By Form, 2023 to 2033

Figure 79: Eastern Europe Market Share and BPS Analysis By End Use Industry, 2023 to 2033

Figure 80: Eastern Europe Market Y-o-Y Growth Projections By End Use Industry, 2023 to 2033

Figure 81: Eastern Europe Market Attractiveness Analysis By End Use Industry, 2023 to 2033

Figure 82: East Asia Market Share and BPS Analysis By Country, 2023 to 2033

Figure 83: East Asia Market Y-o-Y Growth Projections By Country, 2023 to 2033

Figure 84: East Asia Market Attractiveness Analysis By Country, 2023 to 2033

Figure 85: East Asia Market Share and BPS Analysis by Product Type, 2023 to 2033

Figure 86: East Asia Market Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 87: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 88: East Asia Market Share and BPS Analysis By Form, 2023 to 2033

Figure 89: East Asia Market Y-o-Y Growth Projections By Form, 2023 to 2033

Figure 90: East Asia Market Attractiveness Analysis By Form, 2023 to 2033

Figure 91: East Asia Market Share and BPS Analysis By End Use Industry, 2023 to 2033

Figure 92: East Asia Market Y-o-Y Growth Projections By End Use Industry, 2023 to 2033

Figure 93: East Asia Market Attractiveness Analysis By End Use Industry, 2023 to 2033

Figure 94: SAP Market Share and BPS Analysis By Country, 2023 to 2033

Figure 95: SAP Market Y-o-Y Growth Projections By Country, 2023 to 2033

Figure 96: SAP Market Attractiveness Analysis By Country, 2023 to 2033

Figure 97: SAP Market Share and BPS Analysis by Product Type, 2023 to 2033

Figure 98: SAP Market Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 99: SAP Market Attractiveness by Product Type, 2023 to 2033

Figure 100: SAP Market Share and BPS Analysis By Form, 2023 to 2033

Figure 101: SAP Market Y-o-Y Growth Projections By Form, 2023 to 2033

Figure 102: SAP Market Attractiveness Analysis By Form, 2023 to 2033

Figure 103: SAP Market Share and BPS Analysis By End Use Industry, 2023 to 2033

Figure 104: SAP Market Y-o-Y Growth Projections By End Use Industry, 2023 to 2033

Figure 105: SAP Market Attractiveness Analysis By End Use Industry, 2023 to 2033

Figure 106: MEA Market Share and BPS Analysis By Country, 2023 to 2033

Figure 107: MEA Market Y-o-Y Growth Projections By Country, 2023 to 2033

Figure 108: MEA Market Attractiveness Analysis By Country, 2023 to 2033

Figure 109: MEA Market Share and BPS Analysis by Product Type, 2023 to 2033

Figure 110: MEA Market Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 111: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 112: MEA Market Share and BPS Analysis By Form, 2023 to 2033

Figure 113: MEA Market Y-o-Y Growth Projections By Form, 2023 to 2033

Figure 114: MEA Market Attractiveness Analysis By Form, 2023 to 2033

Figure 115: MEA Market Share and BPS Analysis By End Use Industry, 2023 to 2033

Figure 116: MEA Market Y-o-Y Growth Projections By End Use Industry, 2023 to 2033

Figure 117: MEA Market Attractiveness Analysis By End Use Industry, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

An Analysis of the Leak testing Machine Market by Detectors and Sensors Hardware Type through 2035

Market Share Distribution Among Leak Testing Machine Providers

Leak testing Machine Market

Leak Detection Equipment Market Size and Share Forecast Outlook 2025 to 2035

Leak Detection Market Size and Share Forecast Outlook 2025 to 2035

Air Leak Testing Market Size and Share Forecast Outlook 2025 to 2035

Water Leak Sensors Market Size and Share Forecast Outlook 2025 to 2035

Water Leakage Tester Market Size and Share Forecast Outlook 2025 to 2035

Water Leak Detection System for Server Rooms and Data Centers Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Leak Detectors Market Size and Share Forecast Outlook 2025 to 2035

Buried Leak Detector Market Size and Share Forecast Outlook 2025 to 2035

Endoscope Leak Detection Device Market

Roof Water Leak Detector Market Size and Share Forecast Outlook 2025 to 2035

Global Gas Leak Detectors Market

Refrigeration Leak Detector Market Growth - Trends & Forecast 2025 to 2035

Second Lid Air Leakage Test Machine Market Size and Share Forecast Outlook 2025 to 2035

Compressed Air Leak Detection Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Automotive Hydrogen Leak Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Ice Detection System Market Trends, Growth & Forecast 2025 to 2035

Gas Detection Equipment Market Growth – Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA