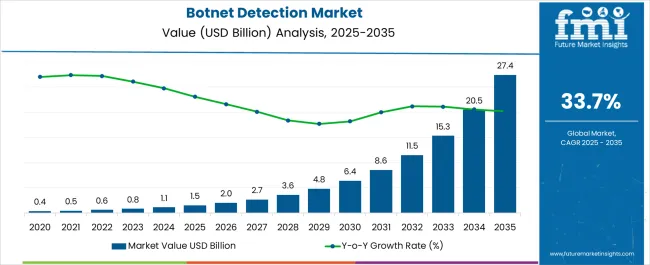

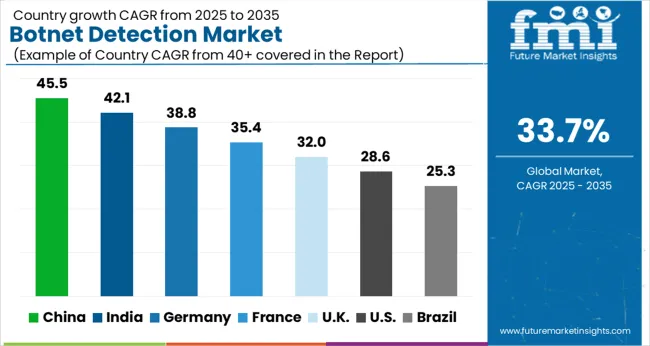

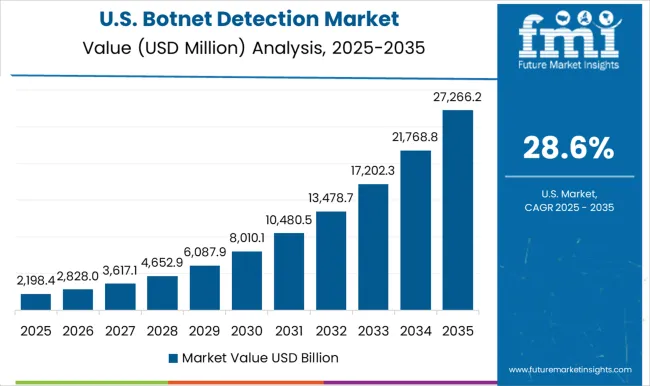

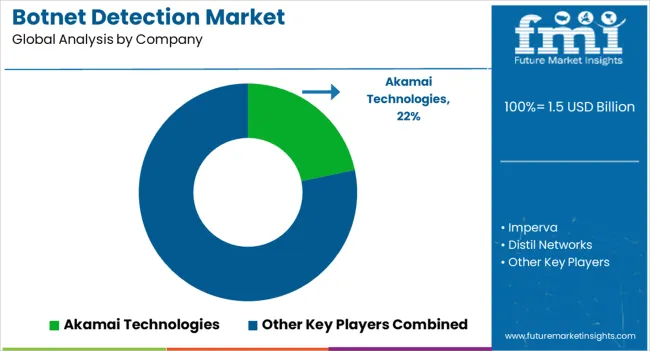

The botnet detection market is estimated to be valued at USD 1.5 billion in 2025 and is projected to reach USD 27.4 billion by 2035, registering a compound annual growth rate (CAGR) of 33.7% over the forecast period.

The market operates within a complex landscape where cybersecurity professionals navigate competing priorities between automated threat response and manual investigation capabilities. Organizations face persistent tension between security teams advocating for comprehensive monitoring solutions and IT departments concerned about network performance degradation from continuous deep packet inspection protocols. This operational friction intensifies when procurement departments encounter budget constraints while security incidents demand immediate technological upgrades.

Manufacturing environments present unique operational challenges where traditional botnet detection systems struggle with industrial control system protocols. Plant engineers often resist implementing network monitoring tools that could interfere with critical production processes, creating conflicts with cybersecurity mandates. Legacy manufacturing equipment lacks modern security features, forcing maintenance teams to develop workaround solutions that balance operational continuity with threat detection requirements. Quality assurance departments frequently clash with security teams over system modifications that might impact product certification standards.

The financial services sector demonstrates distinct operational dynamics where trading floor operations cannot tolerate network latency increases from security monitoring systems. Risk management departments advocate for comprehensive threat detection while trading operations demand minimal system interference during market hours. Compliance teams require detailed audit trails from botnet detection systems while operational staff struggle with alert fatigue from false positive notifications. Back office operations experience different security requirements than customer-facing systems, creating segmented implementation challenges.

Healthcare organizations encounter unique operational constraints where patient care systems require uninterrupted network access while security protocols demand continuous monitoring capabilities. Medical device manufacturers face regulatory approval processes that complicate software updates for botnet detection integration. Hospital IT departments must balance patient safety requirements with cybersecurity mandates, often leading to delayed security implementations. Research facilities handling sensitive medical data require specialized detection capabilities that standard commercial solutions cannot adequately address.

Cross-functional implementation challenges emerge when security vendors provide detection systems optimized for traditional enterprise environments rather than specialized industrial applications. Engineering teams frequently discover that commercial botnet detection solutions lack integration capabilities with proprietary industrial protocols. Maintenance schedules for critical systems rarely align with security update requirements, forcing organizations to accept temporary vulnerability windows. Training programs for operational staff often lag behind technology deployments, creating knowledge gaps that compromise detection effectiveness.

Supply chain integration presents additional operational complexity where partner organizations maintain different security standards and detection capabilities. Vendor management teams struggle to enforce consistent botnet detection requirements across diverse supplier networks. Quality control processes must account for security verification procedures that extend traditional inspection protocols. International supply chains encounter varying regulatory requirements that complicate standardized security implementations across multiple jurisdictions and operational environments.

| Metric | Value |

|---|---|

| Botnet Detection Market Estimated Value in (2025 E) | USD 1.5 billion |

| Botnet Detection Market Forecast Value in (2035 F) | USD 27.4 billion |

| Forecast CAGR (2025 to 2035) | 33.7% |

The botnet detection market is expanding steadily as organizations face increasing risks from sophisticated cyberattacks that leverage large-scale botnets. The rise in distributed denial of service incidents, credential theft, and automated fraud has intensified the demand for advanced detection solutions capable of monitoring and mitigating threats in real time.

Growing digital transformation, expansion of cloud infrastructures, and heightened adoption of IoT devices have further widened the attack surface, making botnet detection an essential component of cybersecurity strategies. Governments and regulatory authorities are also enforcing stricter compliance requirements, compelling enterprises to integrate advanced detection technologies.

The outlook for the market remains positive, supported by continuous advancements in AI driven monitoring, traffic analytics, and behavioral detection systems that enhance security resilience across industries.

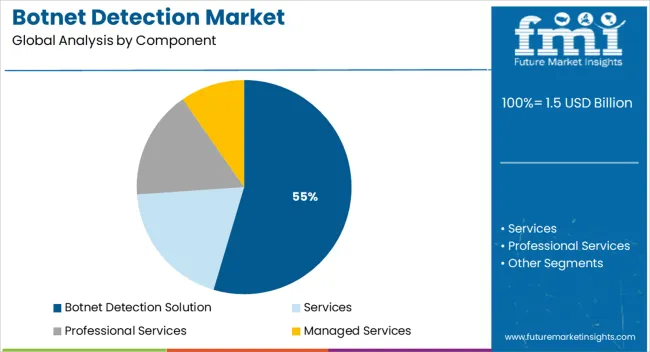

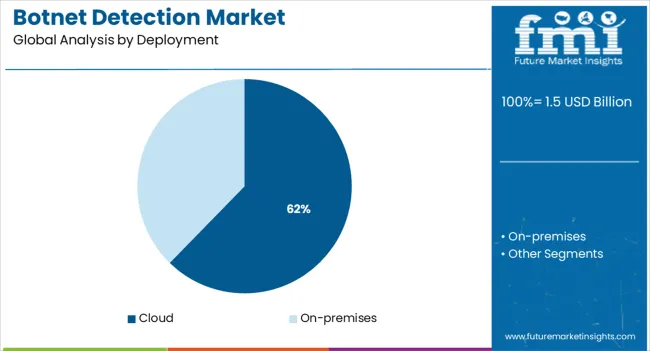

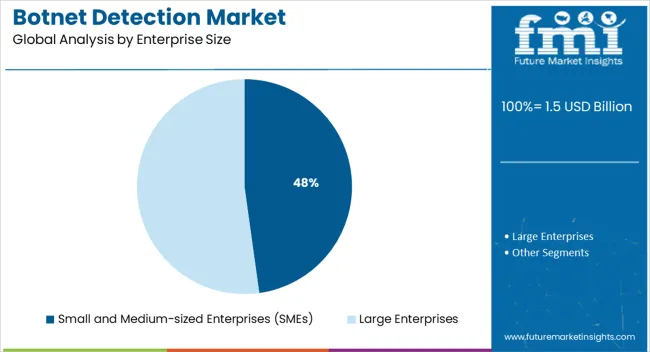

The market is segmented by Component, Deployment, Enterprise Size, and Industry and region. By Component, the market is divided into Botnet Detection Solution, Services, Professional Services, and Managed Services. In terms of Deployment, the market is classified into Cloud and On-premises. Based on Enterprise Size, the market is segmented into Small and Medium-sized Enterprises (SMEs) and Large Enterprises. By Industry, the market is divided into BFSI, Healthcare, IT and Telecom, Retail, Media and Entertainment, Travel and Hospitality, Government, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

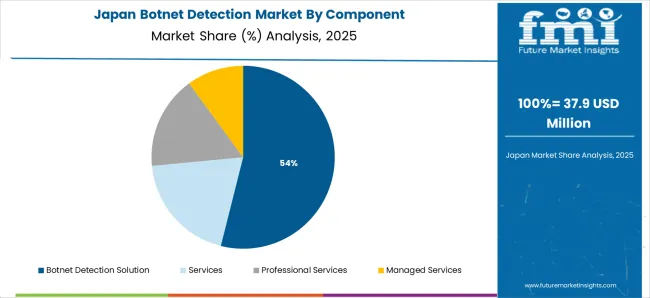

The botnet detection solution segment is projected to represent 54.60% of the total revenue by 2025, making it the leading component category. This growth is being driven by increasing enterprise demand for comprehensive tools that can identify abnormal traffic patterns, prevent infiltration, and secure mission critical applications.

The emphasis on proactive threat intelligence and machine learning powered detection has reinforced the dominance of solution offerings.

Furthermore, enterprises prefer integrated security platforms that offer seamless scalability and adaptability, ensuring that the solution segment continues to maintain its leadership position in the market.

The cloud deployment segment is expected to account for 62.30% of market revenue by 2025, positioning it as the most prominent deployment type. This dominance is supported by the widespread migration of business applications and data to cloud environments, which has created a greater need for scalable and flexible detection solutions.

Cloud deployment provides rapid implementation, reduced infrastructure costs, and the ability to handle fluctuating traffic loads effectively. Its capacity to integrate with cloud native applications and offer real time monitoring has further solidified its adoption.

As enterprises increasingly adopt hybrid and multi cloud strategies, the reliance on cloud based botnet detection continues to expand.

The small and medium sized enterprises segment is projected to hold 47.80% of total market revenue by 2025 within the enterprise size category, making it a key contributor to market growth. The increasing vulnerability of SMEs to cyberattacks, coupled with limited internal cybersecurity expertise, has made botnet detection solutions critical for this group.

Cloud based and cost effective solutions tailored for SMEs have accelerated adoption by offering advanced protection without requiring heavy infrastructure investments. Additionally, growing regulatory pressures and the need to safeguard customer trust have pushed SMEs to integrate robust detection capabilities.

This segment’s contribution underscores the growing awareness among smaller enterprises of the importance of proactive cybersecurity defense.

The botnet detection demand is estimated to grow at 33.7% CAGR between 2025 and 2035 in comparison with 31.6% CAGR during historic period of 2020 to 2025 as the adoption of botnet detection solutions and services is increasing with growing popularity of connected devices and increasing smartphone and internet penetration.

The complexity of modern cyber-attacks and advanced hacking methods are driving the demand for botnet detection among enterprises for better security. Increasing number of botnets are reported these days. For instance, FritzFrog botnet has resurfaced to attack education, healthcare, and government sectors.

This botnet managed to strike at least 500 government and enterprise SSH servers in eight months. Akamai Technologies has classified FritzFrog botnet as a "next-generation" botnet owing to a number of key features such as consistent update and upgrade cycles, an extensive dictionary used in brute-force attacks, and its decentralized architecture.

The increasing adoption of botnet detection solutions is helping enterprises in managing and mitigating risks associated with cyber-threats. Next-generation endpoint security uses modern machine learning, artificial intelligence (AI), and a tighter integration of network and device security to offer more comprehensive and adaptive protection. Next-gen security solutions incorporate real-time analysis of user and system behavior to analyze executables.

System failures in IT infrastructure can cause a payment failure that interrupts global business, while network connection loss shuts down government services like law enforcement. This factor is expected to create potential opportunities for botnet detection vendors over the forecast period.

Governments across the globe are adopting various initiatives to create the awareness about botnet detection and counter the botnet attacks. They are also taking precautionary measures in order to avoid any such instances taking place in the coming years.

For instance, as the part of the “Digital India Programme” the Government of India announced to set the cleaning and examination center for the botnet detection. Thus, this program targets to make the secure cyber space across the country.

Therefore, increase in the number of such government initiatives will create lucrative opportunities for the market growth encourage business owners will start adopting the botnet detection solutions in near future.

Lack of skilled technical professionals is one of the key factors responsible for hampering the botnet detection market growth. In most of the underdeveloped and developing countries lack of skilled technical expertise is acting as a major restrain to the market.

Further, as some of the detection methods are complex which need large processing time and also the trained professionals. Moreover, lack of awareness regarding the botnet related problems among the business is anticipated to hamper the market growth.

| Countries | BPS Change (H2'22 (O) - H2'22 (P)) |

|---|---|

| USA | (+)36 |

| India | (+)33 |

| United Kingdom | (+)29 |

| Japan | (+)28 |

| China | (+)34 |

The H2’22(O)-H2’22(P) BPS change in Japan was of (+)28 units due to the rise in the number of cyber-attacks and increasing sophistication of botnets is driving the demand for effective botnet detection solutions. Where as in India organizations are becoming increasingly aware of the negative impact of botnets on their reputation and financial losses. This is driving the adoption of botnet detection solutions leading to the change of (+)33 units.

Due to the increasing use of cloud technology has created a need for network encryption solutions to secure data in transit between cloud data centres and end-users resulting in USA a BPS change of (+)36 units for the network encryption market.

China encountered a BPS change of (+)34 units for the network encryption market due to the increasing governments regulations and initiatives aimed at improving cybersecurity, which is driving the market growth of botnet detection technology.

United Kingdom witnessed a BPS of (+)29 BPS units for the network encryption market attributed to the development of advanced technologies such as artificial intelligence and machine learning is enhancing the capabilities of botnet detection solutions and driving their market growth.

Demand for Intrusion Detection and Prevention Systems Supporting Growth in the USA.

The botnet detection demand in the USA is expected to account for nearly 68.9% of North America market share through 2035. In the USA, botnet detection providers are focusing on offering intrusion detection and intrusion prevention system that helps in identifying, analyzing and act against irregular deviation from intelligent attacks based on user behavior.

The USA and Canada are increasingly focusing on innovations derived via research and development initiatives and upgrading existing technologies. Demand in North America will continue soaring due to the increasing investments in botnet detection solutions to safeguard websites, APIs, and mobile apps from bot attacks.

Incremental Growth Registered in the United Kingdom to Boost Europe Botnet Detection Market

Europe is predicted to remain one of the most attractive markets over the forecast period. According to the study, United Kingdom is estimated to record an incremental opportunity of USD 585.4 Million during the forecast period.

Countries in Europe are aggressively adopting security solutions in order to ensure safety and integrity of critical information related to citizens. In United Kingdom enterprises are implementing encryption solutions along with adoption of security compliance and updates for data encryption and email encryption to reduce potential data breaches with regard to emails.

Moreover, companies are regularly updating security solutions such as network security, data loss prevention, and other security measures to improve data integrity over the cloud.

Consistently Surging Malicious Botnet Attacks in Japan Positively Affecting Botnet Detection Demand

The sales revenue in Japan is estimated to grow at an impressive rate of around 38.1% CAGR between 2025 and 2035. In Japan, the IT sector is growing rapidly. Along with this, adoption of network security solutions is growing at a high growth rate. Dependence on networks is rising and this has led to surge in adoption of botnet detection solutions.

Holidays seasons sales in China and Japan witness a large increase in malicious botnet attacks on the eCommerce websites. Akamai Technologies has published a data reporting 15% increase in malicious botnet traffic in China around Lunar New Year. Moreover, it further shows an increase of 150% in such traffic in Japan around Gregorian New Year. Owing to this, there has been a huge rise in demand for botnet detection solutions in Japan.

Botnet Detection Solutions to Continue Leading Segment Based on Component

The botnet detection solution segment is expected to hold the largest share of the global market in terms of component. Whereas, the services segment is expected to grow at a higher CAGR over the forecast period. This services segment is predicted to grow by absolute opportunity of USD 4,685.1 Million by the end of 2035.

The botnet detection market by services has been segmented into professional and managed services. The demand for services is directly related to the adoption level botnet detection solutions among organizations. The adoption of botnet detection solutions is increasing in order to APIs, mobile apps, and secure websites.

Increase in the number of enterprises coupled with the changing environment, securities related to the organization are turning complex, resulted in rise of zero-day malwares. Thus, botnets are the major threats in the current digital world. Hence, there has been a huge rise in demand for botnet detection solutions across the globe.

Demand for Improved IT Security Pushing Cloud-based Deployment

The cloud based deployment segment is expected to grow at a significant CAGR of 34.5% over the forecast period. Cloud-based deployment mode is expected to grow at a higher CAGR than on-premises deployment mode during the forecast period. Cloud-based deployment aids organizations with increased scalability, speed, 24/7 service, and improved IT security.

The demand for cloud-based botnet detection solutions is increasing at a rapid pace. Botnets are often controlled via Internet Relay Chat and one possible way to detect IRC-based botnets is to monitor TCP port 6667, which is a default port for IRC traffic. As more applications are deployed over the cloud, there is a shift from traditional on-premises botnet detection solutions to cloud-based botnet detection solutions across large enterprises and SMEs.

While Large Enterprises Will Remain Dominant, SMEs are Expected to Catch Up Soon

The small and medium-sized enterprises (SMEs) segment is expected to grow at a CAGR of 35.2% during forecast period. Small and medium-sized enterprises (SMEs) are adopting botnet detection solutions and services in order to cope with the rising risks and manage the Bot traffic.

Large enterprises segment is expected to hold the largest share of the global botnet detection market. The segment is expected to grow at a CAGR of 33% over the forecast period, while recording an incremental opportunity of USD 7,752.8 Million till 2035.

Demand in the Media and Entertainment Industry To Remain Chief Growth Driver

Media and entertainment industry is estimated to grow at highest CAGR of 37.7% during the forecast period. The growth of the segment can be attributed to the increasing number of enterprises spending a major share on advertisements in order to attract new customers and eventually create brand awareness.

Botnet detection techniques are majorly adopted in media & entertainment industries to reduce vulnerabilities towards advertisements. Botnet attacks may also run illegal activities such as spreading fraudulent content, and others which affect the brand. Owing to this, the media and entertainment companies are constantly monitoring networks and servers to detect any unusual traffic patterns.

Furthermore, social media platforms are also anticipated to get affected by botnet attacks with the use of automated accounts. Hence, demand for botnet detection is expected to increase in the media and entertainment industry.

The botnet detection market is expanding steadily. Leading cybersecurity providers focus on advanced threat intelligence, automation, and AI-driven analytics to detect and mitigate large-scale botnet attacks across industries. Imperva Inc., PerimeterX Inc. (HUMAN Security), and Akamai Technologies Inc. lead the market with comprehensive bot management platforms that combine behavioral analysis and real-time mitigation to protect enterprises from automated fraud and data scraping.

Cloudflare Inc. and DATADOME Group enhance protection capabilities through machine learning algorithms that identify and block malicious traffic while preserving legitimate user access. Reblaze Technologies Ltd. and Radware Ltd. (ShieldSquare) strengthen enterprise defense systems by offering cloud-based security layers that integrate application firewalls, DDoS protection, and bot traffic filtering.

Oracle Corporation and Intechnica Ltd. (Netacea) provide AI-based behavioral detection systems and API protection frameworks designed for web, mobile, and cloud applications. Barracuda Networks Inc. supports mid-size enterprises with affordable, scalable botnet protection solutions integrated into its broader security ecosystem.

Market strategies center on R&D investment, strategic partnerships, and acquisitions to enhance platform performance and expand global reach. Growth depends on AI advancement, automation in threat response, and integration with zero-trust and edge security architectures.

| Attribute | Details |

|---|---|

| Market value in 2025 | USD 1.5 billion |

| Market CAGR 2025 to 2035 | 33.7% |

| Share of top 5 players | Around 45% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD Million for Value |

| Key Regions Covered | North America; Latin America; Europe; South Asia & Pacific; East Asia and the Middle East & Africa |

| Key Countries Covered | USA, Canada, Germany, United Kingdom, France, Italy, Spain, Russia, China, Japan, South Korea, India, Australia & New Zealand, GCC Countries, Turkey and South Africa |

| Key Segments Covered | Component, Deployment, Enterprise Size, Industry and Region |

| Key Companies Profiled |

Imperva Inc., PerimeterX Inc. (HUMAN Security), Akamai Technologies Inc., Cloudflare Inc., DATADOME Group, Reblaze Technologies Ltd., Radware Ltd (ShieldSquare), Oracle Corporation, Intechnica Ltd (Netacea), Barracuda Networks Inc. |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global botnet detection market is estimated to be valued at USD 1.5 billion in 2025.

The market size for the botnet detection market is projected to reach USD 27.4 billion by 2035.

The botnet detection market is expected to grow at a 33.7% CAGR between 2025 and 2035.

The key product types in botnet detection market are botnet detection solution, services, professional services and managed services.

In terms of deployment, cloud segment to command 62.3% share in the botnet detection market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ice Detection System Market Trends, Growth & Forecast 2025 to 2035

Gas Detection Equipment Market Growth – Trends & Forecast 2024-2034

Leak Detection Equipment Market Size and Share Forecast Outlook 2025 to 2035

Odor Detection Equipment Market Size and Share Forecast Outlook 2025 to 2035

Bird Detection System Market Size and Share Forecast Outlook 2025 to 2035

Leak Detection Market Size and Share Forecast Outlook 2025 to 2035

Leak Detection Dye Market Trends & Demand 2025 to 2035

Fall Detection System Market Insights – Size & Forecast 2025 to 2035

Spark Detection System Market Forecast and Outlook 2025 to 2035

Fault Detection and Classification Market Size and Share Forecast Outlook 2025 to 2035

Spoil Detection Based Smart Label Market Size and Share Forecast Outlook 2025 to 2035

Fraud Detection and Prevention Market Size and Share Forecast Outlook 2025 to 2035

Color Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Threat Detection Systems Market

Emotion Detection and Recognition Market

Anomaly Detection Tools Market

Managed Detection and Response Market

Seizure Detection Devices Market

Hydrogen Detection Market Forecast Outlook 2025 to 2035

Moisture Detection Stickers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA