Factors which are fast-tracking the growth of the extended detection and response (XDR) market in every part of the world, are the rising sophistication of cyber threats, growing demand for integrated security solutions, and advancements in artificial intelligence (AI) and machine learning (ML).

The newest development is Extended Detection and Response (XDR), which combines a range of different security data lines. This system enables organizations to better identify, investigate, and react to such cyber-attacks.

As companies shift to the cloud based ecosystems and remote work culture, it has raised the demand of all inclusive & holistic cybersecurity solutions to secure organizations. If enterprises are looking for proactive threat management, XDR platforms offer the ideal solution with their capabilities like centralized visibility, automation, and AI-driven analytics.

Additionally, industries such as healthcare, finance, retail, and government require XDR solutions to protect sensitive information, comply with data security, and compliance regulations, which will increase its adoption.

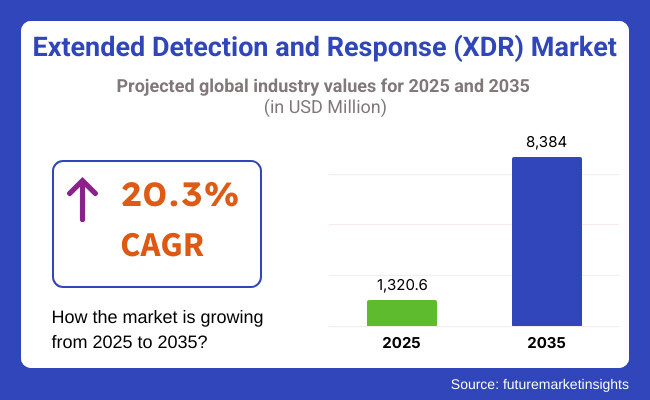

Factors such as the volume of cyber-attack incidents, the establishment of Security Operations Centre (SOC) capabilities and the implementation of advanced security analytics within enterprise security frameworks, are expected to drive the market to grow at a CAGR of 20.3% from 2025 to 2035.

North America controls the XDR market, primarily due to the existence of numerous cybersecurity companies, rising investments in advanced threat detection, and strict data protection laws. Markets where cyberattacks targeting critical infrastructure and financial institutions are climbing particularly play a central role; the United States is one of them.

Market has been further propelled by the increasing adoption of AI-powered security solutions as well as cloud-based extended detection and response (XDR) platforms.

The Europe market is among the prominent user of application security market and is growing at a fast pace owing to its high market penetration of data protection regulations such as GDPR, increasing demand for significant security features.

The countries leading the charge in XDR adoption include Germany, the UK, and France, and with enterprises across Europe prioritizing integrated security solutions to protect themselves against evolving threats. Market growth is also attributable to the increasing need for endpoint security and network protection solutions.

The Asia-Pacific region is projected to grow at the fastest pace due to increasing cyber-attacks, rapid digital transformation, and growing awareness of cybersecurity risks. Countries like Japan, India, and China are making active investments in XDR solutions to upgrade their cybersecurity framework.

Demand for extended detection and response capabilities is especially accelerating with the proliferation of deployments spanning from cloud computing to IoT to 5G networks.

Challenges

Complex Implementation, Data Overload, and Integration Issues

The challenge of implementing XDR is often said to inherently impede XDR's adoption because of the unique complexities of different organizational IT landscapes. Integrating XDR solutions into the existing security framework is challenging for organizations as legacy systems and multi-cloud infrastructures need a high level of customization.

Moreover, XDR produces mountains of security data, causing alert fatigue and making it hard to differentiate between actual threats and false positives. Another big challenge is interoperability seamless integration with third-party security tools, EDR, SIEM, and threat intelligence platforms.

Opportunities

Rise of the AI-Powered Threat Detection, Cloud Security, and Automation

Overall, despite these adoption challenges, growing cyber threat sophistication and the evolution of proactive security measures will ultimately drive XDR demand. Machine learning-based threat detection, behaviour analytics, and automated mitigation mechanisms are strengthening cyber resilience.

As diverse IT environments transition into hybrid and multi-cloud, organizations are increasingly turning to cloud-based XDR platforms to protect those environments while easing operational complexity. Further, regulatory bodies now require cybersecurity compliance across any industry, pushing companies to shore up threat visibility and incident response, a trend that is likely propelling XDR adoption.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with cybersecurity frameworks such as NIST, GDPR, and CCPA. |

| Consumer Trends | Rising demand for proactive threat detection and automated response. |

| Industry Adoption | Early adoption in financial services, healthcare, and government sectors. |

| Supply Chain and Sourcing | Heavy reliance on traditional SIEM, endpoint protection, and security analytics. |

| Market Competition | Dominated by cybersecurity firms specializing in EDR and SIEM solutions. |

| Market Growth Drivers | Growth fuelled by increasing cyberattacks, ransomware threats, and compliance needs. |

| Sustainability and Environmental Impact | Moderate focus on energy-efficient data centres for security operations. |

| Integration of Smart Technologies | Adoption of AI-driven threat analytics, automated detection, and remediation. |

| Advancements in XDR Technology | Development of cloud-native XDR and API-based security integrations. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter regulations for AI-driven security, threat intelligence sharing, and automated cyber defense mandates. |

| Consumer Trends | Expansion in zero-trust security models, AI-based adaptive security, and continuous security monitoring. |

| Industry Adoption | Widespread deployment across SMEs, IoT security, and industrial cybersecurity. |

| Supply Chain and Sourcing | Shift toward AI-native XDR, predictive threat modelling, and cross-platform security orchestration. |

| Market Competition | Entry of AI-driven security start-ups, cloud-native XDR providers, and autonomous cybersecurity platforms. |

| Market Growth Drivers | Accelerated by AI-driven security automation, behavioural threat intelligence, and quantum-resilient cybersecurity solutions. |

| Sustainability and Environmental Impact | Large-scale transition to carbon-neutral cybersecurity infrastructure and AI-powered energy-efficient security operations. |

| Integration of Smart Technologies | Expansion into autonomous threat hunting, block chain-based threat intelligence, and real-time security response. |

| Advancements in XDR Technology | Evolution toward self-learning AI security platforms, AI-driven SOC automation, and real-time behavioural analytics. |

Rising cybersecurity threats, governmental-backed security mandates, and increased investments in AI-powered threat detection solutions are the factors driving the USA XDR market growth. The need for robust cyber-defence against evasive threats and securing cloud environments has made XDR adoption paramount for enterprises.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 20.5% |

That said, regulatory compliance requirements and high-frequency cyberattacks are fuelling strong XDR adoption in the UK, particularly within industries such as financial services, government and healthcare that are increasingly reliant on integrated security.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 20.1% |

With EU regulations, drive for cybersecurity spend and demand for AI threats detection Europe’s XDR market is growing rapidly There's also growth fuelled further by the European Commission's push to strengthen cybersecurity frameworks.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 20.3% |

The growth of the Japan XDR market can be attributed to the government initiatives promoting cybersecurity resilience, an increase in the adoption of cloud security, and the demand for AI-powered threat analytics, particularly in critical infrastructure sectors.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 20.3% |

Their rapid adoption stemmed from the fast-paced digital transformation, increased security demands to counter IoT threats, and the growing demands for AI-powered cyber solutions, presenting opportunities for the XDR market in South Korea.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 20.4% |

The solutions and services sub segments hold the largest market share in the extended detection and response (XDR) market with enterprises implementing advanced cybersecurity frameworks to detect, analyse, and mitigate complex cyber threats. They improve threat intelligence, automate/optimize response/mitigation procedures, and create harder cybersecurity postures across segments.

XDR solutions are an evolutionary approach to security that integrates threat detection and response across endpoints, networks, and the cloud. This is the fastest-growing segment in the cybersecurity market. The XDR market is part of the greater cybersecurity industry, aimed at protecting organizations from cyber threats and attacks.

XDR platforms differ from traditional security tools in that they take a unified security approach, offering improved visibility, faster incident investigation and automated threat containment.

This has led to increasing adoption in the market due to rising demand for AI powered threat intelligence, machine learning based anomaly detection, behaviour analytics, and automated remediation workflows. According to the recent study, more than 65% of enterprises who have adopted XDR consider AI/ML-powered threat correlation and response automation in XDR as the top priority.

The market is growing as extended detection solutions become more prevalent to offer cloud-native security analytics, endpoint protection, and real-time security orchestration for proactive threat detection and risk mitigation.

This, coupled with the deployment of zero-trust security architecture with identity-based access controls, network segmentation, and constant authentication mechanisms, has played a pivotal role in driving adoption and achieving greater traction in providing protection against evolving cyber risks.

The emergence of open XDR platforms, with API-driven security integrations, cross-vendor interoperability, and adaptive security response mechanisms, has been tailored for such market growth and provides a seamless cybersecurity experience within inhomogeneous IT infrastructure from various vendors.

The solutions segment, despite having a handful of advantages such as real-time threat correlation, automated incident response, and enhanced security efficiency, also faces hurdles like high implementation costs, the complexity of integrating with legacy systems, and changing methodologies of cyberattacks.

Yet, key innovations in AI-assisted threat intelligence, continuous attack surface monitoring and distributed security automation are increasing detection fidelity and response efficiency, guaranteeing the continuous growth of the XDR solutions market.

XDR services have received strong adoption in market, especially amongst enterprises that lack in-house security expertise, with managed detection and response (MDR) and managed security services (MSS) becoming a top priority.

These services are unlike traditional security products which focus on the immediate threat detection but are limited in their actions, as XDR services provide round-the-clock monitoring, threat hunting, and advisory support for the enterprise's cybersecurity needs to ensure complete coverage against sophisticated attacks.

The increased demand for outsourced security operations, which include 24/7 managed threat detection, real-time security event correlation and expert-led incident response, has also driven adoption as organizations look for scalable and affordable solutions to address cybersecurity concerns. More than 55% of mid-sized enterprises use managed XDR services to elevate their cybersecurity resilience without huge internal investments, according to studies.

The growing focus on cybersecurity consulting services, such as risk assessment frameworks, security compliance audits, and penetration testing, has further fostered the growth of the market, allowing enhanced compliance with industry regulations and security best practices.

The merger has been made possible by the inclusion of AI-based solutions in security operations, such as automated threat investigation, machine learning-enabled security analytics, and real-time cyber risk scoring that ensure better detection accuracy and incident response efficiency.

Hybrid XDR service models co-managed security operations, on-demand incident response expertise, and customized security service templates have propelled market growth by delivering bespoke security approaches to a wide spectrum of corporate ecosystems.

While the services segment holds a significant market share due to the organizational aspects of continuous threat monitoring, expert-driven incident response, and regulatory compliance, there are several factors challenging the same contributing towards skilled workforce shortage, reliance on third-party security vendors, and the complexity in the management of multi-vendor security ecosystems.

That said, there has been healthy innovation in AI-augmented security automation, predictive threat intelligence modelling, and decentralized cybersecurity operations to help improve service efficiency and ensure that managed and professional XDR security offerings continue to scale and grow.

Major drivers of market expansion include segment solutions, as organizations seek security solutions that allow for flexible infrastructure, compliance requirements, and scalable operations.

On-premise XDR solutions will continue to be an important option for enterprise in jurisdictions such as finance, healthcare and government where organizations require greater control in how security operations and data management occurs. This is in stark contrast to cloud-based deployments, where data is typically hosted on the provider’s servers, thus risking loss of control over data localization and level of third-party dependencies as well as above-average security configurations.

The need for compliance-enabled security implementations including in-house data encryption, dedicated security operation centres (SOCs), and policy-driven threat mitigation has propelled adoption. According to research, more than 50% of financial institutions and critical infrastructure operators favour on premise XDR implementations over cloud deployments for compliance and data security reasons.

The increase of AI-enabled on premise security analytics, characterized by self-learning threat versions, behaviour-based anomaly diagnosis and computerized protection coverage enforcement among others have fuelled the marketplace boom, ensuring upgraded hazard mitigation functionalities.

Hybrid on premise security models with adaptive threat intelligence, cloud-native security management capabilities, and next-gen endpoint telemetry analysis are further increasing adoption, ensuring a consistent security landscape across entire IT environments.

While the on premise segment offers benefits like improved data sovereignty, regulatory compliance, and customizable security management, it also comes with drawbacks, including a high infrastructure burden, low scalability, and lengthy deployment windows. Nonetheless, advancements in AI-powered security orchestration and automated threat responses, along with predictive security intelligence, are boosting on premise XDRs in order to keep the market growing.

As enterprises transition to virtualized workplaces in a post-pandemic economy, cloud-based XDR solutions have found staunch market adoption, particularly among digital-first organizations that require flexible, scalable, and AI-powered security operations for their businesses. Unlike traditional security architectures, Cloud-based XDR provides real-time threat detection, automated correlation of security events, and seamless integration of security across multi-cloud environments.

Cloud-native cybersecurity frameworks built around server less threat intelligence, API-based security automation, and unified cloud security dashboards are now in high demand, and this has been reflected in adoption as organizations adapt to a changing security strategy. Research shows that more than 60% of cloud-first organizations are drawn to cloud-based XDR for its cost effectiveness and ability to scale quickly and easily.

The rise of multi-cloud XDR solutions, including cross-cloud threat detection, federated security policy management, and AI-based security log analysis, has further bolstered the growth of the multi-cloud XDR market, providing better protection against decentralized cyber threats.

The adoption was further bolstered by the integration of AI-driven security analytics, which included automated attack surface mapping, predictive security incident forecasting, and zero-trust cloud security enforcement, which ensured improved cyber resilience in cloud environments.

Scalability, cost-effectiveness and artificial intelligence-driven security automation drive adoption of the cloud-based XDR segment, but it comes with its own challenges such as data privacy issues, third-party security dependency and issues in integrating existing hacks with new ones.

However, breakthrough advancements like AI-oriented cloud security governance, block chain-based security event validation, and decentralized threat intelligence sharing have set the stage for enhanced efficiency of cloud-ready security and will ensure the growth momentum of XDR deployment in cloud environments.

Increasing cyber threats, rising adoption of artificial intelligence in threat intelligence, and demand for integrated security platforms across enterprises are expected to propel growth in the extended detection and response (XDR) market. These organisations are dedicated to AI-assisted threat detection, automated incident response, and interoperability with Security Information and Event Management (SIEM) solutions.

Prominent companies in the industry consist of security solution partners, web security solution providers, managed security services providers (MSSPs), and cloud-based security solution innovators in the areas of advanced analytics, endpoint security, and multi-layered/multi-domain threat intelligence.

Market Share Analysis by Key Players & XDR Solution Providers

| Company Name | Estimated Market Share (%) |

|---|---|

| Palo Alto Networks | 18-22% |

| Microsoft Corporation | 14-18% |

| Trend Micro Incorporated | 10-14% |

| IBM Corporation | 8-12% |

| CrowdStrike Holdings, Inc. | 6-10% |

| Other XDR Solution Providers (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Palo Alto Networks | Provides AI-powered XDR solutions with deep threat analytics, automated response mechanisms, and cloud-native security integration. |

| Microsoft Corporation | Specializes in Microsoft Defender XDR, offering AI-driven threat hunting, cross-domain visibility, and advanced endpoint protection. |

| Trend Micro Incorporated | Focuses on proactive threat intelligence, AI-enhanced behavioural analysis, and integrated network security for XDR solutions. |

| IBM Corporation | Offers QRadar XDR, providing AI-driven threat detection, SOAR (Security Orchestration, Automation, and Response) integration, and automated remediation. |

| CrowdStrike Holdings, Inc. | Develops Falcon XDR, featuring AI-enhanced attack surface monitoring, automated forensic analysis, and cloud-native security analytics. |

Key Market Insights

Palo Alto Networks (18-22%)

Palo Alto Networks leads in AI-powered XDR, leveraging machine learning-based anomaly detection, automated response capabilities, and cloud-integrated security frameworks.

Microsoft Corporation (14-18%)

Microsoft Defender XDR is a dominant force in cross-domain threat detection, utilizing AI-enhanced security analytics, real-time response automation, and enterprise-level SIEM integration.

Trend Micro Incorporated (10-14%)

Trend Micro specializes in predictive threat detection, AI-driven behavioural analysis, and cross-platform cybersecurity defense solutions tailored for enterprise security.

IBM Corporation (8-12%)

IBM’s QRadar XDR integrates AI-enhanced SIEM with real-time security orchestration, leveraging advanced automation and deep security analytics for enterprise threat management.

CrowdStrike Holdings, Inc. (6-10%)

CrowdStrike’s Falcon XDR provides AI-powered endpoint detection, attack surface analysis, and real-time forensic capabilities for advanced cybersecurity defense.

Other Key Players (30-40% Combined)

Several cybersecurity firms, cloud security providers, and AI-driven XDR solution vendors contribute to the evolution of next-generation threat detection, automated incident response, and real-time security intelligence. Key contributors include:

The overall market size for the extended detection and response market was USD 1,320.6 Million in 2025.

The extended detection and response market is expected to reach USD 8,384 Million in 2035.

The demand for extended detection and response solutions is expected to rise due to increasing cyber threats, growing adoption of AI-driven threat intelligence, and the need for centralized security management. Additionally, the expansion of cloud computing, hybrid work environments, and compliance with stringent data protection regulations are further fueling market growth.

The top 5 countries driving the development of the extended detection and response market are the USA, Canada, Germany, the UK, and Japan.

On-Premise and Cloud Deployment are expected to command a significant share over the assessment period, driven by increasing enterprise security demands, the need for real-time threat detection, and the growing preference for scalable, AI-powered cybersecurity solutions.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Deployment Type, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Deployment Type, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Deployment Type, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 13: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Europe Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 15: Europe Market Value (US$ Million) Forecast by Deployment Type, 2018 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 17: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: South Asia Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 19: South Asia Market Value (US$ Million) Forecast by Deployment Type, 2018 to 2033

Table 20: South Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 21: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: East Asia Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 23: East Asia Market Value (US$ Million) Forecast by Deployment Type, 2018 to 2033

Table 24: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 25: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Oceania Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 27: Oceania Market Value (US$ Million) Forecast by Deployment Type, 2018 to 2033

Table 28: Oceania Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 29: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: MEA Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Deployment Type, 2018 to 2033

Table 32: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Component, 2022 to 2033

Figure 2: Global Market Value (US$ Million) by Deployment Type, 2022 to 2033

Figure 3: Global Market Value (US$ Million) by Application, 2022 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2022 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2022 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2022 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Component, 2022 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Component, 2022 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Deployment Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Deployment Type, 2022 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Deployment Type, 2022 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Application, 2022 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Application, 2022 to 2033

Figure 17: Global Market Attractiveness by Component, 2022 to 2033

Figure 18: Global Market Attractiveness by Deployment Type, 2022 to 2033

Figure 19: Global Market Attractiveness by Application, 2022 to 2033

Figure 20: Global Market Attractiveness by Region, 2022 to 2033

Figure 21: North America Market Value (US$ Million) by Component, 2022 to 2033

Figure 22: North America Market Value (US$ Million) by Deployment Type, 2022 to 2033

Figure 23: North America Market Value (US$ Million) by Application, 2022 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2022 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2022 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Component, 2022 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Component, 2022 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Deployment Type, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Deployment Type, 2022 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Deployment Type, 2022 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Application, 2022 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Application, 2022 to 2033

Figure 37: North America Market Attractiveness by Component, 2022 to 2033

Figure 38: North America Market Attractiveness by Deployment Type, 2022 to 2033

Figure 39: North America Market Attractiveness by Application, 2022 to 2033

Figure 40: North America Market Attractiveness by Country, 2022 to 2033

Figure 41: Latin America Market Value (US$ Million) by Component, 2022 to 2033

Figure 42: Latin America Market Value (US$ Million) by Deployment Type, 2022 to 2033

Figure 43: Latin America Market Value (US$ Million) by Application, 2022 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2022 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2022 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Component, 2022 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Component, 2022 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Deployment Type, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Deployment Type, 2022 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Deployment Type, 2022 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Application, 2022 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Application, 2022 to 2033

Figure 57: Latin America Market Attractiveness by Component, 2022 to 2033

Figure 58: Latin America Market Attractiveness by Deployment Type, 2022 to 2033

Figure 59: Latin America Market Attractiveness by Application, 2022 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2022 to 2033

Figure 61: Europe Market Value (US$ Million) by Component, 2022 to 2033

Figure 62: Europe Market Value (US$ Million) by Deployment Type, 2022 to 2033

Figure 63: Europe Market Value (US$ Million) by Application, 2022 to 2033

Figure 64: Europe Market Value (US$ Million) by Country, 2022 to 2033

Figure 65: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Europe Market Value Share (%) and BPS Analysis by Country, 2022 to 2033

Figure 67: Europe Market Y-o-Y Growth (%) Projections by Country, 2022 to 2033

Figure 68: Europe Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 69: Europe Market Value Share (%) and BPS Analysis by Component, 2022 to 2033

Figure 70: Europe Market Y-o-Y Growth (%) Projections by Component, 2022 to 2033

Figure 71: Europe Market Value (US$ Million) Analysis by Deployment Type, 2018 to 2033

Figure 72: Europe Market Value Share (%) and BPS Analysis by Deployment Type, 2022 to 2033

Figure 73: Europe Market Y-o-Y Growth (%) Projections by Deployment Type, 2022 to 2033

Figure 74: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 75: Europe Market Value Share (%) and BPS Analysis by Application, 2022 to 2033

Figure 76: Europe Market Y-o-Y Growth (%) Projections by Application, 2022 to 2033

Figure 77: Europe Market Attractiveness by Component, 2022 to 2033

Figure 78: Europe Market Attractiveness by Deployment Type, 2022 to 2033

Figure 79: Europe Market Attractiveness by Application, 2022 to 2033

Figure 80: Europe Market Attractiveness by Country, 2022 to 2033

Figure 81: South Asia Market Value (US$ Million) by Component, 2022 to 2033

Figure 82: South Asia Market Value (US$ Million) by Deployment Type, 2022 to 2033

Figure 83: South Asia Market Value (US$ Million) by Application, 2022 to 2033

Figure 84: South Asia Market Value (US$ Million) by Country, 2022 to 2033

Figure 85: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: South Asia Market Value Share (%) and BPS Analysis by Country, 2022 to 2033

Figure 87: South Asia Market Y-o-Y Growth (%) Projections by Country, 2022 to 2033

Figure 88: South Asia Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 89: South Asia Market Value Share (%) and BPS Analysis by Component, 2022 to 2033

Figure 90: South Asia Market Y-o-Y Growth (%) Projections by Component, 2022 to 2033

Figure 91: South Asia Market Value (US$ Million) Analysis by Deployment Type, 2018 to 2033

Figure 92: South Asia Market Value Share (%) and BPS Analysis by Deployment Type, 2022 to 2033

Figure 93: South Asia Market Y-o-Y Growth (%) Projections by Deployment Type, 2022 to 2033

Figure 94: South Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 95: South Asia Market Value Share (%) and BPS Analysis by Application, 2022 to 2033

Figure 96: South Asia Market Y-o-Y Growth (%) Projections by Application, 2022 to 2033

Figure 97: South Asia Market Attractiveness by Component, 2022 to 2033

Figure 98: South Asia Market Attractiveness by Deployment Type, 2022 to 2033

Figure 99: South Asia Market Attractiveness by Application, 2022 to 2033

Figure 100: South Asia Market Attractiveness by Country, 2022 to 2033

Figure 101: East Asia Market Value (US$ Million) by Component, 2022 to 2033

Figure 102: East Asia Market Value (US$ Million) by Deployment Type, 2022 to 2033

Figure 103: East Asia Market Value (US$ Million) by Application, 2022 to 2033

Figure 104: East Asia Market Value (US$ Million) by Country, 2022 to 2033

Figure 105: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: East Asia Market Value Share (%) and BPS Analysis by Country, 2022 to 2033

Figure 107: East Asia Market Y-o-Y Growth (%) Projections by Country, 2022 to 2033

Figure 108: East Asia Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 109: East Asia Market Value Share (%) and BPS Analysis by Component, 2022 to 2033

Figure 110: East Asia Market Y-o-Y Growth (%) Projections by Component, 2022 to 2033

Figure 111: East Asia Market Value (US$ Million) Analysis by Deployment Type, 2018 to 2033

Figure 112: East Asia Market Value Share (%) and BPS Analysis by Deployment Type, 2022 to 2033

Figure 113: East Asia Market Y-o-Y Growth (%) Projections by Deployment Type, 2022 to 2033

Figure 114: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 115: East Asia Market Value Share (%) and BPS Analysis by Application, 2022 to 2033

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by Application, 2022 to 2033

Figure 117: East Asia Market Attractiveness by Component, 2022 to 2033

Figure 118: East Asia Market Attractiveness by Deployment Type, 2022 to 2033

Figure 119: East Asia Market Attractiveness by Application, 2022 to 2033

Figure 120: East Asia Market Attractiveness by Country, 2022 to 2033

Figure 121: Oceania Market Value (US$ Million) by Component, 2022 to 2033

Figure 122: Oceania Market Value (US$ Million) by Deployment Type, 2022 to 2033

Figure 123: Oceania Market Value (US$ Million) by Application, 2022 to 2033

Figure 124: Oceania Market Value (US$ Million) by Country, 2022 to 2033

Figure 125: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: Oceania Market Value Share (%) and BPS Analysis by Country, 2022 to 2033

Figure 127: Oceania Market Y-o-Y Growth (%) Projections by Country, 2022 to 2033

Figure 128: Oceania Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 129: Oceania Market Value Share (%) and BPS Analysis by Component, 2022 to 2033

Figure 130: Oceania Market Y-o-Y Growth (%) Projections by Component, 2022 to 2033

Figure 131: Oceania Market Value (US$ Million) Analysis by Deployment Type, 2018 to 2033

Figure 132: Oceania Market Value Share (%) and BPS Analysis by Deployment Type, 2022 to 2033

Figure 133: Oceania Market Y-o-Y Growth (%) Projections by Deployment Type, 2022 to 2033

Figure 134: Oceania Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 135: Oceania Market Value Share (%) and BPS Analysis by Application, 2022 to 2033

Figure 136: Oceania Market Y-o-Y Growth (%) Projections by Application, 2022 to 2033

Figure 137: Oceania Market Attractiveness by Component, 2022 to 2033

Figure 138: Oceania Market Attractiveness by Deployment Type, 2022 to 2033

Figure 139: Oceania Market Attractiveness by Application, 2022 to 2033

Figure 140: Oceania Market Attractiveness by Country, 2022 to 2033

Figure 141: MEA Market Value (US$ Million) by Component, 2022 to 2033

Figure 142: MEA Market Value (US$ Million) by Deployment Type, 2022 to 2033

Figure 143: MEA Market Value (US$ Million) by Application, 2022 to 2033

Figure 144: MEA Market Value (US$ Million) by Country, 2022 to 2033

Figure 145: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 146: MEA Market Value Share (%) and BPS Analysis by Country, 2022 to 2033

Figure 147: MEA Market Y-o-Y Growth (%) Projections by Country, 2022 to 2033

Figure 148: MEA Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 149: MEA Market Value Share (%) and BPS Analysis by Component, 2022 to 2033

Figure 150: MEA Market Y-o-Y Growth (%) Projections by Component, 2022 to 2033

Figure 151: MEA Market Value (US$ Million) Analysis by Deployment Type, 2018 to 2033

Figure 152: MEA Market Value Share (%) and BPS Analysis by Deployment Type, 2022 to 2033

Figure 153: MEA Market Y-o-Y Growth (%) Projections by Deployment Type, 2022 to 2033

Figure 154: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 155: MEA Market Value Share (%) and BPS Analysis by Application, 2022 to 2033

Figure 156: MEA Market Y-o-Y Growth (%) Projections by Application, 2022 to 2033

Figure 157: MEA Market Attractiveness by Component, 2022 to 2033

Figure 158: MEA Market Attractiveness by Deployment Type, 2022 to 2033

Figure 159: MEA Market Attractiveness by Application, 2022 to 2033

Figure 160: MEA Market Attractiveness by Country, 2022 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Extended Release Drugs Market Size and Share Forecast Outlook 2025 to 2035

Extended Stay Hotels Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Extended Reality (XR) Market Trends – Growth & Forecast 2025 to 2035

Key Companies & Market Share in the Extended Stay Hotel Industry

Extended & Continuous Wear Lenses Market

UK Extended Stay Hotel Market Report – Trends, Demand & Forecast 2025-2035

USA Extended Stay Hotel Market Report – Size, Share & Forecast 2025-2035

China Extended Stay Hotel Market Trends – Growth, Demand & Forecast 2025-2035

France Extended Stay Hotel Market Outlook – Growth, Trends & Forecast 2025-2035

Australia Extended Stay Hotel Market Analysis – Size, Share & Forecast 2025-2035

Ice Detection System Market Trends, Growth & Forecast 2025 to 2035

Gas Detection Equipment Market Growth – Trends & Forecast 2024-2034

Leak Detection Equipment Market Size and Share Forecast Outlook 2025 to 2035

Odor Detection Equipment Market Size and Share Forecast Outlook 2025 to 2035

Bird Detection System Market Size and Share Forecast Outlook 2025 to 2035

Leak Detection Market Size and Share Forecast Outlook 2025 to 2035

Leak Detection Dye Market Trends & Demand 2025 to 2035

Fall Detection System Market Insights – Size & Forecast 2025 to 2035

Spark Detection System Market Forecast and Outlook 2025 to 2035

Spoil Detection Based Smart Label Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA