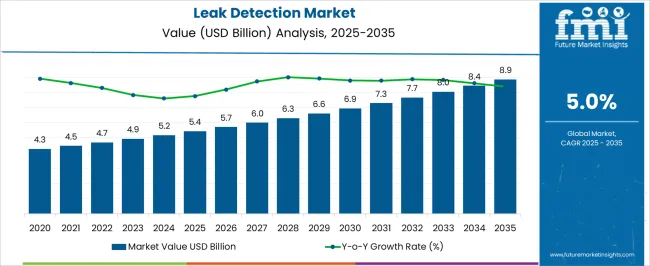

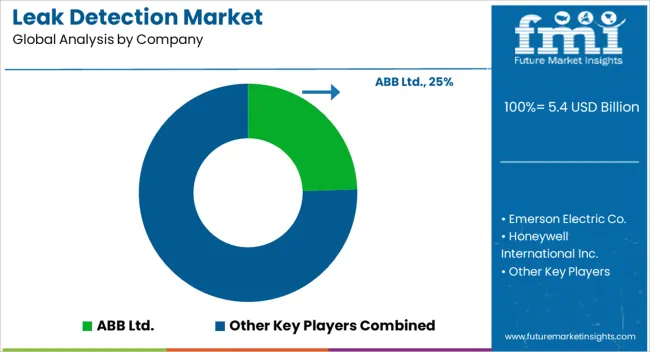

The leak detection market is estimated to be valued at USD 5.4 billion in 2025 and is projected to reach USD 8.9 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period.

The leak detection market is poised for steady growth, with its value expected to rise from USD 5.4 billion in 2025 to USD 8.9 billion by 2035, reflecting a compound annual growth rate (CAGR) of 5%. Market expansion is being driven by increasing attention to operational efficiency and risk mitigation across industrial, commercial, and municipal sectors. Year-on-year progression indicates a consistent increase, reaching USD 6.6 billion by 2029 and surpassing USD 7.7 billion by 2032. Adoption of advanced monitoring techniques, integration with maintenance protocols, and emphasis on reducing operational losses are being recognized as key contributors to market expansion.

Over the forecast period, the leak detection market is being influenced by regulatory compliance requirements, operational cost control measures, and the need for enhanced system reliability. Implementation in pipelines, water networks, and chemical processing units is being accelerated, supporting revenue growth and market consolidation. Competitive advantage is being established through precise detection capabilities, real-time monitoring, and ease of integration with existing infrastructure. By 2035, the market is projected to solidify its role as a critical tool for operational integrity, loss prevention, and efficient asset management across diverse sectors, reflecting sustained demand and value accumulation.

| Metric | Value |

|---|---|

| Leak Detection Market Estimated Value in (2025 E) | USD 5.4 billion |

| Leak Detection Market Forecast Value in (2035 F) | USD 8.9 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The leak detection market is estimated to hold a notable proportion within its parent markets, representing approximately 12-14% of the non-destructive testing market, around 10-11% of the industrial inspection equipment market, close to 8-9% of the pipeline monitoring market, about 5-6% of the fluid control and management market, and roughly 3-4% of the safety and security systems market. Collectively, the cumulative share across these parent segments is observed in the range of 38-44%, reflecting a significant presence of leak detection solutions across industrial, infrastructure, and safety applications.

The market has been influenced by the increasing demand for reliable monitoring of pipelines, storage tanks, and fluid systems, where early detection, operational accuracy, and minimal disruption are highly prioritized. Adoption has been guided by procurement decisions emphasizing system sensitivity, ease of integration, and compatibility with existing monitoring frameworks. Market participants have focused on advanced sensor technologies, real-time monitoring capabilities, and precise diagnostic tools to maintain consistent performance and operational safety across critical applications.

As a result, the leak detection market has not only captured a substantial share within non-destructive testing and industrial inspection segments but has also impacted pipeline monitoring, fluid management, and safety systems markets, highlighting its strategic role in minimizing losses, ensuring operational reliability, and enhancing preventive maintenance measures across multiple sectors.

The leak detection market is experiencing steady expansion due to increasing regulatory pressures, heightened safety standards, and the growing need for operational efficiency across industries. Rising environmental concerns related to hazardous leaks and emissions are driving the adoption of advanced detection systems.

Technological advancements such as real time monitoring, wireless communication, and AI based analytics are enhancing the accuracy and responsiveness of leak detection solutions. Industries are increasingly prioritizing preventive maintenance and early fault identification to minimize downtime and reduce repair costs.

The market outlook remains positive as sectors like energy, manufacturing, aerospace, and transportation integrate leak detection as a critical component of safety and compliance strategies.

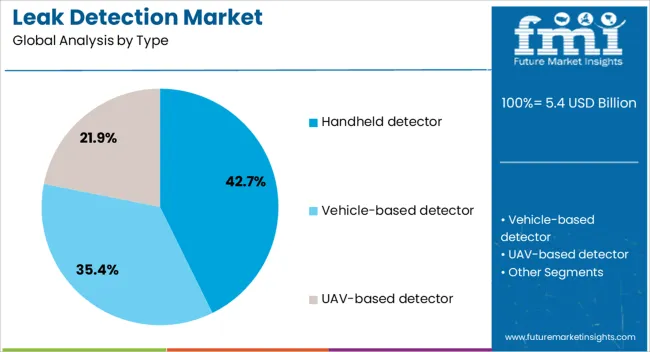

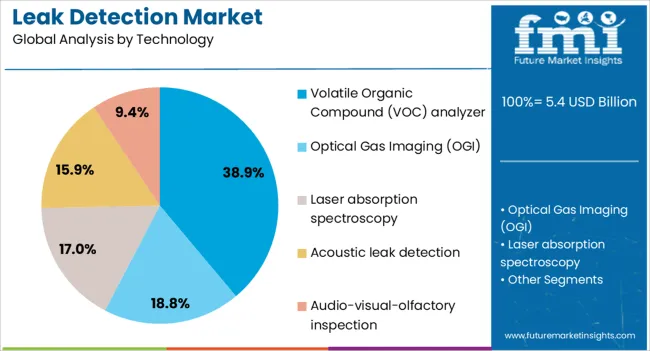

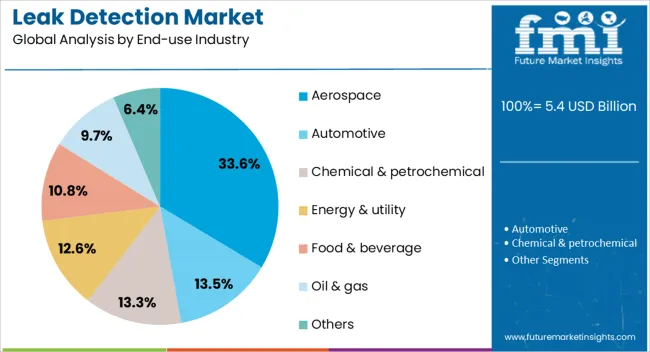

The leak detection market is segmented by type, technology, end-use industry, and geographic regions. By type, leak detection market is divided into Handheld detector, vehicle-based detector, and UAV-based detector. In terms of technology, leak detection market is classified into volatile organic compound (VOC) analyzer, optical gas imaging (OGI), laser absorption spectroscopy, acoustic leak detection, and audio-visual-olfactory inspection. Based on end-use industry, leak detection market is segmented into aerospace, automotive, chemical & petrochemical, energy & utility, food & beverage, oil & gas, and others. Regionally, the leak detection industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The handheld detector segment is expected to hold 42.7% of total revenue by 2025 within the type category, making it the leading segment. This growth is supported by the portability, ease of use, and cost effectiveness of handheld devices, which allow for quick deployment in diverse operational environments.

Their ability to detect leaks in hard to reach areas and deliver immediate results has enhanced their adoption in maintenance, inspection, and safety operations.

The versatility of these detectors across different industries, combined with low training requirements, continues to reinforce their dominance.

The volatile organic compound analyzer segment is projected to account for 38.9% of market revenue by 2025 in the technology category, positioning it as the top segment. This is attributed to its high sensitivity and capability to detect even trace levels of VOC emissions, which is essential in meeting stringent environmental regulations.

The use of VOC analyzers supports compliance reporting and emission control strategies while helping industries reduce environmental impact.

Their application across oil and gas, chemical manufacturing, and industrial processing facilities has strengthened their leadership in this segment.

The aerospace segment is anticipated to contribute 33.6% of market revenue by 2025 within the end use industry category, establishing it as the dominant segment. Growth is driven by the industry’s high safety standards, reliance on precision systems, and the need to prevent costly failures caused by undetected leaks.

Leak detection in aerospace plays a critical role in maintaining structural integrity, ensuring fuel system safety, and supporting environmental compliance.

The integration of advanced detection systems into manufacturing and maintenance processes has reinforced aerospace as a leading end use industry for leak detection solutions.

The leak detection market is driven by growing demand from industrial, municipal, and infrastructure sectors for real-time monitoring of pipelines, water networks, and facilities. Opportunities emerge from expanding oil, gas, and water distribution systems, while trends emphasize wireless, sensor-based, and smart monitoring solutions. Challenges persist due to high equipment costs, installation complexity, and skilled labor requirements. Despite these constraints, leak detection solutions are increasingly deployed to prevent losses, ensure operational efficiency, and provide early warning of leaks, supporting steady market expansion globally.

The demand for leak detection solutions has been increasingly influenced by the need to monitor pipelines, water systems, and industrial facilities for fluid and gas leakage. Utilities, chemical plants, oil and gas refineries, and municipal water networks are relying on advanced leak detection technologies to prevent financial losses, reduce operational downtime, and protect equipment. Acoustic sensors, pressure monitoring systems, and infrared imaging tools are being deployed to detect leaks in real time. Regulatory mandates for safety and operational efficiency have further intensified adoption. Across industries, early detection of leaks is recognized as critical to mitigating environmental hazards, improving asset longevity, and ensuring continuous operations, which continues to propel market growth worldwide.

Opportunities in the leak detection market are being driven by growth in oil, gas, and water distribution infrastructure. Expanding pipeline networks and complex industrial systems require continuous monitoring to detect leakage, prevent losses, and maintain compliance with safety standards. Service providers are developing wireless, sensor-based, and remotely monitored solutions that reduce inspection costs while improving detection accuracy. Utilities and industrial operators are increasingly adopting predictive maintenance programs that integrate leak detection to optimize performance. As infrastructure development accelerates in emerging markets and industrial hubs, leak detection solutions are being positioned as essential for operational efficiency, financial savings, and risk mitigation, highlighting significant market expansion potential.

A key trend in the leak detection market is the adoption of wireless, IoT-enabled, and smart sensor technologies for continuous monitoring. Devices with real-time data transmission, analytics, and predictive algorithms are being deployed to identify leaks before significant damage occurs. Multi-sensor integration, including acoustic, pressure, thermal, and chemical detection, is enhancing accuracy and responsiveness. Cloud-based monitoring platforms allow operators to access data remotely, optimize maintenance schedules, and reduce downtime. These trends are encouraging manufacturers to refine sensor precision, improve connectivity, and offer user-friendly interfaces. Consequently, industries are increasingly adopting advanced, connected leak detection solutions that deliver actionable insights and operational efficiency.

The leak detection market faces challenges due to high equipment costs, complex installation processes, and the requirement for specialized technical expertise. Advanced leak detection systems, particularly those integrating multiple sensors and IoT platforms, demand significant capital investment, which can limit adoption among smaller operators. Installation and calibration require skilled personnel to ensure accuracy and reliability. Environmental factors, such as pipeline accessibility, pressure variations, and material compatibility, can complicate deployment. Service providers are responding with modular solutions, training programs, and rental or subscription models to alleviate cost and skill barriers. Despite these measures, financial constraints and operational complexities continue to influence adoption in certain industrial and municipal segments.

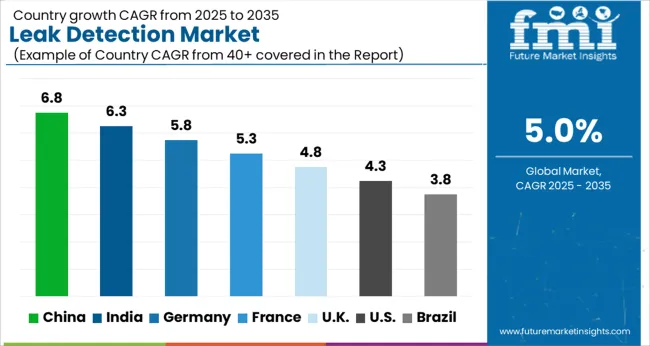

| Country | CAGR |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| France | 5.3% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

The global leak detection market is projected to grow at a CAGR of 5% from 2025 to 2035. China leads with a growth rate of 6.8%, followed by India at 6.3%, and France at 5.3%. The United Kingdom records a growth rate of 4.8%, while the United States shows the slowest growth at 4.3%. Market expansion is supported by the rising demand for industrial safety, water conservation, and pipeline monitoring. Emerging markets such as China and India are experiencing higher growth due to expanding infrastructure, industrialization, and stricter regulatory norms, while mature markets like the USA, UK, and France focus on maintenance efficiency, advanced detection systems, and reducing operational risks. This report covers insights on 40+ countries, with the top markets highlighted here.

The leak detection market in China is projected to grow at a CAGR of 6.8%. Rapid industrial growth, increasing urban infrastructure, and expanding oil and gas, chemical, and water management sectors drive strong demand. Utilities and private companies are adopting advanced leak detection systems for pipelines, storage tanks, and industrial equipment to improve safety, prevent losses, and comply with environmental regulations.

Investments in smart infrastructure and digitization, along with rising awareness of water conservation and safety standards, further accelerate adoption. Manufacturers are providing advanced solutions integrating IoT, sensors, and real-time monitoring capabilities to address complex detection challenges. China’s market is strengthened by the combination of regulatory support, infrastructure growth, and technological deployment.

The leak detection market in India is projected to grow at a CAGR of 6.3%. Industrialization, urbanization, and the modernization of water and oil & gas infrastructure drive significant market expansion. Companies increasingly adopt advanced leak detection systems to improve operational safety, reduce resource loss, and comply with environmental norms.

Smart infrastructure projects and government initiatives promoting efficient water and energy management contribute to higher adoption rates. Manufacturers focus on supplying solutions that integrate real-time monitoring, IoT-enabled sensors, and predictive maintenance technologies to meet industrial and municipal requirements. India’s market is supported by increasing industrial capacity, energy infrastructure development, and stringent safety regulations, creating strong demand for leak detection technologies.

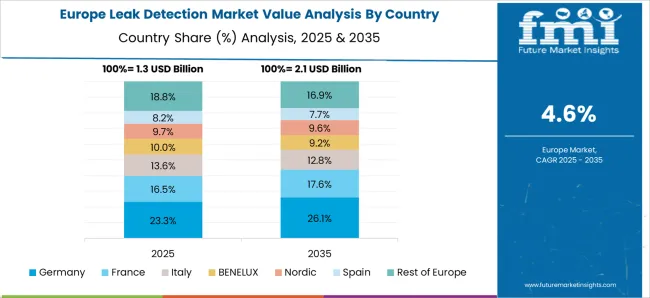

The leak detection market in France is projected to grow at a CAGR of 5.3%. Rising emphasis on industrial safety, environmental protection, and water management drives adoption. Utilities, chemical plants, and energy companies increasingly implement leak detection systems for pipelines, storage tanks, and industrial equipment. Manufacturers provide advanced solutions combining real-time monitoring, sensors, and analytical tools to ensure operational safety and regulatory compliance.

Adoption is further strengthened by government initiatives supporting energy efficiency, pollution reduction, and preventive maintenance practices. Industrial modernization, expansion of energy and water networks, and increasing investment in smart infrastructure contribute to steady market growth in France, making leak detection an integral part of operational safety strategies.

The leak detection market in the United Kingdom is projected to grow at a CAGR of 4.8%. Demand is fueled by industrial modernization, water network expansion, and growing emphasis on safety and efficiency in energy and utility sectors. Companies are increasingly adopting advanced detection systems to reduce resource losses, prevent hazards, and comply with environmental regulations.

Manufacturers offer solutions featuring IoT-enabled monitoring, real-time data analytics, and predictive maintenance to improve reliability and operational safety. Government policies promoting sustainable resource management and investment in smart infrastructure contribute to market growth. Adoption in industrial, commercial, and municipal applications ensures steady expansion of the leak detection market in the UK

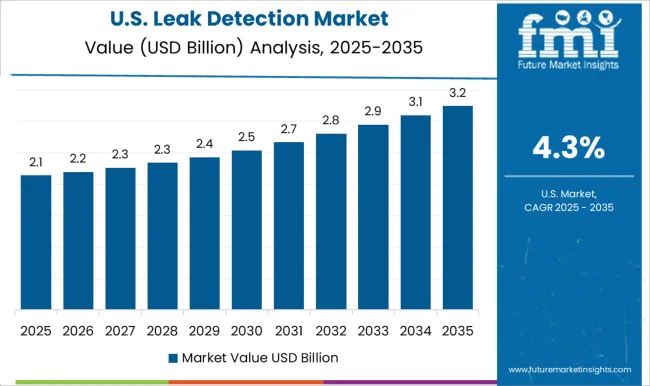

The leak detection market in the United States is projected to grow at a CAGR of 4.3%. Industrial, commercial, and municipal sectors are adopting leak detection systems to enhance safety, reduce losses, and comply with strict environmental standards. Utilities and energy companies invest in sensor-based and IoT-enabled detection solutions for pipelines, storage facilities, and industrial equipment.

The focus on predictive maintenance, operational efficiency, and regulatory compliance drives steady adoption. Expansion of industrial infrastructure, upgrades in water management, and increasing awareness of energy and resource conservation contribute to market growth. Mature industries, advanced technology deployment, and stringent regulations ensure the United States maintains a stable market for leak detection solutions.

The leak detection market is driven by global industrial automation leaders and specialized instrumentation companies providing solutions for process industries, water management, oil and gas, and chemical facilities. Companies such as ABB Ltd., Siemens Energy Global GmbH & Co. KG, and Schneider Electric SE dominate with comprehensive offerings emphasizing real-time monitoring, accuracy, and system integration. Brochures highlight advanced sensor technologies, predictive analytics, and rapid response mechanisms that minimize downtime and prevent environmental hazards. Emerson Electric Co. and Honeywell International Inc. differentiate through scalable solutions and cloud-enabled platforms, enabling remote monitoring and smart reporting.

Krohne Messtechnik GmbH and Yokogawa Electric Corporation emphasize precision measurement, reliability under harsh conditions, and compliance with international standards, appealing to industrial operators seeking both safety and operational efficiency. Marketing materials frequently focus on accuracy, robustness, and seamless integration with existing control systems, positioning leak detection systems as critical investments for risk management and regulatory compliance. Regional and emerging players compete on customization, cost-effectiveness, and local service support.

They often highlight ease of installation, sensor versatility, and adaptability to different piping and containment systems. Product brochures stress rapid leak localization, minimal false alarms, and long-term operational stability. Competition in the market is fueled by technological differentiation, accuracy, sensor sensitivity, and real-time data analytics.

Companies are increasingly promoting solutions that combine acoustic, pressure-based, and flow-based detection methods with smart analytics to ensure continuous monitoring. The strategic focus is on reducing operational losses, enhancing safety, and meeting environmental and compliance mandates, ensuring leak detection systems maintain high relevance across industrial, municipal, and energy sectors.

| Item | Value |

|---|---|

| Quantitative Units | USD 5.4 billion |

| Type | Handheld detector, Vehicle-based detector, and UAV-based detector |

| Technology | Volatile Organic Compound (VOC) analyzer, Optical Gas Imaging (OGI), Laser absorption spectroscopy, Acoustic leak detection, and Audio-visual-olfactory inspection |

| End-use Industry | Aerospace, Automotive, Chemical & petrochemical, Energy & utility, Food & beverage, Oil & gas, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB Ltd., Emerson Electric Co., Honeywell International Inc., Krohne Messtechnik GmbH, Schneider Electric SE, Siemens Energy Global GmbH & Co. KG, and Yokogawa Electric Corporation |

| Additional Attributes | Dollar sales by detection type (acoustic, pressure, flow, chemical) and application (water pipelines, oil & gas, industrial systems, HVAC) are key metrics. Trends include rising demand for efficient, real-time leak monitoring, growth in infrastructure maintenance, and adoption in energy and utility sectors. Regional deployment, technological advancements, and regulatory compliance are driving market growth. |

The global leak detection market is estimated to be valued at USD 5.4 billion in 2025.

The market size for the leak detection market is projected to reach USD 8.9 billion by 2035.

The leak detection market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in leak detection market are handheld detector, vehicle-based detector and uav-based detector.

In terms of technology, volatile organic compound (voc) analyzer segment to command 38.9% share in the leak detection market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Leak Detection Equipment Market Size and Share Forecast Outlook 2025 to 2035

Leak Detection Dye Market Trends & Demand 2025 to 2035

Water Leak Detection System for Server Rooms and Data Centers Market Size and Share Forecast Outlook 2025 to 2035

Endoscope Leak Detection Device Market

Compressed Air Leak Detection Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Automotive Hydrogen Leak Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

An Analysis of the Leak testing Machine Market by Detectors and Sensors Hardware Type through 2035

Market Share Distribution Among Leak Testing Machine Providers

Leak testing Machine Market

Air Leak Testing Market Size and Share Forecast Outlook 2025 to 2035

Water Leak Sensors Market Size and Share Forecast Outlook 2025 to 2035

Water Leakage Tester Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Leak Detectors Market Size and Share Forecast Outlook 2025 to 2035

Buried Leak Detector Market Size and Share Forecast Outlook 2025 to 2035

Roof Water Leak Detector Market Size and Share Forecast Outlook 2025 to 2035

Global Gas Leak Detectors Market

Refrigeration Leak Detector Market Growth - Trends & Forecast 2025 to 2035

Second Lid Air Leakage Test Machine Market Size and Share Forecast Outlook 2025 to 2035

Ice Detection System Market Trends, Growth & Forecast 2025 to 2035

Gas Detection Equipment Market Growth – Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA