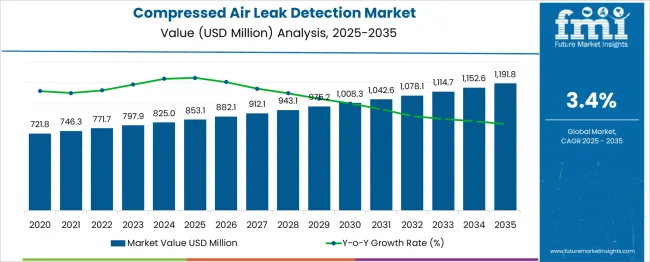

The global compressed air leak detection market is projected to grow from USD 853.1 million in 2025 to approximately USD 1,191.8 million by 2035, recording an absolute increase of USD 338.7 million over the forecast period. This translates into a total growth of 39.7%, with the market forecast to expand at a compound annual growth rate (CAGR) of 3.4% between 2025 and 2035. The overall market size is expected to grow by nearly 1.40X during the same period, supported by the rising adoption of predictive maintenance strategies and increasing demand for energy efficiency solutions across industrial operations.

Between 2025 and 2030, the compressed air leak detection market is projected to expand from USD 853.1 million to USD 1,008.3 million, resulting in a value increase of USD 155.2 million, which represents 45.8% of the total forecast growth for the decade. This phase of growth will be shaped by rising penetration of Industry 4.0 technologies in manufacturing facilities, increasing focus on energy cost reduction, and growing awareness among facility managers about the importance of compressed air system optimization. Service providers are expanding their detection capabilities to address the growing complexity of modern industrial air systems.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 853.1 million |

| Forecast Value in (2035F) | USD 1,191.8 million |

| Forecast CAGR (2025 to 2035) | 3.4% |

From 2030 to 2035, the market is forecast to grow from USD 1,008.3 million to USD 1,191.8 million, adding another USD 183.5 million, which constitutes 54.2% of the overall ten-year expansion. This period is expected to be characterized by expansion of IoT-enabled detection systems, integration of artificial intelligence in leak detection algorithms, and development of standardized detection protocols across different industrial applications. The growing adoption of smart manufacturing and predictive maintenance strategies will drive demand for more sophisticated detection solutions and real-time monitoring capabilities.

Between 2020 and 2025, the compressed air leak detection market experienced steady expansion from USD 744.5 million to USD 853.1 million, driven by increasing awareness of energy waste from compressed air leaks and growing emphasis on sustainable manufacturing practices. The market developed as industrial facilities recognized the significant cost savings potential from systematic leak detection and repair programs. Regulatory requirements for energy efficiency and corporate sustainability initiatives began emphasizing proper compressed air system maintenance and leak detection procedures.

Market expansion is being supported by the significant energy costs associated with compressed air systems and the corresponding need for efficient leak detection solutions to optimize system performance. Industrial compressed air systems are among the most expensive utilities in manufacturing facilities, with leaks typically accounting for 20-30% of total system energy consumption. Even small leaks can result in substantial energy waste and increased operational costs, making systematic detection and repair programs essential for facility efficiency.

The growing complexity of industrial air systems and increasing focus on predictive maintenance are driving demand for advanced detection technologies from certified providers with appropriate equipment and expertise. Energy management programs and corporate sustainability initiatives are increasingly requiring comprehensive leak detection documentation to maintain efficiency targets and reduce environmental impact. Regulatory requirements for energy efficiency and industrial standards are establishing systematic detection procedures that require specialized tools and trained technicians.

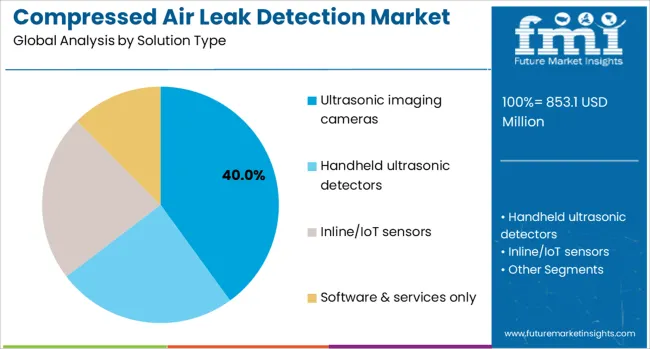

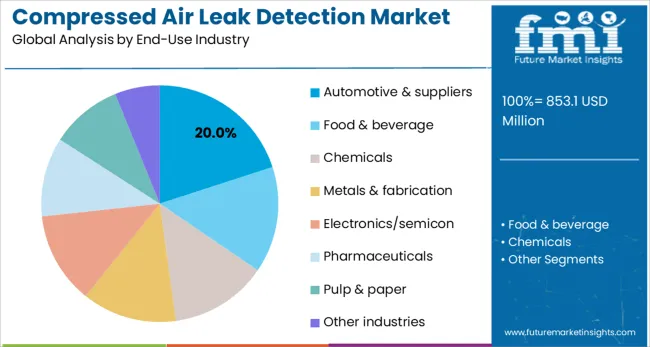

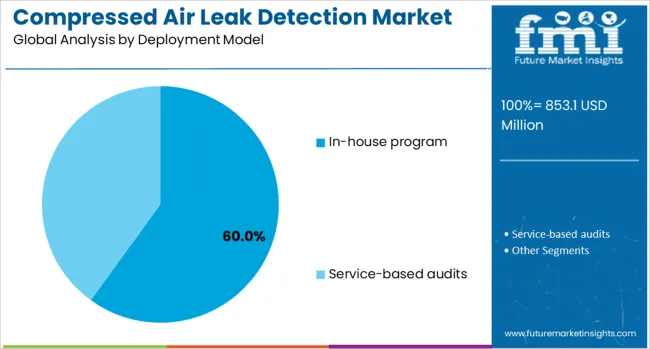

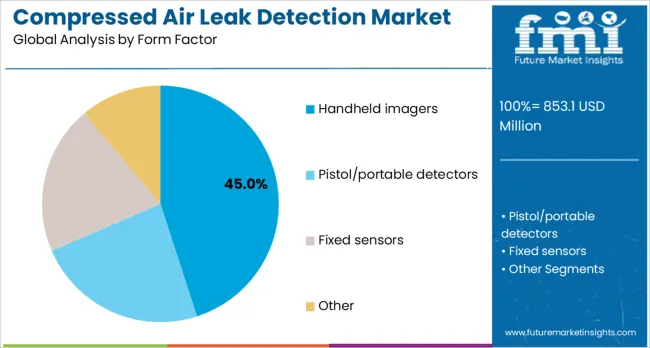

The market is segmented by solution type, end-use industry, deployment model, form factor, and region. By solution type, the market is divided into ultrasonic imaging cameras, handheld ultrasonic detectors, inline/IoT sensors, and software & services only. Based on end-use industry, the market is categorized into automotive & suppliers, food & beverage, chemicals, metals & fabrication, electronics/semiconductor, pharmaceuticals, pulp & paper, and other industries. In terms of deployment model, the market is segmented into in-house programs and service-based audits. By form factor, the market is classified into handheld imagers, pistol/portable detectors, fixed sensors, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

The ultrasonic imaging cameras segment is projected to account for 40% of the Compressed Air Leak Detection market in 2025, reflecting its leadership as the most advanced solution type. These systems convert ultrasonic sound waves generated by leaks into real-time visual maps, enabling technicians to quickly identify and quantify leak sources with high precision. Their ease of use and ability to cover large industrial facilities make them ideal for comprehensive audits and preventive maintenance programs.

Recent advancements in sensor sensitivity, image resolution, and data integration have further improved accuracy and usability, enabling predictive maintenance insights. Multiple equipment suppliers now offer portable and fixed-mount imaging solutions, expanding accessibility across industries. With compressed air representing one of the costliest energy resources in manufacturing, ultrasonic imaging cameras deliver rapid ROI by reducing waste, supporting energy efficiency goals, and aligning with sustainability initiatives, ensuring their continued dominance.

Automotive & suppliers are expected to represent 20% of compressed air leak detection demand in 2025, underscoring the sector’s dependence on compressed air systems for daily operations. Assembly lines, paint shops, stamping processes, and quality control equipment all rely heavily on pneumatic systems, which consume significant amounts of compressed air.

Even small leaks in these extensive networks can drive substantial energy costs and production inefficiencies. Automotive manufacturers are therefore adopting systematic leak detection programs as part of broader operational excellence and sustainability initiatives. Suppliers are also under growing pressure from OEMs to demonstrate energy efficiency and environmental responsibility, driving further adoption. With compressed air accounting for a notable share of energy usage in automotive facilities, leak detection services play a critical role in reducing operating costs, minimizing downtime, and helping companies achieve ambitious carbon reduction targets.

The in-house program segment is projected to account for 60% of the Compressed Air Leak Detection market in 2025, reflecting growing demand for continuous, facility-managed detection capabilities. Large industrial plants are increasingly building internal expertise, investing in handheld imagers and ultrasonic cameras, and training dedicated personnel to manage ongoing leak detection and repair efforts. Unlike outsourced services, in-house programs provide immediate responsiveness, ongoing monitoring, and integration with preventive maintenance schedules.

This approach is particularly valued in energy-intensive sectors where compressed air represents a significant cost center. By developing internal teams, companies not only reduce long-term service costs but also gain better control over performance data and energy savings outcomes. Rising emphasis on sustainability reporting and real-time monitoring is accelerating adoption, positioning in-house programs as the most reliable and scalable deployment model for compressed air leak detection.

The handheld imagers segment is estimated to hold 45% of the Compressed Air Leak Detection market in 2025, reflecting technician preference for portable, easy-to-use equipment. Handheld devices enable flexible inspection across diverse industrial environments, from small workshops to sprawling manufacturing plants. Their portability allows operators to access hard-to-reach areas and perform rapid facility-wide audits, making them essential tools for both service providers and in-house maintenance teams. Handheld imagers combine versatility with high sensitivity, offering clear leak visualization and quantification to support maintenance decisions.

The segment also benefits from declining equipment costs and ongoing improvements in ergonomics, battery life, and digital data integration. By enabling systematic, repeatable leak detection at scale, handheld imagers continue to represent the most practical solution for facilities aiming to balance operational efficiency with energy conservation and sustainability goals.

The compressed air leak detection market is advancing steadily due to increasing energy costs and growing recognition of leak detection program benefits. However, the market faces challenges including high initial equipment costs, need for continuous training on new detection technologies, and varying system configurations across different industrial applications. Standardization efforts and certification programs continue to influence service quality and market development patterns.

The growing deployment of IoT-enabled detection systems is enabling continuous monitoring at facility locations, production lines, and critical equipment installations. Smart sensors equipped with wireless communication capabilities provide real-time leak detection and automated alert systems that reduce response time for maintenance teams. These technologies are particularly valuable for large industrial facilities and multi-site operations that require centralized monitoring capabilities without manual inspection delays.

Modern leak detection service providers are incorporating artificial intelligence and machine learning algorithms that improve detection accuracy and reduce false alarm rates. Integration of AI-powered analysis systems and predictive maintenance databases enables more precise leak identification and comprehensive maintenance planning. Advanced algorithms also support detection of complex leak patterns and trending analysis for proactive system optimization.

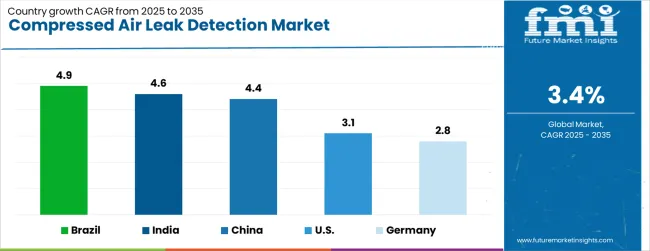

| Country | CAGR (2025 to 2035) |

|---|---|

| Brazil | 4.9% |

| India | 4.6% |

| China | 4.4% |

| United States | 3.1% |

| Germany | 2.8% |

The compressed air leak detection market is growing rapidly, with Brazil leading at a 4.9% CAGR through 2035, driven by industrial modernization, energy cost concerns, and expanding manufacturing facilities. India follows at 4.6%, supported by rapid industrialization and increasing awareness of energy efficiency programs. China grows steadily at 4.4%, integrating leak detection into its advanced manufacturing initiatives. The United States records 3.1%, emphasizing automation, predictive maintenance, and regulatory compliance. Germany shows 2.8% growth, focusing on precision engineering, quality standards, and advanced detection expertise. Overall, Brazil and India emerge as the leading drivers of global compressed air leak detection market expansion.

The report covers an in-depth analysis of 40+ countries; five top-performing countries are highlighted below.

Revenue from compressed air leak detection in Brazil is projected to exhibit the highest growth rate with a CAGR of 4.9% through 2035, driven by rapid industrial expansion and increasing focus on energy efficiency in manufacturing operations. The country's modernizing industrial base and growing awareness of compressed air system optimization are creating significant demand for detection services. Major manufacturing companies and industrial facilities are implementing systematic leak detection programs to reduce operational costs and improve system efficiency.

Revenue from compressed air leak detection in India is expanding at a CAGR of 4.6%, supported by rapid industrial growth and increasing emphasis on operational efficiency in manufacturing facilities. The country's expanding industrial sector and growing awareness of energy management requirements are driving demand for professional leak detection services. Manufacturing companies and industrial service providers are gradually establishing comprehensive detection capabilities to serve diverse industrial applications.

Revenue from compressed air leak detection in China is growing at a CAGR of 4.4%, driven by advanced manufacturing initiatives and systematic approach to industrial efficiency optimization. The country's sophisticated manufacturing sector is increasingly integrating leak detection capabilities into comprehensive maintenance programs. Industrial facilities and service providers are investing in advanced detection technologies and automated monitoring systems to address growing efficiency requirements.

Demand for compressed air leak detection in the United States is projected to grow at a CAGR of 3.1%, supported by the country's emphasis on industrial automation and predictive maintenance strategies. American industrial facilities are implementing comprehensive detection capabilities that integrate with advanced maintenance management systems. The market is characterized by focus on technological innovation, automated monitoring systems, and compliance with comprehensive energy efficiency regulations.

Demand for compressed air leak detection in Germany is expanding at a CAGR of 2.8%, driven by the country's commitment to precision engineering and systematic approach to industrial maintenance. German industrial facilities are implementing comprehensive detection programs that meet stringent quality standards and efficiency requirements. The market benefits from advanced manufacturing practices and emphasis on continuous improvement in industrial operations.

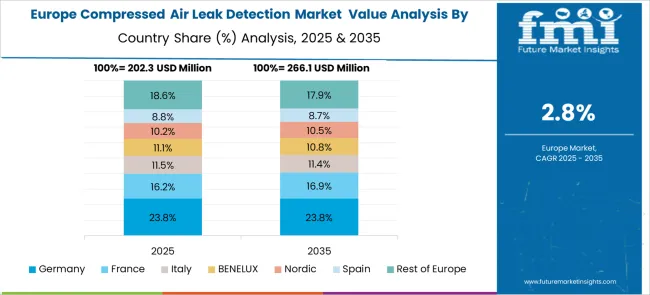

The compressed air leak detection market in Europe demonstrates advanced development across major economies with Germany leading through its precision engineering capabilities and strong industrial automation sector, supported by companies like Atlas Copco, CS Instruments, and SONOTEC pioneering innovative leak detection technologies for diverse manufacturing applications. France and the UK show significant growth in pharmaceutical and food processing industries, where stringent quality standards drive demand for advanced leak detection solutions. Sweden-based Atlas Copco leverages its compressed air expertise to develop comprehensive monitoring systems, while German companies like SONOTEC focus on ultrasonic detection technologies.

Italy and Spain exhibit expanding adoption in automotive and electronics sectors, driven by Industry 4.0 initiatives and energy efficiency regulations. Nordic countries emphasize sustainable manufacturing practices and energy conservation, while Eastern European markets show growing interest in modernizing industrial infrastructure. The market benefits from strict environmental regulations, energy efficiency mandates, and the region's leadership in industrial automation, positioning Europe as a key innovation center for next-generation compressed air leak detection solutions across multiple industrial segments.

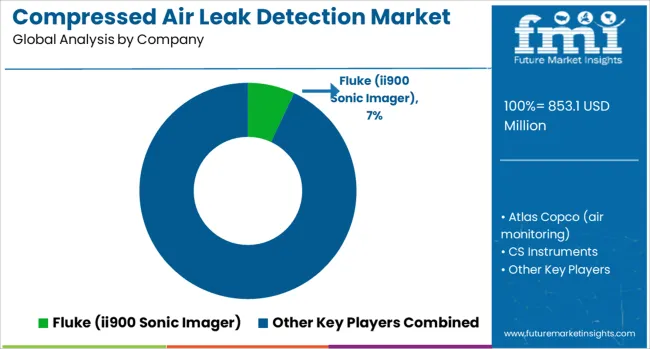

The compressed air leak detection market is defined by competition among specialized equipment manufacturers, industrial service providers, and technology companies. Companies are investing in advanced detection technologies, IoT integration capabilities, user-friendly interfaces, and comprehensive service support to deliver accurate, reliable, and cost-effective leak detection solutions. Strategic partnerships, technological innovation, and geographic expansion are central to strengthening product portfolios and market presence.

Atlas Copco, Sweden-based, offers comprehensive air monitoring solutions with focus on industrial efficiency and system optimization. CS Instruments, Germany, provides specialized detection equipment with emphasis on precision measurement and reliability. Fluke (ii900 Sonic Imager), USA, delivers advanced ultrasonic imaging technology with superior visualization capabilities. LeakQ, USA, focuses on acoustic detection solutions with innovative approach to leak identification.

Parker Hannifin, USA, offers integrated detection solutions as part of comprehensive compressed air system expertise. SDT Ultrasound Solutions, Belgium, provides specialized ultrasound detection equipment with focus on industrial maintenance applications. SONOTEC, Germany, delivers advanced ultrasonic technologies with emphasis on precision and reliability.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 853.1 million |

| Solution Type | Ultrasonic Imaging Cameras, Handheld Ultrasonic Detectors, Inline/IoT Sensors, Software & Services Only |

| End-Use Industry | Automotive & Suppliers, Food & Beverage, Chemicals, Metals & Fabrication, Electronics/Semiconductor, Pharmaceuticals, Pulp & Paper, Other Industries |

| Deployment Model | In-house Program, Service-based Audits |

| Form Factor | Handheld Imagers, Pistol/Portable Detectors, Fixed Sensors, Other |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Atlas Copco, CS Instruments, Fluke, LeakQ, Parker Hannifin, SDT Ultrasound Solutions, SONOTEC, Teledyne FLIR, and UE Systems |

| Additional Attributes | Dollar sales by detection technology and service model, regional demand trends, competitive landscape, buyer preferences for handheld versus IoT-enabled systems, integration with predictive maintenance platforms, innovations in ultrasonic sensors, AI-driven analytics, and energy-efficiency optimization |

The global compressed air leak detection market is estimated to be valued at USD 853.1 million in 2025.

The market size for the compressed air leak detection market is projected to reach USD 1,191.8 million by 2035.

The compressed air leak detection market is expected to grow at a 3.4% CAGR between 2025 and 2035.

The key product types in compressed air leak detection market are ultrasonic imaging cameras, handheld ultrasonic detectors, inline/iot sensors and software & services only.

In terms of end-use industry, automotive & suppliers segment to command 20.0% share in the compressed air leak detection market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Compressed Air Energy Storage (CAES) Market Size and Share Forecast Outlook 2025 to 2035

Compressed Air Treatment Equipment Market Size and Share Forecast Outlook 2025 to 2035

Compressed Air Filtration and Dryer System Market Growth - Trends & Forecast 2025 to 2035

Air Compressor Filters and Compressed Air Dryers Market Growth - Trends & Forecast 2025 to 2035

Airborne Molecular Contamination Control Services Market Forecast and Outlook 2025 to 2035

Airflow Balancer Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Environment Sensor Market Forecast and Outlook 2025 to 2035

Aircraft Flight Control System Market Size and Share Forecast Outlook 2025 to 2035

Airborne Radar Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Electric Motor Market Forecast Outlook 2025 to 2035

Airport Ground Transportation Market Forecast and Outlook 2025 to 2035

Airless Sprayer Accessories Market Size and Share Forecast Outlook 2025 to 2035

Air Purge Valve Market Size and Share Forecast Outlook 2025 to 2035

Air Flow Sensors Market Size and Share Forecast Outlook 2025 to 2035

Air Separation Plant Market Size and Share Forecast Outlook 2025 to 2035

Air Cooled Turbo Generators Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cooling Turbines Market Size and Share Forecast Outlook 2025 to 2035

Air Conditioning Compressor Market Size and Share Forecast Outlook 2025 to 2035

Air Measuring Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Hose Fittings Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA