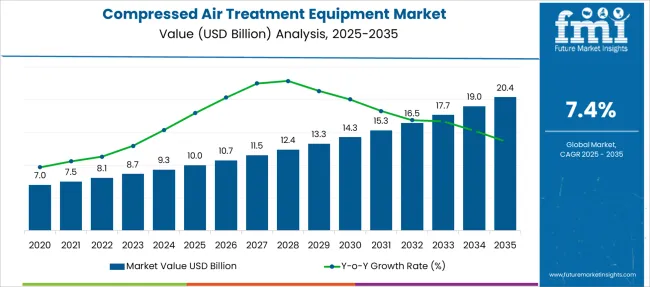

The Compressed Air Treatment Equipment Marketis estimated to be valued at USD 10.0 Billion in 2025 and is projected to reach USD 20.4 Billion by 2035, registering a compound annual growth rate (CAGR) of 7.4% over the forecast period.

| Metric | Value |

|---|---|

| Compressed Air Treatment Equipment Market Estimated Value in (2025 E) | USD 10.0 billion |

| Compressed Air Treatment Equipment Market Forecast Value in (2035 F) | USD 20.4 billion |

| Forecast CAGR (2025 to 2035) | 7.4% |

The compressed air treatment equipment market is expanding steadily, driven by the need for clean and dry air in various industrial processes. Industry trends have emphasized the importance of maintaining air quality to prevent equipment damage and ensure product integrity. Growing automation and the increasing use of pneumatic systems have further intensified demand for reliable air treatment solutions.

Stringent regulations concerning air purity and contamination control have compelled industries to adopt advanced filtration and drying technologies. Furthermore, expanding end-use sectors such as food and beverage processing have increased the adoption of compressed air treatment equipment to meet hygiene and safety standards.

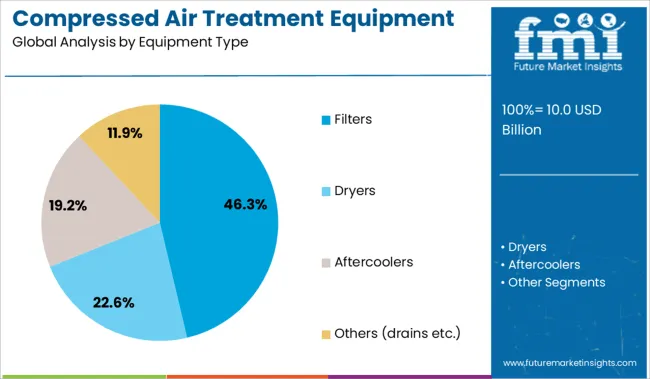

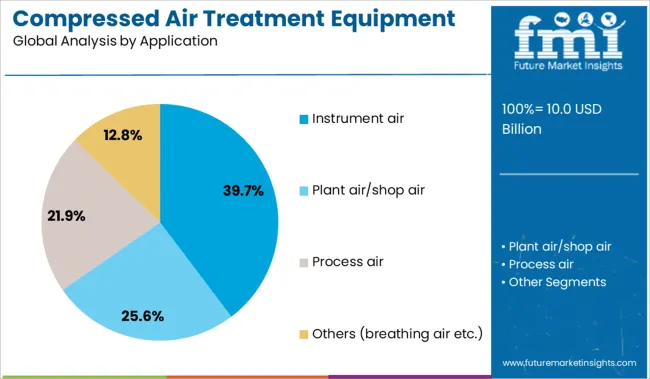

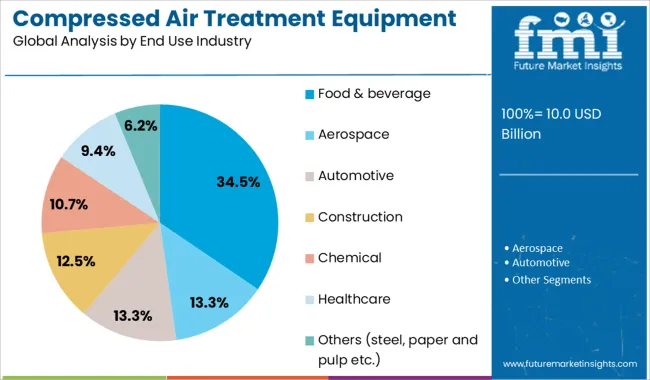

Technological advancements and energy-efficient equipment designs are expected to support market growth. Segmental leadership is projected for Filters in equipment type, Instrument Air in application, and Food & Beverage in end-use industry, reflecting their critical roles in ensuring operational efficiency and product quality.

The market is segmented by Equipment Type, Application, End Use Industry, and Distribution Channel and region. By Equipment Type, the market is divided into Filters, Particulate filter/pre-filter, Coalescing filter/oil removal, Adsorber filter/oil vapor removal, Filtered centrifugal separator, High temperature after filters, Others (moisture separators etc.), Dryers, Refrigerated dryers, Desiccant air dryers, Membrane dryers, Others (deliquescent dryers etc.), Aftercoolers, and Others (drains etc.).

In terms of Application, the market is classified into Instrument air, Plant air/shop air, Process air, and Others (breathing air etc.). Based on End Use Industry, the market is segmented into Food & beverage, Aerospace, Automotive, Construction, Chemical, Healthcare, and Others (steel, paper and pulp etc.). By Distribution Channel, the market is divided into Direct sales and Indirect sales. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Filters segment is expected to hold 46.3% of the compressed air treatment equipment market revenue in 2025, leading other equipment types. This growth is attributed to the essential function filters perform in removing contaminants such as oil, dust, and moisture from compressed air systems. Industrial operators have prioritized filter installation to extend equipment life and reduce maintenance costs.

Advances in filter media technology have improved filtration efficiency while reducing pressure drops and energy consumption. The segment’s demand has been reinforced by expanding pneumatic system applications and the requirement for ultra-clean air in sensitive manufacturing processes.

As industries emphasize sustainability and equipment reliability, filters are anticipated to retain their dominant position.

The Instrument Air segment is projected to account for 39.7% of the market revenue in 2025, maintaining its leading application status. Instrument air is critical in controlling pneumatic instruments and automation equipment across multiple industries. The segment’s growth has been driven by the need for dry and contaminant-free air to ensure precise instrument operation and safety.

Continuous process industries, including chemical and pharmaceutical sectors, rely heavily on instrument air systems, necessitating robust air treatment solutions. Regulatory standards concerning air quality for instrumentation have further propelled segment growth.

With increasing automation and process complexity, the instrument air application is expected to remain a key market driver.

The Food & Beverage segment is projected to represent 34.5% of the compressed air treatment equipment market revenue in 2025, ranking as the top end-use industry. The segment’s expansion is fueled by the strict hygiene and safety requirements in food processing and packaging. Compressed air is widely used for product handling, cleaning, and packaging processes, where air purity directly affects product quality and consumer safety.

Food and beverage manufacturers have invested in advanced air treatment equipment to comply with food safety regulations and minimize contamination risks. The growing demand for packaged and processed foods globally has also boosted the need for reliable compressed air systems.

As consumer focus on food safety intensifies, the Food & Beverage segment is expected to sustain its market leadership.

The compressed air treatment equipment market has been witnessing steady growth, driven by rising demand for moisture-free and contaminant-free air in manufacturing, food processing, electronics, and healthcare sectors. Increasing regulatory pressure on air quality and the need to protect sensitive machinery have reinforced adoption. Despite occasional restraints due to high capital costs and maintenance complexity, long-term opportunities remain strong as industrial automation and smart factory investments continue to expand globally.

Clean, dry, and oil-free compressed air has become a non-negotiable requirement across critical industries including automotive, pharmaceutical, electronics, and food processing. In these sectors, even minor contaminants can lead to corrosion, product defects, or machinery failure, making air treatment systems essential to operational stability. Equipment such as refrigerated and desiccant dryers, particulate and coalescing filters, and moisture separators has been widely adopted to achieve ISO-classified compressed air quality. Manufacturers increasingly emphasize equipment that not only meets purity standards but also supports process reliability and energy efficiency. As compressed air usage grows alongside automated production systems, downtime prevention and production quality are tied directly to the presence of efficient air treatment infrastructure. This has made air treatment equipment a core component of quality assurance across global manufacturing ecosystems.

Accelerating deployment of automation, robotics, and sensor-driven manufacturing has opened a promising avenue for compressed air treatment equipment. Industrial environments leveraging pneumatic systems now require consistent air purity to maintain precise movement control, uninterrupted actuation, and tool accuracy. The integration of Industry 4.0 architecture—including SCADA systems, real-time diagnostics, and smart monitoring tools—has positioned air treatment as a strategic control point rather than just a supporting function. Demand is expected to surge further in emerging economies as manufacturing units modernize and seek compact, modular, and scalable systems compatible with IoT-enabled workflows. Vendors offering digitally integrated solutions with minimal pressure drop and energy losses are expected to lead the next phase of adoption. This convergence of automation and air quality control is likely to define future market differentiation.

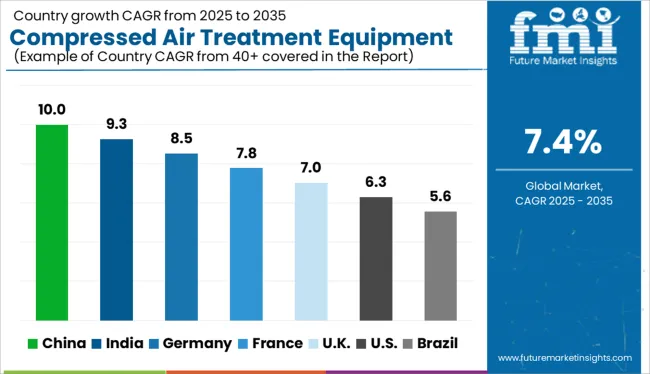

| Country | CAGR |

|---|---|

| India | 9.3% |

| Germany | 8.5% |

| France | 7.8% |

| UK | 7.0% |

| USA | 6.3% |

| Brazil | 5.6% |

The compressed air treatment equipment market is projected to grow at a global CAGR of 7.4% from 2025 to 2035. Among the 40+ countries analyzed, China leads at 10.0%, followed by India at 9.3% and Germany at 8.5%. France posts a 7.8% growth rate, slightly above the global average, while the United Kingdom trails at 7.0%. The steep trajectory in China and India is driven by rapid industrial automation and factory efficiency upgrades. Germany’s performance is shaped by precision manufacturing and energy efficiency mandates. France sees broader adoption across food, pharmaceutical, and automotive verticals. The UK’s relatively modest growth reflects cautious capital expenditure in compressed air infrastructure replacement.

China’s compressed air treatment equipment market is forecast to grow at a 10.0% CAGR, with demand accelerating from manufacturing clusters undergoing digitization and energy audits. Compliance with stricter environmental and ISO air quality standards has pushed industries to upgrade dryers, filters, and condensate management systems. Leading local players have developed compact, energy-efficient desiccant dryers for tier-2 factories. Integration of oil-free air systems in food and electronics sectors has also expanded equipment diversity.

The market in India is expected to expand at a 9.3% CAGR, supported by infrastructure upgrades in automotive, food processing, and textiles. Mid-cap industries in Gujarat, Tamil Nadu, and Maharashtra are investing in high-capacity air dryers and inline filters to ensure consistent tool performance. Local manufacturers are adopting regenerative desiccant dryers and zero-loss drains to improve efficiency. Multinational brands like Atlas Copco and Ingersoll Rand have increased their localization footprint to serve cost-sensitive sectors.

The compressed air treatment market in Germnay is set to grow at 8.5% CAGR, driven by engineering-intensive industries and process-critical applications. Factory upgrades in automotive, precision tools, and aerospace sectors prioritize ISO 8573-1 air purity compliance. German OEMs such as Kaeser and Beko Technologies lead in innovation, offering heatless regenerative dryers, particle filters, and dew point control solutions tailored for industry-specific needs.

France is projected to post a 7.8% CAGR in this sector, with increased penetration in chemical, food, and automotive verticals. Industrial users are enhancing performance of pneumatic tools and actuators by installing refrigerated dryers and particulate filters. National focus on emission reduction and workplace safety reinforces demand for condensate purifiers and air oil separators. Energy service companies (ESCOs) have promoted audits to improve compressed air system integrity in SMEs.

The United Kingdom compressed air treatment equipment market is forecast to grow at a 7.0% CAGR, driven by moderate infrastructure renewal across pharmaceuticals, food packaging, and metal fabrication. End-users are seeking low-maintenance, plug-and-play purification systems to reduce downtime. Regional demand is reinforced by import-reliant industries needing stable air quality. Innovation from local engineering firms focuses on oil vapor removal and smart monitoring integration, but high energy costs restrain broader adoption.

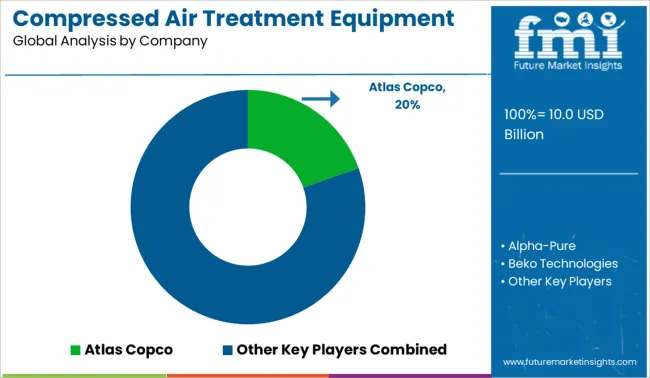

The compressed air treatment equipment market is moderately consolidated, led by Atlas Copco with a 19.6% market share. The company maintains a dominant position through its extensive product line, global service network, and advanced filtration and drying technologies. Tier 1 suppliers include Parker Hannifin and Emerson Climate, both offering integrated treatment systems tailored for industrial reliability and energy efficiency. Tier 2 participants such as Gardner Denver, Elgi Compressors, SPX Flow, and Beko Technologies provide competitive solutions with regional strengths and diverse portfolios. Tier 3 players like Alpha-Pure, Mikropor, Omega Air, Wilkerson, ZEKS Compressed Air, Chicago Pneumatic, Walker Filtration, and Mann+Hummel serve niche segments with cost-effective dryers, mist eliminators, and filter assemblies. Demand is supported by compressed air quality compliance and operational efficiency requirements in manufacturing and processing sectors.

| Item | Value |

|---|---|

| Quantitative Units | USD 10.0 Billion |

| Equipment Type | Filters, Particulate filter/pre-filter, Coalescing filter/oil removal, Adsorber filter/oil vapor removal, Filtered centrifugal separator, High temperature after filters, Others (moisture separators etc.), Dryers, Refrigerated dryers, Desiccant air dryers, Membrane dryers, Others (deliquescent dryers etc.), Aftercoolers, and Others (drains etc.) |

| Application | Instrument air, Plant air/shop air, Process air, and Others (breathing air etc.) |

| End Use Industry | Food & beverage, Aerospace, Automotive, Construction, Chemical, Healthcare, and Others (steel, paper and pulp etc.) |

| Distribution Channel | Direct sales and Indirect sales |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Atlas Copco, Alpha-Pure, Beko Technologies, Chicago Pneumatic, Elgi Compressors, Emerson Climate, Gardner Denver, Mann+Hummel, Mikropor, Omega Air, Parker Hannifin, SPX Flow, Walker Filtration, Wilkerson, and ZEKS Compressed Air |

| Additional Attributes | Dollar sales by equipment type (air dryers, filters, condensate drains, aftercoolers, separators), Dollar sales by treatment technology (refrigerated, desiccant, membrane, coalescing, oil-free), Trends in energy-efficient and IoT-enabled systems, Use of variable-speed drives, heat recovery, and inline sensors in compressed air purification, Growth of applications in food & beverage, pharmaceuticals, electronics, and manufacturing sectors, Regional patterns of adoption and regulatory compliance across North America, Europe, and Asia‑Pacific |

The global compressed air treatment equipment market is estimated to be valued at USD 10.0 billion in 2025.

The market size for the compressed air treatment equipment market is projected to reach USD 20.4 billion by 2035.

The compressed air treatment equipment market is expected to grow at a 7.4% CAGR between 2025 and 2035.

The key product types in compressed air treatment equipment market are filters, particulate filter/pre-filter, coalescing filter/oil removal, adsorber filter/oil vapor removal, filtered centrifugal separator, high temperature after filters, others (moisture separators etc.), dryers, refrigerated dryers, desiccant air dryers, membrane dryers, others (deliquescent dryers etc.), aftercoolers and others (drains etc.).

In terms of application, instrument air segment to command 39.7% share in the compressed air treatment equipment market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Compressed Air Leak Detection Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Compressed Air Energy Storage (CAES) Market Size and Share Forecast Outlook 2025 to 2035

Compressed Air Filtration and Dryer System Market Growth - Trends & Forecast 2025 to 2035

Air Compressor Filters and Compressed Air Dryers Market Growth - Trends & Forecast 2025 to 2035

Airborne Molecular Contamination Control Services Market Forecast and Outlook 2025 to 2035

Airflow Balancer Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Environment Sensor Market Forecast and Outlook 2025 to 2035

Aircraft Flight Control System Market Size and Share Forecast Outlook 2025 to 2035

Airborne Radar Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Electric Motor Market Forecast Outlook 2025 to 2035

Airport Ground Transportation Market Forecast and Outlook 2025 to 2035

Airless Sprayer Accessories Market Size and Share Forecast Outlook 2025 to 2035

Air Purge Valve Market Size and Share Forecast Outlook 2025 to 2035

Air Flow Sensors Market Size and Share Forecast Outlook 2025 to 2035

Air Separation Plant Market Size and Share Forecast Outlook 2025 to 2035

Air Cooled Turbo Generators Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cooling Turbines Market Size and Share Forecast Outlook 2025 to 2035

Air Conditioning Compressor Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Smoke Detection and Fire Extinguishing System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Hose Fittings Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA