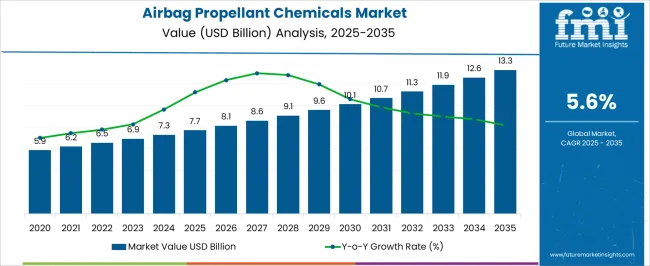

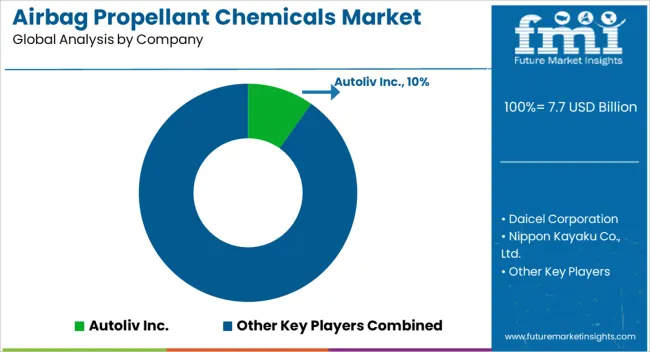

The Airbag Propellant Chemicals Market is estimated to be valued at USD 7.7 billion in 2025 and is projected to reach USD 13.3 billion by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period.

| Metric | Value |

|---|---|

| Airbag Propellant Chemicals Market Estimated Value in (2025 E) | USD 7.7 billion |

| Airbag Propellant Chemicals Market Forecast Value in (2035 F) | USD 13.3 billion |

| Forecast CAGR (2025 to 2035) | 5.6% |

The airbag propellant chemicals market is gaining steady traction as global safety standards and regulatory mandates for occupant protection continue to tighten. Rising automotive production volumes and the increasing installation of advanced safety features in both passenger and commercial vehicles are fueling demand for reliable propellant chemicals. Growing consumer awareness about vehicle safety and the prioritization of technologies that reduce fatalities in collisions are accelerating market adoption.

The market is further supported by innovations in propellant formulations that improve stability, lower toxicity, and enhance environmental compliance, reflecting the industry’s transition toward sustainable solutions. Continuous investments in research and development are enabling improvements in ignition performance, combustion control, and deployment precision, which are critical for airbag reliability.

Additionally, stricter emissions and disposal regulations are encouraging the development of next-generation propellant chemicals, creating new opportunities for manufacturers As road safety regulations expand globally and automakers integrate more airbags per vehicle, the market is positioned for significant long-term growth driven by safety, performance, and regulatory compliance requirements.

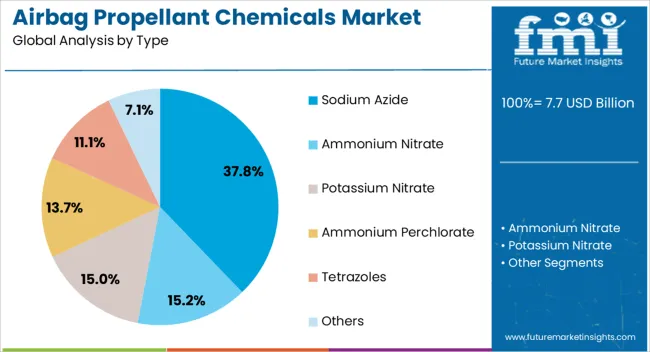

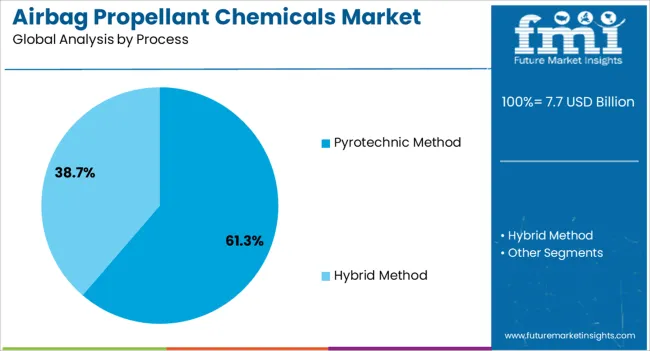

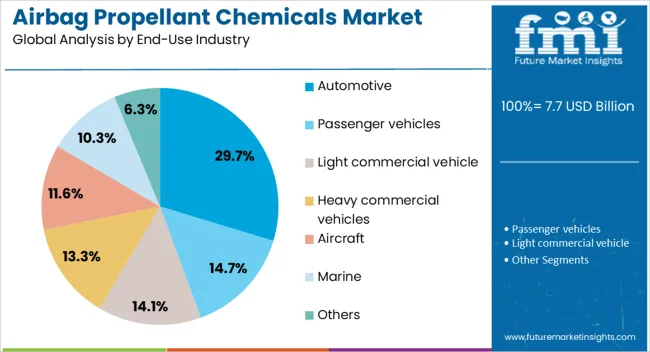

The airbag propellant chemicals market is segmented by type, process, end-use industry, and geographic regions. By type, airbag propellant chemicals market is divided into Sodium Azide, Ammonium Nitrate, Potassium Nitrate, Ammonium Perchlorate, Tetrazoles, and Others. In terms of process, airbag propellant chemicals market is classified into Pyrotechnic Method and Hybrid Method. Based on end-use industry, airbag propellant chemicals market is segmented into Automotive, Passenger vehicles, Light commercial vehicle, Heavy commercial vehicles, Aircraft, Marine, and Others. Regionally, the airbag propellant chemicals industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The sodium azide segment is expected to account for 37.8% of the airbag propellant chemicals market revenue share in 2025, making it the leading type segment. Its dominance is attributed to long-standing use in inflator systems due to consistent performance, controlled gas generation, and proven reliability in diverse environmental conditions.

The ability of sodium azide to rapidly decompose and release nitrogen gas under controlled ignition has made it a preferred choice for ensuring timely and efficient airbag deployment. Although environmental and toxicity concerns have encouraged the exploration of alternative propellants, sodium azide continues to hold strong adoption owing to established manufacturing processes, wide availability, and cost advantages.

The segment benefits from significant infrastructure investments already made in production and integration, ensuring its continued role in the market As automakers and suppliers transition gradually toward newer compounds, sodium azide’s proven track record and legacy presence are expected to sustain its leading market position in the medium term, particularly in regions where traditional propellants remain widely deployed.

The pyrotechnic method segment is projected to hold 61.3% of the airbag propellant chemicals market revenue share in 2025, establishing it as the leading process. Its leadership is supported by its effectiveness in providing controlled and rapid gas generation for reliable airbag deployment. The method involves chemical reactions that deliver high energy density, making it well-suited for consistent performance across varied temperature and environmental conditions.

Its extensive use in both driver and passenger airbags has reinforced its dominance due to proven safety records and strong adoption across the global automotive sector. Established supply chains, mature production infrastructure, and regulatory approvals have also contributed to its widespread application. While hybrid and advanced gas-based inflator technologies are emerging, the pyrotechnic method continues to be preferred for its cost efficiency and ease of integration into existing vehicle designs.

Its compatibility with multiple propellant formulations ensures flexibility, further strengthening its market position Continued demand from mass-market vehicle segments is expected to sustain the dominance of this process over the forecast period.

The automotive end-use industry segment is anticipated to capture 29.7% of the airbag propellant chemicals market revenue share in 2025, making it the largest end-use sector. This prominence is being driven by the increasing number of airbags installed per vehicle, particularly with the adoption of side, curtain, and knee airbags in addition to frontal airbags. Regulatory mandates in regions such as North America, Europe, and Asia-Pacific are requiring automakers to expand airbag coverage, boosting demand for propellant chemicals.

Rising global vehicle production, particularly in emerging economies, is also supporting this segment’s growth as safety systems become a standard feature even in mid-range and entry-level models. Automakers are prioritizing the integration of advanced occupant protection technologies to enhance brand value and meet consumer expectations for safety.

The segment is also benefiting from stricter crash safety ratings, which influence consumer purchasing decisions As automotive safety standards continue to evolve, the reliance on reliable and efficient airbag propellant chemicals is expected to drive the dominance of this end-use industry in the market.

The development of safe automobiles has led to an increase in chemicals used in airbag propellants during the past few years. The creation of cutting-edge airbags has benefited greatly from technological advancements. Airbags improve safety and protection in contemporary vehicles.

When it comes to how airbags function, airbag propellant is crucial since it helps the airbag inflate at the precise moment. After a car accident, the propellant is burned to produce gas, which fills the airbag.

The four main propellant types used in airbags are sodium azide, potassium nitrate, ammonium perchlorate, and tetrazoles. The type of propellant that should be utilized depends on the desired opening speed and airbag size. The propellant is frequently administered as tablets that are airtight combustion changers.

The demand for airbag propellant chemicals is expected to be primarily driven by the increase in automobile production. The increased use of airbags in automobiles, particularly in developing economies throughout the world, is also predicted to result in an increase in the global market for airbag propellant chemicals during the course of the forecast period.

In addition, it's projected that during the projection period, rising demand for airbags from maritime applications, such as those in bigger ships and smaller boats, would gradually fuel the market for airbag propellant chemicals.

The market for airbag propellant chemicals grew at a CAGR of 5.1% between 2025 and 2025. In the 2025 to 2025 timeframe, significant shifts in the end-use sectors were seen in the global market for airbag propellant chemicals. As a result of the supply chain disruption, suspension of transportation, and global lockdown, production and demand in the automobile industry have decreased.

As a result, several sectors have been somewhat impacted by the global halt in industrial production and distribution, as well as the demand for and consumption of chemicals used in airbag propellants.

The International Organization of Motor Vehicle Manufacturers estimates that the number of automobiles produced in 2025 dropped by 16% to 78 million, approximately the same number of vehicles sold in 2010. Which is the very least production compared to current demand.

As per the latest survey conducted by FMI, the airbag propellant chemicals market is expected to progress at a CAGR of 5.6% between 2025 and 2035. The market for airbag propellant chemicals is expanding as a result of the major development and rise in demand for electric automobiles.

The need for technologically improved automobiles and consumer inclination toward safety measures are driving the growth of the airbag propellant chemicals market.

Surging levels of investment in electric automobiles

The demand for fuel-efficient and cutting-edge automobiles raised as urbanization, disposable income, and lifestyle changes occurred. Global digitization and electric mobility are expected to change how the automotive industry develops in the upcoming years.

It is also anticipated that reducing CO2 emissions from the vehicle and transportation sectors will strike a balance between industrial and environmental policy. Electric mobility is a viable alternative to internal combustion engines.

According to the International Energy Agency (IEA), 2.1 million electric cars were sold globally in 2025, representing 2.6% of total automobile sales. Due to technology improvements and the availability of a wide variety of recently announced car models, many customers have been enticed to buy electric vehicles.

Due to increased demand and manufacturing, airbags are becoming more and more necessary in the creation of new electric vehicles. Consequently, it is anticipated that as electric car production and demand increase, so will the market for airbag propellant chemicals.

Consumer Awareness about safety

Over time, customers have become more knowledgeable about and willing to adhere to several safety procedures while buying a new automobile. The driver's actions, the vehicle's design, and the road conditions all had a role in the car crash. Consumer awareness of the safety of automotive systems has compelled manufacturers to design cars with several safety measures, which in turn boosts the installation of airbags in them.

Customers can access safety information and measures in a variety of ways, including evaluation programs, manufacturer advertisements highlighting safety features, and information on specific vehicle safety attributes. As a result, the market for airbag propellant chemicals is expanding due to consumer preference for safety measures and the development of new automobiles with sophisticated safety systems.

Stringent government regulations to constraint the market growth for Airbag Propellant Chemicals

Airbag manufacture and installation in automobiles must abide by a variety of laws to ensure public safety. It has been noted that the installation of ruptured airbags has frequently caused harm to drivers and passengers. The type of propellant used in airbags is subject to government controls since it degrades over time, particularly after coming into contact with moisture in humid environments.

As a result, there is a significant propellant burn following airbag deployment. Therefore, the rigorous government restrictions governing the manufacture and use of airbags may reduce the market demand for airbag propellant chemicals.

In terms of type, sodium azide has the largest market share in the chemicals industry for airbag propellants. Sodium azide, which is solid, has quick-acting properties and no odor. It combines with acids, water, and solid metals to produce a toxic gas that has a pungent stench.

The main application for sodium azide is in automotive airbags, where it explodes and changes into nitrogen gas as a result of the impact of the vehicle creating an electrical charge.

In addition to being explosive, sodium azide can be employed as a pesticide in agriculture, a chemical preservative in labs and hospitals, and as an explosive. Due to the strong demand for sodium azide in vehicle airbags, the global market for airbag propellant chemicals is growing.

The Asia Pacific has dominated the market for airbag propellant chemicals. The increase in demand for airbag propellant chemicals across a variety of regional industries, including the automotive, aerospace, and marine sectors, is the primary driver of this expansion.

Due to the presence of a sizable amount of the world's population as well as developing countries like China and India, the demand for effective transportation and automobiles is growing in this region. The growing urbanization, rising disposable income, and shifting lifestyles in this area are all contributing to the increased demand for vehicles.

The International Organization of Motor Vehicle Manufacturers (OICA) estimates that in 2025, China sold 2,62,74,820 units of new cars, India sold 37,59,398 units, and Japan sold 44,48,340 units. As a result, the market for airbag propellant chemicals grew as a result of the region's increasing automotive demand.

Market participants are spending globally to develop their capacity to create airbag propellant chemicals to meet the growing demands of end customers. The various technological developments and the competitors' increasing efforts to grow through strategic alliances and agreements have opened up a wide range of market prospects.

Additionally, players are working extremely hard to create and implement cutting-edge technology innovations to stay one step ahead of the competition. The market for airbag propellant chemicals may experience significant global expansion in the years to come, according to all of these developments.

For Instance,

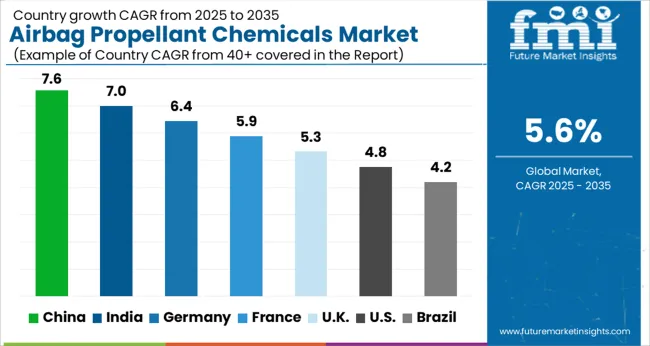

| Country | CAGR |

|---|---|

| China | 7.6% |

| India | 7.0% |

| Germany | 6.4% |

| France | 5.9% |

| UK | 5.3% |

| USA | 4.8% |

| Brazil | 4.2% |

The Airbag Propellant Chemicals Market is expected to register a CAGR of 5.6% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 7.6%, followed by India at 7.0%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 4.2%, yet still underscores a broadly positive trajectory for the global Airbag Propellant Chemicals Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 6.4%. The USA Airbag Propellant Chemicals Market is estimated to be valued at USD 2.9 billion in 2025 and is anticipated to reach a valuation of USD 4.6 billion by 2035. Sales are projected to rise at a CAGR of 4.8% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 415.9 million and USD 247.3 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 7.7 Billion |

| Type | Sodium Azide, Ammonium Nitrate, Potassium Nitrate, Ammonium Perchlorate, Tetrazoles, and Others |

| Process | Pyrotechnic Method and Hybrid Method |

| End-Use Industry | Automotive, Passenger vehicles, Light commercial vehicle, Heavy commercial vehicles, Aircraft, Marine, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Autoliv Inc., Daicel Corporation, Nippon Kayaku Co., Ltd., ARC Automotive Inc., Key Safety Systems, Inc., TRW Automotive Holdings Corp., Takata Corporation, Toyoda Gosei Co., Ltd., Ashimori Industry Co., Ltd., Joyson Safety Systems, Special Devices, Inc., Zhejiang Jinheng Mechanical Co., Ltd., Yanfeng Automotive Safety Systems Co., Ltd., Hubei Kailong Chemical Group Co., Ltd., Chemring Group PLC, MaxamCorp Holding S.L., Hanwha Corporation, Esterline Technologies Corporation, Sichuan Nitrocell Co., Ltd., and Orica Limited |

The global airbag propellant chemicals market is estimated to be valued at USD 7.7 billion in 2025.

The market size for the airbag propellant chemicals market is projected to reach USD 13.3 billion by 2035.

The airbag propellant chemicals market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in airbag propellant chemicals market are sodium azide, ammonium nitrate, potassium nitrate, ammonium perchlorate, tetrazoles and others.

In terms of process, pyrotechnic method segment to command 61.3% share in the airbag propellant chemicals market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Rocket Propellant Chemicals Market

Chemicals And Petrochemicals Electrostatic Precipitator Market Size and Share Forecast Outlook 2025 to 2035

Airbag Control Unit Sensor Market Growth - Trends, Demand & Innovations 2025 to 2035

Airbag Sensors Market

Biochemicals Control Market Size and Share Forecast Outlook 2025 to 2035

Oxo Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Soy Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Fine Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Zinc Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Green Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Fluorochemicals Market Size and Share Forecast Outlook 2025 to 2035

Paper Chemicals Market Growth – Trends & Forecast 2023-2033

Leather Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Aerosol Propellants Market Size and Share Forecast Outlook 2025 to 2035

Roofing Chemicals Market Size & Trends 2025 to 2035

Sulphur Chemicals Market

Cosmetic Chemicals Market Growth - Trends & Forecast 2025 to 2035

Membrane Chemicals Market Growth - Trends & Forecast 2025 to 2035

Aluminum Chemicals Market Growth & Demand 2025 to 2035

Oilfield Chemicals Market Report - Growth, Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA